Résumés

Abstract

With this systematic review, we intend to achieve three aims: (1) to take an inventory of what have been done so far in the field of Chinese investments in Africa; (2) to critically analyze the actors, motivations, mode of entry, impacts and management challenges, in the light of international business theories; and (3) to identify research gaps for what needs to be done in the future. Based on different international business theories, this review offers new insights to explore Chinese investments in African countries and contribute to the overall body of knowledge about Sino-Africa relationship.

Keywords:

- systematic review,

- Africa,

- China,

- Foreign Direct Investment (FDI)

Résumé

Avec cette revue systématique, nous avons l’intention d’atteindre trois objectifs: (1) faire l’inventaire des recherches qui ont été faites jusqu’à présent sur les investissements chinois en Afrique; (2) analyser de manière critique les acteurs, les motivations, le mode d’entrée, les impacts et les défis de gestion, à la lumière des théories en management international; et (3) identifier les lacunes de la recherche afin de proposer des pistes futures de recherche. Basée sur différentes théories, cette revue offre de nouvelles perspectives pour explorer les investissements chinois dans les pays africains et contribuer à l’ensemble des connaissances sur les relations sino-africaines.

Mots-clés :

- revue systématique,

- Afrique,

- Chine,

- Investissements Directs Étrangers (IDE)

Resumen

Con esta revisión sistemática, buscamos alcanzar tres objetivos: (1) hacer un inventario de las investigaciones que se han hecho hasta ahora en el campo de las inversiones chinas en África; (2) analizar de manera crítica los actores, las motivaciones, el modo de entrada, los impactos y los retos de gestión, a la luz de las teorías de gestión internacional y (3) identificar deficiencias de investigación con el objeto de proponer pistas para futuros trabajos de investigación. Basada en diferentes teorías, esta revisión presenta nuevas perspectivas para explorar las inversiones chinas en países africanos y contribuir al conjunto de conocimiento sobre la relación entre China y África.

Palabras clave:

- revisión sistemática,

- África,

- China,

- Inversión Extranjera Directa (IED)

Corps de l’article

The 1978’s reforms allowed China to operate the current economic performances and actively participate in globalization (Tisdell, 2009). This is a strong signal for many African leaders who have unanimously agreed that the socio-economic transformation should have significant impacts on the economic progress. Even though some efforts are required to make it succeed, globalization offers the developing countries, particularly African countries, numerous opportunities for economic growth and poverty reduction (Stiglitz, 2007). To this end, globalization should enable African countries to reinforce their partnership with not only their traditional economic partners, i.e. their former colonial powers, but also with developing countries including China (Konings, 2007; Muekalia, 2004).

Chinese investments in Africa has been influenced by China’s “step-out” strategy adopted in the early 20s, which focused on encouraging investment in the overseas market to sustain its economic development and economic reforms (Brautigam & Tang, 2009; Veeck & Diop, 2012; Zafar, 2007). China has been fostering intergovernmental cooperation with African countries through bilateral and regional investment treaties since many years. The principles and scopes of the Chinese African policy are elucidated in its comprehensive policy statement of 2006. Between 1990 and 2015, China has achieved 9.5% annual economic growth (Kaplinsky, 2006). Chinese FDI in Africa has increased exponentially from US$ 4940 million in 2005 to US$ 45090 million in 2013.

China, as the largest trading partner of Africa since 2009, aims to reach US$ 100 billion of investments in 2020 (FOCAC, 2015). The issue of the rise of China as global economic leader and its relationship with African countries has recently begun to attract increased global interest since China has become a key component of the international economic system as well as the major lever of South−South Cooperation, a new paradigm of development (Amanor & Chichava, 2016). Diverse types of studies involving quantitative, qualitative, and mixed methods as well as internet blogs and news articles have focused on examining the nature of the China−Africa relationship (Kopinski & Sun, 2014; Strauss, 2009). The earlier investigations on this issue have typically assumed that China’s foreign investment does not follow the popular theories underpinning the way of doing business abroad (Buckley et al., 2007). Among the numerous patterns, there are eclectic paradigm, Uppsala model, institutional perspective, social network, etc. This study is inspired by these various theories to decipher the Chinese investments actors, motivations, mode of entry, impacts and management issues in Africa.

Furthermore, since the 1990s, the impacts of Chinese investments on different sectors in Africa have become a prominent topic. For instance, Asiedu (2006), Asongu and Aminkeng (2013) and (Mohan & Power, 2009) have contradictory views about the China’s investments in Africa because of the difficulties in comprehensively assessing its impacts on Africa’s poverty reduction efforts.

Many a variety of literature streams including international development (Alden, 2005; Davies, 2008), political science (Bräutigam, 2009; Michel, 2008), and international business (Kaplinsky, 2013; Mohan & Power, 2008) have been complementary in some aspects and contradictory in others, about Chinese investments in Africa. Since no systematic review has been conducted on this subject so far as noted by Jackson (2014) and Cooke (2014), we therefore conduct a systematic review to examine the below mentioned research question of China’s investments in Africa. Jones and Gatrell (2014) suggested that critical review is essential for understanding the existing scholarship as well as to identify new research directions. This paper is our contribution to the various understanding of the China–Africa relationship. First, it provides an opportunity to clarify Chinese investments in Africa. Then, it identifies problems with the theories or patterns and methodologies about this relationship and suggests an alternative explanation about the dynamics of this relationship by identifying some prospective areas of studies.

The paper begins by summarizing the method used for selecting and reviewing the literature, which includes an assessment of the quality of the research strategy and analysis employed. Next, a summary of the findings from these studies about the investments of China in African countries is explained based on specific theories in international business that explain the internationalization of Chinese enterprises. Then, we discuss the methodological contribution of conducting a systematic review of the China−Africa relationship that enables a holistic perspective of potential research, and then, we conclude by suggesting directions for future research on this topic.

Research method

From the systematic review perspective, we start with a review question: What is the major research impacts discussed in the Sino-African literature? This systematic review is motivated by the absence of such a review on Sino-African relations despite the extensive literature on the subject. This study is an opportunity for effective understanding by those who may not be well acquainted with the literature on China−Africa relationship.

The systematic review is distinguished from the narrative review in terms of its criteria of inclusion and exclusion; the latter does not use statistical and econometric procedure for summarizing finding and analyzing data (Tranfield, Denyer, & Smart, 2003). Thus, to be included in our study, the work must respect the criteria listed in Table 1. This study does not consider any document or studies made on groups of developing or emerging countries. The exclusion of non-empirical studies allows us to have a better comparable body of research, which enhances the quality of this review (Becheikh, Landry, & Amara, 2006). We focus on journal articles because they are considered as validated knowledge and therefore have the most impact on the field (Armstrong & Wilkinson, 2007; Bruton & Lau, 2008).

Table 1

Criteria for inclusion

The Choice of 2003 as the reference year for the systematic review is supported by several facts. First, in the 2000s, China had implemented the step-out policy (Zˇou chū qū zhàn luè), which saw the advent of Forum on China-Africa Cooperation (FOCAC) and multiple trips by Chinese Ministers to Africa to strengthen this cooperation. Furthermore, in 2003, the second FOCAC ministerial conference was held in Addis-Ababa to give priority to Sino-African relationship.

Following a comprehensive electronic search of relevant data that met the requirements of our study, some social sciences multidisciplinary search engines have been selected namely, ABI/INFORM, Business Source Complete, Academic Search, EconLit, PAIS International, Francis, ISI Web of science, and Cairn. By using the Boolean search engine of the SSCI (Social Science Citation Index) database, the papers were identified through specific keywords (Annexes 1). This version of keywords was developed after deep reading on the topic and based on the construction of the chain developed from the research question (Kaushal, Mayor, & Riedl, 2013). This list of keywords is equally valid in both French and English and adapted to different databases.

To avoid bias in the selection of journals, the faculty rank proposed by Université Laval was applied. In total, the ranking identifies 3,735 journals. In this study, we also consider journals that have not been included in the above-mentioned list but whose articles have been cited at least 30 times in Harzing’s Publish or Perish from 2003 to 2014.

In total, with grey literature, 8,306 works were identified through the study’s comprehensive search strategy mentioned in Figure 2. After screening the titles and abstracts from these works in respect of the defined criteria, 103 full papers were retrieved. After reading and consulting some experts in Sino-African relations, we found that 60 peer-reviewed and published articles essentially suited the systematic review. Some important publications (books and reports from institutions etc.) are important not only for the topic under examination but also to support analysis and criticism in the appropriate theoretical foundations while considering relevant recent publications on the subject. Thus, two types of bibliographical references have been developed to specify specific and general references.

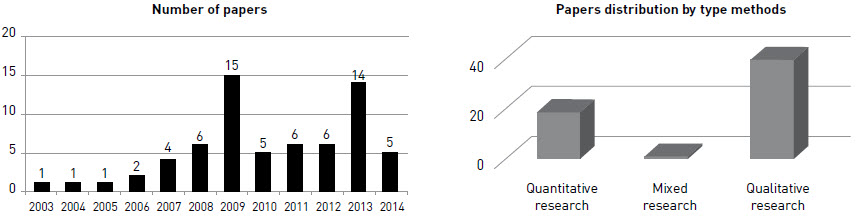

The figure 3 shows that the topic is increasing in its popularity and there is growing number of research on China-African relationship. It also displays the classification of the selected paper under the methodology used by scholars. The interpretation is that the qualitative has been mostly used. In addition, some references are not included in the systematic review but are used to illustrate some theories relating to international business.

FIGURE 2

Flow diagram

Major research issues and findings

Chinese enterprises (actors) in African countries

Chinese enterprises are present in almost all African countries. According to Chinese Ministry of Commerce, in 2013, there are almost 2,398 Chinese companies and entities that were approved to operate abroad between 1998 and 2012. There are 112 SOEs and 1,278 PEs (MOFCOM, 2013). Currently, there are about 2,200 Chinese companies investing in Africa (Pigato & Tang, 2015; Shen, 2014).

China’s government encourages domestic companies to expand their investments abroad and operate transnationally. Since 1982, China’s policies related to foreign operations of national firms have been deeply metamorphosed till 2001. The policies on Chinese outward investment change according to the global market and domestic economic and social conditions. The literature identifies four types of Chinese companies enter African markets. The SOE that are mostly controlled by the central government (Jiang, 2009) for their performance and are protected from competitive pressures (Zhang et al., 2013). Chinese private companies worked synchronously with Chinese SOEs in providing complimentary services (assistance for instance) as highlighted by Corkin (2012). Chinese entrepreneurs establish themselves in the market to provide the goods and services required by the main contractors. The last one is the Chinese provincial enterprises that are vehicles for twinning with African States.

Mol (2011) and Ademola, Bankole, and Adewuyi (2009), among many other scholars argued that Chinese government policy on African countries is a well-coordinated national strategy, where SOEs and PEs, and national and regional State authorities collaborate coherently and harmoniously. By assessing the development implication of Chinese private firms in Africa, Gu (2009) emphasized that most of Chinese companies in Africa are SMEs characterized by strong entrepreneurial spirit or ethos, flexibility, adaptability, and grab market opportunities.

SOEs should ideally help the States to fully play its national sovereign functions such as security, economic, education, health, justice and diplomacy. In the case of China, even though SOEs are not significant in terms of numbers, their investments seem to be most important in direct negotiations with African States. This is the emergence of a form of state capitalism. The Chinese government can impose the direction and pace of technological change in its public investment. The share of the Chinese public sector according to World Bank statistics in the gross capital formation still dominates that of the Western countries. In other words, the Chinese government brings its national companies to the African market for strategic purposes. The Chinese government plans to develop its domestic enterprises into global leaders and restrict others foreign companies in strategic sectors in Africa. The Chinese government may have the intention of controlling African natural resources through its SOEs. African countries could be vulnerable to this form of capitalism because of their economic problems that prevent them from controlling strategic sectors of their economies. Furthermore, some studies criticize Chinese companies because they do not respect the labor laws of the African countries (Hanusch, 2012; Jackson, 2014). It is shown by Cooke (2014) that Chinese companies are not compliant with the labor standards in their host countries (Africa).

Motivations of Chinese investments in Africa

The reasons for the internationalization of companies are amply discussed in the literature (P. J. Buckley & Casson, 1976; Dunning, 1988; Hymer, 1976). But these foundations are less clarified when it comes to emerging markets (Deng, 2013) such as those of Africa. There are considerable studies about the motivations of Chinese investment in Africa (Buckley 2013; Elu & Price, 2010; Pigato & Tang, 2015).

In general, the common motivations of Chinese interest for investment encompass: risk taking, market seeking, and resources seeking (Brenton & Walkenhorst, 2010). Nevertheless, the literature on international business shows that several types of companies have specific motivations or interests in doing business in African countries. As some other MNC, Chinese firms are expected to acquire strategic resources to globally compete. Zhang et al. (2013) studied the determinants of Chinese companies in African and found that Chinese investments are driven mainly by motivation of market seeking. Mostly, Chinese firms are attracted by African market (Alden, 2005; Ramasamy, Yeung, & Laforet, 2012). To be successful in Africa, Chinese firms need to imitate some firms in order to lower its risks when operating in Africa (Bianchi & Arnold, 2004; Mäkelä & Maula, 2005; Mukundhan & Nandakumar, 2013).

Eclectic paradigm (EP) is also part of the theoretical trends of the economic approach to the internationalization of enterprises (Matlay, Jesselyn Co, & Mitchell, 2006). The eclectic paradigm is developed by Dunning (1988). The concept of EP offers a holistic approach that helps to evaluate the factors influencing the economic rational of international production (Rauch, 2001). In this model, the decision to enter a foreign market depends on three types of advantages: ownership, localization and internalization advantages. Ownership refers to firms-specific advantages accumulated by the company to overcome the cost of operating in foreign country. The location is related to institutional and geographical context. It focuses on the question of where the firm chooses to locate its activities so that minimize the costs. Internalization advantages finally influence the strategic choice (wholly-owned subsidiary, licensing, franchising, joint-venture, etc.) of a firm in foreign country.

Chinese firms compared to African ones have some ownership advantages (technology, government supports, cross-border experiences) to transfer through African countries within their own enterprises (Chuan & Orr, 2009; Giovannetti & Sanfilippo, 2009; Rotunno, Vézina, & Wang, 2013). Aside from the market-seeking, the choice of Africa by Chinese enterprises is also determined by the search for natural resources and countries with a weak institution according to some authors (Jackson, 2014; Ovadia, 2013; Rangasamy & Swanepoel, 2011; Zafar, 2007; Zhang et al., 2013).

It is important to note that the recent design - Dunning showed the importance of business networks (Cantwell, Dunning, & Lundan, 2010; Dunning & Lundan, 2008) and global value chains control (Mudambi, 2008) that are under the control of multinationals. Indeed, special attention is now given to the network of MNE, the institutions of the home country and the level of expertise of the host country (Cantwell, 2014). Thus, the works of David Teece have shown that the existence of the MNE depends not only on the differentiated nature of its own capabilities but also the establishment of an appropriate governance structure (Teece, 1977, 2014). His works focus on the dynamic capabilities of enterprises that are integral to the international business theory. The concept of dynamic capabilities emphasizes the company’s ability to integrate, build and configure internal and external competences of the organization to respond rapidly to changing environments (Teece & Pisano 1994; Teece, Pisano, & Shuen, 1997).

Regarding Chinese companies, literature provides information on their strategic operations to coordinate and redeploy internal and external skills effectively in the African environment. The literature is virtually silent on the conditions in which Chinese enterprises in Africa benefit from the innovation and develops dynamic capabilities. Apart from natural resources and the market, it is difficult to assess the sources of innovation and capture wealth building that founded the competition and the performance of Chinese companies in Africa. It is difficult to show the mandates of the Chinese subsidiaries in terms of networks or centers of excellence (Cantwell & Mudambi, 2005; Frost, Birkinshaw, & Ensign, 2002; Rugman & Verbeke, 2001). It is also difficult to assess Chinese High-Tech Born Global which use FDI and partnership to access to valuable knowledge (specific advantages) source in Africa (Hymer, 1976).

FIGURE 3

Publication trend and distribution of the papers by type of methods

Mode of entry of Chinese investments

The internationalization is understood as “(…) the process by which firms both increase their awareness of the direct and indirect influence of international transactions on their future, and establish and conduct transactions with other countries”. This definition offered by Beamish (1990) and cited by Coviello and McAuley (1999, p. 225) allows interpreting the concept of internationalization through the so-called Uppsala Model (UM) (Johanson & Vahlne, 1977; Johanson & Wiedersheim-Paul, 1975). This model primarily deals with the knowledge acquisition (Sinkovics, Yamin, Forsgren, & Hagström, 2007). The main issue is how firms learn and how this learning affects its capabilities to deal with foreign markets. The UM could be the key reference for any study of internationalization. Internationalization is thought as a gradual process, which is carried out in stages. The mechanism of internationalization is “the consequence of a process of incremental adjustment to changing conditions of the firm and its environment” (Johanson & Vahlne, 1977, p. 26). Therefore, a firm that enters a foreign market is faced with great uncertainty. Moreover, the risk to the commitment of resources which is often irreversible, imposes a caution. The gradual learning mechanism enables the acquisition of knowledge, including tacit knowledge (experiential knowledge) gradually adapted (reduce psychologic distance) to the possibilities of the company and provides an answer to these challenges that the firm is facing. The Chinese companies involved in African market penetration develop various strategies to easily get access to assets and overwhelm the competition with the traditional business partners of African countries. As reported by Jiang (2009), the internationalization strategies used by Chinese companies to penetrate the African markets included mainly Greenfield investments and wholly owned subsidiary. Regarding Chinese companies, there is little research that provides clear details about the strategies of Chinese companies with regards to their African market knowledge and commitment. To learn more about the African market and be more competitive, according to the Uppsala model, Chinese enterprises should prioritize conventional entry modes such as exporting, licensing, franchising, acquisition, merger and especially the joint venture, to better identify the African market that is vast with its complex cultural realities and specificities. This could enable them to avoid excessive costs of transaction and accumulate some experiences about African business environment.

The institutional theory also provides a rich foundation on how the host and home institutional environments affect the entry mode of a business unit through isomorphism process (DiMaggio & Powell, 1983; Meyer & Brown 1977; Scott, 2001). Some studies have investigated isomorphism behavior of international firms in terms of their timing and location (Barreto & Baden‐Fuller, 2006; Delios, Gaur, & Makino, 2008; Li, Miller, & Eden 2012; Mukundhan & Nandakumar, 2013). However, limited attention has been paid to using isomorphism perspective as an explanation for entry mode decision. Coercion as explanatory mechanism of China’s entry into African countries is demonstrated by Chinese’s Central government plan (Cheung et al., 2012; Jakobson, 2009; Mol, 2011). Chinese market is also characterized by institutional voids that push Chinese firms to go in foreign countries in order to alleviate institutional constraints (Khanna & Palepu, 2006; Meyer, Estrin, Bhaumik, & Peng, 2009). This seems not to make sense since the environment business in most African countries is also characterized by uncertainties and furthermore, a mimetic behavior does not give the guarantee to achieve the expected high efficiency,

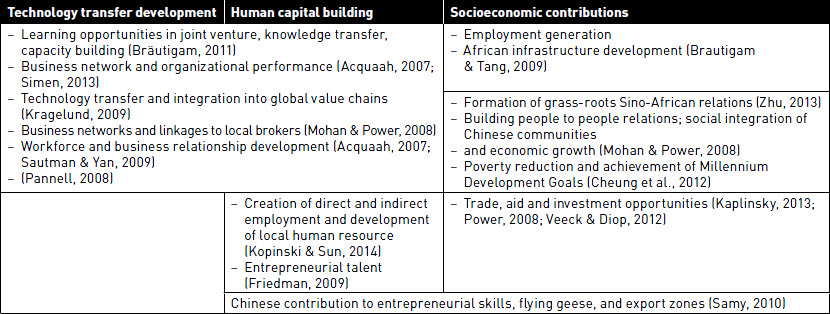

Crowding-in and crowding-out of Chinese FDI in Africa

Borrowed from economics, the concepts of crowding-in and crowding-out are analyzed by considering two assumptions. The first assumes that due to competitive pressure, foreign investment can crowd out local investment (negative effect) (Markusen & Venables, 1999). The second assumes that the investment of multinational stimulates local investment since it increases the request for local suppliers (positive effect) (Cardoso & Dornbusch, 1989). The impacts of FDI in host countries have been the subject of an extensive literature. Studies focused particularly on the effects of FDI in host country on technology transfer (Dunning, 2013), training of human capital capable of mastering these technologies (Damijan, Rojec, Majcen, & Knell, 2012), and the socio-economic contributions of FDI (Leigh & Blakely, 2013).

FIGURE 3

China’s investment in Africa (Quantity in millions)

Since a few years, as shown in the figure 3 above, Chinese investment in Africa continues to grow. Some studies have identified certain negative impacts of Chinese presence in Africa (Table 3). For example, some South African steel-tank producers had to shut down, owing to competition from China (Davies, 2008). Further, Kaplinsky and Morris (2009) and Brautigam and Tang (2009) found that Chinese copies of African fabrics badly affected the producers of Sub-Saharan African printed clothes. From an econometric analysis, Elu and Price (2010) argue that total factor productivity in African countries does not increase with Chinese exports to Africa. By considering economic and political repercussions in Sub-Saharan Africa, Tull (2006) explained that the presence of China in Africa negatively affects political development through violating labor standards in African countries since Chinese firms have little experience with unions at home. Brenton and Walkenhorst (2010) focused on the presence of China in northern Africa and found that in the long-term, China would reduce market opportunities in these countries. Edoho (2011) identifies that Chinese investments in Africa not only is scrambling for African natural resources but also is a voracious competitor and a new colonizing power in Africa. Asongu and Aminkeng (2013) addressed Africans’ opinions on Chinese presence in the respective countries. The findings suggest that Africans’ views of China are nearly equivalent to those that they hold vis-à-vis western countries. Specifically, they perceive imports from China to have a negative effect. Mohan (2013) basically, find that Chinese investments are is perceived as threat to African economies (table 3).

Chinese investments seem to be helping strengthening Africa’s infrastructure, sanitation, and agriculture (Bräutigam & Zhang, 2013; Cooke, 2014; Zhang, Wei, & Liu, 2013). In the same vein, Pigato and Tang (2015) also emphasized the impacts of partnerships with emerging economies such as China on the growth of African countries in recent decades, especially on the improvement of living standards and bolstering human development indicators.

Different surveys (Pew Global Attitudes, 2006 and 2007) about the effects of China and USA on the African countries show that most African respondents (public opinions) have a favorable view for China over USA. China’s interest in Africa transcends natural resources and is multifaceted, including areas such as policy choices, institutions, human capital, entrepreneurship, culture, and leadership (Sautman & Yan, 2009). The rise of China is potentially beneficial to Africa, mainly in terms of African primary products for Chinese manufacture, China supporting African manufacture, and solidarity on issues involving difference with Western powers.

The benefits of Chinese investments in Africa are numerous (Bräutigam, 2011; Zhang et al., 2013). China plays a significant role by improving the infrastructure, increasing the productivity, hosting export, and raising the living standards of millions of Africans. In addition, China helps Africa to diversify its economy by creating jobs (MOFCOM, 2014) across the continent (Pigato & Tang, 2015). In fact, database produced by fDi intelligence showed that between January 2003 and June 2014, a total of 156 Greenfield projects were recorded in Sub-Saharan Africa. These projects have generated the total jobs at about 64,201, as indicated in Table 4. Table 4 shows that Chinese presence in Africa through its firms could have a considerable positive impact on employment.

Due to the Chinese model that could be inspired by African leaders, Ravallion (2009) argued that the African countries could emphasize two important aspects for their development. The first is the initial importance of productivity growth in small-holder agriculture, which requires market-based incentives and public support, and the second is the role of strong leadership and capable public administration at all levels of government.

For Cheung, De Haan, Qian, and Yu (2012), Sino-African relations create incentives for poverty reduction, achievement of Millennium Development Goals and result in a balanced relationship. The rising of cost in Asia and especially in China provide unprecedented opportunity for labor intensive manufacturing in Africa. Rodrik (2014) assumes that it is possible for Africa to become the world’s next manufacturing hub. Chinese investments generate significant multiplier effect through the local economy by the way of sourcing and provision of local management and technology transfer (Sautman & Yan, 2009). In fact, between 2000 and 2006, China has trained almost 16,000 African professionals (Ayodele & Sotola, 2014).

The Chinese are seen by Nigerians to have promoted local welfare and progress and boosted the local business market (Mohan, 2013). Brautigam and Tang (2009) provide a nuanced view of the impact of Chinese FDI on African economies. They state that 80-90% of workforce in Chinese factories in Africa were Africans, and add that in Mauritius and Nigeria, Sino-African joint ventures offered employment and learning opportunities. Friedman (2009) shows that the investments of China in Africa are positively transforming Africa by exporting entrepreneurial talent and bringing industry to Africa as much as Japan brought it to Southeast Asia in the 1960s and 1970s. Cooke (2014) shows that business relationships serve crucial functions in contributing to the learning processes shared between both groups. Acquaah (2007) studied the impacts of China on Sub-Saharan Africa’s social capital and finds that contingency analysis on managerial social networking and ties with community leaders reveals some interesting trends. The scholar states that through a variety of personal, social, and economic relationships, social capital can enhance the organizational performance (Table 5). In oil-rich African countries such as Angola, Chinese infrastructure projects for mineral resources play a vital role by bringing new dynamics in the resources market (Habiyaremye, 2013).

Table 3

Negatives impacts of Chinese presence in Africa from literature

Table 4

Negatives impacts of Chinese presence in Africa from literature

Further, infrastructure development could create opportunities to make African countries a highly dynamic infrastructure industry. Babatunde and Low (2013) described that the investments of Chinese construction companies in Nigeria has brought intense competition on project finance and sectorial deployment, speed of delivery, improved supply-chain management, and overall service quality increase.

Pannell (2008) recognized that China’s activities are by no means entirely self-serving; tangible benefits accrue to the various African states that receive Chinese aid and technical assistance in infrastructure development and improvement in health and educational facilities. Veeck and Diop (2012) demonstrated that Chinese presence and long-term effect of Chinese investment help to develop cultural exchange, humanitarian aid, and trade opportunities, thus positively affecting Madagascar’s economy. De Grauwe, Houssa, and Piccillo (2012) also analyzed the dynamics and determinants of African trade over the last two decades (between 1990s and 2000s) and found that not only is Africa a big market for China but also China is now importing from these countries and creating a market for African countries to export to. China has the capacity to foster the African economy’s inclusive growth because its sourced imports have substituted traditional suppliers, often providing much cheaper and more appropriate products than those sourced from high-income economies (Kaplinsky, 2006, 2013; Lyons & Brown, 2010). Rangasamy and Swanepoel (2011), found that the incursion of cheap Chinese textile into markets formerly dominated by Holland fabrics helped African entrepreneurs not only to develop their business network but also bring the new trading conditions and import opportunities from China.

From these different points, it appears that Chinese investment in African countries has multi-levels impacts. These impacts remain ambiguous because of different controversial views on this topic. Nevertheless, it is urgent to clarify that China is not inclined to colonize Africa. Certainly, there is no doubt that China exploits the natural resources of African countries to support its technological development, but China is more animated by mutual exploitation potential. Therefore, the rise of China in Africa in recent years has been marked by its charm and commitment to grow cooperation based on mutual benefits for African countries. Also, should we say that in 1955 at the Bandung Conference, China and African countries have established the foundations of peaceful coexistence which are based on the five principles of Chinese cooperation (Muekalia, 2004). Besides its participation in the peace and security of Africa, China does not have a military base in Africa and does not interfere in the political problems of African countries. It would be difficult or even pretentious to confirm that China aims to colonize African countries where African civil society organizations are attentive as they have not yet forgotten the past economic experience with Europe.

Table 5

Positive impacts of Chinese presence in Africa from literature

Management issues

The theory of social capital whose essence is the network (Lin, 1999) is often considered as a key resource for exploring corporate internationalization process. The network is an important attribute to be considered when explaining the internationalization behavior of firms. The networks are a critical link for successful internationalization (Coleman & Coleman, 1994; Welch & Welch, 1996) because it helps to exploit the opportunities. Network connections play a facilitative role in various business contexts and help to reduce search costs, transactions costs, contracting costs, ambiguities, moral hazards and opportunism (Barney & Hansen, 1994; Gulati, 1999; Hymer, 1976; J. Li, 2008; Pfeffer & Salancik, 2003; Rauch, 2001). The networks have an impact on the selection of the market to penetrate and especially in emerging markets (Elango & Pattnaik, 2007). It is also worthwhile to note that an efficient network helps in appreciating cultural, geographical and linguistic barriers (Khanna, Kogan, & Palepu, 2006; Langseth, O’Dwyer, & Arpa, 2016; Oviatt & McDougall, 1994).

The modern relationship between China and Africa is the product of this long-standing history of friendly ties, unconditional financial and technical support to both the elites and the needy, and growing commerce between China, the world’s largest developing nation and Africa (Jiang, 2009; Kopinski & Sun, 2014; Taylor, 2009; Zafar, 2007). Chinese investments seem to provoke in Africa the phenomena of Soft Power. Based on intangible and indirect influences such as culture, political values, philosophies and beliefs, China has the abilities to shape the perception of African. Chinese population in host countries has some local network, (international guanxi) and political contacts (Amighini, Sanfilippo, & Rabellotti, 2013; Gu, 2009; Samy, 2010). Therefore, local knowledge acquisition and social network building not only speed the internationalization process of Chinese firms but also facilitate international knowledge spillover in Africa and then provide, as Bräutigam (2003) emphasized, a catalyst for industrialization.

However, Feng and Mu (2010) investigated Chinese companies’ cultural challenges during overseas investment construction in Africa. They categorized these challenges in five aspects: linguistic distance, working habit, religion, socio-economic orientation, and coexistence. Language is the first barrier in the communication between China and Africa. African languages and China’s languages belong to different phyla (Corkin, 2012). The Chinese cultural philosophy is based on great hierarchies, as there is a great willingness to accept authority and practice humility, holistic thinking, mutual support (collectivism), communication, particularly ethical standards, and high reliance on accumulated wisdom (Feng & Mu, 2010; A. Li, 2007). African religions are heterogeneous, involving different beliefs or syncretic practices. By using multidimensional work ethic profile (hard work, leisure, centrality of work, wasted time, religion/morality, self-reliance, and delay of gratification), Slabbert and Ukpere (2011) revealed that Chinese and African productivity and work ethic are diametrically opposed. These distances have adverse consequences on setting up networks likely to have a positive impact on the Chinese presence in Africa.

Concluding remarks and implications

The purpose of this study is to systematically examine and organize the current body of research focusing on analyzing Chinese investments in Africa. It provides an organizing framework for emerging theoretical and methodological issues and identifies future research needs to deepen our knowledge about this field. From this systematic review, the relation between China and Africa is one of the most important of the 21st century and has received abundant reactions from scholars.

This review provides an overview of multiple analyses of actors, motivations, mode of entry, impacts and management challenges of Chinese investments in Africa. It would be difficult to explore Chinese investments through a single theoretical basis, especially as each theory has its strengths and limitations. The intersections of multiples theories to address the modes of entry of Chinese firms in Africa give the ability to highlight the features of Chinese enterprises in terms of presence in emerging markets.

There is no doubt that the China–Africa relation has changed substantially not only in economic terms but also in social and political fields. Through its enterprises (individual entrepreneurs, private enterprises or national champion, provincial enterprises and State-owned enterprises), China exerts a significant impact on African economies (Strange et al., 2013) through its expansion in Africa (Kaplinsky, McCormick, & Morris, 2007).

The motivations and the mode of entry of Chinese FDI in Africa reflect attempts to acquire strategic assets. They are mainly influenced by variables related to the type of business, the relations of Chinese firms in the host countries (for instance, political missions of SOEs), the domestic level of growth, the search for raw materials and others difficult to identify. In their research, Fortanier & Tulder (2009) point out that Chinese enterprises have experienced a rapid and recent internationalization process and consequently a more volatile internationalization trajectory compared to firms in developed countries. It is obvious that some of Chinese firms in African countries, lack international experience supported by psychological and cultural distances as well as networking with local African companies.

China’s impacts on African development are multi-faceted. Although, our findings indicated that there is no accepted consensus over the impacts of Chinese investments in Africa, it remains important that the presence of well skilled Chinese workers could facilitate international knowledge spillovers in Africa which could exploit different benefits of foreign investments. The achievement of these advantages depends on whether African countries have minimal level of absorptive capacity. China also needs Africa to satisfy its domestic industry and for market seeking. There are opportunities for both sides to get benefits from this relationship. This research highlights several avenues which could help African countries to maximize the opportunities open to them by their natural resources (Kaplinsky & Morris, 2009; Zafar, 2007), protect their activities and businesses by law (Melber, 2013), and encourage good practices among African leaders and elites (Melber, 2008). It also helps researchers to better focus on the impacts in studying the phenomenon.

Although the place of the institutional environment, its conception and its importance varies according to the research fields of the researchers, ones should be noted that the institutional constraints are ubiquitous and vary according to the African countries. Institutions are human constraints that structure political, economic and social interaction. Institutions are primarily set up with the aim of reducing uncertainty. They include both informal constraints and formal rules (North, 1990; 2005). As business activities grow beyond a country, the constraints and conflict possibilities related to trade increase. These constraints affect all the activities of Chinese enterprises in their internationalization strategies (timing and mode of entry, motivations, scale of investment, licensing for new companies, payment of taxes, etc.) (Lu, Liu, & Wang, 2011). Chinese companies are facing the challenges of organizational, cultural and managerial issues. They circumvent and interpret rules, whether formal or informal, because of incompleteness arising from an imperfect information situation. In several African countries, the weakness of institutions leads to an anarchic penetration of foreign firms, which in turn could lead to a vicious cycle blocking economic growth. Thus, at the level of each challenge, it is urgent for Chinese companies to invest in acquiring knowledge in order to succeed in their internationalization and to be more efficient even if this process of learning does not guarantee economic or business growth (North, 1990). Analyzes by North (1990, 2005) combined with those of DiMaggio & Powell (1983) provide an understanding of the internationalization of Chinese enterprises in Africa. By their interpretations, the institutions in African countries influences the strategy of penetration and operation of Chinese enterprises. Incremental changes in institutions in Africa can lead to efficiency at the organizational level. Logically, researchers call for more research on how institutional factors matter when determining the strategy of emerging market companies in developed countries (Peng, Wang, & Jiang, 2008).

Although this systematic review was conducted in a disciplined manner, potential limitations must be acknowledged. The research strategy process was done according to the database system with peer-reviewed published articles written in French and English. There are probably more empirical studies published in other languages that would complement or contradict some findings drawn from this review. The lack of transparency and the quality of Chinese FDI in Africa are also obstacles to a real assessment of the Sino-African cooperation. For these reasons, our results could not abusively be generalized. This review helps scholars in the field to identify the areas and contexts that are relatively unexplored in this cooperation and is then ripe for further investigations.

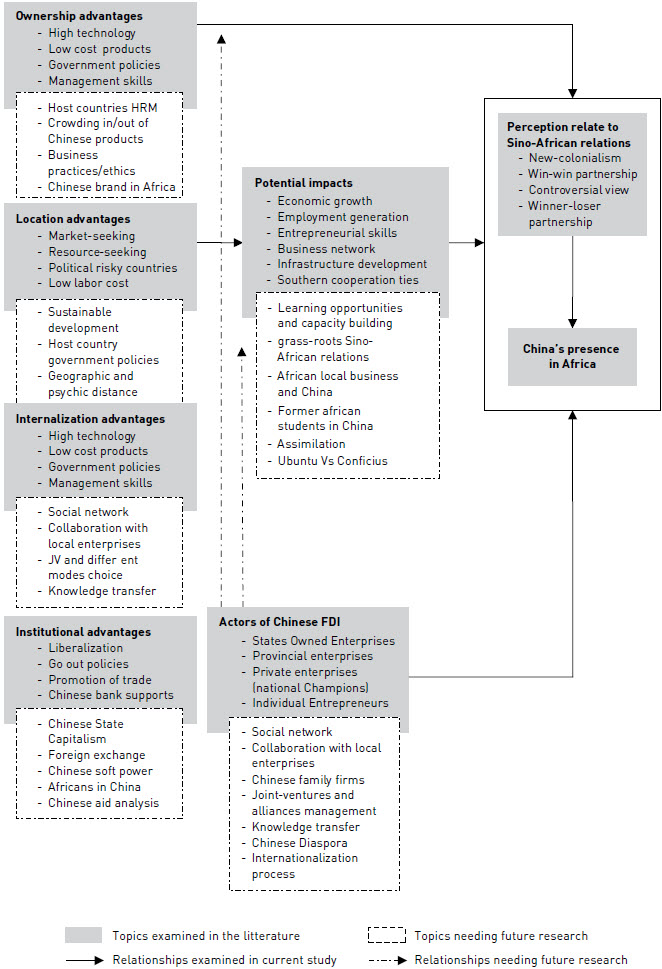

Based on different theories that we have used, figure 4 shows the different areas that have been investigated in black colors and the fields that should be examined in future in white color. More studies need to be carried out on the social roles of Chinese diaspora in African development. Furthermore, the manifestations of Chinese soft power (Fijałkowski, 2011) in Africa also need to be investigated.

While qualitative research on China and Africa has begun to show its limits, empirical analysis or mixed analyses are needed to place this field of research on the auspices of less subjective analysis (Jackson, 2014). This is because most of the literature in the field are philosophical, anecdotal, controversial, or polemical, with significant gaps in evidence of impact analysis of China–Africa cooperation.

FIGURE 4

Areas investigated and future directions of Sino-African research

Parties annexes

Appendix

Specific keywords

table 5

Summary of selected articles December 2013

Biographical notes

Alexis Abodohoui is a PhD candidate in Strategy and International Management at Laval University. He is a Research Assistant at the Stepen A-Jarislowsky Chair in International Affairs. Members of several research centers and institutions (AIB, CIRRELT, CRECI and LAREM). His research focuses on the transfer of knowledge and technology, industrialization, emerging countries, entrepreneurship, Sino-African cooperation and soft power. He has a particular interest in African managerial practices.

Dr. Zhan Su is Professor of Business Strategy at Laval University. He received his Bachelor of Engineering in China in 1982 and his Doctorate in Business Administration in France in 1990. During these past years, Professor Su has carried out many research projects regarding a variety of subjects and published in numerous journals and books. He has also organized many training programs for executives and provided consultation for numerous organizations and firms worldwide. He has received many awards for excellence in teaching and in research.

Imelda Aurore da-Silva, is a PhD student in marketing at the Harbin Institute of Technology (HIT). Imelda da-Silva focuses on brand management and development, intra-African trade, Chinese investment in Africa and business innovation. She made her thesis about the Chinese brand and the perception of international consumers.

Bibliography

- Acquaah, M. (2007). Managerial social capital, strategic orientation, and organizational performance in an emerging economy. Strategic Management Journal, 28(12), 1235.

- Ademola, O. T., Bankole, A. S., & Adewuyi, A. O. (2009). China–Africa trade relations: insights from AERC scoping studies. European Journal of Development Research, 21(4), 485-505.

- Alden, C. (2005). China in Africa. Survival, 47(3), 147-164.

- Amighini, A. A., Rabellotti, R., & Sanfilippo, M. (2013). Do Chinese state-owned and private enterprises differ in their internationalization strategies?. China Economic Review, 27, 312-325.

- Asongu, S. A., & Aminkeng, G. A. (2013). The economic consequences of China–Africa relations: debunking myths in the debate. Journal of Chinese Economic and Business Studies, 11(4), 261-277.

- Ayodele, T., & Sotola, O. (2014). China in Africa: An evaluation of Chinese investment. Institute for Public Policy Analysis: Lagos. Retrieved from: http://www.ippanigeria.org/china_africa_working.pdf.

- Babatunde, O. K., & Low, S. P. (2013). Chinese construction firms in the Nigerian construction industry. Habitat International, 40, 18-24.

- Bräutigam, D. (2003). Close encounters: Chinese business networks as industrial catalysts in Sub-Saharan Africa. African Affairs, 102(408), 447-467.

- Bräutigam, D. (2009). The dragon’s gift: the real story of China in Africa: Oxford University Press.

- Bräutigam, D. (2011). Aid “With Chinese Characteristics’: Chinese Foreign Aid and Development Finance Meet the OECD-DAC Aid Regime. Journal of International Development, 23(5), 752.

- Bräutigam, D., & Zhang, H. (2013). Green Dreams: Myth and Reality in China’s Agricultural Investment in Africa. Third World Quarterly, 34(9), 1676-1696.

- Brautigam, D. A., & Tang, X. Y. (2009). China’s Engagement in African Agriculture: “Down to the Countryside”. China Quarterly(199), 686-706. doi: 10.1017/s0305741009990166.

- Brenton, P., & Walkenhorst, P. (2010). Impacts of the Rise of China on Developing Country Trade: Evidence from North Africa. African Development Review, 22, 577-586. doi: 10.1111/j.1467-8268.2010.00265.x.

- Buckley, L. (2013). Chinese Land-Based Interventions in Senegal. Development and Change, 44(2), 429.

- Cheung, Y. W., De Haan, J., Qian, X., & Yu, S. (2012). China’s Outward Direct Investment in Africa. Review of International Economics, 20(2), 201-220.

- Chuan, C., & Orr, R. J. (2009). Chinese Contractors in Africa: Home Government Support, Coordination Mechanisms, and Market Entry Strategies. Journal of Construction Engineering & Management, 135(11), 1201-1210. doi: 10.1061/(ASCE)CO.1943-7862.0000082.

- Corkin, L. (2012). Chinese construction companies in Angola: a local linkages perspective. Resources Policy, 37(4), 475-483.

- Davies, M. (2008). China’s Developmental Model Comes to Africa. Review of African Political Economy, 35(115), 134-137. doi: 1080/03056240802021450.

- DeGrauwe, P., Houssa, R., & Piccillo, G. (2012). African trade dynamics: is China a different trading partner? Journal of Chinese Economic and Business Studies, 10(1), 15.

- Edoho, F. M. (2011). Globalization and marginalization of Africa: Contextualization of China–Africa relations. Africa Today, 58(1), 102-124.

- Elu, J. U., & Price, G. N. (2010). Does China Transfer Productivity Enhancing Technology to Sub-Saharan Africa? Evidence from Manufacturing Firms*. African Development Review, 22(s1), 587-598.

- Feng, G., & Mu, X. (2010). Cultural challenges to Chinese oil companies in Africa and their strategies. Energy Policy, 38(11), 7250-7256.

- Fijałkowski, Ł. (2011). China’s “soft power” in Africa? Journal of Contemporary African Studies, 29(2), 223-232. doi: 10.1080/02589001.2011.555197.

- Friedman, E. (2009). How Economic Superpower China Could Transform Africa. Journal of Chinese Political Science, 14(1), 1-20. doi: 10.1007/s11366-008-9037-3

- Giovannetti, G., & Sanfilippo, M. (2009). Do Chinese Exports Crowd-out African Goods? An Econometric Analysis by Country and Sector. European Journal of Development Research, 21(4), 506-530. doi: 10.1057/ejdr.2009.20.

- Gu, J. (2009). China’s Private Enterprises in Africa and the Implications for African Development. The European Journal of Development Research, 21(4), 570-587. doi: http:/dx.doi.org/10.1057/ejdr.2009.21.

- Habiyaremye, A. (2013). “Angola-mode” Trade Deals and the Awakening of African Lion Economies. African Development Review, 25(4), 636-647. doi: http://dx.doi.org/10.1111/1467-8268.12057.

- Hanusch, M. (2012). African Perspectives on China–Africa: Modelling Popular Perceptions and their Economic and Political Determinants. Oxford Development Studies, 40(4), 492-516. doi: 10.1080/13600818.2012.728580.

- Jackson, T. (2014). Employment in Chinese MNEs: Appraising the Dragon’s Gift to Sub-Saharan Africa. Human Resource Management, 53(6), 897-919.

- Jakobson, L. (2009). China’s diplomacy toward Africa: drivers and constraints. International Relations of the Asia-Pacific, 9(3), 403-433.

- Jiang, W. (2009). Fuelling the dragon: China’s rise and its energy and resources extraction in Africa. The China Quarterly, 199, 585-609.

- Kaplinsky, R. (2006). Revisiting the revisited terms of trade: Will China make a difference? World Development, 34(6), 981-995.

- Kaplinsky, R. (2013). What Contribution Can China Make to Inclusive Growth in Sub-Saharan Africa? Development and Change, 44(6), 1295-1316. doi: http://dx.doi.org/10.1111/dech.12059.

- Kaplinsky, R., & Morris, M. (2009). Chinese FDI in Sub-Saharan Africa: Engaging with Large Dragons. The European Journal of Development Research, 21(4), 551-569. doi: http://dx.doi.org/10.1057/ejdr.2009.24.

- Konings, P. (2007). China and Africa Building a Strategic Partnership. Journal of Developing Societies, 23(3), 341-367.

- Kopinski, D., & Sun, Q. (2014). New Friends, Old Friends? The World Bank and Africa When the Chinese Are Coming. Global Governance: A Review of Multilateralism and International Organizations, 20(4), 601-623.

- Li, A. (2007). China and Africa: policy and challenges. China security, 3(3), 69-93.

- Lu, J., Liu, X., & Wang, H. (2011). Motives for outward FDI of Chinese private firms: Firm resources, industry dynamics, and government policies. Management and organization review, 7(2), 223-248.

- Lyons, M., & Brown, A. (2010). Has Mercantilism Reduced Urban Poverty in SSA? Perception of Boom, Bust, and the China-Africa Trade in Lomé and Bamako. World Development, 38(5), 771.

- Melber, H. (2008). China in Africa: A New Partner or Another Imperialist Power? Afrika Spectrum, 43(3), 393-402.

- Melber, H. (2013). Reviewing China and Africa: Old interests, new trends–or new interests, old trends? Development Southern Africa, 30(4-5), 437-450.

- Michel, S. (2008). When China met Africa. Foreign Policy(166), 39-46.

- Mohan, G. (2013). “The Chinese just come and do it”: China in Africa and the prospects for development planning. International Development Planning Review, 35(3), v-xii. doi: 10.3828/idpr.2013.14.

- Mohan, G., & Power. (2008). New African Choices? The Politics of Chinese Engagement. Review of African Political Economy, 35(115), 23.

- Mohan, G., & Power, M. (2009). Africa, China and the “new” economic geography of development. Singapore Journal of Tropical Geography, 30(1), 24-28. doi: 10.1111/j.1467-9493.2008.00352.x.

- Mol, A. P. (2011). China’s ascent and Africa’s environment. Global Environmental Change, 21(3), 785-794.

- Muekalia, D. J. (2004). Africa and China’s strategic partnership. African Security Studies, 13(1), 5-11.

- Ovadia, J. S. (2013). Accumulation with or without dispossession? A “both/and” approach to China in Africa with reference to Angola. Review of African Political Economy, 40(136), 233.

- Pannell, C. W. (2008). China’s Economic and Political Penetration in Africa. Eurasian Geography and Economics, 49(6), 706.

- Rangasamy, L., & Swanepoel, J. A. (2011). China’s impact on South African trade and inflation. Development Southern Africa, 28(1), 141-156.

- Ravallion, M. (2009). Are There Lessons for Africa from China’s Success against Poverty? World Development, 37(2), 303-313.

- Rotunno, L., Vézina, P.-L., & Wang, Z. (2013). The rise and fall of (Chinese) African apparel exports. Journal of development Economics, 105, 152.

- Samy, Y. (2010). China’s Aid Policies in Africa: Opportunities and Challenges. Round Table, 99(406), 75-90. doi: 10.1080/00358530903513756.

- Sautman, B., & Yan, H. (2009). African perspectives on China-Africa links. The China Quarterly, 199(10).

- Slabbert, A., & Ukpere, W. I. (2011). A comparative analysis of the Chinese and South African work ethic. International Journal of Social Economics, 38(8), 734-741. doi: http://dx.doi.org/10.1108/03068291111143929.

- Strauss, J. C. (2009). The Past in the Present: Historical and Rhetorical Lineages in China’s Relations with Africa. China Quarterly(199), 777-795.

- Tull, D. M. (2006). China’s engagement in Africa: scope, significance and consequences. The Journal of Modern African Studies, 44(3), 459-479.

- Veeck, G., & Diop, S. H. A. (2012). Chinese Engagement with Africa: The Case of Madagascar. Eurasian Geography and Economics, 53(3), 400.

- Zafar, A. (2007). The growing relationship between China and Sub-Saharan Africa: Macroeconomic, trade, investment, and aid links. The World Bank Research Observer, 22(1), 103-130.

- Zhang, J., Wei, W. X., & Liu, Z. (2013). Strategic Entry and Determinants of Chinese Private Enterprises Into Africa. Journal of African Business, 14(2), 96-105.

- Amanor, K. S., & Chichava, S. (2016). South–south cooperation, agribusiness, and African agricultural development: Brazil and China in Ghana and Mozambique. World Development, 81, 13-23.

- Armstrong, S., & Wilkinson, A. (2007). Processes, procedures and journal development: Past, present and future. International Journal of Management Reviews, 9(2), 81-93.

- Asiedu, E. (2006). Foreign direct investment in Africa: The role of natural resources, market size, government policy, institutions and political instability. The World Economy, 29(1), 63-77.

- Badraoui, S., Lalaouna, D., & Belarouci, S. (2014). Culture Et Management: Le Model D’Hofstede En Question. CrossCultural Management Journal(6), 239-246.

- Barney, J. B., & Hansen, M. H. (1994). Trustworthiness as a source of competitive advantage. Strategic Management Journal, 15(S1), 175-190.

- Barreto, I., & Baden-Fuller, C. (2006). To conform or to perform? Mimetic behaviour, legitimacy-based groups and performance consequences. Journal of Management Studies, 43(7), 1559-1581.

- Beamish, P. W. (1990). The internationalization process for smaller Ontario firms: a research agenda. Research in global business management, 1, 77-92.

- Becheikh, N., Landry, R., & Amara, N. (2006). Lessons from innovation empirical studies in the manufacturing sector: A systematic review of the literature from 1993–2003. Technovation, 26(5), 644-664.

- Bianchi, C. C., & Arnold, S. J. (2004). An institutional perspective on retail internationalization success: Home Depot in Chile. The International Review of Retail, Distribution and Consumer Research, 14(2), 149-169.

- Bruton, G. D., & Lau, C. M. (2008). Asian management research: Status today and future outlook. Journal of Management Studies, 45(3), 636-659.

- Buckley, Clegg, L. J., Cross, A. R., Liu, X., Voss, H., & Zheng, P. (2007). The determinants of Chinese outward foreign direct investment. Journal of International Business Studies, 38(4), 499-518.

- Buckley, P. J., & Casson, M. (1976). Future of the multinational enterprise: Springer.

- Cantwell, J. (2014). Revisiting international business theory: A capabilities-based theory of the MNE. Journal of International Business Studies, 45(1), 1-7.

- Cantwell, J., & Mudambi, R. (2005). MNE competence-creating subsidiary mandates. Strategic Management Journal, 26(12), 1109-1128.

- Cantwell, J., Dunning, J. H., & Lundan, S. M. (2010). An evolutionary approach to understanding international business activity: The co-evolution of MNEs and the institutional environment. Journal of International Business Studies, 41(4), 567-586.

- Cardoso, E. A., & Dornbusch, R. (1989). Foreign private capital flows. Handbook of development economics, 2, 1387-1439.

- Coleman, J. S., & Coleman, J. S. (1994). Foundations of social theory: Harvard university press.

- Cooke, F. L. (2014). Chinese multinational firms in Asia and Africa: Relationships with institutional actors and patterns of HRM practices. Human Resource Management, 53(6), 877-896.

- Coviello, N. E., & Mcauley, A. (1999). Internationalisation and the smaller firm: a review of contemporary empirical research. MIR: management international review, 223-256.

- Damijan, J. P., Rojec, M., Majcen, B., & Knell, M. (2012). Impact of firm heterogeneity on direct and spillover effects of FDI: micro evidence from ten transition countries. Journal of Comparative Economics.

- Delios, A., Gaur, A. S., & Makino, S. (2008). The timing of international expansion: Information, rivalry and imitation among Japanese firms, 1980–2002. Journal of Management Studies, 45(1), 169-195.

- Deng, P. (2013). Chinese Outward Direct Investment Research: Theoretical Integration and Recommendations. 通过研究中国对外投资发展理论: 现实与建议. Management and organization review, 9(3), 513-539.

- Dimaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American sociological review, 147-160.

- Dunning, J. H. (1988). The eclectic paradigm of international production: A restatement and some possible extensions. Journal of International Business Studies, 1-31.

- Dunning, J. H. (2013). Multinationals, Technology & Competitiveness (Vol. 13): Routledge.

- Dunning, J. H., & Lundan, S. M. (2008). Multinational enterprises and the global economy: Edward Elgar Publishing.

- Elango, B., & Pattnaik, C. (2007). Building capabilities for international operations through networks: a study of Indian firms. Journal of International Business Studies, 541-555.

- Fortanier, F., & Tulder, R. V. (2009). Internationalization trajectories—a cross-country comparison: Are large Chinese and Indian companies different?. Industrial and Corporate Change, 18(2), 223-247.

- Frost, T. S., Birkinshaw, J. M., & Ensign, P. C. (2002). Centers of excellence in multinational corporations. Strategic Management Journal, 23(11), 997-1018.

- Gulati, R. (1999). Network location and learning: The influence of network resources and firm capabilities on alliance formation. Strategic Management Journal, 20(5), 397-420.

- Hymer, S. (1976). The international operations of national firms: A study of direct foreign investment (Vol. 14): MIT press Cambridge, MA.

- Johanson, J., & Vahlne, J.-E. (1977). The internationalization process of the firm—a model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8(1), 23-32.

- Johanson, J., & Wiedersheim-Paul, F. (1975). The internationalization of the firm—four swedish cases 1. Journal of Management Studies, 12(3), 305-323.

- Jones, O., & Gatrell, C. (2014). Editorial: The Future of Writing and Reviewing for IJMR. International Journal of Management Reviews, 16(3), 249-264.

- Kaplinsky, R., Mccormick, D., & Morris, M. (2007). The impact of China on sub-Saharan Africa. Brighton UK.

- Kaushal, A., Mayor, T., & Riedl, P. (2013). Les sirènes des manufactures américaines. L’Expansion Management Review(1), 58-71.

- Khanna, T., & Palepu, K. G. (2006). Emerging giants: Building world-class compaines in developing countries. Harvard business review, 84(10).

- Khanna, T., Kogan, J., & Palepu, K. (2006). Globalization and similarities in corporate governance: A cross-country analysis. Review of Economics and Statistics, 88(1), 69-90.

- Langseth, H., O’dwyer, M., & Arpa, C. (2016). Forces influencing the speed of internationalisation: An exploratory Norwegian and Irish study. Journal of Small Business and Enterprise Development, 23(1), 122-148.

- Leigh, N. G., & Blakely, E. J. (2013). Planning local economic development: Theory and practice: SAGE Publications, Incorporated.

- Li, D., Miller, S., & Eden, L. (2012). Entry mode decisions by emerging-market firms investing in developed markets. Institutional theory in international business and management, 25, 207-231.

- Li, J. (2008). Asymmetric interactions between foreign and domestic banks: effects on market entry. Strategic Management Journal, 29(8), 873-893.

- Lin, N. (1999). Building a network theory of social capital. Connections, 22(1), 28-51.

- Mäkelä, M. M., & Maula, M. V. (2005). Cross-border venture capital and new venture internationalization: An isomorphism perspective. Venture Capital, 7(3), 227-257.

- Markusen, J. R., & Venables, A. J. (1999). Foreign direct investment as a catalyst for industrial development. European Economic Review, 43(2), 335-356.

- Matlay, H., Jesselyn Co, M., & Mitchell, B. (2006). Entrepreneurship education in South Africa: a nationwide survey. Education+ Training, 48(5), 348-359.

- Meyer, M. W., & Brown, M. C. (1977). The process of bureaucratization. American journal of sociology, 364-385.

- Meyer, K., E, Estrin, S., Bhaumik, S. K., & Peng, M. W. (2009). Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30(1), 61-80.

- Mudambi, R. (2008). Location, control and innovation in knowledge-intensive industries. Journal of economic geography, 8(5), 699-725.

- Mukundhan, K., & Nandakumar, M. (2013). An Isomorphism Perspective to FDI-Based Entry-Mode Strategies of Emerging Market Firms—A Conceptual Model. Strategic Change, 22(5-6), 259-269.

- North, D. C. (1990). Institutions, Institutional Change and Economic Performance, Cambridge, Mass.: Cambridge University Press.

- North, D. C. (2005). Understanding the Process of Economic Change, Princeton, N. J.: Princeton University Press.

- Oviatt, B. M., & Mcdougall, P. P. (1994). Toward a theory of international new ventures. Journal of International Business Studies, 45-64.

- Peng, M. W., Wang, D. Y., & Jiang, Y. (2008). An institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies, 39(5), 920-936.

- Peter, B., Clegg, L. J., Cross, A. R., Liu, X., Voss, H., & Zheng, P. (2007). The determinants of Chinese outward foreign direct investment. Journal of International Business Studies, 38(4), 499-518.

- Pfeffer, J., & Salancik, G. R. (2003). The external control of organizations: A resource dependence perspective: Stanford University Press.

- Pigato, M., & Tang, W. (2015). China and Africa: Expanding Economic Ties in an Evolving Global Context. World Bank Group Working Paper, Washington DC.

- Ramasamy, B., Yeung, M., & Laforet, S. (2012). China’s outward foreign direct investment: Location choice and firm ownership. Journal of World Business, 47(1), 17-25.

- Rauch, J. E. (2001). Business and social networks in international trade. Journal of economic literature, 1177-1203.

- Rodrik, D. (2014). An African Growth Miracle?: National Bureau of Economic Research.

- Rugman, A. M., & Verbeke, A. (2001). Subsidiary-specific advantages in multinational enterprises. Strategic Management Journal, 22(3), 237-250.

- Scott, W. R. (2001). Institutions and organizations: Sage.

- Shen, X. (2014). Chinese Manufacturers Moving to Africa—Who? What? Where? Does Africa Benefit? Paper presented at the conference “China in the World Economy: Building a New Partnership with Africa.” World Bank, Washington, DC, May.

- Sinkovics, R. R., Yamin, M., Forsgren, M., & Hagström, P. (2007). Ignorant and impatient internationalization? The Uppsala model and internationalization patterns for Internet-related firms. Critical perspectives on international business, 3(4), 291-305.

- Stiglitz, J. E. (2007). Making globalization work: WW Norton & Company.

- Strange, A. M., Park, B., Tierney, M. J., Fuchs, A., Dreher, A., & Ramachandran, V. (2013). China’s development finance to Africa: A media-based approach to data collection. Center for Global Development Working Paper(323).

- Taylor, I. (2009). China’s new role in Africa: Lynne Rienner Publishers Boulder, CO.

- Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 509-533.

- Teece, D., & Pisano, G. (1994). The dynamic capabilities of firms: an introduction. Industrial and corporate change, 3(3), 537-556.

- Teece, D. J. (1977). Technology transfer by multinational firms: The resource cost of transferring technological know-how. The Economic Journal, 87(346), 242-261.

- Teece, D. J. (2014). A dynamic capabilities-based entrepreneurial theory of the multinational enterprise. Journal of International Business Studies, 45(1), 8-37.

- Tisdell, C. (2009). Economic reform and openness in China: China’s development policies in the last 30 years. Economic Analysis and Policy, 39(2), 271-294.

- Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence‐informed management knowledge by means of systematic review. British journal of management, 14(3), 207-222.

- Xing, Y., Liu, Y., Tarba, S. Y., & Cooper, C. L. (2016). Intercultural influences on managing African employees of Chinese firms in Africa: Chinese managers’ HRM practices. International Business Review, 25(1), 28-41.

- Welch, D. E., & Welch, L. S. (1996). The internationalization process and networks: A strategic management perspective. Journal of International Marketing, 11-28.

Selected systematic references

General references

Parties annexes

Notes biographiques

Alexis Abodohoui est doctorant en stratégie et gestion internationale à l’Université Laval. Il est assistant de recherche à la Chaire Stepen A- Jarislowsky en Affaires internationales. Membres de plusieurs centre et institutions de recherches (AIB, CIRRELT, CRECI et LAREM). Ses recherches portent sur le transfert de connaissances et de technologie, l’industrialisation, les pays émergents, l’entrepreneuriat, la coopération sino-africaine et le soft power. Il entretient un intérêt particulier pour les pratiques managériales africaines.

Dr Zhan Su est professeur titulaire de stratégie et de management international à l’Université Laval. Il a obtenu son diplôme d’ingénieur en Chine en 1982 et son doctorat en sciences de gestion en France en 1990. Professeur Su a réalisé de nombreux projets de recherche sur une grande variété de sujets et a fait beaucoup de publications dans des revues et livres. Il a organisé plusieurs formations destinées à des chefs d’entreprises et il est consultant auprès de plusieurs entreprises de nationalités diverses. Il est récipiendaire de plusieurs prix d’excellence en enseignement et en recherche.

Imelda Aurore Da-Silva, est étudiante doctorante en marketing à Harbin Institute of Technology (HIT). Imelda da-Silva s’intéresse surtout à la gestion et développement de la marque, au commerce intra-africain, aux investissements chinois en Afrique et à l’innovation dans les entreprises. Elle fait sa thèse sur la marque chinoise et la perception des consommateurs internationaux.

Parties annexes

Notas biograficas

Alexis Abodohoui es candidato a doctorado en Estrategia y Gestión Internacional en la Universidad Laval. Es asistente de investigación en la Cátedra Stepen A-Jarislowsky en asuntos internacionales. Miembros de varios centros e instituciones de investigación (AIB, CIRRELT, CRECI y LAREM). Su investigación se centra en la transferencia de conocimiento y tecnología, industrialización, países emergentes, emprendimiento, cooperación sino-africana y poder blando. Él tiene un interés particular en las prácticas gerenciales africanas.

Dr, Zhan Su es profesor de estrategia y de gestión internacional en la Universidad Laval. Obtuvo su diploma de ingeniero en China en 1982 y su doctorado en ciencias de gestión en Francia en 1990. Profesor Su ha realizado numerosos proyectos de investigación sobre una gran variedad de temas y ha hecho un gran número de publicaciones en revistas y libros especializados. También ha organizado varios seminarios destinados a jefes de empresas e interviene como consultor de empresas en diferentes países. Ha recibido varios premios de excelencia en investigación y en enseñanza.

Imelda Aurore Da-Silva, es un estudiante de la comercialización de estudiante de doctorado en el Instituto de Tecnología de Harbin (HIT). Imelda da-Silva está particularmente interesado en el desarrollo de la gestión y la marca, el comercio entre los países africanos, la inversión China en África y la innovación en las empresas. Ella hizo su tesis sobre la marca china y la percepción de los consumidores internacionales.

Liste des figures

FIGURE 2

Flow diagram

FIGURE 3

Publication trend and distribution of the papers by type of methods

FIGURE 3

China’s investment in Africa (Quantity in millions)

FIGURE 4

Areas investigated and future directions of Sino-African research

Liste des tableaux

Table 1

Criteria for inclusion

Table 3

Negatives impacts of Chinese presence in Africa from literature

Table 4

Negatives impacts of Chinese presence in Africa from literature

Table 5

Positive impacts of Chinese presence in Africa from literature

Specific keywords

table 5

Summary of selected articles December 2013