Résumés

Summary

A number of conflicting theoretical hypotheses have been advanced regarding the impact of unions on investment behaviour. The net impact of unions on investment is thus an empirical issue. In this article, the available empirical literature is reviewed. In addition, new evidence of the impact of unions on investment is presented using French data. In contrast to previous studies, both aggregate and disaggregate measures of union activity are used. The results indicate that French unions, in general, have not had a negative impact on investment behaviour. However, there is some evidence that the more militant unions have a negative impact on investment.

Résumé

L’influence de l’action syndicale sur le comportement d’investissement des dirigeants d’entreprise est un sujet controversé qui a fait l’objet de nombreuses discussions entre les chercheurs. Les modèles théoriques disponibles ne permettent pas de conclure clairement et définitivement en faveur ou à l’encontre de la présence syndicale. En effet, pour la théorie économique néoclassique, l’action syndicale peut à la fois nuire à l’investissement et susciter celui-ci. La présence syndicale peut, d’une part, freiner l’investissement de l’entreprise en raison du caractère réversible des négociations salariales et, d’autre part, inciter les entreprises à investir davantage en favorisant la substitution du travail par le capital. L’influence des négociations salariales sur les décisions d’investissements peut engendrer une inefficacité provenant de l’irréversibilité de l’investissement. Le caractère irréversible des décisions d’équipement incite l’entreprise à sous-investir lorsque le syndicat ne peut s’engager de manière crédible à ne pas renégocier le salaire une fois que les investissements auront été réalisés. En effet, lorsque l’entreprise réalise un investissement, les salariés sont tentés de renégocier leur salaire, compte tenu de l’amélioration des gains de productivité permis par les nouveaux équipements. Les économistes évoquent le problème du « hold-up ». Dans le cas contraire, les entreprises auront tendance à investir davantage, et tous les agents économiques devraient bénéficier de ce surplus d’investissement. Il est également possible d’envisager une autre approche en considérant que la présence syndicale conduit les employeurs à privilégier l’investissement en capital, étant donné la hausse des coûts salariaux. Depuis une vingtaine d’années, des études empiriques, principalement anglo-saxonnes, ont commencé à étudier l’impact de la présence syndicale sur les décisions d’investissement des entreprises. Les résultats de ces travaux concluent généralement à l’influence négative de la présence syndicale sur l’investissement bien que certains travaux soient plus contradictoires.

L’objet de cet article est de proposer, dans un premier temps, une synthèse de la littérature empirique existante portant sur la relation entre la présence syndicale et le volume des investissements des entreprises. Contrairement aux revues traditionnelles, l’état de la littérature s’appuie ici sur une synthèse quantitative de la littérature dont l’objectif principal est d’étudier la force de la relation (ou la grandeur de l’effet) entre le syndicalisme et le niveau d’investissement des entreprises, en considérant l’ensemble des résultats empiriques existants. Dans un second temps, cet article présente les résultats d’une étude statistique menée à partir d’un échantillon représentatif d’entreprises françaises. Alors que la plupart des études empiriques existantes portent sur des données anglo-saxonnes, cette recherche vise à confronter les résultats obtenus en France à ceux obtenus dans les pays anglo-saxons.

Une recherche bibliographique extensive a permis de collecter 11 études empiriques, explorant le lien entre le syndicalisme et l’investissement en capital des entreprises. Toutes ces études utilisent des méthodes de régression traditionnelles (OLS). Les principales différences entre ces études résident dans la mesure de la variable dépendante et dans le choix des variables indépendantes et de contrôle. L’agrégation des résultats a nécessité de traduire la relation selon un même indicateur. La grandeur d’effet est estimée par le biais du coefficient de corrélation partielle r, en raison de sa facilité d’accès et d’interprétation. Le coefficient de corrélation partielle mesure la liaison entre deux variables, lorsque l’influence d’une ou des autres variables explicatives est retirée.

Finalement, les corrélations partielles calculées à partir des études varient de –0.36 à +0.05. Ainsi, la plupart des études mettent en évidence une association négative entre la présence syndicale et le volume d’investissements en capital. La seule étude qui affiche un lien positif entre le syndicalisme et l’investissement est celle de Coutrot (1996) réalisée dans le contexte français. Selon Coutrot (1996), les gestionnaires français auraient tendance à investir plus que ne l’exige le strict calcul économique. Ce constat viendrait confirmer le fait que le syndicalisme français ne s’oppose pas à l’investissement matériel comme le laisse supposer certaines théories économiques mais, au contraire, inciterait les employeurs à investir davantage dans les équipements.

Après avoir identifié la tendance générale des résultats de la littérature empirique et souligné les résultats contradictoires obtenus par Coutrot dans le contexte français, nous proposons une nouvelle analyse statistique du cas français à partir de données plus récentes issues de l’enquête REPONSE, menée par la DARES (Direction de l’animation de la recherche, des études et des statistiques) du Ministère de l’Emploi et de la Solidarité en 1998.

Les résultats obtenus mettent en exergue l’absence d’influence (positive ou négative) de la présence syndicale sur l’investissement en capital. Ce résultat est sensiblement différent de celui obtenu par Coutrot en 1996 à partir de la première enquête REPONSE menée en 1992. En effet, Coutrot (1996) observait un effet nettement positif de la présence syndicale sur le taux de croissance de l’investissement. Toutefois, nos résultats renforcent la présomption d’une nette différence entre la France et les États-Unis en ce qui concerne l’effet du syndicalisme sur l’investissement. Cette différence peut s’expliquer par les caractéristiques propres à chaque système de relations professionnelles. Le système français des relations professionnelles se caractérise notamment par la faible influence des organisations syndicales sur le lieu de travail.

Resumen

La literatura teórica ha avanzado un cierto número de hipótesis contradictorias respecto al impacto de los sindicatos sobre el comportamiento de las inversiones. En este artículo, revisamos los argumentos teóricos claves y usamos técnicas cuantitativas para evaluar la literatura empírica disponible. Además, son presentadas nuevas constataciones del impacto de los sindicatos sobre la inversión en el sector manufacturero francés. Los nuevos resultados indican que los sindicatos franceses no tienen ningun impacto sobre el comportamiento de las inversiones.

Corps de l’article

The influence of industrial relations and of unions, in particular, on the capital formation process has received a great deal of attention. There is disagreement about the theoretical impact of unions on investment behaviour, and some of the empirical evidence is contradictory. The aim of this article is to offer a quantitative review of the evidence. In addition, we present new estimates of union impact on investment. This study is undertaken using a large sample of French firms. Most of the existing studies have used U.S. data, and find a negative association between unions and investment. In general, analysis of French data does not support the negative findings for the U.S.

The article is set out as follows. In the next section, we briefly review the theoretical arguments. The quantitative review is presented in the second section. The distinctive characteristics of French unionism are discussed in the third section. Comparisons with the U.S. industrial relations system are also made in this section. New estimates using French data are presented in the fourth section, followed by the conclusion in the last section.

Theoretical Considerations

Early contributors to the union-investment effects literature include Baldwin (1983) and Grout (1984), with more recent contributions made by Hirsch (1991), Hirsch and Prasad (1995) and Addison and Chilton (1998). The starting point is the debate between the traditional and the union-rent seeking models. In the traditional model, union wage increases act as a tax on labour inducing both substitution and scale effects. Unionized workers tend to enjoy a wage differential (Jarrell and Stanley 1990; Kuhn 1998). This wage differential induces a substitution of capital for labour that stimulates investment in unionized firms. Higher production costs, however, discourage production. This scale effect results in lower investment levels (Johnson and Mieszkowski 1970). The net effect is expected to be often positive.

In the rent-seeking model, unions are said to capture at least some of a firm’s quasi-rents from capital investments. This is a tax on capital. Long-lived assets are vulnerable to rental expropriation, not just by workers, but also by any party that is able to do so.[1] Employers are reluctant to invest in vulnerable assets if unions are able to capture quasi-rents. Machin and Wadhwani (1991) note that higher levels of investment are likely to raise future wage demands, thereby increasing the cost of investing. Van der Ploeg (1987) argues that unions may announce low future wage demands in order to induce firms to invest, but may subsequently renege on this promise. However, Cavanaugh (1998: 36) notes correctly that “the bargaining problem exists only in the presence of both high union density and asset-specific investment.”

Unions may stimulate investment through other channels. For example, Marxist and radical economists argue that the capitalist strategy to control the labour process is such that employers have an incentive to substitute capital for labour, independently of wage movements. The nature of industrial relations is also likely to be a factor. Where management and unions cooperate and bargain in terms of a win-win strategy, then a favourable investment climate is generated. Where bargaining is confrontational, then the investment climate will be poor. According to efficient bargaining models (e.g. McDonald and Solow 1981), firms are able to move off their demand for labour curves. Hence, it may be possible for the firm and for unions to collaborate in order to maximize the present value of the firm, a proposition that other authors argue is against the interests of a rationally myopic union (Hirsch and Link 1987). However, Hirsch and Prasad (1995) argue that even with efficient bargains, union activity is a tax on capital that will depress investment.

In the Freeman and Medoff approach (1984), unionized firms may experience a more productive working environment, with the retention of higher skilled workers, mechanisms for voicing worker grievances and improved communication channels. Such an environment may well induce additional investment. However, Hirsch and Link (1987) point out that the productivity effects need to be sufficiently positive if they are to offset the union tax on investment. Given these conflicting theoretical arguments, it is clear that the net impact of unions on investment is an empirical issue.[2]

Quantitative Review of the Evidence

Compared to the very substantial literature on union-productivity effects, there have been relatively few empirical investigations on union-investment effects.[3] An extensive computer based search was conducted revealing a total of only 14 empirical studies exploring the links between unions and physical investments. These studies are listed in Table 1, together with the sample size, the country investigated, the time period of the data and the measures of unionization and tangible assets. Two studies are not included in our quantitative review as they present probit estimations and, hence, are not comparable with the rest of the literature (Machin and Wadhwani 1991; Drago and Wooden 1994). A third article by Denny and Nickell (1991) uses identical data as their (1992) article, with very similar results. This article is also not included in the quantitative review.[4]

Two different measures of the union-investment impact are presented in Table 1. The partial correlations were estimated from each study and are presented in column 7. These measure the correlation between unions and investment, after controlling for other factors that may impact on investment. The total investment effects are presented in column 8. These reflect the impact of 100 percent unionization, and can be calculated for most of the studies. A union dummy measures the impact of 100 percent unionization. Studies using union density were evaluated at 100 percent union density/coverage. The works councils dummy is a proxy for union presence and is also treated as a 100 percent unionization measure. As can be seen from Table 1, with the exception of the French study by Coutrot (1996), all productivity effects are either negative or zero.

Table 1

Empirical Studies on the Impact of Unions on Tangible Investments

Meta-analysis can be used to combine all the studies in order to calculate an average union-investment effect. This represents a synthesis of the available evidence and a quantitative overview of what researchers have established (Hedges and Olkin 1985; Hunter and Schmidt 1990; Wolf 1986). Meta-analysis can be applied to a small group of studies, as long as that group represents the population of studies available. It is standard practice in meta-analysis to include studies that use different measures of the dependent and independent variables. Union coverage, union density and union dummies are all different ways of measuring union activity and union presence. In many cases, researchers have no choice in measurement and must use the data that is available. Significantly, some researchers have found no difference in results when different measures are used. This is the case with the econometric results presented in this article. The inclusion of studies from different countries is acceptable also.[5] While the studies differ in many respects, they all share a common exploration of the links between unions and investment.

Average Union-Investment Effect

The average impact of unions on investment for all the available studies is presented in the top part of Table 2. These averages are the central tendency of the findings of this group of studies. Column 2 reports the raw unweighted averages. In addition to the unweighted averages, two weighting regimes were used. The first uses sample size and the second uses a citations index, drawn from the Social Science Citations Index. Larger studies should be given greater importance.[6] Sample size is our preferred way of assigning weights to the studies, as sample size is a more objective approach to assigning weights. Because of the qualitative difference in the result reported by Coutrot (1996), we present averages with and without Coutrot. As can be seen from Table 2, the overall average partial correlation coefficient is negative (–0.07), regardless of the weighting regime. The average of the total union-investment effects ranges from –13% to –17% if the Coutrot study is included (see the figures in squared brackets), and –14% to –23% if this study is excluded. Thus, the literature identifies an overall negative impact of unions on physical investment.

Statistical Significance

A related issue is whether these union-investment effects are statistically significant. A 95 percent confidence interval can be constructed around the averages. The number of studies is small and, hence, the conventional approach to estimating confidence intervals may not be appropriate.[7] In such cases, it is recommended that resampling techniques be used to construct bootstrap confidence intervals (see Adams, Gurevitch and Rosenberg 1997 for details).[8] Bootstrapping was undertaken using 1,000 iterations of the union-investment effects (with replacement) from which the distribution of union-total investment effects was generated. The percentile method was used to construct bootstrap confidence intervals (Efron and Tibshirani 1993). That is, the lower and upper 2.5 percent of the values of the generated distribution are used to construct the 95 percent confidence intervals. The 95% bootstrap confidence interval has a lower bound of –0.10 and an upper bound of –0.04, which does not include zero, indicating statistical significance.

The bottom part of Table 2 presents meta-analysis for sub-groups. The first group is for U.S. studies only. The second group covers all the other studies (for Canada, Germany, the U.K. and France). The union-investment effect is now close to zero and the confidence interval does not rule out the possibility of a zero or even of a positive effect. If the French study is excluded (last row in Table 2), a negative union-investment effect re-emerges. The application of meta-analysis to the existing empirical studies thus points clearly to the conclusion that unions have a negative impact on investment. This negative effect is statistically significant and, more importantly, it is of economic significance. The one exception is the case of France.

Table 2

Average Union-Investment Effects

Unions in France

There are several important differences between the French and U.S. industrial relations systems.

The Bargaining Process

In the U.S., collective bargaining between unions and management in the workplace is decentralized, and agreements between unions and management involve a wide array of working conditions. Also, the State has traditionally been non-interventionist and the autonomy of the collective bargaining process is based on a “culture of contracts.” Collective bargaining with unions in the U.S. has led to a significant positive impact on wages for unionized workers (Lewis 1986; Jarell and Stanley 1990), with the potential for a negative impact on capital investment, as predicted by union rent-seeking theory.

In France, wage differences between unionized and non-unionized workplaces are less pronounced than in the U.S. Indeed, the few empirical studies that have examined the effect of unions on wages in the French context (Coutrot 1987, 1996) have found very small effects (around 3 percent). In contrast to the U.S. situation, the French government is very active in the industrial relations system and in the collective bargaining process. Since the Lois Auroux de 1982, collective bargaining on wages has become mandatory at least once a year in French firms. Employers are required to bargain with respect to the legislation but they are not required to sign an agreement with unions. So, in general, employers themselves choose the level of wage increases with or without union agreement.

Unionization and Activism

France’s unionization rate is one of the lowest among all industrialized countries. Even during their peak, French unions never covered more than 20 percent of the workforce. Consequently, in France union strength has never been linked to the number of union members (Karila-Cohen and Wilfert 1998). However, unionism in France is heavily politicized, and French unions tend to adopt a confrontational attitude. Karila-Cohen and Wilfert (1998: 459) note that “strikes in France always come before negotiation, whereas in the Anglo-Saxon countries, it pretends to force a negotiation.” This orientation towards confrontation has its origins in working conditions in France at the end of the 19th century.

Multi-Unionism

Multi-unionism is one of the most distinguishing aspects of French unions. The Constitution of 1946 and the later texts ratified a pluralistic conception of French unionism that already drew from the Waldeck-Rousseau law of 1884. Multi-unionism has grown in significance. For example, the law of October 1982 facilitated the creation of new unions and limited possibilities of dissolution. While numerous unions exist, five are considered representative at the national level by law since 1966. These are: Confédération générale du travail (CGT); Confédération française démocratique du travail (CFDT); CGT–Force ouvrière (FO); Confédération générale des cadres (CGC); and Confédération française des travailleurs chrétiens (CFTC). There are also many independent unions present in certain industries or firms, but these unions have a weak national audience. Examples include Solidaires, unitaires, démocratiques (SUD) and Union nationale des syndicats autonomes (UNSA).

Each national representative union has adopted a specific strategy in accordance with their individual ideological convictions. Landier and Labbé (1998) draw a distinction between “revolutionary” unions and “reformists” unions. Revolutionary unions adopt the Marxist principle of class struggle, and their objective is to end capitalist domination through the collective appropriation of the means of production. These principles were consistent with the policies and actions led by the Communist party, and served to train the CGT militants, for example, over a long period of time. Reformists unions pursue a more pragmatic course of action. They try to improve workers’ living conditions, without reference to social change. Reformist unions focus on collective bargaining and try to obtain mutual gains for employees and employers.

Recent Developments

According to Landier and Labbé (1998), two events have recently contributed to changes in French industrial relations. First, the CFDT has adopted more centrist policies beginning in 1977 and today this union has clearly become reformist. Second, the downfall of the soviet block deprived the Marxist militants of their hope of witnessing the demise of capitalism. The CGT has kept its rhetorical references but it is now less closely associated with the French Communist party than it was in the past. In this present context, it is now difficult to identify a very clear dividing line between French unions. Since the congress of Strasbourg in 1999, the CGT no longer identifies class struggle as an essential objective. They also consider collective bargaining to be legitimate. This change allowed the CGT to emerge from its isolation and to move closer to the CFDT in 1998. Louis Viannet, the former Secretary General of the CGT, had already set this change in motion in 1995 when he left the World Union Federation (FSM) after the fall of the soviet block. However, as noted by Labbé (2003), “the union tradition remained strong within the CGT and some conservative groups withdraw into a class struggle unionism and an attachment to the Communist parties of the old soviet world.”

The second most important union in France after the CGT, the CFDT today has a more pragmatic position characterized by collective bargaining, breaking with the social transformation will that had marked the CFDT after 1968. However, the CFDT’s more centrist policies led to internal disputes that encouraged the founding of new unions, such as the SUD.

It should be noted that the ideological positions of unions are not necessarily the same at the collective bargaining level. Thus, although the CGT has moved closer to the CFDT at the national level, the CGT still adopts a more confrontational attitude during collective bargaining with employers at the workplace level.

The union rent-seeking model is not well adapted to the French context because French unions do not have enough power to capture rents from future investments. The very low rate of unionization in France (only 6 percent of workers in the economy overall are members of a union) together with multi-unionism, are considered to shift the balance power in favour of employers (Amadieu 1999). Consequently, wage levels are very similar between non-unionized and unionized firms in France.[9] A low rate of unionization can be expected to reduce the potential for adverse effects on investment. However, a confrontational approach to industrial relations is detrimental to investment. This is complicated by the effects of multi-unionism, which in some firms will be of benefit to management, while in others it will be a source of anxiety. Clearly, the net impact on investment is an empirical issue. However, a priori the union impact of investment can be expected to be lower than in other countries.

Unions and Investment in French Industry

In this section of the article, we present new estimates of the impact of unions on capital investment in French industry.

Data

The data used in this study is drawn from two sources. First, the REPONSE (relations professionnelles et négociations d’entreprises) database was used to collect information on the presence of unions and the degree of unionization. The REPONSE survey was conducted in 1998 under the auspices of the French Ministry of Labour and was based on a nationally representative random sample of 2,978 establishments with more than 20 employees.[10] The REPONSE survey collected information from managers and union representatives. This survey contains much information on the establishments, their organizations, the employment practices and the environment in which they operate. The data covered by the 1998 REPONSE survey is a set of French establishments with more than twenty employees. This sample has been obtained randomly from a database of 9,155 establishments. The 9,155 establishments were in turn obtained randomly according to stratification by establishment size (5 ranges of size) and by industry (16 ranges). The main industries of the French economy are represented in the REPONSE database. However, there is an over-representation of the food industry and the automotive industry in the sample, and an under-representation of the consumer goods industry.

Second, the DIANE database was used to collect performance-related measures. DIANE is a French database which provides accounting and financial information on more than 120,000 French firms. Data from the two surveys were matched for several manufacturing and non-manufacturing industries.[11] All the data relate to 1998, as this is the last year for which data on unionization was available at the time of the study. The process of matching the two databases produces a sample of 1,003 French firms for which data on unionization can be matched with economic variables. First, we eliminated from the analysis firms with more than one establishment and for which performance data were not available on an establishment basis. This reduces the sample from 2,978 to 2,505 firms. Second, data on some of the key variables, such as sales, are available for only 1,356 firms. Investment data are available for only 1,003 firms.

Table 3 presents basic descriptive statistics for some of the key variables for some of the major industries. Only limited data is available for some industries, such as banking and the energy sector. Column 6 lists the proportion of firms in each industry that had at least one union present. Nearly half the firms in the intermediate and food manufacturing industries had at least one union present, while the education sector had the lowest union presence. Column 7 lists average union density for each industry. The transport sector had the highest proportion of unionized workers, while commerce had the lowest.

Econometric Specification

The impact of unions on tangible asset formation can be explored through three different specifications:

Level of Investment:

(1) ln Ii = βo + β1 ln Si + β2 ln Ŝi + β3 ln Ni + β4 ln K t–1,i + β5 ln Πi + β6Ui + ui

Capital-Labour Ratio:

(2) ln (K/N) = α0 + α1 ln Si + α2 ln Ŝi + α5 ln Πi + α6Ui + vi

and

Investment Intensity:

(3) In (I/S) = γ0 + γ1 In Ni + γ2 In N2i + γ3 In Kt–1,i + γ4 In Πi + γ5 Ui + ηi

where I is investment in capital, S is the value of sales, Ŝ is sales growth, N is employment (the number of employees), Kt–1 is the value of capital in the previous year (proxied by the value of fixed assets), Π is profits, U is a measure of unionization, ln denotes a natural logarithm, i indexes the ith firm and u, v and η are random noise terms.

Equation 1 specifies the basic investment behaviour equation. This specification has been used by Odgers and Betts (1997), Hirsch (1991, 1992), and Denny and Nickell (1992). The sales variable is included to capture Keynesian notions of investment expenditure undertaken in response to consumer demand. Sales growth is a proxy for demand shifts. Employment is included as a proxy for firm size. Firms invest in order to adjust existing capital stock, hence the inclusion of the lagged capital term in equation 1. Equation 2 is a factor proportion equation. Hirsch (1991) estimated this specification. In addition to their impact on incentives to invest, unions can affect the capital-labour ratio through their impact on manning levels, e.g. through featherbedding. The employment effect may even be in the other direction. Cavanaugh (1998: 38) noted that “reducing employment growth lowers the ability of future employees to appropriate the returns generated from sunk investments.” Thus, unions can lead to higher capital-labour ratios, if firms are fearful of future appropriation of rents and depress employment growth, or they can lead to lower capital-labour ratios, if they depress investment spending and inflate manning levels. Bronars and Deere (1993: 121) noted that “investment will be reduced and employment growth will be lower in unionized firms,” and which is more depressed will impact on the capital-labour ratio. Hirsch and Prasad (1995) argued that unions increase wages and increase also the cost of capital, so that factor price ratios need not change. Hence, because unions may reduce investment and employment, the capital-labour ratio need not change. Estimation of equation 2 thus offers insights on whether the capital-labour ratio differs as a result of unionization, and not whether unions depress investment.

Table 3

Means and Standard Deviations of French Data, 1998

The investment intensity equation (equation 3) is of the form used by Bronars, Deere and Tracy (1994) and Cavanaugh (1998). In equation 3, employment is introduced also in a quadratic form. This term was included also in equations (1) and (2) but was found to be statistically insignificant and, hence, was eliminated subsequently from these equations.

Unfortunately, because of missing observations, the inclusion of a profit variable reduces the sample size significantly. Only the results without profits are presented in this article. The results with the inclusion of the profit variable are available from the authors and are broadly similar to those presented in Table 4.

Several other variables were introduced, but were not found to be statistically significant. These were: (a) the firm’s market share; (b) a dummy variable for whether the firm is an exporter; (c) a dummy variable controlling for firms that are listed on the stock exchange; (d) a variable for the existence of human resource management practices; and (e) research and development expenditures. For some of these variables, data is scarce.

OLS was used to estimate equations 1, 2 and 3 separately for each industry, as well as for all industries combined. In the case of the later, detailed dummy variables are included.

For each of these three equations, we consider three different measures of unionization (the U variable). We consider first the impact of union presence as measured by a dummy variable taking the value of 1 if a union is present and zero otherwise. This is designed to capture the impact of union presence on capital investment, regardless of the degree of unionization and the types of unions that operate within a French firm. Second, we consider the impact of union density as measured by the proportion of the workforce that is unionized. Unfortunately, this information is not available for many firms, reducing the sample size to 658 firms. Union density is expected to have a negative association with investment. Non-linear effects were also explored, by including a squared union density term. This variable was never statistically significant. Third, one of the benefits of the REPONSE database is that it offers disaggregate information on union activity, through data on the presence of individual unions. Therefore, in contrast to previous studies, we are able to explore the impact of six different types of unions. Dummy variables are included for the CGT and the FO unions. These have traditionally been Marxist unions, although in recent years their militancy has declined. They remain, however, more militant and more willing to strike than other unions (Cézard, Malan and Zouary 1996). A negative effect on investment is expected, as these unions are more willing to campaign against the introduction of new technologies and new workplace practices. However, these two unions can also have a positive effect if their activities motivate management to substitute capital for unionized labour. Dummy variables were also included to capture the impact of the CFTC, the CFDT, and the CGC. These are regarded as reformists unions, which are not adverse to changes in the workplace. A positive effect is expected on investment, although a priori, a negative impact cannot be excluded. A sixth category includes all other unions, such as the SUD and the UNSA. In terms of coverage, the CFDT and CGT were present in 24 percent of the firms in the sample, compared to 18 percent, 15 percent, 9 percent and 6 percent, respectively for the FO, CGC, CFTC and the other unions.

Results

Table 4 presents the results for all industries combined. Columns 2, 3 and 4 of Table 4 present the results for the investment equation. Columns 5, 6 and 7 present the results for the capital-labour equation, and columns 8, 9 and 10 present the results for the investment intensity equation. As expected, sales are positively associated with investment and capital-labour ratios. Higher rates of sales growth are positively associated with investment and investment intensity, but are negatively associated with capital-labour ratios. Firm size, as represented by employment, has a positive impact on investment. The coefficient on employment is negative in the investment intensity equation, while the employment squared variable has a positive coefficient. When evaluated at the sample means, the elasticity of investment intensity with respect to employment is negative. However, this elasticity becomes positive for the larger firms in the sample.[12] That is, the incentives to invest appear to be greater for larger firms.

Turning to the unionization variables, it is clear that when all firms are taken together, union presence has no impact on investment, capital-labour ratios, or investment intensity in French industries. While the coefficients on the union dummy are mainly negative, they are not statistically significant. Union density has a positive coefficient in all cases, but this is statistically significant only in the capital-labour equation. Firms with a higher proportion of unionized labour employ relatively more capital per worker. This result is consistent with Coutrot’s (1996) findings. None of the six individual union dummies are statistically significant in the investment and investment intensity equations. However, the dummy variable for the CFTC union is significantly negative. Firms where the CFTC operates tend to have lower levels of capital per employed labour. This fact can be attributed to relatively higher manning levels in these firms. The average level of employment in firms in which the CFTC operates is 874, compared to an average level of employment in firms in which the CFTC does not operate of 633. The average value of capital was 839,132 for firms dealing with the CFTC compared to 769,168 for those without the CFTC.

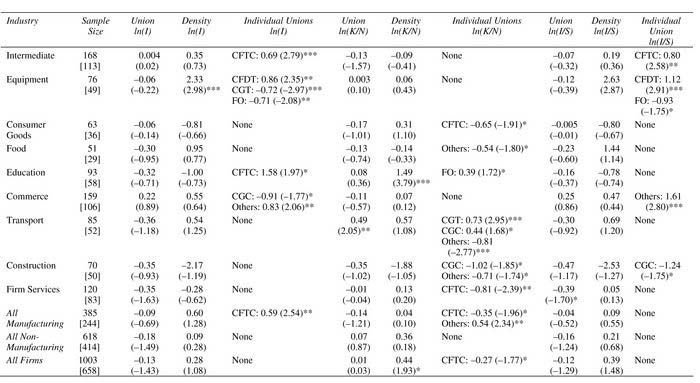

Table 4

Union-Investment Effects, All French Industries

Individual industry estimates are presented in Table 5. The sample sizes are small in many cases so caution must be exercised when interpreting these results. Only the coefficients for the unionization variables are presented. The union dummy variable is not statistically significant in any of the individual industry investment equations. The union presence dummy is statistically significant in the capital-labour equation for the transport industry, where it has a positive coefficient, and has a negative coefficient in the firm services investment intensity equation. Likewise, union density has no impact of capital investment formation (equation 1), except for the equipment manufacturing industry, where it has a positive impact. Union density has a positive association also with the capital-labour ratio in the education industry.

Turning to the individual union dummies, no clear pattern emerges. Positive associations appear in the intermediate and equipment manufacturing industries, as well as the education, commerce and transport industries. Negative associations appear in the equipment, food and consumer goods manufacturing industries, as well as in commerce, transport, construction and firm services. The CFTC has a positive impact on investment in the intermediate and education industries, and has a negative impact on capital-labour ratio in the consumer goods industry and in firm services. The two militant unions (CGT and FO) both have a negative effect on investment in the equipment industry. However, the FO has a positive effect on capital-labour ratio in the education industry and the CGT has a positive impact in the transport industry. That is, they lower investment in some industries and may be causing employment to fall at a faster rate than investment in others, leading to a rise in capital-labour ratios. The CFDT has a positive impact on investment in equipment manufacturing, while the professionals’ union (C.G.C.) has a negative impact on investment in commerce. It is also associated with higher capital-labour ratios in the transport industry, but lower capital-labour ratios in the construction industry. These unions may be behaving differently across industries, or it may be that management is responding differently to the same union tactics. Further research is needed to investigate why the impact on investment varies for these unions.

Table 5

Union-Investment Effects, Individual French Industries

* p ≤ 0.10%;** p ≤ 0.05%;*** p ≤ 0.01%

All equations include detailed industry dummy variables.

t-statistics reported in round brackets.

Sample size for firms with union density reported in square brackets.

The sensitivity of the results was explored in several ways. As noted earlier, several other variables were included in the estimations, but these were not statistically significant, nor do they alter the conclusions regarding the impact of unionization. In addition to the three measures of unionization, we also included a variable for multi-unionism. This is a measure of the number of unions operating in an establishment. This variable ranges from 0 to 6, with an average value of 1. The results were essentially the same. When all the data is used (sample size = 1,003) the coefficients and associated t-statistics on the number of unions variable are: –0.04 (–1.39), 0.01 (1.53) and –0.03 (–1.02) for equations 1, 2 and 3, respectively. As a further test for the robustness of the results, equations 1, 2 and 3 were also estimated using Seemingly Unrelated Regression (SUR). This involved using SUR to estimate a system of equations, each one representing a separate industry. The SUR estimator allows for contemporaneous correlation in the errors across equations. This may arise, for example, if a union’s activities in the transport industry, for example, are influenced by their activities in for example, the equipment industry. There is no evidence of such contemporaneous correlation across the industries. These results are not presented here, but the SUR estimates were similar to OLS.

Coutrot’s study (1996) is the only French empirical work on the link between union and investment. Using data from the first REPONSE survey held in 1992 and data from the EAE (enquête annuelle d’entreprise), Coutrot found that union presence had a significant positive effect on the growth rate of capital intensity between 1985 and 1992. Our conclusions from Tables 4 and 5 are that union presence in general has no impact on investment or investment intensity in French industry. Examination of individual unions reveals that some unions have a negative impact on investment, while others have a positive impact. In his study, Coutrot did not differentiate between unions. Nevertheless, the Coutrot study and the results presented in this article, when taken together, indicate that there is a striking difference between the U.S. and France, in terms of union impact on investment. In the U.S. the evidence points to a negative impact on investment, while in France the evidence points to unions having no overall effect on investment (our study) or to their having a positive impact (Coutrot’s study), although in certain cases, some unions are identified as linked to a negative effect, while others have a positive effect. This disparity in the results can be attributed to the differences in industrial relations and union behaviour noted in section entitled “Unions in France” above.

Conclusion

In this article, a quantitative review of the available evidence of the economic impact which unions have on investment was presented. In addition, a new dataset was used to explore the impact of unions on investment in French manufacturing industry.

The evidence clearly points to unions having a negative impact on physical capital formation, especially in the U.S. Relatively little is known about the impact of French unions on enterprise performance. The results presented in this article indicate that unions in general have no impact at all on physical capital formation in French manufacturing. Negative effects on investment were identified in the case of some unions, but not across all French unions in general. This finding suggests that whatever the costs and benefits of French unions, they do not appear to hinder physical capital formation. This may be attributed to the weakness of collective bargaining between unions and management and to distinct features of the French industrial relations system. Many commentators see the need for collective bargaining in France to re-build union representation and to give unions’ real legitimacy in the workplace. This may very well influence investment patterns in the future.

Parties annexes

Notes

-

[1]

Landlords, local and regional governments can behave in a similar fashion. Thus, even non-unionized industries may face these threats.

-

[2]

Underinvestment effects can exist in non-unionized firms faced with efficiency wages (Shapiro and Stiglitz 1984; Machin and Wadhwani 1991).

-

[3]

A depressed investment environment will tend to have a detrimental impact on future productivity growth, as it limits the adoption of more efficient and productive technology. This effect is distinct from the direct impact of unions on productivity growth through their impact on the organization of work (Doucouliagos and Laroche 2003).

-

[4]

Note that although the study by Addison, Kraft and Wagner (1993) uses works councils, the authors note that this in effect represents union activity.

-

[5]

Indeed, what makes research interesting is the use of different measures and different datasets. Replication with the same data and same measures is not as interesting.

-

[6]

Studies with larger samples will also report lower random error.

-

[7]

There are a number of ways in which confidence intervals are constructed in meta-analysis (for examples, see Hedges and Olkin 1985 and Hunter and Schmidt 1990). These are all based on large samples and assume that the meta-analysis test statistics are asymptotically normally distributed.

-

[8]

Metawin version 2.1 was used to bootstrap the data.

-

[9]

For the firms in the sample used for the empirical analysis (see next section), union firms had wages that were 8 percent higher. However, this is simply a raw figure, and needs to be corrected for a number of other factors such as differences in human capital and productivity.

-

[10]

REPONSE is equivalent to WIRS (Workplace Industrial Relations Survey) in the United Kingdom.

-

[11]

Due to issues of confidentiality, it is not possible to identify the firms covered in the REPONSE database. Hence, it is not possible for researchers themselves to match the DIANE data with the REPONSE data. The matching of the REPONSE and DIANE databases was kindly carried out by Anne Saint-Martin, from the French Ministry of Labour.

-

[12]

This is calculated as ∂ I/S = γ1 + 2γ2 ln N.

∂N

References

- Adams, D. C., J. Gurevitch and M. S. Rosenberg. 1997. “Resampling Tests for Meta-Analysis of Ecological Data.” Ecology, Vol. 78, June, 1277–1283.

- Addison, J. T. and B. Hirsch. 1989. “Union Effects on Productivity, Profits, and Growth: Has the Long Run Arrived?” Journal of Labor Economics, Vol. 7, No. 1, 72–105.

- Addison, J. T., K. Kraft and J. Wagner. 1993. “German Work Councils and Firm Performance.” Employee Representation: Alternatives and Future Directions. B. Kaufman and M. M. Kleiner, eds. Madison, Wisc.: IRRA, 305–335.

- Addison, J. T. and J. Wagner. 1994. “U.S. Unionism and R&D Investment: Evidence from a Simple Cross Country Test.” Journal of Labor Research, Vol. 20, No. 2, 191–197.

- Addison, J. T. and J. B. Chilton. 1998. “Self-enforcing Union Contracts: Efficient Investment and Employment.” Journal of Business, Vol. 71, No. 3, 349–369.

- Allen, S. 1988. “Productivity Levels and Productivity Change under Unionism.” Industrial Relations, Vol. 27, 94–113.

- Amadieu, J. F. 1995. Le management des salaires. Paris: Economica.

- Amadieu, J. F. 1999. Les syndicats en miettes. Paris: Seuil.

- Audretsch, D. B. and J. M. GrafvonderSchulenburg. 1990. “Union Participation, Innovation, and Concentration: Results from a Simultaneous Model.” Journal of Institutional and Theoretical Economics, No. 146, June, 298–313.

- Baldwin, C. Y. 1983. “Productivity and Labor Unions: An Application of the Theory of Self-Enforcing Contracts.” Journal of Business, Vol. 56, April, 155–185.

- Barrat, O., T. Coutrot and S. Mabile. 1996. “La négociation salariale en France, des marges de manoeuvre réduites au début des années 1990.” Données Sociales, INSEE, 199–209.

- Booth, A. 1995. The Economics of Trade Unions. Melbourne and New York: Cambridge University Press.

- Bronars, S. and D. Deere. 1993. “Unionisation, Incomplete Contracting and Capital Investment.” Journal of Business, Vol. 66, January, 117–132.

- Bronars, S., D. R. Deere and J. Tracy. 1994. “The Effects of Unions on Firm Behavior: An Empirical Analysis Using Firm-Level Data.” Industrial Relations, Vol. 33, No. 4, 426–451.

- Cavanaugh, J. K. 1998. “Asset Specific Investment and Unionized Labor.” Industrial Relations, Vol. 37, No. 1, 35–50.

- Cézard, M., A. Malan et P. Zouary. 1996. “Conflits et régulation sociale dans les établissements.” Travail et Emploi, No. 66, 19–25.

- Cooke, W. N. 1997. “The Influence of Industrial Relations Factors on U.S. Foreign Direct Investment Abroad.” Industrial and Labor Relations Review, Vol. 51, No. 1, 3–17.

- Coutrot, T. 1987. “Présence syndicale et compléments du salaire.” Travail et Emploi, No. 31, mars, 47–58.

- Coutrot, T. 1996. “Relations sociales et performance économique: une première analyse empirique du cas français.” Travail et Emploi, No. 66, 39–58.

- Denny, K. and S. J. Nickell. 1991. “Unions and Investment in British Manufacturing Industry.” British Journal of Industrial Relations, Vol. 29, No. 1, 113–121.

- Denny, K. and S. J. Nickell. 1992. “Unions and Investment in British Industry.” Economic Journal, Vol. 102, July, 874–887.

- Doucouliagos, H. and P. Laroche. 2003. “Unions and Productivity Growth: A Meta-Analytic Review.” The Determinants of the Incidence and the Effects of Participatory Organizations. T. Kato and J. Pliskin, eds. Amsterdam: JAI Book Series, Elsevier Science, Vol. 7, 57–82.

- Drago, R. and M. Wooden. 1994. “Unions, Innovation and Investment: Australian Evidence.” Applied Economics, Vol. 26, No. 6, 609–615.

- Efron, B. and R. J. Tibshirani. 1993. An Introduction to the Bootstrap. San Francisco: Chapman and Hall.

- Fallick, B. C. and K. A. Hassett. 1999. “Investment and Union Certification.” Journal of Labor Economics, Vol. 17, No. 3, 570–582.

- Freeman, R. and J. Medoff. 1984. What Do Unions Do? New York: Basic Books.

- Grout, P. A. 1984. “Investment and Wages in the Absence of Binding Contracts: A Nash Bargining Approach.” Econometrica, Vol. 52, No. 2, 449–460.

- Hedges, L. V. and O. Ingram. 1985. Statistical Methods for Meta-Analysis. London: Academic Press.

- Hirsch, B. T. 1990. “Innovative Activity, Productivity Growth and Firm Performance: Are Labor Unions a Spur or a Deterrent?” Advanced in Applied Micro-Economics. Greenwich, Conn.: JAI Press, Vol. 5, 69–104.

- Hirsch, B. T. 1991. Labor Unions and the Economic Performance of Firms. Kalamazoo, Mich.: W.E. Upjohn Institute.

- Hirsch, B. T. 1992. “Firm Investment Behavior and Collective Bargaining Strategy.” Industrial Relations, Vol. 31, Winter, 95–121.

- Hirsch, B. T. 1997. “Unionization and Economic Performance: Evidence on Productivity, Profits, Investment and Growth.” Unions and Right-to-Work Laws. F. Milhar, ed. Vancouver, B.C.: The Fraser Institute, 35–70.

- Hirsch, B. T. and A. N. Link. 1987. “Labor Union Effects on Innovative Activity.” Journal of Labor Research, Vol. 8, Fall, 323–332.

- Hirsch, B. T. and K. Prasad. 1995. “Wage-Employment Determination and a Union Tax on Capital: Can Theory and Evidence be Reconciled?” Economics Letters, Vol. 48, 61–71.

- Hunter, J. E. and F. L. Schmidt. 1990. Methods of Meta-Analysis: Correcting Error and Bias in Research Findings. Newbury Park, Calif.: Sage Publications.

- INSEE Synthèses. 1999. “L’industrie en 1998.” No. 29.

- Jarrell, S. and T. D. Stanley. 1990. “A Meta-Analysis of the Union-Nonunion Wage Gap.” Industrial and Labor Relations Review, Vol. 44, 54–67.

- Johnson, H. G. and P. Mieszkowski. 1970. “The Effects of Unionization on the Distribution of Income: A General Equilibrium Approach.” Quarterly Journal of Economics, Vol. 4, 539–561.

- Karier, T. 1995. “U.S. Foreign Production and Unions.” Industrial Relations, Vol. 34, January, 107–118.

- Karila-Cohen, P. and B. Wilfert. 1998. Leçon d’histoire sur le syndicalisme français. Paris: PUF.

- Kuhn, P. 1998. “Unions and the Economy: What We Know; What We Should Know.” Canadian Journal of Economics, Vol. 31, No. 5, 1033–1056.

- Labbé, D. 2003. “Histoire et enjeux contemporains du syndicalisme français.” Encyclopédie des ressources humaines. J. Allouche, ed. Paris: Economica (forthcoming).

- Labbé, D. and M. Croisat. 1992. La fin des syndicats? Paris: L’Harmattan.

- Labbé, D., J. Derville and M. Croisat. 1993. La syndicalisation à la CFDT dans les années 1990. Grenoble: CERAT-IRES.

- Landier, H. and D. Labbé. 1998. Les organisations syndicales en France. Paris: Editions Liaisons.

- Lewis, H. G. 1986. Union Relative Wage Effects : A Survey. Chicago: University of Chicago Press.

- Machin, S. and S. Wadhwani. 1991. “The Effects of Unions on Investment and Innovation: Evidence from WIRS.” Economic Journal, Vol. 102, March, 324–330.

- McDonald, I. and R. Solow. 1981. “Wage Bargaining and Employment.” American Economic Review, Vol. 71, December, 896–908.

- Odgers, C. W. and J. R. Betts. 1997. “Do Unions Reduce Investment? Evidence from Canada.” Industrial and Labor Relations Review, Vol. 51, No. 1, 18–36.

- Shapiro, C. and J. Stiglitz. 1984. “Equilibrium Unemployment as a Worker Discipline Device.” American Economic Review, Vol. 74, 433–44.

- Stanley, T. D. 2001. “Wheat from Chaff: Meta-Analysis as Quantitative Literature Review.” The Journal of Economic Perspectives, Vol. 15, No. 3, 131–150.

- VanderPloeg, F. 1987. “Trade Unions, Investment, and Employment: A Non-Cooperative Approach.” European Economic Review, Vol. 31, October, 477–501.

- Verma, A. 1985. “Relative Flow of Capital to Union and Nonunion Plants within a Firm.” Industrial Relations, Vol. 24, No. 3, 395–405.

- Wolf, F. M. 1986. Meta-Analysis: Quantitative Methods for Research Synthesis. Beverly Hills, Calif.: Sage University Paper Series, No. 59.

Liste des tableaux

Table 1

Empirical Studies on the Impact of Unions on Tangible Investments

Table 2

Average Union-Investment Effects

Table 3

Means and Standard Deviations of French Data, 1998

Table 4

Union-Investment Effects, All French Industries

Table 5

Union-Investment Effects, Individual French Industries