Résumés

Abstract

Drawing on the dynamic capabilities perspective we examine the relationship between top management team’s (TMT’s) involvement in strategic decision-making and family firm growth. Additionally, we posit that this relationship varies by firm’s prioritized growth mode, internal dynamism and environmental dynamism. Data from 357 German family firms suggest that family firms with highly involved TMTs are less likely to grow in contexts of high internal dynamism, whereas growth benefits from highly involved TMTs in context of environmental dynamism.

Keywords:

- Family firms,

- dynamic capabilities,

- top management teams,

- growth,

- internal dynamism,

- environmental dynamism

Résumé

En nous inspirant de la dynamic capabilities perspective, nous examinons la relation entre l’implication de l’équipe de direction dans la prise de décision stratégique et la croissance de l’entreprise familiale. De plus, nous postulons que cette relation varie selon le mode de croissance prioritaire de l’entreprise, le dynamisme interne et le dynamisme environnemental. Les données de 357 entreprises familiales allemandes suggèrent que les entreprises familiales avec des TMT fortement impliquées sont moins susceptibles de se développer dans des contextes de dynamisme interne élevé, alors que la croissance bénéficie de TMT fortement impliquées dans un contexte de dynamisme environnemental.

Mots-clés :

- Entreprises familiales,

- capacités dynamiques,

- top management teams,

- croissance,

- dynamisme interne,

- dynamisme environnemental

Resumen

Basándonos en la perspectiva de las capacidades dinámicas, en este artículo examinamos la relación entre la participación de los equipos de alta dirección en la toma de decisiones y en el crecimiento de las empresas familiares. Además, argumentamos que esta relación varía según el modo de crecimiento priorizado de la empresa, el dinamismo interno y el dinamismo del entorno. Usando datos de 357 empresas familiares alemanas, nuestros resultados sugieren que las empresas familiares con equipos de alta dirección altamente involucrados tienen menos probabilidades de crecer en contextos de alto dinamismo interno, mientras que, en entornos dinámicos, las empresas familiares se benefician de una participación alta de los equipos de alta dirección.

Palabras clave:

- Empresas familiares,

- capacidades dinámicas,

- equipos de alta dirección,

- crecimiento,

- dinamismo interno,

- entorno dinámico

Corps de l’article

Growth is a topic of fundamental importance to family firm’s survival and prosperity (Wiklund 2007; Salvato 2004) and represents a crucial endeavor to react to today’s changing environments (Chirico and Salvato 2008; Van Gils, Voordeckers, and van den Heuvel 2004). Much effort has therefore been devoted to the identification of growth-related determinants of family firms (Casillas, Moreno, and Barbero 2010; Eddleston et al. 2013). However, the potential contributions of TMTs in this process remain understudied.

Although family firms are not homogeneous (Westhead and Howorth 2007; Leal-Rodriguez, Peris-Ortiz, and Leal-Millan, 2017) TMTs in family firms are typically composed of a majority of family members that have a strong interest to engage in strategic decision-making (Minichilli, Corbetta, and MacMillan 2010; Nielsen 2009; Miller and Le Breton-Miller 2006), but at the same time favor family over business interests (Le Breton-Miller, Miller, and Lester 2011). As a result, such TMTs tend to have in-depth knowledge of family owner’s goals (Colombo et al. 2014) and organization culture (Chirico and Nordqvist 2010). They are also characterized by some rigidity that prevent them from quickly recognizing environmental dynamics (König, Kammerlander, and Enders 2013). Given these contradictories, research on TMT correlates with growth reports inconclusive evidence, ranging from positive effects due to enhanced knowledge sharing within family TMTs (Zahra, Neubaum, and Larrañeta 2007) to negative effects due to family TMT’s interest in preserving the family’s identity, influence, and transgenerational intention (Colombo et al. 2014).

Theoretically, scholars have predominantly drawn on upper-echelons theory to examine the contributions of TMTs in family firms (Ling and Kellermanns 2010; Minichilli, Corbetta, and MacMillan 2010; Sciascia, Mazzola, and Chirico 2013; Patel and Cooper 2014), proposing that strategic decisions reflect on the collective demographic characteristics of TMT members (Hambrick and Mason 1984). However, the upper-echelons tradition has produced mixed results in explaining the impact of TMTs on strategic decision-making in family firms. Whereas some studies have corroborated the TMT demographic approach (Kellermanns et al. 2012), others found non-linear relationships (Sciascia, Mazzola, and Chirico 2013; Minichilli, Corbetta, and MacMillan 2010) or no support (O’Boyle, Pollack, and Rutherford 2012). One reason for these inconsistencies could be that demographic characteristics represent coarse proxies of TMT behavior (Carpenter, Geletkanycz, and Sanders 2004) and oversimplify how TMTs affect strategic decisions (Ensley and Pearson 2005; Ling and Kellermanns 2010).

In this study, we incorporate the dynamic capabilities perspective (Eisenhardt and Martin 2000; Teece 2007; Teece, Pisano, and Shuen 1997) into this line of thought for reconciling inconsistent findings regarding the TMT-family firm growth relationship. The emergence of the dynamic capabilities perspective enhanced the resource based view (Barney, 1991). Indeed, while the resource based view was considered to be static in its view, Teece et al. (1997: p.516) define dynamic capabilities as “the firm’s ability to integrate, build, and reconfigure internal and external competences to address rapidly changing environments”. So the term dynamic refers to the importance of the capacity to renew competences to address major changes in business environments (Eisenhardt and Martin 2000). The term capabilities emphasizes the importance of successfully adapting, integrating and reconfiguring internal and external organizational skills, resources and functional competences to achieve congruence with changing environments (Teece et al. 1997). In this context the role of TMT is fundamental. The dynamic capabilities approach argues that in order for firms to gain competitive advantages over competitors, possessing unique resources and capabilities is not enough, those resources must be allocated and reconfigured to cope with environmental changes (Teece, 2007, 2009). In this context TMT has a fundamental role. Indeed, TMT perceptions of the environment will determine the way that resources are utilized (Easterby-Smith, Lyles, & Peteraf, 2009; Teece, 2007). TMT also provide the vision of processes that shape the dynamic capabilities (Easterby-Smith et al., 2009). Thus, Teece (2007: 1346) finds that dynamic capabilities reside in large measure with a firm’s TMT.

While there is a much literature on dynamic capabilities, studies on the dynamic capabilities of family firms are still few (e.g. Chirico and Salvato, 2008). Those studies argue that generating dynamic capabilities in family firms is different from what happens in non-family firms. Indeed, family firms are characterized by a particular learning process and knowledge management because of the interaction between the family and the firm. So the context of family firms represents an interesting one. Drawing on dynamic capabilities literature and considering the peculiarity of family firms in using dynamic capabilities, in this study we aim at understanding how TMT’s involvement in strategic decision-making affects family firms growth. Furthermore, we posit that this relationship is moderated by how TMTs react to prioritizing an organic growth mode and perceived changes in firm’s internal and external environments (Ambrosini and Bowman 2009; Teece, Pisano, and Shuen 1997). Such conditions are likely to alter how senior managers evaluate growth opportunities (Aragon-Correa and Sharma 2003), leading them to initiate different strategies (Eddleston et al. 2013; Helfat and Martin 2015).

Testing our hypotheses in the context of German family firms, our results show that TMT’s strategic involvement represents an important mechanism through which family firms adapt to dynamic environments. The integration of the dynamic capabilities perspective adds knowledge to the debate on how TMT behavior translates in firm strategies (Hambrick 2007; Carpenter, Geletkanycz, and Sanders 2004; Bromiley and Rau 2016), with a particular focus on family firms (Ling and Kellermanns 2010; Ensley and Pearson 2005). Prior research has primarily looked at coarse proxies of family firm TMTs (Minichilli, Corbetta, and MacMillan 2010; Sciascia, Mazzola, and Chirico 2013), but rarely considered the heterogeneity in their actual strategic decision-making involvement. We propose an intermediate step to explain how dynamic capabilities are translated in firm-level behavior (Martin 2011; Teece 2007) and seek to add to the contradictory findings in previous family firm growth research (Zahra, Neubaum, and Larrañeta 2007; Colombo et al. 2014). Furthermore, we find that the beneficial effect of TMT strategic involvement on firm growth is context-dependent. Whereas family firms with highly involved TMTs grow less in contexts of high internal dynamism, highly involved TMTs are beneficial in contexts with high environmental dynamism and marginally in contexts of high priority to an organic growth mode. These findings contribute to the discussion about how contextual characteristics shape TMT strategic decision-making beyond industry dynamics (Carpenter, Geletkanycz, and Sanders 2004; Le Breton-Miller and Miller 2015; Yamak, Nielsen, and Escribá-Esteve 2014) by theorizing and measuring how TMTs perceive the firm’s prioritized growth strategy and the available resources in the firm and the environment.

Finally, our findings suggest that is necessary to motivate TMT members to actively participate in setting strategic objectives, developing and evaluating strategic options, and implementing growth strategies.

Theory and Hypotheses

A Dynamic Capability Perspective On Top Management Teams

A rich body of literature contends that firms can cope with changing environments by transforming their dynamic capabilities (Helfat and Peteraf 2003; Teece, Pisano, and Shuen 1997; MacLean, MacIntosh, and Seidl 2015). Dynamic capabilities refer to organizational and strategic routines by which managers reconfigure a firm’s resource base in such a way that they generate new strategies (Eisenhardt and Martin 2000; Versailles and Foss, 2019). In other words, dynamic capabilities are processes embedded in firms designed to acquire, exchange and transform internal and external resources in new and distinctive ways (Teece et al., 1997; Eisenhardt and Martin, 2000). Thus, they consist of specific “organizational processes like product development, alliancing, and strategic decision making that create value for firms within dynamic markets by manipulating resources into new value-creating strategies” (Eisenhardt and Martin, 2000: 1106). Specifically, to family firms they need to develop capabilities in order to shed or reconfigure for example resources which erode in value and become obsolete quickly in changing markets (Chirico and Salvato, 2008). Capabilities are unique in family firms as they are the result from the interactions between the family, its individual members and the firm (Sirmon and Hitt, 2003). Family firms are by definition committed organizations characterized by intense interactions among family members within the family and the business (Chirico and Salvato, 2008). For these reasons, they represent an interesting context to use the dynamic capability approach. This is the only type of organization where family members are both active in the family and in the firm thus influencing in many ways how they deal with the changing environment and how they reconfigure resources. According to Dyer (1994, p. 125), “feeling and emotions related to change are likely to be deeper and more intense” in family than in non-family firms, thus making capabilities change more difficult. This rigidity may prevent family firms to adapt to the change environment. For instance, if some family members are not emotionally committed to a change initiative, they may not use their knowledge deliberately. On the contrary, highly committed family members are likely to provide emotional support to change, hence making use of capabilities and knowledge more timely and efficient (Chirico and Salvato, 2008). As reconfigurations require support from organization leaders, few scholars would challenge the potential impact of TMTs on firm growth. This point of view stems from the idea that decision-making outcomes reflect on how TMTs create, extend, and modify the way in which firms react to environmental changes (Adner and Helfat 2003; Teece 2007; Sirmon and Hitt 2009). Subsequent empirical work has shown that family members on TMTs (Zahra, Neubaum, and Larrañeta 2007; Chirico and Bau 2014) and family generations involved in TMTs (Sciascia, Mazzola, and Chirico 2013) are important means to understand how family firms deal with changing environments.

Such studies have largely followed the upper-echelons theory agenda (Hambrick and Mason 1984; Hambrick 2007), focusing on TMTs’ collective demographic characteristics and their effects on outcomes such as growth (Weinzimmer 1997). With a few conceptual (Kor and Mesko 2013) and qualitative exceptions (Martin 2011), these studies therefore implicitly assume a homogenous involvement of TMTs across firms, but rarely describe or measure this involvement. In other words, their focus is on observable demographic proxies rather than actual behavior (Carpenter, Geletkanycz, and Sanders 2004). The result is that our understanding of how TMT pursue their functions is limited, primarily in regard to the decision-making process (Beck and Wiersema 2013; Martin 2011). We posit that focusing on TMT’s involvement in such decision-making represents an important layer to better understand their contributions regarding growth. Figure 1 presents our research framework.

Figure 1

Research framework

Top Management Team Strategic Involvement And Family Firm Growth

An emerging consensus in the dynamic capabilities literature suggests that the involvement of TMTs in the strategic decision making process might result in in superior performance (Sirmon and Hitt 2009). However, it is also important to acknowledge that the involvement of TMT in the strategic decision making process might also have negative consequences (Samba, Van Knippenberg and Miller, 2018). Indeed, TMT is often a conflation of multiple and conflicting ideas, preferences, and beliefs (Cyert and March 1963) which can create, strategic dissent thus having a negative effect on firm outcome. However, there are also studies suggesting positive effects of strategic dissent (e.g., Harrison and Klein, 2007) thus we argue that TMT involvement in strategic decision making has a positive impact on family firm growth. This is even better explained in context of family firms where we contend that high strategic involvement of TMTs in the strategic decision making process facilitates firm growth for three reasons.

First, firm growth is likely to be facilitated by how intensively TMTs identify opportunities and threats through scanning, searching, and exploring changes in the firm’s environment (O’Reilly and Tushman 2008). This is related to understanding latent demands of customers, technological advancements, and employee’s attitude to support growth (Chirico and Nordqvist 2010; Teece 2007). Previous studies indicate that highly involved TMTs are likely to better handle opportunity identification (Martin 2011), because involvement provides access to task-relevant information (Boone and Hendriks 2009), increases TMT member’s confidence in their own abilities (Clark and Maggitti 2012), and eases the processing of available information (Kuvaas 2002). In contrast, low involved TMTs are more likely to rely on narrow information identification strategies (Henderson 1994), look only for familiar information (Hambrick 2007), and limit the exchange of ideas to a few scenarios (Kuvaas 2002). This is even more important in the context of family firms where TMT represents interests that are linked to both the family and the business. Indeed, family involvement in TMT strategic decision making process might bring unique benefits (Habbershon and Williams 1999). The involvement of family firms TMTs in the strategic decision making process might lead to positive outcome (such as growth). Indeed, family firms TMTs involve in the strategic decision making process to develop more successfully seize opportunities in the market (Le Breton-Miller and Miller, 2008), give new employment opportunities to succeeding generations, or simply increase distributable dividends. Thus in the specific context of family firms, growth is not only a measure of business success but also of the well-being of the family over time (Olson et al., 2003; Calabrò et al., 2017). Moreover, Family involvement in the TMT is crucial for growth (Campopiano et al., 2019) due to the critical role of top managers in strategic planning and execution.

Hypothesis 1.

TMT strategic involvement is positively related to family firm growth.

The Moderating Effect Of Prioritizing An Organic Growth Mode

Extant research suggests that family firms grow with different patterns (Eddleston et al. 2013), and we expect that the impact of TMTs depends on family firm’s priority for an organic growth mode. Organic growth refers to firm-internal extensions of existing operations and products (Penrose 1959). In contrast to acquisitive growth, an organic growth mode is likely to increase the emotional attachment of the owning family with the firm and avoid the risk of losing control over the business (Gomez-Mejia, Patel, and Zellweger 2015; Miller, Le Breton-Miller, and Lester 2010, Bouzgarrou and Navatte 2014; Cadiou et al., 2017). Further, an organic growth mode requires less effort to integrate different resource portfolios (Zaheer, Castañer, and Souder 2013), which in turn could help family shareholders to uphold a consistent image of the firm (Dyer and Whetten 2006).

Following Penrose (1959), organic growth strongly depends on the capacity of TMTs to see and act upon matching perceived growth opportunities with the firm’s resources (Lockett et al. 2011; McKelvie and Wiklund 2010). Over time firms develop strong routines that limit the capacity of senior managers to pursue this matching procedure (Vermeulen and Barkema 2001). This in turn is likely to result in focusing on fine-tuning existing products and services instead of identifying growth opportunities (March 1991) and places strong rigidities in pursuing organic growth activities (Lockett et al. 2011). We contend that TMTs with a high strategic involvement are better capable to deal with such burdens when there is a priority to organic growth.

First, TMTs with a high involvement in strategic decision-making may be better able to learn about a firm’s existing operations. Penrose (1959) argues that managers unfamiliar with a firm’s existing operations and services lack the ability to identify growth-related opportunity and threats, especially when they are new to the TMT. Such unfamiliarity is likely to increase TMT’s time spent to learn about firm’s products, services, and customers and leave little room to develop a routinized way to delegate work to subordinates and focus on planning for growth activities (Coad and Guenther 2014), which is an important aspect of successfully reconfiguring resources (Teece 2007). In comparison to non-family firms, highly involved family firm TMTs are unlikely to have such unfamiliarity, as their awareness of organization culture (Chirico and Nordqvist 2010), knowledge of a firm’s industry, competition and technological trends (Zahra, Neubaum, and Larrañeta 2007), networks with external stakeholders (Zahra 2010) and intense social relationships between family members (Chirico and Salvato 2008) may increase their capability to sense, size and reconfigure resources to attain growth.

Furthermore, a clear priority to organic growth is likely to increase the focus of TMTs to identify growth opportunities. In contexts of high priority to organic growth, highly involved TMTs may be better able to accumulate knowledge about firm specific procedures instead of dividing their scarce time to a variety of activities. Salvato, Lassini and Wiklund (2007) for example show that positive outcomes from pursuing a certain growth mode particularly accrue when family managers are capable to accumulate, storage, and exploit knowledge from inside the firm. As TMTs with a high strategic involvement are more likely to access a variety of information (Martin 2011) and better process available information (Kuvaas 2002), we expect that highly involved TMTs are more capable to contribute to family firm growth when there is a clear priority to pursue an organic growth mode.

Hypothesis 2.

A priority for organic growth moderates the TMT strategic involvement–family firm growth relationship such that the positive relationship is stronger when family firms prioritize an organic growth mode.

The Moderating Effects Of Internal Dynamism And Environmental Dynamism

We further argue that the relationship between TMT strategic involvement and firm growth is moderated by internal dynamism and environmental dynamisms. Both factors have been recognized as important to explain the link between dynamic capabilities and decision-making outcomes (Aragon-Correa and Sharma 2003; Drnevich and Kriauciunas 2011; MacLean, MacIntosh, and Seidl 2015). Our distinction between internal dynamism and environmental dynamism is consistent with previous research (Teece, Pisano, and Shuen 1997; Ambrosini and Bowman 2009) and follows from the argument that TMTs have more discretion to deal with internal dynamism (Schäffer and Willauer 2003).

Internal Dynamism

Internal dynamism relates to unpredicted changes in a firm’s stock of financial, technological, and reputational assets (Teece, Pisano, and Shuen 1997) and serves as an important antecedent for manager’s effectiveness in anticipating and implementing strategic decisions (Schäffer and Willauer 2003). High levels of internal dynamism create uncertainty and variability in the firm and in its relations with external actors (Tushman and Rosenkopf 1996). As a result, managers tend to centralize decision-making, decrease long-term planning, non-selectively cut resources, and lose support from subordinates (Cameron, Kim, and Whetten 1987). We expect that TMTs with a high strategic involvement are more capable to avoid such drawbacks for two reasons.

First, previous research shows that senior managers tend to increase their psychological commitment to the firm when there is high level of internal dynamism (Reilly, Brett, and Stroh 1993). As family TMT members are typically characterized by such strong commitment (Patel and Cooper 2014), highly involved TMTs are likely to better circumvent drawbacks from internal dynamism and in turn realize growth when their involvement in decision-making is high. This is likely to be facilitated by family firm leaders promoting a growth-supportive organization climate (Chirico and Nordqvist 2010) and fostering family firm’s continuity and unity (Eddleston et al. 2013), especially through sharing information with all employees (Upton, Teal, and Felan 2001). In turn, as highly involved TMTs are characterized by a strong sense to set strategic objectives and developing strategic options, we expect that TMT strategic involvement is particularly beneficial when internal dynamism is high.

Second, high internal dynamism is associated with perceptions of an insecure future and inadequate treatment by the organization (Kiefer 2005) as well as a destabilization of relationships between organizational departments (Maltz, Souder, and Kumar 2001). Highly involved family TMTs are more likely to have a deep understanding of such inner-organization dynamics and social relationships (Salvato and Melin 2008) and hence are more capable to anticipate resistance in the firm and include information from a variety of sources in their decision-making. Accordingly, we suggest that firm growth is likely to benefit from high TMT strategic involvement in a context of high internal dynamism.

Hypothesis 3.

Internal dynamism moderates the TMT strategic involvement–family firm growth relationship such that the positive relationship is stronger as internal dynamism increases.

Environmental Dynamism

Environmental dynamism refers to the degree of unpredictable changes in a firm’s environment (Miller and Friesen 1983) and is characterized by information ambiguity and inaccuracy as well as a need to engage in fast, yet comprehensive decision-making processes (Eisenhardt 1989). As TMTs in such contexts are likely to lack complete information and sufficient time to discuss growth strategies (Hmieleski and Ensley 2007), TMTs with a higher strategic involvement should be more capable to sense, size, and reconfigure resources to attain growth.

Previous research suggests that dynamic environments require higher levels of efforts as well as more time for scanning information than stable environments (Milliken 1987), with TMTs who do not actively participate in this process are likely to suffer from a lack of information (Hmieleski and Ensley 2007). Senior managers in dynamic environments also tend to be more proactive in searching information, due to their willingness to anticipate emerging opportunities rather than reacting to strategic moves by competitors (Amit and Schoemaker 1993; Aragon-Correa and Sharma 2003). In family firms TMTs such proactive searches are likely to result in a better identification of promising strategies (Sharma 2000) and higher investments in the development of new products and designs (Aragon-Correa and Sharma 2003). Consistently with that family firm’s decision-making speed increases family managers’ beliefs in how easy it is to attain growth through proactive, innovative and risk-taking behaviors (Casillas, Moreno, and Barbero 2010).

Conversely, stable environments are characterized by less ambiguity and time restrictions (Hmieleski and Ensley 2007), in turn decreasing the need for TMT family members to become actively involved in strategic decision. Senior managers in stable environments primarily draw on existing information and mental models to formulate decisions (Hough and White 2003) and take a passive line in identifying growth opportunities to extract resources for private family gains (Chirico and Bau 2014). Furthermore, due to their informal governance mechanisms (Calabrò and Mussolino 2013), family firms show great speed in their decision-making processes (Casillas, Moreno, and Barbero 2010), signaling that TMT family members in stable environments are less likely to dedicate adequate time and effort to strategic decision-makings. Accordingly, we contend that family firm growth benefits from high TMT strategic involvement in contexts of high environmental dynamism.

Hypothesis 4.

Environmental dynamism moderates the TMT strategic involvement–family firm growth relationship such that the positive relationship is stronger as environmental dynamism increases.

Methods

Sample

Our hypotheses were tested through survey data from German family firms. Consistent with previous research (Calabrò et al. 2016), we identified all firms listed in the Bureau van Dijk AMADEUS database that had (1) at least two family members serving on the TMT, and/ or (2) at least 50.1% ownership by one family. 1,567 firms fulfilled these criteria. Following a key informant approach (Kumar, Stern, and Anderson 1993), we sent the survey to the firm’s highest ranking TMT member in summer 2013, with a follow-up mailing administered several weeks afterwards. This approach was suitable for our study, as these individuals consist of the most accurate overview of strategic decision-making (Zahra 2010; Zahra, Neubaum, and Larrañeta 2007). We used a Kolmogorov-Smirnov (K-S) two-sample test to identify a potential bias by comparing CEO and non-CEO responses regarding our key variable firm growth and found no differences (ρ = 0.989). We achieved 460 responses for a response rate of 29.4%. Excluding 103 cases with missing data leaves us with a sample of 357 firms.

We assessed a potential sample selection bias by using an ANOVA between respondents before and after the follow-up mailing and the results indicated no differences. We also conducted K-S two-sample tests to assess whether the mean and distribution of firm size (total number of employees), firm sales (total sales in EUR), family ownership (% of equity held by the family) and family generation (number of family generations since founding) were different for firms with completed and non-completed questionnaires. Analyses showed that sample selection bias is unlikely to confound our results (ρ firm size = 0.650; ρ firm sales = 0.760; ρ family ownership = 0.795; ρ firm age = 0.420). 44% of the firms had 250 employees or less, 13% had between 251 and 500 employees, and 43% had more than 500 employees; the average firm age is 95 years. In comparison to other studies on German family firms (Zellweger et al. 2012; Calabrò et al. 2016), the sample includes larger and older firms. One reason for these deviations may be that our sample is considerably larger than that in prior research, and our identification criteria follow a stricter family firm definition.

Variables

TMT Strategic Involvement

The measure of TMT strategic involvement was developed for the purpose of our study based on Judge and Zeithaml’s (1992) scale and Calabrò et al.’s (2013) and Santulli et al. (2010) suggestion to adapt it to family firm settings. Germany has a two-tier governance system with a strict separation between TMTs (management boards) and supervisory boards. We only addressed TMT members in our questionnaire and reworded the original scale according to the German specifics. Respondents were asked on a five-point Likert scale to assess the degree to which the TMT during the 2009-2013 period was (1) setting strategic objectives, (2) developing strategic options, (3) evaluating strategic options, (4) implementing corporate strategies, and (5) evaluating the implementation of strategy. The variable was computed as a mean of the five items. To validate this measure, we performed a principal component analysis. Results suggested that the items well replicated the overall construct (KMO = 0.830; ρ of Bartlett’s test = 0.000; AVE = 0.788), Cronbach’s Alpha was 0.931.

Organic growth priority

Previous research used secondary data to operationalize organic growth (Delmar, Davidsson, and Gartner 2003; Lockett et al. 2011), yet this approach looks at realized rather than prioritizing an organic growth mode. Accordingly, we measured organic growth priority with a dummy variable by asking the respondents whether they considered organic growth of high relevance for the firm. To establish the construct validity of this measure, we asked the respondents whether they considered growth via acquisitions and mergers of high relevance for the firm. Both variables showed a modest yet significant negative relationship (r = –0.094, ρ < 0.05), indicating that organic and acquisitive growth represent different growth modes.

Internal And Environmental Dynamism

Adopting the approach by Drnevich and Kriauciunas (2011) and comparable with Halevi, Carmeli, and Brueller (2015), we calculated asset dynamism (as a measure of internal dynamism) and profitability dynamism (as a measure of environmental dynamism) by asking the respondents to evaluate how the firm’s total assets/ profitability changed during the 2009-2013 period (Miller and Friesen 1983). Response options included: (1) shrinking significantly, (2) shrinking moderately, (3) about the same, (4) grew moderately, (5) grew significantly. We then calculated the measure for asset/ profitability dynamism by comparing the firm’s response with its industry average (Drnevich and Kriauciunas 2011; Milliken 1987).

Firm Growth

We used four items from Eddelston et al.’s (2013) scale to measure firm growth. Respondents were asked on a five-point Likert scale to which degree the firm currently (2013) grows much worse or much better than its competitors in terms of (1) sales, (2) market share, (3) number of employees, and (4) profitability. The variable was computed as a mean of the four items. Validity was tested through a principal component analysis that suggested a good reflection of the construct by the items (KMO = 0.753; ρ of Bartlett’s test = 0.000; AVE = 0.635), Cronbach’s Alpha was 0.795.

Control Variables

At the firm level, we controlled for the logarithm of firm size (total number of employees), the logarithm of firm age (number of years since founding), the familygeneration in charge (number of family generations since founding), and past employment growth, i.e. the extent to which the number of employees increased during the 2009-2013 period on a five-point Likert-scale (Kraiczy, Hack, and Kellermanns 2015), as these factors may influence growth (Eddleston et al. 2013). Logarithms were used due to the right-skewness of the variables. Considering the importance of industry on growth (Moreno and Casillas 2007) we further controlled for industry (1 = manufacturing; 0 = otherwise) to account for different levels of competitiveness in a firm’s environment (Delmar, Davidsson, and Gartner 2003). Family ownership (% of equity held by the controlling family) reflected on the association between family ownership and risk taking (Zahra 2005; Houssam and Navatte, 2014). At the CEO level, we controlled for CEO family origin (CEO being a family member vs. non-family member) and CEO tenure (number of years in the CEO position). These measures reflected on the CEO’s influence on strategic decision-making (Minichilli, Corbetta, and MacMillan 2010). At the TMT level, following previous research (Weinzimmer 1997; Zahra, Neubaum, and Larrañeta 2007; Chirico and Bau 2014), we controlled for family TMT ratio (number of family TMT members divided by the total number of TMT members) and the logarithm of TMT size (total number of TMT members). The logarithm was used due to the right-skewness of the variable.

Common Method Bias

As our variables were derived from survey measures, common method bias could cause spurious results. We accordingly applied procedural remedies to avoid a common method bias (Podsakoff et al. 2003). This included adjusting the questionnaire through the help of a panel of academics and practitioners, placing the variables of interest in different survey parts, guaranteeing confidentiality, and relying on clearly-worded operationalizations. Furthermore, we employed a regression-based marker technique (Siemsen, Roth, and Oliveira 2010) and estimated our models by including a marker variable that (1) was not correlated with our variables of interest (correlations ranged between r = –0.126 and r = 0.008), and (2) was likely to suffer from social desirability bias. We used an item capturing the extent to which the family firm’s goal is providing job and entrepreneurial opportunities for family members as our marker variable. Including this marker variable in our analyses did not confound the results, indicating that common method bias is not a severe problem.

Analysis and Results

We tested our hypotheses using hierarchical linear regression analysis with Huber/White heteroscedasticity-consistent standard errors. All variables involved in calculating the interaction terms were mean-centered to facilitate the interpretation (Aguinis, Gottfredson, and Wright 2011). None of the variance inflation factors (VIF) approached the commonly accepted threshold of 10. The highest VIF value (2.415) was acceptable; the average VIF in the full model was 1.455. The Breusch-Pagan/ Cook-Weisberg test (χ 2 (1) = 0.62, prob > χ 2 = 0.432) and the White test (χ2 (122) = 139.07, ρ = 0.138) signaled no heteroscedasticity problems.

A potential endogeneity problem was tested by utilizing an instrumental variable for TMT strategic involvement. We identified family economic goals as an instrument, measured by asking respondents on a five-point Likert scale to which extent maximizing profits is important for the firm. The item was mean-centered by the average response to this question in the firm’s industry. The instrument showed a significant positive correlation with TMT strategic involvement (r = 0.324, ρ < 0.01), but was not correlated with firm growth (r = 0.032, ρ > 0.10). The theoretical rational is that family firms differ in the degree to which they pursue economic goals, and this may affect how involved TMTs are in growth-related strategic decision-making, independent from actual growth (Eddleston et al. 2013). Using STATA’s IVREGRESS command, we calculated a two-stage least squares regression with Huber/White heteroscedasticity-consistent standard errors. The Wu-Hausman F test (F = 0.200, ρ = 0.655) and the Durbin-Wu-Hausman χ2 test (χ2 = 0.210, ρ = 0.647) were non-significant, indicating that our independent variable is exogenous and the OLS results are robust.

Results

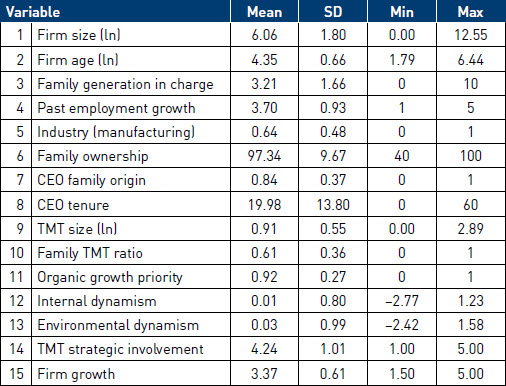

Table 1 provides the descriptives, and Table 2 the correlations for our variables. Table 3 presents the results of the analyses. Model 1 includes only the control variables. They remained insignificant throughout the analyses, with the exception of a positive effect of firm size and past employment growth on firm growth. This is in line with previous research in that larger and fast-growing firms have more resources for future growth investments (Casillas, Moreno, and Barbero 2010; Colombo et al. 2014).

Table 1

Descriptive statistics

Table 2

Correlations

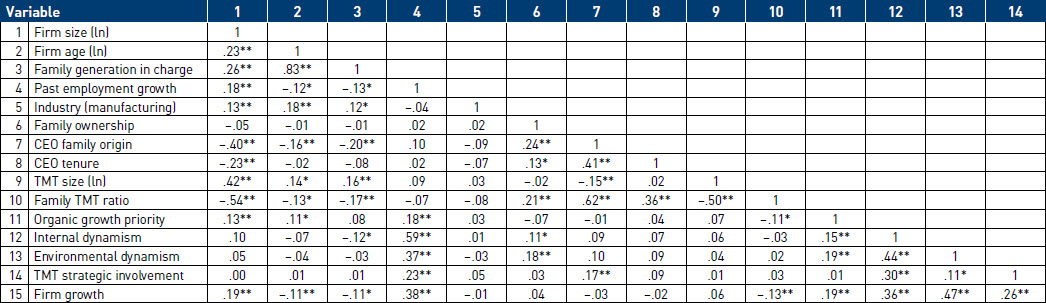

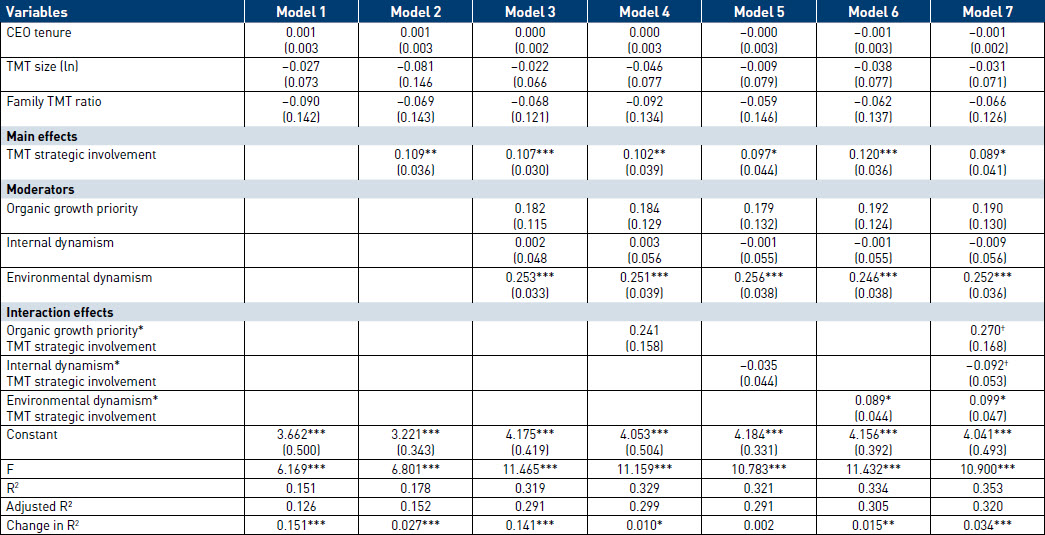

Table 3

Results of hierarchical regressions analysis on firm growth

Note: Unstandardized coefficients with heteroscedasticity-consistent standard errors in parentheses. N = 357.*** ρ < 0.001; ** ρ < 0.01; * ρ < 0.05; † < 0.10.

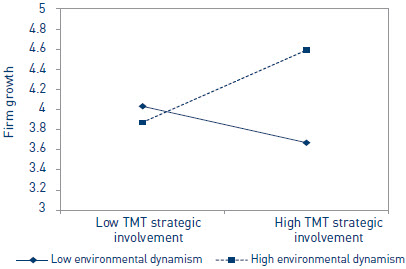

Hypothesis 1 predicts that TMT strategic involvement is positively related to firm growth. All models provide support for this suggestion. When entering TMT strategic involvement in Model 2, we observe a significant change in R2 (Δ R2 = 0.027, ρ < 0.001) and a significant positive effect of TMT strategic involvement on firm growth (β = 0.109; ρ < 0.01). TMT strategic involvement also remains a significant predictor when including the moderating variables (Model 3) and the interaction terms (Model 4-7), lending support to hypothesis 1. Hypothesis 2 suggests that prioritizing an organic growth mode would positively moderate the relationship between TMT strategic involvement and firm growth. The results in Model 4 (β = 0.241, ρ > 0.10) and Model 7 (β = 0.270, ρ < 0.10) provide marginal support for this hypothesis. Hypothesis 3 proposes that internal dynamism would positively moderate the relationship between TMT strategic involvement and firm growth. However, as shown in Model 5 (β = –0.035, ρ > 0.10) and Model 7 (β = –0.092, ρ < 0.10), the interaction term has a marginal negative relationship. Hence, hypothesis 3 is not supported. Hypothesis 4 suggests that the effect of TMT strategic involvement on firm growth will be stronger in contexts of high environmental dynamism. In line with the hypothesis, we find a significant interaction in Model 6 (β = 0.089, ρ < 0.05) and Model 7 (β = 0.099, ρ < 0.05).

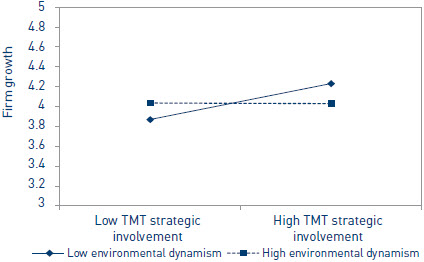

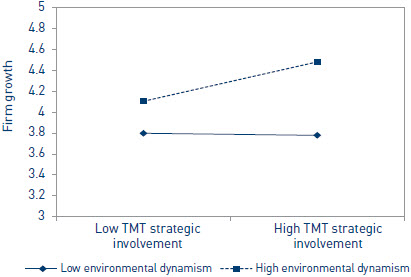

To ease the interpretation of the moderation effects, we plotted all interactions based on Model 7. Figure 2 shows the interaction between TMT strategic involvement and organic growth priority. In support of hypothesis 2, the plot suggests that firm growth is likely to result from highly involved TMTs when family firms prioritize organic growth. Figure 3 presents the interaction between TMT strategic involvement and internal dynamism. In contradiction to hypothesis 3, the plot shows that in highly dynamic internal contexts, there is a small but weak effect of highly involved TMTs on firm growth. However, when internal dynamism is low, higher levels of TMT strategic involvement leads to higher firm growth. Figure 4 underlines the support for hypothesis 4. In family firms with a high TMT strategic involvement, there is a positive relationship between environmental dynamism and firm growth.

Figure 2

Moderating effect of organic growth priority on the relationship between TMT strategic involvement and firm growth

Figure 3

Moderating effect of internal dynamism on the relationship between TMT strategic involvement and firm growth

Figure 4

Moderating effect of environmental dynamism on the relationship between TMT strategic involvement and firm growth

Discussion and Implications

Prior research on TMTs in family firms has predominantly relied on coarse proxies of TMT behavior (Minichilli, Corbetta, and MacMillan 2010; Sciascia, Mazzola, and Chirico 2013) and reports mixed results regarding their contributions for strategic decision-making (O’Boyle, Pollack, and Rutherford 2012). In this study, we contend that integrating a dynamic capabilities perspective into this line of thought adds knowledge to how TMT’s heterogeneous involvement across family firms shapes firm growth, and thereby also make a contribution to disentangle the mixed findings in previous research at the TMT-family firm growth interface (Zahra, Neubaum, and Larrañeta 2007; Colombo et al. 2014; Melin and Nordqvist 2007)

Our findings first underline that growth in family firms depends on the extent to which TMTs are involved in the strategic decision making process (O’Reilly and Tushman 2008; Teece 2007). Highly involved TMTs contribute to family firm growth due to their capacity to collect and synthesize information on growth-related opportunities, analyze multiple alternatives and their drawbacks, and evaluate decision consequences from a variety of perspectives. Our results thus confirm that TMT’s involvement in strategic decision-making can be considered an organizational routine through which the firm’s resource base is altered to generate new strategies (Eisenhardt and Martin 2000), and represents a mechanism to translate managerial traits into decision-making outcomes (Hinsz, Tindale, and Vollrath 1997). Previous research has focused on demographic TMT attributes, such as the number of TMT family members (Zahra, Neubaum, and Larrañeta 2007; Minichilli, Corbetta, and MacMillan 2010), although such attributes show little, if any, consistent relationship with strategic decision-making outcomes (O’Boyle, Pollack, and Rutherford 2012). Our focus on TMT’s actual involvement therefore adds to the sparse literature on processes among senior executives in regard to adapting a firm’s resources to its environment (Martin 2011; Kor and Mesko 2013; Salvato, Lassin, and Wiklund 2007). By investigating the impact of their involvement in strategic decision-making, we offer an intermediate step to explain how dynamic capabilities are translated in firm-level behavior, complementing previous research that focused on managerial collaborative behaviors and interactions (Martin 2011).

We further expected that the relationship between TMT strategic involvement and firm growth is likely to vary by context characteristics. In support of hypothesis 2, we find that highly involved TMTs are more capable to devote their scarce time and efforts to identify growth opportunities when there is a clear organic growth priority. We take this finding as a possible way through which TMTs help to overcome organizational rigidities that are typical results of an organic growth mode (Lockett et al. 2011; McKelvie and Wiklund 2010; Vermeulen and Barkema 2001). Consistent with the Penrosean logic that manager’s joint experience in combination with a proactive search for opportunities is an important means to attain growth (McKelvie and Wiklund 2010; Penrose 1959), prioritizing organic growth may create a clear, common understanding of strategic issues among TMT members that allows both efficiently accumulating and allocating resources to attain growth (Kellermanns et al. 2011). In turn, a priority for organic growth could sustain the strong emotional attachment of the owning family with the firm (Gomez-Mejia, Patel, and Zellweger 2015; Miller, Le Breton-Miller, and Lester 2010) and the desire to uphold a consistent image of the firm (Dyer and Whetten 2006).

In hypothesis 3 we theorized that high levels of TMT’s involvement in strategic decision-making circumvent the drawbacks from high internal dynamism (Kiefer 2005; Maltz, Souder, and Kumar 2001). Our findings yet indicate that growth is weakened from highly involved TMTs in such contexts. One potential explanation follows from the political perspective on strategic decision-making (Eisenhardt and Bourgeois 1988). Internal dynamism may create tensions within TMTs to compete for shrinking assets and increase rivalry among TMT members. In turn, increased TMT strategic involvement is more concerned with political maneuvering than with exploring growth opportunities. Our interpretation is consistent with prior research in that competing interests within family firm TMTs have a diminishing impact on growth (Colombo et al. 2014) and performance (Chirico and Bau 2014).

We further received support for our hypothesis 4 that the relationship between TMT strategic involvement and firm growth is moderated by environmental dynamism. High TMT strategic involvement is particularly beneficial for growth in dynamic environments, as such TMTs have more time for scanning information (Milliken 1987) and are less likely to suffer from a lack of information (Hmieleski and Ensley 2007). This finding is consistent with Teece et al. (1997) in that manager’s contribution to the strategic decision making process benefits from highly dynamic environments, and complements previous research that focused on the moderating role of environmental dynamism on the relationship between family TMT members and firm performance (Chirico and Bau 2014). Interestingly, we also observe a direct effect of environmental dynamism on growth regardless of TMT’s involvement. This is in line with Sciascia, Mazzola, and Chirico (2013), and indicates that family firms operating in dynamic environments are particularly able to profit from perceived changes in their environment by discovering, creating and exploiting growth opportunities.

Two important contributions emerge from our study. First, our research adds to the literature on TMTs in family firms by clarifying the effect of TMT strategic involvement. We show how TMT’s strategic involvement affects growth, and hence provide novel insights to previous studies that found mixed evidence regarding the effect of TMTs on family firm growth (Zahra, Neubaum, and Larrañeta 2007; Colombo et al. 2014). Second, we add some knowledge to the literature on contextual factors of TMT’s impact on strategic decision-making (Yamak, Nielsen, and Escribá-Esteve 2014; Bromiley and Rau 2016) by differentiating between firm’s internal (priority for an organic growth mode, internal dynamism) and external context determinants (environmental dynamism). Our results show that the effect of TMT strategic involvement on firm growth is likely to be altered by how differently senior executives perceive the firm’s internal and external environment, supporting and extending the suggestion that TMTs do not operate in a vacuum (Carpenter, Geletkanycz, and Sanders 2004). With respect to the family firm literature, we also provide empirical support to a recent suggestion that “industry characteristics, when coupled with firm-specific behaviors associated with family governance, can account for why some types of family businesses do well” (Le Breton-Miller and Miller 2015, 1350; Miller and Le Breton-Miller 2003).

Our findings have also implications for family owners. First, family owners must be aware that TMT composition attributes, such as a having family TMT members, may only be a conditioning rather than a determining factor to attain growth. Instead it is necessary to motivate TMT members to actively participate in setting strategic objectives, developing and evaluating strategic options, and implementing growth strategies. Second, family owners may benefit from clearly articulating their prioritized growth mode to TMTs. As highly involved TMTs are especially positive for firm growth when there is a strong priority for an organic growth mode, TMTs must be considered to be a valuable asset to deal with potential drawbacks from an organic growth mode. Finally, family owners should look out for the contextual conditions in which TMTs operate. This is important as the effect of TMT strategic involvement on firm growth differs according to dynamism in the firm’s internal and environmental context. Whereas family owners can profit from a highly involved TMT in context of high environmental dynamism, they should be more cautious in contexts of high internal dynamism.

Conclusion

This study draws attention to the context-driven impact of TMT strategic involvement on family firm growth. Most importantly, growth is facilitated by TMTs with a high involvement in the strategic decision making process in contexts of high priorities to an organic growth mode and high environmental dynamism, while –in contexts of high internal dynamism– growth is more likely to occur with a comparatively low TMT strategic involvement. In sum, our findings illustrate that the dynamic capabilities literature offers interesting insights for understanding family firm growth and the contributions of family firms TMTs in this regard.

Our study has some limitations that offer several future research routes. First, due to the limited availability of information in archival sources, it was difficult to obtain longitudinal data. We relied on a perceptual growth measure, following from the notion that such measures strongly correlate with objective performance data (Ling and Kellermanns 2010) and well captures the construct’s multidimensionality (Dess and Robinson 1984). We encourage scholars to verify our findings by using objective growth measures and employing a longitudinal research design. Second, our sample firms are mainly dominated by a family CEO. Although we do not find that this condition affects our model, it raises some interesting questions; for instance, how do TMTs and CEOs interact with each other to recognize growth potentials? Future studies should incorporate this aspect in a multi-level research design. Third, we limit our study to TMT’s strategic involvement as a determinant of how managers reconfigure a firm’s resource base to attain growth. Future research may investigate if other TMT factors such as human or social capital affect how TMTs react to changing environments. Forth, our data unfortunately do not allow differentiating between various industries and therefore cannot calculate objective measures for external dynamism. Future research may want to compare our questionnaire-based approach with more objective measure for the main constructs. In line with our study we encourage further studies on the dynamic capabilities of family firms which are few and represents a fruitful and interesting area of research.

Finally, the family firms studied are quite large and old. Given that growth is bounded to size contingencies (McKelvie and Wiklund 2010), further research should explore other rationales to explain growth patterns.

Parties annexes

Biographical notes

Mariateresa Torchia is Associate Professor of Management and Director of Research at the International University of Monaco. She holds a PhD in Management and Governance from the University of Rome “Tor Vergata”. Her main research interest is in the area of Corporate Governance, Family Business and Gender Diversity. She is currently chair of the Track Board of Directors and Top Management Teams at the European Academy of Management.

Andrea Calabrò is Director of the IPAG Entrepreneurship & Family Business Center and Professor of Family Business & Entrepreneurship at IPAG Business School, France. He is Global Academic Director of the STEP (Successful Transgenerational Entrepreneurship Practices) Project Global Consortium. He has published journal articles on family firms, internationalization, and corporate governance in leading international journals such as: Strategic Management Journal, Entrepreneurship Theory & Practice, Family Business Review, Harvard Business Review, and Journal of Business Ethics.

Axel Walther works for a Big Four accounting firm and specializes in governance advisory. He completed his Ph.D. at the University of Witten/Herdecke.

Bibliography

- Adner, Ron, and Constance E. Helfat. 2003. “Corporate effects and dynamic managerial capabilities.” Strategic Management Journal 24 (10): p. 1011-25.

- Aguinis, Herman, Ryan K. Gottfredson, and Thomas A. Wright. 2011. “Best‐practice recommendations for estimating interaction effects using meta‐analysis.” Journal of Organizational behavior 32 (8): p. 1033-43.

- Ambrosini, Véronique, and Cliff Bowman. 2009. “What are dynamic capabilities and are they a useful construct in strategic management?” International journal of management reviews 11 (1): p. 29-49.

- Amit, Raphael, and Paul J. H. Schoemaker. 1993. “Strategic assets and organizational rent.” Strategic Management Journal 14 (1): p. 33-46.

- Aragon-Correa, J. Alberto, and Sanjay Sharma. 2003. “A contingent resource-based view of proactive corporate environmental strategy.” Academy of Management Review 28 (1): p. 71-88.

- Barney, J. 1991. “Firm resources and sustained competitive advantage”. Journal of Management, 17(1): p. 99-120.

- Beck, Joseph B., and Margarethe F. Wiersema. 2013. “Executive decision making: Linking dynamic managerial capabilities to the resource portfolio and strategic outcomes.” Journal of Leadership & Organizational Studies 20 (4): p. 408-19.

- Boone, Christophe, and Walter Hendriks. 2009. “Top management team diversity and firm performance: Moderators of functional-background and locus-of-control diversity.” Management science 55 (2): p. 165-80.

- Bromiley, Philip, and Devaki Rau. 2016. “Social, behavioral, and cognitive influences on upper echelons during strategy Process: A literature review.” Journal of Management 42 (1): p. 174-202.

- Cadiou, Christian, Cadiou, Kristen, N’Goma Farrel. 2017. “Performance et défense de l’unité familiale: La valeur du capital émotionnel”. Management International 22(1): p. 87-99.

- Calabrò, Andrea, Giovanna Campopiano, Rodrigo Basco, and Thilo Pukall. 2016. “Governance structure and internationalization of family-controlled firms: The mediating role of international entrepreneurial orientation.” European Management Journal: in press, doi: 10.1016/j.emj.2016.04.007.

- Calabrò, Andrea, Giovanna Campopiano, and Rodrigo Basco. 2017 “Principal-principal conflicts and family firm growth: The moderating role of business family identity.” Journal of Family Business Management 7(3): p. 291-308.

- Calabrò, Andrea, and Donata Mussolino. 2013. “How do boards of directors contribute to family SME export intensity? The role of formal and informal governance mechanisms.” Journal of Management and Governance 7 (2): p. 363-403.

- Calabrò, Andrea, Mariateresa Torchia, Thilo Pukall, and Donata Mussolino. 2013. “The influence of ownership structure and board strategic involvement on international sales: The moderating effect of family involvement.” International Business Review 22 (3): p. 509-23.

- Cameron, Kim S., Myung U. Kim, and David A. Whetten. 1987. “Organizational effects of decline and turbulence.” Administrative Science Quarterly 32 (2): p. 222-40.

- Campopiano, Giovanna, Mara Brumana, Tommaso Minola, and Lucio Cassia. 2019. “Does Growth Represent Chimera or Bellerophon for a Family Business? The Role of Entrepreneurial Orientation and Family Influence Nuances.” European Management Review. In press

- Carpenter, Mason A., Marta A. Geletkanycz, and Wm Gerard Sanders. 2004. “Upper echelons research revisited: Antecedents, elements, and consequences of top management team composition.” Journal of Management 30 (6): p. 749-78.

- Casillas, Jose C., Ana M. Moreno, and Jose L. Barbero. 2010. “A configurational approach of the relationship between entrepreneurial orientation and growth of family firms.” Family Business Review 23 (1): p. 27-44.

- Chatterjee, Debabroto, Rajdeep Grewal, and Vallabh Sambamurthy. 2002. “Shaping up for e-commerce: Institutional enablers of the organizational assimilation of web technologies.” Mis Quarterly 26 (2): p. 65-89.

- Chirico, Francesco, and Massimo Bau. 2014. “Is the family an “asset” or “liability” for firm performance? The moderating role of environmental dynamism.” Journal of Small Business Management 52 (2): p. 210-25.

- Chirico, Francesco, and Mattias Nordqvist. 2010. “Dynamic capabilities and trans-generational value creation in family firms: The role of organizational culture.” International Small Business Journal 28 (5): p. 487-504.

- Chirico, Francesco, and Carlo Salvato. 2008. “Knowledge integration and dynamic organizational adaptation in family firms.” Family Business Review 21 (2): p. 169-81.

- Clark, Kevin D., and Patrick G. Maggitti. 2012. “TMT potency and strategic decision‐making in high technology firms.” Journal of Management studies 49 (7): p. 1168-93.

- Cyert, Richard M., and James G. March. 1963 “A behavioral theory of the firm.” Englewood Cliffs, 2: 4: p. 169-187.

- Coad, Alex, and Christina Guenther. 2014. “Processes of firm growth and diversification: Theory and evidence.” Small Business Economics 43 (4): p. 857-71.

- Colombo, Massimo G., Alfredo DeMassis, Evila Piva, Cristina Rossi‐Lamastra, and Mike Wright. 2014. “Sales and employment changes in entrepreneurial ventures with family ownership: Empirical evidence from high‐tech industries.” Journal of Small Business Management 52 (2): p. 226-45.

- Delmar, Frédéric, Per Davidsson, and William B. Gartner. 2003. “Arriving at the high-growth firm.” Journal of business venturing 18 (2): p. 189-216.

- Dess, Gregory G., and Richard B. Robinson. 1984. “Measuring organizational performance in the absence of objective measures: The case of the privately‐held firm and conglomerate business unit.” Strategic Management Journal 5 (3): p. 265-73.

- Drnevich, Paul L., and Aldas P. Kriauciunas. 2011. “Clarifying the conditions and limits of the contributions of ordinary and dynamic capabilities to relative firm performance.” Strategic Management Journal 32 (3): p. 254-79.

- Dyer, W. Gibb, and David A. Whetten. 2006. “Family firms and social responsibility: Preliminary evidence from the S&P 500.” Entrepreneurship Theory and Practice 30 (6): p. 785-802.

- Eddleston, Kimberly A., Franz W. Kellermanns, Steven W. Floyd, Victoria L. Crittenden, and William F. Crittenden. 2013. “Planning for growth: Life stage differences in family firms.” Entrepreneurship Theory and Practice 37 (5): p. 1177-202.

- Eisenhardt, Kathleen M. 1989. “Making fast strategic decisions in high-velocity environments.” Academy of Management Journal 32 (3): p. 543-76.

- Eisenhardt, Kathleen M., and L. Jay Bourgeois. 1988. “Politics of strategic decision making in high-velocity environments: Toward a midrange theory.” Academy of Management Journal 31 (4): p. 737-70.

- Eisenhardt, Kathleen M., and Jeffrey A. Martin. 2000. “Dynamic capabilities: What are they?” Strategic Management Journal 21 (10-11): p. 1105-21.

- Ensley, Michael D., and Allison W. Pearson. 2005. “An exploratory comparison of the behavioral dynamics of top management teams in family and nonfamily new ventures: Cohesion, conflict, potency, and consensus.” Entrepreneurship Theory and Practice 29 (3): p. 267-84.

- Gomez-Mejia, Luis R., Pankaj C. Patel, and Thomas M. Zellweger. 2015. “In the horns of the dilemma socioemotional wealth, financial wealth, and acquisitions in family firms.” Journal of Management: doi: 10.1177/0149206315614375.

- Habbershon, Timothy G., and Mary L. Williams. 1999. “A resource-based framework for assessing the strategic advantages of family firms.” Family Business Review 12(1): p. 1-25.

- Halevi, Meyrav Yitzhack, Abraham Carmeli, and Nir N. Brueller. 2015. “Ambidexterity in SBUs: TMT behavioral integration and environmental dynamism.” Human Resource Management 54 (S1): p. s223-s38.

- Hambrick, Donald C. 2007. “Upper Echelons Theory: An Update.” Academy of Management Review 32 (2): p. 334-43. doi: 10.5465/amr.2007.24345254.

- Hambrick, Donald C., and Phyllis A. Mason. 1984. “Upper Echelons: The Organization as a Reflection of Its Top Managers.” Academy of Management Review 9 (2): p. 193-206. doi: 10.5465/amr.1984.4277628.

- Harrison, David A., and Katherine J. Klein (2007) “What’s the difference? Diversity constructs as separation, variety, or disparity in organizations.” Academy of management review 32(4): p. 1199-1228.

- Helfat, Constance E, and Jeffrey A Martin. 2015. “Dynamic managerial capabilities: Review and assessment of managerial impact on strategic change.” Journal of Management 41 (5): p. 1281-312.

- Helfat, Constance E, and Margaret A Peteraf. 2003. “The dynamic resource‐based view: Capability lifecycles.” Strategic Management Journal 24 (10): p. 997-1010.

- Henderson, Rebecca. 1994. “Managing innovation in the information age.” Harvard Business Review 72 (1): p. 100-5.

- Hinsz, Verlin B., R. Scott Tindale, and David A. Vollrath. 1997. “The emerging conceptualization of groups as information processors.” Psychological bulletin 121 (1): p. 43-64.

- Hmieleski, Keith M., and Michael D. Ensley. 2007. “A contextual examination of new venture performance: Entrepreneur leadership behavior, top management team heterogeneity, and environmental dynamism.” Journal of Organizational behavior 28 (7): p. 865-89.

- Hough, Jill R., and Margaret A. White. 2003. “Environmental dynamism and strategic decision‐making rationality: An examination at the decision level.” Strategic Management Journal 24 (5): p. 481-9.

- Houssam Bouzgarrou and Patrick Navatte. 2014. “Family Firms and the Choice of Payment Method in

- Domestic and International Acquisitions”. Management International. 18(4): p. 107-124.

- Judge, William Q., and Carl P. Zeithaml. 1992. “Institutional and strategic choice perspectives on board involvement in the strategic decision process.” Academy of Management Journal 35 (4): p. 766-94.

- Kale, Prashant, and Harbir Singh. 2007. “Building firm capabilities through learning: The role of the alliance learning process in alliance capability and firm‐level alliance success.” Strategic Management Journal 28 (10): p. 981-1000.

- Kellermanns, Franz W., Kimberly A. Eddleston, Ravi Sarathy, and Fran Murphy. 2012. “Innovativeness in family firms: A family influence perspective.” Small Business Economics 38 (1): p. 85-101.

- Kellermanns, Franz W., Jorge Walter, Steven W. Floyd, Christoph Lechner, and John C. Shaw. 2011. “To agree or not to agree? A meta-analytical review of strategic consensus and organizational performance.” Journal of Business research 64 (2): p. 126-33.

- Kiefer, Tina. 2005. “Feeling bad: Antecedents and consequences of negative emotions in ongoing change.” Journal of Organizational behavior 26 (8): p. 875-97.

- König, Andreas, Nadine Kammerlander, and Albrecht Enders. 2013. “The family innovator’s dilemma: How family influence affects the adoption of discontinuous technologies by incumbent firms.” Academy of Management Review 38 (3): p. 418-41.

- Kor, Yasemin Y., and Andrea Mesko. 2013. “Dynamic managerial capabilities: Configuration and orchestration of top executives’ capabilities and the firm’s dominant logic.” Strategic Management Journal 34 (2): p. 233-44.

- Kraiczy, Nils D., Andreas Hack, and Franz W. Kellermanns. 2015. “The relationship between top management team innovation orientation and firm growth: The mediating role of firm innovativeness.” International Journal of Innovation Management 19 (1): p. 1-24.

- Kumar, Nirmalya, Louis W. Stern, and James C. Anderson. 1993. “Conducting interorganizational research using key informants.” Academy of Management Journal 36 (6): p. 1633-51.

- Kuvaas, Bård. 2002. “An exploration of two competing perspectives on informational contexts in top management strategic issue interpretation.” Journal of Management studies 39 (7): p. 977-1001.

- Le Breton-Miller, Isabelle, Danny Miller, and Richard H. Lester. 2011. “Stewardship or agency? A social embeddedness reconciliation of conduct and performance in public family businesses.” Organization Science 22 (3): p. 704-21.

- LeBreton‐Miller, Isabelle, and Danny Miller. 2015. “The arts and family business: Linking family business resources and performance to industry characteristics.” Entrepreneurship Theory and Practice 39 (6): p. 1349-70.

- Leal-Rodriguez, Antonio, Peris-Ortiz, Marta, and Leal-Millan, Antonio. 2017. “Fostering Entrepreneurship by Linking Organizational Unlearning and Innovation: The Moderating Role of Family Business”. Management International. 21 (2): p. 86-94.

- Ling, Yan, and Franz W. Kellermanns. 2010. “The Effects of Family Firm Specific Sources of TMT Diversity: The Moderating Role of Information Exchange Frequency.” Journal of Management Studies 47 (2): p. 322-44. doi: 10.1111/j.1467-6486.2009.00893.x.

- Lockett, Andy, Johan Wiklund, Per Davidsson, and Sourafel Girma. 2011. “Organic and acquisitive growth: Re‐examining, testing and extending Penrose’s growth theory.” Journal of Management studies 48 (1): p. 48-74.

- MacLean, Donald, Robert MacIntosh, and David Seidl. 2015. “Rethinking dynamic capabilities from a creative action perspective.” Strategic Organization 13 (4): p. 340-52.

- Maltz, Elliot, William E. Souder, and AjithKumar. 2001. “Influencing R&D/marketing integration and the use of market information by R&D managers: Intended and unintended effects of managerial actions.” Journal of Business research 52 (1): p. 69-82.

- March, James G. 1991. “Exploration and exploitation in organizational learning.” Organization Science 2 (1): p. 71-87.

- Martin, Jeffrey A. 2011. “Dynamic managerial capabilities and the multibusiness team: The role of episodic teams in executive leadership groups.” Organization Science 22 (1): p. 118-40.

- McKelvie, Alexander, and Johan Wiklund. 2010. “Advancing firm growth research: A focus on growth mode instead of growth rate.” Entrepreneurship Theory and Practice 34 (2): p. 261-88.

- Melin, Leif, and Mattias Nordqvist. 2007. “The reflexive dynamics of institutionalization: The case of the family business.” Strategic Organization 5 (3): p. 321-33.

- Miller, Danny, and Peter H. Friesen. 1983. “Strategy‐making and environment: The third link.” Strategic Management Journal 4 (3): p. 221-35.

- Miller, Danny, and Isabelle LeBreton-Miller. 2003. “Challenge versus advantage in family business.” Strategic Organization 1 (1): p. 127-34.

- Miller, Danny, and Isabelle LeBreton-Miller. 2006. “Priorities, practices and strategies in successful and failing family businesses: An elaboration and test of the configuration perspective.” Strategic Organization 4 (4): p. 379-407.

- Miller, Danny, Isabelle Le Breton‐Miller, and Richard H. Lester. 2010. “Family ownership and acquisition behavior in publicly‐traded companies.” Strategic Management Journal 31 (2): p. 201-23.

- Milliken, Frances J. 1987. “Three types of perceived uncertainty about the environment: State, effect, and response uncertainty.” Academy of Management Review 12 (1): p. 133-43.

- Minichilli, Alessandro, Guido Corbetta, and Ian C. MacMillan. 2010. “Top management teams in family‐controlled companies: ‘Familiness’, ‘faultlines’, and their impact on financial performance.” Journal of Management studies 47 (2): p. 205-22.

- Moreno, Ana M, and José C Casillas. 2007. “High-growth SMEs versus non-high-growth SMEs: a discriminant analysis.” Entrepreneurship and Regional Development 19 (1): p. 69-88.

- Nielsen, Sabina. 2009. “Why do top management teams look the way they do? A multilevel exploration of the antecedents of TMT heterogeneity.” Strategic Organization 7 (3): p. 277-305.

- O’Boyle, Ernest H., Jeffrey M. Pollack, and Matthew W. Rutherford. 2012. “Exploring the relation between family involvement and firms’ financial performance: A meta-analysis of main and moderator effects.” Journal of business venturing 27 (1): p. 1-18.

- O’Reilly, Charles A., and Michael L. Tushman. 2008. “Ambidexterity as a dynamic capability: Resolving the innovator’s dilemma.” Research in organizational behavior 28: p. 185-206.

- Patel, Pankaj C., and Danielle Cooper. 2014. “Structural Power Equality between Family and Non-Family TMT Members and the Performance of Family Firms.” Academy of Management Journal 57 (6): p. 1624-49. doi: 10.5465/amj.2012.0681.

- Penrose, Edith Tilton. 1959. The theory of the growth of the firm. Oxford: Blackwell.

- Podsakoff, Philip M., Scott B. MacKenzie, Jeong-Yeon Lee, and Nathan P. Podsakoff. 2003. “Common method biases in behavioral research: A critical review of the literature and recommended remedies.” Journal of Applied psychology 88 (5): p. 879-903.

- Reilly, Anne H., Jeanne M. Brett, and Linda K. Stroh. 1993. “The impact of corporate turbulence on: Managers’ attitudes.” Strategic Management Journal 14 (S1): p. 167-79.

- Salvato, Carlo. 2004. “Predictors of entrepreneurship in family firms.” Journal of Private Equity 7 (3): p. 68-76.

- Salvato, Carlo, Ugo Lassin, and Johan Wiklund. 2007. “Dynamics of external growth in SMEs: A process model of acquisition capabilities emergence.” Schmalenbach Business Review 59 (3): p. 282-305.

- Salvato, Carlo, and Leif Melin. 2008. “Creating value across generations in family‐controlled businesses: The role of family social capital.” Family Business Review 21 (3): p. 259-76.

- Samba, Codou, Daan VanKnippenberg, and C. Chet Miller. 2018 “The impact of strategic dissent on organizational outcomes: A meta‐analytic integration.” Strategic Management Journal 39(2): p. 379-402.

- Santulli, R., Torchia, M., Calabrò, A., and Gallucci, C. (2019). “Family ownership concentration and firm internationalization: p. integrating principal-principal and socioemotional wealth perspectives”. Journal of International Entrepreneurship, 17(2), 220-248.

- Schäffer, Utz, and Bianca Willauer. 2003. “Strategic planning as a learning process.” Schmalenbach Business Review 55 (2): 86-107.

- Sciascia, Salvatore, Pietro Mazzola, and Francesco Chirico. 2013. “Generational involvement in the top management team of family firms: p. Exploring nonlinear effects on entrepreneurial orientation.” Entrepreneurship Theory and Practice 37 (1): p. 69-85.

- Sharma, Sanjay. 2000. “Managerial interpretations and organizational context as predictors of corporate choice of environmental strategy.” Academy of Management Journal 43 (4): p. 681-97.

- Siemsen, Enno, Aleda Roth, and Pedro Oliveira. 2010. “Common method bias in regression models with linear, quadratic, and interaction effects.” Organizational research methods 13 (3): p. 456-76.

- Sirmon, David G., and Michael A. Hitt. 2009. “Contingencies within dynamic managerial capabilities: Interdependent effects of resource investment and deployment on firm performance.” Strategic Management Journal 30 (13): p. 1375-94.

- Teece, David J. 2007. “Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance.” Strategic Management Journal 28 (13): p. 1319-50.

- Teece, David J., Gary Pisano, and Amy Shuen. 1997. “Dynamic capabilities and strategic management.” Strategic Management Journal 18 (7): p. 509-33.

- Tushman, Michael L., and Lori Rosenkopf. 1996. “Executive succession, strategic reorientation and performance growth: A longitudinal study in the US cement industry.” Management science 42 (7): p. 939-53.

- Upton, Nancy, Elizabeth J. Teal, and Joe T. Felan. 2001. “Strategic and business planning practices of fast growth family firms.” Journal of Small Business Management 39 (1): p. 60-72.

- Van Gils, Anita, Wim Voordeckers, and Jeroen vandenHeuvel. 2004. “Environmental uncertainty and strategic behavior in Belgian family firms.” European Management Journal 22 (5): p. 588-95.

- Vermeulen, Freek, and Harry Barkema. 2001. “Learning through acquisitions.” Academy of Management Journal 44 (3): p. 457-76.

- Versailles, David W. and Foss, Nicolai J. 2019. “Unpacking the Constituents of Dynamic Capabilities: A Microfoundations Perspective”. Management International, 23(4): p. 18-20.

- Weinzimmer, Laurence G. 1997. “Top management team correlates of organizational growth in a small business context: A comparative study.” Journal of Small Business Management 35 (3): p. 1-9.

- Westhead, Paul, and Carole Howorth. 2007. “‘Types’ of private family firms: an exploratory conceptual and empirical analysis.” Entrepreneurship and Regional Development 19 (5): p. 405-31.

- Wiklund, Johan. 2007. “Small firm growth strategies.” In Entrepreneurship and growth: The engine of growth, edited by A. Zackarakis and S. Spinelli, 135-54. Westport: Praeger.

- Yamak, Sibel, Sabina Nielsen, and Alejandro Escribá-Esteve. 2014. “The role of external environment in upper echelons theory: A review of existing literature and future research directions.” Group & Organization Management 39 (1): p. 69-109.

- Zaheer, Akbar, Xavier Castañer, and David Souder. 2013. “Synergy sources, target autonomy, and integration in acquisitions.” Journal of Management 39 (3): p. 604-32.

- Zahra, Shaker A. 2005. “Entrepreneurial Risk Taking in Family Firms.” Family Business Review 18 (1): p. 23-40. doi: 10.1111/j.1741-6248.2005.00028.x.

- Zahra, Shaker A. 2010. “Harvesting family firms’ organizational social capital: A relational perspective.” Journal of Management studies 47 (2): p. 345-66.

- Zahra, Shaker A., Donald O. Neubaum, and Bárbara Larrañeta. 2007. “Knowledge sharing and technological capabilities: The moderating role of family involvement.” Journal of Business research 60 (10): p. 1070-9.

- Zellweger, Thomas M., Franz W. Kellermanns, James J. Chrisman, and Jess H. Chua. 2012. “Family control and family firm valuation by family CEOs: The importance of intentions for transgenerational control.” Organization Science 23 (3): p. 851-68.

Parties annexes

Notes biographiques

Mariateresa Torchia est Professeur Associé de Management et Co-Directrice de Recherche à l’Université Internationale de Monaco, Monaco. Elle est titulaire d’un doctorat en gestion et gouvernance de l’Université de Rome « Tor Vergata ». Ses principaux intérêts de recherche sont dans le domaine de la gouvernance d’entreprise, des entreprises familiales et de la diversité des genres. Elle est actuellement chair de la Track Corporate Boards and TMT de l’European Academy of Management.

Andrea Calabrò est directeur de l’IPAG Entrepreneurship & Family Business Center et professeur de Family Business & Entrepreneurship à l’IPAG Business School, France. Il est directeur académique du projet STEP (Successful Transgenerational Entrepreneurship Practices). Il a publié des articles sur les entreprises familiales, l’internationalisation et la gouvernance d’entreprise dans des top journals telles que : Strategic Management Journal, Entrepreneurship Theory & Practice, Family Business Review, Harvard Business Review et Journal of Business Ethics.

Axel Walther travaille pour un des Big Four entreprise d’audit financier, et il est spécialisé dans la « governance advisory ». Il a terminé son doctorat à l’Université de Witten /Herdecke.

Parties annexes

Notas biograficas

Mariateresa Torchia es profesora asociada de Gerencia y directora de investigacion en la International University of Monaco. Ella obtuvo su doctorado en gerencia y gobierno corporativo de la Universidad de Roma “Tor Vergata”. Su investigación es el area de gobierno corporativo, empresa familiar y diversidad de género. Actualmente, es presidenta del Track “Junta Directiva y de los Equipos de Alta Dirección” en la European Academy of Management.

Andrea Calabrò es director del IPAG Entrepreneurship & Family Business Center y profesor de empresa familiar y empredimiento en el IPAG Business School, Francia. El es director académico Consorcio Global del Proyecto STEP (Successful Transgenerational Entrepreneurship Practices). Ha publicado artículos sobre empresas familiares, internacionalización y gobierno corporativo en revistas internacionales como: Strategic Management Journal, Entrepreneurship Theory & Practice, Family Business Review, Harvard Business Review y Journal of Business Ethics.

Axel Walther trabaja para una firma de grandes firmas de consultoría y auditoría, llamadas en inglés Big Four. Él se especializa en asesoría en gobierno corporativo y obtuvo su doctorado en la Universidad Witten/Herdecke.

Liste des figures

Figure 1

Research framework

Figure 2

Moderating effect of organic growth priority on the relationship between TMT strategic involvement and firm growth

Figure 3

Moderating effect of internal dynamism on the relationship between TMT strategic involvement and firm growth

Figure 4

Moderating effect of environmental dynamism on the relationship between TMT strategic involvement and firm growth

Liste des tableaux

Table 1

Descriptive statistics

Table 2

Correlations

Table 3

Results of hierarchical regressions analysis on firm growth

10.7202/1053690ar

10.7202/1053690ar