Résumés

Abstract

This paper addresses drivers behind whether foreign subsidiaries located in Japan possess single or multiple competences. We use an original database compiled by means of survey amongst foreign subsidiaries operating in the Japanese manufacturing sector. Results show that subsidiaries predominantly possess a sales & marketing competence, but some also have multiple competences in business functions and/or technological competences. Subsidiaries with greater autonomy, significant internal network relationships, and external business networks are more likely to demonstrate a wider range of key competences. The paper provides novel contributions, demonstrating that drivers show differences in explaining various competences, and exploring subsidiary competences in the unique Japanese host environment.

Keywords:

- Japan,

- Foreign subsidiary,

- Competences,

- Autonomy,

- Network relationships,

- Multinational enterprises

Résumé

Cet article examine les facteurs explicatifs des compétences des filiales étrangères au Japon. Nous utilisons des données résultant d’une enquête menée auprès des filiales étrangères dans le secteur manufacturier au Japon. Les résultats montrent que les filiales possèdent principalement une compétence en vente et en marketing, mais que certaines ont de multiples compétences dans les fonctions commerciales et /ou des compétences technologiques. Les filiales disposant d’une plus grande autonomie, de relations significatives de réseaux intra-firme et externes avec des partenaires commerciaux sont plus susceptibles de posséder de multiples compétences. Cet article enrichit la connaissance sur les moteurs des différentes compétences des filiales étrangères dans le cas spécifique du Japon.

Mots-clés :

- Japon,

- Filiales étrangères,

- Compétences,

- Autonomie,

- Relations de réseaux,

- Firmes multinationales

Resumen

Este artículo aborda los factores que determinan si las filiales extranjeras en Japón poseen competencias únicas o múltiples. Utilizamos una base de datos original recopilada mediante encuestas entre las filiales extranjeras operantes en el sector manufacturero japonés. Según los resultados las filiales poseen predominantemente una competencia de ventas y marketing, pero algunas también múltiples competencias comerciales y/o tecnológicas. Las filiales con mayor autonomía, importantes relaciones de redes internas y redes comerciales externas demuestran más frecuentemente una mayor gama de competencias clave. El artículo aporta nuevas contribuciones, demostrando que los impulsores presentan diferencias al explicar las distintas competencias, y explorando las competencias de las filiales en el singular entorno japonés.

Palabras clave:

- Japón,

- Filial extranjera,

- Competencias,

- Autonomía,

- Relaciones de redes,

- Empresas multinacionales

Corps de l’article

The evolving roles and contributions of foreign subsidiaries within multinational enterprises (MNEs) have been the object of much academic research. The literature has focused on the rising power of foreign subsidiaries within multinational global networks (Mudambi et al., 2014), and how subsidiary roles evolve over time (Dörrenbächer and Geppert, 2010; Gammelgaard et al., 2012). MNEs locate various value-added functions across national boundaries to leverage differences in locational advantages (Buckley et al., 2019). At subsidiary level, scholars have explored how competences are held and created (Achcaoucaou et al., 2017; Andersson et al., 2014; Cantwell and Mudambi, 2005; Ha and Giroud, 2015). Understanding subsidiary competences matters because it illuminates subsidiaries’ potential to be competitive in local markets as much as their ability to contribute to MNE performance (Prahalad and Hamel, 1990).

Despite this being key to competitiveness, questions remain over how subsidiaries acquire single or multiple competences. Earlier studies highlighted the top-down process, highlighting how headquarters (HQs) design a differentiated network of globally dispersed subsidiaries and the importance of the MNE internal network. Indeed, subsidiary roles, or mandates, are initially assigned by headquarters, setting out their functional specialization (White and Poynter, 1984). Foreign subsidiaries benefit from being part of an MNE network, and the interactions taking place internally within and across MNE units (Dörrenbächer and Gammelgaard, 2006; Frost et al., 2002). More recent studies highlight the bottom-up process leading to the organic emergence of competences in subsidiaries and the importance of external networks in host economies. The literature on subsidiary development demonstrates that the local institutional environment and competitive nature of the host economy facilitate competence creation at subsidiary level (Andersson et al., 2014; Holm et al., 2005). As such, both internal MNE and external business networks and relationships can explain subsidiary competence development (Baraldi and Ratajczak-Mrozek, 2019; Beddi, 2012; Dahms et al., 2020; Forsgren et al., 2005; Scott-Kennel and Giroud, 2015). However, uncertainty persists as to whether internal and external network relationships have differentiated rather than unequivocated influences on competence-creating subsidiaries. An assumption of undifferentiated roles by the two networks can be problematic, given the theoretical debate about the kind of difficulties subsidiaries face in acquiring legitimacy within intra-MNE and outside host-country networks. It is also empirically problematic to assume that both networks can consistently predict the emergence of different types of competence-creating subsidiaries in terms of the scope of competences, whether single or multiple.

Shifts in MNEs towards more heterarchical-based and decentralised structures have meant that individual subsidiaries in foreign markets may pro-actively develop their own competences (Cavanagh et al., 2017), which can result in tensions with HQs (Ambos et al., 2020). Studies show the importance of autonomy in explaining subsidiary specialization and role development (Dörrenbächer and Gammelgaard, 2006). When operating in complex foreign markets, a subsidiary may need sufficient autonomy to identify, access and absorb relevant external information and knowledge (Rugman et al., 2011), to gain and retain competitiveness or counteract a lack of corporate support (Galli Geleilate et al., 2020). Yet scant attention has been given in recent research to the theoretically important role of decision-making autonomy in explaining multiple competences (Gammelgaard et al., 2011).

This paper addresses the following research question: “What key drivers might account for individual subsidiaries demonstrating single or multiple competences in Japan?”. It investigates the specific roles of internal MNE network relationships and external business networks, and of subsidiary autonomy (Jarillo and Martínez, 1990; Minbaeva and Santangelo, 2018), very much in line with the concept of functional upgrading at subsidiary level (Burger et al., 2018). To answer this question, we use an original database compiled by means of survey amongst foreign subsidiaries operating in the Japanese manufacturing sector, and a series of models uncover key factors explaining subsidiary competences. The context selected for the research is Japan, long recognised by MNEs as a key venue for intelligence-gathering, close interaction with global competitors, and a dynamic location for new innovations. Japan is attractive for MNEs, total inward FDI stocks have quadrupled in two decades, up to just over US$222.5 billion in 2019 (UNCTAD, 2020). Recent research analyses key inward FDI motivations (JETRO, 2018; Magnier-Watanabe and Lemaire, 2018), or focuses on new investors from Asia (Amann et al., 2020). Few, however, have explored the competences of foreign subsidiaries in modern Japan; this research therefore goes some way to tackling the issue in this highly competitive environment.

The paper contributes to existing knowledge in a number of ways. First, our study contributes to theory in extending our understanding of the drivers behind a subsidiary’s single or multiple competences. We confirm that the location of decision-making and network relationships are key drivers for competence development, and importantly explain to various degrees whether a subsidiary will develop single or multiple competences. One novelty of our study is that by exploring multiple competences, we can identify how drivers can facilitate subsidiary specialisation and types of competence combination. The second contribution is to enhance knowledge of foreign subsidiaries’ competences in Japan. Our results demonstrate that although foreign subsidiaries in the Japanese manufacturing sector predominantly possess a sales and marketing competence, some have multiple competences, and different types of competence combination arise. Our results show how complexity in local markets results in heterogeneous responses by foreign subsidiaries, and in turn, in the rise of divergent rather than singular types of competences. Thirdly, our study is relevant for managers in MNEs, both in HQs and in subsidiaries in Japan and elsewhere, because it points to the importance of autonomy in decision-making and network relationships on competences and, ultimately, performance.

The paper is structured as follows. The next section presents the theoretical background used in the research. The methodology section then describes the data collection, model specifications, measurement of variables and estimation strategy. Empirical results follow, and the final section concludes.

Drivers of Subsidiary Competences: Theory and Hypotheses

Theoretical Background

International Business scholars have increasingly focused on the competences held and developed by foreign subsidiaries as contributors to knowledge, innovation, and value creation for entire MNEs (Asmussen et al., 2009). Prahalad and Hamel (1990, p. 82) define core competences as the collective learning in an organization, and the ability to coordinate diverse production skills and integrate multiple streams of technologies. Competences can relate to production, product development, marketing and/or other functional areas in which the unit is operating. Within MNEs, the possibility of fine-slicing value-chain activities and distributing them within a global network allows for increased specialization (Rugman and Verbeke, 2001), and when conducting value-chain activities subsidiaries can specialize in a single or range of competences, e.g. business (e.g. supply or market competences) or technical competence (Andersson et al., 2014; Asmussen et al., 2009; Birkinshaw and Hood, 1998). Activities conducted by the subsidiary are recognised as a key competence if they represent a unique set of resources and capabilities recognised by the HQ and other subsidiaries in the MNE (Achcaoucaou et al., 2017; Andersson et al., 2007; Cantwell and Mudambi, 2005; Dahms et al., 2020).

Subsidiary literature has explored how competences can be linked to firm competitiveness (Cantwell and Mudambi, 2005); focused on antecedents (Andersson et al., 2014), and outcomes of competences (Ha and Giroud, 2015); or has provided in-depth analyses of subsidiary competence in isolation, often focusing on technological competence (e.g. Awate et al., 2015; Achcaoucaou et al., 2017; Dahms et al., 2020). However, a single subsidiary may be assigned or develop multiple competences (Burger et al., 2018). This may be because geographic proximity between different value-chain activities can generate positive internal agglomeration effects (Alcácer and Delgado, 2016; Castellani and Lavoratori, 2020; Ivarsson et al., 2017). Research, however, lacks clarity as to why a subsidiary may possess single or multiple competences.

Theory shows that subsidiary competences are initially dependent on resources transferred and roles assigned by HQs (Birkinshaw and Hood, 1998; Dörrenbächer and Gammelgaard, 2006; Jarillo and Martínez, 1990; Taggart, 1998). Over time, subsidiary roles can change, e.g. when they develop valuable competences from operating in the local business environment (Andersson et al., 2014; Asmussen et al., 2009; Holm et al., 2005; Scott-Kennel and Giroud, 2015), gain from resource interdependencies, or gradually assume a greater strategic position within the MNE network (Baraldi and Ratajczak-Mrozek, 2019). A subsidiary’s role across its value-chain activities is defined both by its autonomous actions in successful competence development (Birkinshaw and Hood, 1998; Cantwell and Mudambi, 2005) and its position within a complex network of relationships, both within the MNE and through external business relationships (Achcaoucaou et al., 2017; Ghoshal and Bartlett, 1990). A subsidiary’s network relationships refer to the number of intra-organisational (e.g. HQs, other MNE units, buyers, suppliers or research centres) and inter-organisational partners (e.g. customers, suppliers, competitors) and the frequency of relationships with those actors, including business interactions and knowledge-sharing (Gammelgaard et al., 2012; Najafi-Tavani et al., 2014; Scott-Kennel and Giroud, 2015).

Based upon these earlier studies, we propose that key drivers for a subsidiary to demonstrate single or multiple competences are its level of autonomy and its internal and external network relationships. In the next section, we highlight the specific nature of the Japanese market for foreign subsidiaries before developing our hypotheses.

Subsidiary Competences in Japan

In the specific case of Japan, foreign subsidiaries have traditionally held knowledge-gathering mandates (Hasegawa, 2014), although the role of subsidiaries is changing. This is reflected in foreign investors’ perception of the country’s locational advantages; in 2018, foreign managers mentioned the main advantages included the attractiveness of the Japanese market and country stability, but also the presence of suitable business partners (including both local partners and renowned global companies), and the technological environment (e.g. technology or products, local R&D, infrastructure) (JETRO, 2018). Some subsidiaries take on a greater strategic role managing MNE activities in neighbouring Asian and Oceanian countries, with some being assigned a regional headquarters (RHQ) role (in 2019, METI found that 104 out of 2,714 subsidiaries performed such RHQ mandates) (METI, 2019). Also, new investors from emerging markets (e.g Chinese multinationals) increasingly invest in Japan to acquire core resources and competences (Amann et al., 2020).

To compete in the complex Japanese market is not easy for foreign firms (Suzuki, 2009). Japan is a highly-networked business environment characterised by close institutional clusters or networks of inter-firm organisational linkages (Takeuchi, 2012). Japanese manufacturing firms maintain dense networks and long-term relationships with suppliers and distributors known as keiretsu (Witt, 2019). Recent mergers of firms from different former zaibatsu groups have reduced the number of keiretsu and enhanced market-based exchange relationships, but nonetheless keiretsu still dominate the industrial landscape. Horizontal keiretsu are conglomerates centred on financial institutions in diversified industries; vertical keiretsu are structured around a core manufacturing firm with a network of value-chain partners, with transactions positioned between arm’s-length market and internalized transactions (Jaussaud, 1997; McGuire and Dow, 2009). Vertical keiretsu provide a stable market for suppliers and the possibility of technical, managerial or financial assistance from leading firms. Foreign firms often express concerns about the exclusivity and distinctiveness of the Japanese market (e.g. intragroup transactions, complex logistics channels, difficulties in meeting customer demands, and understanding local business practices), and about the institutional environment (e.g. strict regulations, permits and license systems, or complicated administrative procedures) (Hasegawa, 2014; METI, 2019). Local competition is high, with numerous locally-owned competing MNEs and a demanding customer environment. For these reasons, there may be substantial benefits for foreign subsidiaries that can successfully develop business relationships with local firms or integrate with the supply chain of local business groups. Many foreign subsidiaries target large Japanese MNEs as business partners (Takahashi, 2015), and try to integrate into these firms’ supply chains, notably to acquire locally relevant technological competence (Suzuki, 2009). Thus, we argue that beyond knowledge-gathering mandates, some foreign subsidiaries in Japan have increasingly gained strategic importance because of its unique market specificity, e.g. market-related factors such as demanding local customers or the need to conduct and coordinate activities across Asia, and business environment-related factors such as complex business networks. These unique market specificities may drive competence development in various ways. Next, we discuss the hypotheses.

Hypotheses Development

A key enabler for individual units within an MNE to develop competences is linked to how decision-making authority is allocated across the MNE network (Birkinshaw and Hood, 1998; Foss and Pedersen, 2004; Gammelgaard et al., 2011). Subsidiary autonomy is defined as the ability to take operational and/or strategic decisions autonomously, as opposed to decisions being taken by HQs (Beugelsdijk and Jindra, 2018; Cavanagh et al., 2017; Galli Geleilate et al., 2020; Gammelgaard et al., 2012). White and Poynter (1984) initially identified ‘strategic independent subsidiaries’, i.e. the most competent MNE subsidiaries, based on how much these subsidiaries could expand ‘value-added scope’ and ‘market scope’ for the MNE. Taggart (1998) extended this proposition by suggesting that a subsidiary’s level of competence materialises only when the MNE gives it freedom to act.

Autonomy, whether assigned or assumed (Cavanagh et al., 2017), may explain when a subsidiary has multiple competences in various ways. Although HQs tend to exert control over foreign units, greater autonomy at subsidiary level enables identification and ability to develop new competences of relevance to the local market (Prahalad and Doz, 1981). For instance, subsidiary managers may need to take strategic decisions to form stronger external network linkages in the host environment (Birkinshaw and Hood, 1998), or to identify and pursue interesting market opportunities more rapidly without explicit permission from the parent company (Frost et al., 2002; Kostova et al., 2018; Najafi-Tavani et al., 2014). Operational autonomy can allow subsidiary managers to decide how best to combine existing resources held in one competence in order to develop new competences in other areas (Ivarsson et al., 2017). Overall, autonomy can increase subsidiary performance in the local market, thereby facilitating greater competence development at subsidiary level (Beugelsdijk and Jindra, 2018; Galli Geleilate et al., 2020). In the case of Japan, we propose that autonomy drives competence development at subsidiary level, as managers can better explore the local environment, respond to demanding local customers’ needs, and generate new knowledge.

For these reasons, the first hypothesis is:

Hypothesis 1: ‘In the case of Japan, the greater a subsidiary’s autonomy, the more likely it has multiple competences’.

The type and size of resources transferred and shared by the MNE can lead to subsidiary competence development (Ciabuschi et al., 2014; Kostova et al., 2016), especially for competence-exploiting subsidiaries that need to service the market operationally (Cantwell and Mudambi, 2005; Narula, 2014). Specifically, MNE HQs and/or other units act as providers of both tangible and intangible resources that can support the development of a number of competences (Frost et al., 2002). HQs tend to adopt internal mechanisms and transmission channels to exercise authority (Amann et al., 2017), to facilitate knowledge exchange, gather and monitor knowledge from host countries in which subsidiaries operate, or to bundle competences across business units (Foss and Pedersen, 2004; Kogut and Zander, 1993).

Internal relational and informational factors can boost the number and type of a subsidiary’s competences, because they facilitate resource and knowledge transfer from various units of the firm (Kostova et al., 2016; Najafi-Tavani et al., 2014). Internal knowledge-sharing mechanisms support a subsidiary’s acquisition of relevant skills and expertise across a number of functional activities (Minbaeva and Santangelo, 2018; Noorderhaven and Harzing, 2009). Social interactions, communication channels and cross-cultural teamwork can facilitate knowledge-sharing amongst MNE units (Jensen, 2015; Münch, 2016), which in turn facilitates competence development. Internal network relationships raise the visibility of a subsidiary vis-à-vis its HQ (for instance, by the presence of expatriate managers; Chang et al., 2012; Duvivier et al., 2019), so they may be more willing to transfer resources for competence development (Achcaoucaou et al., 2017; Dahms et al., 2020).

Traditionally, foreign subsidiaries in Japan have a knowledge-gathering mandate; as such, internal network relationships are likely to be an important means for HQs to leverage locally acquired knowledge. Nonetheless, to develop competences locally, foreign subsidiaries in Japan are likely to rely upon internal network relationships for greater access to resources needed from their MNE. For these reasons, we propose that greater internal network relationships are instrumental in a subsidiary acquiring multiple competences in Japan.

Thus, the second hypothesis is:

Hypothesis 2: ‘In the case of Japan, the greater a subsidiary’s internal network relationships, the more likely it has multiple competences’.

Generally, subsidiaries tend to develop competences to be competitive and leverage local knowledge in dynamic and competitive markets (Andersson et al., 2014; Asmussen et al., 2009; Rugman and Verbeke, 2001). Proximity to key business-network partners (upstream and downstream, across business and technical networks) is conducive to knowledge-sourcing, facilitating localized competences that are dependent upon geographically bounded externalities (Asmussen et al., 2009). External business networks provide access to unique strategic resources, upon which both headquarters and subsidiary may depend for competitiveness (Giroud and Scott-Kennel, 2009). Subsidiaries that are more embedded with local business networks can leverage the knowledge and resources of local partners to develop new competences (Ha and Giroud, 2015; Monteiro and Birkinshaw, 2017; Phene and Tallman, 2018).

Because of the unique nature of the Japanese market-related and business environment-related factors, Takahashi (2015) argued that the knowledge possessed by Japanese firms can improve the capabilities of R&D of foreign subsidiaries. Despite challenges experienced by foreign firms in penetrating local networks, we propose that those foreign subsidiaries with external business networks can develop competences. We argue that this raises their ability to respond to demanding local customers and increases knowledge exchange with local business partners, which in turn supports the development of multiple competences.

For these reasons, the third hypothesis is:

Hypothesis 3: ‘In the case of Japan, the greater a subsidiary’s external business networks, the more likely it has multiple competences’.

The following section presents the methodology adopted to test the hypotheses developed above.

Methodology

Data

The data analysed in this paper was collected by means of survey amongst foreign subsidiaries in the manufacturing sector in Japan. The Toyo-Keizai database was used to identify firms (Toyokeizaishinposha, 2008; 2015). We applied the following sampling criteria: (1) firms operate in the manufacturing sector, (2) firms’ foreign ownership ratio is 33.3% or more, and (3) firms are owned by a North American or European MNE. This is because the majority of FDI in Japan (over two-thirds of stocks) is directed to the manufacturing sector (JETRO, 2018), and because combined, North American and European MNEs represent over half of all foreign firms operating in Japan. The questionnaire was initially piloted in 2008 amongst 50 randomly selected MNEs, ensuring that the distribution of size and origin of the MNE was congruent with the overall sample. Following this initial phase, some questions were rephrased to ensure understanding by respondents. The English version was translated into Japanese by an official translator. To increase the response rate, we obtained external endorsement from the Japanese Management Association and a local host higher-education institution (Keio University); several reminders were made by phone following initial mailing of the questionnaire; and we personalised the survey by addressing it to the identified senior manager (Chidlow et al., 2015).

To overcome potential problems of common method bias, we emphasised ex-ante procedural remedies in the design and administration of the survey, as this is the best way to overcome such bias (Chang et al., 2010). When designing the survey, we used established constructs from the literature, we were mindful of using different scale anchors for different questions, and we formulated questions to minimize social desirability in answers. We then tested constructs with a sample of managers and academics to ensure clarity and unambiguousness of the measurement scales. In the administration of the survey, we clearly informed respondents that information collected would remain confidential to avoid apprehension in the evaluation process, and we collected data in two different points in time. Bias can further be overcome by adopting ex-post remedies (Podsakoff et al., 2003). Here, we analysed qualitative responses provided by respondents, and we used the principle component analysis to construct the dependent variable of types of competences, minimizing the risk that tested relationships could be part of managers’ cognitive maps. Because we use survey data, we were mindful of potential reverse causality, and addressed this issue theoretically and in the research design (Feng et al., 2018). When responding to the survey, respondents were clearly informed of the research objective, eg. identifying factors driving subsidiary competence development. We also carefully checked our findings against those existing in the literature.

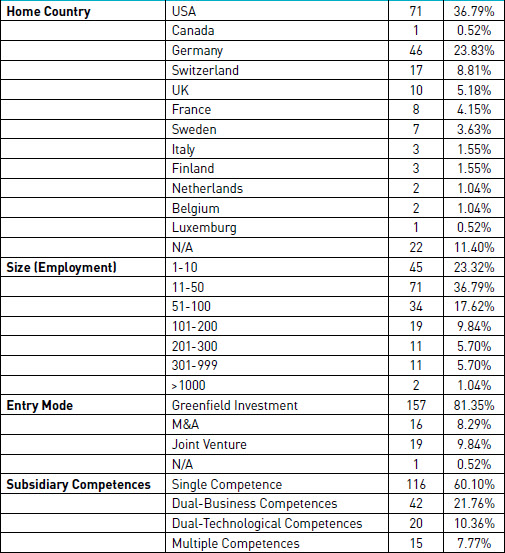

The survey was conducted over two time periods, in 2009 and 2016. Questionnaires were sent by mail and addressed to the subsidiary CEO or similar high-level position. In 2009, a total of 1,438 foreign subsidiaries were targeted and 134 responses received, a response rate of 9.3%. In 2016, a total of 1,141 foreign subsidiaries were targeted and 210 responses received, a response rate of 18.5%. The final database used in this research is composed of 193 usable responses (removing all cases with missing values). Nearly all respondents chose to answer in Japanese (90%). The overall sample is composed predominantly of small and medium-size MNEs (average annual sales of 14,363 million JPY and average number of employees 87 for the 2009 sub-sample, and 12,154 million JPY and 136 respectively for the 2016 sub-sample). One-third of companies had HQs in the USA, and over half in Europe (see Table 1). Four-fifths had invested in Japan using the ‘greenfield’ entry mode. Nearly all subsidiaries had been in operation for 10 years or more at the time of survey, operating in a variety of manufacturing sectors, with the largest group (nearly one-quarter) in the machinery-related sub-sector.

Table 1

Description of Subsidiaries in the Sample

Variable Measurements

Dependent Variable

Our analysis aims to determine factors explaining the likelihood of dual or multiple competences, as opposed to a single competence, arising in a foreign subsidiary. Our dependent variable is a categorical variable that differentiates subsidiaries. Adapted from Burger et al. (2018), the dependent variable is based on subsidiaries’ self-recognition as to whether a functional activity is a key competence or not; and recognition from other units of the MNE (Baraldi and Ratajczak-Mrozek, 2019; Frost et al., 2002). We first extracted from the survey the five-point Likert scores about the level of recognition that a subsidiary received within the MNE regarding nine functional activities, namely basic research, applied research, product development, production of goods & services, sales & marketing, logistics & distribution, procurement, human resources management, and international strategy development. Using principal component analysis, we identified groups of subsidiary competences, and double-checked the internal consistency of the result using Cronbach’s alpha. One group of subsidiaries demonstrated a competence in sales & marketing. The principle component analysis helped identify a second group with technological competence (basic & applied research, product development, production of goods & services, and international strategy development (α=0.788)). We classify and assign 1 for subsidiaries active in all five items, and 0 otherwise. The third group of subsidiaries demonstrated business competence (logistics & distribution, procurement, human resource management (α=0.652)). We assigned 1 for subsidiaries active in all three items, and 0 otherwise.

The distinction between sales & marketing and business & technological competences is consistent with the types of competences identified in the literature (Andersson et al., 2014; Asmussen et al., 2009). In our sample, 60% of subsidiaries demonstrated a single key competence in sales & marketing; about 20% had dual sales & marketing and business competences; about 10% dual sales & marketing and technological competences; fewer than 10% had multiple competences.

Finally, the dependent variable is a categorical variable differentiating subsidiaries into four types – 1 for subsidiaries with a single competence in sales & marketing (single competence), 2 for subsidiaries with dual competences comprising business and sales & marketing (dual-business competence), 3 for subsidiaries with dual competences comprising technological and sales & marketing (dual-technological competence), and 4 for subsidiaries with sales & marketing, business and technological competences (multiple competences).

Independent Variables

Subsidiary autonomy: Following other studies (e.g. Frost et al., 2002; Cantwell and Mudambi, 2005), autonomy is defined as the decision-making power held by the MNE subsidiary. Using a 5-point Likert scale, respondents answered how much decision-making autonomy the subsidiary had in Japan in terms of: i) Promotion and hiring of top management in Japan, ii) Entering new markets within Japan, iii) Entering new markets outside Japan, iv) Changes of internal organization in Japan, v) New supplier selection, vi) Business planning in Japan, vii) Advertising in Japan, viii) Investment/CAPEX in Japan, and ix) Business operations in Japan. The final measurement for subsidiary autonomy is the mean of these 9 items.

Internal network breadth: Internal network breadth is defined as the role of HQs and other MNE units in supporting the development of competences in the Japan subsidiary. Respondents were asked to answer on 5-point Likert scales the extent to which internal units influenced the development of firm competences, including: i) Corporate HQs, ii) Specific corporate research units, iii) Specific internal/corporate customers, iv) Specific internal/corporate suppliers. The final measurement for internal network breadth is the mean of these 4 items.

Internal functional integration: Internal integration is the mean of the 4 items derived from respondents’ rating based on the 5-point Likert scales concerning the extent to which various business functions conducted by the Japanese subsidiary are integrated within the MNE global system, including: i) Purchasing processes in Japan, ii) Manufacturing processes in Japan, iii) R&D functions in Japan, iv) Marketing activities in Japan.

Expatriate ratio: The independent variable expatriate ratio is based on the respondents’ reports of staff profiles in the survey and defined as the ratio of expatriates that the MNE HQ assigned to the Japanese subsidiary relative to the total number of employees in the subsidiary.

Internal knowledge-sharing: Respondents were asked to apply a binary scale (1 for Yes, 0 for No) for whether the firm engages in knowledge-sharing with other MNE units, by having permanent cross-functional teams installed in different modes: i) Within the Japanese subsidiary, ii) Within the same global business unit, iii) Within Asia, and iv) Globally. The final measurement for internal knowledge-sharing is the sum of the 4 items.

External networks breadth: Respondents were asked to rate on a 5-point Likert scale the extent to which external business partners influenced the development of competences of the firm, including: i) Customers, ii) Suppliers, iii) Distributors, iv) External research units, and v) Government institutions. External networks breadth is therefore the mean of these 5 items.

External networks access: Access to a local business network provides a measure of external relational factors within Japan. Respondents were asked to rate the degree of network barriers using a 5-point Likert scale, re: i) the difficulties foreign subsidiaries face in recruiting talent in Japan, ii) the extent to which business networks are closed, iii) the extent to which there are insufficient business-school graduates (Japanese or foreign) in Japan, and iv) how Japan’s business environment inhibits the development of competences. We first calculate the mean of these 4 items and then multiply it by -1 to reverse-convert the scale about barriers to a scale about ease of access.

Control Variables

We controlled for other firm-level characteristics using further information gathered from the survey. Local competition is measured by the mean of the four Likert scales regarding the extent to which rivalry among business competitors, demands from customers, demands from suppliers, and conditions of access to competent suppliers affect the subsidiary’s business in Japan. Sales volume is the log transformation of annual sales in the respondent’s company in Japan in the year of the survey. Greenfield investment is a dummy variable noting 1 for a greenfield mode of establishment and 0 for everything else. Repeat is a dummy variable about whether the respondent or anyone in the same company participated in the survey in both 2006 and 2016. Finally, we entered the year dummy to control unobserved events from the year of survey. Thus, Year 2016 is a dummy variable indicating whether the case was collected in 2016.

Models and Estimation Strategy

Our main model is estimated by multinomial logit regression. This model allows us to simultaneously test the effects of independent variables on the likelihood of a subsidiary being in discrete categories of outcome, as defined earlier. While our hypotheses can be tested through a series of separate logistic regressions coding each outcome as a binary variable, results then could suffer bias due to uncontrolled correlations between the outcomes. The multinomial regression model tests determinants of the multiple outcomes within a single model, while addressing the correlations between the multiple alternative outcomes (Belderbos et al., 2013). This regression result is reported as a series of columns corresponding to three outcomes. The reference group is subsidiaries with single competence, and as such each coefficient indicates the effect of an independent variable on the likelihood that a subsidiary has a different competence category (dual or multiple competences), relative to the single competence category.

Empirical Results

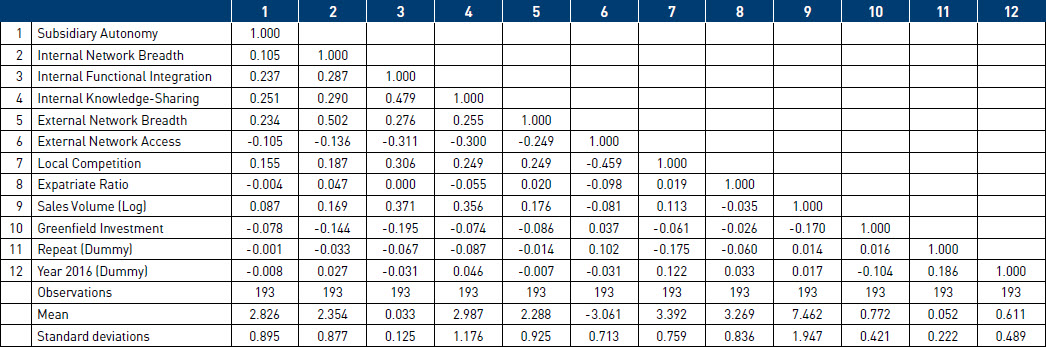

Table 2 delineates correlations and descriptive statistics of variables. Table 3 summarises our findings. The robust standard errors are reported within the brackets under the coefficients.

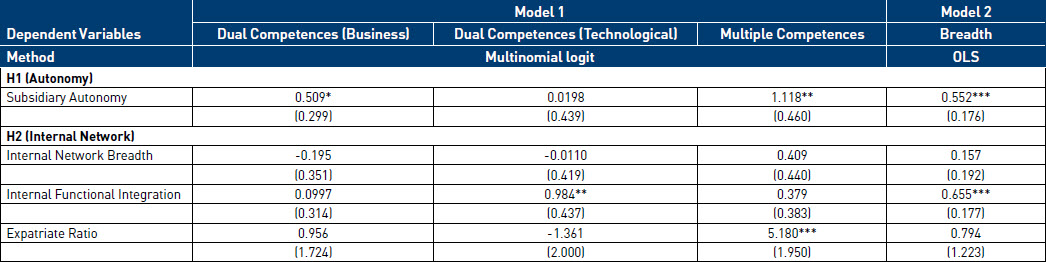

Hypothesis 1 concerns the effect of subsidiary autonomy on the likelihood of the subsidiary being in the dual or multiple competences categories as opposed to single competence. In Model 1, subsidiary autonomy is positive and significant in Columns 1 and 3, but is not significant in Column 2. This means Hypothesis 1 is supported for foreign subsidiaries with dual-business competence, or multiple competences.

Hypothesis 2 focuses on the effect of internal networks. Internal integration is positive and significant in Column 2 and expatriate ratio is positive and significant in Column 3 of Model 1. This implies a positive relationship between the subsidiary’s integration into the MNE’s internal networks and the likelihood of the subsidiary combining sales, marketing and technological competences. A subsidiary with high expatriate ratios can further develop multiple competences. Overall, Hypothesis 2 can be supported regarding the selected aspect of internal networks and the selected groups of subsidiaries.

Table 2

Correlations and Descriptive Statistics

Table 3

Empirical Results

Notes: (1) Model 1 presents the multinomial logit regression. The base outcome is a subsidiary with a single-competence in the sales and marketing function activity. The model tests the likelihoods of a subsidiary presenting dual or multiple competences rather than a single competence. (2) Robust standard errors appear in parentheses. (3) *** p<0.01, ** p<0.05, * p<0.1.

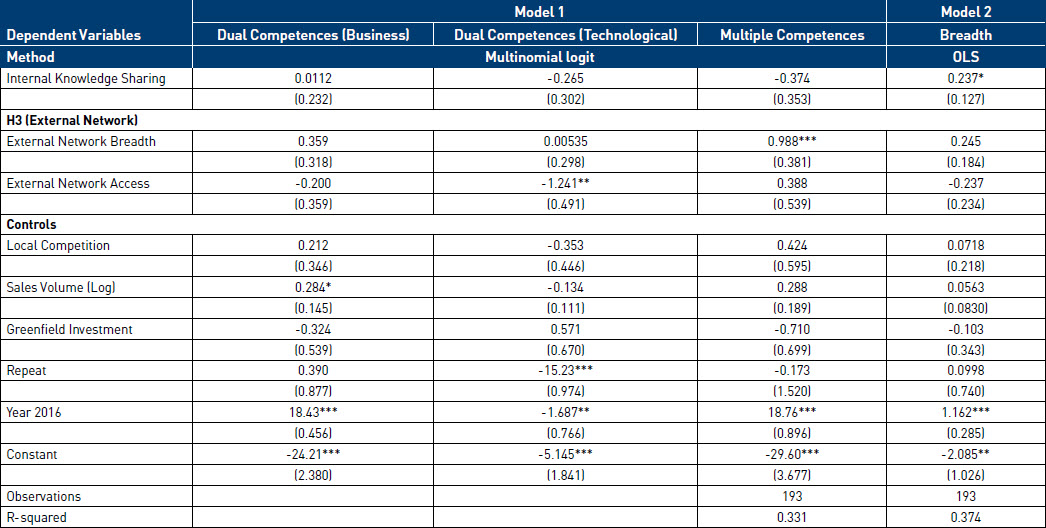

Hypothesis 3 is about the effect of external networks. External networks breadth is positive and significant in Columns 2 and 3 in Model 1, respectively. This means external networks with a broad range of local business partners is related to the configuration of multiple competences in a subsidiary. However, the ease of access to local networks has a negative and significant effect on the likelihood of the subsidiary having a dual technological competence. Hence, Hypothesis 3 can be supported with regard to breadth of external networks and in the selected sub-set of subsidiaries.

Further Analysis

We further estimate Model 2 using an alternative dependent variable and the same set of independent variables. A breadth of functions can mirror a breadth of competences, and as such we computed the number of subsidiary activities. In the survey, for nine functional activities (basic research, applied research, products development, production of goods & services, sales & marketing, logistics & distribution, procurement, human resources management, international strategy development), respondents were asked to assign 1 if the subsidiary recognised the function as a key activity conducted by the subsidiary, or 0 otherwise. We computed the sum of the binary scores and produced a scale for breadth of functional activities running from 1 (one key activity) to 9 (subsidiary possesses all 9 key activities).

In Table 3, Model 2 is based on the OLS regression. It reports that subsidiary autonomy and internal network integration have positive and significant influences on the breadth of activities within a subsidiary. This is consistent with our results from Model 1 on drivers explaining subsidiary competences, i.e. dual or multiple competences. Other results are not fully consistent. While the effect of internal knowledge-sharing is positive and significant in Model 2, it was not significant in Model 1. The effect of variables concerning external networks is not confirmed.

Discussion and Conclusions

Discussion of Results

This research sheds light on drivers of subsidiary competences in the case of Japan, and the research question addressed is: What are the key drivers that might explain when individual local subsidiaries demonstrate single or multiple competences in Japan? Our first contribution is to demonstrate that a greater level of subsidiary decision-making autonomy, internal network relationships, and external business networks are key drivers for multiple competences in MNE subsidiaries; however, there are nuances, and not all drivers explain competences in the same way. Our results are consistent with existing theoretical insights about MNE subsidiary competences in overseas locations, and extend knowledge in two novel ways: we identify how drivers can explain the breadth of competences held by subsidiaries, and provide insights on how drivers can lead to different competence combinations.

The results support the suggestion that subsidiary autonomy explains subsidiary competences, a relationship that is well established in the literature (e.g. White and Poynter, 1984; Taggart, 1998; Birkinshaw and Hood, 1997). Not all studies support this finding; for instance, Frost et al. (2002) found that subsidiary autonomy was not important in the formulation of centres of excellence in Canada. Our data provides novel insights that may explain why the results of previous studies differ, because we can distinguish between competences. First, we show a strong positive significant association between subsidiary autonomy and multiple competences or dual business competences, but not in the case of dual technological competences. Thus, although subsidiary autonomy enables the development and deployment of MNE capabilities that support the firm’s competitive advantages in the local economy, this may be different in the case of technological competences (e.g. those combining sales & marketing and technological competences). One explanation could be that there should be more nuance to the binary distinction between competence-exploiting and competence-exploring subsidiaries, and that HQs tend to retain decision-making over technological competences, at least initially, perhaps because greater internal resources are required to develop such competences (Beugelsdijk and Jindra, 2018; Cantwell and Mudambi, 2005). Another explanation may be that subsidiaries that have gained greater trust from HQs to operate more autonomously acquire multiple competence-creation capability, and/or because dual business competences tend to be closely related to the need for subsidiaries to be more embedded locally (Ryan et al., 2018).

The paper contributes to our understanding of how and which type of intra-firm network relationships explain whether a subsidiary has single or multiple competences. Intra-firm network relationships can be used by HQs for monitoring and control of foreign subsidiaries (Dörrenbächer and Gammelgaard, 2006) and for intra-firm knowledge-sharing amongst various units of the MNE (Foss and Pedersen, 2004; Najafi-Tavani et al., 2014; Noorderhaven and Harzing, 2009), but they have also been identified as key drivers for subsidiary competences (Rugman and Verbeke, 2001). Our results support such existing knowledge, but provide greater detail as to why this is the case. We find that for internal network relationships, the number of actors is not significantly related to a subsidiary having single or multiple competences. This means that what matters most is the nature of the relationships, which supports the idea of resource dependencies – a subsidiary is likely to rely upon either the HQs or a few sister subsidiaries for competence development (Kostova et al., 2016; Scott-Kennel and Giroud, 2015). Internally, stronger functional integration between the subsidiary and other units of the MNE explains the likelihood of a subsidiary combining sales and marketing with technological competences, as well as the breadth of functional activities it engages in. One explanation for this result can be that firms with sales & marketing and technological competences depend more upon internal embeddedness to be competitive (Achcaoucaou et al., 2017; Awate et al., 2015; Dahms et al., 2020). The number of expatriates in foreign subsidiaries was also found to be a driver. This may be linked to the desire by HQs to retain control over activities overseas, to align HQs and subsidiary strategies (Beddi, 2012), to the need to establish new capabilities, or to the importance of the subsidiary in the overall competitiveness of the MNE (Chang et al., 2012; Duvivier et al., 2019). It may be because expatriates act as boundary-spanners (Minbaeva and Santangelo, 2018). Another explanation is that subsidiaries with multiple competences have also acquired strategic roles within their MNEs (Rugman and Verbeke, 2001; Taggart, 1998).

Further, our findings confirm that external business networks explain subsidiary competences, and – in our case – explain when a subsidiary has multiple competences. The relationship between external networks and competences is well established (Andersson et al., 2014; Asmussen et al., 2009; Rugman et al., 2011), but our results demonstrate that external business networks are not always key drivers. We confirm that strong external business networks enable firms to exploit specialised knowledge in the market, to compete when local markets require new product lines, and explain multiple competences in a subsidiary (Alcácer, 2006;). Developing a sound understanding of close links with local competitors is an important aspect of strengthening performance (Kim, 2019). Undoubtedly, external embeddedness boosts opportunities to access valuable resources and benefit from knowledge-sharing with external partners (Najafi-Tavani et al., 2014; Ryan et al., 2018), and our results emphasize the complexity of knowledge identification, absorption and exploitation amongst business partners (Cohen and Levinthal, 1990). Here, we acknowledge that this may be context specific.

Japan: A Complex Environment

Our results show that although most subsidiaries present a single competence in sales and marketing, some demonstrate dual or multiple competences. Thus, in the case of Japan, MNEs seem to exploit existing knowledge and resources internal to the firm more than they develop explorative strategies. The sales and marketing competence amongst foreign subsidiaries helps MNEs serve local Japanese markets, and are essential to gather information on demanding local customers. What is surprising in our findings, however, is that external networks do not impact upon subsidiaries’ competences in the same way, network breadth drives multiple competences, but ease of network access can have a negative impact on subsidiaries with dual technological competence. This may be linked to the unique nature of the Japanese business environment.

The Japanese economy is characterised by a deeply embedded institutional context. Although integration with local business groups can support the development of multiple competences (Kimino et al., 2012), few foreign subsidiaries succeed in the process. This lends support to the importance of overcoming potential liability of outsidership experienced by foreign entrants (Edman, 2016; Johanson and Vahlne, 2009), but doing so in Japan is very challenging. A recent survey by METI shows nearly half of foreign-subsidiary managers find that the Japanese market remains very closed to them (METI, 2020). Besides, we find a negative relationship between ease of network access and dual technological and sales & marketing competences, which indicates that foreign subsidiaries exert caution, avoid unintended technological spillovers, and try and minimize the risks of local firms learning from their activities (Ha and Giroud, 2015; Kimino et al., 2012).

This calls for further research into understanding the roles and competences of foreign subsidiaries in Japan, and the specific locational advantages – or disadvantages − that the country offers for MNEs.

Managerial Implications

Our results present a number of useful managerial implications. Autonomy is not always conducive to a subsidiary building multiple competences, which points to a potential tension between HQs strategy and subsidiary role development. Managers should therefore assess the key roles and strategic objectives of subsidiaries. Different mechanisms can be adopted internally to ensure that the firm can deploy and exploit its competences across national borders. In the case of Japan, we find that strong internal functional integration drives dual technological competences, while the presence of expatriate managers is conducive to subsidiaries having multiple competences. Overall, various internal networks relationship mechanisms can be utilised to promote various competence combinations amongst foreign subsidiaries. In addition, as an alternative to expatriate management, encouraging Japanese managers to take up positions within HQs could strengthen strategic links once they return to Japan. This may, over time, strengthen multiple competences in subsidiaries locally, and ultimately their competitiveness in the market.

The business environment in Japan is changing, but strengthening external business networks can still be challenging. This suggests business networks in Japan should not be overlooked by HQs managers. One recommendation is to adapt to Japan’s uniqueness by increasing the frequency of visits to customers and suppliers to strengthen linkages with local business partners.

Overall, weighing the types of value-added activity performed by subsidiaries must be done carefully, and those firms seeking to boost units’ competences in Japan must carefully consider which competences are needed, and how to balance level of autonomy, internal network relationships, and the means to strengthen external business networks.

Limitations and Future Research

Our study has several limitations. Methodologically, to capture the complexity of subsidiary competences, we use cross-sectional, self-reported, single-source data, which presents limitations.

To overcome the risk of common method bias, we adopted a number of ex ante remedial actions in the research design, implementation and analysis, including careful phrasing of the questionnaire, or two waves of data collection to control unobserved year-specific trends. We also adopted remedial actions to overcome the risk of potential reverse causality in the design of the survey. Nonetheless, bias may remain. To minimize such risks, future research could consider collecting data from a variety of sources, collecting data in different time-points, and using qualitative data (e.g. building case studies). Further, in exploring the specific case of subsidiaries in Japan, we do not integrate HQs’ strategic objectives and mandates assigned to individual subsidiaries, nor do our results enable us to explore competence combination with other units of the MNEs, within Japan or elsewhere. Future research may adopt a multi-unit perspective into the identification of competences. To conclude, this study provides useful insights into competences held by foreign subsidiaries in Japan, uncovering the need for more research to better understand how MNEs operate in this dynamic business environment.

Parties annexes

Biographical notes

Axèle Giroud (Dr.) is Professor of International Business and Head of the Comparative and International Business Group at the Alliance Manchester Business School (U.K.). She holds Visiting Research Professorships with the University of Gothenburg (Sweden), and with Rennes School of Business (France). She was previously President of the Euro-Asia Management Studies Association, and Senior Economist with the United Nations Conference on Trade and Development. Her research interests include multinational firms strategies, technology and knowledge transfer, FDI impact, sustainable development, and emerging markets. Dr. Giroud has published over 40 academic journals. She is senior editor for International Business Review, and Journal of International Business Policy.

Yoo Jung Ha (Dr.) is a Lecturer (Assistant Professor) in International Business Strategy at Sheffield University Management School, University of Sheffield, UK. Yoo Jung holds a PhD in Business Administration from the Alliance Manchester Business School and an MPhil in International Development from the University of Oxford. She previously worked for the University of York, UK, the Korea Institute for International Economic Policy and the Government of South Korea. Her work has been published in such journals as Asian Business and Management, International Business Review, Journal of Business Research, and Multinational Business Review.

Kazuyuki Marukawa (Dr.) is Vice Chairman of TANIOBIS GmbH and CEO of JX Metals Circular Solutions Europe GmbH in Germany. He also serves as Senior Advisor of JX Nippon Mining & Metals Cooperation and Board observer of Alloyed/OxMet Technologies, Oxford. He holds his Doctor of Business Administration degree in International Business Strategy from Alliance Manchester Business School and MBA from London Business School. He also holds his Bachelor’s degree in Economics from Keio University, Japan. His research interests include MNE strategies, its subsidy roles, its innovation strategies, and FDI impact.

Chie Iguchi (Dr.) is Professor of International Business at the Faculty of Business and Commerce, Keio University, Japan. She received her Ph.D. from the University of Reading, UK. She was previously President of the Association of Japanese Business Studies (AJBS), and National Representative of Japan of European International Business Academy (EIBA). Her research focuses on MNE subsidiary roles and MNE innovation strategies and their impacts on host countries, technology and knowledge transfer and inter-organisational linkages. She has published in journals including Asia Pacific Journal of Management and Asian Business and Management.

Bibliography

- Achcaoucaou, Fariza; Miravitlles, Paloma; León-Darder, Fidel (2017), “Do We Really Know The Predictors of Competence-Creating R&D Subsidiaries? Uncovering The Mediation of Dual Network Embeddedness”, Technological Forecasting and Social Change, Vol. 116, p. 181-195.

- Alcácer, Juan (2006), “Location Choices Across The Value Chain: How Activity and Capability Influence Collocation”, Management Science, Vol. 52, No 10, p. 1457-1471.

- Alcácer, Juan; Delgado, Mercedes (2016), “Spatial Organization of Firms and Location Choices Through The Value Chain.”, Management Science, Vol. 62, No 11, p. 3213-3234.

- Amann, Bruno; Futagami, Shiho; Jaussaud, Jacques; Jean-Amans, Carole (2020), “Emerging Countries Multinationals Investing in Developed Countries: The Issue of Reciprocal Asymmetries in the Case of Chinese Investments in Japan”, in Andréosso-O’Callaghan, Bernadette (Ed.), The Changing Global Environment in Asia and Human Resource Management Strategies. Nova Science Publishers, New York, p. 139-160.

- Amann, Bruno; Jaussaud, Jacques; Schaaper, Johannes (2017), “Control in Subsidiary Networks in Asia: Toward an Extension of the Centralisation-Formalisation- Socialisation (CFS) Model”, Management International, Vol. 21, No 4, p. 89-108.

- Ambos, Tina C.; Fuchs Sebastian, H.; Zimmermann, Alexander (2020), “Managing Interrelated Tensions in Headquarters–Subsidiary Relationships: The Case of a Multinational Hybrid Organization”, Journal of International Business Studies, Vol. 51, No 6, p. 906-932.

- Andersson, Ulf; Dellestrand, Henrik; Pedersen, Torben (2014), “The Contribution of Local Environments to Competence Creation in Multinational Enterprises”, Long Range Planning, Vol. 47, No 1/2, p. 87-99.

- Andersson, Ulf; Forsgren, Mats; Holm, Ulf (2007), “Balancing Subsidiary Influence in The Federative MNC: a Business Network View”, Journal of International Business Studies, Vol. 38, No 5, p. 802-818.

- Asmussen, Christian G.; Benito, Gabriel R. G.; Petersen, Bent (2009), “Organizing Foreign Market Activities: From Entry Mode Choice to Configuration Decisions”, International Business Review, Vol. 18, No 2, p. 145-155.

- Awate, Snehal; Larsen, Marcus, M.; Mudambi, Ram (2015), “Accessing VS Sourcing Knowledge: A Comparative Study of R&D Internationalization Between Emerging and Advanced Economy Firms”, Journal of International Business Studies, Vol. 46, No 1, p. 63-86.

- Baraldi, Enrico; Ratajczak-Mrozek, Milena (2019), “From Supplier to Center of Excellence and Beyond: The Network Position Development of a Business Unit Within “IKEA Industry””, Journal of Business Research, Vol. 100, p. 1-15.

- Belderbos, René; VanRoy, Vincent; Duvivier, Florence (2013), “International and Domestic Technology Transfers and Productivity Growth: Firm Level Evidence”, Industrial and Corporate Change, Vol. 22, No 1, p. 1-32.

- Beddi, Hanane (2012), “Les Relations Siège-Filiales dans les Firmes Multinationales: Vers une Approche Differenciée”, Management International, Vol. 17, No 1, p. 89-101.

- Beugelsdijk, Sjoerd; Jindra, Björn (2018), “Product Innovation and Decision-Making Autonomy in Subsidiaries of Multinational Companies”, Journal of World Business, Vol. 53, No 4, p. 529-539.

- Birkinshaw, Julian; Hood, Neil (1998), “Multinational Subsidiary Evolution: Capability and Charter Change in Foreign-Owned Subsidiary Companies”, Academy of Management Review, Vol. 23, No 4, p. 773-795.

- Burger, Anže; Jindra, Björn; Marek, Philipp; Rojec, Matija (2018), “Functional Upgrading and Value Capture of Multinational Subsidiaries”, Journal of International Management, Vol. 24, No 2, p. 108-122.

- Cantwell, John A.; Mudambi, Ram (2005), “MNE Competence-Creating Subsidiary Mandates”, Strategic Management Journal, Vol. 26, No 12, p. 1109-1128.

- Castellani, Davide; Lavoratori, Katiuscia (2020), “The Lab and the Plant: Offshore R&D and Co-Location with Production Activities”, Journal of International Business Studies, Vol. 51, No 1, p. 121–137.

- Cavanagh, Andrew; Freeman, Susan; Kalfadellis, Paul; Herbert, Kendall (2017), “Assigned Versus Assumed: Towards a Contemporary, Detailed Understanding of Subsidiary Autonomy”, International Business Review, Vol. 26, No 6, p. 1168-1183.

- Chang, Yi-ying; Gong, Yaping; Peng, Mike W. (2012), “Expatriate Knowledge Transfer, Subsidiary Absorptive Capacity, and Subsidiary Performance”, Academy of Management Journal, Vol. 55, No 4, p. 927-948.

- Chang, Sea-Jin; VanWitteloostuijn, Arjen; Eden, Lorraine (2010), “From the Editors: Common Method Variance in International Business Research”, Journal of International Business Studies, Vol. 41, No 2, p. 178-184.

- Chidlow, Agnieszka; Ghauri, Pervez N.; Yeniyurt, Sengun; Cavusgil, S. Tamer (2015), “Establishing Rigor in Mail-Survey Procedures in International Business Research”, Journal of World Business, Vol. 50, No 1, p. 26-35.

- Ciabuschi, Francesco; Holm, Ulf; MartínMartín, Oscar (2014), “Dual Embeddedness, Influence and Performance of Innovating Subsidiaries in The Multinational Corporation”, International Business Review, Vol. 23, No 5, p. 897-909.

- Cohen, Wesley M.; Levinthal, Daniel A. (1990), “Absorptive Capacity: A New Perspective on Learning and Innovation”, Administrative Science Quarterly, Vol. 35, p. 128-152.

- Dahms, Sven; Cabrilo, Slaðana; Kingkaew, Suthikorn (2020), “The Role of Networks, Competencies, and IT Advancement in Innovation Performance of Foreign-Owned Subsidiaries”, Industrial Marketing Management, Vol. 89, p. 402-421.

- Dörrenbächer, Christoph; Gammelgaard, Jens (2006), “Subsidiary Role Development: The Effect of Micro-Political Headquarters–Subsidiary Negotiations on The Product, Market and Value-Added Scope of Foreign-Owned Subsidiaries”, Journal of International Management, Vol. 12, No 3, p. 266-283.

- Dörrenbächer, Christoph; Geppert, Mike (2010), “Subsidiary Staffing and Initiative-Taking in Multinational Corporations”, Personnel Review, Vol. 39, No 5, p. 600-621.

- Duvivier, Florence; Peeters, Carine; Harzing, Anne-Wil (2019), “Not All International Assignments are Created Equal: HQ-Subsidiary Knowledge Transfer Patterns Across Types of Assignments and Types of Knowledge”, Journal of World Business, Vol. 54, No 3, p. 181-190.

- Edman, Jesper (2016), “Reconciling The Advantages and Liabilities of Foreignness: Towards an Identity-Based Framework”, Journal of International Business Studies, Vol. 47, No 6, p. 674-694.

- Feng, Taiwen; Huang, Yufei; Avgerinos, Emmanouil (2018), “When Marketing and Manufacturing Departments Integrate: The Influences of Market Newness and Competitive Intensity”, Industrial Marketing Management, Vol. 75, p. 218-231.

- Forsgren, Mats; Holm, Ulf; Johanson, Jan (2005), Managing The Embedded Multinational (A Business Network View). Edward Elgar, Cheltenham, UK.

- Foss, Nicolai Juul; Pedersen, Torben (2004), “Organizing Knowledge Processes in The Multinational Corporation: an Introduction”, Journal of International Business Studies, Vol. 35, No 5, p. 340-349.

- Frost, Tony S.; Birkinshaw, Julian M.; Ensign, Prescott C. (2002), “Centers of Excellence in Multinational Corporations”, Strategic Management Journal, Vol. 23, No 11, p. 997-1008.

- Galli Geleilate, Jose-Mauricio; Andrews, Daniel S.; Fainshmidt, Stav (2020), “Subsidiary Autonomy and Subsidiary Performance: A Meta-Analysis”, Journal of World Business, Vol. 55, No 4, p. N.PAG.

- Gammelgaard, Jens; McDonald, Frank; Stephan, Andreas; Tüselmann, Heinz; Dörrenbächer, Christoph (2012), “The Impact of Increases in Subsidiary Autonomy and Network Relationships on Performance”, International Business Review, Vol. 21, No 6, p. 1158-1172.

- Gammelgaard, Jens; McDonald, Frank; Tüselmann, Heinz; Dörrenbächer, Christoph; Stephan, Andreas (2011), “Effective Autonomy, Organisational Relationships and Skilled Jobs in Subsidiaries”, Management Research Review, Vol. 34, No 4, p. 366-385.

- Ghoshal, Sumantra; Bartlett, Christopher A. (1990), “The Multinational Corporation as an Interorganizational Network”, Academy of Management Review, Vol. 15, No 4, p. 603-625.

- Giroud, Axèle; Scott-Kennel, Joanna (2009), “MNE linkages in International Business: A framework for analysis”, International Business Review, Vol. 18, No 6, p. 555-566.

- Ha, Yoo Jung; Giroud, Axèle (2015), “Competence-Creating Subsidiaries and FDI Technology Spillovers”, International Business Review, Vol. 24, No 4, p. 605-614.

- Hasegawa, Shinji (2014), “Zainichi Gaishikei Kigyo no Doko - Zainichi Gaishikei Kigyo no Yakuwari ni Kansuru Anke-to Chosa no Kekka Kara”, Waseda Shakai Kagaku Sogo Kenkyu, Vol. 15, No 1, p. 59-77.

- Holm, Ulf; Holmström, Christine; Sharma, Deo (2005), “Competence Development Through Business Relationships or Competitive Environment? -- Subsidiary Impact on MNC Competitive Advantage”, Management International Review, Vol. 45, No 2, p. 197-218.

- Ivarsson, Inge; Alvstam, Claes Göran; Vahlne, Jan-Erik (2017), “Global Technology Development by Colocating R&D and Manufacturing: The Case of Swedish Manufacturing MNEs”, Industrial and Corporate Change, Vol. 26, No 1, p. 149-168.

- Jarillo, J. Carlos; Martínez, Jon I. (1990), “Different Roles for Subsidiaries: The Case of Mutinational Corporations in Spain”, Strategic Management Journal, Vol. 11, No 7, p. 501-512.

- Jaussaud, Jacques (1997), “Cooperation and Strategic Alliances with Japanese Companies”, in Dzever, Sam; Jaussaud, Jacques (Eds.), Perspectives on Economic Integration and Business Strategy in the Asia-Pacific Region. Palgrave Macmillan UK, p. 208-217.

- Jensen, Karina R. (2015), “Global Innovation and Cross-cultural Collaboration: The Influence of Organizational Mechanisms”, Management International, Vol. 19, No Special, p. 101-116.

- JETRO (2018), JETRO Invest Japan Report 2018, Japan External Trade Organisation (JETRO), Tokyo.

- Johanson, Jan; Vahlne, Jan-Erik (2009), “The Uppsala Internationalization Process Model Revisited: From Liability of Foreignness to Liability of Outsidership”, Journal of International Business Studies, Vol. 40, No 9, p. 1411-1431.

- Kim, Seong-Young (2019), “Competitive Market Embeddedness, Diversity of the Institutional Environment, and Firm Performance”, Management International, Vol. 23, No Special, p. 183-196.

- Kimino, Satomi; Driffield, Nigel; Saal, David (2012), “Do Keiretsu Really Hinder FDI into Japanese Manufacturing?”, International Journal of the Economics of Business, Vol. 19, No 3, p. 377-395.

- Kostova, Tatiana; Marano, Valentina; Tallman, Stephen (2016), “Headquarters–Subsidiary Relationships in MNCs: Fifty Years of Evolving Research”, Journal of World Business, Vol. 51, No 1, p. 176-184.

- Kostova, Tatiana; Nell, Phillip C.; Hoenen, Anne K. (2018), “Understanding Agency Problems in Headquarters-Subsidiary Relationships in Multinational Corporations: A Contextualized Model”, Journal of Management, Vol. 44, No 7, p. 2611-2637.

- Magnier-Watanabe, Rémy; Lemaire, Jean-Paul (2018), “Inbound Foreign Direct Investment in Japan: A Typology”, International Business Review, Vol. 27, No 2, p. 431–442.

- McGuire, Jean; Dow, Sandra (2009), “Japanese Keiretsu: Past, Present, Future”, Asia Pacific Journal of Management, Vol. 26, No 2, p. 333-351.

- METI. (2019), “Survey of Trends in Business Activities of Foreign Affiliates”, available from: https://www.meti.go.jp/english/statistics/tyo/gaisikei/index.html (accessed 1 June 2020).

- METI. (2020), “Survey of Trends in Business Activities of Foreign Affiliates”, available from: https://www.meti.go.jp/english/statistics/tyo/gaisikei/index.html (accessed 1 April 2021).

- Minbaeva, Dana; Santangelo, Grazia D. (2018), “Boundary Spanners and Intra-MNC Knowledge Sharing: The Roles of Controlled Motivation and Immediate Organizational Context”, Global Strategy Journal, Vol. 8, No 2, p. 220-241.

- Monteiro, Felipe; Birkinshaw, Julian (2017), “The External Knowledge Sourcing Process in Multinational Corporations”, Strategic Management Journal, Vol. 38, No 2, p. 342-362.

- Mudambi, Ram; Pedersen, Torben; Andersson, Ulf (2014), “How Subsidiaries Gain Power in Multinational Corporations”, Journal of World Business, Vol. 49, No 1, p. 101-113.

- Münch, Fabienne (2016), “From Europe to North America to Asia: Overcoming the Hurdles of Interdisciplinary Multicultural Teams Through a Design-Driven Process”, Management International, Vol. 20, No Special, p. 38-48.

- Najafi-Tavani, Zhaleh; Giroud, Axèle; Andersson, Ulf (2014), “The Interplay of Networking Activities and Internal Knowledge Actions for Subsidiary Influence Within MNCs”, Journal of World Business, Vol. 49, No 1, p. 122-131.

- Narula, Rajneesh (2014), “Exploring the Paradox of Competence-Creating Subsidiaries: Balancing Bandwidth and Dispersion in MNEs”, Long Range Planning, Vol. 47, No 1-2, p. 4-15.

- Noorderhaven, Niels; Harzing, Anne-Wil (2009), “Knowledge-Sharing and Social Interaction Within MNEs”, Journal of International Business Studies, Vol. 40, No 5, p. 719-741.

- Phene, Anupama; Tallman, Stephen (2018), “Subsidiary Development of New Technologies: Managing Technological Changes in Multinational and Geographic Space”, Journal of Economic Geography, Vol. 18, No 5, p. 1121-1148.

- Podsakoff, Philip M.; MacKenzie, Scott B.; Lee, Jeong-Yeon; Podsakoff, Nathan P. (2003), “Common Method Biases in Behavioral Research: A Critical Review of the Literature and Recommended Remedies”, Journal of Applied Psychology, Vol. 88, No 5, p. 879-903.

- Prahalad, C. K.; Doz, Y. L. (1981), “An Approach to Strategic Control in MNCs”, Sloan Management Review, Vol. 22, p. 5-13.

- Prahalad, C. K.; Hamel, Gary (1990), “The Core Competence of The Corporation”, Harvard Business Review, Vol. May-June, p. 79-91.

- Rugman, Alan M.; Verbeke, Alain (2001), “Subsidiary-Specific Advantages in Multinational Enterprises”, Strategic Management Journal, Vol. 22, No 3, p. 237-250.

- Rugman, Alan, M.; Verbeke, Alain; Quyen, T. K. Nguyen (2011), “Fifty Years of International Business Theory and Beyond”, Management International Review, Vol. 51, No 6, p. 755-786.

- Ryan, Paul; Giblin, Majella; Andersson, Ulf; Clancy, Johanna (2018), “Subsidiary Knowledge Creation in Co-Evolving Contexts”, International Business Review, Vol. 27, No 5, p. 915-932.

- Scott-Kennel, Joanna; Giroud, Axèle (2015), “MNEs and FSAs: Network Knowledge, Strategic Orientation and Performance”, Journal of World Business, Vol. 50, No 1, p. 94-107.

- Suzuki, Kayuzuki (1993), “R&D Spillovers and Technology Transfer Among and Within Vertical Keiretsu Groups”, International Journal of Industrial Organization, Vol. 11, No 4, p. 573-591.

- Suzuki, Yotaro (2009), Sangyo Ricchiron, Hara Shobo, Tokyo.

- Taggart, James H. (1998), “Strategy Shifts in MNC Subsidiaries”, Strategic Management Journal, Vol. 19,, No 7, p. 663-681.

- Takahashi, Ichiro (2015), “Nihon Shijo ni Okeru COEs no Tokucho to Keieiseika”, Japan Academy of International Business Studies, Vol. 7, No 2, p. 89-103.

- Takeuchi, Ryusuke (2012), “Sengo Gaishikei Seiyaku Kigyo no Zainichi Keiei - Shakai Kankei Shihon ni Chumoku Shite”, Japan Academy of International Business Studies, Vol. 4, No 1, p. 109-121.

- Toyokeizaishinposha (2008), Foreign Subsidiaries in Japan CD-ROM, Toyo Keizai Shinposha, Tokyo.

- Toyokeizaishinposha (2015), Foreign Subsidiaries in Japan CD-ROM, Toyo Keizai Shinposha, Tokyo.

- UNCTAD. (2020), “FDI Database”, available at: https://unctadstat.unctad.org/EN/ (accessed 15 January 2021).

- White, Roderick, E; Poynter, Thomas, A. (1984), “Strategies for Foreign-Owned Subsidiaries in Canada”, Business Quarterly, Vol. 49, No 2, p. 59-69.

- Witt, Michael A. (2019), “The Business System in Japan”, in Hasegawa, Harukiyo; Witt Michael, A. (Eds.), Asian Business and Management: Theory, Practice and Perspectives. McMillan International, London, p. 194-207.

Parties annexes

Notes biographiques

Axèle Giroud (Dr) est professeur de commerce international et chef du groupe de commerce comparatif et international à l’Alliance Manchester Business School (Royaume-Uni). Elle est professeure affiliée à l’Université de Göteborg (Suède) et à la Rennes School of Business (France). Elle a été présidente de l’Association EAMSA et économiste à la CNUCED. Ses domaines de recherche comprennent les stratégies des entreprises multinationales, le transfert de technologie et de connaissances, l’impact de l’IDE, le développement durable et les marchés émergents. Dr Giroud a publié plus de 40 articles scientifique. Elle est rédactrice principale des revues scientifiques International Business Review et Journal of International Business Policy.

Yoo Jung Ha (Dr) est maître de conférences (professeur adjoint) en stratégie commerciale internationale à la Sheffield University Management School, Université de Sheffield, Royaume-Uni. Yoo Jung est titulaire d’un doctorat en administration des affaires de l’Alliance Manchester Business School et d’une maîtrise en développement international de l’Université d’Oxford. Elle a auparavant travaillé pour l’Université de York, au Royaume-Uni, pour le Korea Institute for International Economic Policy et pour le gouvernement de la Corée du Sud. Ses travaux ont été publiés dans des revues telles que l’Asian Business and Management, International Business Review, le Journal of Business Research et la Multinational Business Review.

Kazuyuki Marukawa (Dr) est vice-président de TANIOBIS GmbH et président-directeur-général de JX Metals Circular Solutions Europe GmbH en Allemagne. Il est également conseiller principal de JX Nippon Mining & Metals Cooperation et observateur du conseil d’administration d’Alloyed/OxMet Technologies, Oxford. Il est titulaire d’un doctorat en administration des affaires en stratégie commerciale internationale de l’Alliance Manchester Business School et d’un MBA de la London Business School. Il est également titulaire d’une licence en économie de l’Université Keio, au Japon. Ses domaines de recherche incluent les stratégies des multinationales, leurs rôles de subvention, leurs stratégies d’innovation et l’impact de l’IDE.

Chie Iguchi (Dr) est professeur de commerce international à la Faculté des affaires et du commerce de l’Université Keio, au Japon. Elle a obtenu son doctorat de l’Université de Reading, au Royaume-Uni. Elle était auparavant présidente de l’Association of Japanese Business Studies (AJBS) et représentante nationale du Japon de l’European International Business Academy (EIBA). Ses recherches portent sur les rôles subsidiaires des EMN les stratégies d’innovation des EMN et leurs impacts sur les pays d’accueil, le transfert de technologie et de connaissances et les liens interorganisationnels. Elle a publié dans des revues telles que l’Asia Pacific Journal of Management et l’Asian Business and Management.

Parties annexes

Notas biograficas

La Dra. Axèle Giroud es catedrática de Comercio International y Jefe del Grupo de Negocios Comparativos e Internacionales de la Alliance Manchester Business School (Reino Unido). Es profesora visitante de investigación en la Universidad de Gotemburgo (Suecia) y en la Escuela Superior de Comercio de Rennes (Francia). Anteriormente fue presidenta de la Asociación de Estudios de Gestión Euroasiática (EAMSA) y economista superior en la Conferencia de las Naciones Unidas sobre Comercio y Desarrollo (UNCTAD). La Dra. Giroud ha publicado en más de 40 revistas académicas. Es editora principal de International Business Review y Journal of International Business Policy.

La Dra. Yoo Jung Ha es profesora adjunta de Estrategia Empresarial Internacional en la Escuela de Administración de la Universidad de Sheffield (Reino Unido). Yoo Jung tiene un doctorado en Administración de Empresas por la Alliance Manchester Business School y un máster en Desarrollo Internacional por la Universidad de Oxford. Anteriormente trabajó para la Universidad de York (Reino Unido), el Instituto de Política Económica Internacional de Corea y el Gobierno de Corea del Sur. Sus trabajos han sido publicados en revistas como Asian Business and Management, International Business Review, Journal of Business Research y Multinational Business Review.

El Dr. Kazuyuki Marukawa es vicepresidente de TANIOBIS GmbH y director general de JX Metals Circular Solutions Europe GmbH en Alemania. También es asesor principal de JX Nippon Mining & Metals Cooperation y observador del conseio de administración de Alloyed/OxMet Technologies, Oxford. Es Doctor en Administración de Empresas en Estrategia Empresarial Internacional por la Alliance Manchester Business School y posee un MBA por la London Business School. También es licenciado en Economía por la Universidad de Keio, Japón. Sus intereses de investigación incluyen las estrategias de las EMN, sus funciones de subvención, sus estrategias de innovación y el impacto de la IED.

La Dra. Chie Iguchi es profesora de Negocios Internacionales en la Facultad de Negocios y Comercio de la Universidad de Keio, Japón. Se doctoró en la Universidad de Reading (Reino Unido). Anteriormente fue presidenta de la Asociación de Estudios Empresariales Japoneses (AJBS) y representante nacional de Japón de la Academia Europea de Negocios Internacionales (EIBA). Sus investigaciones se centran en las funciones de las filiales de las EMN y las estrategias de innovación de las EMN, así como sus repercusiones en los países de acogida, la transferencia de tecnología y conocimiento y los vínculos entre organizaciones. Ha publicado en revistas como Asia Pacific Journal of Management y Asian Business and Management.

Liste des tableaux

Table 1

Description of Subsidiaries in the Sample

Table 2

Correlations and Descriptive Statistics

Table 3

Empirical Results

Notes: (1) Model 1 presents the multinomial logit regression. The base outcome is a subsidiary with a single-competence in the sales and marketing function activity. The model tests the likelihoods of a subsidiary presenting dual or multiple competences rather than a single competence. (2) Robust standard errors appear in parentheses. (3) *** p<0.01, ** p<0.05, * p<0.1.

10.7202/1053580ar

10.7202/1053580ar