Résumés

Abstract

This study uses the absorptive capacity framework of Zahra and George (2002) to explain how exporting SMEs can achieve higher international financial performance. Based on the survey of 107 SMEs from the steel industry, results show that the impact of export knowledge processing on international financial performance is indirect, depending on the organizational process devoted to export knowledge absorption. The acquisition and assimilation of export knowledge have a direct influence on the export responsiveness capacity of SMEs, which ultimately allows them to derive higher turnover rates and profits from foreign market operations.

Keywords:

- absorptive capacity,

- export knowledge management,

- international financial performance of SMEs

Résumé

Ce travail adopte le cadre théorique de la capacité d’absorption (Zahra et George, 2002) pour expliquer la performance internationale financière des PME exportatrices. L’étude, menée auprès de 107 entreprises exportatrices de l’industrie des métaux, montre que l’impact de l’exploitation de la connaissance à l’export sur la performance internationale financière des PME est indirect et qu’il dépend du processus organisationnel d’absorption de la connaissance. L’acquisition et l’assimilation de la connaissance à l’export ont un impact direct sur la capacité de réponse à l’export des PME qui, à son tour leur permet d’augmenter le volume des ventes et les profits à l’export.

Mots-clés :

- la capacité d’absorption,

- gestion de la connaissance à l’export,

- performance internationale financière des PME

Resumen

Este trabajo adopta el marco teórico de la capacidad de absorción (Zahra et George, 2002) para explicar la realización financiera internacional de las PYME exportadoras. El estudio, realizado entre 107 empresas exportadoras de la industria del metal, muestra que el impacto de la explotación del conocimiento de la exportación sobre la realización financiera internacional de las PYME es indirecto y que depende de los procesos organizativos de absorción del conocimiento. La adquisición y asimilación del conocimiento de la exportación tienen un impacto directo sobre la capacidad de respuesta de la exportación de las PYME, que, a su vez, les permite aumentar el volumen de las ventas y los beneficios de la exportación.

Palabras clave:

- capacidad de absorción,

- gestión del conocimiento de la exportación,

- realización financiera internacional de las PYME

Corps de l’article

In the contemporary knowledge-intensive business arena, firms increasingly depend upon external sources of knowledge to improve their resource allocation and business performance (Camison and Forés, 2010; Lisboa et al., 2011; Ramaswami et al., 2009). Many firms, however, face difficulties in benefiting from external knowledge flows, even though the access to knowledge sources has significantly improved over the last decade (Kuivalainen et al., 2010). More specifically, for small and mid-sized firms (SMEs), the most frequent barriers to exporting are their general lack of resources and their specific lack of access to knowledge about foreign markets (European Commission, 2009; Kuivalainen et al., 2010).

In order to palliate such deficiencies, all enterprises, small or large need to develop their ability to recognize the value of new knowledge, assimilate it, and apply it to commercial ends (Cohen and Levinthal, 1990), in other words their absorptive capacity. The absorptive capacity (AC) construct has gained notable scientific significance, largely because of the increased importance of external knowledge resources for fostering business performance (Camison and Forés, 2010; Jansen et al., 2005; Lane et al., 2006; Zahra and George, 2002). Previous research in the field proposes theoretical frameworks to explain the nature, antecedents, and consequences of AC (Lane et al., 2006; Zahra and George, 2002). However, only a small number of studies examine the empirical validation of these frameworks (Lane et al., 2006; Lisboa et al., 2011), and empirically investigate how firms convert the acquired knowledge into action and financial benefits (Escribano et al., 2009; Grimpe and Sofka, 2009; Kostopoulos et al., 2011).

Most AC related studies consider technological innovation in high-tech firms as the major outcome of AC (Morgan et al., 2003). The impact of AC on financial measures of performance is rarely addressed (Lane et al., 2006; Kostopoulos et al., 2011). Furthermore, the AC literature aims mainly at describing knowledge related organizational processes in large firms, somehow neglecting SMEs (Liao et al., 2003; Lane et al., 2006; Mogos Descotes et Walliser, 2011). The present study addresses at least partly theses gaps. It proposes three types of contributions to the existing literature by 1) focusing on the effects of external export-market related knowledge absorption; 2) investigating the process of export knowledge absorption at the exporting SME level of analysis; 3) linking knowledge absorption to financial market indicators rather than subjective measures of business performance. In sum, this research analyzes to which extent the export knowledge absorption capacity of SMEs impacts their financial export performance. This question seems to be of great relevance to SMEs and policymakers alike.

Policy makers are highly concerned with the sustainability of SMEs’ export operations. The ultimate goal of virtually any foreign venture is to generate profit, in financial or other terms (European Commission, 2009). In almost all developed countries of the world, governments implement support programs, aimed at sustaining SMEs’ internationalization and thereby reinforcing the overall competitiveness of a country in the international arena (Mogos Descotes et al., 2011).

Exporting SMEs increasingly depend upon external sources of foreign market knowledge to improve their international business performance in the contemporary knowledge-intensive international business arena (Julien and Ramangalahy, 2003; Kuivalainen et al., 2010). Achieving higher rates of return from export operations is of great importance to SMEs’ in today’s business context. In Europe, SMEs lost about half of their export turnover between 2008 and 2010. More precisely, in France, 58 % of the SMEs suffered a decrease of their turnover, almost twice more than Germany (32 %) or the United Kingdom (32 %) (KPMG, 2010). Managers of SMEs should therefore be keen to learn more about the process that leads from export knowledge absorption to international financial performance.

We proceed by first reviewing the literature that links SMEs’ export knowledge levels to international performance. We then introduce the theoretical framework underlying the relationship between export knowledge and SMEs’ international performance and formulate a series of research hypotheses. After describing our methodology, we present the results, and conclude with a discussion and relevant implications.

Literature review

Export knowledge and the international performance of SMEs

Most literature in the field of export knowledge notes the link between the use of different export knowledge sources (e.g., foreign clients, export assistance, marketing research) and the international performance of SMEs. Those studies often investigate the connection between the frequency of use or the perceived importance of certain knowledge sources with performance indicators (Julien and Ramangalahy, 2003; Souchon and Durden, 2002; Yeoh, 2000). However, few empirical studies address the relationship between SMEs’ actual knowledge of foreign markets and international performance; we provide on overview and a discussion of the results of these studies hereafter.

For example, Hart et al. (1994) and Hart and Tzokas (1999) assess the perceived importance of different export knowledge elements, classified into three categories, namely market feasibility (e.g., international competition, buyers’ preferences, price trends), adaptation information (e.g., adaptation of current products to export and legal requirements), and background information (e.g., social, political and economic backgrounds of the export market). Of those knowledge sets, only the perceived importance of background information appears to be a determinant of the international performance of SMEs. Evaluating the perceived importance of knowledge about foreign markets, competition, norms, opportunities, and operations, Julien and Ramangalahy (2003) observe a positive, indirect impact of the perceived importance of the first three variables on SMEs’ export performance, through the enhancement of competitive strategy. Morgan et al. (2003) find that export market knowledge (i.e., regarding customers, distributors, and competitors in the export market, how to do business) influences marketing planning and implementation capabilities; the latter in turn have direct impacts on the adaptive performance of export ventures. A recent qualitative research, undertaken by Mogos Descotes and Walliser (2011) explores the acquisition and exploitation of export knowledge in SMEs. The empirical results suggest that efficiency of export knowledge acquisition conditions the use of export knowledge in SMEs. The use of export knowledge takes various forms : sense-making, decision making, and development of new export market-related know-how and capabilities.

Of these studies, only Morgan et al. (2003) and Mogos Descotes and Walliser (2011) define knowledge explicitly, using the term “informational knowledge” to refer to explicit knowledge (Polanyi, 1966). Explicit knowledge is objective by nature, can take the form of quantifiable data, is codifiable, and thus can be transferred (Nonaka, 1991; Nonaka and Takeuchi, 2004). In contrast, tacit knowledge is embedded in a person (Nonaka, 1994), subjective, experiential, and hard to formalize (Nonaka and Takeuchi, 2004). Therefore, when we use the term “export knowledge,” we refer to explicit knowledge regarding foreign markets, also called informational knowledge by Morgan et al. (2003), including the knowledge stocks companies possess about foreign clients, competitors, and market environments.

Overall, prior studies linking export explicit knowledge, which is often called export information in these studies (Souchon et al., 2003), and international performance offer rather contradictory and heterogeneous results, largely because of the variation in the export market knowledge and export performance measures they have used. Diamantopoulos and Souchon (1997) also note the difficulty of determining if a company effectively uses the export knowledge sources or market knowledge elements it has acquired by incorporating the knowledge into its operations. Some export knowledge could be perceived as particularly useful or important by export managers, but such perceptions do not guarantee that they use it effectively. They might ignore it or store it for future use (Diamantopoulos and Souchon, 1997; Souchon and Durden, 2002). Thus, beyond the question of the perceived usefulness of knowledge, assessing SMEs’ export knowledge levels might offer an indication of the extent to which companies integrate and consolidate their foreign market–related knowledge stocks over time. Morgan et al. (2003) evaluate the extent to which SMEs know their markets better than their main competitors. But their taxonomy of export knowledge is not exhaustive. They rely on a perceptual measure of adaptive performance, which offers no indication of the profits or turnover generated by export knowledge. In addition, though Hart et al. (1994) and Hart and Tzokas (1999) specifically link export knowledge to financial indicators of export performance, they do not use a theoretical framework to reveal how export knowledge might be used to enhance business or financial performance.

Theory framework : absorptive capacity and business performance

Defined by Cohen and Levinthal (1990) as firms’ capacity to exploit knowledge for commercial ends, Zahra and George (2002) reconceptualize AC as a set of organizational routines and processes that firms can use to acquire, assimilate, transform, and exploit knowledge. Accordingly, AC is viewed as a dynamic capability that influences the firm’s ability to create and deploy the knowledge necessary to build, modify, or renew organizational capabilities, in line with shifting market conditions.

Zahra and George (2002) also differentiate two subsets of AC : potential (PACAP) and realized (RACAP). Whereas PACAP entails the acquisition and assimilation of knowledge, RACAP refers to its transformation and exploitation. These four dimensions are combinative in nature and build on one another to yield an organizational dynamic capability. In addition, PACAP is a sine qua non for building RACAP, but only RACAP has a direct impact on competitive advantage or organizational performance. The authors define an “effectiveness rate” or “efficiency factor” to refer to the ratio of transformation of PACAP to RACAP. Firms with high efficiency factors are more skilled in developing and using their knowledge. Then the impact of RACAP on performance depends on “regimes of appropriability,” including the regulative and industry-specific features that affect a firm’s capacity to benefit from the advantages offered by its products and processes. Figure 1 depicts Zahra and George’s (2002) AC model.

Figure 1

Relationships among PACAP, RA CAP, and organizational performance

Despite the widespread use of this framework, the definitions of the construct and its antecedents are somewhat ambiguous, and relatively few studies empirically validate it (Camison and Forés, 2010; Lane et al., 2006; Jansen et al., 2005). Other studies instead offer a multidimensional operationalization of the AC process, which has been validated empirically (e.g., Jansen et al., 2005; Lisboa et al., 2011). Those studies use different measurement instruments that embody PACAP and RACAP. However, the conceptualization of AC still lacks consensus (Camison and Forés, 2010; Lane et al., 2006). We thus propose a specific possible conceptualization of SMEs’ AC for export knowledge.

SMEs’ absorptive capacity for export information

Applying the AC framework to the context of internationally operating SMEs offers better insights into the internal export knowledge transformation processes that are vital for success. The acquisition dimension of PACAP refers to the firm’s capability to identify and acquire external knowledge to support its operations. For this research, we define it as the efficiency of export knowledge acquisition in SMEs, or their level of knowledge about foreign market elements, such as foreign clients and competitors, products, prices, communication and distribution practices, and the legal environment (Julien and Ramangalahy, 2003).

The assimilation dimension of PACAP refers to organizational processes and routines that can enhance analyses, as well as the interpretation and understanding of market knowledge. For exporting SMEs, assimilation involves organizational mechanisms that enable small firms to internalize export information efficiently, such as coordination and communication (Julien and Ramangalahy, 2003; Souchon et al., 2003). Several organizational practices likely influence knowledge assimilation, such as centralization, formalization, and communication of coordination (Julien and Ramangalahy, 2003). However, most SMEs offer informal, centralized structures with efficient communication procedures (DeBurca et al., 2012; Julien, 1994). If these informal coordination and communication capabilities appear efficient, SMEs are unlikely to develop formal knowledge transfer or integration processes (Ramangalahy, 2001). Yet formal organizational practices can increase the effectiveness of knowledge transfers and integration, such as through regular discussions about errors, failures, new ideas, and activities, managerial teamwork, and the effective use of formal instruments (e.g., manuals, databases, files, organizational routines) to apply lessons learned even in the face of employee turnover (Jerez-Gomez et al., 2005). Therefore, the efficiency of knowledge transfer and integration is a suitable construct to capture SMEs’ knowledge assimilation capacities.

RACAP entails the use and implementation of acquired knowledge. In its transformation dimension, RACAP refers to the consolidation of export knowledge stocks by integrating new, incoming knowledge. In that sense, it is similar to a firm’s export responsiveness capacity or ability to react to incoming foreign market knowledge (Cadogan et al., 1999, 2002).

Finally, the exploitation dimension of RACAP emphasizes the application of knowledge and the firm’s propensity to refine, create, and apply new knowledge to operations. We assume that export responsiveness is largely equivalent to this exploitation dimension, because it refers to firms’ capacity to respond to foreign market knowledge by integrating it into operations, such as through meetings to determine appropriate reactions or changing marketing mix decisions in different export settings (Cadogan et al., 1999; 2002). In this sense, SMEs’ export responsiveness might encompass both knowledge transformation and exploitation dimensions. Although some authors suggest that knowledge transformation capacity may not be the phase that precedes exploitation, but rather an alternative process (Todorova and Durisin, 2007), at the behavioral level, transformation and exploitation combine. Thus, capturing export knowledge transformation and exploitation with SMEs’ export responsiveness capacity seems acceptable.

Zahra and George (2002) define an “effectiveness rate” or “efficiency factor” as the ratio of the real transformation of PACAP to RACAP. Firms with high efficiency factors are more skilled in developing and using knowledge or designing RACAP, and they ultimately achieve better organizational performance. Although this effectiveness rate represents an interesting potential moderator, its conceptualization is broad and difficult to assess on an empirical basis. Therefore, we chose to concentrate on the internal process of export information management, that is, the impact of PACAP’s antecedents on PACAP and the impact of PACAP on RACAP.

Research model

Because of the accent put on knowledge and knowledge development processes, but also because of the explanation of the link between knowledge processes and business performance, both perspectives, AC and the knowledge based view (KBV) of the firm, are highly appropriate to explore the existing link existing between export knowledge and international performance. Moreover, the integrative and dynamic character of those two theoretical perspectives makes them suitable to explain processes related to the internationalization of SMEs (Kuivalainen et al., 2010; Kamakura et al., 2012). Therefore we combine insights from both theoretical frameworks for the construction of our research model.

The impact of PACAP on RACAP : how export information acquisition and assimilation influence SMEs’ export responsiveness ?

The AC framework of Zahra and George (2002) suggests that firms’ propensity to acquire and assimilate knowledge determine firms’ propensity to furthermore exploit the new incoming knowledge, by enclosing it in firms’ operations and actions. The KBV makes a similar claim, sustaining that market knowledge must be converted into action for firms to respond to their environments and learn (Kamakura et al., 2012; Morgan et al., 2003; Zahra and George, 2002). According to the KBV, a firm’s knowledge base guides its effective action (Kodama, 2005; Kuivalainen et al., 2010; Spender, 2007).

Previous research in the field of SMEs shows that their export knowledge acquisition proficiency determines the extent to which they actually use the acquired knowledge for decision-making purposes (Souchon and Diamantopoulos, 1999; Souchon and Durden, 2002), or for enclosing it into companies’ operations to respond to foreign markets’ shifts (Kuivalainen et al., 2010; Liao et al., 2003; Cadogan et al., 2002). The more SMEs know about their foreign markets, the more they will be able to implement effective responses for adapting their products offerings to foreign clients’ demands or to changes in the socio-political and economic environment of their international markets. Therefore, we propose :

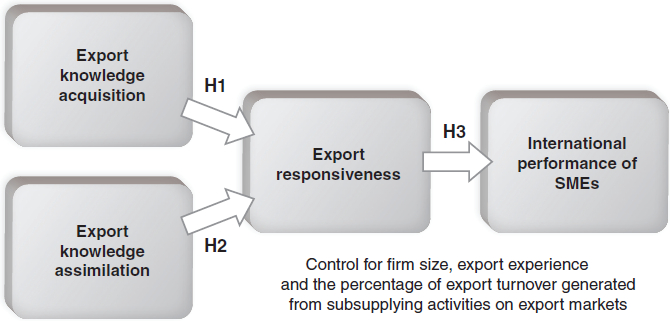

H1 : SMEs’ export knowledge acquisition has a positive impact on their export responsiveness capacity.

The AC perspective claims that after knowledge has been acquired, it must be assimilated if it is to enhance future use (e.g., Cohen and Levinthal, 1990; Lisboa et al., 2011). Knowledge sharing and integration in organizations depend on a wide range of formal and informal coordination procedures (Jerez-Gomez et al., 2005). Knowledge transfer and integration are basic mechanisms through which firms internalize and transform information to commercial ends (Jerez-Gomez et al., 2005; Zahra and George, 2002). Successfully transferring knowledge implies significant and efficient information flows that ensure that information reaches the right person in the firm who needs it for undertaking responsive action (Kohli and Jaworski, 1990; Cadogan et al., 1999, 2002). In the export context, empirical evidence suggests that after export knowledge has been collected, it has to be assimilated and used for decision making in order to achieve higher export performance rates (Diamantopoulos and Souchon, 1997; Souchon and Durden, 2002; Souchon et al., 2003). Mogos-Descotes and Walliser (2011) suggest that successful export knowledge transfer and integration enhances SMEs’ propensity to use knowledge for efficiently reacting to foreign markets shifts. Liao et al. (2003) also corroborate this finding, however in the domestic market; their study reveals a significant impact of SMEs’ knowledge dissemination capacity on their responsiveness capacity. Thus, the following is proposed in an export context :

H2 : Efficient knowledge transfer and integration in SMEs has a positive impact on their export responsiveness capacity.

The impact of RACAP on business performance : the impact of SMEs’ export responsiveness on the financial export performance of SMEs

RACAP is seen as a dynamic capability (Zahra and George, 2002) that can be deployed repeatedly in new situations to ensure business performance and long-term competitive advantage (Kodama, 2005; Freiling et al., 2008). The efficiency of firms’ responses to the environment is a well-established determinant of organizational success within the AC (Cohen and Levinthal, 1990; Zahra and George, 2002) and the KBV literature (Kuivalainen et al., 2010; Patriotta, 2004; Teece et al., 1997). Such responsiveness can also be conceptualized as firms’ capacity to react to new knowledge, defined as one dimension of a firm’s market orientation by Kohli and Jaworski (1990). Empirical evidence shows an impact of responsiveness on business performance in various national settings (e.g., Harris and Ogbonna, 2001; Homburg and Pflesser, 2000; Rose and Shoham, 2002).

Even though the literature on export responsiveness has extensively developed over the last decade, relatively few studies discuss its link with business performance in SMEs (Keskin, 2006; Pelham, 1999, 2000). Compared with large organizations, SMEs should be more innovative, customer-oriented, and should have shorter response times (DeBurca et al., 2012; Francis and Collins-Dodds, 2000; Liao et al., 2003). Responsiveness is seen by most scholars as a valuable resource for SMEs and an important driver of their business performance (Keskin, 2006; Pelham, 1999, 2000), at least in domestic settings. In international settings, export responsiveness entails continuous adjustments of the export strategy to meet foreign clients’ demands, as well as to address foreign market–related constraints (Cadogan et al., 1999). Although empirical evidence regarding the impact of export responsiveness on export performance is rather scarce (Cadogan et al., 1999, 2002), the literature provides empirical support regarding the fact that export success is dependent upon the degree of the firm’s market orientation in overseas markets (Hooley and Nowcomb, 1983; Cadogan et al., 1999, 2002). We therefore propose that in international settings, and in the case of SMEs, export responsiveness improves financial success abroad :

H3. Export responsiveness has a positive impact on SMEs’ financial international performance.

Several scholars suggest that translating marketing competence into successful export performance depends on firm characteristics (Cadogan et al., 2002; Cavusgil and Zou, 1994; Porter, 1980). To assess the impact of SMEs’ export responsiveness on their international financial performance, we control for the impact of firm size, export experience of the company, and the percentage of export turnover generated from subsupplying activities. Firm size represents a salient element in levels of foreign performance (e.g., Burton and Schlegelmilch, 1987; Calof, 1994), in that it affects SMEs’ capacity to allocate resources to export efforts. Export experience plays overall a key role in the internationalization process (Angué and Mayrhofer, 2010; Cadogan et al., 2002), and refers to the demonstrated capability of the firm to engage in international operations (Eriksson et al., 2000; Wright et al., 2007). Moreover, strong empirical support links international performance to SMEs’ export experience (e.g., Cavusgil and Zou, 1994; Mogos Descotes and Walliser, 2010). SMEs’ international experience might offer a form of internationalization-related knowledge (Eriksson et al., 2000) that helps firms enhance the consolidation of their export market knowledge. Finally, SMEs that benefit from stable subsupply contracts might increase their turnover more easily than those that must independently search for export contracts (Julien, 1994; Torrès, 1999). In Figure 2, we display our research hypotheses graphically.

Figure 2

Research model

Methodology

Measures

Noting the causal nature of the research problem, we opted for a quantitative methodological approach. The questionnaire design was based on our review of relevant literature and in-depth interviews with 12 SME managers. Several measures that have appeared in prior studies were adapted to capture the constructs of interest (as detailed in Appendix 1).

For export knowledge acquisition efficiency, we adapted a reflexive scale provided by Julien and Ramangalahy (2001). Respondents revealed the extent to which they believed they possessed more market knowledge than their main competitors in the following areas related to foreign markets : general market situation, clients and competitors, products, prices and payment methods, communication, and distribution practices.

As discussed previously, SMEs’ capacity to transfer and integrate knowledge can be considered a measure of knowledge assimilation. The knowledge transfer and integration scale we employed is reflexive (Jerez-Gomez et al., 2005) and included three items that assess the discussions around errors and failures, new idea and activities as well as their usefulness for the firm, efficiency of the managerial teamwork, and the use of instruments (manuals, databases, files, organizational routines, etc.) that allow what has been learned in past situations to remain valid even when employees change.

To capture the two dimensions of RACAP, knowledge transformation and implementation, we measured the export responsiveness capacity of SMEs with the reflexive scale provided by Cadogan et al. (1999). Several items were difficult to translate into French, and the managers who participated in the pretest perceived high redundancy in these items. Therefore, we used only six of the items from the initial scale.

Our measure of international financial performance is inspired by the study of Ramaswami et al. (2009). Those authors define financial performance as the magnitude of the financial gains companies derive from their operations, and measure it by using subjective financial performance aspects such as for instance perceived satisfaction with net profits or sales volumes obtained. However, we adapted their measure and used two truly financial and objective measures to capture SMEs’ international performance : the average growth of export sales volume and export profits over the past three years. Both indicators were extracted from the DIANE database, rather than being reported by respondents, which helped us avoid recall bias and common method bias (Sousa, 2004). Moreover, with this procedure we overcame managers’ reluctance to provide such data (Francis and Collins-Dodd, 2000; Leonidou, Katsikeas and Samiee, 2002).

Finally, we measured firm size as the number of employees, export experience as the number of years the firm had been operating in at least one foreign market, and sales derived from subsupplying as a percentage of their total export turnover.

Data collection

After a pre-test with the export managers of 12 small exporting firms, the questionnaire was administered to respondents of 624 French SMEs operating in the steel industry. After some years of decline, the French steel industry has become a significant contributor to the international status of the country’s manufacturing sector and is therefore a worthwhile object of analysis. The steel industry is a traditional and mature industry, somehow lacking in radical innovation, with a steady growth rate in recent years, relatively high export ratios, and a good competitive position in the European market (Business Monitor International, 2012). Therefore, our study results may generalize, to a certain degree, to companies operating in other mature, export-oriented industries in industrialized European economies.

The DIANE database provided company information, such as location, number of employees, and industrial sector. This database regroups the financial information that French companies are required to provide; it also includes the names of managing directors, the respondents we targeted with this research as influential in fostering firms’ international developments (e.g., Bijmolt and Zwart, 1994; Leonidou, 2004). The questionnaire was administered in four waves, accompanied by a cover letter that explained the aim of the research, addressed to the managing director, and a prepaid response envelope. We received 107 usable questionnaires, for a final response rate of 19.1 %, which is satisfactory in comparison with similar studies of export performance. For example, Sousa (2004) reports average response rates between 15 % and 20 % for equivalent studies.

Follow-up analyses revealed some details about non-respondents. Some companies no longer exported or some company policies did not allow survey participation. None of the reasons suggested that their non-response behavior reflected characteristics that could affect the findings related to the substantive research topic (Souchon and Diamantopoulos, 1999).

Results

We processed the data in two stages. First, we used descriptive statistics to identify the characteristics of the sample firms and their information practices. Second, to test the research hypotheses, we used partial least squares (PLS) path modeling, which is preferable to co-variance based structural equations because it is particularly advantageous for a relatively small sample size and in the initial phases of theory building (Fornell and Bookstein, 1982). According to Fornell and Larcker (1981), the PLS method is more robust than co-variance based structural equations, in that it does not require normally distributed data.

The 107 firms in our final sample employed an average of 86.70 persons each (standard deviation [sd] = 70.02). To ensure an adequate sample size for the analysis, we conducted a power test (Green, 1991), using the R² for the endogenous constructs. Assuming a medium effect size (f² = .15; R² = .13), a maximum of two predictors, a significance level (α) of .05, and a desired power (1 − β) of .80, our analysis would require a sample size of 66. The power test affirmed that our sample size was sufficient to estimate our model using PLS.

In these firms, exports accounted for an average of 40.49 % of total turnover (sd = 26.77), and the percentage of export turnover derived from sub-supplying averaged 20.56 % (sd = 13.77). They had been participating in international activities for about 24.04 years on average (sd = 15.66).

Regarding the level of export knowledge acquisition, SMEs generally were above average : The items that capture the knowledge assimilation dimension (knowledge transfer and integration) reveal that our sample SMEs achieved high assimilation capacities, well above the average of 4 (all constructs were measured on scales ranging from 1 to 7). Furthermore, their export responsiveness levels were slightly above average. According to the two objective measures of financial international performance, export sales increased by 19.20 % over the previous three years (sd = 38.42), and companies registered an average increase of 17.24 % of export sales profits over that period (sd = 35.28). Therefore, the sample appeared composed of relatively successful companies, compared with average French SMEs operating in the steel industry. Yet the firm size of the companies in the sample was similar to that of the wide population. We provide fuller details of the descriptive analysis of the sample in Appendix 2.

The measures all achieved internal consistency (unidimensionality and reliability). The latent constructs we investigated are all unidimensional (i.e., we could extract a single eigenvalue greater than 1). Moreover, the manifest variables all loaded on their respective latent constructs, as theoretically expected; even the lowest loading of .58 for one of the items from the export responsiveness construct, “we rapidly respond to competitive actions that threaten us in our export markets,” was above the critical accepted value of .5 (Rivard and Huff, 1988). The Rhô coefficient of all five latent constructs also was greater than .7 (Fornell and Bookstein, 1982; Fornell and Larcker, 1981), which indicates construct reliability.

Finally, we assessed discriminant validity by examining whether each construct shared more variance with its measures than with other constructs in the model (Barclay et al., 1995; Chin, 1998). The lowest squared root of the average variance extracted (AVE) was .510 (for export responsiveness), and the highest value reached .908, so they all exceeded the cut-off value of .5 proposed by Fornell and Larker (1981). Finally, we assessed discriminant validity by examining whether each latent variable shared more variance with its measures than with other latent variables in the model (Barclay et al., 1995; Chin, 1998). As we show in Appendix 2, the constructs’ squared correlations in the model do not exceed the AVE.

As we depict in Figure 3, all our research hypotheses received confirmation at the 99 % level. We can therefore assert that for the 107 exporting SMEs sampled for this research, 20.8 % of their export financial performance can be explained by their degree of export responsiveness (β = .335, p <.001). The potential absorptive capacity, which entails both export knowledge acquisition (β = .351, p <.001) and assimilation effectiveness (β = .482, p <.001), provided a strong determinant of the export responsiveness of SMEs (58.3 % of variance explained).

Figure 3

Research hypotheses’ validation

Neither firm size nor international experience exerted a significant impact on the observed relationships. Only the percentage of export sales derived from sub-supplying positively influences export responsiveness of SMEs (β = .240, p <.001), without affecting SMEs’ international financial export performance.

We also applied Tenenhaus et al.’s (2005) global goodness of fit (GoF) index (0≤GoF≤1), adapted to PLS path modeling, which reflects the geometric mean of the communality (or AVE in PLSPM). The Absolute Goodness of Fit (GoF) index is the most widely used GoF indicator and matches the effect sizes for R-square proposed by Cohen (1988). Inspired by Cohen (1988), Antioco et al. (2008) set GoF criteria for small, medium, and large R-square effect sizes equal to .1, .25, and .36. Accordingly, the Absolute GoF index for our model (.476) can be deemed satisfactory; the hypothesized model offered good predictive quality, and the measurement models fit the data well. Indeed, the inner GoF index (influence paths) and outer GoF index (measurement model evaluation) both exceed the cut-off point of .9.

Additional results that are worth being mentioned relate to the indirect effects of PACAP on the international financial performance of SMEs[1]. We used Sobel’s (1982) test (performed with SPSS 20.00) to verify that the mediating variable, namely SMEs’ levels of export responsiveness carry the influence of PACAP on the financial performance. The results confirm the full mediation for the knowledge assimilation dimension of PACAP (knowledge transfer and integration) (z = 2.36, p < 0.05), which has a strong direct significant effect on export responsiveness (β = .480, p < 0.001) and a non significant direct impact on SMEs’ financial international performance. Furthermore, the results reject the mediation for the export knowledge acquisition dimension of PACAP (z = 1.14, p > 0.05). In the meanwhile, the latter construct has a direct significant effect on both export responsiveness (β = .351, p < 0.001) and financial performance (β = .259, p < 0.005).

Figure 4 depicts the magnitude of the direct effects of PACAP on both RACAP and the financial performance of SMEs. As expected, RACAP (export responsiveness) is the main determinant of the financial international performance of SMEs. However, one of the dimensions of RACAP (export knowledge acquisition) also exerts a direct effect on the financial international performance of SMEs. Taking into account the latter effect improves the explained variance of the financial international performance of SMEs (from 20.2 % - compare figure 3 - to 27.3 %) and also (even though only slightly) the overall quality of the structural model (the Absolute GoF index progresses from .476 to .495).

Figure 4

Modified model including the direct impact of PACAP on the international financial performance of SMEs

Since our data were collected using a survey questionnaire, we verify for common method variance (CMV). Lindell and Brandt (2000) and Lindell and Whitney (2001) suggest that the smallest correlation with a theoretically unrelated variable is a judicious estimate of CMV. Then, for all bivariate correlations the effect of the smallest correlation (rs) needs to be partialed out in order to remove the effect of CMV. However, our survey questionnaire did not contain such a theoretically unrelated construct.

Therefore, in line with Antioco et al. (2008), we took a slightly different approach by selecting the smallest correlation among our theoretical variables. This is the correlation between firm size and the percentage of export sales derived from sub-supplying (|rs|=.015). From our application of the procedure, we conclude that for all significant effects in our model, the corresponding bivariate correlation coefficients remain statistically significant at p < 0.05 after adjusting for CMV. Therefore, we may conclude that the effects due to CMV are negligible in our study.

Conclusion, discussion, limits and contributions

The main assumption guiding this research holds that the efficiency of SMEs, in terms of export knowledge exploitation, gets reflected by their levels of AC of export knowledge, which ultimately leads to their financial success. Overall, our results support this claim. With this research, we confirm that Zahra and George’s (2002) AC framework is appropriate for explaining the export knowledge exploitation process and its impact on SMEs’ international financial performance. We also validate the impact of PACAP on RACAP. Export knowledge is essential for remaining responsive to foreign market shifts. However, this outcome emerges only through the implementation of efficient knowledge transfer and integration practices. Liao et al. (2003) offer empirical support for the fact that information acquisition and dissemination influence firms’ responsiveness in domestic markets. Our study tends to confirm similar relationships for exporting SMEs.

Furthermore, we observe a strong impact of the export responsiveness capacity of small firms on their international financial performance. Accordingly, we offer support for a main assumption underlying the absorptive capacity framework of Zahra and George (2002). The SMEs in our sample which are characterized by superior levels of RACAP (export responsiveness) generate superior economic rents in the long run. These findings corroborate the results of previous studies using the same framework to explain the impact of knowledge absorption on business performance in a domestic context (e.g., Camison and Forés, 2010; Jansen et al., 2005; Escribano et al., 2009; Grimpe and Sofka, 2009). Irrespectively of the conceptualization of AC chosen by these authors, they all underline a direct and significant impact of RACAP on business performance. Based on our results, we can assert that RACAP also is the main determinant of the financial performance of internationally operating SMEs.

Our results show that RACAP partially mediates the impact of PACAP on the financial international performance of SMEs. However, if export responsiveness mediates the impact of knowledge assimilation on the financial international performance of SMEs, it does not mediate the impact of export knowledge acquisition. The latter construct exerts at the same time a direct effect on export responsiveness and on the financial international performance. This result is not very surprising; several studies concluded that the intensity of export knowledge acquisition is positively related to export performance (e.g.. Hart and Tzokas, 1999; Yeoh, 2000; Rose and Shoham, 2002). However, the main determinant of the financial international performance of SMEs remains RACAP (export responsiveness), validating Zahra and George’s (2002) theoretical framework.

Neither firm size nor international experience had significant impacts on the observed relationships. Regardless of their size or export experience, SMEs from the steel industry seem able to absorb foreign market-related knowledge and achieve high levels of international financial performance. Their internationalization learning cycles may be shorter because of globalization and the increasing availability of knowledge (Kuivalainen et al., 2010; Kamakura et al., 2012), such that knowledge development in SMEs might no longer be the incremental process previously suggested in the past (e.g., Johanson and Vahlne, 1977, 1990; Sapienza et al., 2006).

The percentage of export sales derived from sub-supplying has a positive impact on export responsiveness but no impact on financial international performance. It thus appears that dependency on a foreign sub-supplier does not lead directly to higher profits or higher sales volumes. Rather, it provides a driver of SMEs’ export responsiveness. This interesting finding contradicts the general idea that in manufacturing industries, SMEs are confined to serving as sub-suppliers for main clients if they want to increase export profits or sales volume (Julien, 1994). Rather, we argue that companies which supply major foreign clients develop their own response actions to serve these clients effectively.

This study offers insights into the complexity of export knowledge management in small firms. In particular, the impact of export knowledge processing on levels of international performance is mostly indirect, and dependent on the efficiency of the overall organizational process of export knowledge absorption. Export knowledge must be assimilated within organizations to enable them to respond to foreign market shifts. This finding is in line with results and recommendations of previous studies (e.g., Julien and Ramangalahy, 2003; Ramangalahy, 2001; Souchon and Durden, 2002), but it offers extended implications on theoretical, managerial, empirical, and policy making levels.

From a theoretical point of view, we identify the relatively intuitive, simple AC framework as the best means to capture the impact of knowledge on levels of organizational performance. Our results confirm the validity of the AC perspective for understanding how knowledge resources absorption can determine the financial gains of SMEs in foreign settings.

From a methodological perspective, the current study proposes and validates several possible operationalizations of Zahra and George’s (2002) AC model, in the context of exporting SMEs. Accordingly, we provide a set of measurement tools that can evaluate the export knowledge AC in SMEs. Measures extracted from the DIANE database enabled us to assess the international financial performance of the sampled companies. This important advance marks the first use of objective information about international performance measures rather than biased perceptual or recall measures (Sousa, 2004).

Moreover, this study offers guidance for SME managers who want to improve their export information activities and achieve higher levels of financial gains in export markets. First, our study draws a detailed picture of the export information AC of French SMEs and their levels of export performance. Thus, SME managers can compare themselves against highly successful exporting SMEs. If SMEs attain higher levels of foreign market–related knowledge, they can implement more efficient responses to foreign market shifts. However, acquiring export knowledge is not sufficient; knowledge transfer and integration offers a much better explanation of the export responsiveness levels of SMEs. Thus, export information can be effectively prioritized in SMEs that design efficient knowledge assimilation practices. Export responsiveness constitutes a main determinant of financial gains from foreign operations.

Policymakers can gain insights from our study into the factors that determine SMEs’ international performance and thereby design more suitable support programs that enhance knowledge management skills. Programs designed to develop SMEs’ managers skills and know-how, in terms of export marketing planning, formulating creative export marketing strategies, translating marketing strategies into action, and ensuring the control and evaluation of marketing costs in a foreign setting, would be valuable forms of aid that should encourage the international performance of SMEs.

As does any research conducted on new grounds, this study has several limitations. In line with Zahra and George’s (2002) framework, we implicitly assumed the dynamic and process-like nature of AC (see also Jansen et al., 2005; Kostopoulos et al., 2011; Lisboa et al., 2011) and supported its applicability to export knowledge absorption with our empirical study. Yet, studies of processes benefit from longitudinal approaches that reveal the evolution of the state of AC possessed by small firms over time.

Another limit relates to the fact that previous studies have shown that the AC of export knowledge in SMEs takes place at several levels of analysis : individual, managerial team and organizational level (Mogos Descotes and Walliser, 2011). This research privileged the latter level since it aimed to explain the financial export performance of SMEs, which is by definition an organizational construct.

Although several scholars stress that international performance is a multi-dimensional construct (e.g., Zou et al., 1998; Sousa, 2004), we did not conceptualize it as such, since our objective was to determine how knowledge-based resources absorption impact SMEs’ financial gains in foreign markets. Moreover, to the best of our knowledge no specific multi-dimensional measure for the international financial performance has been developed in the literature. Thus, objective data concerning the evolution of foreign profits and sales volume appear as interesting proxies for the financial performance of SMEs in foreign settings.

The sample is similar to the SME population in terms of size, and the response rate is satisfactory, compared to other investigations of export performance (Sousa, 2004). However, further studies still should increase the external validity of the results by investigating representative samples of other industries. For example, it would have been interesting to observe AC processes in industries characterized by high growth rates over the recent years, such as for instance the European alternative energies support industries (European Commission, 2009). However, we speculate that such high growth rate industries might neither have reached the same stage in the innovation cycle across different European countries (European Commission, 2009), nor be homogeneous in terms of information availability, and therefore lead to very contrasting AC processes. For these reasons, focusing on a steady growth and mature industry such as the steel industry represents an interesting first choice which nevertheless calls for validation in other industries in the future.

Parties annexes

Appendices

Appendix 1. Operationalization of the research variables

Table 1

Operationalization of the research variables

Appendix 2. Descriptive analysis of the data

Table 1

Constructs, items, standardized loadings, composite reliability, and average variance extracted

Table 2

Discriminant and convergent validity assessement

Biographical notes

Raluca Mogos Descotes works as Assistant Professor at University of Lorraine (IUT Charlemagne). Her main research interests are SMEs’ international performance and knowledge management.

Björn Walliser is Professor of Marketing at the University of Lorraine (ISAM-IAE) and head of the research group in marketing of the CEREFIGE research center. His main research interests are in the fields of international marketing and marketing communication.

Note

-

[1]

We thank one of the reviewers for suggesting to test these effects.

Bibliography

- Antioco, Michael; Moenaert, Rudy K.; Feinberg, Richard A.; Wetzels, Martin G. M. (2008). “Integrating service and design: the influences of organizational and communication factors on relative product and service characteristics”, Journal of Academy of Marketing Science, Vol. 36, p. 501-521.

- Angué, Katia; Mayrhofer, Ulrike (2010). “Le modèle d’Uppsala remis en question: une analyse des accords de coopération noués dans les marchés émergents”, Management International, Vol. 15, N° 1, p. 33-46.

- Barclay, Donald W.; Higgins, Chris; Thompson, Ron (1995). “The partial least squares approach to causal modeling: personal computer adoption and use as illustration”, Technology Studies, Vol. 2, N° 2, p. 285–309.

- Bijmolt, Tammo H. A.; Zwart, Peter S. (1994). “The impact of internal factors on the export success of Dutch small and medium-sized firms”, Journal of Small Business Management. Vol. 32, N° 2, p. 69-83.

- Business Monitor International (2012). Métaux France Rapport Q1 2012. Press release, accessed February 29, 2012, from http://www.fr-communiquedepresse.net/jj/march%C3%A9+de+la+Nouvelle+M%C3%A9taux+France+Rapport+Q1+2012%C2%BB+a+%C3%A9t%C3%A9+publi%C3%A9_cbfhba.htm

- Burton, F. N.; Schlegelmilch, Bodo B. (1987). “Profit analysis of non-exporters versus exporters grouped by export involvement”, International Management Review, Vol. 27, N° 1, p. 38-49.

- Cadogan, John W.; Diamantopoulos, Adamantios; De Mortanges, Charles P. (1999). “A measure of export market orientation: scale development and cross-cultural validation”, Journal of International Business Studies, Vol. 30, N° 4, p. 689-707.

- Cadogan, John W.; Diamantopoulos, Adamantios; Siguaw, Judy A. (2002). “Export market-oriented activities: their antecedents and performance consequences“, Journal of International Business Studies, Vol. 33, N° 3, p. 615-626.

- Calof, Jonathan L. (1994). “The relationship between firm size and export behavior revisited”, Journal of International Business Studies, Vol. 25, N° 2, p. 367-387.

- Camison, Cesar; Forés, Beatriz (2010). “Knowledge absorptive capacity: new insights for its conceptualization and measurement”, Journal of Business Research, Vol. 63, N° 7, p.707-715.

- Cavusgil, Tamer S.; Zou, Shaoming (1994). “Marketing strategy-performance relationship: an investigation of the empirical link in export market ventures”, Journal of Marketing, Vol. 58, N° 1, p. 1-21.

- Chin, Wynne (1998). “The partial least squares approach to structural equation modeling” in J.A. Marcoulides (Eds.), Modern Business Research Methods New Jersey: Lawrence Erlbaum Associates, p. 295-336.

- Cohen, Jacob (1988). Statistical power analysis for the behavioral sciences. New Jersey: Lawrence Erlbaum.

- Cohen, Wesley M.; Levinthal, Daniel A. (1990). “Absorptive capacity: a new perspective on learning and innovation”, Administrative Science Quarterly, Vol. 35, N°1, p. 128-152.

- de Búrca, Seán; Roche, Evelyn; Fynes, Brian; Wiengarten, Frank (2012), “Manufacturing practices and performance: a comparative study of European SMEs“, International Journal of Business Strategy, Vol. 12, N° 2, p. 99-108.

- Diamantopoulos, Adamantios; Souchon, Anne L. (1997). “Use of non-use of export information: some preliminary insights into antecedents and impact on export performance”, Journal of Marketing Management, Vol. 13, N°1-3, p. 135-151.

- Eriksson, Kent; Johanson, Jan; Majkgärd, Anders; Sharma, Deo D. (2000). “Effect of variation on knowledge accumulation in the internationalization process”, International Studies of Management and Organization, Vol. 30, N° 1, p. 26-44.

- Escribano, Alvaro; Fosfuri, Andrea; Tribo, Josep A. (2009). “Managing external knowledge flows: the moderating role of absorptive capacity”, Research Policy, Vol. 39, N° 1, p. 96-105.

- European Commission (2009). Study on the Competitiveness of the EU eco-industry. accessed July 15, 2012, from http://ec.europa.eu/enterprise/newsroom/cf/_getdocument.cfm?doc_id=5416

- Fornell, Claes; Bookstein, Fred (1982). “Two structural equation models: LISREL and PLS applied to consumer exit-voice theory”, Journal of Marketing Research, Vol. 19, N° 4, p. 440-452.

- Fornell, Claes; Larcker, David F. (1981). “Evaluating structural equation models with unobserved variables and measurement error”, Journal of Marketing Research, Vol. 18, N° 1, p. 39-50.

- Francis, June; Collins-Dodd, Colleen (2000). “The impact of firms’ export orientation on the export performance of high-tech SMEs”, Journal of International Marketing, Vol. 8, N° 3, p. 84-103.

- Freiling, Jorg; Gersch, Martin; Goeke, Christian (2008). “On the path towards a competence-based theory of the firm”, Organization Studies, Vol. 29, N° 8-9, p. 1143-1164.

- Green, Samuel B. (1991). “How many subjects does it take to do a regression analysis?”, Multivariate Behavioral Research, Vol. 26, N° 3, p. 499–510.

- Grimpe, Cristoph; Sofka, Wolfgang (2009). “Search patterns and absorptive capacity: low- and high-technology sectors in European countries”, Research Policy, Vol. 38, N° 3, p. 495–506.

- Hart, Susan; Tzokas, Nicolas (1999). “The impact of marketing research activity on SME export performance: evidence from UK”. Journal of Small Business Management, Vol. 37, N° 2, p. 63-75.

- Hart, Susan J.; Webb, John R.; Jones, Marian V. (1994). “Export marketing research and effect of export experience in industrial SMEs”, International Marketing Review, Vol. 11, N° 6, p. 4-22.

- Harris, Lloyd C.; Ogbonna, Emmanuel (2001). “Strategic human resource management, market orientation, and organizational performance”, Journal of Business Research, Vol. 51, N° 2, p. 157-166.

- Homburg, Christian; Pflesser, Christian (2000). “A Multiple-Layer Model of Market-Oriented Organizational Culture: Measurement Issues and Performance Outcomes”, Journal of Marketing Research, Vol. 37, N° 4, p. 449-462.

- Hooley, Graham; Newcomb, Ron (1983). “Ailing British exports: symptoms, clauses and cures”. Quarterly Review of Marketing, Vol. 8, N° 4, p. 15-22,

- Jansen, Justin J. P.; van den Bosch, Frans A. J.; Volberda, Henk W. (2005). “Managing potential and realized absorptive capacity: how do organizational antecedents matter?”, Academy of Management Journal, Vol. 48, N° 6, p. 999-1015.

- Jerez-Gomez, Pilar; Cespedes-Lorente, José; Valle-Cabrera, Ramon (2005). “Organizational learning capability: a proposal of measurement”, Journal of Business Research, Vol. 58, N° 6, p. 715-725.

- Johanson, Jan; Vahlne, Jan-Erik (1977). “The Internationalization of the firm. A model of knowledge development and increasing foreign market commitment”, Journal of International Business Studies, Vol. 8, N° 1, p. 23-32.

- Johanson, Jan; Vahlne, Jan-Erik (1990). “The mechanism of internationalization”, International Marketing Review, Vol. 7, N° 4, p. 11–24.

- Julien, Pierre-André (1994). Les PME, bilan et perspectives, Paris: Economica.

- Julien, Pierre-André; Ramangalahy, Charles (2003). “Competitive strategy and performance of exporting SMEs: an empirical investigation of the impact of their export information search and competencies”, Entrepreneurship, Theory and Practice, Vol. 27, N°3, p. 227- 245.

- Kamakura, Wagner A.; Ramón-Jerónimo, Maria A.; VecinoGravel, Julio D. (2012), “A dynamic perspective to the internationalization of small-medium enterprises”, Journal of the Academy of Marketing Science, Vol. 40, N° 2, p. 236–251.

- Keskin, H. (2006), “Market orientation, learning orientation, and innovation capabilities in SMEs: an extended model”, European Journal of Innovation, Vol. 9, N° 4, p. 396 - 417.

- Kodama, Mitsuru (2005). “New knowledge creation through leadership-based strategic community – a case of new product development in IT and multimedia business fields”, Technovation, Vol. 25, N° 8, p. 895-908.

- Kohli, Ajay K.; Jaworski, Bernard J. (1990). “Market orientation: the construct, research propositions and managerial implications”. Journal of Marketing, Vol. 54, N° 2, p. 1-18.

- Kostopuolos, Konstantinos; Papalexandris, Alexandros; Papachroni, Margarita; Ioannou, George (2011), “Absorptive capacity, innovation, and financial performance”, Journal of Business Research, N° 64, 1335-1343.

- KPMG (2010), “Les PME européennes confiantes dans la sortie de crise”, available at http://www.focusifrs.com/content/view/full/5080 (accessed the 15th of March 2012).

- Kuivalainen, Olli; Puumalainen, Kaisu; Sanna, Sintonen; Kyläheiko, Kalevi (2010). ”Organisational capabilities and internationalization of the small and medium-sized information and communications technology firms”, Journal of International Entrepreneurship, Vol. 8, N° 2, p. 135–155.

- Lane, Peter J.; Koka, Balaji R.; Pathak, Seemantini (2006). “The reification of absorptive capacity: a critical review and rejuvenation of the construct”, Academy of Management Review, Vol. 31, N° 4, p. 833-863.

- Leonidou, Leonidas C. (2004). “An analysis of the barriers hindering small business export development”, Journal of Small Business Management, Vol. 24, N° 3, p. 279-302.

- Leonidou, Leonidas C.; Katsikeas, Constantine S.; Samiee, Said (2002). “Marketing strategy determinants of export performance: a meta-analysis”, Journal of Business Research, Vol. 55, N° 1, p. 51–67.

- Liao, Jiawen; Welch, Harold; Stoica, Michael (2003). “Organizational absorptive capacity and responsiveness: an empirical investigation of growth-oriented SMEs”. Entrepreneurship, Theory and Practice, Vol. 28, N° 1, p. 63-86.

- Lindell, M. K., & Brandt, C. J. (2000). “Climate quality and climate consensus as mediators of the relationship between organizational antecedents and outcomes”. Journal of Applied Psychology, Vol. 85, June, P. 331–348.

- Lindell, M. K., & Whitney, D. J. (2001). “Accounting for common method variance in cross-sectional research designs”. Journal of Applied Psychology, Vol. 86, February, p. 114–121.

- Lisboa, Ana; Skarmeas, Dionysis; Lages, Carmen (2011). “Entrepreneurial orientation, exploitative and explorative capabilities, and performance outcomes in export markets: A resource-based approach”. Industrial Marketing Management, Vol. 40, N° 8, p. 1274-1284.

- Mogos Descotes, Raluca; Walliser, Björn (2010). “The impact of entry modes on export knowledge resources and the international performance of SMEs”, Management International, Vol. 15, N° 1, p. 73-86.

- Mogos Descotes, Raluca; Walliser, Björn (2011). “The process of export information exploitation in French and Romanian SMEs”, Journal of Small Business and Enterprise Development, Vol. 18, Nº 2, p. 311-330.

- Mogos Descotes, Raluca; Walliser, Björn; Holzmüller, Hartmut H.; Guo, Xiaoling (2011). “Capturing institutional home country conditions for exporting SMEs”, Journal of Business Research, Vol. 64, N° 12, p. 1303-1310.

- Morgan, Neil A.; Zou, Shaoming; Vorhies, Douglas, W.; Katsikeas, Constantine S. (2003). “Experiential and informational knowledge, architectural marketing capabilities, and the adaptive performance of export ventures”, Decision Sciences, Vol. 34, N° 2, p. 287-321.

- Nonaka, Ikujiro (1991). “The Knowledge Creating Company”, Harvard Business Review, November-December, p. 96-104.

- Nonaka, Ikujiro (1994). “A dynamic theory of organizational knowledge creation”, Organization Science, Vol. 5, p. 14-36.

- Nonaka, Ikujiro; Takeuchi, Hirotaka (2004). “Theory of organizational knowledge creation » in I. Nonaka and H. Takeuchi (eds), Hitotsubashi on knowledge management, John Wiley and Sons: Singapore, p. 47-91.

- Patriotta, Gerardo (2004). Organizational knowledge in the making: How firms create, use and institutionalize knowledge. Oxford UK: Oxford University Press.

- Pelham, Alfred M. (1999). “Influence of environment, strategy, and market orientation on performance in small manufacturing firms”, Journal of Business Research, Vol. 45, N° 1, p. 33–46.

- Pelham, Alfred M. (2000). “Market orientation and other potential influences on performance in small and medium-sized manufacturing firms”, Journal of Small Business Management, Vol. 38, N° 1, p. 48-67.

- Polanyi, Michael (1966). The Tacit Dimension. Routledge and Kegan Paul: London, UK.

- Porter, Michael E. (1980). Competitive Strategy. The Free Press: New York.

- Ramangalahy, Charles (2001), “Capacité d’absorption de l’information, compétitivité et performance des PME exportatrices: une étude empirique”, PhD dissertation, Université de Montréal, Canada.

- Ramaswami, Shridar N.; Srivastava, Rajendra K.; Bhargava, Mukesh (2009). “Market-based capabilities and financial performance of firms: insights into marketing’s contribution to firm value”, Journal of the Academy of Marketing Science, Vol. 37, N° 2, p. 97-116.

- Rivard, Susan; Huff, Sid L. (1988). “Factors of success for end-user computing”. Communications of the ACM, Vol. 31, N° 5, p. 552–561.

- Rose, Gregory M.; Shoham, Aviv (2002). “Export performance and market orientation: establisbing an empirical link”, Journal of Business Research, Vol. 55, N° 3, p. 217-25.

- Sapienza, Harry J.; Autio, Erkko; George, Gerard; Zahra, Shaker A. (2006). “A capabilities perspective on the effects of early internationalization on firm survival and growth”. Academy of Management Review, Vol. 31, N° 4, p. 914–933.

- Sobel, M. E. (1982). “Asymptotic intervals for indirect effects in structural equations models”, in S. Leinhart (Ed.), Sociological methodology, San Francisco, CA: Jossey-Bass.

- Souchon, Anne L.; Diamantopoulos, Adamantios (1999). “Export information acquisition modes: measure development and validation”, International Marketing Review, Vol. 16, N° 2, p. 143-168.

- Souchon, Anne L.; Diamantopoulos, Adamantios; Holzmüller, Hartmut H.; Axinn, Catherine N.; Sinkula, James M.; Simmet, Heike; Durden, Geoffrey R. (2003). “Export information use: a five-country investigation of key determinants”. Journal of International Marketing, Vol. 11, N° 3, p. 106-127.

- Souchon, Anne L.; Durden, Geoffrey K. (2002). “Making the most out of export information: an exploratory study of UK and New Zeeland exporters”, Journal of Euromarketing, Vol. 11, N° 4, p. 65-86.

- Sousa, Carlos M. P. (2004). “Export performance measurement: an evaluation of the empirical research in the literature”, Academy of Marketing Science Review, Vol. 4, N° 9, p. 35-58.

- Spender, John-Christopher (2007). “Data, meaning and practice: how the knowledge-based view can clarify technology’s relationship with organizations”. International Journal of Technology Management, Vol. 38, N° 1-2, p. 78-196.

- Teece, David J.; Pisano, Gary; Shuen, Amy (1997). “Dynamic capabilities and strategic management”, Strategic Management Journal, Vol. 18, N° 17, p. 509-533.

- Tenenhaus, Michel; Esposito Vinzi, Vincenzo; Chatelin, Yves. M.; Lauro, C. (2005). PLS path modeling. Computational Statistics and Data Analysis, Vol. 48, N° 1, p. 159-205.

- Torrès, Olivier (1999), Les PME, Flammarion, Paris: Collection Dominos.

- Todorova, Gergana; Durisin, Boris (2007). “Absorptive capacity: valuing a reconceptualization”, Academy of Management Review, Vol. 32, N° 3, p. 774–86.

- Wright, Mike; Westhead, Paul; Ucbasaran, Deniz (2007). “The internationalization of SMEs and international entrepreneurship: a critique and policy implications”, Regional Studies, Vol. 41, N° 7, p. 1013-1029.

- Yeoh, Poh-Lin (2000). “Information acquisition activities: a study of global start-up exporting companies”, Journal of International Marketing, Vol. 8, N° 3, p. 36-60.

- Zahra, Shaker A.; George, Gerard (2002). “Absorptive capacity: a review, reconceptualization and extension”, Academy of Management Review, Vol. 27, N° 2, p. 185-203.

- Zou, Shaoming; Fang, Eric; Zhao, Shuming (2003). “The effect of export marketing capabilities on export performance: an investigation of Chinese exporters”, Journal of International Marketing, Vol. 11, N° 4, p. 32-55.

- Zou, Shaoming; Taylor, Charles R.; Osland, Gregory E. (1998). “The EXPERF Scale: A Cross-National Generalized Export Performance Measure”, Journal of International Marketing, Vol. 6, N° 3, p. 37-58.

Parties annexes

Notes biographiques

Raluca Mogos Descotes travaille comme Maîtres de Conférences au sein de l’Université de Lorraine (IUT Charlemagne). Ses recherches portent sur la performance internationale des PME et le management du savoir.

Björn Walliser, Agrégé des Facultés, est Professeur des Universités à l’ISAM-IAE de l’Université de Lorraine et responsable de l’équipe marketing du centre de recherche CEREFIGE. Ses recherches portent notamment sur le marketing international et la communication d’entreprise.

Parties annexes

Notas biograficas

Raluca Mogos Descotes es profesora de conferencias en la Universidad de Lorraine (IUT Charlemagne). Sus principales temas de investigación son el funcionamiento internacional de las pequeñas y medianas empresas (PyMEs) y le management del conocimiento.

Björn Walliser es Profesor de Marketing en la Universidad de Lorraine (ISAM-IAE), responsable del grupo de investigación en marketing del centro de investigación CEREFIGE. Sus trabajos de investigación principales están centrados en los campos del marketing internacional y de la comunicación.

Liste des figures

Figure 1

Relationships among PACAP, RA CAP, and organizational performance

Figure 2

Research model

Figure 3

Research hypotheses’ validation

Figure 4

Modified model including the direct impact of PACAP on the international financial performance of SMEs

Liste des tableaux

Table 1

Operationalization of the research variables

Table 1

Constructs, items, standardized loadings, composite reliability, and average variance extracted

Table 2

Discriminant and convergent validity assessement