Résumés

Abstract

Over the last twenty years, the debate on financial performance of socially responsible investment (SRI) has not yielded a clear consensus, arguing mainly that there was no difference in performance between SRI and ‘conventional’ investment, although SRI could underperform or outperform in some cases. Our research, based on a meta-analysis ‘vote-counting’ approach of the empirical literature, allows us to observe that the effects of SRI on financial performance are multiple. Second, we conclude that the financial performance of SRI is radically changing according to the empirical methods employed by researchers.

Keywords:

- ethical investment,

- financial performance,

- socially responsible investment,

- SRI

Résumé

Au cours des vingt dernières années, le débat sur la performance financière de l’investissement socialement responsable (ISR) n’a pas généré de consensus clair, démontrant essentiellement qu’il n’existe pas de différence de performance entre ISR et investissement « conventionnel », bien que l’ISR puisse sous-performer ou surperformer dans certains cas. Notre recherche, basée sur une approche méta-analytique « vote-couting » de la littérature empirique, nous permet de constater que les effets de l’ISR sur la performance financière sont multiples. Nous concluons dans un second temps que la performance financière de l’ISR change radicalement selon les méthodes empiriques utilisées par les chercheurs.

Mots-clés :

- investissement éthique,

- performance financière,

- investissement socialement responsable,

- ISR

Resumen

En los últimos veinte años, el debate sobre el rendimiento financiero de la inversión socialmente responsable (ISR) no ha generado un consenso claro, lo que demuestra que no hubo ninguna diferencia esencial en el rendimiento entre el ISR y inversión « convencional », aunque puede ISR desempeño inferior o superan en algunos casos. Nuestra investigación, basada en un enfoque meta-analítico « vote-couting » de la literatura empírica, podemos ver que los efectos de ISR sobre los resultados financieros son numerosas. Llegamos a la conclusión de que en un segundo tiempo el desempeño financiero de los cambios ISR radicalmente dependiendo de los métodos empíricos utilizados por los investigadores.

Palabras clave:

- la inversión ética,

- el desempeño financiero,

- la inversión socialmente responsable,

- ISR

Corps de l’article

Socially Responsible Investment (SRI), a recent form of investment including respect for ethical values, environmental protection, and improvement of social conditions or ‘good’ governance is attracting more and more interest not only from institutional and private investors but also from the academic world. Historically, investments called ‘ethical’ first appear in the 1920s in the US and exclude from their selection companies linked to immoral activities (alcohol, tobacco, nuclear activity). ‘Socially responsible’ investments appear later (late 1980s in the U.S. and Britain) and adopt a technique called ‘inclusion’[1]. Some investments called ‘thematic’ may emphasize one of three inclusive approaches (environmental, social, governance) and SRI can also take the form of an engagement or shareholder activism, requiring companies to pay greater attention to their social and environmental responsibility through direct dialogue and the exercise of voting rights in general meetings[2]. In the absence of consensus in the scientific community about the definition of SRI, we will retain the broad definition given by Renneboog et al. (2008, p.1723)[3] for whom “SRI applies a set of investment screens to select or exclude assets based on ecological, social, corporate governance, or ethical criteria, and often engages in the local communities and in shareholder activism”. From a scientific point of view, the work treating SRI concerns mainly the search for its financial profitability, or in other words, tries to understand if this type of investment does not present financial cost compared to traditional investment.

Thus, the main question is does ‘socially responsible’ investing have an impact on financial or stock-market performance[4] ?

The answer to this question lacks theoretical foundations. Following Déjean (2002), this field of research is characterized by “the exclusive presence of empirical studies whose theoretical foundations are very implicit”. Since 2002, theoretical foundations have been proposed and will be exposed in section 1. A lack of clear consensus on the link between socially responsible or ethical investing and financial performance also appears in empirical studies. Some studies argue that SRI can generate financial returns higher than conventional funds or indices and thus has no financial cost (Mallin et al., 1995; D’Antonio et al., 1997; Statman, 2000; Plantinga and Scholtens, 2001; Galema et al., 2008). Other studies show a negative impact, stating that SRI is destructive of value and gives performance inferior to those of conventional investments (Havemann and Webster, 1999; Burlacu et al., 2004; Girard et al., 2007; Jones et al., 2008). A last group of studies concluded on neutral or not statistically significant impact of SRI on performance (Hamilton et al., 1993; Dhrymes, 1998; Kreander et al., 2005; Bauer et al., 2007).

The objective of the paper is not to contribute to the construction of theoretical foundation to explain SRI performance but to clarify the results obtain by empirical studies. In order to reach this objective, this paper is the first to offer a quantitative research synthesis on a large corpus of 75 empirical studies and 161 experiments[5] conducted over the period 1972-2009[6]. On this corpus we have made a synthesis of the different impacts (positive, negative, or neutral) of SRI observed and determined whether there is different methodological bias explaining those different impacts. To date, and according to our knowledge, only a few reviews in scientific literature (Kurtz, 1997, 2005; Renneboog et al. 2008) as well as two institutional studies[7] have been published. But there’s no survey in the SRI literature which gives a global interpretation of the relation between SRI and financial performance. All meta-analyses proposed by Orlitzky et al. (2003), Allouche and Laroche (2005), or Margolis et al. (2007) treat this issue from an economic point (the financial performance is measured by different economical or accounting ratios). Moreover, the meta-analysis of Frooman (1997), including 27 event studies, deals with the link between “having a behavior deemed socially irresponsible” and shareholders’ wealth. This study is positioned to the opposite of our subject, since the events recorded did not focus on the study of SRI, but on the criminal conduct, fraud, legal proceedings, or failure to comply with environment, and their impact on stock prices of companies involved. The author concludes that if being “irresponsible” does not create shareholder wealth, being socially responsible should allow this. We cannot consider this meta-analysis as the first SRI on the subject. To say that being socially irresponsible downward impacts stock prices is not the same thing as to say that SRI generates shareholder wealth.

The paper is organized as follows. At first, the theoretical foundations of the financial performance of SRI will be explained. In the second section, following an approach similar to that of meta-analysis, we explain the constitution of the empirical corpus, the determination of the SRI impact by studies, and the valuation of the publication bias. The third section presents the moderators of the financial performance of SRI. The last section offers discussion and conclusion.

Conceptual framework of research

From socially responsible company (SRC) to socially responsible investment (SRI)

First of all, we need to distinguish the financial performance of socially responsible companies (SRC) from that of the socially responsible investment (SRI). Although SRI directly arises from the concepts of corporate social responsibility (CSR) and sustainable development (SD), and is viewed as the application of CSR to financial markets, and although the SRI funds and portfolios are composed of stocks from SRC, both have their own theoretical foundations. Economic performance of a high SRC does not consistently involve good performance of SRI; it also depends on market anticipations and management constraints of the market (Lucas-Leclin, 2006). SRI takes the form of funds which can include stocks of SRC. Thus, good CSR performance is a necessary but not sufficient condition of good SRI performance.

Some theories can explain a positive performance of SRC. This is particularly true for the ‘Stakeholder Theory’ (Freeman, 1984) or the Porter’s assumption (1991). Theory states that taking into account the expectations of stakeholders and improving the environmental performance creates value for the company. Kurtz (2002), in his theory of ‘information effect’ also states that “extra-financial rating can be interpreted as reflecting some control of risks facing the company. Therefore, companies that manage the most their socio-environmental stakes limit risks of labor or industrial unrests, liable to harm their image in particular, and are so called ultimately to outperform their competitors”. Conversely, companies which do not take into account shareholder interests are confronted with a higher risk of failure and withdrawal of capital by investor.

In contrast, some theories argue that taking into account CSR in corporate strategy would reduce economic performance. The position of Milton Friedman (1962, 1970) aims to criticize the proponents of corporate social responsibility. Friedman said there is no compatibility between investing in a socially responsible company and profitability, and the only “social responsibility of business is to increase its profits”. Taking into account social and environmental concerns in the policy of the company generates additional external costs which have to be internalized and irreversibly cause a decrease of firm value.

Theoretical foundations of SRI financial performance (market-based)

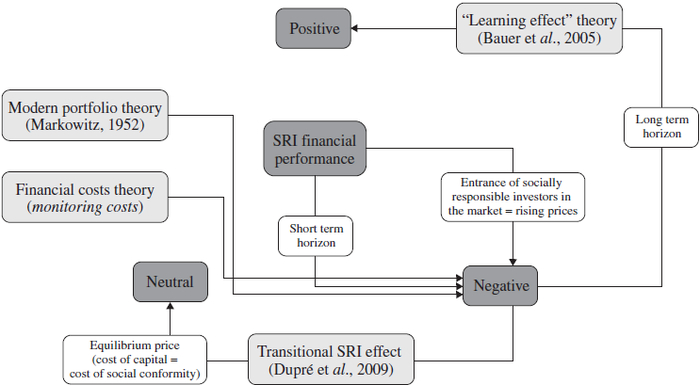

Opponents of SRI base their arguments in the modern portfolio theory (Markowitz, 1952). According to them, SRI reduces investment opportunities by the constraints of required selection and exclusion, reducing de facto potential diversification gains. This should result in a performance lower than a traditional investment, “the efficient frontier of SRI was therefore under the limit of Markowitz” (Le Maux and Le Saout, 2004). This is consistent with the theory of Clow (1999) who claims that SRI, by its selective approach, would lead to a sector bias by restricting itself to a smaller number of investment sectors, thereby increasing their risk while reducing its profitability[8]. Rudd (1981) also argues that the introduction of constraints in investment portfolios (including social and environmental constraints) could also play a negative role on their performance. Finally, the theory of ‘cost’ of SRI is also advanced to explain the underperformance of SRI compared to conventional investment. According to Rudd (1981), every transaction generates financial costs represented by a brokerage commission, by the expenditures for prosecuting, or by the exclusion of some blocks of stocks in the portfolio selection (what Luther et al. (1992, p.57) define as ‘monitoring costs’ or costs of supervision). Thus, SRI’s screening criteria decreases in the long term the average liquidity of assets (and therefore increase the market’s impact on each future transaction), and also leads to more complex and expensive asset management (more research to find if a stock meets SRI criteria or not). All these costs would diminish performance over time (Munnell et al. 1983; Lamb, 1991, Luther et al. 1992; Tippet 2001, Bauer et al. 2005; Barnett and Salomon, 2006).

In contrast, SRI has theoretical contributions that tend to prove that such investment can generate value. This is the case of the ‘learning effect’ presented by Bauer et al. (2005, 2006), for whom in the short-term, SRI would tend to underperform conventional investment, and then reduce this gap in the medium term to reverse in the long term. A long-term horizon would be the key factor of success of SRI (Cummings, 2000; Barnett and Salomon, 2006).

Although several theories can explain the nature of the financial performance of SRI, the theory developed by Dupré et al. (2009) provides a conceptual framework more specific and focused on the influence of socially responsible investors on the ethical stocks price. The authors state that the emergence of a social rating will encourage socially responsible investors to enter the market. This will cause an increase of the demand of ethical stocks, inducing an increase of their price, generating a low profitability for ethical investors (‘cost of ethics’). This price differential is borne by socially responsible investors, who promote the ethical conduct of business at the expense of profitability. From a standpoint of ethical companies, higher prices will decrease the cost of their equity capital. Thus, in a second stage, in front of the lower cost of capital, companies will be encouraged to conduct programs of social conformity (Dupré et al., 2009, p.18). The benefit generated by the lower cost of capital will be offset by the cost of social compliance, bringing an equilibrium price between ethical and non-ethical stocks (inducing a similar performance between SRI and conventional investment).

Figure 1 provides a model of all theoretical foundations developed in the context of the financial performance of SRI.

The effect of SRI on financial performance

We can say today that a theoretical framework exists for the theme of the financial performance of SRI. But it is difficult, due to the different bases that surround the field, to really set the financial performance of SRI in a specific category (positive, neutral, or negative). It is tempting to explain this performance by the ‘transitional SRI effect’ theory developed by Dupré et al. (2009), more recent and more focused on the role of socially responsible investors. But the complexity of the concept does not allow us to assert that the financial performance of SRI is neutral and that SRI has no effect on performance. Thus, we have to draw up an inventory of the empirical literature to understand the relationship between ethics and value creation.

For this, we use the same method as meta-analysis to select studies which will be included in our empirical corpus of treatment, namely the selection of the empirical corpus and the description of the different statistical treatment.

Selection of the data and constitution of an empirical corpus

To make our empirical corpus (EC) as comprehensive as possible and avoid excluded empirical studies dealing with the financial performance of SRI, two methods of bibliographical collection were selected: manual search (bibliographical saturation) and research on computerized databases (Scopus, ABI Inform / Proquest, JSTOR, Ebsco, Science Direct, Emerald, Cairn, Springer Link, Wiley-Blackwell, Google Scholar, Google Books, EconPapers, Social Science Research Network (SSRN) Social Science Citation Index (SSCI), EconLit, Doge, Current Contents, Contents and Management Journal of Economic Literature).

Figure 1

Conceptual framework of the financial performance of SRI

We selected studies based on keywords appearing recurrently in the literature to analyze issues relating to the financial performance of SRI (the EC is based on the language used by the scientific community of SRI, which is very expansive). We searched the French and English words to reach all international studies in the area and thus provide a broad generalization[9].

Finally, our literature review includes 75 empirical studies in the period between 1972 and 2009. All these studies test the link between SRI and performance. Experimental methods of these studies compare the performance of SRI mutual funds or indices with those of conventional mutual funds or indices (or non-SRI), in order to highlight a trend of outperformance or underperformance or even similar performance. Some studies use several experiments to test this relationship (several combinations of different methods to locate the performance of SRI in many contexts). Thus, we identify 161 experiments or estimates of the relationship between SRI and financial performance.

We decided to include in our corpus all types of studies (published and unpublished researches) to overcome the different publication bias as preconized by Song et al. (2000), Doucouliagos et al. (2005), and Laroche (2007).

Determination of the SRI impact by studies

To determine the nature of the relationship between SRI and performance, we relied on the “conclusion” and “discussion” provided by the authors in their studies. These findings stem from a global interpretation of the different performance of SRI observed by the technique of vote counting[10].

We chose this technique over a quantitative meta-analytical approach[11] for several reasons. First, vote-counting allows us to aggregate the largest number of studies in our empirical corpus (in order to preserve a large number of studies for which the effect size cannot be estimated). The second and main reason is that we can take into account the wide diversity of financial performance measures which makes problematic the calculation of the weighted mean effect size. Moreover, financial performance measure, being a major methodological choice, is one of the main independent variables in our study.

Tableau 1

SRI impact depending on the type of research

However, except the estimation of the SRI impact by study, our methodology follows the classical framework of a meta-analytical approach: selection of the studies, effect by study or experiments, evaluation of the publication bias, central tendency of the effect, influence of moderators on the relation between SRI and performance.

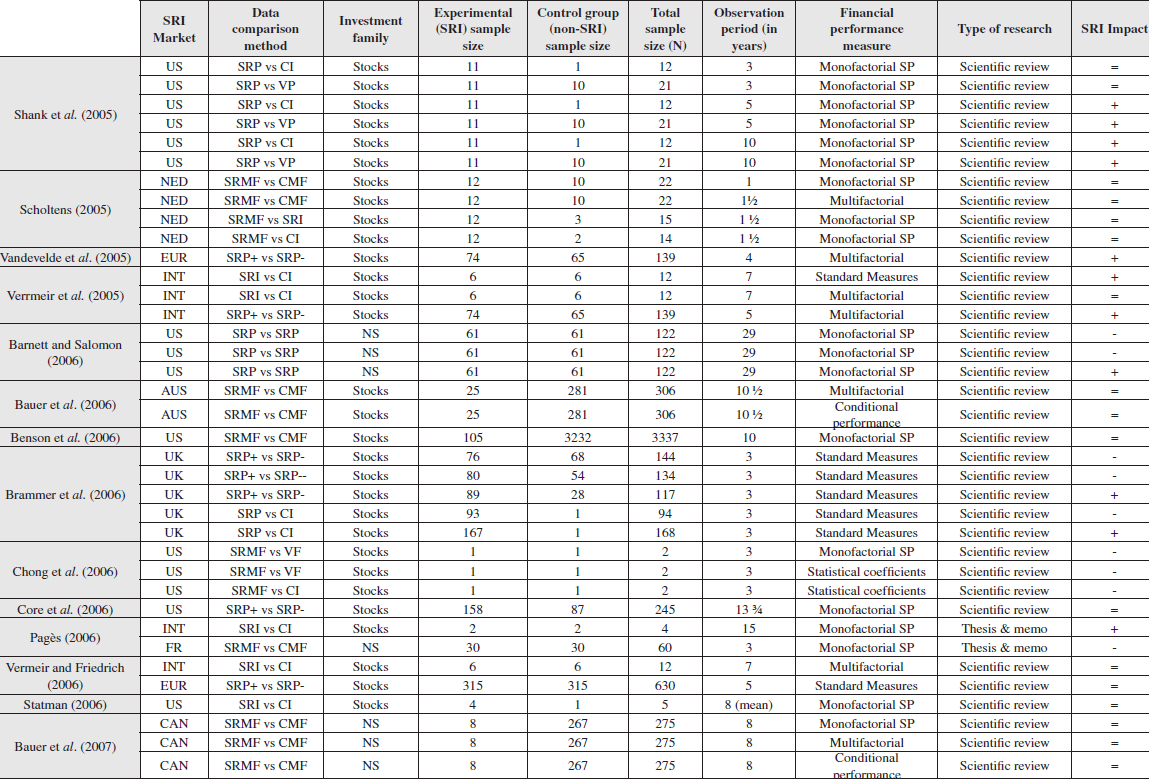

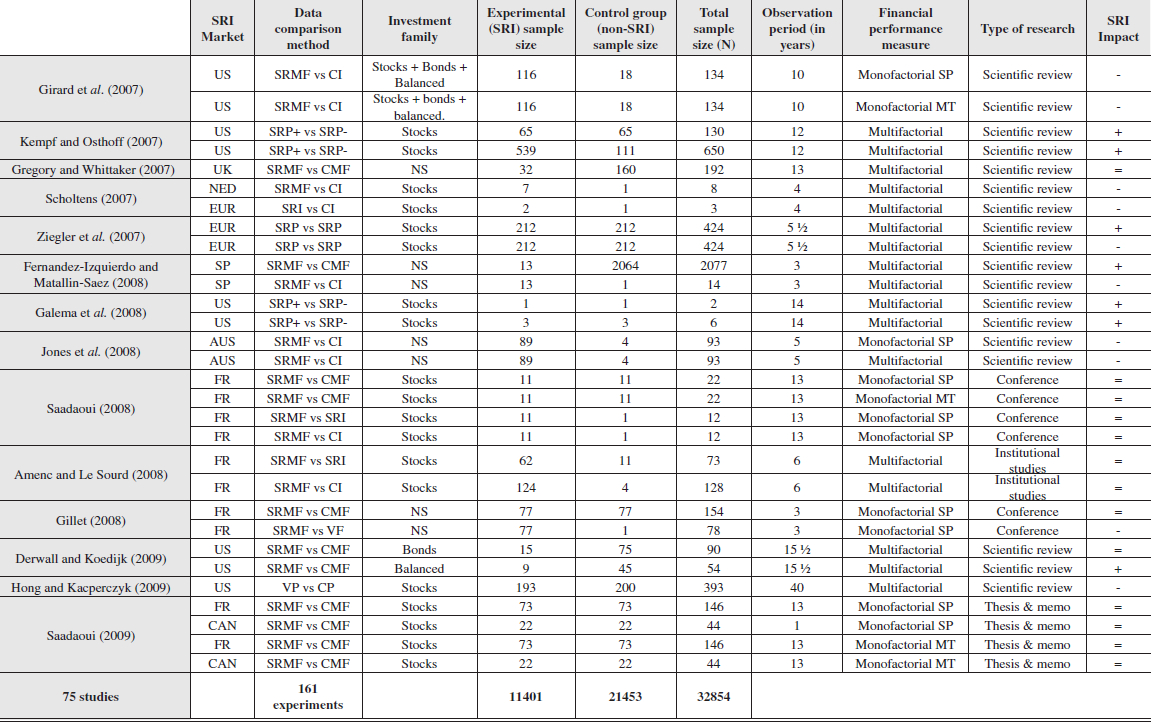

Appendix 1 provides a review of these studies and the number of experiments identified by study, SRI market, data comparison method, investment family, sample size (SRI, non-SRI and total), financial performance measure, and type of research. All these variables are part of the method used by the authors of the studies. We also recorded for each experiment an estimate of the relationship between SRI and financial performance.

We identify 40 positive SRI impacts on financial performance (outperformance of SRI compared to the non-SRI), 80 neutral impacts (similar performance), and 41 negative impacts (underperformance of SRI). A significant trend of no effect of SRI on financial performance emerges (49 % of empirical corpus). This would confirm the theoretical contributions of Dupré et al. (2009) who explain the similar performance by an equilibrium price between ethical stocks and non-ethical stocks. Beyond this initial finding, we have also to analyze the different publication bias as preconized by Stanley (2005) and Laroche (2007).

Evaluation of the publication bias

The publication bias can be defined as the tendency to include in the analysis only studies which have been published. Statistically significant or potentially interesting results are more likely to be submitted or published than researches with insignificant or no results (Song et al., 2000; Laroche, 2007). It can create a selective publication.

Doucouliagos et al. (2005, p.321) show “that areas of research where mainstream economic theory supports a specific effect (e.g., negative price elasticity and the effect of property rights on economic growth) are likely to contain publication bias”. The authors add that “where there is widely accepted theoretical support for both positive and negative effects, or where a range of values is ‘acceptable’, research areas are likely to be free of significant publication bias because all empirical outcomes are consistent with theory”. We observed that the theme of financial performance of SRI offers no real theoretical consensus. However, as the authors argue, it should be free of publication bias, since the empirical evidence should offer varied and conflicting results. Moreover, techniques such as funnel plots and FAT (funnel asymmetry test) used in publication bias tests are more appropriate for meta-analysis based on the calculation of effect sizes rather than vote-counting.

Table 1 shows the different SRI impacts on financial performance depending on the nature of the publication (type of research).

As stated by Doucouliagos et al. (2005), empirical results are correlated to theoretical foundations, and we can conclude that this topic is free of publication bias. We observe both positive and negative effects, with unpublished papers, and in a symmetric repartition (28 positive effects and 31 negative effects for published papers, and 12 positive effects and 10 negative effects for unpublished papers).

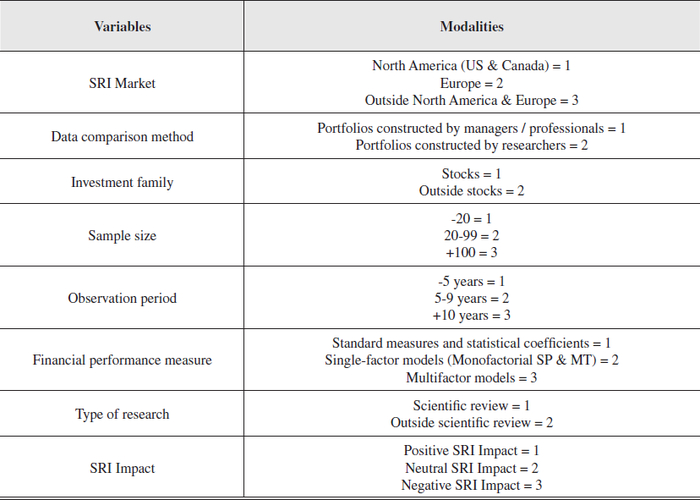

Moderators of the financial performance of SRI

Facing the heterogeneity of the SRI impacts, we have to test what kinds of moderators can influence the relationship between SRI and financial performance. All meta-analyses consider this issue and test different methodological criteria on the standardized effect (Doucouliagos and Laroche, 2003 2009; Laroche and Schmidt, 2004; Allouche and Laroche, 2005). We have to identify the different factors of influence. As suggested by Stanley (2001, p.131-132), “moderators are elements of the method (design) or data choices made by researchers”. We divide moderators in two groups. The first one contains factors improving the methodological quality of the study; the second one contains more contingent characteristics of each study.

Moderators characterizing the quality of the study

These determinants have no predicted effect on the nature of the impact of SRI on financial performance but are very important to assess the reliability of results obtain by each studies. We selected four determinants:

Financial performance measure: Financial performance is measured by the stock-market performance of funds or stocks. Experiments composing the corpus use different measures proposed by portfolio management theory. This could extend to the simplest evaluation measures such as raw returns to single-factor models derived from the CAPM regression (Sharpe Ratio (1966) and Jensen’s Alpha (1968, 1969)) via more complex multifactorial models (Fama-French, 1993; Carhart, 1997). As suggested by Derwall et al. (2005) and Galema et al. (2008), we expect to obtain different results depending on whether the financial performance measures are risk-adjusted or not. More complex financial performance measures permit to better isolate the SRI effect on performance (taking into account the potentially perturbations caused by risk, size, growth potential, etc).

Observation period: The observation period is also a factor that may influence the nature of the performance of SRI. Core et al. (2006) as well as Amenc and Le Sourd (2008) demonstrate empirically that the longer the observation period, the more significant the results, and the more the effect of SRI on the observed performance should be positive or negative rather than neutral. Furthermore, we have seen in our conceptual framework that Bauer et al. (2005) argue that the higher the learning effect is, the more performance of SRI is important, compared to that of a traditional investment.

Sample size: Research should take into account the size of the sample as an observation variable. Sample size is measured by the sum of the experimental sample size (SRI group) and the control group sample size (non-SRI). Sizes are grouped into homogeneous and representative categories. As for the length of the observation period, sample size improves the quality of the statistical estimations and tests.

Type of research (journal effect): Finally, the assumption that the type of research may affect the financial performance of SRI should be tested to determine whether the results can be influenced or moderated depending on whether they were published or not in academic journals. We have seen in the analysis of publication bias that SRI impacts could depend on whether the research has been published or not. A scientific journal can be viewed as a filter for the quality of the studies.

Moderators characterizing the methodology of the study (contingent moderators)

These factors are chosen by the authors of the studies but can have a systematic effect on the link between SRI and financial performance. Three characteristics are selected:

SRI market: researches cover the various SRI markets. Geographic areas are European or international; some SRI investments are invested in markets larger than that of a single country. Thus, we chose to respect the historic SRI market segmentation as identified by Louche and Lydenberg (2006). According to the authors, shareholder activism and negative screening are more common in the United States, while positive screening (selective approach or Best-in-class) is more used in Europe. So we expect to see different impacts depending on the markets studied, more particularly for US SRI markets and non-US SRI markets.

Data comparison method: We expect to observe different results according to the data used by the authors. Diltz (1995) demonstrates in his work that the performance of SRI differs depending on whether we observe existing SRI funds or if researchers establish their own SRI portfolios using the SRI ratings of extra-financial analysts.

Investment family: The investment family (bonds, stocks, balanced) can act as a moderator of the performance of SRI. In their work, Hutton et al. (1998) and D’Antonio et al. (2000) show that an SRI-oriented ‘bonds’ or ‘balanced’ may outperform an SRI-oriented ‘stocks’. The performance of SRI can vary according to the degree of risk of investment vehicles, in the same way as more conventional investments. Investment, SRI or not, remains sensitive to financial risk, whether it is specific or systematic.

It is interesting to observe the influence of all these moderators on the financial performance of SRI. Appendix 2 presents the coding used for statistical treatments.

Influence of the moderators on the financial performance of SRI

We first investigate if the factors of methodological quality are determinants of the perceived quality of the paper. Then we concentrate on the impact of methodological choice on the relation between SRI and financial performance.

Quality of the methodology

The mean number of citations by year of each article in the corpus (the detailed computation of this index is explained in note 14) can be seen as a measure of the perceived quality of the paper. We want to investigate what are the methodological determinants of the perceived quality of the paper by implementing Ordinary Least Squares (OLS) with methodological variables as independent variables and citation index as dependent variable.

Tableau 2

Influence of determinants on the number of citations (quality of the paper)

Results of model 1 in table 2 confirm the validity of our distinction between qualitative and contingent methodological variables: the length of the observation period, the complexity of the performance measure, and the nature of the research (0 for scientific review, 1 for non-published researches) have a positive significant impact on the perceived quality of the paper. Nevertheless there are two notable exceptions: the number of citations by year is a significant positive function of the data comparison method (when the portfolio is constructed by academics the number of citations increases) and the sample size has no significant impact on the perceived quality of the paper. The second result is probably due to the difficulty to correctly measure sample size. Indeed, our study could examine stocks, funds, or indexes. It is difficult to find a basis of common understanding for all these investment vehicles[12]. For the first result we conduct a complementary analysis (model 2 of table 2) by adding a dummy variable (1 when the impact is neutral and 0 for negative or positive impact). We observe an interesting phenomenon: papers with a neutral impact are less cited than papers with a positive or negative impact. If we take into account this phenomenon, all the coefficients of our qualitative methodological variables remain significant, but the ‘data comparison method’ is no more significant. That is explained by the fact that when researchers construct their own SRI portfolio, there is a greater probability to obtain a positive SRI impact. We can conclude that the construction of portfolio by academics is not seen as a better method, but the higher number of citations is due to the positive impact obtained by these studies. Finally, as the adjusted R-squared are relatively low, we deduce that methodological variables explain only a relatively small part of the interest for a paper.

Impact of methodological choices on the relationship between SRI and financial performance

To analyze the impact of methodological choices on the relationship between SRI and financial performance we use two different measures of the dependent variable: the first one is just an indicator for negative, neutral, and positive impact of SRI on financial performance; for the second one, in order to take into account the perceived quality of the study, this indicator is weighted by the impact factor of the article.[13]

As in the first approach the dependent variable is categorical, we use a multinomial logit model to investigate the impact of methodological characteristics. The variant results in the fact that the dependent variable takes (r) values and that one of these modalities serves as reference in the model (in our case “Negative SRI Impact”). From results of this model presented in table 3 we can deduce the[14] following conclusions. “Data comparison method” and “Type of research” significantly increase the probability to obtain a positive SRI impact. Impact is more likely to be positive for SRI portfolios created by researchers and in unpublished works. Except for this last variable, none of the methodological variables representing quality have a significant or even quasi-significant impact. Positive impact seems to be obtained when researchers have a greater control on their research. One possible explanation could be that in this case researches are more driven by societal convictions than by scientific rigor.

Tableau 3

Regression coefficients from the multinomial logit model

Note: the reference modality is “Negative SRI Impact”

To give a key of interpretation in the case of a multinomial logit model, each coefficient obtained is compared to 0 to determine the corresponding significance. A negative coefficient (positive) has a negative (positive) impact on the modality to explain compared to the reference modality. A positive (negative) coefficient involves interpreting the independent variable in an ascending (descending) way. In other words, if the coefficient is positive, the modality explaining the dependent variable is the highest (lowest) in the independent variable (report to appendix 2 to see the coding used).

To take into account the fact that experimentations reported within the same study could not be independent we conduct the same analysis but replace the value of the variable for each experimentation by the mean value of all experimentations within the same study; we obtain very similar results to those presented here.

“Length of the observation period” significantly increases the probability to observe a neutral impact. A contrario negative impact results are obtained for shorter observation periods; thus are less stable. If all coefficients are taken into account (significant or not) it seems that studies with neutral impact have a better methodological quality than others. The introduction of citation index in model 2 confirms that papers that obtain a neutral impact are less cited than papers obtaining a positive or negative impact.

Discussion and conclusion

The purpose of this study was to propose an “empirical” synthesis of the literature on the financial performance of SRI.

Thus, after selecting an empirical corpus of 75 studies including 161 experiments, we find that there is no apparent link between SRI and financial performance. This would confirm the theory of the equilibrium prices between ethical stocks and non-ethical stocks developed by Dupré et al. (2009) that would cause a similar expected return between SRI and conventional investment. But this result undermines the principle of inefficiency of SRI according to modern portfolio theory (SRI should underperform conventional investment; given the selection and diversification constraints, that is necessary). These results generate interest to investors and companies if SRI obtains the same performance as conventional investment; so it may reinforce investors to bring their choice to the SRI assets and encourage companies launching into a sustainable development pace, facilitating access to financial resources and reducing the cost of equity by diversifying the shareholding with the entry of “green investors” (Merton, 1987; Heinkel et al., 2001, Mackey et al., 2007).

However, we observe some heterogeneity between SRI impacts (40 positive impacts, 80 neutral, 41 negative). Given this heterogeneity, we identified two groups of potential moderators: moderators characterizing the quality of the study (financial performance measure, sample size, observation period, and type of research) and moderators characterizing the methodology of the study (SRI, data comparison method and investment family). We find that when SRI portfolios are elaborated directly by researchers and that research is not published, then the SRI impact is positive. Given this assessment, two major issues must be asked: do the researchers using ratings of extra-financial analysts to build their own SRI portfolios tend to make a selection ex-post of best-performing stocks or to implement strategies such as data-mining in order to observe the results in accordance with their original targets (more based on societal beliefs rather than scientific rigor) ?. Or should we consider that SRI funds and stocks are not as ethical as they claim, joining the conclusions made by Le Maux and Le Saout (2004) or Burlacu et al. (2004) ? While the former implies that researchers could introduce different selection bias in their data selection, it is difficult to accept in the latter that a fund manager may be less effective than a researcher in terms of portfolio management; it would therefore be interesting to analyze more thoroughly the process of selection of managers and researchers to detect possible bias in the constitution of their SRI portfolios.

In addition, we also note that studies identifying no link between SRI and performance are less cited than studies founding positive and negative links.

Finally, the results obtained in determination of the financial performance of SRI should be weighed by the fact that the method dramatically influences the nature of the relationship between SRI and performance.

Parties annexes

Appendices

Appendix 1. Empirical corpus and SRI impacts by experiments

Appendix 2. Coding of moderators

Biographical notes

Christophe Revelli is assistant professor of Finance at Euromed Management Marseille. Holding a Ph.D in Management Sciences from University Montpellier 1, his thesis was awarded by the RIODD-VIGEO research trophy (International Network for Research into Organisations and Sustainable Development). His researches focus on financial performance of Socially Responsible Investment (SRI), SRI mainstreaming, financial crisis and Corporate Social Responsibility (CSR), and positioning of extra-financial analysis in financial analysis.

Jean-Laurent Viviani is professor of Finance at IGR (University of Rennes 1). His researches focus on Socially Responsible Investment, Islamic finance, green finance, financial strategy and risk management in agricultural companies and banks.

Notes

-

[1]

Internal extra-financial analysts in asset management companies (buy-side) or external (sell side) evaluate companies on ESG criteria (environment, social, and governance), enabling integration or inclusion of the best companies in asset portfolios.

-

[2]

Source Novethic, www.novethic.fr

-

[3]

We choose the SRI’s definition of Renneboog et al. (2008) because it is based on a synthesis of the recent literature.

-

[4]

A distinction must be made between work studying the relationship ‘Corporate Social Performance / Corporate Financial Performance’ from an accounting perspective (CSP / CFP) and work studying the financial performance of SRI from a market perspective (stock-exchange performance). For work exploring the relationship CSP/CFP, refer to Orlitzky et al. (2003), Allouche and Laroche (2005) and Margolis et al. (2007).

-

[5]

An empirical study contains several experiments from the time the author uses various combinations of variables for analysis and observation. Each experiment identified can be considered to a specific test.

-

[6]

The definition of the observation period corresponds to the pioneering work of Moskowitz (1972) on the financial performance of SRI, knowing that most empirical studies considered in this research lie between 1990 and 2009, corresponding to the real period of institutionalization of SRI in the financial markets.

-

[7]

Phillips, Hager & North (2007), www.phn.com and study UNEP.FI / Mercer (2007), www.unepfi.org

-

[8]

We should weigh these arguments because the modern portfolio theory and the principle of market efficiency can be reappraised in the case of SRI. Since the efficient frontier includes the efficient portfolios in a mean-variance framework (optimization of risk-return), it is possible to admit that in some cases SRI can provide a better return than some conventional portfolios. If portfolio manager uses active management to its portfolio by overweighting SRI assets because he believes that they are performing, he can expect a return greater than that given by the efficient frontier in the case of passive management where the reduction of the investment universe reduces the gains from diversification.

-

[9]

We used a list of 53 keywords or groups of words in English and French. The main keywords used for this collection are “socially responsible investment” (“investissement socialement responsable”), “SRI” (“ISR”), “ethical investment” (“investissement éthique”), “financial performance” (“performance financière”), “ethical mutual funds” (“fonds éthiques”), “socially responsible mutual funds” (“fonds socialement responsable”). This list is available upon request.

-

[10]

The aim of the vote counting technique is to identify the links between variables in a non-statistical way, simply on a census of studies showing a positive, neutral or negative relationship.

-

[11]

The meta-analytical approach is based on the calculation of an effect size by study or experiment, which is a statistical estimation of the link between two variables. Hedges and Olkin (1985) and Hunter and Schmidt (2004) describe the meta-analytical process, which correspond to evaluate all the effect size and aggregate them in a weighted mean effect size to give a central tendency of the link between the variables studied.

-

[12]

Sample size is measured by the number of SRI stocks, indexes or funds whose performance is analyzed.

-

[13]

The second method shows similar results in terms of coefficients and does not bring additional interest to the analysis. We present here only the results from the first method.

-

[14]

SRMF: Socially responsible mutual funds; CMF: Conventional mutual funds; VF: Vice Funds; SRI: Socially responsible indexes; CI: Conventional Indexes; SRP: Socially responsible portfolios made by searchers on social ratings; CP: Conventional portfolios made by searchers; VP: Vice stocks portfolios; SRP+: Socially responsible portfolios made by searchers on positive social ratings (highly rated); SRP-: Socially responsible portfolios made by searchers on negative social ratings (low rated).

-

[15]

NS: Not specified

-

[16]

The variable « Financial performance measure » is divided into six modalities representing all the measures used in the studies of the empirical corpus: « Standard Measures » (raw returns, standard deviation, variance), statistical coefficients (Jobson-Korkie, T-Stat, Z-Stat, correlation coefficient, autocorrelation test, cointegration test), Monofactorial measures Stock-picking SP (Sharpe Ratio, Treynor Ratio, Jensen Alpha, Tracking-error, Information Ratio, Modigliani and Modigliani, Black-Treynor Ratio), Monofactorial measures Market-timing MT (Henriksson and Merton, Treynor and Mazuy), Multifactorial measures (Fama-French, Carhart) and conditional performance measures (Ferson et Schadt).

Parties annexes

Notes biographiques

Christophe Revelli est professeur assistant de Finance à Euromed Management Marseille. Titulaire d’un doctorat en Sciences de Gestion de l’Université Montpellier 1, sa thèse a été récompensé par le prix de recherche RIODD-VIGEO (Réseau International de recherche sur les Organisations et le Développement Durable). Ses recherches portent sur la performance financière de l’Investissement Socialement Responsable (ISR), l’ISR mainstream, le lien entre crise financière et Responsabilité Sociale de l’Entreprise (RSE), ainsi que le positionnement de l’analyse extra-financière au sein de l’analyse financière.

Jean-Laurent Viviani est professeur de Finance à l’IGR (Université de Rennes 1). Ses recherches portent sur l’investissement socialement responsable, la finance islamique la finance verte, la stratégie financière et la gestion des risques dans les entreprises agricoles ainsi que dans les banques.

Bibliographie

- Abramson, Lorne; Chung, Dan (2000). « Socially Responsible Investing: Viable for Value Investors ? » Journal of Investing, Vol. 9, Iss. 3, p. 73-80.

- Alexander, Gordon J.; Buchholz, Rogene A. (1978). « Corporate Social Responsibility and Stock Market Performance », Academy of Management Journal, Vol. 21, N° 3, September, p. 479-486.

- Amenc, Noël; LeSourd, Véronique (2008). « Les performance de l’investissement socialement responsable en France », Étude Edhec, Edhec Risk Asset Management Research Centre, décembre.

- Asmundson, Paul; Foerster, Stephen R. (2001). « Socially Responsible Investing: Better for Your Soul or Your Bottom Line ? » Canadian Investment Review, Vol. 14, N° 4, p.26.

- Barnett, Michael L.; Salomon, Robert M. (2006). « Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance », Strategic Management Journal, Vol. 27, Iss. 11, p. 1101-1122.

- Bauer, Rob; Koedijk, Kees; Otten, Roger (2005). « International evidence on ethical mutual fund performance and investment style », Journal of Banking and Finance, Vol. 29, p. 1751-1767.

- Bauer, Rob; Otten, Roger; Tourani Rad, Alireza (2006). « Ethical investing in Australia: Is there a financial penalty ? », Pacific-Basin Finance Journal, Vol. 14, p. 33-48.

- Bauer, Rob; Derwall, Jeroen; Otten, Roger (2007). « The ethical mutual fund performance debate: New evidence from Canada », Journal of Business Ethics, Vol. 70, N° 2, p. 111-124.

- Bello, Zakri Y. (2005). « Socially Responsible Investing and Portfolio Diversification », Journal of Financial Research, Vol. 28, Iss. 1, Spring, p. 41-57.

- Benson, Karen L.; Brailsford, Timothy J.; Humphrey Jacquelyn E. (2006). « Do Socially Responsible Fund Managers Really Invest Differently ? », Journal of Business Ethics, Vol. 65, N° 4, p. 337-357.

- Brammer, Stephen; Brooks, Chris; Pavelin, Stephen (2006). « Corporate social performance and stock returns: UK evidence from disaggregate measures », Financial Management, Vol. 35, N° 3, p. 97-116.

- Burlacu, Radu; Girerd-Potin, Isabelle; Dupré, Denis (2004). « Y’a-t-il un sacrifice à être éthique ? Une étude de performance des fonds socialement responsables américains », Banque et Marchés, n° 69, p. 20-29.

- Butz, Christoph (2003). « Decomposing SRI performance - Extracting value through factor analysis », Pictet Quants, September.

- Chong, James; Her, Monica; Phillips, G. Michael (2006). « To sin or not to sin ? Now that’s the question », Journal of Asset Management, Vol. 6, N° 6, p. 406-417.

- Cohen, Mark A.; Fenn, Scott A; Konar, Shameek (1997). « Environmental and financial performance: Are they related ? », Working paper, May.

- Core, John E.; Guay, Wayne R.; Rusticus, Tjomme O. (2006). « Does weak governance cause weak stock returns ? An examination of firm operating performance and investors’ expectations », Journal of Finance, vol. 56, N° 2, p. 655-687.

- Cummings, Lorne S. (2000). « The financial performance of ethical investment trusts: An australian perspective », Journal of Business Ethics, vol. 25, N° 1, p. 79-92, May.

- D’Antonio, Louis; Johnsen, Tommi; Hutton, R. Bruce (1997). « Expanding socially screened portfolios: An attribution analysis of bond performance », Journal of Investing, Vol. 6, Iss. 4, p. 79-86.

- D’Antonio, Louis; Johnsen, Tommi; Hutton, R. Bruce (2000). « Socially Responsible Investing and Asset Allocation », Journal of Investing, Vol. 9, N °3, autumn.

- Derwall, Jeroen; Guenster, Nadja; Bauer, Rob; Koedijk, Kees (2005). « The Eco-Efficiency Premium Puzzle », Financial Analysts Journal, Vol. 61, N° 2, p. 51-63.

- Derwall, Jeroen; Koedijk, Kees (2009). « Socially responsible fixed-income funds », Journal of Business Finance and Accounting, Vol. 36, N° 1, p. 210-229.

- Dhrymes, Phoebus J. (1998). « Socially responsible investment: Is it profitable ? » in The Investment Research Guide to Socially Responsible Investing, The Colloquium on Socially Responsible Investing, June.

- DiBartolomeo, Dan; Kurtz Lloyd (1999). « Managing Risk Exposures of Socially Screened Portfolios », Northfield Working Paper, Boston, September.

- Diltz, J. David (1995). « The private cost of socially responsible investing », Applied Financial Economics, Vol. 5, p. 69-77.

- Fernandez-Izquierdo, Angeles; Matallin-Saez, Juan Carlos (2008). « Performance of Ethical Mutual Funds in Spain: Sacrifice or Premium », Journal of Business Ethics, Vol. 81, p. 247-260.

- Galema, Rients; Plantinga, Auke; Scholtens, Bert (2008). « The stocks at stake: return and risk in socially responsible investment », Journal of Banking and Finance, Vol. 32, Iss. 12, p. 2646-2654.

- Geczy, Christopher C.; Stambaugh, Robert F.; Levin, David (2003). « Investing in socially responsible mutual funds », Working Paper, Wharton School, University of Pennsylvania, www.wharton.upenn.edu.

- Gillet, Philippe (2008). « Les performances des fonds « éthiques » et vicieux », États Généraux du Management, Paris, octobre.

- Girard, Eric; Rahman, Hamid; Stone, Brett (2007). « Socially responsible investment: Goody-two-shoes or bad to the bone », Journal of Investing, Vol. 16, Iss. 1, p. 96-110.

- Goldreyer, Elisabeth F.; Diltz J. David (1999). « The Performance of Socially Responsible Mutual Funds: Incorporating Sociopolitical Information in Portfolio Selection », Managerial Finance, Vol. 25, N° 1, p. 23-36.

- Gompers, Paul; Ishii, Joy; Metrick, Andrew (2003). « Corporate governance and equity prices », The Quarterly Journal of Economics, Vol. 118, N° 1, p. 107-155.

- Gregory, Alan; Matatko, John; Luther, Robert. G. (1997). « Ethical unit trust financial performance: Small company effects and full size effects », Journal of Business Finance and Accounting, Vol. 24, N° 5, p. 705-725.

- Gregory, Alan; Whittaker, Julie (2007). « Performance and Performance Persistence of Ethical Unit Trusts in the UK », Journal of Business Finance and Accounting, Vol. 34, N° 7-8, September – October, p. 1327-1344.

- Guenster, Nadja; Derwall, Jeroen; Bauer, Rob; Koedijk, Kees (2005). « The economic value of corporate eco-efficiency », Working Paper, Erasmus University, July 25th.

- Guerard Jr, John B (1997a). « Is There a Cost to Being Socially Responsible », Journal of Investing, Vol. 6, Iss. 2.

- Guerard Jr, John B (1997b). « Additional Evidence on the Cost of Being Socially Responsible in Investing », Journal of Investing, Vol. 6, Iss. 4, p. 31-35.

- Hamilton, Sally; Jo, Hoje; Statman, Meir (1993). « Doing well while doing good ? The investment performance of socially responsible mutual funds », Financial Analysts Journal, Vol. 49, N° 6, p. 62-66.

- Havemann, Ros; Webster, Peter (1999). « Does ethical investment pay ? », Ethical Investment Research Service (EIRIS), London, September.

- Hong, Harrison; Kacperczyk, Marcin (2009). « The price of sin: The effect of social norms on markets », Journal of Financial Economics, Vol. 93, p. 15-36.

- Hutton, R. Bruce; D’Antonio, Louis; Johnsen, Tommi (1998). « Socially responsible investing », Business and Society, Vol. 37, N° 3, p. 281-305.

- Jones, Stewart; VanderLaan, Sandra; Frost, Geoff; Loftus, Janice (2008). « The investment performance of socially responsible investment in Australia », Journal of Business Ethics, Vol. 80, p. 181-203.

- Kempf, Alexander; Osthoff, Peer (2007). « The effect of socially responsible investing on portfolio performance », European Financial Management, Vol. 13, N° 5, p. 908-922.

- Kreander, Niklas; Gray, Robert H.; Power, David M.; Sinclair, C. D. (2005). « Evaluating the performance of ethical and non-ethical funds: A matched pair analysis », Journal of Business Finance and Accounting, Vol. 32, Iss. 7/8, p. 1465-1493.

- LeMaux, Julien; LeSaout, Erwan (2004). « La performance des indices socialement responsables: mirage ou réalité ? », Revue Sciences de Gestion, vol. 44, p. 51-79.

- Luther, Robert G.; Matatko, John; Corner, Desmond C. (1992). « The investment performance of UK ethical unit trusts », Accounting, Auditing and Accountability Journal, Vol. 5, Iss. 4, p. 57-70.

- Luther, Robert G.; Matatko, John (1994). « The performance of ethical unit trusts: Choosing an appropriate benchmark », British Accounting Review, Vol. 26, Iss. 1, p. 77-89.

- M’Zali, Bouchra; Turcotte, Marie-Françoise (1998). « The Financial Performance of Canadian and American Environmental and Social Mutual Funds », 7th International Conference of The Greening of Industry Network, Rome, Italie, 15-18 novembre.

- Mallin, Christine A.; Saadouni, Brahim; Briston, R. J. (1995). « The financial performance of ethical investment funds », Journal of Business Finance and Accounting, Vol. 22, N° 4, p. 482-496.

- Miglietta, Federica (2005). « Socially responsible investments in continental Europe: A multifactor style analysis », 10th symposium of Finance, Bank and insurance, University of Karlsruhe, Germany, 14-16th December.

- Moskowitz, Milton R. (1972). « Choosing socially responsible stocks », Business and Society Review, spring.

- Newell, Graeme ; Acheampong, Peter (2002). « The Role of Property in Ethical Managed Funds », Conference of Pacific Rim Real Estate Society (PRRES), Christchurch, 2002, 21-23 janvier.

- Opler, Tim C.; Sokobin, Jonathan (1995). « Does coordinated institutional activism work ? An analysis of the activities of the Council of Institutional Investors », Working paper, Ohio State University.

- Otten, Roger; Koedijk Kees (2001). « Beleggen met een Goed Gevoel », Publié dans Economische Statistische Berichten (ESB), 13 avril (A summary of this study is provided in English in ABM-AMRO (2001), p.91-92).

- Pagès, Adrienne (2006). « Les performances de l’Investissement Socialement Responsable: mesures et enjeux », Mémoire de fin d’études Majeure Finance – HEC Paris, mai.

- Plantinga, Auke; Scholtens, Bert (2001). « Socially responsible investing and management style of mutual funds in the Euronext stock markets », University of Groningen, Research Institute SOM (Systems, Organisations, and Management), Research Report, May.

- Reyes, Mario G.; Grieb, Terrance (1998). « The External Performance of Socially-Responsible Mutual Funds », American Business Review, Vol. 16, N° 1, January, p.1-6.

- Saadaoui, Khaled (2008). « L‘engagement éthique pénalise-t-il la performance ? Analyse de la performance financière des fonds socialement responsables français », Actes du 5ème congrès de l’ADERSE, janvier, Grenoble.

- Saadaoui, Khaled (2009). « La performance financière de l’investissement socialement responsable: cas des fonds socialement responsables français et canadiens », Thèse de Doctorat en sciences de gestion, Université Paris-sud 11, janvier.

- Sauer, David A. (1997). « The Impact of Social Responsibility Screens on Investment Performance: Evidence from the Domini Social Index and Domini Equity Mutual Fund », Review of Financial Economics, Vol. 6, N° 2, p. 137-149.

- Scholtens, Bert (2005). « Style and performance of dutch socially responsible investment funds », Journal of Investing, Vol. 14, Iss.1.

- Scholtens, Bert (2007). « Financial and Social Performance of Socially Responsible Investments in the Netherlands », Corporate Governance: An International Review, Vol. 15, N° 6, November.

- Schröder, Michael (2004). « The performance of socially responsible investments: Investment funds and indices », Financial Markets and Portfolio Management, Vol. 18, N° 2, p.122-142.

- Serret, Vanessa (2003). « Does Ethical Investment Pay ? », Journée de recherche sur le Développement Durable organisée par l’ESSCA et l’AIMS, Angers, 15 mai.

- Shank, Todd M.; Manullang, Daryl K.; Hill, Ronald Paul (2005). « Is it Better to be Naughty or Nice ? », Journal of Investing, Vol. 14, Iss. 3, p. 82-87.

- Smith, Michael P. (1996). « Shareholder activism by institutional investors: Evidence from CalPERS », Journal of Finance, Vol. 51, N° 1, p. 227-252.

- Statman, Meir (2000). « Socially responsible mutual funds », Financial Analysts Journal, vol. 56, N° 3, p. 30-39.

- Statman, Meir (2006). « Socially Responsible Indexes: Composition, Performance and Tracking-Error », Journal of Portfolio Management, Vol. 32, N° 3, p. 100-109.

- Stone, Bernell K.; Guerard Jr, John B.; Gultekin, Mustafa N.; Adams Greg (2002). « Socially Responsible Investment Screening: Strong Empirical Evidence of No Cost for Actively Managed Value-Focused Portfolios », Working Paper, Marriott School of Finance, Brigham Young University, October.

- Tippet, John (2001). « Performance of Australia’s ethical funds », The Australian Economic Review, vol. 34, N° 2, p. 170-178.

- Vance, Stanley C. (1975). « Are Socially Responsible Corporations Good Investment Risks », Management Review Vol. 64, p. 18-24.

- VandeVelde, Eveline; Vermeir, Wim; Corten, Filip (2005). « Corporate Social Responsability and Financial Performance », Corporate Governance, Vol. 5, N° 3, p. 129-138.

- Vermeir, Wim; VandeVelde, Eveline; Corten, Filip (2005). « Sustainable and Responsible Performance », Journal of Investing, Vol. 14, Iss. 3, autumn.

- Vermeir, Wim; Friedrich, Catherine (2006). « La performance de l’ISR », Revue d’Economie Financière, n° 85.

- Wheat, Doug (2002). « Performance of Socially and Environmentally Screened Mutual Funds », SRI World Group, www.ishareowner.com.

- Ziegler, Andreas; Schröder, Michael; Rennings, Klaus (2007). « The effect of environmental and social performance on the stock performance of european corporations », Environmental and Resource Economics, vol. 37, N° 4, p. 661-680.

- Allouche, José; Laroche, Patrice (2005). « A meta-analytical investigation of the relationship between corporate social and financial performance », Revue de Gestion des Ressources Humaines, vol. 57, p. 18–41.

- Carhart, Mark M. (1997). « On persistence in mutual fund performance », Journal of Finance, Vol. 52, N° 1, p. 57-82.

- Clow, Robert (1999). « Money that grows on trees », Institutional Investor, Vol. 33, Iss. 10, p. 212-215.

- Déjean, Frédérique (2002). « L’investissement socialement responsable: une revue de la littérature », Actes du 23ème Congrès de l’Association francophone de comptabilité (AFC), Toulouse.

- Doucouliagos, Christos; Laroche, Patrice (2003). « What Do Unions Do to Productivity ? A Meta-Analysis », Industrial Relations, Vol. 42, n° 4, p. 650-691.

- Doucouliagos, Christos; Laroche, Patrice ; Stanley, Tom D. (2005), « Publication Bias in Union-Productivity Research », Relations Industrielles/Industrial Relations, Vol. 60, N°2, p. 320-347.

- Doucouliagos, Christos; Laroche, Patrice (2009). « Unions and Profits: a Meta-Regression Analysis », Industrial Relations, Vol. 48, N° 1, p. 146-184.

- Dupré, Denis; Girerd-Potin, Isabelle; Jimenez-Garces, Sonia; Louvet, Pascal (2009). « Influence de la notation éthique sur l’évolution du prix des actions », Revue Économique, vol. 60, janvier.

- Fama, Eugène F.; French, Kenneth R. (1993). « Common risk factors in stock and bond returns », Journal of Financial Economics, Vol. 33, p. 3-56.

- Freeman, R. Edward (1984). Strategic management: A stakeholder approach, Boston, Marshall, M. A. Pitman.

- Friedman, Milton (1962). Capitalism and Freedom. University of Chicago Press, Chicago.

- Friedman, Milton (1970). « The Social Responsibility of Business is to Increase Its Profits », The New York Times Magazine, 13th September.

- Frooman, Jeff (1997). « Socially irresponsible and illegal behavior and Shareholder wealth: a meta-analysis of event studies », Business and Society, Vol. 36, N° 3, September, p. 221-249.

- Hedges, Larry V.; Olkin, Ingram (1985). Statistical Methods for Meta-Analysis, London, Academic Press.

- Heinkel, Robert; Kraus, Alan; Zechner, Josef (2001). « The Effect of Green Investment on Corporate Behaviour », Journal of Financial and Quantitative Analysis, Vol. 36, N° 4, p. 431-449.

- Hunter, John E.; Schmidt, Franck L. (2004). Methods of Meta-Analysis: Correcting Error and Bias in Research Findings, (2nd Ed), Sage publications.

- Jensen, Michael C. (1968). « The performance of mutual funds in the period 1945-1964 », Journal of Finance, Vol. 23, N° 2, p. 389-415.

- Jensen, Michael C. (1969). « Risk, the pricing of capital assets, and the evaluation of investment performance », Journal of Business, Vol. 42, N° 2, p. 167-247.

- Kurtz, Lloyd (1997). « No effect, or net effect ? Studies on socially responsible investing », Journal of Investing, Vol. 6, Iss. 4, p. 37-49.

- Kurtz, Lloyd (2002). « Studies in the Field of SRI Investing », Working Paper, www.sristudies.org.

- Kurtz, Lloyd (2005). « Answers to four questions », Journal of Investing, Vol. 14, Iss. 3, p. 125-139.

- Lamb, Deborah (1991). « Morals and Money », Money Management, p. 39-46, September.

- Laroche, Patrice (2007). « L’exploration statistique du biais de publication », Journal de la Société Française de Statistique, tome 148, n° 4.

- Laroche, Patrice; Schmidt, Géraldine (2004). « La méta-analyse en sciences de gestion: utilités, utilisations et débats », Academy of Management, Research Methods Division, Crossing Frontiers in Quantitative and Qualitative Research Methods, ISEOR, Lyon, France.

- Louche, Céline; Lydenberg, Steven (2006). « Investissement socialement responsable: différence entre Europe et États-Unis », Revue d’Économie Financière, n° 85, avril.

- Lucas-Leclin, Valéry (2006). « Qu’apporte l’analyse ISR à l’analyse financière », Revue d’Économie Financière, n° 85, avril.

- Mackey, Alison; Mackey, Tyson B.; Barney, Jay B. (2007). « Corporate Social Responsibility and Firm Performance: Investor Preferences and Corporate Strategies », Academy of Management Review, Vol. 32, N° 3, p. 817-835.

- Margolis, Joshua D.; Elfenbein, Hillary A.; Walsh, James P. (2007). « Does it pay to be good ? A Meta-Analysis and Redirection of Research on the Relationship between Corporate Social and Financial Performance », Paper presented at the Academy of Management, Philadelphia.

- Markowitz, Harry (1952). « Portfolio Selection », Journal of Finance, Vol. 7, N° 1, p. 77-99.

- Merton, Robert C. (1987). « A Simple Model of Capital Market Equilibrium with Incomplete Information », Journal of Finance, Vol. 42, p. 483-510.

- Munnell, Alicia H.; Blais, Lynn E.; Keefe K. M. (1983). « The pitfalls of social investing: The case of public pensions and housing », New England Economic Review, p. 20-37, Boston, September-October.

- Orlitzky, Marc; Schmidt, Frank L.; Rynes, Sara L. (2003). « Corporate social and financial performance: A meta-analysis », Organization Studies, Vol. 24, p. 403–441.

- Porter, Michael E. (1991). « American’s Green Strategy », Scientific American, Vol. 264, N° 4, April.

- Renneboog, Luc; Ter-Horst, Jenke; Zhang, Chendi (2008). « Socially responsible investments: Institutional aspects, performance and investor behaviour », Journal of Banking and Finance, Vol. 32, p. 1723-1742.

- Rudd, Andrew (1981). « Social responsibility and portfolio performance », California Management Review, N° 23, p. 55-61.

- Sharpe, William F. (1966). « Mutual fund performance », Journal of Business, Vol. 39, p. 119-138.

- Song, Fujian; Easterwood, Alison J.; Gilbody, Simon M.; Duley, Lelia; Sutton, Alex J. (2000), « Publication and Other Selection Biases in Systematic Reviews », Health Technology Assessment, Vol. 4, N° 10, p. 1-115.

- Stanley, Tom D. (2001). « Wheat from Chaff: Meta-Analysis as Quantitative Literature Review », Journal of Economics Perspectives, Vol. 15, N° 3, summer, p. 131-150.

- Stanley, Tom D. (2005). « Beyond Publication Bias », Journal of Economic Survey, N° 19, p. 309-337.

Others references

Parties annexes

Notas biograficas

Christophe Revelli es profesor adjunto de Finanzas de Euromed Management de Marsella. Ph.D. en Ciencias Empresariales por la Universidad de Montpellier 1, su tesis fue galardonado con el Premio de Investigación RIODD-VIGEO (Red Internacional para la Investigación sobre Organizaciones y el Desarrollo Sostenible). Su investigación se centra en el desempeño financiero de la Inversión Socialmente Responsable (ISR) ISR « mainstreaming », el vínculo entre la crisis financiera y la Responsabilidad Social Corporativa (RSC), así como el posicionamiento del análisis extra-financiero en el análisis financiero.

Jean-Laurent Viviani es professor de Finanzas del IGR (Universidad de Rennes 1). Su investigación se centra en el Inversión Socialmente Responsable, Las finanzas islámicas, las finanzas verde, estrategia financiera y de gestión de riesgos en las empresas agrícolas y los bancos.

Liste des figures

Figure 1

Conceptual framework of the financial performance of SRI

Liste des tableaux

Tableau 1

SRI impact depending on the type of research

Tableau 2

Influence of determinants on the number of citations (quality of the paper)

Tableau 3

Regression coefficients from the multinomial logit model

Note: the reference modality is “Negative SRI Impact”

To give a key of interpretation in the case of a multinomial logit model, each coefficient obtained is compared to 0 to determine the corresponding significance. A negative coefficient (positive) has a negative (positive) impact on the modality to explain compared to the reference modality. A positive (negative) coefficient involves interpreting the independent variable in an ascending (descending) way. In other words, if the coefficient is positive, the modality explaining the dependent variable is the highest (lowest) in the independent variable (report to appendix 2 to see the coding used).

To take into account the fact that experimentations reported within the same study could not be independent we conduct the same analysis but replace the value of the variable for each experimentation by the mean value of all experimentations within the same study; we obtain very similar results to those presented here.

10.7202/011724ar

10.7202/011724ar