Résumés

Abstract

We propose to explore the research question of whether managers use available non-committed financial resources at their discretion to respond to stakeholder pressure. To address this question, we investigate the relationship between the corporate social performance (CSP) of industrial companies listed on Standard & Poor’s 500 and the financial resources (financial slack) at the discretion of their managers. We find that managers can use financial slack to extend and intensify the CSP of their companies. In terms of types of CSP, these resources are not allocated to reduce the impacts of their companies’ activities on the environment. They are rather oriented toward addressing social issues and social conditions. Moreover, we find that management decisions concerning the allocation of slack resources toward an increase in CSP vary according to a company’s risk profile.

Keywords:

- Corporate social responsibility,

- Financial slack,

- Corporate social performance,

- Managerial discretion,

- Industry risk profiles

Résumé

Les dirigeants utilisent les ressources financières non engagées disponibles à leur discrétion pour répondre à la pression des parties prenantes ? Pour répondre à cette question, nous étudions la relation entre la performance sociale des entreprises industrielles cotées au Standard & Poor’s 500 et les ressources financières à la discrétion de leurs dirigeants. Nous montrons que ces derniers peuvent utiliser les ressources financières disponibles à leur discrétion pour augmenter la performance sociale de leurs entreprises. Egalement, nous signalons que ces ressources ne sont pas allouées pour réduire les impacts environnementaux des activités de leurs entreprises. Ces ressources financières sont utilisées à la résolution des problèmes sociaux et des conditions sociales affectant les parties prenantes. Enfin, nous constatons que les décisions de gestion concernant l’allocation de telles ressources financières varient selon le profil de risque d’une entreprise.

Mots-clés :

- Responsabilité sociale des entreprises,

- Slack financier,

- Performance sociale des entreprises,

- discrétion managériale,

- Profil de risque des secteurs d’activité

Resumen

Proponemos explorar la pregunta de investigación de si los gerentes usan los recursos financieros no comprometidos disponibles a su discreción para responder a la presión de las partes interesadas. Para abordar esta pregunta, investigamos la relación entre el desempeño social corporativo (CSP) de las empresas industriales que figuran en Standard & Poor’s 500 y los recursos financieros (holgura financiera) a discreción de sus gerentes. Encontramos que los gerentes pueden usar la holgura financiera para extender e intensificar el CSP de sus compañías. En términos de tipos de CSP, estos recursos no se asignan para reducir el impacto de las actividades de sus empresas en el medio ambiente. Están más bien orientados a abordar problemas sociales y condiciones sociales. Además, descubrimos que las decisiones administrativas relacionadas con la asignación de recursos flojos hacia un aumento en la CSP varían según el perfil de riesgo de una empresa.

Palabras clave:

- Responsabilidad social corporativa,

- Holgura financiera,

- Desempeño social corporativo,

- Discreción gerencial,

- Perfiles de riesgo de la industria

Corps de l’article

In a time where large listed companies are subject to social ratings, improving relationships with stakeholders has emerged as a central concern for the management teams of public companies. Consequently, the antecedents of corporate social performance (CSP) have been the subject of an extensive literature. As CSP is often defined as the discretionary allocation of resources by corporations toward meeting stakeholder needs (Ackerman, 1975), financial slack is considered to be an obvious prerequisite. Orlitzky et al. (2003) claim that the most widely accepted explanation for why companies differ in their levels of stakeholder commitment is offered by the slack resource theory (Kraft and Hage, 1990; Waddock and Graves, 1997). According to this theory, there is a positive relationship between non-committed company resources and CSP. However, empirical studies exploring the slack resource hypothesis have led generated conflicting findings (Tan and Peng, 2003; Arora and Dharwadkar, 2011; Shahzad, Mousa and Sharfman, 2016). On one hand, proxies used for financial slack are assumed to be responsible for such inconclusive results. Indeed, Margolis and Walsh (2003) list a total of 22 studies that operationalize financial slack using accounting or market based indicators of performance rather applying the notion of available non-committed resources developed by Bourgeois (1981); and most recent works (Amato and Amato, 2011; Melo, 2012; Nelling and Webb, 2009) present the same limitation. Thus, testing the relationship between financial slack and CSP remains on the agenda. On the other hand, non-committed corporate expenditures in favor of stakeholders and society at large are often viewed as a major cost to firms (Vilanova, 2007). This may result in a corporate reticence to dedicate financial resources in surplus to corporate social responsibility (CSR) policies. Therefore, the conditions under which company management teams have used non-committed resources at their disposal to address stakeholder concerns should be scrutinized. Of the possible constituents of this decision, Kassinis and Vafeas (2006) show that pressures exerted by stakeholders significantly influence company commitments to environmental concerns. Following these authors, we investigate whether company exposure to environmental or social risks may facilitate the allocation of financial slack toward addressing stakeholders’ claims.

Thus, the present paper explores the research question of whether managers use available non-committed financial resources at their discretion to respond to stakeholder pressure. To address this question, we investigate the relationship between the CSP of 404 industrial companies listed on Standard & Poor’s 500 and the financial resources (financial slack) at the discretion of their managers. We carry out our study over 8 years (2009-2016) drawing on two databases: The Asset4 database managed by Thomson Reuters and the Orbis database developed by Bureau van Dijk. We conduct a two-step generalized method of moments (SYS-GMM) study of our data panel.

We find that managers can use financial slack to extend and intensify the CSP of their companies. In terms of types of CSP improvements, these resources are not allocated to reduce the impacts of their companies’ activities on the environment. They are rather oriented toward addressing social issues and social conditions. These findings lead to the conclusion that to understand the role and use of financial slack through CSP, a distinction must be made between the view of CSP as a response to legal obligations and norms of soft law and the view of CSP as a means to reduce pressures from community stakeholders.

Moreover, in assigning our sample firms to industries using Fama and French’s (1997) classification scheme, we find that management decisions concerning the allocation of slack resources toward an increase of CSP vary according to a company’s risk profile. Thus, this paper reveals a possible bias in the aggregation of past results; we also recommend better accounting for company risk profiles, and particularly those of large companies using globalized value chains, in the study of CSP.

The remainder of the paper proceeds as follows. In the following section (2), we present a literature review on the links between CSP and financial slack leading our hypotheses. Section 3 describes the methodology adopted in this study as well as the data and variables used. In Section 4, we present our main results before concluding in Section 5.

Literature Review and Hypothesis Development

Corporate Social Performance as a Configuration of Social Principles

Wood (1991) defines CSP as “a business organization’s configuration of principles of social responsibility, processes of social responsiveness, and policies, programs, and observable outcomes as they relate to the firm’s societal relationships”. Therefore, CSP should be view as an overarching concept that includes responsibilities, responsiveness, and policies and action in the social and societal domain (Wartick and Cochran, 1985; Wood, 1991, De Bakker et al., 2005). Social benefits in regards to the quality of life of community and society should derived from such policies (Tosun, 2016). Corporate policies to particular stakeholder groups form the grounds on which the social responsiveness of large and listed companies is deployed (Aguilera et al. 2007; Jensen 2002). Thus, social policies correspond to the orientations that companies assign to their decisions relative to all stakeholders or privileged stakeholders (Boncori et al., 2016). Many authors (Berry and Rondinelli, 1998; Shrivastava, 1995; Henriques and Sadorsky, 1999; Buysse and Verbeke, 2003, Kassinis and Vafeas, 2006) indicate that such policies are defined as a companies’ responses to pressures exerted by stakeholder groups. According to Kassinis and Vafeas (2006), four stakeholder groups are likely to influence company decisions: community stakeholders (groups organized around a social or environmental cause for the purpose of protecting their welfare), regulatory stakeholders (governments and legislatures), organizational stakeholders, and the media. In practice, such groups strive to influence company decisions either directly in the marketplace or indirectly through the public policy process. Mitchell, Agle, and Wood (1997) argue that the degree to which managers give priority to a stakeholder group claims is a function of managers’ perceptions of three key stakeholder attributes: power, legitimacy, and urgency. Thus, a manager’s willingness to response to stakeholders’ claims should be a function of environmental and social risks incurred by the company. As expenditures in favor of stakeholders are often viewed as a major cost to firms, the managers’ ability to satisfy stakeholder claims is dependent on the financial resources at their disposal (Vilanova, 2007).

The Non-Committed Resources at Managers Discretion: The Financial Slack

Historically, Cyert and March (1963) defined slack as “the difference between total resources and total necessary payments.” Organizational researchers (Bourgeois and Singh, 1983; George, 2005) conceptualized slack based on managerial discretion in the deployment of resources. In their view, slack resources are considered part of a continuum of managerial discretion which is defined as the “latitude of managerial action” (Hambrick and Finkelstein 1987, p. 371). High-discretion resources (e.g., cash and credit lines) increase a manager’s flexibility and strategic options while low-discretion resources (e.g. debt and fixed capacity) lower it.

Voss, Sirdeshmukh and Voss, (2008) distinguish four different types of slack – financial slack, operational slack, customer relational slack, and human resource slack. The financial slack is “financial resources in excess of what is required to maintain the organization” (Ang and Straub, 1998). It differs from other types of slack in two dimensions – rarity and absorption. Voss et al. (2008) describe financial slack as a bulk of financial resources characterized by low rarity and low absorption. Therefore, financial slack is related to high liquid assets (cash, short-term investments, receivables, etc.), and the facility to receive external financing (credit lines, reserve borrowing capacity, etc.). Since there are many ways to generate internally or acquire from financial markets such resources, they are not rare. Moreover, the financial slack’s perfect divisibility facilitates easy and quick allocation in different programs. Consequently, the financial slack has a low degree of absorption. Heterogeneity of financial slack must also be stressed. Bourgeois and Singh (1983) divide financial slack in three parts: available, recoverable, and potential slack. Available slack includes all the financial resources that are not yet assimilated into the organizational processes of the company (e.g., excess liquidity). Recoverable slack consists of resources that have already been absorbed into the organizational design as excess costs (e.g., excess overhead costs), but may be recovered during adverse times. Potential slack consists of the capacity of the organization to generate extra resources from the environment, as by raising additional debt or equity capital. These three slack dimensions are measured using financial data from annual reports. Financial slack gives decision agents the greatest degree of freedom in allocating it to alternate uses. Under these circumstances, excess resources and safety nets offered by financial slack enable firms to pursue new ideas and projects that require longer investment horizons, and whose outcomes are more uncertain and remote in time and space (Bourgeois 1981, March 1991).

Therefore, for the purpose of our study, we focus on available financial or unabsorbed slack for several reasons. First, financial slack represents excess uncommitted financial resources, including cash and receivables (Bourgeois and Singh 1983, Greve 2003, George 2005). These financial resources are highly flexible and can be applied to a wide range of activities, thereby constituting high discretion slack (Sharfman et al. 1988, George 2005). Financial slack gives decision agents the greatest degree of freedom in allocating it to alternate uses and is more easily redeployable than other types of slack in support of innovative investments (Nohria and Gulati 1996). Second, financial slack has been the focus for many previous studies (Bourgeois and Singh 1983, Greve 2003, George 2005, Nohria and Gulati 1996), providing both a theoretical and empirical

The Impact of Slack Resources on Corporate Social Performance

One of the most well-accepted explanation for why firms differ in their level of stakeholder engagement is offered by the “slack-resource theory” (Orlitzky, Schmidt, and Rynes, 2003, p. 406).

According to Bourgeois (1981), “slack is that cushion of actual or potential resources which allows an organization to adapt successfully to internal pressures for adjustment or to external pressures for change in policy, as well as to initiate changes in strategy with respect to the external environment.” Consequently, slack is considered to be an “obvious prerequisite” of CSP (Shahzad, Mousa and Sharfman 2016). Rooted in the behavioral theory of the firm, the slack resources hypothesis presents an explanation for why companies differ in their levels of CSP (Orlitzky, Schmidt and Rynes 2003). However, some studies have explored the slack resource hypothesis and have revealed contrasting findings. On the one hand, Seifert, Morris and Bartkus (2004) find a positive relationship between slack resources and corporate philanthropy. Measuring slack by past financial performance (FP), Waddock and Graves (1997) and Amato and Amato (2007) come to the same conclusion: slack resources at the discretion of managers are positively associated with CSP. On the other hand, Tan and Peng (2003) show that slack resources can be channeled by managers to their negative worth projects and into their objectives to acquire managerial influence.

Thus, the question of whether managers use such financial resources at their discretion to raise the CSP of their companies still remains. Moreover, empirical tests of this hypothesis have principally focused on prior firm FP as a means to assess slack (e.g., McGuire, Sundgreen and Schneeweis 1988). While the work of Kraft and Hage (1990) limits the measurement of slack resources to the proxy of the relative size firm. These mixed results and problems of the conceptualization and assessment of slack (Arora and Dharwadkar 2011; Shahzad, Mousa and Sharfman 2016) call for additional studies on (1) slack operationalization methods that best reflect its concept, (2) more sophisticated methods, and (3) applications to large samples and over long periods (Arora and Dharwadkar 2011; Panwar et al. 2015; Shahzad, Mousa and Sharfman 2016). This leads us to test the relationship between financial slack and CSP while taking these recommendations into account. We state the following hypothesis:

Hypothesis 1. Past financial slack of a firm is positively correlated with its current CSP.

Hypothesis 1a. Past financial slack of a firm is positively correlated with its current environmental performance.

Hypothesis 1b. Past financial slack of a firm is positively correlated with its current social performance.

The Impact of Industry Risk Profiles

The literature has shown that managerial discretion over slack resource allocation activities varies with different external contexts (Hambrick and Finkelstein 1987; Shahzad, Rutherford, and Sharfman 2016a). Drawing on this notion, Shahzad et al. (2016a: p. 515) recently found that higher levels of managerial discretion “derived from operating in munificent markets” capacitate managers to allocate the tangible and intangible resources generated by active stakeholder management such that FP is positively affected. On the contrary, higher levels of discretion provided by complex and uncertain environments lead to managerial discretion that lessen the stakeholder management-FP link. As for internal contexts, Aragón-Correa, Matias-Reche and Senise-Barrio (2004) found that environmental commitments of firms is associated with two endogenous factors: the fact that some managers feel responsible for environmental matters, and that superior environmental commitment is linked with executives having high levels of managerial discretion as members of their companies’ dominant coalitions. Therefore, evidence confirms that managerial discretion contexts also shape corporate commitment to the natural environment (Aragón-Correa et al. 2004). Thus, taking into account contexts is key to examine non-committed financial resources allocation by managers and its link with stakeholder management.

In the introduction of this paper, we note that a manager’s willingness to respond to stakeholder pressures is dependent on the environmental and social risks borne by a given company. Stakeholder power and legitimacy and risk urgency levels shape managers’ decisions in regards to environmental and social concerns (Mitchell, Agle, and Wood, 1997). Stakeholders can shape managers’ decisions in two ways (Frooman, 1999). First, a stakeholder group can influence managers’ decisions by withholding or manipulating a firm’s flow of resources. For instance, when consumers choose to boycott a company, they are placing direct pressure on that company. Second, a stakeholder group can inflect company decisions with the help of an ally which manipulates the flow of resources to the company. For instance, communities and governments: (1) provide the physical infrastructure and markets that firms use and operate within, (2) promulgate laws and regulations that influence the ways firms do business, and (3) impose taxes and other financial costs on firms (Clarkson, 1995; Hillman and Keim, 2001). According to Kassinis and Vafeas (2006), stakeholder pressure through regulatory and fiscal institutional allies is the most important strategy used by stakeholder groups. Once again, the legitimacy of stakeholder claims increases the likelihood that institutions will consider such claim. This leads us to distinguish between two types of claims.

First, environmental concerns have attracted the attention of many authors (Aragón-Correa et al., 2004; Berry and Rondinelli, 1998; Buysse and Verbeke, 2003; Henriques and Sadorsky, 1999; Shrivastava, 1995). Kassinis and Vafeas (2006) highlight the impacts of stakeholder pressures on the emissions of 5,033 individual plants in the most heavily polluting industries in the United States: chemicals, primary metals, and electric utilities. Second, the social risks borne by large and globalized firms are the subject of a nascent literature. Cruz (2013) or Zimmer et al. (2017) show that the business patterns specific to each industry rely more or less on global supply chains. This raises work conditions issues as well as questions regarding workforce development and the equality of opportunities along the value chain. According to the authors, bad press and stakeholder pressures on these concerns can damage a firm’s reputational capital and can impact its profitability. The recent political choices of U.S. voters stress that employment is a major concern for a large part of the population. Through the federal state, these voters want to place pressure on companies’ decisions regarding activity relocation. As environmental issues and business patterns are unique to each industry, we postulate the following hypotheses:

Hypothesis 2. The impact of financial resources at the managers’ discretion on CSP depends on the risk profile of their firm.

Hypothesis 2a. The impact of financial resources at the managers’ discretion on environmental performance depends on the risk profile of their firm.

Hypothesis 2b. The impact of financial resources at the managers’ discretion on social performance depends on the risk profile of their firm.

Methodology

A System of General Method Of Moments

The identification of the background and consequences of social responsibility policies in a company involves highlighting the dynamics linking different CSP proxies to study variables that may explain the evolution of CSP proxy values. However, regardless of the variable considered, its current value may depend in part on its value over recent years. For instance, levels of company social performance may be linked to efforts already made in this area in past years. In the same way, it is difficult to assume that major governance features are redefined each year from scratch. Moreover, financial ratios are driven by dynamics that are not exhausted at the end of each fiscal year, and these values show significant temporal correlations. Furthermore, previous studies indicate that dynamics at work are unique to each company (Black et al. 2006, Boncori et al. 2016). This means that individual fixed effects are important and that the dynamics of microeconomic order can be clouded through a bias of aggregation. Finally, as is supported by many management models, we cannot exclude any feedback from current or past shocks on the current value of explanatory variables. These are not strictly exogenous and this prohibits the use of panel regression models based on ordinary or double least squares. For all of these reasons, we apply the two-step system of generalized method of moments (SYS-GMM) proposed by Blundell and Bond (1998). This method is designed for the dynamic study of samples characterized by short time series of typically less than ten years and a large number of observations. The Model is treated as a system of equations (one per year) and Roodman (2006) shows that SYS-GMM allows for considerable heterogeneity between individuals and for the presence of idiosyncratic errors, which are heteroskedastic and correlated for the same individual. SYS-GMM allows for independent variables that are not strictly exogenous, meaning they are correlated with past and possibly current occurrences of the error; fixed effects; and heteroskedasticity and autocorrelation within individuals (Roodman, 2009). We treat the instruments following the recommendations of Holtz-Eakin et al. (1988): a set of instruments is built from the lagged dependent variable. This set of instruments is then transformed into a vector to generate a condition of moments that makes sense. Finally, we apply the correction proposed by Windjmeijer (2005), without which the variances of estimated parameters tend to be downward biased.

The validity of the econometric Model is dependent on testing: (1) error serial autocorrelations of order one and two according to the Arellano and Bond test and (2) the relevance of lagged variables used as an instrument according to the over-identification test proposed by Hansen. Moreover, Roodman (2009) shows that a very large number of instruments can be collectively invalid because they lead to an overfitting of endogenous variables. For this reason, we limit the time interval of the instruments to three years. When these conditions are met, Blundell and Bond (1998) show that estimators of the SYS-GMM are convergent.

Sample and Data

We present here the databases used to construct our sample as well as the variables of our study.

Sample

Numerous authors (Dierkes and Coppock, 1978; Trotman and Bradley, 1981; Fombrun and Shanley, 1990; Van Beurden and Gossling’s; 2008, Agan et al., 2016) have notice that size of the firms plays a role in the CSP. Larger firms have a higher value of CSP Index. Moreover, quoted firms are in the public scrutiny and therefore more aware (and caring) of their social and environmental reputation whilst markets are increasingly willing to reward good and responsible firms (Stanwick and Stanwick, 1998). Tyrrell (2006) contends that firms with a greater media exposure are spending billions annually in the name of corporate social responsibility. Consequently, in order to gather a homogeneous sample, we decide to focus our study on S&P 500’s firms. Our sample includes 404 industrial companies listed on Standard & Poor’s 500 for 2009-2016. Governance variables and those assessing the social responsibility of these companies were collected from the Asset4 database managed by Thomson Reuters, and financial variables were extracted from Bureau van Dijk’s Orbis database.

The Asset4 database offers objective, relevant and systematic information on the social responsibility commitments, performance and governance practices of 6,000 companies worldwide (July 2017). Thus, 750 data points collected at least annually are used to calculate 250 key performance indicators (KPI). These KPI are organized into 15 category variables that serve as a basis for computing 3 pillar scores: environment (3 categories: emissions reduction, the reduction of resources and product innovation); social (7 categories: quality of employment, health and safety, training and development, diversity, human rights, community, and product responsibility); and corporate governance (5 categories: the structure of the Board of Directors, functions of the Board of Directors, compensation committee, shareholder rights, vision and strategy). Finally, a global CSP score reflects a balanced view of a company performance in all three areas by computing an equal-weighted rating from the three pillar scores aforementioned.

The primary data sources used in Asset4 to establish different scores include all information provided by the company to financial market authorities, annual reports and CSP reports, information available on the websites of non-governmental organizations and information provided through the general or economic press. Shaukat et al. (2016) show that a growing number of analyses on the social and environmental performance of U.S. companies have been based on Asset4 (Cheng et al. 2014; Ionnou and Serafeim 2012; Kocmanova et al. 2011). Compared to its rival KLD, scores provided by Asset4 are based on more comprehensive calculations, creating less bias than the binary notation system generated by KLD.

We complemented information from Asset4 with financial variables drawn from the Orbis database. This database permits access to all accounting and financial information collected by regulatory agencies on more than 170 million companies around the world.

Study variables

Two types of variables were used in our study. First, we extracted Asset4 information on the CSP of Standard Poor’s 500 companies. Second, we drew financial variables relevant to our study from the Orbis database.

Variables reflecting environmental, social and governance performance

Overall Corporate Social Performance (OCSP)

Wood (1991) defines CSP as “a business organization’s configuration of principles of social responsibility, processes of social responsiveness, and policies, programs, and observable outcomes as they relate to the firm’s societal relationships.” The equal-weighted rating given by Asset4 aims to compute a balanced score from environmental, social, governance company ratings. Therefore, this variable equally weights the interests attached to each stakeholder and reflects a balanced approach of CSP. We thus adopt as proxy of CSP the variable “equal-weighted rating” used in Asset4.

Corporate environmental score (CES)

Asset4’s environment pillar summarizes company scores in regards to reducing emissions and resource use levels and elements of eco-efficient innovation included products. The Asset4 glossary states that the environment pillar “measures the impact of a company on the living natural systems and not living, including air, land and water, as well as complete ecosystems. It reflects the way in which a company uses the best management practices to avoid environmental risks and capitalize on environmental opportunities in order to generate a long term shareholder value.” To establish this score, Asset4 evaluators use information on energy used by a company as well as its CO2 emissions, water usage and waste recycling protocols. All controversies concerning spills or pollution caused by a company’s activities are also taken into account in the rating.

We thus use the corporate environmental score (CES) as a proxy for a company’s environmental performance.

Corporate social score (CSS)

The Asset4 social pillar measures a company’s ability to gain the trust and loyalty of its employees and customers and of society as a whole through the use of best management practices. It reflects a company’s reputation and the health of its operations, which are key factors determining its ability to generate long-term shareholder value. This variable summarizes a company’s scores on the following issues: (1) diversity and equal opportunities in the workforce, (2) high-quality employment benefits and job conditions, (3) healthy and safe workplace conditions, and (4) workforce training and professional development.

Therefore, we use the corporate social score (CSS) as a proxy for a company’s performance regarding social issues.

Financial variables

Company financial slack (Slack)

According to Bourgeois (1981), a “cushion of actual or potential resources” allows a firm to respond to internal or external needs for strategic change. The availability of financial resources not only provides firms with opportunities to commit resources to social causes (Waddock & Graves, 1997), but it also renders them more likely to satisfy stakeholder demands (Arora and Dharwadkar, 2011). Therefore, a company’s financial slack should be only approximated from available financial resources at the discretion of management teams. Arora and Dharwadkar (2011) stress that with the exception of Navarro (1988) and Seifert, Morris, and Bartkus (2004), studies have often approximated this resource based on a company’s financial performance. However, numerous conceptualizations of financial slack ignore that only the portion of financial resources which is not already reserved for a specific, planned use should be regards as financial slack. Moreover, Bourgeois (1981) argued that, from a research perspective, relative measures of slack are generally more useful. Hence, using the current ratio (current assets divided by current liabilities) to operationalize financial slack (e.g., Greve, 2003; Kim et al., 2008; Singh, 1986) may result in more valid and generalizable empirical findings. Operationalization that attempt to measure the amount of cash held by the firm that is above and beyond some minimum level of operational need (e.g., current liabilities) are most consistent with theoretical definitions of financial s lack existing in excess of foreseeable need. Consequently, like Bourgeois III and Singh, (1983;), Bradley, Wiklund, and Shepherd (2010), Bromiley (1991), Chiu and Liaw (2009), Geiger and Cashen (2002) we use the current ratio as the main proxy of financial slack. Firm with higher current ratio have higher level of financial slack (Bourgeois and Singh, 1983).

In addition, we also decide to compute quick ratio (defined as the sum of cash, markeTable securities and accounts receivable to the current liabilities) which is a restrictive proxy of financial slack and the working capital ratio (working capital divided by sales) for our robustness check. If working capital grows faster than sales, then excess liquidity and financial slack increase (Daniels et al., 2004).

However, the competitive task environment common to firms in the same industry influences the slack reference point needed to face risk taking (Singh, 1986; Ferrier and Lee, 2002). Hence, Latham and Braun (208) suggest that slack serves as a discretionary tool used by managers to insulate external impacts from the competitive environment and industry factors. Therefore, we adjust the measures of financial slack, by taking, for each proxy, and for each year, the difference between the firm ratio considered and the mean of the industry’ value of that ratio as recommended by reviewer of the present article. This adjusted measure of slack is denoted Adjust-slack in the remainder of this paper.

Industry Risk Profiles

As stressed by Fama and French (1997) and by Ozbas and Sharfstein (2010), firms in the same industry face similar exposure risks. Among them, environmental risks are directly linked to the operations undertaken. For instance, Gatzert et al. (2016) highlight the $59 billion loss recorded by BP shareholders as a financial consequence of the 2010 Gulf Coast oil spill. The social risks borne by large and globalized firms are the subject of a nascent literature. Cruz (2013) and Zimmer et al. (2017) show that the business patterns specific to each industry are more or less shaped by global supply chains. This raises work conditions issues as well as questions regarding workforce development and on the equality of opportunities along the value chain. According to the authors, bad press and stakeholder pressures regarding these concerns can damage a firm’s reputational capital and can influence its profitability. Therefore, from the industrial classification proposed by Fama and French, we identify five industries that present different risk profiles[1]:

Cnsmr: Consumer Durables, Nondurables, Wholesale and Retail

Manuf: Manufacturing, Energy, and Utilities

HiTec: Business Equipment, Telephone and Television Transmission

Hlth: Healthcare, Medical Equipment, and Drugs

Other: Mines, Construction, Construction Materials, Transport, Hotels, Business Services, Entertainment

Control variables

GMM is an autoregressive Model that allows for the absence of quasi-stationary control variables (Roodman, 2007). However, numerous authors have noted that CSP are correlated with company size. We thus control for this variable using balance sheet total assets (TA). In addition, we take into accounts the potential time-related effects by including a full set of year dummies.

Empirical Analysis and Results

Descriptive Statistics

The descriptive statistics of the variables used in our study are given in Table 1. A comparison drawn between the medians and means of variables associated with the extra-financial performance (OCSP, CES, and CSS) for our sample’s companies shows that these variables are left skewed. Moreover, the dispersion of these variables is large and values for the first quartile show that a quarter of the S&P companies take little account of environmental and social issues. The total assets variable (TA) highlights the size dispersion of the companies in our sample as well as the severe right skewness of this variable. Finally, the slack ranges from zero to twenty-three while the median is less than two.

Such major differences in the dispersion of variables and in their distribution asymmetries lead us to standardize the variables of our study. In the remainder of the article we use a Z abbreviation to denote a transformed variable.

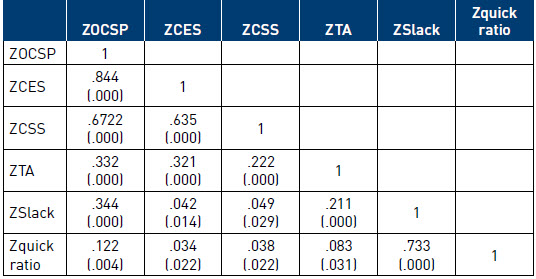

Table 2 presents the pairwise correlations of the study variables. The results of the Pearson correlation tests are shown. However, the nature of our variables (indices and ratios) leads us to interpret the results of these tests with great caution (Aldrich, 1995). Correlations between the variables reflecting extra-financial commitments (OCSP, CES, and CSS) of the S&P 500 companies are high. These variables are positively and significantly correlated with company size and financial slack. Finally, Table 3 reports the distribution of our sample based on company risk profiles. The distribution based on risk profiles is relatively well balanced even though consumer goods and manufacturing industries dominate our sample.

Table 1

Descriptive statistics of the study variables

Table 2

Pairwise correlations of the study variables

Table 3

Risk profile distribution of the company sample

Econometric Results

Here, we present the results of our SYS-GMM models in two steps based on a finished sample correction and the robust estimator of standard deviations (White 1980). First, we assess the validity of our specification. For each SYS-GMM model, we calculate the Hansen J test score on restrictions of over identification and conduct an Arellano and Bond test (1991) relating to first and second order serial auto-correlations. The Hansen J test validates the adequacy of instruments used in the SYS-GMM models. The Arellano and Bond tests on serial autocorrelations of the first order should be significant and negative while the second order autocorrelation test must reject the H0 hypothesis. When these conditions are met, the convergence of SYS-GMM estimators is ensured.

Table 4 presents the effects of previous financial slack on the current performance of S&P 500 companies regarding their overall, environmental, social and governance performance. First extra-financial performance of the past two years positively and very significantly influences the current extra-financial performance of a given company (models I, II and III). Therefore, companies committed in extra-financial issues tend to reinforce their CSR commitment year after year. Second, financial slack accumulated during the previous two years positively and significantly influences the current overall CSP (Model I). Therefore, hypothesis H1 is validated which means that increasing a firm overall CSP requires the accumulation of slack resources in previous years. However, financial slack is not geared towards improving the environmental impacts of company operations and past two years financial slack values do not significantly influence the current environmental performance of the companies included in our sample (Model II). Thus, our hypothesis 1a is invalidated. Model III shows that managers use financial slack to address social concerns through the company and to acknowledge different stakeholders: past financial slack values significantly and positively affect the current social performance of S&P 500 companies. Consequently, our hypothesis 1b is validated.

Table 4

The effects of previous industry adjusted financial slack on the current performance of S&P 500 companies regarding their overall, environmental and social performance

*p<.1, ** p<.05, ***p<.01

Note: Two-step SYS-GMM estimation with finite-sample correction and robust standard errors, controlling for size (company total assets) and risk profile. The set of instruments is built from the three years lagged dependent variables. We use ***, **, and * to denote significance at the 1%, 5%, and 10% level (two-sided), respectively.

ZOCSP is the normalized score reflecting the overall CSP of sample companies, ZCES is the normalized score reflecting their environmental performance and ZCSS is the normalized score reflecting social performance. ZAdjust-slack is the normalized difference between the current ratio of the firm and the mean current ratio in its industry. ZTA the normalized total assets of sample companies.

SYS-GMM, generalized method of moments in system.

In accordance with the assumptions of our literature review, we also study the impact of past financial slack on the current overall CSP of S&P 500 companies according to their risk profiles. Table 5 shows the results of the SYS-GMM regressions we conducted. The effect of the two previous years’ financial slack on current overall CSP depends on company risk profile. While companies in industries that rely on global supply chains and low wage workforces (Cnsmr, Manuf, and Other) use financial slack to further their overall CSP (Model IV, V and VIII), high-tech and health companies basing their operations primarily on highly educated and well-paid engineers do not need financial slack to reduce pressures exerted by stakeholders (Model VI and VII). Thus, our hypothesis 2 is validated.

We deepen these results and estimate the effects of the previous two years slack on the current environmental and social score according to each of the five-risk profile defined. The results are presented below (Table 6). First, the coefficients associated to the lagged values of the slack are non-significant at the five percent threshold (Model IX, XI, XIII, XV, and XVII). Thus, whatever the risk profile considered, the slack accumulated by our sample’s firms during the two previous years does not nurture the increase of the environmental performance. Consequently, our Hypothesis 2a is not validated. Second, the effects of previous two years’ slack on the current social performance of S&P500 industrial firms according to their risk profile present contrasted results. In the one hand, this effect is positive and significant at the five percent threshold for firms’ profiles that rely on global supply chains and low wage workforces (Model X, Model XII and Model XVIII). On the other hand, the effect of past slacks on the current social performance of High Tech or Healthcare firms is very low and insignificant at the 10 percent threshold. Therefore, the impact of slack on social performance depends on the firm’s risk profile. Our hypothesis 2b is validated. Finally, while Table 5 highlights the significant impact of past slacks on the current overall corporate social score of firms in the High Tech or Healthcare industries Table 6 does not allow us to show the direction of these expenditures. Firms’ managers in these industries do not use financial resources at their discretion to respond meaningfully to environmental or social concerns. Therefore, more in-depth analyzes are needed to explore the governance-related interests of the overall corporate social score for high-tech and healthcare firms.

Table 5

The effects of previous industry adjusted financial slack on the current overall social performance of S&P 500 companies according to their risk profiles

*p<.1, ** p<.05, ***p<.01

Note: Two-step SYS-GMM estimation with finite-sample correction and robust standard errors, controlling for size (company total assets) and risk profile. The set of instruments is built from the three years lagged dependent variables. We use ***, **, and * to denote significance at the 1%, 5%, and 10% level (two-sided), respectively.

ZOCSP is the normalized score reflecting the overall CSP of sample companies, ZCES is the normalized score reflecting their environmental performance and ZCSS is the normalized score reflecting social performance. ZAdjust-slack is the normalized difference between the current ratio of the firm and the mean current ratio in its industry. ZTA the normalized total assets of sample companies.

SYS-GMM, generalized method of moments in system.

We also ran additional tests to ensure the robustness of our results. Although current ratio is the most used and most robust variable to measure the non-committed financial resources at managers ‘disposal, we also conducted robustness checks to ensure that our results are not dependent on the selection of our variable definition. Therefore, we reran the GMM by replacing current ratio by quick ratio and working capital ratio. Moreover, we ran different specification of our GMM-SYS Model including different span of lag and different instruments. These additional robustness tests resulted in similar finding. These two ratios positively affect the social performance of our sample’s companies while the effect on environment performance is insignificant. In addition, quick ratio impact on the overall CSP is notably stronger for industries characterized by global supply chains and low wages workforce.

Discussion

The research question raised in this study was whether managers use available non-committed financial resources at their disposal to respond to stakeholder pressures or not. We have found that managers can use financial slack to increase their companies’ CSP. These findings suggest that the intensifying of CSR commitments are highly dependent on the non-committed financial resources associated with managerial discretion.

Table 6

The effects of previous industry adjusted financial slack on the current environmental and social performance of S&P 500 companies according to their risk profiles

*p<.1, ** p<.05, ***p<.01

Note: Two-step SYS-GMM estimation with finite-sample correction and robust standard errors, controlling for size (company total assets) and risk profile. The set of instruments is built from the three years lagged dependent variables. We use ***, **, and * to denote significance at the 1%, 5%, and 10% level (two-sided), respectively. ZCES is the normalized score reflecting their environmental performance and ZCSS is the normalized score reflecting social performance. ZAdjust-slack is the normalized difference between the current ratio of the firm and the mean current ratio in its industry. ZTA the normalized total assets of sample companies. SYS-GMM, generalized method of moments in system.

The theoretical Model of organizational slack addresses the issue of the link between CSP and FP by advancing the idea that it is not social responsibility that is the condition for achieving a high level of FP but higher level of FP that allows the company to engage in socially responsible actions (McGuire et al., 1988; Preston, 1991). Kraft and Hage (1990) show that excess resources and managers’ attitudes towards society strongly influence the overall level of CSR. However, they limit the measurement of slack resources taken as a whole to the firm’s “relative size” proxy. Nevertheless, slack resources are of four different types of slack: financial slack, operational slack, customer relational slack, and human resource slack (Voss et al., 2008). Therefore, our research contributes to their work by showing here that it is specifically the non-committed financial resources at managers’ disposal which increase CSP.

Second, our study shows that the discretionary allocation of financial slack resources toward CSP fluctuate according to CSP components. Executives turn to further social aspects of CSP when they have extra financial resources at their disposal and are left free of shareholder scrutiny. This result is consistent with the findings of McGuire et al. (1988), Waddock and Grave (1997), and Fauzi and Idris (2009) who show that corporate FP is the most important variable in promoting CSR in manufacturing firms.

These two finding can be interpreted within the framework of institutionalism theory (DiMaggio and Powell, 1983) as a consequence of two different approaches of CSP. On one hand, the environmental aspect of CSP is improved for coercive and mandatory reasons. On the other hand, the social aspect of CSP is improved in response to normative and mimetic pressures. Indeed, the environmental impacts of business activities are subject to regulations and results that companies must submit themselves to. Therefore, corporate discretionary resources used to meet mandatory standards, rules and laws are meaningless, as investments needed to meet standards are budgeted. On the other hand, social conditions for employees and subcontractors are subjected to scrutiny and stakeholder pressure. Thus, in this case, financial slack is used to reduce such pressures. These results lead to conclude that to understand the role and use of financial slack for CSP improvement, we ought to distinguish between CSP as a response to legal obligations and norms of soft law and CSP as a means to reduce pressures exercised by stakeholders (Marano and Kostova 2016).

In line, with the question raised in this research whether past financial slack of a firm is positively correlated with its current CSP or not, we have found that financial slack accumulated during previous years positively and significantly influences the current overall CSP. This result echoes to the work of Waddock and Graves (1997), and Amato and Amato (2007).

Finally, this research highlights the influence of firm risk profiles related to industry groups on the discretionary allocation of financial resources to CSP. More specifically, our findings lead us to conclude that the impact of slack on social performance depends on the firm’s risk profile, whereas the impact of financial slack on environmental performance does not depend on the studied firms’ risk profile. As previous studies have shown the impact of companies’ internal contexts to managerial discretion in favor of environmental commitments (e.g. Aragón-Correa et al. 2004), our findings contribute to the existing literature by examining one specific external context which is the industry level and the associated firm risk profiles. First, it confirms the idea that managerial discretion over slack resource allocation activities varies with external contexts (Hambrick and Finkelstein 1987; Shahzad et al. 2016a). Second, it complements the work of Shahzad et al. (2016a) which focuses on managerial discretion levels derived from operating in munificent markets and the ones offered by complex and uncertain environments, and their impacts on the stakeholder management-FP link. Indeed, it extends it by taking into consideration that a given company bears specific environmental and social risks in relation to its industry and that this influences the impact of financial resources at the managers’ discretion on CSP.

Conclusion

The aim of this paper was to assess whether and/or to what extent managers use financial resources at their disposal to extend the extra-financial performance of their companies. Drawing on data collected over a long period (2009-2016), from a sample composed of large US listed companies, we apply an econometric Model based on the system of the generalized method of moments (SYS-GMM). This method can be used to rectify endogeneity biases in regression models based on panel data. Our paper makes several contributions to the extant literature on CSP.

First, it shows that managers use financial slack to improve their overall CSP suggesting that the furthering of CSR commitments are highly dependent on the non-committed financial resources at the managers’ disposal. Second, it suggests that the discretionary allocation of financial resources toward CSP varies according to CSP components. Managers tend to favor social aspects of CSP when they have access financial resources and are left free of shareholder scrutiny. Third, this paper outlines the impacts of firm risk profiles related to their industry groups on the discretionary allocation of financial resources to CSP. In particular, industries that rely on global supply chains and low wage workforces use financial slack to enhance their CSP contrary to the other. This could mean that the globalized firms’ managers tend to reduce social pressures from stakeholders using the non-committed financial resources at their disposal.

The managerial implications of the present study are manifold. We show that non-committed financial resources at the managers ’disposal can be used in response to the stakeholders’ social claims. We then stress that the usefulness of such an allocation of non-committed financial resources highly depends on the business pattern of each industry. Finally, we show that this means of reducing social pressure is satisfactory for managers who further the allocation of non-committed financial resources to CSP improvement year after year.

It should be pointed out that this study has several limitations. The first limitation is related to the sample. We used US firm data only. These results may be valid in other developed economies that are similar to the U.S., however, this might not be the case in countries where greater stakeholder engagement is a part of the social and institutional setting (Shahzad, Rutherford and Sharfman 2016b). The second limitation is that no study has examined the constructs of this research (the use of resources by managers to improve the CSP of their firms according to the company risk profiles). So, the comparison of our results to the existing literature is difficult. Finally, the multidimensional nature of CSP implies that each dimension may be impacted by the availability of funds with different intensities. According to Orlitzky et al. (2003) and Sahut, Mili, Tekayac and Teulon (2016), investment in each particular dimension may provide a different level of CSP and return to the firm. We suggest that future researchers are even more specific, by combining quantitative and qualitative analyses. Taking into account company risk profiles, this level of detailed analysis may precisely indicate which are the exact financial resources that are the more prone to impact CSP improvement.

The paper also opens up interesting avenues for future research. For example, what are the differences between the U.S. and the E.U. about impacts of financial slack on CSP? Does the financial slack affects CSP and may alleviate social concerns in emerging countries?

Parties annexes

Biographical notes

Eric Braune is a Professor in Management and Finance at INSEEC U Lyon. He received his Ph.D. in management from IAE Aix-en-Provence (2011), a Master of Research in Economics Philosophy from Aix-en-Provence University and a Master in Econometrics from Paris I. His research mainly deals with innovation management, organizational theory and corporate governance. He was previously the Regional Managing Director of a large French group and he is still committed to business incubators and science park in Lyon (France)

Lubica Hikkerova is a professor at the IPAG Business School, Paris. She obtained her PhD at Matej Bel University in Banska Bystrica, Slovakia (ISO 9001 certified). His main research fields are summed up in two axes; marketing in tourism on the one hand, the creation and development of entrepreneurs and small businesses on the other.

Anne-Laure Boncori is an Associate Professor in Management and Strategy at INSEEC School of Business & Economics. Her research focuses on the models of management and corporate governance, and examines the diffusion of management idea and practices. Nominee in 2013 for the William H. Newman Award (cross-divisional best paper award based on dissertation for the whole Academy of Management), Anne-Laure is also specialized in Business History.

Note

-

[1]

This five-industry classification is detailed on the Kenneth R. French webpage: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/Data_Library/det_48_ind_port.html

Bibliography

- Ackerman R.W. (1975). The Social Challenge to Business, Harvard University Press.

- Ağan, Y., Kuzey, C., Acar, M.F., Açıkgöz, A. (2016). “The Relationships Between Corporate Social Responsibility, Environmental Supplier Development, and Firm Performance”, Journal of Cleaner Production, Vol. 112, N° 3, p. 1872-1881.

- Aguilera, R.V., Rupp, D.E.; Williams, C.A., Ganapathi, I. (2007). “Putting the S back in Corporate Social Responsibility: A Multilevel Theory of Social Change in Organizations”, Academy of Management Review, Vol. 32, N° 3, p. 836-863.

- Amato, C.H., Amato, L.H. (2011). “Corporate Commitment to Global Quality of Life Issues: Do Slack Resources Industry Affiliations and Multinational Headquarters Matter?”, Business and Society, Vol. 50, N° 2, p. 388-416.

- Aragón-Correa, J.A., Matias-Reche, F., Senise-Barrio, M.E. (2004). “Managerial Discretion and Corporate Commitment to the Natural Environment”, Journal of Business research, Vol. 57, N° 9, p. 964-975.

- Arellano, M., Bond, S. (1991). “Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations”, The Review of Economic Studies, Vol. 58, N° 2, p. 277-297.

- Arora, P., Dharwadkar, R. (2011). “Corporate Governance and Corporate Social Responsibility (CSR): The Moderating Roles of Attainment Discrepancy and Organization Slack”, Corporate Governance: An International Review, Vol. 19, N° 2, p. 136-152.

- Bebbington, J., Larrinaga, C., Moneva, J.M. (2008). “Corporate Social Reporting and Reputation Risk Management”, Accounting Auditing and Accountability Journal, Vol. 21, N° 3, p. 337-361.

- Berry, M.A., Rondinelli, D.A. (1998). “Proactive Corporate Environmental Management: A New Industrial Revolution”, Academy of Management Executive, Vol. 12, N° 2, p. 38-50.

- Black, B.S., Jang, H., Kim, W. (2006). “Does Corporate Governance Predict Firms’ Market Values? Evidence from Korea”, Journal of Law Economics and Organization, Vol. 22, N° 2, p. 366-413.

- Blundell, R., Bond, S. (1998). “Initial Conditions and Moment Restrictions in Dynamic Panel Data Models”, Journal of Econometrics, Vol. 87, N° 1, p. 115-143.

- Boncori, A.L., Braune, E., & Mahieux, X. (2016). “Corporate Commitments to Stakeholders over Time and Across Countries: A European Comparative Study (2000-2010)”, Management International/International Management, Vol. 20, p. 162-178.

- Bourgeois, L.J., Singh, J.V. (1983, August). “Organizational Slack and Political Behavior among Top Management Teams”. In Academy of Management Proceedings, Vol. 1983, N° 1, p. 43-47. Briarcliff Manor, NY 10510: Academy of Management.

- Bourgeois, L.J. (1981). “On the Measurement of Organizational Slack”, Academy of Management Review, Vol. 6, N° 1, p. 29-39.

- Bradley, S.W., Shepherd, D.A., Wiklund, J. (2011). “The Importance of Slack for New Organizations Facing ‘Tough’Environments”, Journal of Management Studies, Vol. 48, N° 5, p. 1071-1097.

- Bromiley, p. (1991). Testing a Causal Model of Corporate Risk Taking and Performance”, Academy of Management Journal, Vol. 34, N° 1, p. 37-59.

- Buysse, K., Verbeke, A. (2003). “Proactive Environmental Management Strategies: A Stakeholder Management Perspective”, Strategic Management Journal, Vol. 24, N° 5, p. 453-470.

- Cheng, B., Ioannou, I., Serafeim, G. (2014). “Corporate Social Responsibility and Access to Finance”, Strategic Management Journal, Vol. 35, N° 1, p. 1-23.

- Chiu, Y.C., Liaw, Y.C. (2009). “Organizational Slack: Is More or Less Better?”, Journal of Organizational Change Management, Vol. 22, N° 3, p. 321-342.

- Clarkson, M.B. (1995). “A Stakeholder Framework for Analyzing and Evaluating Corporate Social Performance”, Academy of Management Review, Vol. 20, N° 1, p. 92-117.

- Clarkson, M.B. (1995). “A Stakeholder Framework for Analyzing and Evaluating Corporate Social Performance”, Academy of Management Review, Vol. 20, N° 1, p. 92-117.

- Cruz, J.M. (2013). “Mitigating Global Supply Chain Risks Through Corporate Social Responsibility”, International Journal of Production Research, Vol. 51, N° 13, p. 3995-4010.

- Cyert, R.M., March, J.G. (1963). A Behavioral Theory of the Firm, Englewood Cliffs, N.J.

- De Bakker, F.G., Groenewegen, P., Den Hond, F. (2005). “A Bibliometric Analysis of 30 Years of Research and Theory on Corporate Social Responsibility and Corporate Social Performance”, Business & Society, Vol. 44, N° 3, p. 283-317.

- Dierkes, M., R. Coppock. (1978). “Europe Tries the Corporate Social Report”, Business and Society Review, Printemps, Vol. 25, p. 21-24.

- Fombrun, C., M. Shanley. (1990). “What’s in a Name? Reputation Building and Corporate Strategy”, Academy of Management Journal, Vol. 33, N° 2, p. 233-258.

- DiMaggio, P., Powell, W.W. (1983). “The Iron Cage Revisited: Collective Rationality and Institutional Isomorphism in Organizational Fields”, American Sociological Review, Vol. 48, N° 2, p. 147-160.

- El Ghoul, S., Guedhami, O., Kwok, C.C., Mishra, D.R. (2011). “Does Corporate Social Responsibility Affect the Cost of Capital?”, Journal of Banking and Finance, Vol. 35, N° 9, p. 2388-2406.

- Fama, E.F., French, K.R. (1997). “Industry Costs of Equity”, Journal of Financial Economics, Vol. 43, N° 2, p. 153-193.

- Fauzi, H., Idris, K. (2009). “The Relationship of CSR and Financial Performance: New Evidence from Indonesian Companies”, Issues in Social and Environmental Accounting, Vol. 3, N° 1, p. 66-87.

- Ferrier, W., Lee, H. (2002). “Strategic Aggressiveness, Variation, and Surprise: How the Sequential Pattern of Competitive Rivalry Influences Stock Market Returns”, Journal of Managerial Issues, Vol. 14, N° 2, p. 162-180.

- Frooman, J. (1999). “Stakeholder Influence Strategies”, Academy of Management Review, Vol. 24, N° 2, p. 191-205.

- Gatzert, N., Schmit, J.T., Kolb, A. (2016). “Assessing the Risks of Insuring Reputation Risk”, Journal of Risk and Insurance, Vol. 83, N° 3, p. 641-679.

- Geiger, S.W., Cashen, L.H. (2002). “A Multidimensional Examination of Slack and its Impact on Innovation”, Journal of Managerial Issues, p. 68-84.

- George, G. (2005). “Slack resources and the performance of privately held firms”, Academy of Management Journal, Vol. 48, N° 4, p. 661-676.

- Hambrick, D.C., Finkelstein, S. (1987). “Managerial discretion: Bridge between polar views of organizational outcomes,” Research in Organizational Behavior, N° 9, p. 369-406.

- Henriques, I., Sadorsky, p. (1999). “The Relationship between Environmental Commitment and Managerial Perceptions of Stakeholder Importance”, Academy of Management Journal, Vol. 42, N° 1, p. 87-99.

- Hillman, A., Keim, G. (2001). “Stakeholder Value Stakeholder Management and Social Issues: What’s the Bottom Line?”, Strategic Management Journal, Vol. 22, N° 2, p. 125-139.

- Holtz-Eakin, D., Newey, W., Rosen, H.S. (1988). “Estimating Vector Autoregressions with Panel Data”, Econometrica: Journal of the Econometric Society, p. 1371-1395.

- Ioannou, I., Serafeim, G. (2012). “What Drives Corporate Social Performance? The Role of Nation-Level Institutions”, Journal of International Business Studies, Vol. 43, N° 9, p. 834-864.

- Jensen, M. (2002). “Value Maximization Stakeholder Theory and the Corporate Objective Function”, Business Ethics Quarterly, Vol. 12, p. 235-56.

- Kassinis, G., Vafeas, N. (2006). “Stakeholder Pressures and Environmental Performance”, Academy of Management Journal, Vol. 49, N° 1, p. 145-159.

- Kocmanová, A., Hrebicek, J., Docekalova, M. (2011). “Corporate Governance and Sustainability”, Economics and Management, Vol. 16, p. 543-550.

- Kraft, K.L., Hage, J. (1990). “Strategy Social Responsibility and Implementation”, Journal of Business Ethics, Vol. 9, N° 1, p. 11-19.

- Latham, S., Braun, M. (2008). “The Performance of Financial Slack during Economic Recession and Recovery: Observations from the Software Industry (2001-2003)”, Journal of Managerial Issues, Vol. 20, N° 1, p. 30-50.

- Marano, V., Kostova, T. (2016). “Unpacking the Institutional Complexity in Adoption of CSR Practices in Multinational Enterprises”, Journal of Management Studies, Vol. 53, N° 1, p. 28-54.

- Margolis, J.D., Walsh, J.P. (2003). “Misery Loves Companies: Rethinking Social Initiatives by Business”, Administrative Science Quarterly, Vol. 48, N° 2, p. 268-305.

- McGuire, J.B., Sundgren, A., Schneeweis, T. (1988). “Corporate Social Responsibility and Firm Financial Performance”, Academy of Management Journal, Vol. 31, N° 4, p. 854-872.

- Melo, T. (2012). “Slack-Resources Hypothesis: A Critical Analysis under a Multidimensional Approach to Corporate Social Performance”, Social Responsibility Journal, Vol. 8, N° 2, p. 257-269.

- Mitchell, R.K., Agle, B.R., Wood, D.J. (1997). “Toward a Theory of Stakeholder Identification and Salience: Defining the Principle of Who and What really Counts”, Academy of Management Review, Vol. 22, N° 4, p. 853-886.

- Nelling, E., Webb, E. (2009). “Corporate Social Responsibility and Financial Performance: The Virtuous Circle Revisited”, Review of Quantitative Finance and Accounting, Vol. 32, N° 2, p. 197-209.

- Orlitzky, M., Benjamin, J.D. (2001). “Corporate Social Performance and Firm Risk: A Meta-Analytic Review”, Business & Society, Vol. 40, N° 4, p. 369-396.

- Orlitzky, M., Schmidt, F.L., Rynes, S.L. (2003). “Corporate Social and Financial Performance: A Meta-Analysis”, Organization Studies, Vol. 24, N° 3, p. 403-441.

- Ozbas, O., Scharfstein, D.S. (2010). “Evidence on the Dark Side of Internal Capital Markets”, Review of Financial Studies, Vol. 23, N° 2, p. 581-599.

- Panwar, R., Nybakk, E., Hansen, E., Pinkse, J. (2015). “Does the Business Case Matter? The Effect of a Perceived Business Case on Small Firms’ Social Engagement”, Journal of Business Ethics, p. 1-12.

- Ribeiro, S.P., Menghinello, S., De Backer, K. (2010). “The OECD ORBIS Database: Responding to the Need for Firm-Level Micro-Data in the OECD”, OECD Statistics Working Papers, N° 1, p. 1.

- Roodman, D. (2006). “How to Do Xtabond2: An Introduction to Difference and System GMM in Stata”, The Stata Journal, Vol. 9, N° 1, p. 86-136.

- Roodman, D. (2009). “A Note on the Theme of Too Many Instruments”, Oxford Bulletin of Economics and Statistics, Vol. 71, N° 1, p. 135-158.

- Sahut, J.M., Mili, M., Tekayac, S.B., Teulon, F. (2016). “Financial Impacts and antecedents of CSR: a PLS Path Modelling Approach”, Economics Bulletin, Vol. 36, N° 2, p. 736-751.

- Seifert, B., Morris, S.A., Bartkus, B.R. (2004). “Having Giving and Getting: Slack Resources Corporate Philanthropy and Firm Financial Performance”, Business & Society, Vol. 43, N° 2, p. 135-161.

- Shahzad, A.M., Mousa, F.T., Sharfman, M.P. (2016). “The Implications of Slack Heterogeneity for the Slack-Resources and Corporate Social Performance Relationship”, Journal of Business Research, Vol. 69, N° 12, p. 5964-5971.

- Shahzad, A.M., Rutherford, M. A., Sharfman, M. P., (2016a), “In Good Times But Not in Bad: The Role of Managerial Discretion in Moderating the Stakeholder Management and Financial Performance Relationship”, Business and Society Review, Vol. 121, N°4, p. 497-528.

- Shahzad, A.M., Rutherford, M.A., Sharfman, M.P. (2016b). “Stakeholder-centric governance and corporate social performance: A cross-national study”, Corporate Social Responsibility and Environmental Management, Vol. 23, N° 2, p. 100-112.

- Shaukat, A., Qiu, Y., Trojanowski, G. (2016). “Board Attributes Corporate Social Responsibility Strategy and Corporate Environmental and Social Performance”, Journal of Business Ethics, Vol. 135, N° 3, p. 569-585.

- Shrivastava, p. (1995). “The Role of Corporations in Achieving Ecological Sustainability”, Academy of Management Review, Vol. 20, N° 4, p. 936-960.

- Singh, J. (1986). “Performance, Slack, and Risk Taking in Organizational Decision Making”, Academy of Management Journal, Vol. 29, N° 3, p. 562-585

- Stanwick, P.A., Stanwick, S.D. (1998). “The Relationship between Corporate Social Performance, and Organizational Size, Financial Performance, and Environmental Performance: An Empirical Examination”, Journal of Business Ethics, Vol. 17, N° 2, 195-204.

- Tan, J., Peng, M.W. (2003). “Organizational Slack and Firm Performance During Economic Transitions: Two Studies from an Emerging Economy”, Strategic Management Journal, Vol. 24, N° 13, p. 1249-1263.

- Tosun, O.K. (2016). “Is Corporate Social Responsibility Sufficient Enough to Explain the Investment by Socially Responsible Funds?”, Review of Quantitative Finance and Accounting, p. 1-30.

- Trotman, K.T., & Bradley, G.W. (1981). “Associations between Social Responsibility Disclosure and Characteristics of Companies”, Accounting, Organizations and Society, Vol. 6, N° 4, p. 355-362.

- Tyrrell, A. (2006). “Corporate Social Responsibility: What’s Your View”, Accountancy Ireland, Vol. 38, N° 1, p. 44-45.

- Van Beurden, P., Gössling, T. (2008). “The Worth of Values-a Literature Review on the Relation between Corporate Social and Financial Performance”, Journal of Business Ethics, Vol. 82, N° 2, p. 407-424.

- Vilanova, L. (2007). “Neither Shareholder nor Stakeholder Management: What Happens When Firms are Run for their Short-term Salient Stakeholder?”, European Management Journal, Vol. 25, N° 2, p. 146-162.

- Voss, G.B, Sirdeshmukh, D., Voss, Z.D. (2008). “The Effects of Slack Resources and Environmental Threat on Product Exploration and Exploitation”, Academy of Management Journal, Vol. 51, N° 1, p. 147-164.

- Waddock, S.A., Graves, S.B. (1997). “The Corporate Social Performance-Financial Performance Link”, Strategic Management Journal, Vol. 18, N° 4, p. 303-319.

- White, H. (1980). “A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity”, Econometrica, Vol. 48, N° 4, p. 817-838.

- Windmeijer, F. (2005). “A Finite Sample Correction for the Variance of Linear Efficient Two-Step GMM Estimators”, Journal of Econometrics, Vol. 126, N° 1, p. 25-51.

- Wood, D. J. (1991(. “Corporate Social Performance Revisited”, Academy of Management Review, Vol. 16, N° 4, p. 691-718.

- Zimmer, K., Fröhling, M., Breun, P., Schultmann, F. (2017). “Assessing Social Risks of Global Supply Chains: A Quantitative Analytical Approach and its Application to Supplier Selection in the German Automotive Industry”, Journal of Cleaner Production, Vol. 149, p. 96-109.

Parties annexes

Notes biographiques

Eric Braune est professeur de management et finance à l’INSEEC U Lyon. Il a reçu son doctorat en management de l’IAE d’Aix-en-Provence (2011). Il est également titulaire d’un master de recherche en philosophie économique de l’Université d’Aix-en-Provence et d’un master en économétrie de l’Université de Paris I. Ses recherches portent principalement sur la gestion de l’innovation, la théorie des organisations et la gouvernance d’entreprise. Il était auparavant directeur régional d’un grand groupe français et il est toujours engagé auprès des pépinières d’entreprises et du parc scientifique de Lyon (France).

Lubica Hikkerova est professeur à l’IPAG Business School, Paris. Elle a obtenu son doctorat à l’Université Matej Bel de Banska Bystrica, Slovaquie (certifiée ISO 9001). Ses principaux champs de recherche se résument en deux axes; le marketing dans le tourisme d’une part, la création et le développement des entrepreneurs et des petites entreprises d’autre part.

Anne-Laure Boncori est Professeure Associée de Stratégie et Management à l’INSEEC School of Business & Economics. Ses travaux de recherche portent sur les modèles de management et de gouvernance des entreprises. Elle étudie notamment la question de la diffusion des idées et pratiques managériales. Primée en 2013 par l’Academy of Management en tant que nominee pour le William H. Newman Award (meilleure communication, toutes divisions confondues, tirée d’une thèse), Anne-Laure est également spécialisée en Histoire des entreprises.

Parties annexes

Notas biograficas

Eric Braune es profesor de administración y finanzas en INSEEC U Lyon. Recibió su Ph.D. en gestión de IAE Aix-en-Provence (2011), un Máster de Investigación en Filosofía de la Economía de la Universidad de Aix-en-Provence y un Máster en Econometría de París I. Su investigación se ocupa principalmente de la gestión de la innovación, la teoría organizacional y el gobierno corporativo. Anteriormente fue Director Gerente Regional de un gran grupo francés y todavía está comprometido con las incubadoras de empresas y el parque científico en Lyon (Francia)

Lubica Hikkerova es profesora en IPAG Business School, París. Obtuvo su doctorado en la Universidad Matej Bel en Banská Bystrica, Eslovaquia. Sus principales campos de investigación se resumen en dos ejes; Por una parte, la comercialización y el marketing en el sector turístico y por otra la creación y el desarrollo de pequeñas y medianas empresas.

Anne-Laure Boncori es Profesor de Estrategia y Gestión de empresas en la Escuela de negocios INSEEC School of Business & Economics. Su investigación se centra en los modelos de gestión y de gobierno de las empresas. Ella examina la cuestión de la difusión de las ideas y prácticas de gestión de las empresas. Gratificada nominee por el William H. Newman Award (mejor artículo resultante de una tesis entre todas las divisiones de la Academy of Management) en 2013, Anne-Laure es también especializada en la Historia de las empresas.

Liste des tableaux

Table 1

Descriptive statistics of the study variables

Table 2

Pairwise correlations of the study variables

Table 3

Risk profile distribution of the company sample

Table 4

The effects of previous industry adjusted financial slack on the current performance of S&P 500 companies regarding their overall, environmental and social performance

*p<.1, ** p<.05, ***p<.01

Note: Two-step SYS-GMM estimation with finite-sample correction and robust standard errors, controlling for size (company total assets) and risk profile. The set of instruments is built from the three years lagged dependent variables. We use ***, **, and * to denote significance at the 1%, 5%, and 10% level (two-sided), respectively.

ZOCSP is the normalized score reflecting the overall CSP of sample companies, ZCES is the normalized score reflecting their environmental performance and ZCSS is the normalized score reflecting social performance. ZAdjust-slack is the normalized difference between the current ratio of the firm and the mean current ratio in its industry. ZTA the normalized total assets of sample companies.

SYS-GMM, generalized method of moments in system.

Table 5

The effects of previous industry adjusted financial slack on the current overall social performance of S&P 500 companies according to their risk profiles

*p<.1, ** p<.05, ***p<.01

Note: Two-step SYS-GMM estimation with finite-sample correction and robust standard errors, controlling for size (company total assets) and risk profile. The set of instruments is built from the three years lagged dependent variables. We use ***, **, and * to denote significance at the 1%, 5%, and 10% level (two-sided), respectively.

ZOCSP is the normalized score reflecting the overall CSP of sample companies, ZCES is the normalized score reflecting their environmental performance and ZCSS is the normalized score reflecting social performance. ZAdjust-slack is the normalized difference between the current ratio of the firm and the mean current ratio in its industry. ZTA the normalized total assets of sample companies.

SYS-GMM, generalized method of moments in system.

Table 6

The effects of previous industry adjusted financial slack on the current environmental and social performance of S&P 500 companies according to their risk profiles

*p<.1, ** p<.05, ***p<.01

Note: Two-step SYS-GMM estimation with finite-sample correction and robust standard errors, controlling for size (company total assets) and risk profile. The set of instruments is built from the three years lagged dependent variables. We use ***, **, and * to denote significance at the 1%, 5%, and 10% level (two-sided), respectively. ZCES is the normalized score reflecting their environmental performance and ZCSS is the normalized score reflecting social performance. ZAdjust-slack is the normalized difference between the current ratio of the firm and the mean current ratio in its industry. ZTA the normalized total assets of sample companies. SYS-GMM, generalized method of moments in system.

10.7202/1063712ar

10.7202/1063712ar