Résumés

Summary

We examine the relationship between union power and redistribution in Canada’s ten provinces between 1986 and 2014. Subnational jurisdictions are thus the focus of research questions that have previously been addressed at the international level. Multilevel models with time-series cross-sectional data are used to estimate the long-term association between union density and redistribution through provincial transfer payments and income taxes. We found that higher union density correlates with considerably more redistribution over the long term but not over the short term. This finding is confirmed by three distinct measures of inequality and poverty reduction, an indication that it is quite robust. The association is significant for the entire study period and for its second half. This finding is consistent with power resource theory in its original form, but not with more recent work in that area or with comparative political economy scholarship, which generally now neglects or downplays the impact of organized labour on social and economic policy outcomes. Our findings suggest a need to re-assess the diminished interest of recent researchers in the political influence of organized labour. It will also interest scholars in other countries where tax and transfer systems are decentralized, and where the impact of organized labour on such measures has been understudied at the subnational level. Additionally, we show that unionized voters in Canada are more favourably disposed than their non-unionized counterparts toward redistribution and toward pro-redistribution political parties. Unions may consequently affect redistribution in part by socializing their members to favour it. This possibility is advanced with preliminary data in this paper. We argue that further scholarly attention is both required and deserved on this subject in Canada and elsewhere.

Keywords:

- Inequality and poverty reduction,

- Subnational jurisdictions,

- Organized labour and social equity,

- Power resource theory,

- Time-series cross-sectional analysis

Résumé

Cette étude porte sur la relation entre le pouvoir syndical et la redistribution des revenus dans les provinces canadiennes. En contribuant à la littérature sur l’inégalité, déjà abondante, elle met en évidence le rôle important du syndicalisme dans la réduction des inégalités à long terme. Ce constat, conforme à la théorie des ressources de pouvoir dans sa forme originale, intéressera les étudiants en relations industrielles qui s’intéressent au rôle du syndicalisme dans la promotion de l’équité sociale. Par rapport à la recherche en politique sociale, cette étude innove en soulignant le rôle des acteurs infranationaux dans la réduction ou le maintien de l’inégalité, car les études antérieures se limitaient presque exclusivement au niveau national. De plus, elle démontre qu’au Canada la redistribution, ainsi que les partis politiques la prônant, gagne plus de soutien électoral chez les syndiqués que chez les non-syndiqués. Il se peut, donc, que les syndicats influencent la redistribution, en partie par une socialisation redistributionniste de leurs membres. Cette possibilité mérite une plus grande attention de la part des chercheurs.

Précis

Cette étude porte sur la relation entre le pouvoir syndical et la redistribution dans les dix provinces du Canada entre 1986 et 2014. Ces juridictions infranationales font alors l’objet des questions de recherche qui se posaient antérieurement au niveau international. Afin d’évaluer la relation à long terme entre le taux de syndicalisation et la redistribution via les transferts provinciaux et l’impôt sur le revenu, nous utilisons des modèles multiniveaux reposant sur des données transversales de séries chronologiques. Il en ressort une forte corrélation entre le taux de syndicalisation et la redistribution à long terme, mais pas celle à court terme. Ce résultat est confirmé par trois mesures distinctes de l’inégalité et de la réduction de la pauvreté, ce qui indique une corrélation robuste. Cette dernière est significative dans toute la période étudiée, prise collectivement, et dans la deuxième moitié de cette période, prise séparément. La relation syndicalisme-redistribution appuie la théorie des ressources de pouvoir, dans sa forme originale, mais pas les travaux récents s’inspirant de cette perspective, ni les études récentes de l’économie politique comparée; en général, ces dernières négligent ou minimisent l’impact du syndicalisme sur l’élaboration des politiques sociales et économiques. Il faudrait donc réévaluer la baisse d’intérêt des chercheurs récents pour l’influence politique du syndicalisme. De plus, ces résultats intéresseraient les chercheurs des pays où le système fiscal et de transfert est décentralisé et où l’impact du syndicalisme sur la redistribution demeure sous-étudié au niveau infranational. Enfin, nous démontrons que les syndiqués canadiens, comparés à leurs homologues non-syndiqués, soutiennent davantage la redistribution et les partis politiques la prônant. Il se peut, donc, que les syndicats influencent la redistribution, en partie par une socialisation redistributionniste de leurs membres. Cette possibilité, qui repose ici sur des données préliminaires, mérite et exige une plus grande attention de la part des chercheurs au Canada et ailleurs.

Mots-clés:

- inégalité et réduction de la pauvreté,

- juridictions infranationales,

- syndicalisme et équité sociale,

- théorie des ressources de pouvoir,

- analyse transversale de séries chronologiques

Corps de l’article

This article addresses the existence of a long-term relationship between union density and redistribution in Canada’s provinces. It makes three contributions to extant scholarship. First, it adds to research on a subject now of pervasive concern to scholars and the general public: the sharp rise in income inequality since the 1980s. The global extent of this increase, and its origins, has been studied prominently by Piketty (2014), Stiglitz (2013) and Milanovic (2007). In Canada, this subject has been addressed in collective works edited by Banting and Myles (2013) and Green and Kesselman (2006).

For some observers, the widespread rise in inequality has been caused by structural changes that are affecting all countries and which national and subnational governments can do little about. The most commonly cited changes are globalization and post-industrialism. For other observers, inequality is instead—or, more plausibly, additionally—shaped by institutions and interests that vary considerably among countries and which are more susceptible to conscious change by domestic political and social agents (Van Kersbergen and Vis 2014).

The present study is informed by Power Resource (PR) theory (Korpi 1980, Esping-Andersen 1990). This approach posits that inequality and poverty are attenuated to considerably different degrees in different capitalist democracies; these divergences reflect variations in the balance of power between the political left and right. PR theory is therefore related to the second, agency-based current of thought described above. Scholarship in this vein nevertheless must also address the degree to which the above structural changes constrain the ability of governments to limit rising inequality and poverty, and this is done here.

PR theory initially contended that organized labour and left-wing parties play a prominent role in promoting income redistribution over the long term. Yet recent PR scholarship, discussed below, focuses much more on parties than on unions. This issue will be revisited here to determine whether the impact of organized labour on redistribution should receive renewed attention. This study will therefore test the value of an agency-based perspective, in supplement to structural perspectives, by asking whether organized labour plays a vital role in determining the degree to which the now much-discussed rise in inequality can be attenuated by government, a neglected possibility in recent Canadian and international research.

The present study will also interest industrial relations scholars with a broad concern for the current potential of organized labour to enhance equality and social equity, an evident focus of many recent contributions to this journal. For instance, Yu (2014) documented the varied outcomes of local-level efforts to organize low-skilled service workers in American cities. Dupuis (2020) tracked the similarly diverse outcomes of union campaigns to revitalize in the face of corporate restructuring in Canada and France. Casperesz and Barrett (2020) underlined the potential of social campaigns to strengthen unions in Australia. Scrimger (2020) traced the changes in the impact of organized labour on market inequality in Canada’s provinces. The present study complements Scrimger’s by investigating the impact of organized labour on province-level redistribution, to determine how much the market inequality that Scrimger examined is reduced by the influence of organized labour on government redistribution.

Thirdly, the present study will look at redistribution on a smaller scale. Subnational governments have received limited attention in academic investigations into the correlates of inequality reduction by government. By pointing to the vital role of provinces in determining redistribution in Canada, this study will highlight a gap in extant work on the subject. Nation-states perform most redistribution in developed countries (Van Kersbergen and Vis, 2014). In Canada, however, the provinces are responsible for most areas of social policy. They also possess greater fiscal resources than do subnational jurisdictions in most other developed democracies. Redistribution by provincial governments is substantial in Canada, and highly variable among them. International research has shown what is widely agreed to be a high level of variation in the redistribution of income by developed countries (Van Kersbergen and Vis 2014). Haddow (2014, 2015) shows that Canada’s provinces also redistribute extensively, and that interprovincial variations in inequality and poverty reduction are comparable to international differences. Accordingly, Canada represents a propitious case for testing whether the politics of redistribution, long compared between countries, can also be examined at the subnational level. The findings reported here suggest that it should be.

Drawing on the PR theoretical literature referred to above and reviewed in the next section, I will test two hypotheses: (i) income redistribution is positively associated with union density. In line with PR theory, (ii) the association is significant over the long term but not over the short term. The evidence I will present below strongly supports both hypotheses. Redistribution does strongly correlate with long-term interprovincial differences in union density and very weakly with short-term variations. This is true for three separate measures of inequality and poverty reduction: the Gini coefficient, the P10/P50 ratio and the low-income measure (LIM), the main measure of poverty in Canada. Moreover, this association is significant for the 29-year period from 1986 to 2014, as well as for the second half of that period (from 2000 to 2014).

I will next review relevant extant scholarship. The subsequent sections will cover methodology, data and results. Having established an association between union power and income redistribution, I will then address the question of what mediates this link. The penultimate section will show that views on redistribution and party preferences differ between union members and non-members. The difference may arise because unions socialize their members to favour redistribution and support likeminded parties. This possibility will be put forward in an exploratory way here and will require further research to be substantiated. If confirmed, an important causal relationship would be identified between union strength and inequality reduction. This paper will present firm evidence that the association between unions and redistribution is a very powerful one; future work is needed to confirm that union socialization causes the association. I will conclude by summarizing and suggesting avenues for future research.

Organized Labour, Power Resources and Redistribution

Two features of extant research are addressed in this section: (i) why PR theory predicts a long-term association between the power of left-wing parties and unions, on the one hand, and income redistribution, on the other; and (ii) how recent PR scholarship nevertheless de-emphasizes unions, in line with a broader trend in comparative political economy research.

Power Resources and Redistribution: Scholars documented in the 1980s and 1990s that stronger labour movements are associated with less wage inequality across industrial societies. (Ahlquist 2017). Power Resource (PR) theory extended this analysis to redistribution by government, arguing that unions also promote inequality reduction via taxes and transfers. PR is an internationally prominent approach to the study of welfare states that stresses the importance of the balance of power between propertied and non-propertied economic interests. This approach was most prominently articulated by Walter Korpi (1980) and Gösta Esping-Andersen (1985, 1990).

PR theory underscores the importance of a desire for social security and solidarity among non-propertied interests in mature welfare states. For Esping-Andersen, “[s]ocial policy … becomes an arena for the accumulation of working-class power resources; the overriding principle is to substitute market exchange with social distribution and property rights with social rights… For the individual, the issue is primarily one of securing adequate means of sustenance that are independent of market chances. For the labour movement, the strength and solidarity of the collectivity depend on its capacity to provide workers with an acceptable exit from the cash nexus” (1985: 228). Korpi similarly points to the desire of unions and left-wing parties “to mobilize the dependent labour force for broadly based collective action reflecting their shared position on the labour market as wage and salary earners” (2001: 251). Unionized workers depend on employment to secure a livelihood; this dependence motivates unions and their members to support redistribution.

According to Korpi (1980), welfare states reflect the balance of power between workers and employers. In a process that social scientists now term “path dependent” (Pierson 1996), welfare state programs, once established, will feed back into the underlying power balance, thus reinforcing it. Outcomes are affected by the policy regime in place, as well as by ongoing conflict between labour and capital. If a mature welfare state is encompassing and equality-enhancing, the working class has a stronger foundation for the exercise of its power; if not, the left’s egalitarian goals face a persistent institutional obstacle in addition to continuing resistance from opposing class interests. In a mature welfare state, the balance of power is consequently effective mostly over the long term (see also Esping-Andersen 1990, Huber and Stephens 2000). A shift of government from right to left, or a temporary increase in union density, may not affect redistribution; the effect will happen only if the changes endure. PR theorists have not, to my knowledge, ever precisely defined the number of years during which power must be exercised for the effect to be deemed “long-term,” and not “short-term.” But we can infer an answer from their research. Esping-Andersen’s regressions detected an impact for “left-power mobilization” on social policy outcomes over durations of 27, 31 and 45 years (1990: chapter 5); Huber and Stephens found the same impact for 13- and 7-year periods before 1980, but not for subsequent 11- and 15-year periods (2000: 214-218). From these examples, I infer that for PR theorists long-term associations should usually be measured over a period of at least a decade, or much longer if possible.

De-emphasizing Unions: Early PR scholarship, especially by Korpi, focused both on how much left-wing parties participate in governments and also on the strength of organized labour, usually measured by union density, in explaining variable social policy outcomes, including income redistribution (Korpi 1980, 2001). Esping-Andersen subsequently shifted the focus of most PR scholarship by contending that implementing the left’s social agenda depended on left-wing parties forming governing coalitions (1985, 1990). Union strength thereafter became much less important for PR researchers in measuring the power balance (see also Huber and Stephens 2000; Allen and Scruggs 2004).

This shift in PR research reflected a broader trend in comparative political economy (CPE) toward ascribing a diminished importance to unions. During the 1970s and 1980s, CPE scholars commonly stressed the importance of variable union power in differentiating the political economies of advanced capitalist countries. The strength of organized labour was understood to be key to distinguishing between corporatist and pluralist political economies, and to determining macroeconomic policy (Cameron 1984). In contrast, organized labour’s power is not central to the “Varieties of Capitalism” (VoC) approach that has largely displaced scholarship on corporatism as the leading approach to CPE. VoC instead focuses on the distinctive forms of competitive advantage that companies have in different milieus (Hall and Soskice 2001). The strength of organized labour is likewise not central to Paul Pierson’s influential “New Politics” approach to social policy (1996). David Rueda’s Insider/Outsider theory addresses the role of left-wing parties and unions in social and labour market policies (Rueda 2007), but he claims that they no longer promote the interests of less-advantaged and precarious workers. Hassel (2015) reviews a large body of other recent CPE work, which de-emphasizes the role of unions and instead stresses the importance of political parties.

In sum, PR scholarship initially predicted a significant long-term relationship between union density and redistribution, but this relationship has since been de-emphasized. The analyses I will present below justify a return to PR’s initial focus on organized labour. Unions significantly influence redistribution, and this influence is exercised mainly over the long term, as PR theory originally predicted.

Modelling, Variables and Methods

This section addresses methods. The data are from all ten Canadian provinces and cover the 29 years from 1986 to 2014, when inequality rose markedly. A dataset of this kind is called “time-series cross-sectional” (TSCS). A multilevel approach is used to construct models. Social science researchers now acknowledge the value of multilevel modelling for this kind of macro-level TSCS data (Bell and Jones 2016, Bartels 2015). With a multilevel model, associations are measured between independent variables and dependent variables at two or more levels. In the area of education, for instance, the impact of a curriculum change on student achievement might be examined both at the school level, to compare the impact between schools, and at the level of individual students within each school. The two levels are termed, respectively, level-2 and level-1. In this scenario, schools are called “cross-sections.” If we extend this method to the TSCS dataset used here, we replace schools with provinces, and students with years. Level-2 modelling shows the relationship of dependent to independent variables between provincial cross-sections, and level-1 modelling measures the impact over time within provinces.

This separation of between- from within-case estimations also distinguishes long- from short-term variations. This is important for our purposes because, as noted above, PR theory contends that unions and left-wing parties shape redistribution over the long term. The level-2 results tell us the association between independent and dependent variables over the entire 29-year period and, separately, over the last 15 years (2000-2014). Level-2 results therefore identify long-term associations, as understood in PR scholarship. In contrast, level-1 coefficients “estimate short-term effects” (Kennedy 2003: 307-8). Such effects are believed by Beck and Katz (2011) to dissipate within a period of three or four years. Accordingly, level-2 results, and not level-1 ones, are used here to address hypotheses (i) and (ii) about the long-term association between union density and income redistribution. (Technical details about these and other methods treated in this section are discussed in Appendix A.)

The inequality data are from the Longitudinal Administrative Dataset (LAD), a Statistics Canada dataset that includes a random sample of 20 percent of all Canadian tax files.[1] Microdata of this kind provide a direct and highly accurate measure of taxpayers’ incomes, including taxes paid and government benefits received. Information is provided on each taxpayer’s family income. To adjust for economies of scale in spending, family income is divided by the square root of family size; this is the standard approach to calculating family income in inequality research. Provincial redistribution (i.e., the dependent variable) is the difference between a family’s income before they pay income tax and receive transfer payments from the government and the same family’s income afterward. The leading transfer payments received by Canadian families from provinces are social assistance, child tax credits and workers’ compensation. Because municipalities are constitutionally subordinate to provinces in Canada, their transfer payments (consisting mostly of social assistance in a few provinces) are included with provincial ones. Federal income taxes and transfers are omitted. The models in this paper concern only taxpayers under the age of 65 because redistribution for older Canadians is dominated by federal pension benefits. In 2016, near the end of our study period, 77.9 percent of Canada’s 27.5 million taxpayers were under 65.[2]

Measured redistribution can vary considerably depending on how it is calculated. Three separate inequality indices are used here. The Gini coefficient is dominated by the highly populated middle of the distribution. In contrast, the P10/P50 ratio reports the family income of a taxpayer in the tenth percentile (from the bottom) as a percentage of the median earner’s. The Low-Income Measure (LIM) identifies the proportion of taxpayers whose adjusted family incomes fall below half the median. At the time of writing, we have LAD data for the period from 1982 to 2014, but social assistance and workers’ compensation payments are reported separately only after 1985. I therefore use LAD data from 1986 to 2014 for dependent variables.

Market income inequality increased in Canada during the 1980s and 1990s. Yet, while redistribution compensated for this increase in the first decade, it did not in the second, which resulted in a rise in final income inequality during the 1990s (Banting and Myles 2015). Since 2000, overall income inequality has changed little. Redistribution became less effective during the 1990s in part because federal and provincial governments became less generous in their transfer payments (Haddow 2014). As is evident from Figure 1, year-to-year changes in redistribution were nevertheless strongly associated with unemployment rates. As the latter declined after the early 1990s so did redistribution. The first three graphs in Figure 1 show that average provincial redistribution grew for several years after 1985 as measured by all three measures. It then began a long decline that closely paralleled a fall in average provincial unemployment rates (fourth graph). There nevertheless was much interprovincial variation in redistribution throughout the study period, which may reflect the political influences investigated below.

Figure 1

Three Measures of Average Provincial Redistribution, and Unemployment Rate, 1986-2014

In line with PR theory (Korpi 1980), union density, (i.e., the percentage of employees who belong to a union) is the measure of union power used here and the political variable of foremost interest. It is based on data from Statistics Canada surveys of unions and labour market participants (see Appendix B; Galarneau and Sohn 2013). These surveys are used by the OECD in its reporting of data for Canada and are the main source of union membership data in Canada. Data for the years with no membership survey (1991-96) are imputed using the Stata command ipolate. Data for all other variables are available without interruption from 1986 to 2014.

While union bargaining coverage has declined precipitously in some English-speaking countries, including the U.S., the fall has been less dramatic in Canada. In that country, coverage was 31.8 percent in 1960, 37.1 percent in 1980, around its peak, and 28.1 percent in 2016 (OECD 2018). Interprovincial differences in union density are sizable and have not declined since the 1980s. The standard deviation for provincial density was 4.4 for the first five years of the study period, and 4.8 during its last five. (Figure 2 depicts provincial union density levels).

Figure 2

Union Density, Canadian Provinces, 1986-2016

PR theory gives left-wing parties a key role in promoting redistribution. Accordingly, a dummy variable, left, coded “1” in years when either the New Democratic Party (NDP) or the Parti Québécois (PQ) governed, and “0” otherwise, is included in the full models. These parties are identified as being to the left of their rivals (Cochrane 2015; Johnston 2017). The NDP and the PQ governed for 22 percent of the years under study. It is common in interprovincial research to test the impact of Liberal Party incumbency separately from that of conservative governments (Pétry et al. 1999, Tellier 2006). The variable Liberal is therefore included in all models, with conservative remaining as the reference variable. Following Pétry et al. and Tellier, the latter includes Progressive Conservatives (PCs), Social Credit and the Saskatchewan Party. Conservative parties governed provinces for 42 percent of the period, and Liberal Parties for 36 percent.

One alternative to party dummy variables in international research, the Comparative Manifestos Project, has not been extended to Canadian provincial parties. Another option, use of a scale that ranks all parties from left to right on the basis of expert opinion, cannot be used for provincial research because Canadian evaluations of this kind are available only for the federal parties (Simon and Tatalovich 2014).

Other variables control for influences that international scholars believe are likely to affect the impact of parties and unions on redistribution. Foremost among these is the level of market inequality or poverty. Meltzer and Richard (1981) argue that support for redistribution should increase as market inequality increases. Recent research provides only inconsistent support for this hypothesis (Lupu and Pontusson 2011, Alt and Iversen 2017). Nevertheless, the potential influence of market inequality is now commonly tested. Accordingly, some models include measures of market inequality that mirror the form of redistribution measured by each model: the market-income Gini coefficient in models where redistribution is measured by the Gini coefficient; P10/P50 ratio-measured inequality in models where redistribution is measured by that ratio; and LIM-measured poverty in models of poverty alleviation.

Additional independent variables control for domestic economic and fiscal factors, for globalization and for post-industrialism. The last two are now widely assigned an important role in constraining government efforts to impede rising inequality. Measures of these phenomena are routinely employed by comparative scholars. Thus, Huber and Stephens use controls for unemployment, dependent population, post-industrialism, GDP per capita and trade (Huber and Stephens 2001). Brady (2009) employs the first three and productivity. Allen and Scruggs (2004) test the impact of deficits, trade and unemployment. All controls that are widely used in research on redistribution and relevant to Canadian provinces were considered for inclusion here. To measure the impact of the domestic economy and fiscal health, the models include independent variables for provincial gross domestic product (GDP) per capita (GDP per capita) and unemployment (Unemployment). Deficit data are not available for all years, so interest payments on the provincial debt (Debt interest) are used instead. The impact of globalization and post-industrialism is measured by several variables: province-level international trade as a share of provincial GDP (International Trade); the post-industrial workforce (Post-industrial employment); and the size of the dependent population (Dependency). Several commonly used controls are omitted because preliminary modelling showed no effect on coefficients of interest, including inflation, growth and interprovincial trade. Controls for political institutions, such as parliamentarism, federalism or veto points, are absent because the provinces share similar institutions within the Canadian federation. No directional hypotheses are proposed for these controls, which are included to accommodate factors widely thought to affect redistributive outcomes. (See Appendix B for sources and calculations of independent variables).

A Panel-Corrected Standard Errors (PCSE) estimator is employed. (Details about this and other modelling choices are reported in Appendix A). TSCS models can be affected by multicollinearity, which occurs when there is excessive overlap between different independent variables, on the one hand, and the dependent one, on the other. Such overlap can make point estimates too imprecise. Preliminary modelling showed excessive multicollinearity in models that included all independent variables.

The next section therefore relies on evidence from reduced models. Each model excludes some variables, but the models collectively identify the impact of each variable of concern without multicollinearity becoming a problem. The first two sets of reduced models exclude the market inequality independent variable, the cause of much multicollinearity. In addition, the first set also excludes the three domestic economic and fiscal independent variables—GDP per capita, unemployment and debt interest—while the second set instead drops the party dummy variables for left-wing and Liberal parties. Market inequality has been an important measure in much recent research but is absent from these models. Accordingly, the third and fourth sets include the market inequality variable. To alleviate multicollinearity in the presence of market inequality, these models drop whichever independent variable has the highest multicollinearity, except union density. Multicollinearity scores are acceptable for all four sets. As we will see, results for union density also are consistent across all four. In spite of the challenge that multicollinearity poses for our modelling strategy, we can be confident in the results.

Results

In line with the original PR literature, I hypothesized that (i) density is positively associated with each inequality-reduction measure. Because PR focuses on long-term influences (ii) the association will be evident in results for level-2 independent variables in multilevel models. The discussion in the next eight paragraphs will refer to level-2 results unless otherwise stated.

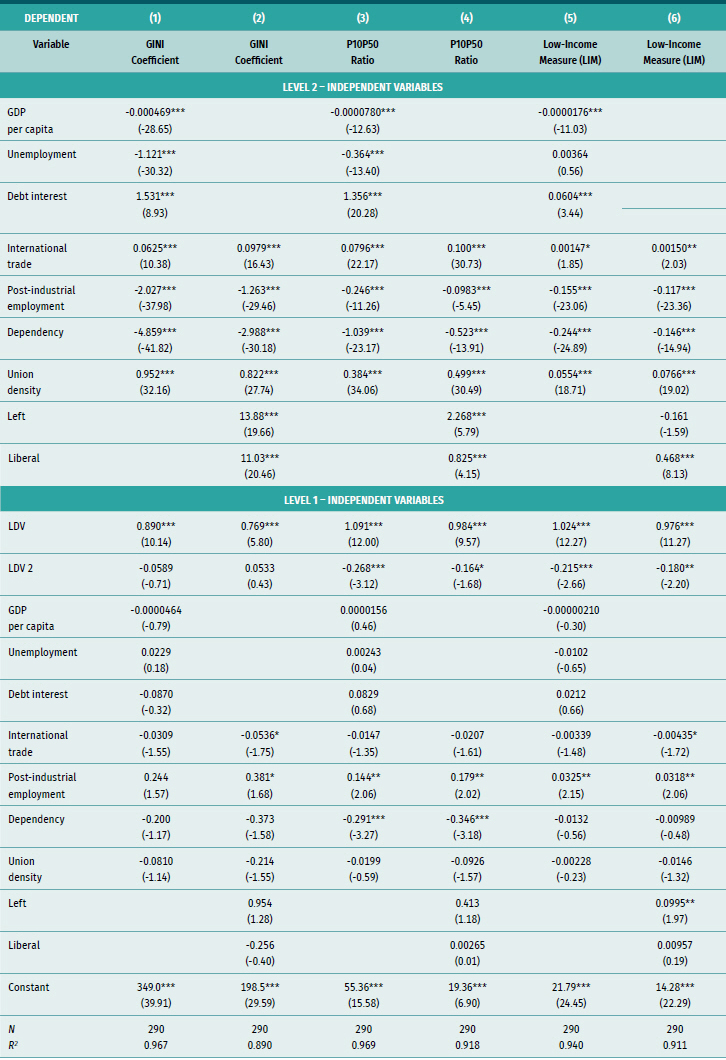

Table 1 gives results for the first two model sets described above, which try to reduce multicollinearity by omitting the market inequality variable and either the economic (GDP per capita, unemployment and debt interest) variables or the party ones (left-wing and Liberal). There is strong and consistent support for the proposed long-term association between union density and redistribution. The density independent variable is statistically significant at the one percent level in all six models. We can be more than ninety-nine percent confident that the proposed positive relationship between union density and redistribution holds true. This is so for all three measures of inequality and poverty reduction used here, regardless of whether the model excludes the economic variables (columns 1, 3 and 5) or the party variables (2, 4 and 6).

Table 1

Inequality Reduction, 1986-2014; Multilevel Models without Market Inequality Independent Variables

Table 2

Inequality Reduction, 1986-2014; Multilevel Models without Alternative High-Multicollinearity Independent Variables

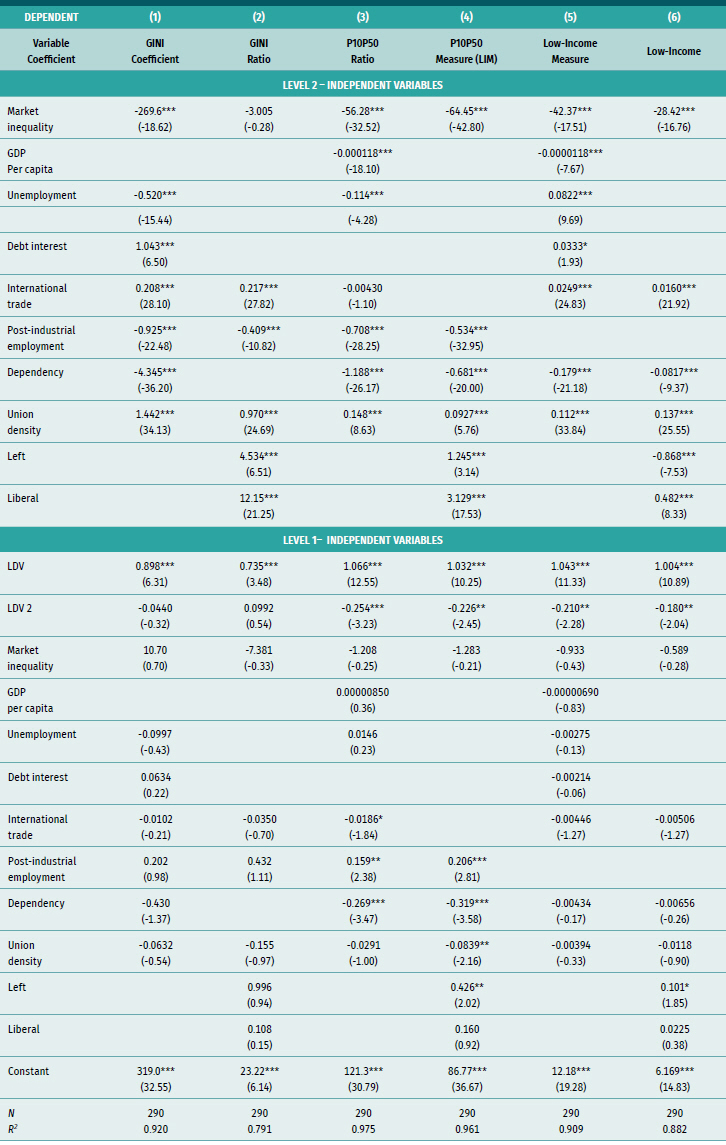

Table 2 gives the results for the third and fourth reduced models discussed above, which include the market inequality variable, while removing the independent variable (except union density) that has the highest level of multicollinearity.

All Table 2 results again indicate a positive long-term association between union density and redistribution, which is always significant at the one percent level. For inequality and poverty reduction, according to the Gini coefficient and the LIM, the coefficients are as large as those in Table 1 or larger. The presence of market inequality does not weaken the association between union density and redistribution. However, the coefficients for the union density variable are smaller in Table 2 than those in Table 1 for the P10/P50 ratio. The association between union density and redistribution nevertheless remains highly significant.[3]

Having discussed the statistical significance of the association between union density and redistribution, I will now address its substantive magnitude. The preceding analysis shows that the association very likely does exist. But how large is it? How big is the impact of variations in union density on inequality and poverty? The answer is that the impact is considerable. This point is best illustrated with beta coefficients, which express the strength of the relationship between independent and dependent variables in standard deviations (SDs). A standard deviation is the average divergence of a variable from its mean. By using SDs, we can express how much a change in an independent variable will change a dependent variable. This is done in units (SDs) that are the same for both. We can think of a substantial change in a variable as one that represents a major shift in relation to its characteristic range of variation. Thus, a change in a student’s grade from 50 to 55 is modest if the full distribution of grades in a class ranges from 0 to 100, with the average grade varying from the mean by 30 percent; but the same change would be judged substantively large if grades range only from 45 to 55, with the average departing from the mean by only one percent. The same logic applies when SDs are used to measure relationships between variables: They inform us about the association between two variables when change in each is measured in magnitudes that are substantively the same because amounting to the same amount of change relative to its characteristic range of levels.

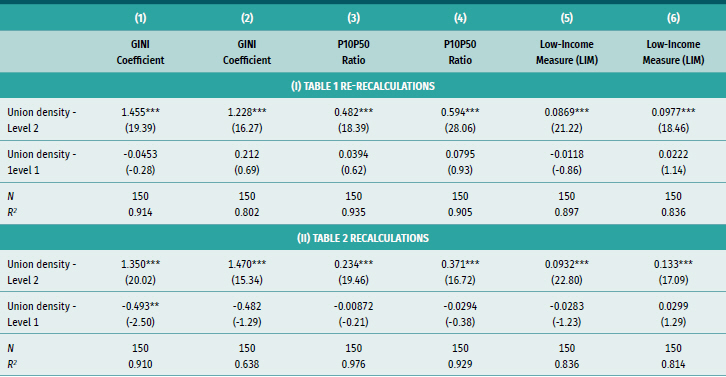

Table 3 gives beta coefficients for all Table 1 and 2 models. For Table 1 models (top half of Table 3), without the market inequality variable, the association between union density and redistribution is always substantial and does not vary much between models. For instance, a one SD change in union density between provinces correlates with a reduction in the incidence of poverty, as measured by the LIM, of between 0.324 (model 5) and 0.449 (model 6) standard deviations. This is a substantial effect: If long-term union density is one SD higher in province X than in province Y, the higher density is associated with a long-term level of poverty that is almost one-third (model 5) or almost half of an SD lower (model 6) in province X than in province Y. For the Gini coefficient and LIM dependent variables, the impact is even higher for Table 2 models, in the presence of the market inequality independent variables (bottom half of Table 3). A one standard deviation shift in the density independent variable is associated with SD shifts in the dependent variable of between 0.441 (model 2) and 0.654 (model 5). Results in the bottom half of Table 3 again indicate that the association with redistribution is now much smaller when measured by the P10/P50 ratio, though remaining highly significant.

Table 3

Beta Coefficients for Level-2 Independent Variables in Table 1 and Table 2 Models

We can also see that union density has a major impact on inequality and poverty if we compare its impact, as measured in SDs, with that of the other independent variables used in our models. Among level-2 independent variables, union density has the strongest positive association with redistribution in 10 of the 12 models. The results also indicate a significant association between left-wing and Liberal governments, on the one hand, and redistribution, on the other, as PR theory predicts. However, union density has a substantively larger association with redistribution in 11 of the 12. Overall, of the variables included in the models, union density has the largest effect in reducing inequality and poverty. Unions clearly matter for redistribution, whether the effect is measured in terms of statistical significance or substantive magnitude.

The level-1 variables in the above models also indicate that, as expected, the long-term association of union density with redistribution is not matched by a short-term one. Only one level-1 coefficient is statistically significant (and marginally so, at the ten percent level); it is in the fourth model of Table 2. The very strong long-term association between union density and redistribution is absent over the relatively short time horizon of a few years. The association requires more than a few years to become significant.[4]

A possible objection to the above evidence is that it might hide important changes during the 29 years covered by the models. If, as scholarship discussed above suggests, unions have become less politically important in recent years, their influence may have declined during this time, a decline that models of this time span may hide. To address this possibility, Table 4 presents results for level-2 and level-1 union density independent variables from alternative versions of the models discussed above; these new estimations cover only the last 15 years of the study period (2000-2014). The time frame still exceeds a decade and can be understood as long-term in the sense identified by PR research. We can see from Table 4 that the long-term association between union density and redistribution remains statistically significant during the last half of the study period. All level-2 coefficients are very large, and significant at the one percent level. In contrast, only one level-1 correlation for union density is statistically significant. All other level-1 coefficients are tiny.

Table 4

Union Density Coefficients from Recalculations of Table 1 and Table 2 Models, 2000-2014

In sum, union density increases redistribution in Canada’s provinces over the long term. Union density independent variables are always associated with redistribution well above the one percent level of significance; the association also is substantively large, though reduced by a market inequality variable in models for the P10/P50 ratio. As predicted, the association is valid only over the long term and is absent over the short term. It is just as valid for the last half of the study period as it is for the entire study period; therefore, it has not weakened in recent years.

Do Unions Socialize Their Members to Favour Redistribution? An Avenue for Future Research

The long-term association between union density and redistribution, as shown above, is fully consistent with initial PR theory. This section draws attention to a causal mechanism that might mediate this persistent association, but which would have to be investigated further: unions may socialize their members to favour redistribution, inducing them to vote for parties that support it and to favour policies that promote it. Where union density is higher, the effect would be stronger. This possibility is put forward here as a preliminary hypothesis. Investigating it further may require case studies of how unions try to shape the views of their members, and how effective the efforts are. Such further investigation is beyond the scope of this paper.

This hypothesis is supported by Iversen and Soskice (2015), who found that union members in twenty affluent democracies were more likely than non-union respondents to locate themselves on the left of the ideological spectrum. Mosimann and Pontusson (2017) similarly reported that union members in twenty-one European countries support redistribution more than do non-union employees; they concluded that union socialization of members may explain the difference.

Table 5 presents data on the preferences of unionized and non-unionized respondents for Canada Election Study (CES) questions in 2008, 2011 and 2015. It is the foremost source of data used by scholars to study Canadian electoral behaviour. The CES offers evidence that Canadian unions may likewise socialize members to support redistribution. Union members were 5.2 percent more likely to favour more redistribution over the three election campaigns (first row). Although recognition of the left-right spectrum is reportedly weaker among Canadian voters than in most democracies (Cochrane 2015: 158-9), union members were nevertheless to the left of non-unionized workers (second row). This is consistent with Iversen and Soskice’s findings, although the difference declined considerably between 2008 and 2015.

Table 5

Differences in Selected Preferences, Unionized vs. Non-Unionized Workers

Author’s compilation from Canadian Election Studies, 2008, 2011 and 2015.

† Question: “How much should be done to reduce the gap between the rich and the poor in Canada?” Results show differences between percentage responding “much more” and percentage “somewhat more”.

‡ 0 = far left, 10 = far right.

§ Union minus non-union level for percentage of left-wing voters minus percentage of conservative voters. For provincial preferences, left = NDP or PQ; conservative = PC, Saskatchewan Party, Wild Rose or Action Démocratique du Québec. For federal voters, left = NDP or Bloc Québécois, conservative = Conservative.

Row three reveals the degree to which union members prefer provincial parties well to the left of their non-union counterparts. The percentage preferring conservative parties is subtracted from the percentage preferring left-wing parties for both categories of respondents. (Along with the parties mentioned earlier, Wild Rose (Alberta) and the Action Démocratique du Québec are coded as conservative, as is conventional.) In row three, the difference between union and non-union respondents is always very large. Among union respondents, 34.7 percent preferred a left-wing provincial party in 2008, and 28.0 percent a conservative one, a positive difference of 6.7 percent. Among non-union respondents, only 23.8 percent preferred a left-wing party, and 34.5 percent a conservative one, a negative difference of 10.7 percent. The difference between these two differences is 17.4 percent. For all surveys, it is 20.4 percent. The union/non-union gap is similarly large for federal preferences (fourth row). (Here the Bloc Québécois, the PQ’s federal counterpart, is coded as left). On average, union respondents are 23.0 percent more likely than non-union ones to prefer a left-wing federal party to a conservative one.

Union members are thus more likely than non-union members to vote for a left-wing party, and this disposition can reasonably be expected to affect the orientation of the government that holds office. Governments might be more likely in provinces with higher union density than in those with lower density to support policies that appeal to voters who lean left, including policies that increase redistribution.

A possible objection to the above analysis is that the relationship of union membership to preferences may be endogenous; individuals may join unions because of their preferences, rather than having their preferences shaped by union membership. Working with international data, Mosimann and Pontusson argued that this is not likely (2017: 456-7). Addressing this question at length, Kim and Margalit (2017) came to the same conclusion for the U.S. For Canada, it is especially doubtful that union membership self-selection explains differences between union and non-union preferences. Canadian unions organize at the enterprise level. Workers in unionized establishments usually are not compelled to join the union. However, in line with the “Rand Formula,” which prevails in most provinces, most of them must pay union dues (Taras and Ponak 2001). With no financial incentive not to do so, the vast majority of workers in unionized establishments accept union cards. In the nine provinces outside Quebec, 95 percent did so in 2018.[5] Even if the minority who did not join the union are more conservative than the other employees in these establishments, their numbers are too small to account for the aggregate differences between union and non-union voters reported above.

The hypothesis put forward in this section deserves additional scholarly attention. How unions socialize their members on the issue of redistribution is a question that warrants further investigation with more refined public opinion data than were available for this study.

Conclusion

Much recent research on social and economic policy has assigned a limited or diminished role to organized labour. This research also has long used comparisons only among nation-states. Each of these features are questioned in the present paper.

In Canada, union power reduces inequality over the long term, a reduction that is observable in variations among the country’s provinces. The impact of organized labour is always highly significant in models that are not unduly affected by multicollinearity. It is also very large substantively in most of the models. The impact is much weaker over the short term, as predicted by power resource theory.

These findings are a major advance in addressing the concerns expressed at the beginning of this paper. Are rising levels of inequality a fate to be endured, an inevitable result of global economic change? Or can they be substantially reduced through public policy? The evidence presented here shows that agency is important. Moreover, it points to a key role for organized labour in Canada’s provinces in achieving this outcome, a finding not echoed in recent research in this country or elsewhere.

As well as being of interest to students of social policy and inequality, these findings will interest researchers in industrial relations, many of whom are concerned about the continuing potential of unions to contribute to the egalitarian objectives that the labour movement has long championed. International researchers, as well as Canadian ones, should evaluate anew the political and economic importance of unions in reducing inequality and poverty by shaping public policy, a focus that has faded in recent years.

Furthermore, these findings will interest students of industrial relations and redistribution at the subnational level in other countries that either are federations or have experienced social policy decentralization. Loughlin (2008) documented the devolution of the welfare state in many European countries since the 1970s. Are variations in inequality reduction among the subnational jurisdictions of those countries likewise determined by the power of organized labour? This question would be a new point of departure for research that has heretofore focused largely on international comparisons (Van Kersbergen and Vis, 2014).

In light of the above, finally, more research is also needed on the causal mechanism that links union power to redistribution. That this association is very strong has been documented here; however, further work is required to understand the causal process linking organized labour and inequality reduction. Recent scholarship has pointed to the possible role of unions in socializing members to support left-wing parties that favour redistribution, and to support redistribution itself. Some evidence points in the same direction for Canada. That possible role for unions has been examined here, and elsewhere, in a preliminary way. Further research will hopefully elucidate the importance of this and other causal mechanisms in linking union power to greater redistribution.

Parties annexes

Appendix

Appendix A: Technical Features of Data and Calculation Procedures

Level-2 data in a multilevel estimation consist of province-level averages for each variable for all years of data included in the model. In this study, the averages were calculated separately for the 29- and 15-year periods for which models are presented. Level-2 data for each province are consequently identical for all years. Level-1 data are calculated by subtracting each annual figure for a variable from its level-2 mean (Bartels 2015). Unlike level-2 data, level-1 data varies year-to-year, and estimation results at this level reflect change over time. The impact of a change in an independent variable on a dependent variable in this case “has a declining geometric form” and usually “dissipates fairly quickly” (Beck and Katz: 2011: 336). For a lagged dependent variable (LDV) model of the kind used here, Beck and Katz (2011) consider a realistic scenario to be one in which this short-term effect dissipates within three or four years. Unbiased calculation of multilevel models requires that all independent variables enter models in both level-1 and level-2 variants (Bell and Jones 2015). This is done for all models. All independent variables are lagged by one year.

The three approaches to calculating inequality used here are all widely used in the relevant literature. International examples include Kenworthy and Pontusson (2005), who measure inequality-reduction across households by subtracting the final income Gini coefficient from the one for market income; and Mahler and Jesuit (2006), who do the same and add a measure of poverty like the LIM. For Canada, including its provinces, Frenette, Green and Picot (2006) compare market and final income using the Gini coefficient and decile and vigintile (twentieths) measurements. In line with most PR research, these three inequality measures pertain to the middle and bottom of the income distribution. Income transfers, the mainstay of the welfare state that is PR’s core preoccupation, have their greatest impact within this range. There is now interest in the influence of organized labour on inequality at the top of the distribution (Ahlquist 2017: 416-7). This important question is not addressed here.

The models were tested for heteroscedasticity and cross-panel dependence, which were found to be present. Panel-Corrected Standard Errors (PCSEs) are therefore reported and are robust for these issues. For models including each dependent variable and all independent variables, calculations with two lags of the dependent variable fell below critical values for the Lagrange Multiplier test for serial correlation. This was not the case when only one lagged dependent variable was used. All models therefore are calculated with Ordinary Least Squares (OLS), PCSEs and two lags of the dependent variable (these are identified as LDV and LDV 2 in the tables). To control for unobserved temporal shocks, all models include temporal fixed effects.

Excessive multicollinearity can be identified by using the Variance Inflation Indicator (VIF). A VIF of ten or more is considered unacceptable (Stata 2016: 2163). With severe multicollinearity, coefficients and standard errors become extremely unstable, varying dramatically with even small changes in model specification (Kennedy 2003). In calculations with all independent variables employed here, VIF scores for many level-2 independent variables were excessive. (Full results for these models, and others not presented in the paper are available from the author). I therefore proceeded with the reduced-model strategy discussed in the text.

The VIF also was used to identify the independent variables that contributed the most to multicollinearity in the third and fourth models in the text. To ensure the robustness of the results in Tables 1 and 2, I performed additional estimations by regressing union density and market inequality, along with each of the three groups of other independent variables (i.e., partisanship; domestic economic and fiscal circumstances; and globalization and post-industrialism) separately on each dependent variable. VIF scores were again acceptable, and results for union density were consistent with the hypotheses advanced. Results for these additional three sets of regressions are available from the author on request.

Appendix B: Data Sources and Variable Calculations

(i) Data Sources

Inequality: Longitudinal Administrative Database (LAD) data for market income inequality and for inequality after taxes and transfers were purchased from Statistics Canada. Market income includes capital gains. Interest payments on public debt: 1981-2006: Statistics Canada, CANSIM, Table 3840004; 2007-14: Table 3840047. GDP, exports, and imports: Table 3840038. Population, including under 15 and over 64 age groups: Table 510001. Implicit price index: Table 3840039. Employment, including employment in different sectors, and unemployment rate: Table 2820008. Left, Liberal and conservative: www.electionalmanac.com/. Labour union data: The Labour Market Activity Survey (1986-1990) and The Labour Force Survey (1997-2014). Labour surveys were accessed at the University of Toronto Statistics Canada Research Data Centre.

(ii) Variable Calculations

Redistribution was calculated by subtracting after tax-and-transfer inequality levels for three inequality measures from the corresponding level of market income inequality.

Debt interest = interest payments on public debt/gross domestic product (GDP)

Dependency = (population under 15 + population over 64)/total population

GDP per capita = (GDP/population)/implicit price index

International trade = (exports + imports)/GDP

Post-industrial employment = (1 – (employment in agriculture, forestry, mining and related sectors, and manufacturing/total employment)) x 100

Unemployment = Statistics Canada unemployment rate

Union density = (union members/all employees) x 100. Data are for employees aged 17 to 64.

Notes

-

[1]

Statistics Canada. Longitudinal Administrative Data Dictionary, 2018 ; catalogue number 12-585-X. (Ottawa : Statistics Canada, November 18, 2020).

-

[2]

Calculation based on data from Canada Revenue Agency, Individual Tax Statistics by Tax Bracket, 2018 Edition (2016 tax year) ; https://www.canada.ca/en/revenue-agency/programs/about-canada-revenue-agency-cra/income-statistics-gst-hst-statistics/individual-tax-statistics-tax-bracket/individual-tax-statistics-tax-bracket-2018-edition-2016-tax-year.html#toc4. Consulted on June 6, 2021.

-

[3]

Market inequality levels attenuate the association of union density with inequality reduction in this case.

-

[4]

Somewhat surprisingly, level-1 union density coefficients have a negative sign in many models. With the one exception mentioned in the text, these coefficients are very small.

-

[5]

The proportion probably is similar in Quebec, but some employees in Quebec work in non-union enterprises covered by collective agreements. Details for the Quebec case are available from the author. Data from Statistics Canada, CANSIM, Table 141-00129.

References

- Ahlquist, John. 2017. “Labour Unions, Political Representation, and Economic Inequality.” Annual Review of Political Science 20: 409-432.

- Allen, James and Lyle Scruggs. 2004. “Political Partisanship and Welfare Sate Reform in Advanced Industrial Societies.” American Journal of Political Science 48: 496-512.

- Alt, James, and Torben Iversen. 2017. “Inequality, Labour Market Segmentation, and Preferences for Redistribution.” American Journal of Political Science 61: 21-36.

- Banting, Keith, and John Myles. 2013. “Introduction: Inequality and the Fading of Redistribution.” In Inequality and the Fading of Redistributive Politics. K. Banting and J. Myles, ed. Vancouver: UBC Press.

- Bartels, Brandon. 2015. “’Beyond Fixed Versus Random Effects.’ Quantitative Research in Political Science, volume IV. Robert Franzese, ed. Los Angeles: Sage Reference.

- Beck, Nathaniel, and Jonathan Katz. 2011. “Modelling Dynamics in Time-Series-Cross-Section Political Economy Data.” Annual Review of Political Science. 14: 331-52.

- Bell, Andrew, and Kelvyn Jones. 2015. “Explaining Fixed Effects.” Political Science Research and Methods 3: 133-53.

- Brady, David. 2009. Rich Democracies, Poor People. Oxford University Press.

- Cameron, David. 1984. “Social Democracy, Corporatism, Labour Quiescence and the Representation of Economic Interests in Advanced Capitalist Society.” In Order and Conflict in Contemporary Capitalism. John Goldthorpe, ed. Oxford: Oxford University Press.

- Casperesz, Donell, and Tom Barrett. 2020. “From Industrial to Social Campaigns.” Industrial Relations 75: 547-568.

- Cochrane, Christopher. 2015. Left and Right: The Small Worlds of Political Ideas. Montreal: McGill-Queen’s University Press.

- Dupuis, Mathieu. 2020. “Construire des mobilisations face aux restructurations d’entreprises.” Industrial Relations 75: 449-472.

- Esping-Andersen, Gösta. 1985. “Power and Distributional Regimes.” Politics and Society 14: 223-56.

- Esping-Andersen, Gösta, and Walter Korpi. 1984. “Social Policy as Class Politics in Post-War Capitalism.” In Order and Conflict in Contemporary Capitalism. John Goldthorpe, ed. Oxford: Oxford University Press.

- Esping-Andersen, Gösta. 1990. The Three Worlds of Welfare Capitalism. Princeton, NJ: Princeton University Press.

- Frenette, Marc, David Green and Garnett Picot. 2006. “Rising Income Inequality in the 1990s.” In Dimensions of Inequality in Canada. D. Green and J. Kesselman, ed. Vancouver: UBC Press.

- Galarneau, Diane and Thao Sohn. 2013. Long-Term Trends in Unionization. Ottawa: Statistics Canada, cat. No. 75-006-x.

- Green, David, and Jonathan Kesselman, editors. 2006. Dimensions of Inequality in Canada. Vancouver: UBC Press.

- Haddow, Rodney. 2014. “Power Resources and the Canadian Welfare State,” Canadian Journal of Political Science 47: 717-739.

- Haddow, Rodney. 2015. Comparing Quebec and Ontario: Political Economy and Public Policy at the Turn of the Millennium. Toronto: University of Toronto Press.

- Hall, Peter, and David Soskice, ed. 2001. Varieties of Capitalism. Oxford: Oxford University Press.

- Hassel, Anke. 2015. “Trade Unions and the Future of Democratic Capitalism.” In The Politics of Advanced Capitalism, P. Beramendi, et al., eds. Cambridge: Cambridge University Press.

- Huber, Evelyne, and John Stephens. 2000. Development and Crisis of the Welfare State. Chicago: University of Chicago Press.

- Iversen, Torben, and David Soskice. 2015. “Information, Inequality, and Mass Polarization: Ideology in Advanced Democracies.” Comparative Political Studies 48: 1781-1813.

- Johnston, Richard. 2017. The Canadian Party System. Vancouver: UBC Press.

- Kennedy, Peter. 2003. A Guide to Econometrics, 5th ed. Cambridge, MA: MIT Press.

- Kenworthy, Lane, and Jonas Pontusson. 2005. “Rising Inequality and the Politics of Redistribution in Affluent Countries.” Perspectives on Politics 3: 449-471.

- Kim, Sung Eun, and Yotam Margalit. 2017. “Informed Preferences? The Impact of Unions on Workers’ Policy Views.” American Journal of Political Science 61: 728-743.

- Korpi, Walter. 1980. “Social Policy and Distributional Regimes in the Capitalist Democracies.” West European Politics 3: 296-316.

- Korpi, Walter. 2001. “Contentious Institutions.” Rationality and Society 13: 235-83.

- Korpi, Walter. 2006. “Power Resources and Employer-Centred Approaches in Explanations of Welfare States and Varieties of Capitalism.” World Politics 58: 167-206.

- Laughlin, John. 2008. “Federal and Local Government Institutions.” In Comparative Politics, Daniele Caramani, ed., Oxford: Oxford University Press, 262-288.

- Mahler, Vincent, and David Jesuit. 2006. “Fiscal Redistribution in the Developed Countries.” Socio-Economic Review 4: 483-511.

- Meltzer, Allan, and Scott Richard. 1981. “A Rational Theory of the Size of Government.” Journal of Political Economy 89: 914–27.

- Milanovic, Branko. 2007. Worlds Apart: Measuring International and Global Inequality. Princeton, NJ: Princeton University Press.

- Mosimann, Nadja, and Jonas Pontusson. 2017. “Solidaristic Unionism and Support for Redistribution in Contemporary Europe.” World Politics 69: 448-92.

- OECD. 2018. “Collective Bargaining Coverage”. OECD.Stat. https://stats.oecd.org/Index.aspx?DataSetCode=TUD#. Consulted on 26 March.

- Pétry, François, Louis Imbeau, Jean Crête and Michel Clavet. 1999. “Electoral Cycles and Partisan Cycles in the Canadian Provinces.” Canadian Journal of Political Science 32: 273–92.

- Pickety, Thomas. 2014. Capital in the Twenty-First Century. Cambridge, Mass: Belknap Press.

- Pierson, Paul. 1996. “The New Politics of the Welfare State.” World Politics 48: 143-179.

- Rueda, David. 2007. Social Democracy Inside Out. Oxford: Oxford University Press.

- Scrimger, Phillippe. 2020. “Unions, Industrial Relations, and Market Income Inequality in Canada’s Provinces.” Industrial Relations 75: 321-350.

- Simon, Christopher, and Raymond Tatalovich. 2014. “Party, Ideology, and Deficits.” Canadian Journal of Political Science 47: 93-112.

- Stata. 2016. Stata Base Reference Manual, Release 14. College Station, TX: Stata Press.

- Stiglitz, Joseph. 2013. The Price of Inequality. New York: Norton.

- Taras, Daphne Gottlieb, and Allen Ponak. 2001. “Mandatory Agency Shop Laws as an Explanation of Canada – U.S. Union Density Divergence.” Journal of Labour Research 22: 541-568.

- Tellier, Geneviève. 2006. “Public Expenditures in Canadian Provinces.” Public Choice 126: 367–85.

- Van Kersbergen, Kees, and Barbara Vis. 2014. Comparative Welfare State Politics. Cambridge: Cambridge University Press.

- Yu, Kyoung Hee. 2014. “Organizational Contexts for Union Renewal.” Industrial Relations 69: 501-523.

Liste des figures

Figure 1

Three Measures of Average Provincial Redistribution, and Unemployment Rate, 1986-2014

Figure 2

Union Density, Canadian Provinces, 1986-2016

Liste des tableaux

Table 1

Inequality Reduction, 1986-2014; Multilevel Models without Market Inequality Independent Variables

Table 2

Inequality Reduction, 1986-2014; Multilevel Models without Alternative High-Multicollinearity Independent Variables

Table 3

Beta Coefficients for Level-2 Independent Variables in Table 1 and Table 2 Models

Table 4

Union Density Coefficients from Recalculations of Table 1 and Table 2 Models, 2000-2014

Table 5

Differences in Selected Preferences, Unionized vs. Non-Unionized Workers

Author’s compilation from Canadian Election Studies, 2008, 2011 and 2015.

† Question: “How much should be done to reduce the gap between the rich and the poor in Canada?” Results show differences between percentage responding “much more” and percentage “somewhat more”.

‡ 0 = far left, 10 = far right.

§ Union minus non-union level for percentage of left-wing voters minus percentage of conservative voters. For provincial preferences, left = NDP or PQ; conservative = PC, Saskatchewan Party, Wild Rose or Action Démocratique du Québec. For federal voters, left = NDP or Bloc Québécois, conservative = Conservative.

10.7202/1072343ar

10.7202/1072343ar