Résumés

Abstract

This article explores the experiences of informal construction and home renovation workers with payment-related violations of employment standards. Such violations, often broadly referred to as ‘wage theft,’ can comprise an array of practices including, but not limited to, withholding workers’ wages for long periods of time, paying workers below the minimum wage, extracting illegal deductions from workers’ paycheques, and outright not paying the wages due.

Drawing on twenty-two in-depth interviews with foreign-born men employed informally in residential construction and home renovations in Toronto, Ontario, the first half of the article documents the specific forms of wage theft that workers experienced in these sectors where flat daily rates and piece rates are common, but written contracts are not. I also explore the individuated and extra-legal strategies that workers adopted in trying to recoup stolen wages. In general, they framed their sustained efforts to persuade employers to adhere to the law as a form of employment standards enforcement running parallel to the tactics of state enforcement.

In the second half of the article, I examine the accessibility of the more formal legal channels that exist to assist workers in recouping lost wages—specifically, claims filed through the Ontario Labour Relations Board. Through a review of recent case law on Board adjudication of employment standards complaints about wages owing to informally-employed, non-citizen workers, I highlight the document burden that informal workers in this sector must bear in order to file a robust claim with the state.

Drawing on scholarship that has shown how employment standards violations are pervasive in the more sub-contractual and informal tiers of the construction industry, I pinpoint multiple interlocking conditions in informal construction and home renovations that not only increase the likelihood of wage theft for workers in these sectors, but also disproportionately burden them with the responsibility of enforcing the law or proving their employer’s non-compliance. In so doing, I show how this group of workers shoulders the responsibilities of either the state or their employer in recouping lost wages.

Keywords:

- informal work,

- home renovations,

- employment standards violations,

- wage theft,

- informal economy

Résumé

Cet article s’intéresse aux expériences de travailleurs oeuvrant dans les secteurs informels de la construction et de la rénovation domiciliaire où de fréquentes violations des normes d’emploi liées aux salaires furent constatées. De telles violations, souvent appelées « vol de salaires », peuvent comprendre un éventail de pratiques, qui s’étendent, mais sans s’y limiter, de la retenue du salaire des travailleurs pendant de longues périodes, au paiement des travailleurs en dessous du salaire minimum, à l’extraction de retenues illégales sur les chèques de paie des travailleurs, jusqu’au non-paiement du salaire dû.

S’appuyant sur vingt-deux entrevues approfondies avec des hommes nés à l’étranger employés de manière informelle dans la construction résidentielle et la rénovation résidentielle à Toronto, en Ontario, la première partie de l’article documente les formes spécifiques de vol de salaires que les travailleurs ont subies dans ces secteurs où les tarifs journaliers et le travail à la pièce sont courants, mais où les contrats écrits sont rares. J’explore également les stratégies individualisées et extra-légales que les travailleurs ont adoptées pour tenter de récupérer les salaires volés. En général, ils ont mis des efforts soutenus afin de persuader les employeurs d’adhérer à la loi comme une forme d’application des normes du travail, parallèlement aux tactiques d’application de la loi par l’État.

Dans la seconde partie de l’article, j’examine l’accessibilité des voies juridiques plus formelles qui existent pour aider les travailleurs à recouvrer les salaires perdus, en particulier les réclamations déposées auprès de la Commission des relations de travail de l’Ontario. À travers un examen de la jurisprudence récente sur le jugement par le Conseil des plaintes relatives aux normes du travail concernant les salaires dus à des travailleurs non-citoyens employés de manière informelle, je souligne le fardeau documentaire que les travailleurs informels de ce secteur doivent supporter afin de déposer une réclamation solide auprès de l’État.

En m’appuyant sur des études scientifiques qui ont montré à quel point les violations des normes du travail sont omniprésentes dans les niveaux sous-contractuels et informels de l’industrie de la construction, je souligne les multiples conditions interdépendantes dans la construction informelle et les rénovations domiciliaires qui, non seulement, augmentent la probabilité de vol de salaires pour les travailleurs de ces secteurs, mais fait également peser sur eux, cela de manière disproportionnée, la responsabilité de faire appliquer la loi ou de prouver la non-conformité de leur employeur. Ce faisant, je montre comment ce groupe de travailleurs assume tant les responsabilités de l’État que de leurs employeurs lors de leurs démarches pour récupérer ces salaires perdus.

Mots-clés:

- travail informel,

- rénovation résidentielle,

- violations des normes du travail,

- vol de salaires,

- économie informelle

Corps de l’article

Introduction

Recently, a number of studies have highlighted the troubling prevalence of employment standards violations across the province of Ontario. This research has not only documented violations across occupational sectors (Vosko and Thomas, 2014), but has also highlighted the state’s failure to enforce provincial employment standards legislation and to follow up on employers’ court orders to comply with the law (Vosko et al., 2017a; 2017b). Chief among these violations has been what is often referred to as wage theft, which Kennedy (2016: 519) defines broadly as “the illegal underpaying of employees”. In Ontario, wage theft often entails an employer’s contravention of provisions in the Employment StandardsAct (herein the ESA). This can include a variety of violations, such as the non-payment of mandatory employment benefits, paying workers less than the minimum wage, underreporting the actual hours that an employee worked, withholding wages for long periods, or otherwise failing to pay a worker the wages they are legally due. The ESA stipulates employers’ responsibilities regarding the payment of employee wages and outlines some employees’ entitlements beyond the hourly wage such as overtime pay and provincial and federal benefit contributions by employers. It can also exempt workers from certain entitlements depending on the specificities of their occupation. However, as Thomas (2009) notes, an overarching goal of the ESA is to establish basic employment standards for all workers in Ontario, particularly those who have little bargaining power and those who are not represented by a union (see also Vosko et al., 2017a and Mirchandani et al., 2019).

For many years, workers’ rights organizations, unions and workers in Ontario have been fighting monetary employment standards violations by employers across the province. Newcomers to the country, and particularly newcomer women and those with limited language facility in English or French, tend to be underrepresented by unions, overrepresented in low-wage and precarious work in Ontario, and more prone to experiencing wage theft (Workers’ Action Centre, 2011a). Across Canada and the USA, scholars at the forefront of research on matters of employment standards violations have demonstrated that wage theft is especially pervasive across a swath of low-waged, racialized and feminized industries, including hospitality and restaurant work, care work and retail work (Fine and Gordon, 2010; Weil, 2014; Bobo, 2014; Vosko and Thomas, 2014). Workers in low-waged and precarious jobs tend to be more prone to having wages unpaid precisely because they possess the least bargaining power to negotiate fair wages and payment practices with their employer (Workers’ Action Centre, 2011a; 2011b). Research has highlighted that these workers are also often less able to recoup stolen wages in cases of employer theft either because of the lack of a formal contract, their dependence on a single employer for work and residency (particularly among those with precarious legal status), or because of a fear of reprisals from their employer (Vosko and Thomas, 2014; Workers’ Action Centre, 2011b).

In Ontario, wage theft is also common within subsectors of the construction and home renovations industries (Waren, 2014; Juravich et al., 2015; Kilibarda, 2015; Weil, 2014). This is particularly the case in the most informal tiers of construction and renovations work, such as day labour (Meléndez et al., 2014; Theodore et al., 2008), low-rise residential construction work performed by non-citizens (Doussard, 2013; Doussard and Gamal, 2016) and work in the cash-only economy (Kilibarda, 2015). Indeed, wage theft in construction in the US has been called an “epidemic” (Juravich, 2016: 4), while other scholars have noted that wage arrears and non-payment are endemic facets of many construction markets outside of North America (Ross, 2019; Pun and Lu, 2010; Srinivas, 2008; Wells, 2007).

While a rich body of sector-specific research now exists on wage theft in construction and renovations in the US context (Doussard and Gamal, 2016; Juravich et al., 2015; Rabourn, 2008; Fussell, 2011; Koenig, 2018; Simpson, 2009; Sung et al., 2013; Waren, 2014), there is far less research on theft in these sectors in Canada (though see Mirchandani et al., 2019). In Ontario, construction is second only to the food industry in being the most over-represented sector for complaints to the Ministry of Labour about wage theft—particularly in residential construction and specialty trades (Vosko et al., 2017a). Yet, little research to date has probed the micro-relations that make wage theft in construction and renovations so pervasive in these sectors in the province. In this regard, this paper makes two contributions—one empirical, the other theoretical. First, drawing on twenty-two in-depth interviews with casually-employed foreign-born men employed in 2014 and 2015, this article examines the pervasiveness of wage-theft within the more informal tiers of construction and renovations in the Greater Toronto Area (GTA). Respondents’ experiences in having their wages paid late, deducted or withheld are pinpointed in order to detail the specific ways that employers in these sectors are contravening the ESA. Building on scholarship on employment standards violations in Ontario (e.g. Gellatly et al., 2011; Vosko and Thomas, 2014; Vosko et al., 2017a; 2017b; Mirchandani et al., 2019), it is argued that intersecting conditions of precarious immigration status, informal employment relations and short-term production dynamics that transect low-rise construction and renovations work make informal workers in these sectors disproportionately more likely to experience wage theft, and disproportionately burdened with the responsibility of making violations visible to the state and ensuring employers’ compliance with the law. This study sheds empirical light on these sectoral dynamics in the Greater Toronto Area, adding to the evidence of wage theft and the barriers to legal justice for informal renovations and low-rise construction workers across North America.

In the second half of this article, a consideration of the implications of these findings is offered for theory on workers’ responsibilities within employment standards (herein ES) regimes by exploring the options informal workers have in recouping lost wages. Scholars in recent decades have recognized the growth of complaints-driven ES regimes as a reflection of how “markets increasingly police themselves in an increasingly deregulated economy” (Haughton and Peck, 1996: 321). Others have highlighted the everyday institutional and bureaucratic barriers in workers’ “journey[s] to claims making” (Gleeson, 2016: 3), which foreground the expansion of voluntary and largely self-monitoring ES regimes that have placed increasing responsibility on workers to ensure employers’ compliance. As a contribution to these debates, this article explores how, alongside the ongoing marginalization of some ES institutions, informal workers already play a significant role in enforcing employer compliance as a result of the multi-scalar and intersecting forms of precarity they face in this line of work. I also foreground the time and effort expended—and the variety of informal strategies that these workers used—in trying to recoup the wages they were owed. In light of this, I argue that a substantive amount of employment standards enforcement is undertaken by renovations and construction workers in these cases. I suggest that these tactics reflect how sector-specific forms of informality in construction and renovations disproportionately burden informal workers with responsibilities of enforcement that are arguably the state’s.

Secondly, I argue that the province’s legal claims process for recouping wages poses a distinct set of barriers to informal workers in these sectors. Through a review of recent case law of informally-employed construction workers’ ES claims through the courts in Ontario, this paper shows how successful claims for these workers required them to anticipate and document the theft of their earnings in order for the legal system to be of use. Following Mirchandani et al.’s (2019) study highlighting the disproportionate documentation informal workers must undertake in filing such claims, it is suggested that the legal claims process fosters a contradictory form of self-securitization for informally-employed claimants; to gain access to the legal process, they not only must shoulder employers’ legal responsibilities, but also become capable administrators in the theft of their own earnings. Building on Mirchandani et al.’s (2019) analysis of how workers in Ontario face pressure to become entrepreneurial subjects in the province’s ES enforcement regime, the paper contributes to the theorization of worker responsibility in ES compliance by foregrounding ‘securitization’ and ‘enforcement’ as two dimensions of entrepreneurial subjectivity that require informal workers to take on either the responsibilities of the employer or the state.

Interview participants hailed from a range of countries, including Zimbabwe, Mexico, Bulgaria, Romania, Argentina, Ireland, St. Vincent, Granada, India and the Ukraine. This diversity reflects the importance that the GTA plays as a major gateway region for newcomers to Canada. It also reflects the significant role that residential construction and renovations play in providing precarious employment for newcomer men in urban labour markets, including those who, often deskilled by a lack of labour market contacts or ‘Canadian’ credentials and experience, turn to the more marginal tiers construction because they are unable to find work in their field (Kilibarda, 2015; Mills, 2017; Buckley, 2018). I draw inspiration in this paper from insightful work by scholars such as Gleeson (2016) and Mirchandani et al. (2019), in which theory-making arises through a close engagement with workers’ own experiences. In-depth interviews offer a means of elucidating the economies of wage recuperation that occur outside the law. Respondents were recruited through face-to-face introductions by labour advocacy groups in the Toronto area and, also, through advertisements in English in a Toronto free newspaper. Respondents’ names, and in some cases the details of their workplace and other work activities, have been anonymized to protect their identities. Further data for this paper were gathered through a review of adjudications of provincial ES violations through the Ontario Labour Relations Board; this review focused on cases involving informal sector workers in the trades and workers with precarious legal status. It includes cases occurring between 1990 and 2020.

Mapping wage theft: false hour reports, day rate exploitation and payment delays

Wage theft embraces varied practices that contravene the law. In the US context, as Doussard and Gamal (2016: 784), citing Bernhardt et al. (2009) note, “...underpayment or non-payment can be the result of a wide range of causes, from ‘wrongly compensated’ overtime, denied or foreshortened breaks, and ‘off the clock’ violations”, in which managers underreport the number of hours worked, creating a complex set of challenges for workers’ centres and other organizations seeking to recoup these wages. In other cases, conceptions of wage theft have included the deduction of illegal ‘fees’ for lodging, supplies, food or services provided by the employer (Bobo, 2014). As with Ontario, in the US context, Carre and Heintz (2009) note that construction is the sector with the highest documented incidence of false self-employment classifications, in which workers operate as ‘independent contractors’ in order for employers to lower labour costs by avoiding employment benefit payments to employees (see also Buckley, 2018).[1]

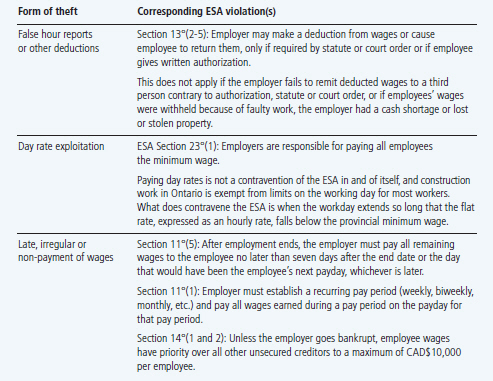

Among the twenty-two study respondents in this study, all but three reported experiencing some form of wage violations as defined in the ESA: some had not been paid at all for hours worked, others were chronically paid late or received less than what they were owed, while others still were paid a flat rate that resulted in below minimum wages for the hours worked. Moreover, despite the provisions in the ESA covering hours of work and overtime pay, only three of the workers in this sub-segment of nineteen workers had received overtime pay from their employer when they worked longer than 8 hours per day or more than the 48 hours per week, the threshold for overtime stipulated in the Act. From workers’ testimonies, it is clear that they experienced a range of contraventions to the ESA that resulted in the loss of wages. In this section, I highlight what I consider to be three distinct forms of theft that were common in respondents’ stories: false hour reports, day rate exploitation and late- or non-payment of wages (see Table 1). The most prevalent form of ESA violation in the sample was the withholding of wages for periods of time, sometimes indefinitely. The failure to pay on time is a contravention of the ESA, which stipulates particular timelines for payment.

Table 1

Some variants of wage theft among informal workers in the trades

ESA excerpts above taken from the Employment Standards Act 2000 (https://www.canlii.org/en/on/laws/stat/so-2000-c-41/latest/so-2000-c-41.html).

Contractors offered a range of excuses for not paying workers, saying they had not been able to get to the bank yet, they had not been paid by the main contractor, or that there had been other unexpected problems in their capital flow. The experience of one respondent we shall call ‘Pedro’ was emblematic in this regard. Pedro was a former bank manager from Mexico City who had moved to Canada fleeing gang violence. On a two-year temporary work visa, at the time of the interview, Pedro was working several jobs in the GTA, one of which included doing casual carpentry (despite having no carpentry experience) in low-rise residential construction for a roofing subcontractor on a large suburban housing subdivision. He recounted his experiences there:

You don’t have a [written] contract. You get your money on a Saturday, but if the contractor doesn’t have money, you have to wait another week to get paid. [It happened] three or four times. He said, “I don’t have money, I didn’t get paid, so I can’t pay you this week”. He says he’s not getting paid by the contractor. […]

In Pedro’s case, despite not having a contract, the verbal understanding was that workers would be paid weekly, in cash, on Saturday. However, he and his co-workers often experienced more than a week in payment delays. Another respondent named ‘Kimani’, from Grenada, explained that after working for two years in residential construction without a formal contract, he would not be paid for weeks on end because his employer was fairly far down the subcontracting chain, and would often claim they hadn’t been paid themselves. Kimani recounted:

I wouldn’t be paid, like, every Friday or every two weeks or month. I was paid whenever the contract was done, and the contractor paid the guys that I was working with… It was just my friends and the contractor [at the bottom of the subcontracting chain].

Often Kimani would wait for a month after the job had been completed to get paid. This payment was notoriously irregular: in his words, he and his coworkers “[s]o we’d go and do [complete the work on] one house and get the money, but sometimes we [would get] bamboozled and would have to wait for a few weeks to get the money.”

In an industry in which contracts are casual and often very short term, this form of late payment can often be a deliberate strategy of labour control to retain workers for the duration of a contract. It is also a means to intensify working conditions; the sooner a contract is finished, the sooner a worker can get paid. A fuller examination of the labour process implications of wage-withholding is outside the scope of this article, but wage withholding needs to be understood in part as a product of the specificities of production in construction—where capital flow to small subcontractors can be hampered by pay and production schedules at upper tiers of the contracting ladder, but where wage withholding is a crucial—if unscrupulous—strategy of worker retention and labour intensification in smaller operations where contracts are casual and rates of employee turnover may be high (see also Doussard, 2013 on this point).

Other respondents were subject to disputes over hours worked or other deductions. ‘Amor’, for example, was a young worker who had just turned 18, but had gained permanent residency after coming to Canada with his family from Mexico as a refugee, and who had been working as a labourer on a construction site while awaiting the decision on his asylum claim. The subcontractor regularly withheld wages from Amor on a basis without explanation. He explained that at one point in the contract,

[It happened] almost every week. When we were getting paid, they [the subcontractor] would say, ‘You’re not getting your cheque today. Maybe can you wait until next week?’ He’d always say, ‘I’m on vacation, I’m not here, call my secretary’. And then the secretary was like, ‘I don’t know, you have to talk to him’. So we were playing this game.

It would often take him and many of his co-workers days to get paid, and when they did, he and his colleagues would find they had not been paid for the full hours they had worked. Moreover, because there was no contract and no formal documentation of the hours worked, they had no way of proving that they had worked more hours. Amor said,

Sometimes it wasn’t the money I worked for. I tried to, for example, show them my hours [on his personal calendar]. They’d [payroll staff] say, ‘No, they [the boss] only sent me these hours, from the office on the site’.

Other respondents experienced ad hoc ‘deductions’—some of which were tantamount to a wholesale change in the terms of pay—without explanation. ‘Manish’, from Sri Lanka, could not find work as a mechanical engineer, which was his profession where he had previously lived in Dubai. Manish eventually found work for which the stated pay in the online ad was $20/hour doing drywall. In his words,

[I would work for] 10 hours a day, but after the day he [the contractor] was paying me $140 or $150… He said $20 per hour he’d pay. But after deductions, $160 he said. I don’t know [what the deductions were for].

As Vosko et al. (2017a) note, deductions and underreporting, among other forms of non-compliance with the ESA are a means of labour cost savings for some employers in Ontario; this is particularly so in low-rise construction and renovations (on this, see in particular Doussard, 2013). In other cases, the tendency in some trades to pay flat day rates (e.g. general labouring) or piece rates (e.g. dry-walling) without a written contract or pay stubs both complicates and facilitates wage theft. As one respondent, Kimani, explained,

[I got] about a hundred dollars a day, most of the time, because I’m not a really skilled labour. Over the years, I consider I got better, but my wages remained $100 a day… [The work involved] long hours. Sometimes we’d start at 8 in the morning and [finish at] 8 o’clock at night. Sometimes longer. We’d just get the job done.

The use of flat day rates in informal construction was cited by several respondents as either part of their particular employer’s method of payment, or more generally as a common arrangement in the sector. Day rates complicate the relations of theft because, under these conditions, theft becomes a function of time; extending the working day is a means of labour cost savings by getting more labour for a fixed day rate. Moreover, if the working day has no fixed duration and never has, negotiating the terms of theft for workers becomes a day to day practice of monitoring and accounting. For example, under the ESA, construction workers are exempt from provisions limiting the working day and they are permitted by law to work more than 8 hours in a day, provided that a- they are paid overtime beyond 8 hours; and b- that their hourly rate is at least the provincial minimum wage. In neither of the cases above was Kimani getting either of these forms of compensation. This is a form of what Galvin (2016) calls ‘minimum wage noncompliance’; a typical twelve-hour day would net Kimani just CAD$8.30 per hour, which at the time was well below Ontario’s minimum wage. As we shall see in the following section, however, workers adopted a range of strategies to compel employers to pay wages owed.

Casual justice and enforcement: informal strategies and tactics of combatting wage theft

Scholars have widely argued that state-centric, complaints-based ES enforcement regimes are insufficient to protect workers’ rights (Vosko and Thomas, 2014; Gleeson, 2012; Brown and Wright, 2018). Concurrently, a wealth of scholarship has explored the role—potential or existing—of unconventional state and non-state actors that fill gaps in enforcement and oversight produced by such ES regimes. This includes actors ranging from international unions to workers’ parents and friends (Vosko and Thomas, 2014). Others have noted the role that civil society groups across North America have played in using direct action to name, shame and pressure deviant employers to pay wages owed (e.g. Gleeson, 2012: Workers Action Centre, 2011; Fine, 2011) or in consumer boycotts to enforce ES within commodity chain production (Brown and Wright, 2018). Scholars focused on the role played by contract law in wage protection have, meanwhile, considered the transformation of construction liens—existing legal agreements that make firms higher up a construction subcontracting chain liable for obligations to contractors further down—as a possible legal mechanism of ensuring worker payment (Mildren, 2017). The turn to these strategies is reflective of trends towards the underfunding and dismantling of ES enforcement regimes in many countries. In other cases, this focus on third party enforcement reflects scholars’ growing concern with the twinning of workplace rights enforcement with immigration enforcement by local state agents like the police (for example see Gleeson, 2012), or the erosion of power among non-state institutions that have historically played a role in enforcement, such as unions (Hardy and Howe, 2009). Notably, however, Mirchandani et al. (2019: 352) and other scholars on ES in Ontario explicitly frame Ontario’s complaints based system as one in which the state views workers and government officials as “collectively engaged in the protection of basic labour standards” and as active agents in making ES systems of legal recourse function.

While experiences of wage theft were common among the interviewees, also common were informal efforts to either prevent or address wage theft when it happened. David’s story of stolen wages is emblematic of many of the respondents’, as were his strategies of redress. Originally from Zimbabwe, David was working as a general labourer in construction and home renovations when he experienced wage theft. Having worked several short term jobs in housing renovation and low-rise residential construction, he explained,

I worked again for another guy renovating a house next to where my sister lives… He never asked me my [legal] status, [I] worked 1.5-2 months, mostly handiwork, installing drywall, so I had some skills now, painting, plastering, etc. $11 an hour—I asked for a raise but he said that was all he could give me. No contract—hours varied, some days 7, some days 10 if we needed to finish, other days 4 or 5 hours. no [overtime] pay… But this guy, I had a problem with him and I left before the end of the contract, the agreement was he would pay me every two weeks, but he wasn’t paying me. This went on for some time—sometimes he would owe me $1000 or $2000. It happened a bunch of times, finally one time I had to pay rent and I was owed for two weeks work and he said ‘I only have $400, will give you the rest next week’ and he didn’t pay, he owed me money, like $1000, and I had had it. I just walked off the job and said, that’s it, I’m out of here.

With no formal contract, no legal immigration status at the time, and no pay stubs to show he had been employed to recoup his wages, David felt he had no recourse but to confront daily his former employer: “It took me three weeks to get it back after calling him every day and exchanging words—I finally got paid.”

‘Miguel’ and his brother, from Nicaragua, found work in housing demolition in their late teens in central Toronto. They experienced theft or late payment by multiple employers in the first two years of work. On one contract, Miguel explained the lack of transparency about who the employer was, who was paying who, and what the terms of his employment were. In his words,

They [the real bosses] paid this guy, and that guy was our boss, I guess, I’m not really sure…We finished [the job] and then after the work was all done, he [the boss] left to [another country] on some vacation. It took him a long time to pay us….I think four or five months... For me and my brother, it was only $110 each. But he didn’t really pay us because before he went, we said: ‘Can we have our money’? He was kinda like, ‘No worries, no worries’… But after that, we called him again and again, and he wouldn’t answer. He would hang up, because he didn’t want to deal with us. After we called him [again], he said: ‘I’m in [another country] on vacation’, so he couldn’t… [So] we had to bug him, but then, one day, he came to my brother and gave him a check, so my brother gave me my part.

Daily phone calls, emails and surprise visits to confront with their former boss at a new worksite—often repeatedly—were common methods respondents employed to get wages owed.

As scholars have noted, in recent years, the responsibility of ensuring that a claim is legitimate has been shifted more generally onto workers’ shoulders since the passing of the Open for Business Act (OBA) in 2010 (Vosko and Thomas, 2014). It has deepened the relations of what Vosko et al. (2017a) call the growing ‘self-reliance’ of individual workers in these regimes, including the requirement to make their employer aware that they are contravening the ESA, or to try to solve the dispute with their employer themselves before they submit a complaint to the Ministry of Labour. This not only puts the onus on employees for getting paid, but as Thomas (2009) points out, it assumes that employees will have the capacity and power to represent their interests to employers on an equal footing with them (see also Vosko et al., 2017a). While the workers in this sample group would likely be deemed ‘vulnerable’ and, therefore, exempt from having to confront their employer prior to filing a claim, as we have seen, respondents already engage in the kind of worker-directed confrontation and deliberation required by the OBA. More than this, however, they engage in enforcement in the sense that workers here are not merely telling their boss they owe wages, but they are also engaging in targeted and sustained tactics which are intended to compel compliance from their employer.

Whether these forms of enforcement are the result of entrepreneurialization and growing trends towards the self-responsibilization of workers, or if they are a reflection of informalized and precarious conditions of employment in the trades, is perhaps worth considering. Not unlike construction more generally, the more casual sectors of renovations and construction often operate on brief, project-based production units which can mean short-term jobs and a high movement of workers between firms as different projects begin and end (Bosch and Philips, 2003; Rabourn, 2008; Doussard, 2013; Mills, 2017). Indeed, Carre and Heintz (2009) note that scattered worksites and high rates of turnover that are emblematic of construction make the enforcement of employment standards difficult. Construction is an emblematic ‘fissured workplace’ (Weil, 2014), where, as Mills (2017) notes, workers are scattered across many small building sites, siloed in different production units on a single site, or embedded in heavily subcontracted and varied employment relations that can distance them from each other and from their true employer. In the GTA, overlapping forms of mobility, ranging from precarious legal and work visa statuses, but equally importantly employer/workplace mobility, characterizes work in this sector (see Figure 1).

Figure 1

Sectoral, employment and legal precarity in informal construction and renovations work

Wage theft can be common for informal workers in the trades, but it is also noteworthy that theft often occurs across multiple employers and multiple jobs. Workers on average in the study had between one to five different employers over the course of a given year. This ranged from respondents such as ‘Yavor’, who had a single employer, a labour supply company, but who worked for several different contractors over the course of the year, to respondents like Pedro (Mexico), Louie (Greece), Nikhil (India), Teras (Ukraine), David (Zimbabwe) and Amor (Argentina), who worked casually in the year of our interview for different employers on jobs ranging in duration from two weeks to six months.

Renovations and residential construction firms in both the US and Canada tend to be highly decentralized (Rabourn, 2008), with the sectors in these countries being populated by large numbers of small-scale contracting firms. Their multisite operations, which are both mobile and short-term compared with more geographically fixed sites for production such as manufacturing, make workers on such sites difficult to organize, and enforcement of labour standards challenging (Carre and Heintz, 2009; Doussard and Gamal, 2016; Juravich et al., 2015). Alongside this, employers in these tiers of construction can be difficult to hold legally accountable through the claims process; the success of an ES claim relies on the assumption that the employer will be both findable and financially solvent if the OLRB finds in favour of the worker and orders the payment of back wages. Yet, in this sample, it was not uncommon for workers to only know their contractors’ first name and their cellphone number; these were often very small enterprises with fewer than five employees, whose contact with workers is when they pick them up and drop them off in a van, and who often operate without a bricks and mortar company address. For example, when Pedro was asked if he knew his colleagues, he said he didn’t know their names or countries of origin, nor did he even know his boss’s full name. In his words, “I didn’t even know his [the employer’s] name. He just said his name is Jorge.”

Additionally, the dynamics of financing and payment within the subcontracting chain often adversely affects smaller subcontractors—especially those with five or fewer employees. Small contractors may be less able to pay on time because they are poorly capitalized (Mildren, 2017; see also Vosko, Noack and Tucker, 2016: 57) or as subcontractors they may be particularly vulnerable to not getting paid on time by the main contractor when cash flow issues or disputes over work completed arise between contractors higher up the chain. Moreover, the possibility that the employer will file for bankruptcy or place their commercial entity in liquidation is a risk in the construction sector. Across Canada, this industry has consistently shown high rates of bankruptcy claims; in one study of claims lodged between 2005-2008 (which, notably, tracked claims before the global financial crisis), construction posted the highest number of proposals for bankruptcy protection out of any other sector in the country (Sarra, 2009).

The results of workers’ informal enforcement tactics were mixed. Most directly, they were not always successful; in two cases, respondents chose to walk away, rather than spend more time trying to get their employer to pay wages owed. Some respondents recouping unpaid wages from their boss, meanwhile, emphasized the sheer amount of effort and time involved day after day; this meant taking productive time out of the workday that respondents might otherwise have been working on another contract or securing a new job. Even a successful outcome is eroded when one considers the labour time that must be spent simply to get paid. As Mirchandani et al. (2019: 351) note in the context of workers’ entrepreneurial management of the formal complaints process, “[t] here is little emphasis on the unpaid labor, time and financial resources that accompanies engagement with continuous learning [about Ontario’s complaints system].” They emphasize that within Ontario’s complaints-driven system, burdening workers with the management of an ES claims process becomes “seen as natural and necessary” (ibid.). While Mirchandani et al. (2014) rightly point to the unpaid labour that workers shoulder, we might also consider that this enforcement work carries costs for workers if this work gets in the way of paid jobs or lost time sourcing new employment opportunities, and thus lost worker wealth even in cases where wages are eventually paid.

Would there have been better outcomes if workers had pursued an ES claim through legal channels? What are the opportunities and barriers informal renovation and construction workers might face in doing so? We turn now to explore these questions through a review of the formal ES claims process and recent case law. We consider the accessibility of the claims process to this group of workers focusing on three factors: informal contracts, precarious legal status and employment and subcontracting practices in casual construction. What is highlighted in the next section is that, in practice, the ES claims system can burden informal workers with additional forms of “entrepreneurialized” labour.

Burdens of the law: documentation and securitization in informal workers’ wage theft claims

In Ontario, complaints of wage theft in the form of ESA violations are heard by the Ontario Labour Relations Board (herein the OLRB or ‘the Board’), which is charged with addressing breaches of the Employment Standards Act. The process for submitting a claim to the ESA is relatively straightforward (see Figure 2). The process for claiming is exempt for those who are represented by a union already, or who have already filed a claim through the courts.

Figure 2

How to file an ES claim in Ontario

Generally, conditions of informalized employment where there is no written contract or formal records of pay—as in the cases of respondents such as Amor, Manish, Kimani, David and others—is not technically a barrier to recouping wages through an ES claim. Handshake deals or cash-only arrangements are eligible for consideration by the OLRB. Under the ESA (Sections 15-16), the burden of proof is squarely on the employer to produce and retain records of employment, including hours worked and payment (see also Mirchandani et al., 2019).

The case law appears to corroborate this. If an employee makes a claim and the employer puts forward no evidence, the Labour Relations Board may accept the evidence as put forward by the worker as long as it is credible and not contradicted by other evidence (for example, see cases Zhi Dai v. HK Wong’s Palace Restaurant Inc. 2016; City Petroleum Inc. vs. Toor 2003; and 625041 Ontario vs. Melegh, 2007). In 1284316 Ontario Ltd. v.Malyugin 2009 for example, the employee had no formal proof that he had been working for the company in the form of pay stubs or a federal income tax form. Instead, he presented the OLRB with a copy of his personal calendar to prove he had worked hours he was not paid for, as well as information about wage rate and pay schedule as discussed with his employer. From the case proceedings:

Malyugin testified that Sentra [employer’s company] was always late in paying its employees and provided copies of cheque stubs which indicated that there was not a regular pay period and that payment for wages often occurred 6 weeks after the pay period. Malyugin testified that he became frustrated that he was not being paid and provided the company with two weeks’ notice of his resignation.

The employer, meanwhile, was not present and offered no evidence during the case. As a result, the Board accepted the employee’s explanation and he was awarded lost wages (see also 625041 Ontario vs. Melegh, 2007). Within the case law, this appears to be a similar fact pattern to claims made by other informal workers. In Harper v. Everyday Maintenance Ltd. 2007, there was a verbal contract but no formal written contract or paper trail proving payment. In lieu of this, the employee presented as evidence his personal agenda in which he had transcribed his and his colleagues’ logbooks. The employee had also even provided the Board with recordings of phone calls with the employer—which is legal in Ontario provided that one party is aware of the recording—and which were in fact considered by the Board as evidence. The Board determined that the employee’s claims were probably inflated, but the Board still accepted it as partially true, and had to estimate the amount of overtime pay that would be awarded to the employee.

Similar to the absence of a formal contract, the lack of legal status to work and live in Canada does not legally preclude a worker from filing an ES claim; indeed, that the ESA itself contains no provisions that explicitly articulate that the ESA applies only to some workers—such as Canadians and permanent residents, for example—is noteworthy. Case law in Ontario, meanwhile, has not ruled that a worker’s legal status should have any bearing on their right to contest wage theft. On the issue of whether workers without legal status to work and live in Canada can unionize, the case law has taken a similar tack; in Impact Demolition Services Ltd, [1998] for example, the OLRB determined that someone employed in contravention of the Immigration Act would still covered by the Labour Relations Act and be eligible to unionize or join a union (for a more extensive review of this case, see Bihari, 2011). Similar rulings have been made, and upheld, regarding unauthorized workers’ access to Workplace Insurance through the Workplace Safety and Insurance Board (WSIB) (2016 ONWSIAT 51; upheld in 2016 ONWSIAT 2845).

Bihari (2011) demonstrates this in detail. Drawing from Bihari’s discussion of Apollo Real Estate 1994, the employer argued the ESA only applies to citizens, permanent residents and those who have valid work permits. The adjudicator, however, determined that she did not have the jurisdictional authority to enforce immigration law, and that the ESA doesn’t explicitly suggest such limitations. However, as many scholars have noted, even if precarious legal status has no de jure bearing on workers’ rights, it is most certainly a major de facto barrier to workers accessing rights and entitlements. As scholars rightly highlight, there are major barriers posed by a complaints-based process in which workers with precarious legal status may not wish to make an ES claim or confront their employer because they fear their boss will report them to immigration authorities in retaliation (Noack et al., 2015). Studies to date have highlighted the reluctance of workers who are unauthorized to work legally to come forward and report employer misconduct. Dewhurst (2014: 5), for example, suggests that unless unauthorized migrants are totally insulated from prosecution under immigration law, their protection under employment law to back pay will inevitably be limited (see also Fussell, 2011).

It is notable, however, that the majority of the workers in this study were not ‘unauthorized’; some were asylum claimants awaiting a decision on their claim, several were on a one-year work visa, and others had come to Canada on a two-year ‘working holiday’. Regardless, temporary legal status did seem to have an important effect on workers’ access to formal legal assistance; as newcomers to Canada, interviewees generally pointed to their lack of knowledge about legal channels for assistance, their general feelings of having to be self-reliant and being legally precarious despite being authorized to work. Despite being given legal authorization to work, this latter point highlights how, in Canada, short-term work visa status erects institutional barriers between workers and the agencies that could connect them to civic supports for workers’ rights or better jobs. After experiencing wage theft, Pedro, on a temporary work visa, said when asked which supportive organizations he turned to for workplace assistance,

I went to COSTI – a settlement agency. They told me I’m not a resident, I’m not a citizen, I’m just a worker [on a one-year work visa], so I don’t have the right to get any support or any services from them. I think that’s why I quit looking for [other, better] jobs because [they] told me that and Employment Toronto told me the same. Ontario Employment told me the same. Because my SIN starts with ‘9’ I don’t have any right [to access their services].

It is perhaps no surprise then that newcomers with temporary legal status may not access channels like the OLRB because they either assume, or are told, that they are excluded from accessing state-funded programs of support and advocacy more generally.

The responsibility that the ESA places on employers to keep records of employment and the pay of employees, and the capacity of the OLRB to consider claims made by workers without a formal contract or pay record are both notable. However, Mirchandani et al. (2019) demonstrate the significant documentary burden that accessing the claims process places on workers across a range of sectors, including filling out complex paperwork and submitting existing paystubs. They note that, particularly for workers in the study without a formal contract or pay records, the failure to submit a claim to the OLRB “…was often not because of a lack of desire or skills that workers were unable to provide documentary proof to support their complaints, but rather because employers did not comply with workers’ requests for such proof” (ibid.: 355). The case law suggests that, for an informal economy worker to take advantage of the ES claims process, they must engage not only in submitting documentary evidence of their employers’ transgressions, but also in producing that evidence—sometimes going to extraordinary lengths to do so, for example, by recording telephone calls. Thus, despite employers’ legal responsibility to document employment and pay, in practice, the responsibility of documenting accurate employment histories and establishing ES violations to the courts falls squarely on the shoulders of informal workers. The magnitude of this burden would also be contingent on the kinds of wage agreements in the employment relationship; in cases where a worker is paid a flat day rate, and theft varies from day to day depending on the length of the working shift, the documentation of theft for the worker could become especially complex and onerous.

Furthermore, it is important to note that in the case law, the purpose of workers producing documentary evidence to the Board is not to prevent wage theft; it merely serves to place the worker in a better position to successfully pursue their wages when they are stolen. Despite being systemically more vulnerable than formal sector workers with stable employers, non-precarious legal status and formal contracts, informal workers in this study are not provided with additional layers of security and protection by the state. On the contrary, they must disproportionately self-securitize and self-protect precisely because they are more vulnerable to irrecoverable wage theft. In conjunction with recent critiques that the ES complaints process as it currently stands does nothing to prevent theft from occurring in the first place (Vosko and Thomas, 2014), I suggest that Ontario’s claims system codifies theft into the employment relation for informal workers in this sector. This is because the documentary burden requires informally-employed ES claimants to operate from the outset as documentary participants in ES violations, in some cases taking detailed notes of employment violations as they occur. The proactive tracking and recording of employment and pay details ‘just in case’ requires a worker to assume from the outset that theft will occur. By recording and detailing theft over time, an informal worker must become an effective participant in the theft of their wages in order to both accurately establish the terms and scope of theft and, more importantly, to stand any chance of being successful in the Board’s adjudication process. I suggest that self-securitization is a key dimension of the individuated entrepreneurialism that Mirchandani et al. identify. I posit that this is connected to, but distinct from, neoliberal entrepreneurialism as a set of orientations and actions aimed at constant improvement of one’s working conditions or the individualized pursuit of self-advancement or social mobility (see Freeman, 2014; Gooptu, 2009; c.f. Mirchandani et al., 2019). This is because the purpose of documentation is not to improve one’s working conditions but to secure oneself against permanent losses.

Conclusions

In this article, I have explored the experiences of informal home renovation and construction workers in combatting wage theft. While this group of respondents is not necessarily a representative sample of the whole informal construction workforce in Ontario, the nearly universal prevalence of one or more wage-related ESA violations in their testimonies may provide some indication of the pervasiveness of wage theft in more casualized forms of employment in these sectors. It also corroborates other studies in the Ontario context (Kilibarda, 2015; Vosko et al., 2017a; Mills, 2017). As these scholars have shown in detail, respondents in this study are among Ontario’s most vulnerable workers—they frequently have precarious legal status, no fixed employer or formal contract, they work in a sector that operates on short- to medium-term projects, and their sector is subject to acute boom/bust cycles and contractor insolvency. The pervasiveness of theft, meanwhile, has meant that these workers often employed their own forms of casual enforcement to recoup unpaid wages.

What I have argued is that fighting wage theft through either informal or formal legal channels places additional and distinct burdens of entrepreneurial self-responsibility onto this group of workers. Workers who pursue lost wages informally must take on the enforcement responsibilities of the state, while those pursuing claims formally must often shoulder the documentary burdens of the employer. Secondly, in teasing out the informal relations of theft and the opportunities for recouping wages, I have argued for the importance of sector-specific analyses of vulnerability and the burdens of the law on particular workers. In informal renovations and construction, the production process, labour market, company size and dynamic nature of production that characterizes these sectors are crucial factors that shape these relations of theft and the prospects for theft prevention and justice.

Following Mirchandani et al. (2019) and Gleeson (2016), this article illuminates how the self-responsibilization of vulnerable workers can be found through attention to the everyday practices of theft that transect informal workplaces and workers’ responses to them. These burdens of recuperation are extra-legal, in the sense that they are not responsibilities dictated by provincial statutes. As Mirchandani et al. (2019) point out, moreover, these create additional labour that informal workers must often undertake no matter what channel for wage recuperation they choose to pursue. In responding to scholars’ call to look carefully at the “institutional forms” (Haughton and Peck, 1996: 319) that govern labour markets, this study underscores how decentralized, individuated strategies of enforcement and self-securitization are potentially a significant extension of the state apparatus which stands in for, and thus shores up, inadequate enforcement regimes and the protections granted by statutes like the ESA. Together, foregrounding these relations of securitization and enforcement are meant to advance understandings of the character and magnitude of individualized entrepreneurialization that informal workers in these sectors experience, and the responsibilities they bear to self-protect and compel employer compliance with the law.

Parties annexes

Acknowledgements

I would like to sincerely thank Leah Vosko and Alexandra Flynn for various conversations on this paper, as well as Sara Tatelman and Enbal Singer for their exceptional assistance in compiling figure data and in conducting background research on case law and provincial statutes. Any shortcomings or errors in this paper are the author’s own responsibility. This work was supported by the Social Sciences and Humanities Research Council of Canada [Grant #430-2013-001007].

Note

-

[1]

It should be noted that none of the respondents in this study were self-employed.

References

- Bihari, Luiz A. (2011) “Clashing Laws: Exploring the Employment Rights of Undocumented Migrants.” University of Toronto Faculty of Law Review, 69 (2), 10-31.

- Bobo, Kim (2014) “Wage Theft.” In: Johnston D. C. (Ed) Divided: The Perils of Our Growing Inequality. New York, USA: The New Press, p. 50-64.

- Bosch, Gerhard and Peter Philips (Eds.) (2003) “Introduction.” In: G. Bosch and P. Philips (Eds) Building Chaos: An International Comparison of Deregulation in the Construction Industry. London: Routledge, p. 1-23.

- Brown, William and Chris F. Wright (2018) “Policies for Decent Labour Standards in Britain.” Political Quarterly, 89 (3), 482-489.

- Buckley, Michelle (2018) “Between House and Home: Renovations Labor and the Production of Residential Value.” Economic Geography, 95 (3), 1-22.

- Carre, Françoise and James Heintz (2009) “The United States: Different Sources of Precariousness in a Mosaic of Employment Arrangements.” In: L. Vosko, M. MacDonald and I. Campbell (Eds) Gender and the Contours of Precarious Employment. London and New York: Routledge, p. 43-59.

- Dewhurst, Elaine (2014) “The Right of Irregular Immigrants to Back Pay: The Spectrum of Protection in International, Regional, and National Legal Systems.” In: C. Costello and M. Freeland (Eds) Migrants at Work: Immigration and Vulnerability in Labour Law. Oxford: Oxford University Press, p. 217-238.

- Doussard, Marc (2013) Degraded Work: The Struggle at the Bottom of the Labor Market. Minneapolis and London: University of Minnesota Press.

- Doussard, Marc and Ahmad Gamal (2016) “The Rise of Wage Theft Laws.” Urban Affairs Review 52 (5), 780-807.

- Fine, Janice R. and Jennifer Gordon (2010) “Strengthening Labor Standards Enforcement through Partnerships with Workers’ Organizations.” Politics and Society, 38 (4), 552-585.

- Fine, Janice R. (2011) “New Forms to Settle Old Scores: Updating the Worker Centre Story in the United States.” Relations industrielles/Industrial Relations, 66 (4), 604-630.

- Fussell, Elizabeth (2011) “The Deportation Threat Dynamic and Victimization of Latino Migrants: Wage Theft and Robbery.” The Sociological Quarterly, 52 (4), 593-615.

- Galvin, Daniel J. (2016) “Deterring Wage Theft: Alt-Labor, State Politics, and the Policy Determinants of Minimum Wage Compliance.” Perspectives on Politics, 14 (2), 324-350.

- Gellatly, Mary, John Grundy, Kiran Mirchandani, Adam Perry, Mark P. Thomas and Leah Vosko (2011) “’Modernising’ Employment Standards? Administrative Efficiency and the Production of the Illegitimate Claimant in Ontario, Canada.” Economic and Labour Relations Review, 22 (2), 81-106.

- Gleeson, Shannon (2012) Conflicting Commitments: The Politics of Enforcing Immigrant Worker Rights in San Jose and Houston. Ithaca, United States: Cornell University Press.

- Gleeson, Shannon (2016) Precarious Claims: The Promise and Failure of Workplace Protections in the United States. Oakland: University of California Press.

- Hardy, Tess and John Howe (2009) “Partners in Enforcement? The New Balance between Government and Trade Union Enforcement of Employment Standards in Australia.” The Australian Journal of Labour Law, 23 (3), 306-336.

- Haughton, Graham and Jamie Peck (1996) “Geographies of Labour Market Governance.” Regional Studies, 30 (4), 319-321.

- Juravich, Tom (2016) “A Year to Remember: Reviewing Labor Movement Highlights and Low-lights.” New Labor Forum, 25 (2), 80-87.

- Juravich, Tom, Essie Ablavsky and Jake Williams (2015) “The Epidemic of Wage Theft in Residential Construction in Massachusetts.” In: Center UAL (Ed) Working Paper Series. Amherst, Mass., p. 1-56.

- Kennedy, Elizabeth J. (2016) “Wage Theft as Public Larceny.” Brooklyn Law Review, 81 (2), 517-562.

- Kilibarda, Kole (2015) Constructing Toronto.Toronto: Toronto Workplace Innovation Group.

- Koenig, Biko (2018) “Economic Inequality and the Violation Economy.” Poverty and Public Policy, 10 (4), 505-523.

- Meléndez, Edwin J., M. Anne Visser, Nik Theodore and Abel Valenzuela Jr. (2014) “Worker Centers and Day Laborers’ Wages.” Social Science Quarterly, 95 (3), 835-851.

- Mildren, Kellie (2017) “Towards a Model of Third-Party Liability for Wage Theft: Lessons from Other Regulatory Regimes.” Canadian Labour and Employment Law Journal, 20 (1), 69-100.

- Mills, Suzanne E. (2017) “Fractures and Alliances: Labour Relations and Worker Experiences in Construction.” Labour/Le Travail, 80 (Fall), 13-26.

- Mirchandani, Kiran, Mary Jean Hande and Shelley Condratto (2019) “Complaints-Based Entrepreneurialism: Worker Experiences of the Employment Standards Complaints Process in Ontario, Canada.” Canadian Review of Sociology, 56 (3), 347-367.

- Noack, Andrea, Leah F. Vosko and John Grundy (2015) “Measuring Employment Standards Violations, Evasion and Erosion—Using a Telephone Survey.” Relations industrielles/Industrial Relations, 70 (1), 86-109.

- Pun, Ngai and Hullin Lu (2010) “A Culture of Violence: The Labor Subcontracting System and Collective Action by Construction Workers in Post-Socialist China.” China Journal, 64, 143-158.

- Rabourn, Mark (2008) “Organized Labor in Residential Construction.” Labor Studies Journal, 33 (1), 9-26.

- Ross, Andrew (2019) Stone Men: The Palestinians Who Built Israel, London: Verso.

- Sarra, Janis (2009) “Failure to Capture the Brass Ring: An Empirical Study of Business Bankruptcies and Proposals under the Canadian Bankruptcy and Insolvency Act.” Annual Review of Insolvency Law. Toronto, Canada: Thomson Carswell.

- Simpson, Patricia (2009) “Wage Theft in America: Why Millions of Working Americans Are Not Getting Paid--And What We Can Do about It.” Labor Studies Journal, 34 (4), 572-573.

- Srinivas, Smita (2008) “Urban Labour Markets in the 21st Century: Dualism, Regulation and the Role(s) of the State.” Habitat International, 32 (2), 141-159.

- Sung Hung-En, Sheyla Delgado, Deysbel Peña and Amalia Paladino (2013) “Tyrannizing Strangers for Profit: Wage Theft, Cross-Border Migrant Workers, and the Politics of Exclusion in an Era of Global Economic Integration.” In: D. Brotherton, D. Stageman and S. Leyro (Eds) Outside Justice: Immigration and the Criminalizing Impact of Changing Policy and Practice. Springer: New York, p. 247-267.

- Theodore Nik, Edwin J. Meléndez, Abel Valenzuela Jr. and Ana L. Gonzalez (2008) “Day Labor and Workplace Abuses in the Residential Construction Industry: Conditions in the Washington, DC Region.” In: A. Bernhardt, A. Boushey, L. Dresser et al. (Eds) The Gloves Off Economy: Workplace Standards at the Bottom of America’s Labor Market. Champaign, IL: Labor and Employment Relations Association, p. 91-110.

- Thomas, Mark (2009) Regulating Flexibility: The Political Economy of Employment Standards, Montreal and Kingston: McGill-Queen’s University Press.

- Vosko, Leah F. and Mark Thomas (2014) “Confronting the Employment Standards Enforcement Gap: Exploring the Potential for Union Engagement with Employment Law in Ontario, Canada.” Journal of Industrial Relations, 56 (5), 631-652.

- Vosko Leah F., John Grundy and Mark Thomas (2017a) “Beyond New Governance: Evaluating New Approaches to Employment Standards Enforcement in Liberal Market Economies.” In: C. Fenwick (Ed) Regulating for Equitable and Job-Rich Growth. International Institute for Labour Studies. Geneva: Palgrave/International Labour Organization, p. 63-90.

- Vosko, Leah F., John Grundy, Eric Tucker, Mark P. Thomas, Andrea M. Noack, Rebecca Casey, Mary Gellatly and Jennifer Mussell (2017b) “The Compliance Model of Employment Standards Enforcement: An Evidence-Based Assessment of its Efficacy in Instances of Wage Theft.” Journal of Industrial Relations, 48 (3), 256-273.

- Waren, Warren (2014) “Wage Theft among Latino Day Laborers in Post-Katrina New Orleans: Comparing Contractors with Other Employers.” Journal of International Migration and Integration, 15 (4), 737-751.

- Weil, David (2014) The Fissured Workplace: Why Work Became So Bad for So Many and What Can Be Done to Improve It. Cambridge, Massachusetts and London, England: Harvard University Press.

- Wells, Jill (2007) “Informality in the Construction Sector in Developing Countries.” Construction Management and Economics, 25 (1), 87-93.

- Workers’ Action Centre (2011a) Taking Action against Wage Theft: Recommendations for Change. Toronto, Toronto Workers’ Action Centre.

- Workers’ Action Centre (2011b) Unpaid Wages, Unprotected Workers: A Survey of Employment Standards Violations. Toronto, Toronto Workers’ Action Centre.

Liste des figures

Figure 1

Sectoral, employment and legal precarity in informal construction and renovations work

Figure 2

How to file an ES claim in Ontario

Liste des tableaux

Table 1

Some variants of wage theft among informal workers in the trades

ESA excerpts above taken from the Employment Standards Act 2000 (https://www.canlii.org/en/on/laws/stat/so-2000-c-41/latest/so-2000-c-41.html).

10.7202/1007636ar

10.7202/1007636ar