Résumés

Abstract

Pension fund capitalism is a new, albeit evolving, stage of Anglo-American capital market development. It is marked by the ability of pension funds to aggregate the widely disbursed ownership of beneficiaries and therefore act as single entities with a unified voice. Pension funds within their investment portfolios are increasingly using this voice to engage companies. Such corporate engagement in its broadest definition is the use of one’s ownership position to influence company management decision making. Corporate engagement brings together four distinct underlying currents: first, the increased use of passive index funds; second, the corporate governance movement; third, the growing impact of socially responsible investing; and, finally, the impact of new global standards. At its best corporate engagement offers a long-term view of value that both promotes higher corporate, social and environmental standards and adds share value, thus providing long-term benefits to future pension beneficiaries.

Résumé

L’influence des fonds massifs de pension actuels se fait sentir dans chaque marché financier de la planète. L’impact ne consiste pas en un « socialisme de fonds de pension » tel qu’envisagé par Peter Drucker, mais plutôt en un capitalisme reconfiguré (Clark 2000; Monks 2001). Loin d’une certaine timidité (Drucker 1976), les gestionnaires des caisses de retraite se servent de leur influence pour lier, et dans certains cas, défier d’une façon agressive la direction des entreprises dans lesquelles ils investissent. Ils le font ainsi afin d’assurer une valeur à l’actionnariat à long terme pour les futurs bénéficiaires. L’engagement corporatif de ce type représente un glissement de pouvoir au sein de l’entreprise partant des administrateurs pour aller vers les actionnaires et les gestionnaires des fonds de pension qui les représentent.

La lutte pour le contrôle de l’entreprise entre les propriétaires et les dirigeants a une longue histoire dans les écrits en droit et en économie (Roe 1994). L’émergence des entreprises publiques qui a été un trait dominant du 20e siècle s’est traduite par une dispersion des droits de propriété parmi de larges segments de la population. Pendant que la venue des entreprises publiques diffusait plus largement les bénéfices du capitalisme, les propriétaires abandonnèrent le contrôle de la prise de décision au niveau de l’entreprise au profit d’un groupe d’administrateurs professionnels qui géraient l’entreprise en leur nom (Berle et Means 1933). Cependant, les fonds de pension actuels déplacent les responsabilités de la prise de décision au sein de l’entreprise. Cet essai analyse ce déplacement de pouvoir et les quatre forces principales qui sont les catalyseurs de l’engagement corporatif des fonds de pension. Ces derniers réunissent en un tout les détenteurs d’actions auparavant dispersés au sein de concentrations de propriété inégalées depuis les grands industriels du 19e siècle. Nous soutenons que les fonds de pension se servent de cette concentration du pouvoir des actionnaires et des coûts plus faibles de transaction qui en résultent pour s’impliquer activement dans la gestion des entreprises en exigeant de meilleurs critères de gouvernance corporative, tels l’imputabilité et la transparence, dans les entreprises dans lesquelles ils investissent. Le terme retenu ici pour décrire ce nouveau phénomène est l’engagement corporatif et cet article tentera de décrire en détail son développement.

L’engagement corporatif dans son acception la plus large consiste dans le recours à une position de propriétaire en vue d’influencer la prise de décision des directions d’entreprises. Il réunit quatre courants sous-jacents et distincts dans le processus d’investissement global des fonds de pension. Dans cet essai, chacun des moteurs de l’engagement corporatif est interpellé. Nous analysons l’usage croissant des fonds indiciels passifs par les gestionnaires des fonds de pension. Nous constatons que la gestion indicielle engendre une incapacité chez les fonds de pension à expulser les entreprises dont on est insatisfait. Cet enfermement crée une tension entre ces dirigeants financiers qui proposent une approche à main levée dans les décisions d’investissement et ceux qui souhaitent voir le pouvoir de marchandage de leur capital de retraite utilisé d’une manière socialement orientée, un pouvoir qui façonne les effets du marché. Chez ce dernier groupe, il devient une prise de conscience accrue de leur part des normes, de l’imputabilité et de la transparence des entreprises dans lesquelles ils investissent.

La section suivante de cet essai traite du mouvement de régie de l’entreprise qui agit à titre de deuxième moteur de l’engagement corporatif. Ce phénomène, qui prend de l’ampleur depuis le début des années 1980, se préoccupait au départ des enjeux des conseils d’administration et des structures de régie des entreprises, tels que le rôle des directeurs indépendants, la rémunération des administrateurs plus vieux et le recours aux pilules empoisonnées. De nos jours, la gouvernance d’entreprise s’en prend à des sphères beaucoup plus larges de la transparence et de l’imputabilité à l’échelle de l’entreprise.

La troisième section de cet article s’intéresse à l’influence croissante de l’investissement socialement responsable sur l’engagement corporatif des fonds de pension en y ajoutant un regard sur les normes sociales et environnementales du comportement de l’entreprise. Ce moteur s’est développé comme un effet de la législation britannique de divulgation récemment introduite sur l’investissement responsable et à partir des préoccupations des fonds de pension à l’endroit de la valeur de l’équité de leurs investissements en longue période.

La quatrième section de cet article analyse l’influence de la mondialisation des marchés de capitaux associée à l’émergence des normes sociales, internationales et environnementales de comptabilité sur l’engagement corporatif des fonds de pension. Dans cette section, on se demande si une telle mondialisation de la finance détermine la marge de manoeuvre disponible chez les États-nations et chez les entreprises particulières. Enfin, nous constatons que la terminologie de l’engagement corporatif est inadéquatement précisée et bénéficierait d’une plus grande clarté et d’une meilleure compréhension de ses expériences à ce jour. Pour le moment, un tel engagement corporatif peut aller de simples discussions avec les directions et des votes par procurations jusqu’à des approches plus litigieuses telles que des campagnes croissantes de résolutions par des actionnaires dissidents, le retrait public d’entreprises, voire l’exclusion de pays entiers du portefeuille d’investissement des fonds de pension (une décision récente et litigieuse de Calpers).

Alors que l’engagement corporatif partage ces approches avec les investisseurs socialement responsables, une première préoccupation des fonds de pension demeure la valeur de l’équité de l’entreprise à long terme. C’est pourquoi l’engagement corporatif n’exige pas de l’entreprise qu’elle renonce à une rentabilité à long terme, mais il demande plutôt d’élever les normes en vue de réduire le risque avec le temps. Il se sert d’outils déjà à la disposition des propriétaires au sein de la structure organisationnelle et se présente comme une revendication des droits des propriétaires d’établir les normes de comportement d’une entreprise. Cet article aborde les moteurs de l’engagement corporatif de même que ses cibles dans un effort de mieux comprendre l’engagement corporatif et sa capacité d’affermir le capital dans certaines collectivités, de civiliser les pratiques de gestion des ressources humaines à l’intérieur des entreprises et d’encourager le respect des normes du travail et de l’environnement à l’échelle domestique et internationale.

Resumen

El capitalismo de los fondos de pensión es una nueva fase, aunque en evolución, del desarrollo del mercado de capital anglo-americano. Este está marcado por la habilidad de los fondos de pensión de congregar los titulos de propiedad ampliamente dispersos de los beneficiarios y así actuar como entidades individuales con voto unificado. Los fondos de pensión dentro de los portafolios de inversión están usando cada vez más este voto para comprometer las compañías. Tal compromiso corporativo en su definición mas amplia es el uso de la posición de un propietario para influenciar la toma de decisión de la dirección de la compañía. El compromiso corporativo provoca a su turno cuatro distintas corrientes subyacentes: primero, el uso incrementado de fondos a indice pasivo; segundo, el movimiento por un gobierno corporativo; tercero, el impacto creciente de la inversión socialmente responsable; y finalmente, el impacto de nuevos estándares globales. En el mejor de los casos, el compromiso corporativo ofrece a largo plazo una visión del valor que promueve estándares corporativos, sociales y ambientales, mas elevados y también agrega valor compartido, proporcionando así, a largo plazo, beneficios para los futuros beneficiarios de pensiones.

Corps de l’article

This article interrogates pension funds’ use of corporate engagement to challenge the corporate, social and environmental standards of the firms in which they invest. It seeks to understand the underlying drivers of this phenomenon in order to gain a deeper understanding of the potential impact of corporate engagement on firms’ decision-making and long-term performance.

The influence of today’s massive pension funds is being felt in every capital market in the world. The result is not the pension fund ‘socialism’ envisioned by Peter Drucker, but rather a reconfigured capitalism (Clark 2000; Monks 2001). Far from timidity (Drucker 1976), pension funds are using their influence to engage and, in some cases, aggressively challenge the management of corporations in which they invest. They do so in order to ensure long-term shareholder value for future beneficiaries. Corporate engagement of this kind reflects a power shift within the firm away from managers and toward shareholders and the pension funds who represent them.

The struggle for corporate control between owners and managers has a long history in the legal and economic literatures (Roe 1994). The rise of public corporations that dominated the 20th century meant a dispersal of ownership rights across large segments of the population. While the advent of public corporations spread the benefits of capitalism more broadly, owners surrendered control of firm-level decision making to a cadre of professional managers who administrated the firm on their behalf (Berle and Means 1933). Much academic work focuses on firm-level decision making, examining the components of the production function, the impact of location, sunk costs, and path dependence on such decisions. Within this framework, managers are assumed to be the dominant actors in the decision-making process with the owners’ role reduced to that of capital providers awaiting the pay-off of managers’ decisions.

But today’s pension funds are shifting decision-making roles within the corporation. This article examines that power shift and the four central drivers that are the catalysts of pension fund corporate engagement. Pension funds re-aggregate previously dispersed shareholders with concentrations of ownership unseen since the great industrialists of the 19th century (Clark 2000; Davis and Steil 2001; Hawley and Williams 2000; Monks 2001). We assert that pension funds are using this concentration of shareholder power, and the resulting lowered transaction costs, to actively engage company management in order to raise firm-level standards of behaviour across a range of issues, including, accountability, transparency, and social and environmental standards. The term employed herein to describe this new phenomenon is corporate engagement and this article will describe its development in more detail.

We use qualitative methods to develop our argument. We combine an extensive literature review with in-depth interviews of both U.K. and U.S. pension fund trustees and managers as well as other knowledgeable industry players. Given the senior positions held by our interviewees we draw on the elite interviewing techniques developed by Gordon L. Clark (see Clark 1998 for an in-depth review of elite interviewing styles). These interviews are further augmented by extensive internal document reviews in order to develop a grounded theory of pension fund corporate engagement (for detailed description of grounded theory, see Strauss and Corbin 1998).

Corporate engagement in its broadest definition is the use of ownership position to influence company management’s decision making. It brings together four distinct underlying currents in global pension fund investing. Each of the drivers of corporate engagement will be interrogated in this article. We examine pension funds’ growing use of passive index funds. We find that passive indexing results in pension funds’ inability to exit firms with which they are dissatisfied. This lock-in creates a tension between those money managers who advocate a hands off approach to investment decisions and those who want to see the market power of their retirement capital used in a more socially-motivated manner, one that shapes market outcomes. For this latter group of pension fund investors, the result of indexing is an increased awareness on their part of the standards, accountability and transparency of the firms in which they invest.

The fourth section of this article deals with the corporate governance movement that acts as the second driver of corporate engagement. This phenomenon, growing rapidly since the early 1980s, initially focused on issues of boards of directors’ and the governance structures of the firm such as the role of independent directors’, senior management compensation, and the use of poison pills. Today corporate governance tackles much broader areas of firm-level transparency and accountability.

The fifth section of the article looks at the growing impact of socially responsible investing (SRI) on pension fund corporate engagement with a focus on the social and environmental standards of firm-level behaviour. This driver developed both as a result of the newly introduced British SRI disclosure legislation and out of pension funds’ concerns for the long-term share value of their investments.[1]

The sixth section of the article examines the role globalization of financial markets combined with the rise of international social, environmental and accounting standards are beginning to have on pension fund corporate engagement. This section asks whether such globalization of finance dictates the scope of action available to both nation-states and individual firms. Finally we find that the terminology of corporate engagement is ill-defined and would benefit from greater clarity of its goals and understanding of its experiences to date. Currently such corporate engagement can range from quiet discussions with management and the voting of proxies, to more contentious approaches such as mounting dissident shareholder resolution campaigns and public removal of firms and even whole countries from the pension fund investment portfolio (a recent and contentious CalPERS’ decision).

While corporate engagement shares these approaches with socially responsible investors, a primary concern of the pension fund investor is the long-term share value of the company.[2] Therefore corporate engagement does not ask the firm to sacrifice long-term profitability but rather to raise its standards in order to reduce risk over time. It uses tools already available to owners within the corporate structure and represents a claim of the rights of owners to establish standards of firm behaviour. This article addresses both the drivers of corporate engagement and its targets in an effort to better understand corporate engagement and its potential to anchor capital in certain communities, civilize human resource practices within firms, and encourage compliance with labour and environmental standards domestically and internationally.

The Fifth Stage of Capitalism

While current financial markets continue to exist within a nexus of nation-state regulatory controls, they operate with global reach and global impact. In essence the financial system is in transition to a truly global market. While there appears to be tacit agreement among policy makers and the public more generally about the benefits of a global financial system, part of this understanding is predicated on a growing demand that international rules and standards of behaviour be established to serve a broader societal interest beyond simply those of financial elites (Stiglitz 2002). What differentiates these global demands from the national frameworks of the past is the inclusion of environmental and labour standards in addition to financial regulatory regimes. The impact of this transformation from a national to a supra-national configuration is a contested status for the proper arrangement of the financial system, simultaneously national and global in scope and scale.

Not only are we grappling with spatial change in financial markets, but we are also witnessing a change in the dominant actors within the system. We suggest this shift represents a new stage of capitalism, one in which institutional investors, more generally, and pension funds, more specifically, play the key role. Pension funds and other institutional investors aggregate shareholders’ interests within a broadly dispersed capitalist system, thus reversing the Berle and Means (1933) pattern of widely held ownership with declining shareholder power.[3] In addition to their ability to re-aggregate ownership patterns and their growing assets, pension funds increase their leverage within the financial system through a newfound willingness to act as owners both individually and in coalition with others. As a result, pension funds lower the transaction costs of intervening in the market that previously prohibited such action by owners. The result is pension funds and other institutional investors beginning to use their position to exert control over the corporations they hold in their portfolios.

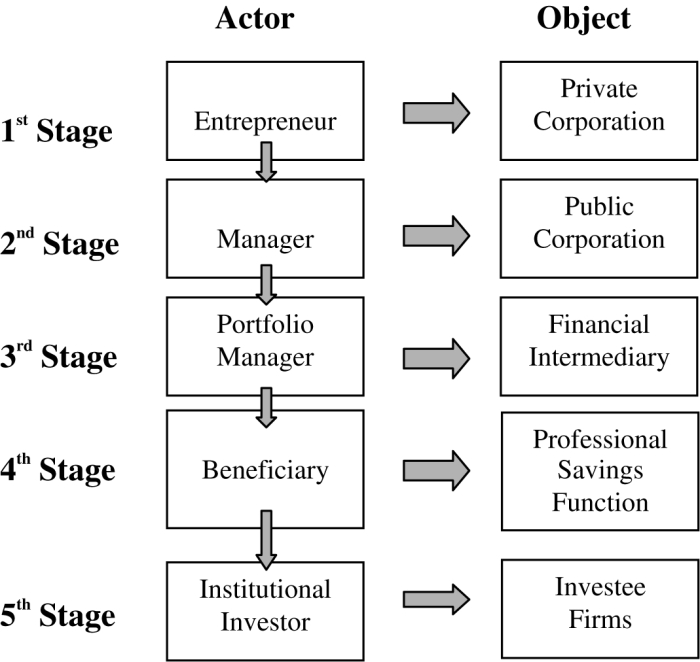

Robert Clark (1981) in his paper “The Four Stages of Capitalism” offers an interesting model to examine how capitalism has changed over time (see Figure 1 for our version of Clark’s stages of capitalist change). Clark’s four distinct phases of capitalism can be neatly traced through the last two hundred years of history. In the first stage the entrepreneur was the primary actor and the object of his activity was the private corporation. The second stage saw the professional business manager usurping the role of entrepreneur. The object of his attention was the publicly held corporation, ideas central to the Berle and Means analysis of the 1930s managerial economy.

The third stage of capitalism witnessed the ascendancy of the portfolio manager with the rise of financial intermediation in the capital supply chain. The fourth stage of capitalism, which emerged in the 1970s and 1980s, heralded the beneficiary as the principal actor and the professionalizing of the savings function as the object. Peter Drucker (1976) went so far as to call this stage the Unseen Revolution, positing such power in the hands of beneficiaries that he attached the term socialism to the new role they were to play. Each of these distinct stages procreates the next, with the object of action becoming the primary actor of the next generation. In the fourth stage, beneficiaries are the principal actor. For both R. Clark (1981) and Drucker (1976), these beneficiaries represent an era of ‘pension fund socialism’ with mass control of the financial system. But neither thinker fully articulates the mechanisms by which such dispersed ownership would act in concert.

Figure 1

The Five Stages of Capitalism

In contrast, we posit a fifth stage of capitalism, not one defined in terms of pension fund socialism, but rather in terms of pension fund capitalism. Our construct builds on Robert Clark’s model by offering deeper insight into the evolving nature of pension funds and the role they play in today’s financial system. Our aim, similar to Clark’s, is to provide a conceptual framework in order to better grasp the impact of these dominant players on the financial system. However, the purpose here is not to bring forward a set of statistical proofs drawn from quantitative data to back our claim of capitalism’s evolution. We argue that the fifth stage of capitalism is dominated by pension funds who represent broad share ownership, but who are in fact single industry players whose very presence in the market dwarfs and dominates the financial system (Clark 2000). Despite the envisioned ‘revolution’ articulated by Peter Drucker or Robert Clark, it is the inability of beneficiaries to sustain their role as central actors that marks the transition to the fifth stage of capitalism. Like the ‘silent majority’, it turns out beneficiaries are often referred to but seldom seen in the world of pension fund management.

If we think of the 19th and 20th centuries in terms of Clark’s four distinct stages of capitalism, we contend that the 21st century is witnessing a fifth stage in that evolution. This fifth stage of capitalism belongs to a single entity: pension funds that mediate beneficiaries’ future claims against the actions of firms today. Unlike the fourth stage of capitalism, the professionalized savings function of yesterday becomes today’s pension fund investors, whose decisions while taken in the interest of these same beneficiaries, are no longer controlled by them. In the fifth stage of capitalism, pension funds draw their power from their ability to aggregate the interests of broadly dispersed beneficial owners combined with their newfound ability to represent that interest through a single course of action. In the name of long-term share value, institutional investors are seeking increased control over firm-level decision making.

Corporate Control by Fifth Stage Capitalists

Control of firm-level decision-making by pension funds reverses the long-term trend of managerial control of the corporation first documented by Berle and Means (1933) at the beginning of the last century. They traced the wide dispersal of share ownership through publicly held corporations and demonstrated that this ownership structure effectively transferred control of decision-making to managers. The massive ownership power of beneficiaries identified in the fourth stage of capitalism nominally represents a shift in control of the corporation back toward shareholders. In reality, that power has only been felt recently in the fifth stage as beneficiary interests are re-aggregated through pension fund investors (Clark 2000; Davis 2002; Fung, Hebb and Rogers 2001; Ghilarducci 1992; Hawley and Williams 2000; Monks 2001).

Pension funds derive their power as central actors from their ability to represent large numbers of beneficiaries combined with their day-to-day control of investment decision-making. The object of their attention is the firm in which they invest in order to deliver future streams of revenue against which beneficiaries have a prior claim. In essence this means that stage five capitalists are value investors who derive long-term share value from the fundamentals of the firm rather than through the growth of the stock or sector. What differentiates these investors from the earlier stage four as envisioned by Robert Clark is that they not only seek out firm fundamentals as the key driver of future growth, but in addition are beginning to bring their influence to bear on firm-level standards and management oversight in order to ensure these fundamentals are maintained when faced with the uncertainty of future events.

Beneficiaries’ ownership power allows pension funds to lower the transaction costs of monitoring firm behaviour and taking subsequent action. In the past, the costs associated with corporate engagement, when measured against the possible gain in share value, meant that few individuals were willing to take on company management no matter how dominant shareholders were deemed to be in theory (Coffee 1997). Corporate engagement, as with so many socially desired outcomes, suffers from the free rider problem. Action undertaken by one shareholder benefits all shareholders if the result of such conduct is a rise in share prices. Because today’s pension funds hold such large stakes in individual firms, they are able to either bear these costs alone or, more often, act in coalition with other pension funds. The result is that corporate engagement has become a more potent force than in the past (Becht and Mayer 2001).

What further separates pension fund investors from the earlier third and fourth stage portfolio managers is the long-term decision-making time frame necessary to realize retirement claims. Stage three and four capitalists were defined by their ability to use financial intermediaries and capital market instruments that prized liquidity above control (Coffee 1991). While these market-mechanisms no longer required in-depth knowledge of their traded securities, the rise of pension funds as the central drivers of the system removes this intermediation. The long-term temporal nature of their investment decisions require stage five capitalists to have greater information than their predecessors about the underlying fundamentals of the firms in which they invest. As value investors, they are also required to hold these securities in their portfolios for longer periods of time in order to realize gains in shareholder wealth.

Added to the temporal requirements of pension fund management is the spatiality of today’s pension funds in capital markets. Clusters of nation-states, particularly within the Anglo-American axis, have large pools of capital no longer anchored solely in the nation-states of the pension fund beneficiaries, but rather roaming the world in search of both portfolio diversification and increased rates of return (albeit with higher associated risk). Stage five capitalists are caught between the nation-state rule-setting that so heavily influences pension fund regimes and the supra-national flows of pension fund capital in a global financial market (Clark 2003).

In addition to the spatiality of capital flows, we also find the enormous size of today’s pension fund capital pools denies them the ability to exit from firms in which they are invested even in the face of dissatisfaction with firm performance (Coffee 1991, 1997). Pension fund managers must continue to hold firms in their portfolios either because they are part of a passive market index or because their size of ownership would erode share prices on exit. As a result, pension funds are increasingly resorting to voice in order to influence investee firms and ensure long-term shareholder value for beneficiaries (Hirschman 1970). The use of voice over exit that results from the increased use of passive indexes by pension funds is a key driver of pension fund corporate engagement. Figure 2 for example demonstrates the massive increase of holdings of U.S.-based defined benefit pension plans in passive index funds over the 1990s. This increase in passive index holdings has been parallelled across the Anglo-American pension fund world. The result is a use of voice over exit that as a form of corporate control represents a further departure from fourth stage capitalism in the relationship between the actor and object acted upon (Kostant 1999).

Figure 2

Impact of Indexing

The Long-Term versus Short-Term Debate

Through most of the 1990s, the bull market roared through the Anglo-American financial system, reinforcing the myth of the ‘new economy’ and its attendant stock market riches. In the face of the collapsing stock market bubble, there remains considerable debate as to the impact of the ‘new economy’ on global productivity and wealth as articulated by Jorgenson (2000) and Shiller (2000). Regardless of the outcome of this debate, the 1990s witnessed the impact of huge pension fund investors active in financial market decisions. While the power and potential influence of pension funds was present through the boom, for the most part pension fund trustees and money managers used their market position in very conventional ways. These approaches, which reflected the prevailing wisdom of the decade, have subsequently been seen to favour short run stock prices at the expense of long-term value (Romano 2000).

Indeed, beginning with the collapse of the TMT stock bubble in 2000 and the corporate governance scandals of 2001 and 2002, we are starting to see a potentially seismic shift in Wall Street’s ‘conventional wisdom’, a shift partially driven by pension funds’ need for long-term value. This shift in conventional wisdom is marked by three changes in investment behaviour. The first is a shift in investment style away from ‘growth’ and toward ‘value’ investing. The second is increasing awareness among pension fund investors about their apparent short-term myopia and the prospects for a longer-term investment horizon necessary to realize increased share price from ‘value’ investing. The third change is a return back to active investment management over passive investment strategies. All three investment strategies require both the need to seek firm fundamentals that deliver value over time, and a lengthening of investment time horizons in order to realize equity premium increases over the long run.

Higher standards of accountability, transparency, and social and environmental behaviour are all core firm-level fundamentals receiving more attention from pension fund investors in the post-Enron, post-WorldCom business environment. Seeking these firm-level attributes in a period of low equity premiums runs directly counter to much of the short-term myopic behaviour exhibited by pension funds in the 1990s. In fact some say pension fund managers’ tendency toward short-term investment stands in direct contradiction to the long investment period necessary to realize gains from high standards of corporate behaviour. It is well documented that pension fund managers measure performance on a quarterly basis and trade aggressively in the face of small short-term declines even when these declines are associated with long-term firm-level improvements. In his recent paper “Bubbles, Human Judgment and Expert Opinion”, Robert Shiller (2001) eloquently chronicles the herd-like, short-term instincts of pension fund managers who continued to invest in the TMT bubble in 2000, even in the face of the findings that he had previously detailed in his book Irrational Exuberance (2000). Shiller argues that in the current period of expected low equity premiums, pension funds need to focus on underlying fundamentals in their investment portfolio, and lengthen the time horizons necessary to achieve positive equity return.

We believe that pension fund managers must inevitably be concerned with both short-term returns, as part of the benchmarking process fundamental to fiduciary duty, and long-term value, as expressed through raising firm-level accountability, transparency, social and environmental standards.[4]

There is a considerable body of research that finds Anglo-American pension funds to be dominated by short-term, myopic investors whose impatience often erodes share value (Bushee 1998; Romano 2000; Shleifer and Vishny 1988). Pension funds’ tendencies toward short-termism are not simply hallmarks of the Anglo-American financial system. Becht and Mayer (2001) examined corporate control in Europe and concluded that given the myopic tendencies of pension fund investors, only projects with short-term realization periods benefit from market control of firms, while projects with long realization periods benefit from management control of firms. But many of these findings are based on short-term examinations of stochastic shocks measured around specific corporate announcements rather then examinations of pension fund investment behaviour over longer time horizons (Bauer and Gunster 2003).

We contend that many of today’s pension fund investors are in fact lengthening their investment time horizons (Davis 2002; Monks 2001), contrary to the view of some observers (Miles 1993; Poterba and Summers 1992). This conclusion is reinforced by studies that demonstrate pension funds value long-term investment in research and development as well as other capital expenditures (Jarrell, Lehn and Marr 1985; Levis 1989; Marsh 1990; McConnell and Muscarella 1985). While pension fund managers will continue to use quarterly benchmarks as measurement of short-term gains, fifth stage capitalists, contrary to a decade ago, are beginning to favour both control and liquidity in their portfolios. Control is added to, rather than replacing, liquidity. (For a detailed examination of pension funds’ tendencies to act as ‘lone wolves’ in the last two decades, see Coffee 1991).

During the extraordinary rise of the bull market, active fund managers found they could not outperform the market as a whole. The message to pension funds was to move away from active fund management with its additional costs, and toward passive management that mimics major stock market indices. With Standard and Poor’s average annual returns of seventeen percent through the 1990s, most pension funds were happy to oblige. This change from active to passive portfolio management marks a shift away from the ‘value’ style of investing with its detailed investigation of each firm’s fundamentals, toward the ‘growth’ investment style that depends on sector and company future expectations of productivity advances. Predictions of a Dow Jones Industrial Index at 36,000 fueled the belief that such index driven growth was possible (Glassman and Hassett 1999).

Interestingly, as increasing amounts of pension fund capital made its way into index funds in the 1990s (see Figure 2), there was a both a simultaneous pull away from the active investigation of firm-level fundamentals, and a corresponding drive toward increased pension fund corporate engagement. While seemingly paradoxical, pension funds found the lack of liquidity that resulted from their passive market investments meant the ‘Wall Street walk’ was unavailable when they became dissatisfied with corporate performance.

Albert O. Hirshman’s (1970) seminal work Exit, Voice and Loyalty assumes that when exit is no longer an option, individuals and organizations turn to voice, or as Robert Monks said, “If you can’t sell, you have to care” (Monks 2001). The result of the illiquid holdings of large and powerful pension funds, particularly public sector funds,[5] forced many pension funds to seek ways of influencing management decision-making particularly in under-performing firms within their indexed holdings. In the United States coalitions of institutional investors, most notably the Council of Institutional Investors (CII), began to play a key role in using tools such as corporate governance to improve returns of under-performing companies from which they could not exit.

Corporate Control through Corporate Governance

Within the corporate governance debate, shareholders are generally assumed to be widely dispersed and to hold primarily small minority ownership positions. Because they face high transaction costs, minority shareholders only infrequently act in concert. However, today’s institutional investors own over fifty percent of outstanding equity with pension funds controlling half of those assets. These investors exercise levels of corporate concentration unseen since the heyday of 19th century industrialists. While some theorists have grappled with the implications of the emerging power of new pension fund investors, most work on corporate governance has not yet recognized the potential impact of pension funds and other institutional investors on the standard behaviour of minority shareholders (for exceptions see Clark 2000; Coffee 1997; La Porta et al. 1998; Monks 2001; Monks and Minow 1995; Shleifer and Vishny 1997).

La Porta, Lopez-de-Silanes and Shleifer (1999) provide a map of corporate governance that allows us to understand how varying legal regimes shape diverse systems in different countries. For example, while Continental Europe has no common law standards of common care, it have evolved structures of mutual care that recognize the rights of stakeholders to a much greater degree than found in common law countries. In contrast, Anglo-American legal regimes continue to place shareholders as dominant actors within corporate governance structures. Beginning in the 1980s, pension fund investors’ focus on corporate governance marked a shift in Anglo-American corporate control away from managers and toward minority shareholders.

La Porta, Lopez-de-Silanes and Shleifer (1999) found most countries outside the Anglo-American common law tradition, did not replicate what Berle and Means (1933) described as a world of strong managers and weak owners. Rather, single majority owners hold power over firms “significantly in excess of their cash flow rights” (La Porta, Lopez-de-Silanes and Shleifer 1999: 471). Corporate control by equity-based pension fund investors is a product of two Anglo-American institutions. The first is large fully funded pension plans with their attendant massive capital pools and the second is the common law tradition that offers shareholder protection not provided in civil code regimes. Some fear that the drive toward more fully funded pension systems in Continental Europe will result in increased financialization of the European economy and further erode the role stakeholders have played in their economy in preference to shareholders’ rights (Engelen 2002).

Much of the discourse surrounding corporate governance concerns the divergence of management interests from those of owners within publicly held corporations (Roe 1994). The forty-nine country study of La Porta et al. (1998) found that some concentration of ownership position provides managers with incentives to work and owners with incentive to monitor (Jensen and Meckling 1976; Shleifer and Vishny 1986, 1997). Shleifer and Vishny (1997) state that “All these findings support the view that large shareholders play an active role in corporate governance” (p. 755). However further research indicates that ownership concentration at the five-percent level is most closely associated with increased profitability, while concentrations above five percent result in decreases in profitability (Shleifer and Vishny 1988, 1997). Interestingly, corporate ownership at the five-percent threshold is consistent with most pension plan investments, where government regulation often prevents higher ownership concentrations of each firm in the portfolio. At the five percent level of concentration, pension funds have some incentive to monitor and the results of their monitoring are equally shared with all owners (Faccio and Lasfer 2000).[6] When ownership concentrations exceed five percent the effects of monitoring tend to be captured for dominant shareholders’ exclusive use.

In the past, researchers examining the effectiveness of pension funds as corporate monitors identified the tendency of such funds to act as ‘lone wolves’. In the early 1990s this tendency toward isolation was seen as the major drawback to pension funds’ effectiveness as corporate monitors (Coffee 1991, 1997; O’Barr and Conley 1992). One of the significant changes between fourth stage and fifth stage capitalists is their newfound ability to work in coalition in order to affect the governance of their investee firms (Monks 2001; Strickland, Wiles and Zenner 1996). Such coalitions are possible because changes in securities laws allow for easier communication between shareholders and because transaction costs of both monitoring and coordinating responses have been lowered when measured against the increases in share value such activity generates. We predict that new coalitions of pension fund and other institutional investors will greatly increase their effectiveness as corporate monitors in the future.

Initial forays into corporate governance by some pension funds, particularly large U.S. public pension plans, were limited to issues of direct concern to shareholders. The separation of board chair from CEO, the use of anti-takeover poison pills by management, and executive compensation levels tied to performance were classic examples of pension fund capitalism exercising internal control on corporate decision-making (see Figure 3). These early corporate governance campaigns were strengthened in the U.S. by pension fund regulatory requirements to vote annual shareholder proxies as plan assets, reinforcing the concept of beneficial owners’ shareholder rights exercised through institutional investors (U.S. DOL 1994).

Once engaged directly with firms through corporate governance over longer time periods, some pension fund investors began making linkages between the underlying fundamentals of the firm, its day-to-day decision-making process and long-term shareholder wealth (Davis 2002; Del Guercio and Hawkins 1999; Kang 1999; Smith 1996; Strickland, Wiles and Zenner 1996; Wahal and McConnell 2000). Such increases in shareholder wealth as a direct result of corporate governance campaigns suggest that pension funds are indeed effective monitors of firm management behaviour.

Figure 3

Internal and External Control of the Firm

This conclusion contradicts findings by Bushee (1998), Duggal (1999), Karpoff, Malatesta and Walkling (1996), and Romano (2000) who argue that pension funds are ineffective corporate monitors. These studies focus primarily on short-term stock price changes around specific public targeted corporate governance events. These conclusions were based mainly on short-term price changes and volatility. Clearly, more work is needed in order to evaluate the links between long-term stock price changes and volatility and firm-level accountability, transparency, social and environmental standards, and the ability of pension funds to act as effective monitors in raising these firm-level standards.

We should expect to see greater awareness of the impact of corporate governance on long-term share value in the post-Enron, post-WorldCom financial environment. Between 2000 and 2002 it is estimated that investors worldwide lost half a trillion dollars through corporate irresponsibility from just eleven U.S. firms. Recent findings by Clark and Wojcik (2003) on German ownership concentration and the impact of corporate governance reinforce the theory that firm-level value is associated with strong corporate governance systems and monitoring and the availability of information to external investors.

Corporate Control and Socially Responsible Investing

While accountability and transparency within firms’ governance structures have tended to dominate the corporate governance debate, issues of corporate social responsibility (CSR) with an emphasis on the social, community, and environmental impacts of the firm, also play a role in determining investment fundamentals (Parkinson 1993; Smith 1990; Williams 1999). In contrast, many mainstream theorists contend that the unique legal structure of the trustee relationship, defined as fiduciary duty, limits pension funds from taking issue with broader community and social concerns (Langbein 1995; Posner 1981; Romano 1993). Increasingly there is debate as to the interpretation of pension funds’ use for the exclusive benefit of plan beneficiaries. It is argued that long-term corporate governance and social, and environmental standards are appropriate concerns for pension plans in order to ensure long-term returns to members and therefore fulfill rather than detract from their fiduciary duty (Collier 2000).

While it has always been acknowledged that shareowners have the right to determine the standards of Board behaviour, investor concern for non-financial attributes of the firm is a relatively new phenomenon. Previously, pension fund corporate engagement on broad social and environmental issues was limited to single issues such as the South African divestment campaign of the 1970s and 1980s. But pension fund investors are increasingly engaged in raising firm-level standards in much broader areas of social and environmental concern.

For many, the question at the heart of the CSR debate is in whose interests the corporation ought to be run? While some hold the view that firms ought to serve the broad interest of society rather than simply shareholders, even at a direct cost to themselves (Galbraith 1967; Nader and Green 1973; Sen 1985; Smith 1990), the new pension fund investors do not necessarily agree. Many pension fund investors argue that their greater regard for the long-term impacts of firm decision-making and increased corporate social responsibility reduces risk, adds share value, and in the long run serves owners’ interests better than short-term decisions based strictly on financial data.

The drive towards a deeper investigation of the underlying fundamentals of the firm lies at the core of both value investing and active fund management. This investing style argues that the market is inefficient and thus requires increased information flows between investors and firms to accurately assess the long-run value of the firm (Shleifer 2000). The current financial market circumstances of Enron, WorldCom and other corporate scandals have brought the need for greater mandatory information disclosure to the fore. Interestingly, it is not simply greater financial disclosure that is being called for, but also mandatory disclosure of social and environmental aspects of firm behaviour (Williams 1999).

Disclosure itself is an interesting tool that both ensures information in the financial market and serves to align corporate behaviour with public expectations (Williams 1999). In light of the loss of confidence in current financial markets, the public is once again demanding a more socially responsible role for today’s corporations, combined with greater disclosure of both financial and non-financial information. A 2002 survey by the Canadian research firm Environics polled twenty-five thousand individuals in twenty-five countries and found twenty-nine percent reported punishing companies because of poor social performance.[7]

Concern for social and environmental standards of firm behaviour is the third driver of pension fund corporate engagement. Unlike the second driver, corporate governance, this undercurrent extends the reach of owners into day-to-day decisions of the firm. However, while pension fund investors seek control to increase social and environmental standards, they are not acting solely in response to broad societal demands for corporate awareness of external stakeholders. Rather they adopt this course of action because increased social and environmental standards lower risk and uncertainty over the long run and hence have the potential to pay off for these investors over time. In fact, while corporate engagement and traditional socially responsible investing (SRI) utilize the same tools, each seek very different outcomes. Pension fund investors look for increased shareholder wealth within the traditional corporate paradigm, while more traditional SRI seeks to make corporations more responsive to society as a whole rather than simply serving the narrow interests of shareholders. This dynamic tension within corporate engagement’s third driver requires further exploration.

In theory, conventional investment decisions are made on the basis of the expected risk-adjusted rates of return with the stream of future earnings embedded in current prices (Fama 1965; Houthakker and Williamson 1996; Samuelson 1980). But increasingly, it is recognized that the longer the time-horizon over which pension funds hold their investments, the higher the standards of firm must be in order to minimize risks in the future. Corporate control in the fifth stage of capitalism has therefore come to include social and environmental standards that previously were seen as extraneous investment criteria for most pension funds.

The use of non-financial measurement of social, ethical and environmental firm behaviour, known as socially responsible investing (SRI), was formerly the exclusive purview of small individual investors who wished to align their social values and morals with their investment behaviour (Brudney 1982; Engel 1979; Herman 1982; Parkinson 1993). But increasingly, pension funds are also taking SRI seriously as a tool to control risk. What is interesting in the current convergence between those who adopt traditional methods of SRI and the new-found interest by some pension funds is that the same concept embraces two quite distinct and somewhat hostile approaches to corporate control. Each approach has different origins, rationale and objectives, yet both use the same investment tool to wrestle control of firm-level decision making away from managers and into the hands of shareholders.

Those concerned with the moral dimension of socially responsible investing seek control of corporations in order to deliver a set of outcomes by the firm that have broad impacts on society. By contrast, pension funds are primarily interested in the financial aspects of SRI. They believe companies that behave with certain social, ethical or environmental standards maintain and even gain value over the long run (ABI 2001, Bauer, Koenijk and Otten 2002; EPA 2000, Griffin and Mahon 1997; Kiernan and Levinson 1998; Guerard 1997; Monks 2001; Pava and Krausz 1995; Porter 1995; UNEP 2001). Pension funds use the outcomes of SRI not as ends in themselves, but rather as a set of attributes that add long-term value to the firm and by extension to its shareholders. Because the outcomes of these activities, in terms of firm-level standards, are the same as those sought by traditional SRI advocates, social, ethical and environmental standards create an intersection of interest between traditional SRI advocates and newer institutional proponents (see Figure 4).

Figure 4

Intersecting Interest in SRI

The intersection of interest between corporate engagement and socially responsible investing is evident when we examine the impact of British legislation, which came into effect in 2000, on disclosure of socially responsible investing. Under British law, pension funds must disclose within their Statements of Investment Principal “whether and to what extent they use social, ethical and/or environmental criteria in their investment selection” (United Kingdom 1999). Initially conceived and advocated by traditional SRI associations such as United Kingdom Social Investment Forum (UKSIF), this legislative agenda has proved to be a powerful driver of pension fund corporate engagement in Britain. While sixty percent of British pension funds now declare the use of non-financial (social) criteria in their investment portfolio,[8] most U.K. pension funds indicate that they prefer to use some form of corporate engagement to implement these decisions rather than the traditional SRI strategies. In fact, only ten percent of U.K. pension assets are exclusively invested in SRI funds.[9]

While many of these fund managers see traditional SRI techniques such as portfolio screening as potentially damaging to their bottom line and therefore contrary to their fiduciary duty to plan beneficiaries, they embrace corporate engagement as a sound mechanism to raise firm-level standards and long-term rates of return. This engagement has lead to coalitions of institutional investors, including pension funds such as the large Association of British Insurers (ABI 2001), to call for increased corporate social responsibility (CSR) reporting by companies through the use of social audits in order to improve transparency and disclosure of these aspects of firm behavior. However it should be noted that of the sixty percent of British pension funds declaring the use of social, ethical and/or environmental criteria in investment selection, seventy percent indicate that they instruct their fund manager to take this criterion into account, with the proviso that it does not interfere with expected rates of return.

Therefore, corporate engagement should be seen as a tool to raise firm-level accountability, transparency, and social and environmental standards, not as a vehicle for major transformation of the capitalist system.

Global Environmental and Labour Standards

Given pension fund corporate engagement’s reliance on shareholders as key actors, it is unlikely these forces alone will radically humanize the capitalist system. But there are other forces on the horizon with the potential to shift pension fund corporate engagement in this direction. Moving well beyond the corporate governance community, these global social forces provide the final driver of pension fund corporate engagement. While this driver is diffuse and currently unformed, its power, if realized, could have far reaching implications for the conduct of corporations and pension funds alike. Identifying this broad global societal driver raises more questions than it answers in understanding pension fund corporate engagement in a global arena.

We are currently witnessing a shift away from strict anti-globalization reactions that favour nation-states above all other actors, toward a deeper understanding within global civil society of the enormous influence pension fund investors wield. There is recognition that with political clout, global capital markets could be brought to serve the broader interests of society as a whole. While pension funds trustees and managers’ concern remains limited to the impact of higher firm-level standards on long-term share value, this fourth driver of pension fund corporate engagement is explicitly and unapologetically moral and political in nature.

A new generation of international activists are drawing the world’s attention to the deepening divide between developed and developing nations and more explicitly, the growing gap between the world’s wealthy and the world’s poor. One need look no further back than Seattle in 1999 to understand that many believed the goals of social justice, equality, human rights, labour rights, and environmental standards to be unattainable in the rush to serve the needs of global capital. But the past three years has seen a realization that global capital flow can indeed become a useful tool if investment is harnessed to meet demands for sustainability and global social justice.

This fourth driver of pension fund corporate engagement transcends simple long-term rate-of-return arguments. It recognizes that pension plan members and beneficiaries, who exercise democratic rights within the world’s largest capital pools, have social concerns beyond simply maintaining their own standards of living. These concerns include global climate change, sustainable development, human rights, labour rights and social justice issues such as the availability of HIV/AIDS drugs to South Africa.

Johannesburg’s World Summit on Sustainable Development (2002) provides an example of the search for new supra-national institutions to deliver on the promise of global social justice. Rather than narrow-minded rejection of globalization in the face of humanity’s concerns, global players are being held to global standards with increasing vigor. World agreements such as the Kyoto Protocol are among the new drivers of moral, political and social change. Further evidence of this shift was seen in 2002 when the World Economic Forum was forced to share the spotlight with the World Social Forum. Witness Joseph Stiglitz’s recent criticism of the International Monetary Fund and World Bank for serving the needs of the developed world at the expense of the developing world (Stiglitz 2002). A shift is occurring, but rather than a retrenchment in the nation-state, there is a search for new global tools to accomplish broadly social and political aims.

Pension funds are not immune to these same forces. Given the growing power of pension fund international investment flows (see Figure 5 for the growth of pension fund assets in this asset category), it is little wonder that global activists see pension funds as potential points of leverage to reach global equity and social justice goals. Recent concern for the availability of HIV/AIDS drugs to South Africa where thirty million people are infected with this disease, ties pension fund investment to the moral imperative and results in pension fund corporate engagement with the world’s largest pharmaceutical companies. Much as we saw during the anti-apartheid divestment campaign of the 1970s and 1980s, the line between long-term financial benefit and social action is being blurred by global pressure to respond to social justice issues around the world.

Figure 5

Growth of Pension Fund International Investing

New global regimes of social, environmental and labour standards create a social/political driver that lies at the heart of the contested status of the proper arrangement of the financial system (Henderson 2000; Stiglitz 2002), with pension fund capital pulled between national and supra-national regulatory frameworks. Three standards in particular are often used in emerging market and international pension fund investment; the Global Sullivan Principles (Seidman 2003), the International Labour Organization (ILO) Labour Standards, and the Coalition for Environmentally Responsible Economies (CERES) Principles (Hoffman 1996). Each of these global frameworks raises the bar well above levels tolerated by many national governments in terms of social and environmental behaviour.

The fourth driver of pension fund corporate engagement attempts to humanize capital with explicit moral and political objectives. It also has the reach necessary to extend these goals into global financial systems. As the new internationalists shift in their recognition and use of the tools global standards provide, we should expect to see growing use of pension fund corporate engagement in the global arena.

Conclusion

The recent downturn in financial markets combined with massive corporate governance failures in the United States have shaken confidence in financial markets around the world. Ranging from the U.S. Sarbanes-Oxley Act, to the U.K. Company Law Review, governments, industry, and financial markets are seeking answers to ensure the financial system works in the interests of all citizens. Some advocate strengthened regulatory regimes similar to the actions taken after the 1929 stock market collapse, much as John Kenneth Galbraith (1967) proposed in the 1960s. We suggest that pension fund corporate engagement may well hold answers to aligning company managers’ decisions with both shareholders and stakeholders through raised standards of firm behaviour.

Until recently, pension funds’ claim of ownership was held at arms-length by pension fund managers whose primary concern was for quarterly earning statements with only limited oversight for company standards and behaviour. However recent events such as the collapse of Enron and WorldCom demonstrate the need for higher degrees of oversight by pension funds and other institutional investors. In effect pension funds are redefining the power relationships within the firm. A fuller investigation of pension fund corporate engagement is needed in order to judge the extent to which this oversight is being exercised by pension fund investors and its success in moving companies from short-term to longer term ‘best practices’ both domestically and internationally.

We assert that four drivers are pushing pension funds into a new stage of capitalism, in which pension funds acting on behalf of beneficiaries are able to aggregate their ownership position to influence the management of companies they own. With their concern for the long-term, pension funds are beginning to use their influence to increase transparency and accountability and to raise social and environmental standards of corporate behaviour. Rather than simply reshuffling the players within the existing framework of the shareholder dominated financial system, it is our contention that pension fund corporate engagement holds new possibilities for humanizing capital in the global arena. Such a bold thesis will require further exploration in order to understand and use this tool effectively.

Parties annexes

Remerciements

We wish to thank Katherine McFate and the Rockefeller Foundation for their assistance and sponsorship of this paper. We also wish to thank Paul Tracey and David Mackenzie for their views and assistance with this paper. All remaining errors are the sole responsibility of the authors. The opinions expressed in this paper are solely those of the paper’s authors.

Notes

-

[1]

A growing number of pension fund trustees and managers have come to believe that SRI considerations lower the risks associated with an uncertain future. They believe companies that behave with certain social, ethical or environmental standards maintain and even gain value over the long run (ABI 2001, Bauer, Koenijk and Otten 2002; EPA 2000, Griffin and Mahon 1997; Kiernan and Levinson 1998; Guerard 1997; Monks 2001; Pava and Krausz 1995; Porter 1995; UNEP 2001). The longer the time-horizon over which pension funds hold their investments, the higher the standards of the firm must be in order to minimize risks in the future.

-

[2]

Because pension funds have long-term liabilities they need to match their temporal requirements against their assets in order to pay out over time. The result of this investment horizon is an increased sensitivity to both long-term and short-term performance. Long-term share value has received greater attention in the aftermath of Enron and WorldCom where long-term value was sacrificed for short-term profits. In the end pension funds bore much of the cost of these short-term strategies.

-

[3]

Adolf Berle and Gardiner Means’ 1933 seminal book The Modern Corporation and Private Property demonstrated that the 20th century rise of public corporations meant a growing dispersal of ownership rights across large segments of the population. They concluded that while the advent of public corporations spread the benefits of capitalism more broadly, owners lost control of firm-level decision making. Managers usurped this role.

-

[4]

Witness a recent competition by Universities Superannuation Scheme, one of the largest pension funds in the U.K., challenging money managers to create a portfolio that reflected a long-term view of wealth creation. The entries from over forty conventional money managers around the globe make for fascinating reading.

-

[5]

It should be noted that to date public pension funds have been the dominant corporate engagement actors as private corporate pension plans are reluctant to undertake this activity for fear of the scrutiny of their own behaviour that such engagement in other companies’ activities might invite.

-

[6]

However, we find some difference in opinion as to whether Faccio and Lasfer found such monitoring added value to the firms. Unlike Davis (2002), we do not interpret Faccio and Lasfer in support of the theory that pension fund monitoring encourages firms to comply with Best Codes of Practice or outperform industry counterparts.

-

[7]

Environics. 2002. Third Annual Corporate Responsibility Monitor. Toronto.

-

[8]

UKSIF. 2000. “Response of U.K. Pension Funds to SRI Disclosure Legislation.”

-

[9]

Pensions Week, November 5th 2001, 10.

References

- ABI (Association of British Insurers). 2001. Investing in Social Responsibility. London: ABI.

- Bauer, Robert, and Nadja Gunster. 2003. Response Paper to Understanding Pension Fund Corporate Engagement in a Global Arena. Brussels: ABP Investments and Maastricht University.

- Bauer, Robert, Kees Koenijk, and Roger Otten. 2002. International Evidence on Ethical Mutual Fund Performance and Investment Style. Brussels: ABP Investments and Maastricht University.

- Becht, Marco, and Colin Mayer. 2001. “Corporate Control in Europe.” The Control of Corporate Europe. F. Barca and M. Becht, eds. Oxford: Oxford University Press, 149–173.

- Berle, Adolf A., and Gardiner C. Means. 1933. The Modern Corporation and Private Property. Revised ed. New York: Harcourt, Brace and World.

- Blair, Margaret M. 1995. Ownership and Control: Rethinking Corporate Governance for the Twenty-first Century. Washington: Brookings.

- Brudney, Victor. 1982. “The Independent Director-Heavenly City or Potemkin Village?” Harvard Law Review, Vol. 95, 597–659.

- Bushee, Brian. 1998. “Institutional Investors, Long Term Investment, and Earnings Management.” Harvard Business School Working Paper, No. 98–069.

- Calpers. 2002. http://www.calpers-governance.org/. Sacramento: California Public Employees Retirement System (accessed 20 December 2003).

- Clark, Gordon L. 1998. “Stylized Facts and Close Dialogue: Methodology in Economic Geography.” Annals of Association of American Geographers, Vol. 88, 73–87.

- Clark, Gordon L. 2000. Pension Fund Capitalism. Oxford: Oxford University Press.

- Clark, Gordon L. 2003. European Pensions and Global Finance. Oxford: Oxford University Press.

- Clark, Gordon L., and Dariusz Wojcik. 2003. “An Economic Geography of Global Finance: Ownership Concentration and Stock Price Volatility in German Firms and Regions.” Annals of the Association of American Geographers, Vol. 93, 909–924.

- Clark, Robert C. 1981. “The Four Stages of Capitalism.” Harvard Law Review, Vol. 94, 561–582.

- Coffee, John. 1981. “No Soul to Damn, No Body to Kick: An Unscandalized Inquiry into the Problem of Corporate Punishment.” Michigan Law Review, Vol. 79, 386–459.

- Coffee, John. 1988. “Shareholders versus Managers: The Strain in the Corporate Web.” Knights, Raiders, and Targets. J. Coffee, L. Lowenstein and S. Rose-Ackerman, eds. New York: Oxford University Press.

- Coffee, John. 1991. “Liquidity versus Control: The Institutional Investor as Corporate Monitor.” Columbia Law Review, Vol. 91, 1277-1368.

- Coffee, John. 1997. “The Folklore of Investor Capitalism.” Michigan Law Review, Vol. 95, 1970–1989.

- Collier, Robert. 2000. “Pension Fund Tightens Foreign Stock Rules.” San Francisco Chronicle, November 14.

- Davis, E. Philip. 2002. Institutional Investors, Corporate Governance and Performance. London: Brunel University.

- Davis, E. Philip, and Benn Steil. 2001. Institutional Investors. Cambridge, Mass.: MIT Press.

- DelGuercio, Diane, and Jennifer Hawkins. 1999. “The Motivation and Impact of Pension Fund Activism.” Journal of Financial Economics, Vol. 52, No. 3, 293–340.

- Drucker, Peter F. 1976. The Unseen Revolution: How Pension Fund Socialism Came to America. London: Heinemann.

- Drucker, Peter F. 1991. “Reckoning with the Pension Fund Revolution.” Harvard Business Review, Vol. 69, No. 2, 106–115.

- Duggal, Rakesh, and James A. Millar. 1999. “Institutional Ownership and Firm Performance: The Case of Bidder Returns.” Journal of Corporate Finance, Vol. 5, No. 2, 103–117.

- Engel, D. L. 1979. “An Approach to Corporate Social Responsibility.” Stanford Law Review, Vol. 32, 1–98.

- Engelen, Ewald. 2002. Financialization, Pension Restructuring, and the Logic of Funding. Amsterdam: University of Amsterdam.

- EPA (U.S. Environmental Protection Agency). 2000. Green Dividends: The Relationship Between Firms’ Environmental Performance and Financial Performance. Washington D.C.: EPA.

- Faccio, Mara, and M. Ameziane Lasfer. 2000. “Do Occupational Pension Funds Monitor Companies in which they Hold Large Stakes?” Journal of Corporate Finance, Vol. 6, No. 1, 71–110.

- Fama, E. F. 1965. “The Behavior of Stock Market Prices.” Journal of Business, Vol. 38, 34-105.

- Friedman, Milton. 1970. “The Social Responsibility of Business is to Increase its Profits.” New York Times Magazine, September 13.

- Fung, Archon, Tessa Hebb, and Joel Rogers, eds. 2001. Working Capital: The Power of Labor’s Pensions. Ithaca: ILR Press, Cornell University Press.

- Galbraith, John Kenneth. 1967. The New Industrial State. Second, Revised Ed. London: Andre Deutsch.

- Ghilarducci, Teresa. 1992. Labor’s Capital: The Economics and Politics of Private Pensions. Cambridge, Mass.: MIT Press.

- Glassman, James K., and Kevin A. Hassett. 1999. Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market. Three Rivers, Mich.: Three Rivers Press.

- Griffin, Jennifer J., and John F. Mahon. 1997. “The Corporate Social Performance and Corporate Financial Performance Debate: Twenty-Five Years of Incomparable Research.” Business and Society, Vol. 36, No. 1, 5–31.

- Guerard, John B. 1997. “Is There a Cost to Being Socially Responsible in Investing?” Journal of Investing, Vol. 6, Summer, 11–18.

- Hawley, James P., and Andrew T. Williams. 2000. The Rise of Fiduciary Capitalism. Philadelphia: University of Pennsylvania Press.

- Hebb, Tessa. 2004. “The Economic Inefficiency of Secrecy.” Oxford: Working Paper, School of Geography and the Environment, University of Oxford.

- Hebb, Tessa, and Dariusz Wojcik. 2004. “The Institutional Investment Value Chain: CalPERS’ Emerging Markets Strategy.” Oxford: Working Paper, School of Geography and the Environment, University of Oxford.

- Henderson, Hazel. 2000. “Transnational Corporations and Global Citizenship.” American Behavioural Scientist, Vol. 43, No. 8, 1231–1261.

- Herman, Edward S. 1982. Corporate Control and Corporate Power. Cambridge: Cambridge University Press.

- Hirschman, Albert O. 1970. Exit, Voice, and Loyalty. Cambridge, Mass.: Harvard University Press.

- Hoffman, Andrew J. 1996. “A Strategic Response to Investor Activism.” Sloan Management Review, Winter, 51-64.

- Houthakker, Hendrik S., and Peter J. Williamson. 1996. The Economics of Financial Markets. New York: Oxford University Press.

- Jarrell, Greg, Ken Lehn, and Wayne Marr. 1985. Institutional Ownership, Tender Offers, and Long-Term Investments. New York: The Office of the Chief Economist, Securities and Exchange Commission.

- Jensen, Michael, and William Meckling. 1976. “Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure.” Journal of Financial Economics, Vol. 3, No. 4, 305–360.

- Jorgenson, Dale. 2000. “Raising the Speed Limit: U.S. Economic Growth in the Information Age.” Brookings Papers on Economic Activity, No. 1.

- Kang, David L. 1999. “The Impact of Activist Institutional Investors on Performance in Public Corporations: A Study of the U.S. Fortune 500, 1982-1994.” Cambridge, Mass.: Harvard Business School Working Papers 00-049.

- Karpoff, Jonathan M., Paul H. Malatesta, and Ralph A. Walkling. 1996. “Corporate Governance and Shareholder Initiatives: Empirical Evidence.” Journal of Financial Economics, Vol. 42, No. 3, 365–395.

- Kiernan, Matthew, and Jonathan Levinson. 1998. “Environment Drives Financial Performance: The Jury Is In.” Environmental Quality Management, Vol. 7, 1–7.

- Kostant, Peter C. 1999. “Exit, Voice and Loyalty in the Course of Corporate Governance and Counsel’s Changing Role.” Journal of Socio-Economics, Vol. 28, No. 3, 203–246.

- Langbein, J. 1995. “The Contractarian Basis of the Law of Torts.” Yale Law Journal, Vol. 105, 655-675.

- La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny. 1998. “Law and Finance.” Journal of Political Economy, Vol. 106, 1113–1155.

- La Porta, Rafael, Florencio Lopez-de-Silanes, and Andrei Shleifer. 1999. “Corporate Ownership around the World.” Journal of Finance, Vol. 54, No. 2, 471–517.

- Levis, M. 1989. “Stock Market Anomalies; A Reassessment Based on U.K. Data.” Journal of Banking and Finance, Vol. 13, 675–696.

- Marsh, Paul. 1990. Short-termism on Trial. London: Institutional Fund Managers Association.

- McConnell, John, and Chris Muscarella. 1985. “Corporate Capital Expenditure Decisions and the Market Value of the Firm.” Journal of Financial Economics, Vol. 14, 399–422.

- Miles, David. 1993. Testing for Short Termism in the U.K. Stock Market. London: Bank of England.

- Monks, Robert A. G. 2001. The New Global Investors. Oxford: Capstone Publishing.

- Monks, Robert A. G., and Nell Minow. 1995. Corporate Governance. Oxford: Blackwell.

- Nader, Ralph, and Mark J. Green. 1973. Corporate Power in America. New York: Grossman.

- O’Barr, William M., and John M. Conley. 1992. Fortune and Folly: The Wealth and Power of Institutional Investing. Irwin: Business One.

- Parkinson, John. 1993. Corporate Power and Responsibility. Oxford: Clarendon Press.

- Pava, Moses L., and Joshua Krausz. 1995. The Association Between Corporate Social Responsibility and Financial Performance: The Paradox of Social Cost. Westport, Conn.: Quorum Books.

- Porter, Michael. 1995. “Green and Competitive: Ending the Stalemate.” Harvard Business Review, Vol. 73, No. 5, 120-134.

- Posner, Richard A. 1981. The Economics of Justice. Cambridge, Mass.: Harvard University Press.

- Poterba, James M., and Lawrence H. Summers. 1992. Time Horizons of American Firm: New Evidence from a Survey of CEOs. Cambridge, Mass.: Harvard Business.

- Roe, Mark. 1994. Strong Managers, Weak Owners: The Political Roots of American Corporate Finance. Princeton: Princeton University Press.

- Romano, Roberta. 1993. “Public Pension Fund Activism in Corporate Governance Reconsidered.” Columbia Law Review, Vol. 93, No. 4, 795–853.

- Romano, Roberta. 2000. Less is More: Making Shareholder Activism a Valued Mechanism of Corporate Governance. New Haven: Yale Law School, Yale International Center for Finance and NBER.

- Samuelson, Paul A. 1980. Economics. 11th ed. Tokyo: McGraw-Hill.

- Sen, Amartya. 1985. “The Moral Standing of the Market.” Ethics and Economics. F. Paul, F. D. Miller and J. Paul, eds. Oxford: Oxford University Press, Chapter 1.

- Seidman, Gay W. 2003. “Monitoring Multinationals: Lessons from the Anti-Apartheid Era.” Politics and Society, Vol. 31, No. 3, 381-406.

- Shiller, Robert. 2000. Irrational Exuberance. Princeton: Princeton University Press.

- Shiller, Robert. 2001. “Bubbles, Human Judgment, and Expert Opinion.” Cowles Foundation Discussion Paper No. 1303, Cowles Foundation for Research in Economics, Yale University, New Haven, Connecticut.

- Shleifer, Andrei. 2000. Inefficient Markets. Oxford: Oxford University Press.

- Shleifer, Andrei, and Robert W. Vishny. 1986. “Large Shareholders and Corporate Control.” Journal of Political Economy, Vol. 94, June, 461–465.

- Shleifer, Andrei, and Robert W. Vishny. 1988. “Value Maximization and the Acquisition Process.” Journal of Economic Perspectives, Vol. 2, No. 1, 7–20.

- Shleifer, Andrei, and Robert W. Vishny. 1997. “A Survey of Corporate Governance.” Journal of Finance, Vol. 52, June, 737–783.

- Smith, Michael P. 1996. “Shareholder Activism by Institutional Investors: Evidence from CalPERS.” Journal of Finance, Vol. 51, 227–252.

- Smith, N. Craig. 1990. Morality and the Market. London: Routledge.

- Stiglitz, Joseph. 2002. Globalization and its Discontents. New York: W.W. Norton and Co.

- Strauss, Anselm, and Juliet Corbin. 1998. Basic Qualitative Research: Techniques for Developing Grounded Theory. 2nd ed. Thousand Oaks, Calif.: Sage.

- Strickland, Deon, Kenneth W. Wiles, and Marc Zenner. 1996. “A Requiem for the USA: Is Small Shareholder Monitoring Effective?” Journal of Financial Economics, Vol. 40, No. 2, 319–338.

- UNEP. 2001. Buried Treasure: Uncovering the Business Case for Corporate Sustainability. London: UNEP.

- United Kingdom. 1999. The Occupational Pension Schemes (Investment, and Assignment, Forfeiture, Bankruptcy, etc.) Amendment 1999. Statute No. 1849.

- U.S. DOL. 1994. “Interpretive Bulletin 94–2 on Proxy Voting” (The Avon Letter).

- Wahal, Sunil, and John J. McConnell. 2000. “Do Institutional Investors Exacerbate Managerial Myopia?” Journal of Corporate Finance, Vol. 6, No. 3, 307–329.

- Williams, Cynthia. 1999. “The Securities and Exchange Commission and Corporate Social Transparency.” The Harvard Law Review, Vol. 112, 1199–1307.

Liste des figures

Figure 1

The Five Stages of Capitalism

Figure 2

Impact of Indexing

Figure 3

Internal and External Control of the Firm

Figure 4

Intersecting Interest in SRI

Figure 5

Growth of Pension Fund International Investing