Résumés

Abstract

We provide survey evidence on the use of derivatives for the management of foreign exchange risk among French non-financial firms. We focus particularly on the way firms might alter the size and the timing of the hedges, a practice called selective hedging. We rely on observations gathered between 2010 and 2015 via e-mail surveys and one-on-one interviews. The results show that French corporations are hedging more systematically than their foreign counterparts. Together, we observe that highly indebted and smaller firms tend to be more selective. We relate our findings to cultural differences and communication issues.

Keywords:

- Selective hedging,

- foreign exchange,

- risk management,

- survey

Résumé

Nous rapportons des résultats d'enquêtes sur l'utilisation des produits dérivés pour la gestion du risque de change par les entreprises françaises non financières. Nous nous intéressons, notamment, à l’aspect sélectif de la couverture lorsque les entreprises contrôlent le moment et la taille de la couverture. Nous nous appuyons sur des observations recueillies entre 2010 et 2015. Les résultats montrent que les sociétés françaises couvrent de manière plus systématique que leurs homologues étrangers. Nous constatons aussi que les entreprises les plus endettées et/ou de petite taille sont plus sélectives. Nous relions ces observations aux différences culturelles et aux besoins de communication.

Mots-clés :

- couverture sélective,

- taux de change,

- gestion du risque,

- enquête

Resumen

Presentamos resultados de encuestas sobre el uso de derivados para la gestión del riesgo de cambio en empresas francesas. Nos centramos en particular en el aspecto selectivo de la cobertura cuando las empresas controlan la duración y el tamaño de la cobertura. Nuestra muestra comprende observaciones recogidas entre 2010 y 2015. Los resultados muestran que las empresas cubren de manera más sistemática que sus contrapartes extranjeras. En conjunto, observamos que las empresas altamente endeudadas y las más pequeñas tienden a ser más selectivas. Relacionamos nuestras conclusiones con las diferencias culturales y las necesidades de comunicación según la empresa.

Palabras clave:

- cobertura selectiva,

- riesgo de cambio,

- encuestas

Corps de l’article

With globalization companies face a wide variety of risks, including market risks relating to interest rates, foreign exchange and commodities price fluctuations. One undeniable characteristic of the past decade is greater concern with the volatility of these prices and their possible significant effects on the profitability and the financial equilibrium of the firms. For instance, the fluctuation of exchange rates may have a significant impact on competitiveness. A well-known example is the European firm Airbus, whose base cost is in euros but which faces market prices in dollars. To manage these risks, finance practitioners use a wide variety of derivative instruments such as forwards, futures, swaps and options.

Since the mid-1980s, the questions as to why and how firms should hedge financial risks have been central to finance literature. Factors such as the credit quality of the firms, the way managers are compensated or the size of the firms have been found significant in determining firms’ hedging processes[1]. A companion question to these ones in the literature is the following: should firms condition the timing and the size of their hedging to reduce costs? Indeed, it seems natural that time-varying risk (volatility) might call for time-varying hedging ratios, especially lower volatility would call for lower hedging ratios. This point called selective hedging was first raised by Froot, Scharfstein and Stein (1993) and later by Stulz (1996) from a theoretical standpoint.

Using surveys, among other methods, Dolde (1993), Bodnar, Hayt and Marston (1998), Glaum (2002) and more recently Adam, Fernando and Salas (2015) confirm that a majority of firms use time-varying hedging ratios in their foreign exchange risk management process. However, the conclusions of these studies are sometimes contradictory, especially about the factors justifying the choice of a particular hedging process (systematic versus selective). This paper contributes to this literature in three steps: first we gather inside information from French corporations which yet and to the best of our knowledge have not been surveyed on this particular topic. This will add to our understanding on why and how non-financial firms hedge their foreign exchange risk using derivatives. This also gives us the opportunity to update some of the results of a preceding survey from 2002 (i.e. Mefteh, 2005) and of several surveys dating back to 1993 by the French Association of Corporate Treasurers (AFTE). Together, we put a particular emphasis on the factors that lead firms to adopt a selective hedging process as opposed to a more systematic one. Many studies have looked at the factors justifying whether firms are either hedgers or non-hedgers (i.e. Mefteh, 2005, for France). Also, many papers have looked at the impact of the hedging policy on the value or the stock return of the firm (i.e. Nguyen et al., 2007; Clark and Mefteh, 2010 or Ben Khediri and Folus, 2010 for French firms). In this paper, we look whether these factors may justify the choice of a particular hedging process (selective versus systematic). Especially, following Glaum (2002), we hypothesize that some factors could influence similarly both the decision to hedge or not and the way hedging is implemented. Finally, we raise evidences that tend to favor selective hedging versus pure systematic hedging.

For the empirical analyses, we rely on two surveys sent by e-mail (the first one sent in 2010 which received 211 answers and the second one sent in 2015, 152).These two surveys were anonymous which surely helped to collect inside information but narrows mechanically the scope of analysis. We override this limitation by studying a sub sample of 48 firms of which the corporate treasurer accepted one-on-one interviews. These interviews were conducted in 2012. The questionnaires used for the two surveys and the interviews were similar and the results we obtain are homogenous across the three samples, as we do not notice significant changes during the period.

Our results tend to indicate that French corporations are less selective than their peers in other countries when they hedge foreign exchange risk. We suggest to relate this observation to differences in risk perception and in culture toward risk across countries (e.g. Weber and Hsee, 1998) as well as a possible higher aversion to the so-called “social cost of risk” in France (e.g. Ramey and Ramey, 1995 and Vieider et al., 2015). Together, we find that smaller firms are inclined to be more selective which would tend to confirm an economy of scale argument[2] proposed by Smith and Stulz (1985). However, we think this argument is no longer sufficient in highly competitive markets as now the cost of using derivatives varies little with the size of the corporations. Rather, we pinpoint a cost of “communication” for the largest firms which are over scrutinized by the analysts.

Also, based on several logit regressions, we show that the subset of French non-financial firms which are highly indebted tends to be a more selective group than the others. This would support an agency-cost justification of the process. A higher cost of hedging related to a higher probability of default would make firms more selective when hedging.

All in all, our work suggests that the choice of a particular hedging process (selective versus systemactic) might be related to factors that also justify the decision to hedge or not. This suggests a continuum of hedging processes between firms which do not hedge at all and firms which systematically hedge 100% of their cash-flows. From a managerial point of view, this shows that the choice of a particular hedging process should be made with great care and conditional on the characteristics of the firm. We show also that selective hedging seems to be preferable to fully systematic hedging if one considers the models recently developed in the literature.

The remainder of this paper is presented as follows: in Section one, we survey the theoretical and empirical literature on firms’ usage of derivatives for hedging foreign exchange risk. In Section 2, we describe our methodology to gather and analyze the information. Especially, we detail the articulation between the results obtained via the questionnaire sent by e-mail and the one-on-one interviews. We report the empirical results of the surveys and the statistical analysis in Section 3. We also extract from the interviews quotations which illustrate our statistical findings. In Section 4, we compare our main results for French non-financial firms to results obtained earlier in other countries and regions. Finally, in Section 5, we analyze the implications of our findings, notably in terms of costs for French firms. We conclude in Section 6.

Theory and practice of risk management in corporations

Theoretical backgrounds

Since Modigliani and Miller (1958) we know that in perfect markets in which shareholders can diversify the risk away at no cost, firms cannot create value by hedging risks with derivatives. However, Smith and Stulz (1985) have shown that firms may have certain information advantages which together with market imperfections may justify hedging and in the end create value. For instance, Smith and Stulz (1985) show that hedging may reduce the variability of pre-tax income and therefore of total taxes. Also, they show that hedging may reduce the ex-ante risk of bankruptcy and therefore the final cost of managing bankruptcy events. In their model they expect smaller firms to be particularly watchful for this risk and to hedge more than the larger ones. However, the relationship between size and hedging is mixed as they also note that large firms may well profit from economy of scale when dealing with derivatives, which might increase the usage they make of them. Cooper and Melo (1999) complement their analysis by pointing out that the hedging contract issued by the counterparty (the bank) cannot ignore the default probability of the firm. Especially the cost of hedging may rise with the probability of default and may thus reduce the ability to hedge.

Smith and Stulz (1985) also show that risk averse managers receiving compensation based on the value of the firm may seek to hedge all the risk, creating possible conflicts with well diversified investors (agency costs).

Froot, Scharfstein and Stein (1993) criticize this proposition implying that the optimal strategy for a firm might be to be always fully hedged. This echoes the intuition of Stulz (1996) who considers that financially stronger firms may tailor the size and the timing of their hedging according to the market views of the risk manager in a bid to increase profit or to reduce costs (selective hedge). Notably, firms might generate positive profits on this activity when they exploit unique information from the market in which they are specialized.

Finaly, Rebelo (1995) and De Marzo and Duffie (1995) suggest that firms may be prone to hedging their financial risk because this may reduce the information asymmetry between them and their capital holders. Especially, publicizing their final risk exposure to both bondholders and shareholders may reduce agency problems (signaling).

More recent contributions can be found in Geczy et al. (2007) and Adam et al. (2007) but, as mentioned by Spano (2013), in the recent period, most of the efforts have been devoted to empirical research, most likely because testing the hypothesis proposed in the earlier literature implies first of all having access to data often unavailable from usual sources (database).

Literature review of existing international surveys

The studies on the use of derivatives by non-financial companies seem to have been initiated in the US when firms were required to expand their derivatives disclosure following the publication of the Statement of Financial Accounting Standards 119 in 1994. The seminal works are the well-known surveys of US non-financial firms of the Treasury Management Association (1996) and the two large-scale surveys conducted by the Wharton School: one in 1994 (e.g. Bodnar, Hayt, Marston and Smithson, 1995) and another carried out in 1995 by Bodnar, Hayt and Marston (1996). These first studies are in a descriptive-positivist vein as they provide some insight into the use of derivatives for risk management without really referring to the theoretical background described in the above section[3]. In the next two decades, these seminal works were replicated in many different countries across the world.

These papers share several findings. Notably, following Bodnar, Hayt and Marston (1998), they find that non-financial firms tend to use mainly basic Over The Counter (herein OTC) products, forward contracts being the most popular instruments[4]. This result has been confirmed recently by Bodnar et al. (2012) who survey and analyze the risk management goals, policies and perceptions of risk managers around the world. Also, Bodnar, Hayt and Marston (1998) find that the larger firms use derivatives instruments more often than smaller firms, especially when it comes to options. This is in line with the scale economy hypothesis[5] of Smith and Stulz (1985). For instance, they find that 83% of the largest firms hedge their foreign exchange risk using derivatives among which 44% use options. Inversely, only 45% of medium size firms hedge their risks. Together, and in line with the idea that firms aim at minimizing their probability of bankruptcy, their results show that the primary goal of hedging with derivatives is to minimize fluctuations in cash flows: 80% of the firms use derivatives to hedge operating cash flows whereas only 44% use derivatives to hedge their balance sheet (consolidation purposes).

Looking at the issue from a broader perspective, Servaes, Tamayo and Tufano (2009) conducted a global survey of over 300 Chief Financial Officers (herein CFO) of non-financial companies. For most corporate executives responding to their survey, the top benefit of risk management is to improve company-wide decision-making, with the ability to deliver more stable earnings and strengthen business reputation also being important.

Beyond these common observations, many papers point out differences in the hedging process between firms located in different countries. For instance, Bodnar and Gebhardt (1998) find that for almost half of the American companies (48.6%), the main reason for using derivatives is minimizing the variability of real cash flows, while, for a significant majority of the German firms (55.3%), the primary objective of hedging is to minimize the variability in accounting earnings. One may ask why the management of accounting earnings is considered as so important by financial managers. As a matter of fact, and from a pure financial theory point of view, only cash flows and firm value should matter. One explanation is to say that accounting earnings matter to managers because of their relevance to analysts’ perceptions and predictions of future earnings which affect the current market value of the firm, or because of their relevance in management compensation (e.g. Bodnar and Gebhardt, 1999). Concerning France, Mefteh (2005) reports that 56.7% of firms hedge the variability of real cash flows which makes them closer to their American peers.

Other international differences can be found in Alkebäck, Hagelin and Pramborg (2006) who find that Swedish firms tend to hedge, first of all, their balance sheet accounts. Also, the authors cannot confirm significant differences in the behavior of small and large firms. Together, Loderer and Pichler (2000) show that Swiss firms do not really quantify their exposure to risk while Bodnar, Consolandi, Gabbi and Dale (2008) suggest that Italian firms are less likely to use derivatives than US firms because primarily they look at avoiding “large losses from unexpected price movements/events (VaR)”. In their cases, reducing operating cash flow volatility only ranks as the third most important objective (20.9%).

Finally, most of the papers mention that a significant share of the firms uses their market views to alter the timing or the size of their hedge. For instance, in a survey of 244 firms, Dolde (1993) reported that 90% of firms, at least sometimes, based their hedge on their market views. This number is reported at 50% in Bodnar, Hayt and Marston (1998), 54% in Glaum (2002) and jumps to 68% in Loderer and Pichler, 2000. These observations are consistent with the selective hedging hypothesis as proposed by Stulz (1996).

All these studies have the advantage of producing data which are of interest for both finance practitioners and academics and unavailable elsewhere. They are particularly interesting because, often, they reveal differences across countries which are not yet fully justified by the theoretical framework which currently exists. One of the precise aims of this paper is to gather information about selective hedging practices by French firms which, to the best of our knowledge, have not been yet surveyed on this particular topic.

Sample and survey procedure

The opportunity for this research stems from the relationship of one of the co-authors with the AFTE, the French Association of Corporate Treasurers. With around 1350 members making it probably the largest national association of treasurers in the world, the AFTE represents the profession to market authorities and government bodies. The treasurer is the operational manager in charge of maintaining the corporation’s ability to face its financial commitments, especially in terms of liquidity. The treasurer is also responsible for implementing the hedging policy by buying and selling derivatives (via banks) on financial markets.

For the survey procedure, we have followed the method used by Brav, Graham, Harvey and Michaely (2005) who employed both an e-mail survey and one-on-one interviews so as to minimize biases and errors. First, in 2010, a questionnaire was sent to the members[6] of AFTE. We received 211 anonymous responses which gave rise to discussion and analysis. This motivated a second step in the research based on individual interviews[7]. Over the year 2012, we contacted 57 firms. These firms were not randomly chosen because we purposely attempted to obtain some cross-sectional differences in firm size. Thanks to the implication of the AFTE, the answer rate was very high for this step with 52 treasurers accepting the interview, enabling us to work in the end on a set of 48 usable interviews. This high rate of response insures against the non-response bias which is one limitation of survey-based research (e.g. Baker, Singleton and Veit, 2011). Also, these 48 interviews resulted in a saturation effect as defined by Glaser and Strauss (1967). Finally, our sample of 48 corporations spans a significant cross section of firm sizes. The list of companies whose treasurers agreed to participate is presented in Appendix 1.

We adopted a semi-structured approach for our interviews. Often used by scholars in management or strategy (Eisenhardt & Graebner, 2007; Kownatski & al. 2013), in-depth interviews are likely to help us to better identify the motivations and attitudes of the treasurers with respect to their decision-making process. Obtaining insider views is particularly important for the case of derivative use. Indeed, the information contained in financial reports often lacks details on this point which might impel the analyst to hazardous interpretation and/or hypothesis[8].

Much better than closed questions, a semi-open discussion also enables us to grasp the perceptions of the treasurers about the hedging policy they implement. Notably, the respondent’s answers can dictate the direction of the interview. The interviews usually lasted between a half-hour and an hour. They were conducted either face-to-face or over the phone. They were systematically recorded and transcribed before being coded and analyzed. Finally, in 2015, we sent again the survey by e-mail to check for possible time-varying behaviors. We received 152 answers.

The results obtained with the questionnaire sent by e-mail in 2010 or the one-on-one interviews are largely similar once corrected for sample differences (recall that the questionnaires used were similar). As a result, for the statistical analysis, the answers obtained during the interviews from the treasurers that had not participated[9] in the survey sent by e-mail were added (19 occurrences). The results obtained in 2015 are used for robustness tests only. Based on existing theoretical and empirical work about risk management, especially Servaes, Tamayo and Tufano (2009) and Bodnar, Giambona, Graham, Campbell and Marston (2012), we developed the following set of questions[10] for both the questionnaires and the interviews. Together, during the interviews we asked the respondents to comment and illustrate their answers.

First, we asked the respondents whether their corporation was exposed to foreign exchange risks. Only those who answered positively to this question had access to the following questions:

Q1: Do you or does someone in your corporation hedge foreign exchange risk?

Q2: Would you say that the way foreign exchange risk is hedged is systematic or selective[11]?

Q3: Which type of risk is hedged? Transaction risk and/or consolidation risk?

Q4: What do you hedge? Operational real cash flows, expected sales and purchases, earnings or future dividends, balance sheet accounts?

Q5: Which types of derivative instruments are used? Forward contract, vanilla options, complex options, structured products?

Q6: Is there a written hedging policy document?

Q7: Who has approved the hedging policy?

Q8: Do you or does someone in your corporation form capital market expectations before hedging any position?

Q9: Do you or does someone in your corporation rely on banks‘ forecasts, internal models, or external advisors to form market expectations?

Q10: Is the treasury department a profit center?

Empirical results

In this section, we provide a descriptive analysis of the statistical results we obtain for the questions 1 to 7 and 10. We blend the quantitative results with the qualitative ones.

These results add to our understanding on why and how non-financial firms hedge their foreign exchange risk using derivatives.

Our main conclusions are the following:

On average, in our sample, French corporations are systematic hedgers

Smaller firms tend to be more selective in their approach to hedging than larger ones

Highly indebted firms tend to be more selective, other financial factors being non-significant.

Firms of all sizes bear large hedging costs but do not measure the risk they hedge against effectively.

Systematic hedgers

French non-financial corporations are not profit maximizers in the foreign exchange market: only 9% of them consider the treasury department as a profit center. This is in line with the observation of Stulz (1996) who reported that only 7% of US firms treat their treasury function as a profit center. The firms aim mainly to hedge the risk arising from their international business transactions (exports – imports): “Our role here is to eliminate risk. Hence we hedge 100% of our transactions” (Interview 1)[12]. Together, they hedge the risk arising from international consolidation (i.e. dividend repatriation). But few speculate in the foreign exchange market either from a financial point of view or from an intellectual point of view: “We don’t have any speculative positions. When I see the volatility in some markets, I think it is better for us. We don’t have the people and the confidence necessary to forecast the currency market” (Interview 2).

As a consequence, although 87% of them use derivatives[13], they do so in a very systematic fashion (67%) as opposed to a selective one. Also, when firms declare hedging selectively, our interviews have enabled us to understand that they mostly describe a tactical postponing of the hedging for a very short period of time, i.e. a few days, which does not really concern the size of the hedge. This tends to indicate that they only try to anticipate daily market movements as opposed to medium-term change in the value of the currencies.

Together, for a large number of French firms (75%), the hedging policy is specified in a written document (i.e. the hedging policy statement), approved by the CFO or the top management. This would tend to confirm the results obtained by Lel (2012) who shows that firms with better governance tend to avoid speculation.

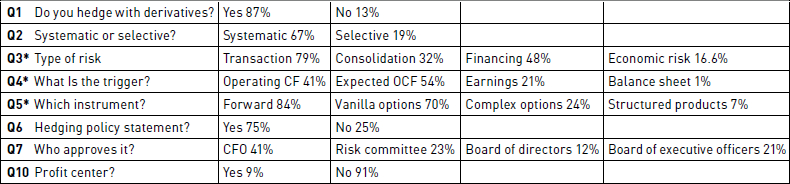

The hedging policy statement sets strict guidelines for hedging policy and the use of derivatives which in many cases forbids speculation. As reported in Table 1, the primary objective of hedging is to minimize the fluctuation in real cash flows which is consistent with the hypothesis that firms seek to reduce their probability of bankruptcy (e.g. Smith and Stulz, 1985).

Two main methodologies coexist:

many corporations (41%) hedge foreign exchange risk on a very regular basis (sometimes daily) on the back of the invoices received and issued (operating cash flows);

on the other hand, the majority (54%) hedge the expected operating cash flows. Amongst this group, 31% have set a rolling hedging program in which hedges are layered-in every period on the back of expected figures (often quarterly).

In our sample, a majority of treasurers use only simple OTC forward contracts and non-complex (vanilla) options to hedge foreign exchange risk. This is fully in line with the findings of the literature. However, during the interviews we understood that those treasurers hedging on the back of the invoices received and issued favor forwards over options. The opposite is true for those implementing layered programs. This is probably the case because the latter are hedging future transactions on which a residual uncertainty remains.

While a majority of the treasurers we met attempt to avoid speculation as already reported in this paper, we have to mention that some others consider the treasury department as a profit center. This is the case for 9% of the firms in our sample. These treasurers know they are a minority as stated by one of them: “We know we are different, clearly we have speculative positions but these are, we think, very well controlled, we have a matrix of risk combining macro risk, market risk and statistics.” (Interview 3).

As a confirmation of this observation, in our sample, only 7% of the treasurers use structured products[14] sold by the banks to optimize their cash management. Finally, we report no significant differences in the results of the survey made in 2015.

Small corporations tend to be more selective than larger ones

Now, we focus on the decision by the firms to implement a selective or systematic hedging policy. Interestingly, we find that the way corporations tend to deal with foreign exchange risk is dependent on the size of the corporation. Behavior differs significantly when we look at large corporations rather than medium size or small corporations. In Table 2, the results are reported based on the market classification of the company. This sorting enables us to suggest a possible link between the choice of a type of hedging process (systematic versus selective) and the way analysts scrutinize firms conditionally based on their market classification. We distinguished four types of respondents: those from the largest corporations which belong to the French CAC40, those from mid-size corporations belonging to the Mid100, those from small corporations in the Small90 and a separate category called NL for not-listed. We also produce the same results sorted on the total turnover of the firms as declared by the respondents in the questionnaire sent by e-mail[15].

Table 1

Hedging policy and the use of derivatives

Table 1 reports the frequency of answers for the 10 questions of our survey for the full sample of around 230 corporations. Starting from Q2, the total in each row may not equal 100% as, when necessary, only the answers of the hedgers (Q1) are reported. Also, the questions with an “*” allowed for multiple answers. The answers to Questions 8 and 9 are reported in Table 5.

We find that the frequency of the item “systematic” rather than “selective“ is significantly higher for the corporations which belong to the blue chip index CAC40. Indeed, only 3% of the treasurers working in these corporations follow a selective hedging policy. This number jumps to 24% on average in the other categories. Within our sample, this difference is significant as confirmed by a Fisher-Yates-Irwin test (p-value = 0.028). Conversely, there is no significant difference between the categories Mid100, Small90 and NL and the test does not reject the hypothesis of equal proportion between the three subsamples (p-value = 0.549). Also, we find that treasurers working in the firms belonging to the CAC40 tend to use vanilla derivatives, as opposed to complex derivatives, more often than their colleagues in the other categories. This is in line with the recent findings of Adam, Fernando and Salas (2015).

The size of the corporation has long been put forward as a factor of major importance in justifying hedging practices. For instance, in the case of France, Clark and Mefteh (2010) find a significant and positive relationship between the use of derivatives and the value of the firms, especially for larger firms. Also, Mefteh (2005b) and Nguyen et al. (2007) show that the decision whether to use derivatives is related, among other factors, to the size of corporations. Large corporations may be able to exploit scale economies when hedging their foreign exchange risks as first proposed by Smith and Stultz (1985). As a result, these firms would be in a better position to hedge more and more systematically. However, the scale economies argument, proposed in the mid-1980s, is no longer sufficient. Today, in highly competitive markets, the cost of using derivatives varies little with the size of the corporation both in terms of transaction costs and fixed costs of management. Also, when we look at the results sorted by total turnover (bottom table) or by global turnover (i.e. foreign currency sales over total sales, not reported), we see no difference between the categories[16].

Table 2

Breakdown of answers by category

Table 2 reports the frequency of answers for Questions 2, 5 and 10 for four categories of firms sorted by their market capitalization (above) and total turnover (below). The total in each row may not equal 100% as, when necessary, only the answers of the hedgers (Q1) are reported. Also, the questions with an “*” allowed for multiple answers.

Rather, we pinpoint the fact that firms belonging to the CAC40 are probably more exposed to financial communication issues because they are more closely scrutinized by analysts (Lang & Lundholm 1994, Yu 2008). The “cost” they may pay in case of bad signaling might be higher[17]. Hence, their CFOs and CEOs are probably more sensitive to the volatility induced by foreign exchange movements in financial results. As a consequence, the treasurers of these corporations internalize this sensitivity by modifying their behavior accordingly. In particular, they mainly try to use vanilla derivatives in a systematic fashion to qualify for the “hedge accounting” option of the IFRS norm (see Section 4).

In addition, in our sample, all the corporations that claim not to hedge their risk exposure –thus, which accept maintaining risk in their account- belong to the non-CAC40 types. Similarly, all the profit maximizers –which accept the addition of risk- but one fall into the three bottom categories. For instance, we heard from a Non-Listed corporation: “If we can boost financial income we are not reluctant to do it but there is certainly a risk” (Interview 4, NL type) while treasurers from large firms would rather say: “clearly, the top management is obsessed by the volatility of earnings, it is cultural here, I can’t add financial volatility” (Interview 5, CAC40 type).

Also, our findings related to the size of the corporations and their hedging process go against the bankruptcy hypothesis of Smith and Stulz (1985) for whom smaller firms, more exposed to bankruptcy risk, should hedge more and more systematically. Following our interviews, we believe the opposite. Being less scrutinized by the analysts and, for some, having a lower standard of governance, they tend to accept more risk exposure.

Finally, the results obtained from the 2015 survey largely confirmed these findings even though the larger firms seem to be a little bit more selective in their approach.

Other determinants of the hedging policy

To deepen our understanding of the factors justifying the choice of a particular hedging process, we focus now on the subsample of 48 corporations whose treasurers we met. The literature shows that several variables may influence this decision. Especially, firms with more leverage (e.g. Myers, 1977) and with high R&D spending (e.g. Froot, Scharfstein and Stein, 1993) should hedge more and more systematically. Inversely, firms which export more abroad (e.g. Geczy et al., 2007), which hold more cash and have a low level of liquidity (Quick ratio), should hedge less systematically (e.g Adam et al., 2007). Finally the effect of the size might be mixed as already mentioned (e.g. Smith and Stulz, 1985). Such variables are used, for instance, by Nguyen, Faff and Marshall (2007).

For this empirical work, the dependent variable called SYS is binary. It takes a value equal to 1 if the firm has adopted a systematic hedging policy and 0 otherwise (i.e., selective). The observations come from the answer to question 2 (Q2). For the independent variables, we use data from Worldscope available on Datastream. As the answers to the survey sent by email were anonymous, we can only rely on the sample of 48 interviews for this analysis. Also, as there is only data for the listed corporations, our final sample is limited to the 41 listed ones. The binary data has been collected in 2012. As to control for the information held by the treasurers at the time of the interviews, for the main results of this section, we use the financial ratios of 2011. However, as robustness tests, we have also estimated the regressions based on the financial ratios of 2012 and on their average value for 2011 and 2012. The results we obtain do not change our conclusions. We measure the size of the firms as the log of the book value of the total assets of the firm, denominated in millions of euros. The debt ratio is the ratio of the book value of long term debt to the total assets, the cash ratio is the ratio of cash to total assets, the Quick ratio is the ratio of the current assets to the current liabilities and we measure international exposure as the ratio of foreign currency sales over total sales. Table 3 reports the summary statistics of these variables.

Table 3

Summary characteristics of the firms in the sample

Table 3 reports summary statistics for the variables used for the empirical analysis. Size is the log of the book value of the total assets of the firm denominated in millions of euros. Debt ratio is the ratio of the book value of long term debt to the total assets, Cash ratio is the ratio of cash to total assets, Quick ratio is the ratio of the current assets to the current liabilities and Foreign sales is the ratio of foreign currency sales over total sales. We report the mean, the standard-deviation and the number N of observations for which the statistics are calculated.

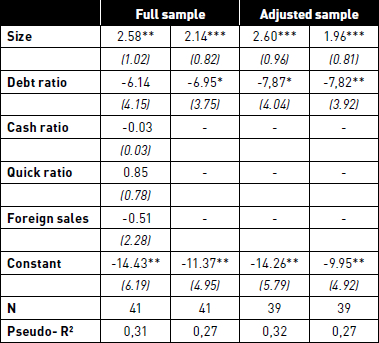

In Table 4, we report the results of the empirical analysis. We run several logistic regressions to estimate firms’ likelihood to adopt systematic hedging policies based on their characteristics. The results confirm the observation we made in the preceding section: the larger the firm, the higher the probability for the management to adopt a systematic hedging policy. Together, we find that highly indebted firms tend to be more selective when hedging[18]. This result goes against Myers (1977) and Glaum (2002) but echoes the work of Stulz (1996) and Cooper and Melo (1999) who pinpoint that firms with a higher probability of bankruptcy may hedge less due respectively to agency problems and higher hedging costs. These findings are also in line with Adam, Fernando and Salas (2015) and they complement those of Mefteh (2005b) and Nguyen et al. (2007) who both found size and leverage as key factors determinant of the intensity of derivatives usage. Although their signs are in line with expectations, all the other variables do not significantly justify the firms’ hedging policies[19].

Particularly, while the share of foreign sales may be a significant factor justifying the intensity of foreign derivatives (i.e. Nguyen, Faff and Marshall, 2007 and Capstaff, Marshall and Hutton, 2007), it has no impact, at least in our sample, on the selection of a particular hedging process. In a second step, we perform several robustness tests. Especially, we have adjusted the samples for possible outliers by removing the firms exhibiting the smallest and largest observations for a given variable. For instance, column 4 in Table 4 reports the results of the estimation when the largest and the smallest firms are removed from the panel. In column 5, we report the results when the firms with the lowest and highest Foreign sales ratios are removed. The results confirm the initial findings. However, the larger the number n of extreme observations we remove, the larger the pseudo-R² indicating that the relationships are particularly strong for intermediary firms. For instance, when n equals 3 for the Foreign sales ratios, the pseudo-R² reaches almost 50% (not reported). As already mentioned, we also estimated the relationship based upon the contemporaneous data (observed in 2012) but this does not change our conclusions. Finally, we estimated the regressions on randomly selected subsamples. The results were again similar even though the cash ratio sometimes became significant with the correct sign at the 10% level.

Table 4

The determinant of systematic hedging

Table 4 reports the results of the logit regression of the binary variable SYS on five variables. SYS takes a value of 1 if the firm has a systematic hedging policy and 0 otherwise (selective). Size is the log of the book value of the total assets of the firm denominated in millions of euros. Debt ratio is the ratio of the book value of long term debt to the total assets, Cash ratio is the ratio of cash to total assets, Quick ratio is the ratio of the current assets to the current liabilities and Foreign sales is the ratio of foreign currency sales over total sales. *, ** and *** indicate significance at respectively 10%, 5% and 1%. The standard-deviations are in brackets. We also report McFadden pseudo-R² and the sample size (N).

Of course, as the sample we have in hand is rather small, we do not want to overstate the significance of our findings.

International comparison

It is difficult to make international comparisons based on surveys because these are typically hampered by the lack of comparability in the design and questions. Also, the set of surveys we are using in this paper covers a period of almost 20 years meaning that the results should be read and compared with care as the economic circumstances and the institutional framework may have changed. Significantly, since 2005, European corporations must report the fair value of their derivative instruments in their earnings statement or balance sheet. This might have a certain impact on the usage of derivatives as shown by Zhang (2009). Nevertheless, in this section, we discuss similarities and differences between the main results of our study on French firms and prior surveys made in other countries notably in the US, UK and Germany. Since the industrial structure and corporate culture in these countries are different, we would expect some differences in the use of derivatives in foreign exchange risk management.

Foreign exchange risk hedging strategies and market view

Several surveys have shown that many non-financial companies make their hedging strategy contingent on their own view of the future development of FX rates. For instance, Loderer and Pichler (2000) find that 68% of the Swiss firms alter the size and the timing of the hedge. Also, more recently, Bodnar at al. (2012) find that 58% of US firms condition their hedging decision on their market view and that this number reaches 45% at a global level. This number was 54% for Glaum (2002) in Germany and El Masry (2003) in the UK. In France, the number is very low: many firms, especially the largest ones, tend to have a policy of hedging which is very systematic with few references to managers’ market views. Furthermore, from our interviews, we understand that when a market view is formulated, it is based often on some technical analysis and very short term concerns.

Also, in most countries, the willingness to actively manage the risk according to their market view tends to increase with the size of the firms (e.g. Dolde, 1993 and Glaum, 2002). We note that in France the pattern is different since the smallest firms seem to be the ones with the most selective behaviors. Again, we attribute this observation to the determination of the top management of the largest corporations to comply with the hedge accounting option offered by IAS39 and to avoid any volatility in earnings and/or cash flows.

All in all, it seems that French firms are, on average, much more conservative in their risk management than their foreign peers, notably in the UK and US. This behavior is difficult to understand since systematic hedging policies have a cost which could be reduced somewhat by conditioning the hedging decisions on market views. This difference cannot be related to the way French managers are compensated as they are not particularly paid in stocks of their own company (agency costs) nor this difference can be related to any particularity in terms of analysts’ scrutiny of French firms. Rather, we see here the impact of cultural differences about risk and risk perception as reported by Weber and Hsee (1998). Also, Bartram, Brown and Fehle (2009) mention this point for the case of derivatives usage. According to our observations, French firms would sense higher risks or would be particularly averse to risk: they seem to hedge more and more systematically than their peers. This mirrors the cross-section of accepted GDP growth volatility and the so-called “social cost of risk” in countries (see Ramey and Ramey, 1995 and Barro, 2009 among others).

Objectives and FX derivatives instruments

According to our results, French firms look at hedging primarily for their operational cash flows, whether it is expected or not. This finding is in line with the results obtained for the US and the UK by respectively Bodnar, Hayt and Marston (1998) and EL-Masry (2003). However, this is clearly different from what has been found for German or Italian firms. German firms tend to hedge earnings volatility (e.g. Bodnar and Gebhardt, 1998) while Italian firms would tend to use derivatives as pure insurance contracts protecting against extreme downside risk. Therefore, when it concerns the objective for hedging, French firms seem to be closer to the market-oriented position of their Anglosphere peers.

Looking at the preference of the firms for the type of derivative instruments, it seems that there is a consensus on the simplest ones across the world. Indeed, the financial markets offer a broad variety of derivatives instruments for FX management including “plain vanilla” instruments such as forwards, swaps or futures, OTC and exchange traded options and highly sophisticated structured derivatives. However, in line with the findings of surveys made earlier in other countries, we find that French firms often prefer the simplest ones: OTC currency forwards are by far the most important instruments that they use primarily to hedge their risk.

One argument explaining a preference for the simplest instruments at an international level, especially the forward-type ones, is the existence of the hedge accounting option under both the US GAAP and the IFRS accounting standards (IAS39 and soon IFRS9). Indeed, in both standards, derivatives instruments must be reported in the income statement at their fair value – i.e. their market value (mark-to-market) when available – or on the basis of a financial model (mark-to-model) in the case of illiquid markets. Throughout the life of the instrument, the variation of its fair value might generate a lot of volatility especially in the earnings. To limit this, the standard setters offer an alternative called “hedge accounting” which enables one to record, under strict conditions[20], the value of the derivatives instruments in the balance sheet, where their impact will be mitigated. Yet, the strict conditions under which an instrument qualifies for hedge accounting are far easier to meet with simple instruments rather than the most complex ones.

In line with the literature, we find that the larger firms are the ones using derivatives instruments most often. Also, in line with several papers except Alkeback, Hagelin and Pramborg (2006) for Swedish firms, we find that smaller firms tend to hedge less (i.e. Nguyen et al., 2007 for France). This favors the scale economies factor proposed by Smith and Stulz (1985). However, in the case of French firms, we find also that the smaller ones tend to use complex derivatives such as complex options or structured products (Table 2) more often than the larger ones. This is confirmed, again, by the results we obtained from the survey made in 2015. This observation weakens the usual conclusion favoring the economy of scale argument. Rather, we think it favors our point on communication issues (signaling). Large corporations, particularly scrutinized by analysts (e.g. Lang & Lundholm 1994, Yu 2008), would tend to avoid complex instruments because the latter can be difficult to qualify for hedge accounting under IAS39. Inversely, the aversion of the management of small firms to cash flow or earnings volatility resulting from hedging may be lower as they are less exposed to communication issues.

Finally, it is important to mention that if smaller firms tend to hedge less than the larger ones across the world, in France the difference between the two groups is less significant. For instance, Bodnar, Hayt and Marston (1998) report that only 45% of the medium size firms hedge their risks against 83% of the large ones. In France, these numbers are around 80% for the non-members of the CAC40 and 95% for its members whether we look at numbers gathered in 2010, 2012 or 2015. Again, we relate this to the difference of risk perception and culture toward risk.

The cost of systematic hedging

As a final part of our study, we look at the consequences of the adoption of systematic hedging policies by French firms. A direct consequence is that treasurers pay little attention to the risks they face. More specifically, they do not estimate the expected cash flow volatility related to market movements they hedge against: “The currency market is unpredictable, very clever people have failed to do it, I certainly do not claim to have any sort of ability to do it” (Interview 6). As already mentioned, when they do (22%) they often rely on short term expectations based on technical analysis. Similarly, only 26% declare using the forecasts produced by banks: “Banks are not very helpful, you know, in forecasting short-term and/or medium-term foreign exchange movements. Basically, they take the forwards and then that’s it. So it’s not a great help” (Interview 7). Finally the number of corporations relying on external advisors is very small, standing at only 12%. All in all, it seems that French firms are hedging a risk they do not know much about.

Table 5

Capital market expectations

Table 5 reports the frequency of answers for Questions 8 and 9 for the full sample. The total in each row may not equal 100% as, when necessary, only the answers of the hedgers (Q1) are reported. Also, the questions with an “*” allowed for multiple answers.

Yet, any hedging policy has a cost equal either to the interest rate differential for forward instruments or the premium for vanilla options. For instance, if we take the case of a French corporation exporting goods to Brazil in 2015, the cost of hedging 100% of the value of the transaction over a year was around 14% of the value of the real transaction, i.e. the equivalent of the differential of interest rates between the Eurozone and Brazil.

In this example, the cost of hedging might be somewhat reduced thanks to dynamic adjustments of the hedges. Indeed, we know that there exist significant differences of returns in the cross section of the currencies ranked by their time-varying yield, momentum or value (e.g. Burnside, 2012 and Asness, Moskowitz and Pedersen, 2013). For instance, in line with the results of these papers, exporters might lower the hedge ratios of high yielding currencies. Also, they might lower the hedge ratio of the currencies with positive momentum. Conversely, systematic hedging policies incur significant costs in protecting against risks that remain largely unquantified by the treasurers.

Finally, as mention in Section 1.1, one can find in the financial literature several reasons why systematic hedging might not be optimal.

Firstly, the theoretical results of the CAPM and the Fisher separation theorem imply that the firm’s hedging policy is irrelevant to shareholders’ investment decisions because shareholders can diversify the unsystematic risk away by holding portfolios of assets. As a result, firms could simply override the hedging step. Furthermore if, in imperfect markets, there remain many reasons to hedge, few if any justify doing it in a fully systematic fashion[20]. Especially, as long as hedging is costly, full hedging (100%) is not optimal because firms may want to reduce cash-flows and earnings volatility only up to the point where the cost of hedging equals the benefits, especially in term of the reduction of the cost of capital.

Secondly, the regret theory as developed by Bell (1982) and Loomes and Sugden (1982) says that agents who do not form market expectations, i.e. who think currencies follow a random path, should choose to hedge 50% of the amount of the transaction in preference to 100%. This is to avoid suffering unnecessarily high opportunity costs. Only if one has a strong view on the market, should one move away from the 50% hedge.

Within our sample of French corporations, reality did not follow this theory. If one respondent claimed to hedge a maximum of 50% of his position, most of his/her colleagues have hedging policies that command higher hedge ratios: “For us 80% is a floor below which we would not go but we could hedge 100% of our position” (Interview 8). “Usually we hedge 75% of our position” (Interview 9). “Being prudent, we hedge around 80% of the amounts of purchases and sales” (Interview 10).

Conclusion

In this paper, we present the results of surveys on derivatives usage in foreign exchange risk management by French non-financial firms made in 2010, 2012 and 2015. While firms from many countries have been surveyed in the last 20 years, to the best of our knowledge this is the first attempt concerning French firms. Surveys are important because they enable one to gather unique information about insiders’ view on risk management. We particularly study selective hedging as proposed by Stulz (1996). Indeed, French firms seem to be less selective than their international peers when hedging. We relate this finding to differences of culture toward risk and risk management across countries as proposed by Bartram et al. (2009) or Ramey and Ramey (1995). However, we also find that the smaller firms tend to be more selective and that together they use more often complex derivatives. This is in opposition with the current theoretical framework which suggests that due to the economy of scale large corporations should be the primary users of complex derivatives. We attribute this observation to the sensitivity of the larger firms to communication issues. Being less scrutinized by the analysts, smaller firms have more room for the use of complex derivatives. Also, we find that the subset of highly indebted firms lean towards being inversely more selective when hedging. This would tend to confirm the proposition of Stulz (1996) and Cooper and Melo (1999) who pinpoint that firms with a higher probability of bankruptcy may hedge less systematically due respectively to agency problems and higher hedging costs. Reassuringly, we would reach largely similar conclusions by working in each of the three samples separately. We do not find any significant differences whether we look at observation in 2010, 2012 or 2015[21].

We also show that firms share many common traits across the world. For instance, like their international peers, French non-financial firms prefer simple OTC instruments rather than more complex ones. Also, larger firms tend to hedge more than the smaller ones.

Finally, in term of managerial implication, our work reveal how firms could rely on the recent findings of the literature on financial risk management (e.g. Burnside, 2012 and Asness, Moskowitz and Pedersen, 2013 among others) to lower their average cost of hedging. Especially, they might control their cost of hedging by tailoring their positions on derivatives instruments on the back of the signals generated by these models of foreign exchange risks. Nonetheless, our results tend to show also that the choice of a particular hedging process should be made with great care and conditional on the characteristics of the firm.

Of course, the comparison of results at the international level is limited by the lack of homogeneity of the questions and the periods of observation which differ. This limit calls clearly for the need of a unique research survey that would cover a large number of countries at the same time. This looks like an interesting future project around which many academics, at least one in each targeted country, could gather quite easily.

Parties annexes

Appendix

Appendix 1. List of companies whose treasurers we met

ADP

Air France

Air Liquide

Akka

Alcatel-Lucent

Alstom

Alten

Angst-Pfister

ArcelorMittal

Arc-International

Ariane-espace

Auchan

Bic

Biomérieux

Boiron

Bourbon

Carrefour

Cegid

Comap

Danone

Dassault-Aviation

EDF

Eramet

GDF-Suez

Hermès

JC-Decaux

L’Occitane

L’Oréal

Mersen

Norbert-Dentressangle

Orange-France Telecom

Pernod-Ricard

Petzl

PPR

Rossignol

Saint-Gobain

Safran

Sanofi

SEB

Sodexo

Soitec

Somfy

STMicroelectronics

Tarkett

Total

Ubisoft

Veolia Environnement

Vivendi

Biographical notes

Michel Albouy is professor of finance at Grenoble Ecole de Management (GEM), France. Before joining GEM he was a professor at the University Grenoble Alpes. He has been a member of the scientific committee of the French Security Exchange Commission (AMF, 2004-2013). The broad area of his research is corporate finance. He holds a PhD from the University of Texas at Austin, USA, and has published some hundred articles in leading academic and professional finance and management journals and several books (Economica, France). He is on the editorial board of the Revue Française de Gestion and of Finance-Contrôle-Stratégie.

Philippe Dupuy joined Grenoble Ecole de Management in 2009 as associate professor of Finance. His research examines issues related foreign exchange risk management by both corporations and asset managers. He has published several papers in international academic journals and developed a Mooc about financial markets. Prior to joining Grenoble Ecole de Management, Philippe Dupuy worked for 13 years as an analyst and fund manager in international banks. Philippe received a PhD in Economics in 2003 from Paris IX Dauphine.

Notes

-

[1]

see Baker, Singleton and Veit, 201. and Spano, 201. for recent surveys on the literature about derivatives usage.

-

[2]

This observation could also indicate that, managers at smaller firms are financially less sophisticated than managers at larger firms (e.g. Graham and Harvey, 2001).

-

[3]

For prescriptive-normative papers based on theoretical motivations, see Dolde (1993. or Nance, Smith and Smithson (1993).

-

[4]

The recent attempts to regulate the foreign exchange market by forcing corporations to exchange only standardized (non-OTC) derivatives through Central Clearing Counterparties has been abandoned because corporations are very large users of OTC products which fits perfectly with their needs (See for instance EMIR FAQ, 2014).

-

[5]

The size of the corporation has long been put forward as a factor of major importance in justifying hedging practices: large corporations may be able to exploit scale economies to hedge their foreign exchange risks at lower costs. Nowadays however, the cost of using non-complex derivatives varies little with the size of corporation which tends to weaken this argument.

-

[6]

These are non-financial institutions only: treasurers working in the banking and insurance sector have their own association called the AFTB (Association Française des Trésoriers de Banque). This is in line with the literature which tends to study these sectors separately.

-

[7]

The questionnaire and the individual interviews were part of a larger research project including topics such as the impact of the IFRS norm on the use of derivatives and the possible impact of the evolution of trade settlement on the use of derivatives. For the questionnaire, we chose to rely on anonymous answers so as to increase the response rate.

-

[8]

For instance, the ratio of the notional value of the derivatives to total assets extracted from the financial accounts might be interpreted as a measure of the hedging ratio of the firm. However, without any indication about the average maturity of the contracts, hence on the roll-over policy of the firm and the direction of the trades which might well cancel out together, this proxy might be misleading.

-

[9]

During the interviews, we first ask the following question: have you participated to our survey sent in 2010?.

-

[10]

The initial survey has been tested on a small set of academics and treasurers and revised several times so as to maximize the response rate and minimize biases.

-

[11]

We defined selective hedging as the practice to alter the size and the timing of the hedges (e.g. Stulz, 1996).

-

[12]

In this paper we extract verbatim from 10 interviews among the 48 we have made. They are the most representative ones. These interviews have been ranked by order of appearance from 1 to 10.

-

[13]

This number was 80% in Mefteh (2005). Also, a very small number of respondents claim to use options only.

-

[14]

Accumulators or Target Redemption Forwards (TARF) for instance.

-

[15]

These data come from the declaration of the respondents. They might suffer from many approximations in terms of reference year, scope of activity, rounding. Also non-listed corporations may not use the IFRS standard. Therefore, one has to be careful when using these numbers.

-

[16]

In our subsample of 48 corporations, we can obtain a significant cross-sectional variance of the observations, by considering the firms with the largest turnover on one side and the firms with the lowest turnover on the other side. But, in this case, the sets differ little from the category CAC40 on one side and Small90 on the other.

-

[17]

For instance, Clarck and Mefteh (2010) find a significant and positive relationship between the use of derivatives and the value of the firms especially for the larger ones.

-

[18]

In the 2015 survey, we collected the debt ratio of the responding firms. The results we obtained confirm the observation. Especially, while 73.9% of the least indebted firms are systematic hedgers, this number falls to 47.4% for the most indebted ones.

-

[19]

We have also tested an R&D to sales ratio on a sub-sample of 28 firms for which data were available. Again, although the ratio has the correct sign (+), it is not significant.

-

[20]

This option is subject to conditions, including the demonstration that the hedging position is highly efficient. This efficiency is measured by a ratio that compares the change in the fair value of the hedging instrument with the value of the underlying hedged item.

-

[20]

See Froot, Scharfstein and Stein (1993) and De Marzo and Duffie (1995) for rationales to corporate hedging when the theoretical assumptions of the CAPM do not hold.

-

[21]

In 2015, firms look marginally more selective when hedging. This might be related to the increasing cost of hedging in the post 2008 crisis era, especially due to the use of credit support annex (csa), central repositories etc.

Bibliography

- Adam, T.; S., Dasgupta; S., Titman (2007). “Financial Constraints, Competition, and Hedging in Industry Equilibrium”, Journal of Finance, vol. 62, p. 2445-2473.

- Adam, T.; C., Fernando; J., Salas (2015). “Why Do Firms Engage in Selective Hedging? Evidence from the Gold Mining Industry”, Journal of Banking and Finance, forthcoming

- Association Française des Trésoriers d’Entreprise (AFTE). (1993, 1999, 2003, 2011, 2016). Surveys on Financial Derivatives usage. Cahiers Technique AFTE.

- Alkebäck, P. N.; B., Hagelin, Pramborg (2006). “Derivatives Usage by Non-Financial Firms in Sweden 1996 and 2003: What Has Changed?”, Managerial Finance, vol. 32, n° 2, p. 101-114.

- Asness, C.; T.J., Moskowitz; L. H., Pedersen (2013). “Value and Momentum Everywhere”, Journal of Finance, vol. 68, n° 3, p. 929-985.

- Baker, H.K.; J.C., Singleton; E.T., Veit (2011). “Survey Research in Corporate Finance: Bridging the Gap Between Theory and Practice”, Oxford University Press.

- Barro, J., R. (2009). “Rare disasters, Asset Prices, and Welfare Costs”, American Economic Review, vol 99, n° 1, p. 243-264.

- Bartram, S. M.; G.W., Brown; F.R., Fehle (2009). “International Evidence on Financial Derivative Usage”, Financial Management, vol. 38, p. 185-206.

- Brav, A.; J.R., Graham; C.R., Harvey; Roni Michaely (2005). “Payout Policy in the 21st Century”, Journal of Financial Economics, vol. 77, n° 3, p. 483-527.

- Bell, D. E. (1982). “Regret in Decision Making under Uncertainty”, Operations Research, vol. 30, p. 961-981.

- BenKhediri, K.; D., Folus (2010). “Does Hedging Increase Firm Value? Evidence from French Firms”, Applied Economic Letters, vol. 17, n° 10, p. 995-998.

- Bodnar; G.; G., Hayt; R. Marston; C., Smithson (1995). “Wharton Survey of Derivative Usage by U.S. Non-Financial firms”, Financial Management, vol. 24, n° 2, p. 104-114.

- Bodnar; G.; G., Hayt; R., Marston (1996). “1995 Wharton Survey of Derivative Usage by U.S. Non-Financial Firms”, Financial Management, vol. 25, n° 4, p. 113-133.

- Bodnar; G.; G., Hayt; R., Marston (1998). “Wharton 1998 Survey of Derivative Usage by U.S. Non-Financial Firms”, Financial Management, vol. 27, n° 4, p. 70-91.

- Bodnar; G.; Gebhardt (1999). “Derivatives Usage in Risk Management by US and German Nonfinancial firms: a Comparative Survey”, Journal of International Financial Management and Accounting, vol. 10, n° 3, p. 158-187.

- Bodnar, G.; C., Consolandi; G., Gabbi; A., Jaiswal-Dale (2008). “A Survey on Risk Management and Usage of Derivatives by Non-Financial Italian Firms”, CAREFIN Research paper n° 7/08, http://ssrn.com/abstract=1305033

- Bodnar, G.; E., Giambona; J., Graham; C., Harvey; R., Marston (2012). “Managing Risk Management”, March, AFA 2012 Chicago Meetings Paper, http://ssrn.com/abstract=1787144

- Burnside C. (2012). “Carry Trade and Risk”, in: James J., I.W. Marsh and Sarno L. Handbook of Exchange Rates, Wiley & Sons, Hoboken, New Jersey.

- Capstaff, K.; A., Marshall; J., Hutton (2007). “The introduction of the Euro and Derivatives Use in French Firms”, Journal of International Financial Management and Accounting, vol. 18, n° 1, p. 1-17.

- Clark, E.; S., Mefteh (2010). “Foreign Currency Derivatives Use, Firm Value and the Effect of the Exposure Profile: Evidence from France”, International Journal of Business, vol. 15, n° 2.

- Cooper, I. A.; A. S., Mello. (1999). “Corporate Hedging: The Relevance of Contract Specifications and Banking Relationships”, European Finance Review, vol. 2, p. 195-223.

- DeMarzo, D.; D., Duffie (1995). “Corporate Incentives for Hedging and Hedge Accounting”, Review of Financial Studies, vol. 8, p. 743-771.

- Dolde, W. (1993). “The Trajectory of Corporate Financial Risk Management”, Journal of Applied Corporate Finance, vol. 6, n° 3, p. 33-41.

- Eisenhardt, K. M.; M.E., Graebner (2007). “Theory Building from Cases: Opportunities and Challenges”, Academy of Management Journal, vol. 50, p. 25-32.

- El-Masry, A. (2003). “A Survey of Derivatives Use by UK Nonfinancial Companies”, Working Paper Manchester Business School 455-03, http://ssrn.com/abstract=397400.

- European Commission Technical Papers (2014). EMIR: Frequently Asked Questions.

- Froot, K.A.; D.S., Scharfstein; J.C., Stein (1993). “Risk Management: Coordinating Corporate Investment and Financing Policies”, Journal of Finance, vol. 48, p. 1629-1658.

- Glaser, B. G.; A.L., Strauss (1967). The Discovery of Grounded Theory, New York: Aldine de Gruyter.

- Glaum, M., (2002). “The Determinants of Selective Exchange Risk Management: Evidence from German Non-financial Corporations”, Journal of Applied Corporate Finance, vol. 14, n° 4, p. 108-121.

- Geczy, C.; B., Minton; C., Schrand (2007). “Taking a View: Corporate Speculation, Governance and Compensation”, Journal of Finance, vol. 62, p. 2405-2443.

- Graham, J. R.; R.H., Campbell (2011). “The Theory and Practice of Corporate finance: Evidence from the Field, Journal of Financial Economics, vol. 53, p. 43-71.

- Lang, M.H; R.J., Lundholm (1996). “Corporate Disclosure Policy and Analyst Behavior”, The Accounting Review, vol. 71, p. 467-492.

- Lel, U. (2012). “Currency Hedging and Corporate Governance: a Cross-Country Analysis”, Journal of Corporate Finance, vol. 18, p. 221-237.

- Loderer, C.; Karl Pichler (2000). “Firms: Do you know your Currency Risk Exposure? Survey Results”, Journal of Empirical Finance, vol. 7, p. 317-344.

- Loomes, G.; R., Sugden (1982). “Regret Theory: An Alternative Theory of Rational Choice under Uncertainty”, Economic Journal, vol. 92, p. 805-824.

- Mefteh, S. (2005). “Le comportement face aux risques financiers des entreprises cotées françaises: les résultats d’une enquête “, Revue du Financier, vol. 149-150, p. 46-58.

- Mefteh, S. (2005b). “L’utilisation des produits dérivés et les caractéristiques financières des entreprises: le cas français “, Banque et Marchés, vol. 76, p. 30-38.

- Modigliani F.; M. H., Miller (1958). “The Cost of Capital, Corporate Finance and the Theory of Investments”, American Economic Review, vol. 48, n° 3, p. 261-297.

- Myers, S. C. (1977). “The Determinants of Corporate Borrowing”, Journal of Financial Economics, vol. 5, p. 147-175.

- Nance D. R.; C. W., Smith; C. W., Smithson (1993). “On the Determinant of Corporate Hedging”, Journal of Finance, vol. 48, p. 267-284.

- Nguyen H.; R.W., Faff; A.P., Marshall (2007). “Exchange Rate Exposure, Foreign Currency Derivatives and the Introduction of the Euro: French Evidence”, International Review of Economics and Finance, vol. 16, p. 563-577.

- Ramey G.; V. A., Ramey (1995). “Cross-Country Evidence on the Link Between Volatility and Growth”, American Economic Review, vol. 85, n° 5, p. 1138-1151.

- Rebello, M. (1995). “Adverse Selection Costs and the Firms Financing and Insurance Decisions”, Journal of Financial Intermediation, vol. 4, p. 21-47.

- Servaes, H.; A., Tamayo; P., Tufano (2009). “The Theory and Practice of Corporate Risk Management”, Journal of Applied Corporate Finance, vol. 21, p. 60-78.

- Smith, C.W.;R., Stulz (1985). “The Determinants of Firms Hedging Policies”, Journal of Financial and Quantitative Analysis, vol. 20, p. 391-405.

- Spano, M. (2013). “Theoretical Explanations of Corporate Hedging”, International Journal of Business and Social Research, vol. 3, p. 84-102.

- Stulz, R. M. (1996). “Rethinking Risk Management”, Journal of Applied Corporate Finance, vol. 9, p. 8-24.

- Vieider F.M.; M., Lefebvre; R., Bouchouicha; T., Chmura; T., Hakimov; M., Krawczyk; P. Martinsson (2015). “Common Components of Risk and Uncertainty Attitudes Across Contexts and Domains: Evidence from 30 Countries”, Journal of the European Economic Association, vol. 13, n° 3, p. 421-452.

- Yu F. (2008), “Analyst Coverage and Earnings Management”, Journal of Financial Economics, vol. 88, p. 245-271.

- Weber E. U.; C., Hsee (1998). “Cross cultural differences in risk perception, but cross cultural similarities in attitude toward perceived risk”, Management Science, vol. 44, n° 9.

- Zhang H. (2009). “Effect of Derivative Accounting Rules on Corporate Risk-management Behavior”, Journal of Accounting and Economics, vol. 47, p. 244-264.

Parties annexes

Notes biographiques

Michel Albouy est professeur de finance à Grenoble Ecole de Management (GEM), France. Avant de rejoindre GEM il était professeur à l’Université Grenoble Alpes. Il a été membre du conseil scientifique de l’Autorité des marchés financiers (AMF, 2004-2013). Son champ de recherche est la finance d’entreprise. Il est titulaire d’un Ph.D. de l’Université du Texas à Austin, USA, et il a publié plus d’une centaine d’articles dans des revues académiques et professionnelles de finance et de management ainsi que plusieurs ouvrages (Economica, franc). Il est membre du comité éditorial de la Revue Française de Gestion et de la revue Finance-Contrôle-Stratégie.

Philippe Dupuy est professeur associé en Finance à Grenoble Ecole de Management depuis 2009. Il est titulaire d’un Doctorat en Sciences Économiques obtenu en 2003 à l’université Paris IX Dauphine. Ses recherches portent sur la gestion du risque de change par les entreprises et les gérants d’actifs. Philippe est l’auteur de plusieurs articles de recherche sur le sujet et d’un Mooc sur la finance de marché. Auparavant, Philippe Dupuy a travaillé pendant 13 ans comme analyste et gérant de portefeuille dans des banques internationales.

Parties annexes

Notas biograficas

Michel Albouy es profesor de Finanzas en Grenoble Ecole de Management (GEM) Francia. Antes de integrar GEM era profesor en la Universidad Grenoble Alpes. Ha sido miembro del consejo científico de la Autoridad de mercados financieros (AMF, 2004-2013). Su campo de investigación es la finanza de empresa. Es titular de un Ph.D de la Universidad de Texas en Austin, USA* y ha publicado más de un centenar de artículos en revistas académicas y profesionales de finanza y de gestión así como varias obras (Economica, France). Es miembro del comité editorial de la Revue Française de Gestion y de la revista Finance-Contrôle-Stratégie.

Philippe Dupuy es profesor asociado de Finanzas en Grenoble Ecole de Management desde 2009. Doctor en Economía desde 2003 (Universidad de París IX Dauphine), su investigación se centra en la gestión de riesgo de cambio para las empresas y los gestores de activos. Philippe es autor de varios trabajos de investigación sobre el tema y de un Mooc relativo a las finanzas de mercado. Con anterioridad Philippe Dupuy trabajó durante 13 años como gestor y analista de cartera, en bancos internacionales.

Liste des tableaux

Table 1

Hedging policy and the use of derivatives

Table 1 reports the frequency of answers for the 10 questions of our survey for the full sample of around 230 corporations. Starting from Q2, the total in each row may not equal 100% as, when necessary, only the answers of the hedgers (Q1) are reported. Also, the questions with an “*” allowed for multiple answers. The answers to Questions 8 and 9 are reported in Table 5.

Table 2

Breakdown of answers by category

Table 2 reports the frequency of answers for Questions 2, 5 and 10 for four categories of firms sorted by their market capitalization (above) and total turnover (below). The total in each row may not equal 100% as, when necessary, only the answers of the hedgers (Q1) are reported. Also, the questions with an “*” allowed for multiple answers.

Table 3

Summary characteristics of the firms in the sample

Table 3 reports summary statistics for the variables used for the empirical analysis. Size is the log of the book value of the total assets of the firm denominated in millions of euros. Debt ratio is the ratio of the book value of long term debt to the total assets, Cash ratio is the ratio of cash to total assets, Quick ratio is the ratio of the current assets to the current liabilities and Foreign sales is the ratio of foreign currency sales over total sales. We report the mean, the standard-deviation and the number N of observations for which the statistics are calculated.

Table 4

The determinant of systematic hedging

Table 4 reports the results of the logit regression of the binary variable SYS on five variables. SYS takes a value of 1 if the firm has a systematic hedging policy and 0 otherwise (selective). Size is the log of the book value of the total assets of the firm denominated in millions of euros. Debt ratio is the ratio of the book value of long term debt to the total assets, Cash ratio is the ratio of cash to total assets, Quick ratio is the ratio of the current assets to the current liabilities and Foreign sales is the ratio of foreign currency sales over total sales. *, ** and *** indicate significance at respectively 10%, 5% and 1%. The standard-deviations are in brackets. We also report McFadden pseudo-R² and the sample size (N).

Table 5

Capital market expectations