Résumés

Abstract

This study investigates the mediating effect of corporate innovation on the relationship between gender diversity in top management and firm performance. Using panel data from French firms listed in the SBF120 index (2013-2017), Generalized Method of Moments (GMM) regressions revealed that the presence of woman on the board and the executive committee positively and significantly influences both corporate innovation and firm performance, and innovation mediates the relationship between gender diversity and firm performance. We conclude that gender diversity in the strategic level improves the firm’s decision-making process, facilitating the initiative to innovate.

Keywords:

- Top management gender diversity,

- corporate innovation,

- mediating effect,

- firm performance,

- GMM regression,

- panel data

Résumé

Cette étude examine l’effet médiateur de l’innovation dans la relation entre la diversité de genre et la performance de l’entreprise. Utilisant des données panel des firmes françaises de l’indice SBF120 (2013-2017), les régressions de la méthode des moments généralisés (GMM) révèlent que la présence de femmes au conseil d’administration et au comité exécutif influence positivement et significativement l’innovation et la performance de l’entreprise, et l’innovation joue un rôle médiateur entre la diversité de genre et la performance. Nous concluons que la diversité de genre aux niveaux stratégiques améliore le processus de prise de décision de l’entreprise, facilitant l’initiative d’innover.

Mots-clés :

- diversité de genre,

- innovation,

- effet médiateur,

- performance de l’entreprise,

- régression GMM,

- données de panel

Resumen

Este estudio examina el efecto mediador de la innovación en la relación entre diversidad de género y desempeño empresarial. Utilizando un panel de firmas francesas del índice SBF120 (2013-2017), las regresiones del método generalizado de momentos revelan que la presencia de mujeres en el consejo de administración y en el comité ejecutivo influye positivamente en la innovación y el desempeño empresarial, y la innovación juega un papel mediador entre la diversidad de género y el desempeño. Concluimos que la diversidad de género a niveles estratégicos mejora el proceso de toma de decisiones de la empresa, facilitando la iniciativa de innovar.

Palabras clave:

- diversidad de género,

- innovación,

- efecto mediador,

- desempeño de la empresa,

- regresión GMM,

- datos de panel

Corps de l’article

Gender diversity has become the subject of several studies over the past few decades. It emerged in the 1980s–90s in the US and was developed as a part of the managerial issue within the “management of diversity”. Presently, it represents financial and managerial challenges faced by firms. Additionally, this issue is of high interest for policy makers, firms, and investors. Several countries have implemented directives and regulations to ensure balanced representation of men and women in the decision-making structures due to the underrepresentation of women in governance and management positions in companies.

In 2020, the Global 500 Fortune firms[1] included only 14 firms (2.8%) headed by female CEO. Many countries such as France, Norway, North America, and Italy have opted for regulation by imposing gender quotas ranging from 40% to 50% representation of women in board of directors. Other countries such as Spain and the UK have adopted a flexible approach that recommends and encourages greater representation of women in corporate boards (Smith, 2014). According to the report entitled “Women, Business and the Law 2019: A Decade of Reform,” published in 2019 by the World Bank Group, 131 economies have adopted 274 legislative and legal reforms ensuring the improvement of equality between men and women along with the latter’s economic integration. The issue of women’s inclusion in management and governance structures embodies not only social and managerial challenges but also financial and managerial goals. It is also considered as one of the foundations of sustainable development and a major dimension of corporate social responsibility.

Numerous studies have investigated the impact of gender diversity on firm governance (Toé, 2012; Frye and Pham, 2018; Ye et al., 2019), risk taking (Palvia et al., 2015; Sila et al., 2016; Bacha and Azouzi, 2019; Almenberg et al., 2020), performance (Miller and Triana, 2009; Dezso and Ross, 2012; Toé, 2012, Toé, 2014; Post and Byron, 2015; Isidro and Sobral, 2015; Low et al., 2015; Bauweraerts et al., 2017; Chen et al., 2018; Bibi et al., 2018; Bennouri et al., 2018; Aggarwal et al., 2019; Toé and Bationo, 2019; Brahma et al., 2020), and corporate social responsibility (Nekhili et al., 2017; Liu, 2018; Francoeur et al., 2019; Beji et al., 2020). However, only a few studies have examined the impact of gender diversity on corporate innovation which is a key factor of competitiveness and a powerful determinant of firm development (Su et al., 2019).

From a theoretical point of view, innovation is a major factor for economic growth and business development. Presently, companies are investing in it increasingly to improve their competitiveness. The surging investment in research and development (R&D) enables companies to obtain patents within well-defined periods and derive significant profits. Therefore, innovation is considered as an essential element of corporate strategy since it introduces more efficient means of production, preferable reputation with its customers, competitive advantage in the long term, and above all greater performance in the market (Gunday et al., 2011). In this paper, we empirically analyze the direct effect of gender diversity in top management on performance and innovation. The results can be used by managers to understand the relationship between gender diversity, innovation, and performance. Specifically, we investigate whether gender diversity affects firm performance directly or through other channels. Thus, our study is significant because it hypothesizes the mediating effect of innovation on the above-mentioned relationship.

Previous studies have been inconclusive regarding the effect of gender diversity on firm performance. While some researches have observed that the presence of more women in management and decision-making structures improves firm performance, other scholars have highlighted the negative impact of gender diversity on firm performance. This discrepancy can be explained by two major reasons. First, the impact of female representation in top management on performance can be contextual (Klein and Harrison, 2007; Dezso and Ross, 2012). Dezso and Ross (2012) observed that gender diversity in top management positively affects firm performance, specifically in the context of innovation. Further, previous studies have assumed a direct impact of gender diversity on firm performance. However, the relationship between these variables can be mediated by other factors. We hypothesize that corporate innovation can be a moderating factor since gender diversity is particularly beneficial for firms with high innovation intensity (Dezso and Ross, 2012). This potential mediating effect of innovation can be also explained by a translational effect. While some studies report the positive impact of gender diversity on innovation, others consider innovation as a fundamental driving factor for firm performance. Thus, we believe that gender diversity affects innovation, which in turn affects performance.

Using a sample of US firms, Chen et al. (2018) observed that the positive translational effect only exists in innovation intensive industries where creativity and innovation are pillars of corporate strategy. Miller and Triana (2009) studied the Fortune 500 firm sample and found that the relationship between gender diversity and corporate performance is mediated by innovation and reputation. Our paper extends the above-mentioned literature along two dimensions. First, the study is not restricted to the representation of women on the board but also in executive committees. In other words, our study is concerned with gender diversity in top management. In our sample, the main strategic decision-making structures of a company are both the board of directors and executive committee. Further, Miller and Triana’s (2009) and Dezso and Ross’s (2012) finding are also extended by using patenting activity as a proxy to innovation productivity along with R&D expenditures. Second, the aforementioned studies have focused on the US (Dezso and Ross, 2012; Chen et al., 2018) and the Fortune 500 firms’ context (Miller and Triana, 2009); our study highlights the French context. Consequently, we investigated a sample of listed French firms over the period 2013 to 2017, characterized by the adoption of legislative changes to improve gender diversity of the board of directors. We chose the French context for several reasons. Gender diversity in France constitutes a managerial, economic, and financial issue. In recent years, France has adopted the policy of feminization of boards of directors or supervisors to involve more women in management and decision-making zstructures. In 2011, the “Copé-Zimmermann” law was adopted. It mandated French companies to have 20% and 40% women members on their boards of directors[2] in 2014 and 2017, respectively. Consequently, this quota quickly accelerated from 23.2% in 2013 to 43.6% in 2018 for SBF120 companies. Thus, France is one of the first three European countries to achieve the objective of the feminization of boards of directors. Additionally, in the worldwide list of top50 companies that practice equality between men and women, 10 companies are French. Corporate innovation in this country is a major issue from both microeconomic and macroeconomic perspectives. According to OECD (Organization for Cooperation and Development), R&D expenditures constituted 2.191% of the French GDP in 2019. France invests in innovative activities more than the average of the other European Union countries that are members of OECD. This is corroborated by 15,812 patents and 99,054 trademarks in 2019[3]. In 2019, France was ranked second[4] as a patent holder in Europe. The French government is also adopting several measures, such as the research tax credit (CIR) and industrial research training agreements (CIFRE), to stimulate innovation and encourage companies to invest in innovative activities.

The remainder of the paper is organized as follows. Section 2 includes a brief review of the literature and enlists the hypotheses for empirical investigation. Section 3 includes the details of the sample and variable measurements. The research methodology is presented in section 4. Section 5 reports the results and discussions, which is followed by the conclusion in section 6.

Literature Review and Hypotheses Development

Gender Diversity and Firm Performance

The issue of gender diversity in governance structure is no longer only a managerial and ethical concern, aiming to reduce the underrepresentation of women in strategic structures of companies. Currently, it represents a “business case” as the presence of more women directors represents potential value creation, better productivity, and greater performance (Miller and Triana, 2009; Dezso and Ross, 2012; Toé, 2012; Liu et al., 2014; Toé, 2014; Post and Byron, 2015; Low et al., 2015; Bauweraerts et al., 2017; Chen et al., 2018; Bibi et al., 2018; Toé and Bationo, 2019; Brahma et al., 2020). Previous studies have reported mixed results on the relationship between gender diversity and firm performance. According to one perspective, increase in the proportion of women directors on the board can deteriorate firm performance (Ahern and Dittmar, 2012), deeming diversity as a factor of inefficiency. Board diversity may cause conflicts and internal problems between members. Kanter (1977) argued that heterogeneous teams do not adapt and cooperate easily because of the differences that exist between its members. Using a sample of listed French companies from 2009 to 2011, Boubaker et al. (2014) observed that female managers exert a negative impact on financial performance. Adams and Ferreira (2009) reported a negative relationship between gender diversity and performance due to over monitoring led by female presence on boards. Darmadi (2011) suggested that in the context of Indonesian firms, female representation on boards may be driven by familial relationship rather than skills and expertise. Rose (2007) and Marimuthu and Kolandaisamy (2009) illustrated that the presence of women on boards of directors does not affect the performance of Danish and Malaysian companies, respectively. Accordingly, Bauweraerts et al. (2017) found that the presence of women directors has no effect on the performance due to the curvilinear relationship while female executive directors influences negatively economic performance of Belgian companies. According to Toé et al (2012), they suppose that the greater creativity and innovation induced by female presence in top management can be neutralized by the occurrence of internal conflict due to additional heterogeneity.

Nevertheless, several theories have claimed the economic value created by the presence of women in top management. First, the human capital theory assumes that each board member brings a set of skills and experience to an organization (Becker, 1967; Bruna and Chauvet, 2010) that can enlarge the range of knowledge, information, and perspectives. Consequently, gender diversity embodies greater access to human and capital resources that can improve firm performance (Miller and Triana, 2009; Low et al., 2015). Hence, the presence of female directors improves the efficiency of decision-making of the board, enhancing firm performance (Kim and Starke, 2017). Second, the resource dependency theory assumes that firms are like open structures that depend on external organizations and economic conditions. This suggests that women on board help companies in optimizing access to critical resources by using their skills and knowledge that are different from those of male administrators (Hillman et al., 2007). Carter et al. (2003) found that gender diverse boards have better decision-making capabilities associated with a finer understanding of the marketplace. Hence, women in top management are considered as complementary resources, that is, beneficial for firm performance. Third, the effect of gender diversity on firm performance can also be explained by the agency theory. According to this perspective, the presence of females improves board monitoring (Yi, 2011) and facilitates civilized behavior and better governance (Singh and Vinnicombe, 2004). Carter et al. (2003) confirmed that gender diversity might enhance board independence and reduce agency conflicts through effective monitoring and control. Fourth, according to the stewardship theory, female managers are considered as transformational leaders since they tend to have aligned communal behavior (Eagly et al., 2003). They pay more attention to collaboration, communication and networking (Claes, 1999) which can improve firm performance.

Several empirical studies have confirmed the positive relationship between gender diversity and firm performance in accordance with these theories. Toé (2012) studied the determinants for integrating women into the board and analyzed the expected impact of female participation in top management on economic and financial performance and on corporate governance. Considering French firms listed on the SBF120 index, from 2004 to 2009, results report positive impact of gender diversity on ROA and ROE. This impact becomes negative on Tobin’s Q ratio. It appears also that integrating women into the board affects positively the quality of governance and the market value of the company. The relationship between female representation in top management and the financial market reaction was also studied by Toé and Bationo (2019) proving a positive effect. Chakrabarty and Bass (2014) focused on micro-financial institutions and illustrated that women are better at reducing operating costs and improving financial performance (Strom et al., 2014). Indeed, the female board representation influences not only the average performance of companies, but also the dispersion of their performance (Conyona and He, 2017). Post and Byron (2015) conducted a meta-analysis of 140 studies and concluded that diversity within the boards of directors is positively linked to accounting returns, especially in countries where shareholder protection is reinforced. Similarly, Bibi et al. (2018) found that the presence of women on the board is positively associated with the performance of microfinance institutions. Bennouri et al. (2018) demonstrated that the reputation of women directors is positively associated with firm performance. Recently, Tsou and Yang (2019) illustrated that highly educated women improve Chinese firm performance. Considering the FTSE100 firms in the UK, Brahma et al. (2020) found that the positive relationship between gender diversity and firm performance became highly significant in the case of the appointment of three or more females to the boards compared to the appointment of two or less females. Therefore, based on these studies, our first hypothesis is as follows:

H1: There is a positive direct effect of gender diversity on firm performance.

Gender Diversity and Innovation

Most studies on gender diversity have focused on the effect of women directors on firm value, governance, risk-taking, and corporate social responsibility. However, few studies have investigated the effect of gender diversity on corporate innovation, even though it is a determining factor of the competitiveness of companies and countries (Wojnicka-Sycz and Sycz, 2016). Innovation is of interest to a large number of stakeholders such as business leaders, employees, and investors (Fang et al., 2014). It is widely regarded as a major catalyst for economic growth and industrial evolution. Investing in innovative activities and devoting various human and financial resources to it, are some of the most important decisions that a company can take.

An emergent strand of literature has investigated the effect of gender diversity on a firm’s innovation, but the results remain inconclusive. Few studies have shown that gender diversity does not affect innovation or can have a negative impact on it. Assessing a sample of 25 banks, Iren and Tee (2018) found that the presence of women managers does not significantly affect bank innovativeness. Likewise, Bianchi et al. (2012) found that for Italian companies, gender diversity does not influence investment in innovation. Investing in innovative activities is very risky for a company and requires significant financial resources. In most cases, the manager follows the rooting theory; meaning, irrespective of their gender, they do not prefer to invest in innovative projects that can be unprofitable and lead to dismissal in the case of loss.

Contrarily, other works have concluded that gender diversity has a positive impact on innovation (Teruel et al., 2015). This positive impact is explained by the behavioral theory of the firm (Cyert and March, 1963). Accordingly, gender diversity produces a wider range of ideas, information, and perspectives producing high quality decisions (Joshi and Roh, 2009). Thus, it generates greater creativity and innovative decisions through cognitive conflicts (Chen et al., 2005; Østergaard et al., 2011; Garcia Martinez et al., 2017). Managers can benefit from these different contributions and encourage their companies to create new products by investing in innovation and developing an innovative strategy. According to Chen et al. (2018), women are more productive in terms of innovation, as they spend more on R&D and acquire more patents. Horbach and Jacob (2018) reported that a large representation of highly qualified women and mixed-gender board positively correlate with activities of innovation in the environmental sector. Roh and Koo (2019) illustrated that companies with a more diverse team of researchers demonstrate a better capacity for innovation due to various experience and knowledge (Faems and Subramanian, 2013). Díaz-García et al. (2013) revealed that gender diversity within R&D teams enhances radical rather than incremental innovation. Na and Shin (2019) suggested that female representation in top management positively affects innovation for two reasons. First, top female managers use a style of leadership that facilitates information exchange and communication and promotes more collaboration and creativity (Zuraik and Kelly 2019). Second, they are less likely to give or receive bribes than male managers, which affects available funds for innovation (Jha and Sarangi, 2018). According to the agency theory, women in top management are associated to less agency related problems. Women leaders have greater capacity to monitor and follow-up, which enables them to solve agency problems linked to innovation (Chen et al., 2018). However, this female monitoring should not be excessive to prevent managerial myopia causing less innovation investments (Becker-Blease, 2011). Empirically, we propose to test the following hypothesis:

H2: There is a positive effect of gender diversity on innovation.

The Mediating Effect Of Innovation

As mentioned above, previous literature provides mixed results regarding the effect of gender diversity on firm performance. Kochan et al. (2003) highlighted that to understand the relationship between gender diversity and performance, it should be relevant to examine when and how gender diversity can improve performance. Two main reasons can explain the divergent results and examine the context (when) and ways (how) through which gender diversity affects firm performance. First, the impact of female representation in top management on performance can be contextual. Dezso and Ross (2012) proposed a model to explain how the impact of female representation in top management is moderated by strategically relevant organizational contexts. Specially, they believed that gender diversity positively affects firm performance and this effect is not general but context specific (Klein and Harrison, 2007). The authors’ theoretical model explains how female representation in top management positively affects firm performance by improving managerial task performance. The authors argue that it is due to the informational and social diversity benefits associated with female representation in top management team that the behaviors exhibited by managers throughout the firm are enriched, and middle management women are motivated. Women in middle management are expected to be more motivated and engaged in the case of a greater female presence on the top management, particularly, in the presence of an interactive and participative leadership style encouraged by gender diversity (Rosener, 1995). Testing their model using data from the S&P500, Dezso and Ross (2012) found that gender diversity in top management positively affects firm performance, specifically in the context of innovation. Moreover, Van Knippenberg et al. (2004) observed that tasks demanding creative solutions are more valuable because these require divergent views and detailed information processing headed by female representation in top management. Creativity is facilitated by gender diversity (Stahl et al., 2009) which is particularly relevant to managerial activities and beneficial for innovative firms (Dezso and Ross, 2012). Motivation and commitment are important to engage with an effective innovation strategy.

This contextual effect of gender diversity on performance leads us to the second reason explaining the divergent results. Previous studies have assumed that the relationship between female representations in top management on firm performance is direct. However, the link between gender diversity and firm performance can be mediated by other factors, for example, corporate innovation, since gender diversity is particularly beneficial for firms with high innovation intensity (Dezso and Ross, 2012). The mediating effect of innovation on financial performance can be explained by a translational effect.

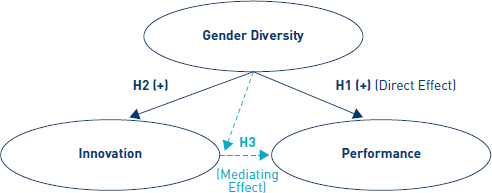

Female representation in top management plays a particularly important role in corporate decision-making, especially in innovative industries (Dezso and Ross, 2012). It influences the choice of strategic decisions such as investment in innovation. Ruiz-Jimenez et al. (2016) revealed that gender diversity plays a positive moderating role in the relationship between knowledge combination capability and innovation. It improves creativity, external collaboration (Joshi and Jackson, 2003), and generation of new ideas, which positively affect innovation (Lu and Wang, 2018). It also provides greater cognitive ability and is considered a valuable strategy to pursue to improve incremental and radical innovation performance (Garcia Martinez et al., 2017). Morris (2018) illustrated that companies that increase spending on R&D and create innovative products, achieve improved productivity and generate higher profits than companies that do not innovate. Innovative companies can gain a competitive advantage in the market, facilitating their improvement in terms of increased profitability. Griffin et al. (2019) highlighted that gender diversity is beneficial for innovative performance due to three mechanisms: failure-tolerant and long-term oriented managerial incentives schemes, corporate culture, and inventor diversity. The authors suggest that gender diverse boards positively affect corporate innovative efficiency because female managers avoid investing in projects that are unlikely to succeed. Therefore, we hypothesize that gender diversity affects innovation, which in turn influences firm performance. We postulate an indirect effect of gender diversity on firm performance through corporate innovation (Fig. 1).

Empirically, this induces the following hypothesis:

H3: Innovation mediates the relationship between gender diversity and firm performance.

Figure 1

The mediating effect of innovation

Data and Variable Measurements

Our study assesses a sample of French companies listed in the SBF120 index from 2013 to 2017. We excluded financial firms from the sample to obtain homogenous data. The final panel included 95 companies (475 observations). Data was collected from various sources. For example, data on gender diversity was extracted from the Ethics & Boards survey which is the main corporate governance observatory for listed companies related to the composition of boards. Financial data was obtained from Datastream. Rest of the data were collected manually from reference documents and annual reports published by companies on their official websites.

Considering our research question, the following three variables are considered: gender diversity in top management, innovation, and firm performance. To measure gender diversity in top management, we employ two proxies. First, we consider the percentage of women on the board of directors (Female board representation or FB). This measure has been frequently used in previous studies (Dang and Nguyen, 2016; Chen et al., 2018; Ye et al., 2019) to signify female representation at a firm’s strategic level. The second variable measures the proportion of women in the executive committee (Female executive representation or FE). The executive committee implements the strategic orientations defined by the board and controls its performance. It represents a relevant committee to corporate development. In the French context, the board of directors and executive committee are the main strategic decision-making structures of a company.

Then, we measure mediator variable innovation by employing two proxies focusing essentially on product innovation as output innovation. The first proxy, measuring innovation input, is defined as the natural logarithm of R&D expenditures, calculated as follows: . The second proxy, measuring product innovation output, is based on the natural logarithm of patent number, defined as . According to Hsu et al. (2014) and Chen et al. (2018), R&D represents the first step in the investment in an innovation strategy. Markovic and Bagherzadeh (2018) believed that investment in R&D is a proxy for an innovation that indicates companies’ initiative to innovate. In addition, R&D is an essential and primordial component of innovation, indicating the intensity with which companies explore new products. The natural logarithm of patent number available to a company (Lu and Wang, 2018; Sheikh, 2018) represents a formal method of protecting the intellectual property rights associated with an invention. Atanassov (2013) confirmed that R&D expenditures do not constitute the effective results of the innovation process. Hence, several authors have considered the patent measure as complementary to R&D expenditures, indicating the efficiency and productivity through which the company uses its inputs. This measure cannot be used alone to quantify innovation because innovations are not completely patented within a company. It differs from one firm to another, for example, there are countries where property rights are sparse, so companies have to file fewer patents (Wadho and Chaudhry, 2018).

Third, to measure performance we focus on financial performance, using a marked based measure, that is, the Market-to-Book (MB) ratio (Barber and Lyon, 1997; Adams and Ferreira, 2009; Bennouri et al., 2018). To ensure robustness, we also employ accounting measures such as the return on assets (ROA) and return on equity (ROE) (Mefteh-Wali and Rigobert, 2018). Accounting measures generally reflect previous profits and short-term performance. The Market-to-book ratio values all the activities of a company and considers the current and future cash flow. More importantly, it provides a measure to evaluate intangible factors such as innovation.

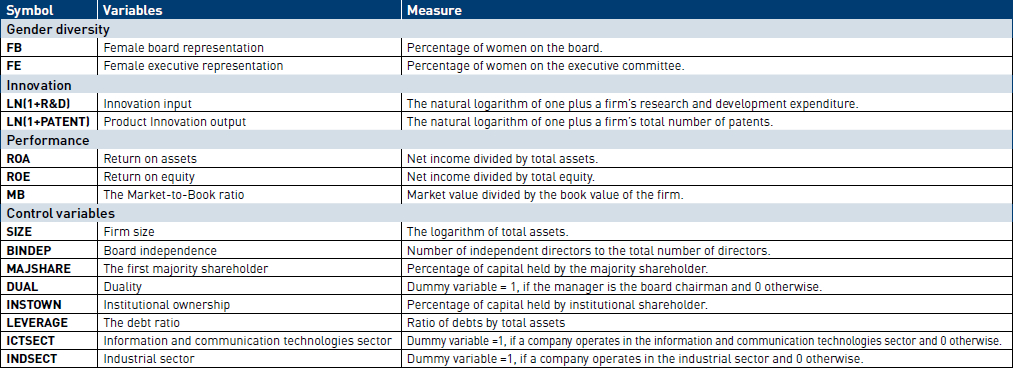

Finally, based on previous literature, we include control variables that may affect innovation and firm performance. In our analysis, we retain board independence (BINDP), duality of the manager function (DUAL), institutional ownership (INSTOWN), block shareholders (MAJSHARE), firm size (SIZE), leverage (debt ratio [LEVERAGE]). Moreover, we include the following two sector variables: information and communication technologies sector (ICTSECT) and industrial sector (INDSECT). We explain this choice based on the CIS[5] survey. Accordingly, the ICT and industrial sectors remain the most innovative sectors between 2014 and 2016. Table 1 summarized all the variables.

Research Methodology

The main objective of our research is to explore the mediating effect of innovation on the relationship between gender diversity and firm performance. The mediating effect, also known as the indirect effect, determines the impact of an independent variable on a dependent variable (Edwards and Lambert, 2007). A mediator acts as a tool explaining the mechanism through which one variable affects another. In other words, the mediating effect explains the influence of an independent variable upon a mediating variable, which then influences a dependent variable. Therefore, the mediating variable is perceived as a bridge between the independent and dependent variables (Musairah, 2015).

Table 1

Description of Variables

We used Baron and Kenny’s (1986) approach, to test whether innovation mediates the relationship between gender diversity and firm performance. This approach includes three steps: (1) prove that the independent variable is correlated with the dependent variable; (2) prove that the independent variable is correlated with the mediating variable; and (3) regress the dependent variable on both the independent and mediator variables. This allows us to detect the indirect effect of gender diversity on firm performance through innovation and compare it with the direct effect. Therefore, we begin by investigating the direct effect of gender diversity on firm performance (H1), using the following Model 1.

Here, index (i) refers to the company, index (t) indicates the year of Perf study. denotes the performance measures assessed by the following three proxies: ROA, ROE, and MB. and denote gender diversity measures: Female board representation and Female executive committee representation, respectively. Xk where K = 1, …9, denotes the control variables mentioned above. The fixed effect over a period is indicated by αi and μi,t is the idiosyncratic term that denotes error.

To test the effect of gender diversity on corporate innovation (H2), we utilize Model 2.

Here, denotes both the proxies of innovation: innovation input and innovation output (Table 1). Fixed effect over time is indicated by α'i and εi,t is the idiosyncratic term that denotes error.

Finally, we study the mediating effect by regressing firm performance on both gender diversity and innovation (H3) using the following model.

Here, denotes three proxies of performance: ROA, ROE, and MB. Fixed effect over time is indicated by α''i and πi,t is the idiosyncratic term that denotes error.

We used the Generalized Method of Moments (Blundell and Bond, 1998) to estimate the model above and avoid several statistical problems. It tackles the bias of reverse causality and omitted variables, as well as endogeneity. In addition, it assures the simultaneous control of specific temporal and individual effects of the variables, specifically in case of the existence of more than one lags at the level of the dependent variable. We employ the dynamic panel system GMM estimator, which favors estimation efficiency and includes fixed effects to gauge unobservable heterogeneity among companies. To ensure the relevance of GMM estimators, we tested the validity of two statistical tests. First, the Sargan-Hansen test, which examined the validity of the model instruments based on the assumption that error terms and exogenous variables are not correlated. Second, the Arellano and Bond test that examines the autocorrelation of errors.

Results

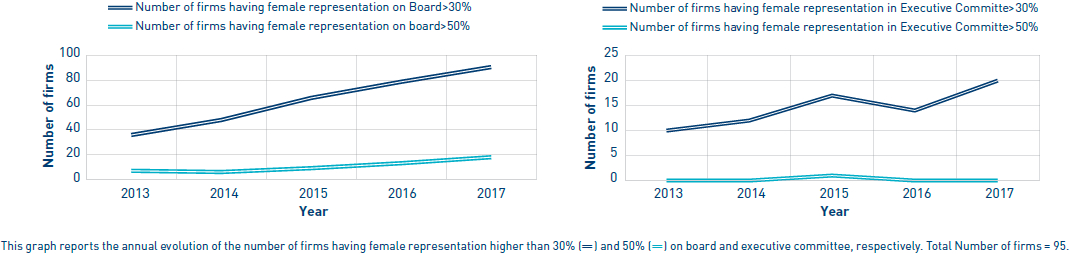

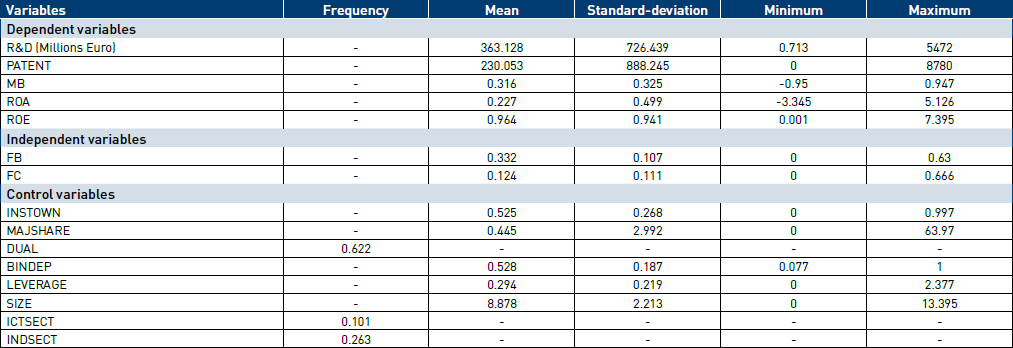

Table 2 incorporates the descriptive statistics. It depicts that on an average, SBF120 companies have 33.2% female board member, with a maximum proportion of 63%—exceeding the 40% quota imposed by the Copé-Zimmermann law. Further, French companies have an average of 12.4% woman in the executive committee. Figure 2 demonstrates the temporal evolution of the number of firms with female representation exceeding 30% and 50% on board (FB) and on executive committee (FE), respectively. It appears that French firms continue to make efforts to increase women’s representativeness on boards. However, executive committees remain underrepresented by women.

In terms of innovation variables, R&D expenditures and patent numbers correspond with an average of 363 Million Euros and 230, respectively. The ICT and industrial sectors spend 366 Million Euros in R&D and register 232 patents annually, which confirms the innovative potential of these sectors.

Regarding financial performance, French companies obtained an average MB, ROA, and ROE of 0.316, 0.227, and 0.964, respectively. Additionally, Table 2 depicts 52.8% as the mean of independent directors with a dispersion of 18.7%. This indicates that independence of directors is important in French firms, which is consistent with the corporate governance code. The SBF120 companies are characterized by concentrated shareholding capital. On an average, the major shareholder procures 44.5% of the entire capital. Further, institutional investors maintain an average of 52.5% of the capital shares. Besides, 62.26% of French companies have duality. Debt ratio represents an average of 29.4% with a 21.9% spread rate. Finally, the sector variables indicate that 10.11% and 26.32% of the companies operate in the ICT and industrial sector, respectively.

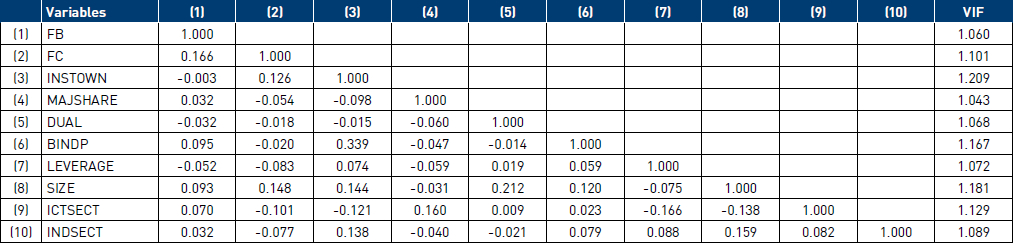

Table 3 reports the correlation matrix of all the variables utilized in our statistical analyses. The variance inflation factor (VIF) was also calculated to ensure the multicollinearity of the variables. The correlation matrix and VIF confirm the absence of a multicollinearity bias.

Figure 2

Female representation on board and executive committee between 2013 and 2017

Table 2

Descriptive Statistics

Table 3

Correlation matrix and Variance inflation factor (VIF)

This table provides the correlation between variables. The description of each variable is summarized in Table 1.

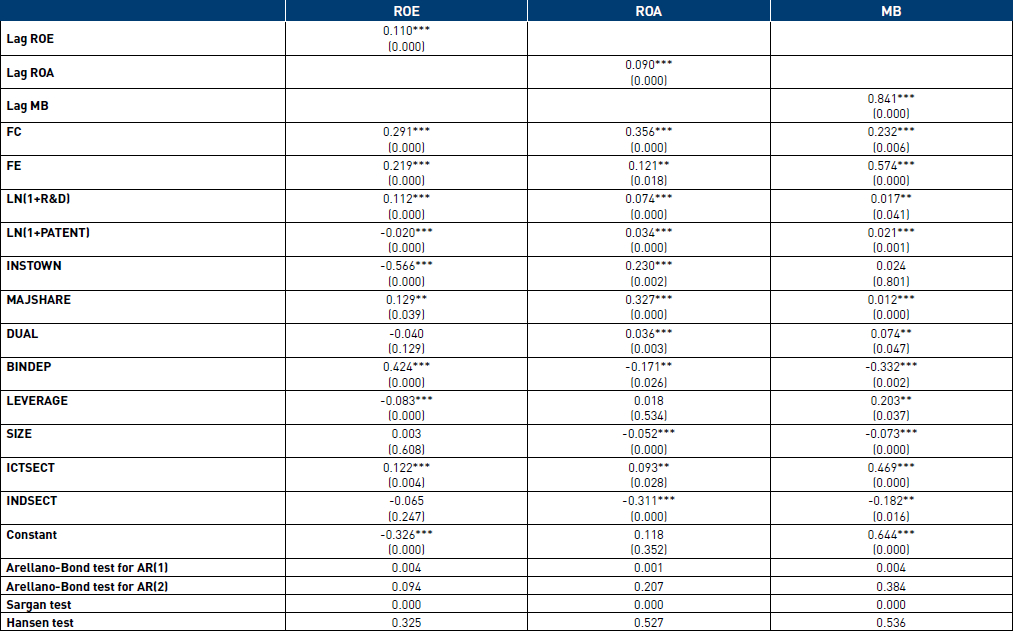

Table 4 reports the results of the GMM regression examining the direct effect of gender diversity on firm performance (Hypothesis 1). The results indicate that the presence of women on the board of directors is positively associated with firm performance at 1% significance level. These results correspond with Toé (2012), Strom et al. (2014), Conyona and He (2017), and Bibi et al. (2018). This positive effect can be explained by the agency theory and human capital theory. Gender diversity collates different viewpoints in management structures, improving strategic decision-making. In addition, a gender diversified board ensures better and effective supervision and control that can reduce information asymmetry and avoid agency related conflicts between different directors, promoting firm performance (Ahmadi et al., 2017).

Moreover, the results prove that the presence of women in the executive committee positively and significantly influences firm performance. Women executive directors contribute to the improvement of firm performance (Smith et al., 2006; Brahma et al., 2020). In this regard, Nekhili and Gatfaoui (2013) argued that, in the French context, several demographic attributes such as age, education level, and experience enable women in top management positions to improve firm performance. This is contradiction to Bauweraerts et al. (2017) in the Belgian context and to Boubaker et al. (2014) who found that gender diversity negatively affects French companies’ performance. These studies were conducted before the adoption of the “Copé-Zimmermann” law, which possibly explains this negative effect.

Table 4 suggests that the governance variables significantly influence firm performance. Governance mechanisms are relevant determinants of firm performance (Kiradoo, 2019). Additionally, the debt ratio positively affects firm performance, and firm size and sector variables significantly influence firm performance.

Table 4

Model 1—The direct effect of gender diversity on firm performance

Table 4 summarizes the two-step Dynamic Panel System GMM regression results, examining the direct effect of gender diversity on firm performance. The dependent variable is firm performance measured by the return on assets (ROA), return on equity (ROE), and market-to-book ratio (MB). Lag ROA, Lag ROE, Lag MB are the lagged vales of our dependent variable. The independent variable is gender diversity, which includes two measures: FB and FE. We control the effect of governance (by using INSTOWN, MAJSHARE, DUAL, and BINDEP), debt ratio (LEVERAGE), firm size (SIZE), information and communication technologies sector (ICTSECT), and industrial sector (INDSECT). ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Values in the parentheses represent p-values.

Table 5

Model 2—Impact of gender diversity on corporate innovation

Table 5 summarizes the two-step Dynamic Panel System GMM regression results, examining the effect of gender diversity on innovation. The dependent variable is innovation which is measured by its input LN (1+R&D) and output LN (1+PATENT). Lag LN (1+R&D) and Lag LN (1+PATENT) are the lagged values of our dependent variable. The independent variable is gender diversity, which includes FB and FE. We control the effect of governance (by using INSTOWN, MAJSHARE, DUAL, and BINDEP), debt ratio (LEVERAGE), firm size (SIZE), market-to-book ratio (MB), information and communication technologies sector (ICTSECT), and industrial sector (INDSECT). ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Values in the parentheses represent p-values.

Table 5 summarizes the results of the effect of gender diversity on corporate innovation (Hypothesis 2). It is indicated that the presence of women on the board of directors has a significant and positive impact on R&D expenditures and patents. Meaning, the presence of women on the board of directors improves the decision-making process, facilitating the initiative to innovate and generate more patents. In addition, the presence of women in the executive committee positively and significantly affects innovation input and output. These results are explained by the fact that women directors have a specific leadership style characterized by empathy, creativity, and collaboration that promotes innovation performance (Horbach and Jacob, 2018). In fact, a gender diverse team facilitates the promotion of innovation investment and its performance (Garcia Martinez et al., 2016; Díaz-García et al., 2013). Our results are consistent with Ruiz-Jiménez et al. (2016) who observed that gender diversity in top management teams enhances the association between knowledge capability and corporate innovation.

Table 5 indicates that majority ownership has a positive and significant impact on R&D investment. Majority shareholders are more interested to invest in long term R&D projects that yield firm value. In addition, manager duality has a negative impact on innovation input and output. In fact, it increases conflicts between the board and management, due to which the president refuses to engage in long-term strategic and investment decisions such as innovation projects. Furthermore, the presence of independent directors negatively influences corporate innovation. Independent directors as consultants cannot disseminate adequate information that enables the amelioration of the firm’s innovation performance and effectiveness. Also, firm size has a significant and positive effect on corporate innovation. It is considered as one of the primary determinants and generators of corporate innovation since large companies possess the resources and skills necessary to facilitate innovations.

Table 6 reports the mediating effect of corporate innovation on the relationship between gender diversity and firm performance (Hypothesis 3). The results indicate that innovation significantly mediates the relationship between gender diversity and firm performance. Correlation coefficients of the indirect effect of innovation on gender diversity and firm performance are lower than the direct effect. Consequently, based on Baron and Kenny’s (1986) method, the results confirmed that corporate innovation mediates the relationship between gender diversity and firm performance.

Considering the culture and specificity of the French business environment, gender diversity improves the decision-making process, increasing the initiative to innovate and generate more patents. In fact, as a member of the board of directors, women have the right to vote and actively participate in formulating strategic decisions. Moreover, as executive directors, they participate in the decision-making process, policy direction, and oversight. Accordingly, the presence of women at the strategic levels ameliorates firm performance, specifically in the innovative fields (Dezso and Ross, 2012). In conclusion, adopting an innovative strategy promotes the positive influence of the presence of women in top management positions on firm performance.

Table 6

Model 3—The mediating effect of innovation on the relationship between gender diversity and firm performance

This table summarizes the two-step Dynamic Panel System GMM regression results, examining the impact of gender diversity and corporate innovation on firm performance. The dependent variable is firm performance measured by the return on assets (ROA), return on equity (ROE) and market-to-book ratio (MB). Lag ROA, Lag ROE, Lag MB are the lagged values of our dependent variable. The independent variables are innovation input and output measured by LN (1+R&D) and LN (1+PATENT) and gender diversity, which includes FB and FE. We control the effect of governance (by using INSTOWN, MAJSHARE, DUAL, and BINDEP), debt ratio (LEVERAGE), firm size (SIZE), information and communication technologies sector (ICTSECT), and industrial sector (INDSECT). ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Values in the parentheses represent p-values.

Conclusion

The paper aimed to investigate the mediating effect of innovation on the relationship between gender diversity and firm performance. We began by testing the direct effect of gender diversity on firm performance. Then, we explored the effect of gender diversity on innovation. For this, we used two complementary innovation measures: R&D expenditures as innovation input, and patents number as innovation output. Finally, we examined the mediating effect of innovation on the relationship between gender diversity and firm performance.

Our results confirm that the presence of women on the board of directors and in the executive committee positively and significantly affects firm performance. This implies that gender diversity in the strategic decision-making process improves a company’s financial performance.

In addition, we highlight that gender diversity significantly and positively influences innovation when women are board’ and executive’ directors. Furthermore, corporate innovation significantly mediates the relationship between gender diversity and firm performance. Based on these results and the imposition of gender quota law in France since 2011, we observe an increasing engagement of women at the strategic levels of a firm. In fact, the presence of women on the board of directors and executive committees improves the decision-making process, and positively influences corporate innovation and financial performance.

However, our study has a limitation, as we focus only on product innovation. Future research should consider different forms of innovation such as process innovation, organizational innovation, or marketing innovation.

Parties annexes

Biographical notes

Imen Bouchmel is a doctoral candidate in Management Science with a specialization in finance at the High Institute of Management of Tunis (ISG of Tunis). She is a researcher member of the Corporate Governance, Applied Finance and Audit laboratory at ISG Tunis (LR-GEF2A). She works on the themes of green and sustainable finance. In parallel with her doctoral studies, she teaches at the Higher Institute of Management of Tunis.

Jihene El Ouakdi received her Ph.D in Finance from Laval University. She currently works as an Assistant Professor at the Higher School of Digital Economy (ESEN) and as senior consultant investment. She is member of the board of directors of TICDCE and VP Finance in the “Réseau Tuniso-Canadien des Affaires (RTCA)”. Dr. El Ouakdi was the former dean of ESEN for the mandatory period 2017-2020. She was R&D manager in the Quebec Ministry of Finance’ Department of Debt 2006-2008. She was awarded a number of academic honors and she has published several research articles on a variety of finance topics.

Zied Ftiti is a full professor of Financial Econometrics and Head of the Research Center (OCRE), and Associate Dean of Research at EDC Paris Business School. After completing his Master’s degree in Money, Finance and International Economics (Option of Applied Macroeconomics) at University of Lyon 2, he has obtained his PhD in Economics in University of Lyon (GATE Laboratory, CNRS-UMR 5824). In 2019, he obtained Habilitation for supervising doctoral in Economics in University of Cergy-Pontoise. His research area includes Financial Econometrics, Econometrics, Financial Markets, Monetary Economics, and Macroeconomics. Prof. Zied Ftiti has published books and many papers in top-tier journals.

Waël Louhichi is currently a Full Professor of Finance at ESSCA School of Management. He obtained a Ph.D. from both Perpignan University (France) and Louvain School of Management (Belgium). He has published several articles in international journals as Sustainability Accounting, Management and Policy Journal, Journal of Financial Markets, Review of Quantitative Finance and Accounting, International Review of Financial Analysis, Review of Accounting and Finance, Management Decision, Journal of Applied Accounting Research, Econometric Reviews, Comptabilité, Contrôle, Audit, among others).

Abdelwahed Omri is a professor in Financial and Accounting Methods at the High Institute of Management (ISG) of Tunis and director of the GEF2A Lab. Prof. OMRI has held various positions. He was Director of the Doctoral School of the ISG . His field of research includes the choice of accounting methods and the manipulation of information, governance and Corporate Social Responsibility.

Notes

- [1]

-

[2]

This law applies to listed firms and companies with more than 500 employees and a total balance sheet or a turnover exceeding 50 million euros.

-

[3]

Source: INPI (National Institute of Industrial Property).

-

[4]

Source: European Patent Office.

-

[5]

CIS is the Capacity to Innovate and Strategy survey conducted by the French national institute for statistical and economic studies.

Bibliography

- Adams, R. B., and Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of financial economics, 94(2), p. 291-309.

- Aggarwal, R., Jindal, V., and Seth, R. (2019). Board diversity and firm performance: The role of business group affiliation. International Business Review, 28(6), 101600.

- Ahern, K. R., and Dittmar, A. K. (2012). The changing of the boards: The impact on firm valuation of mandated female board representation. The Quarterly Journal of Economics, 127 (1), p. 137-197.

- Ahmadi, A., and Bouri, A. (2017). Board of directors’ composition and performance in French CAC 40 listed firms. Accounting, 3(4), p. 245-256.

- Almenberg, J., Lusardi, A., Säve-Söderbergh, J., and Vestman, R. (2020). Attitudes toward debt and debt behaviour. The Scandinavian Journal of Economics, Forthcoming.

- Atanassov, J. (2013). Do Hostile Takeovers Stifle Innovation? Evidence from Antitakeover Legislation and Corporate Patenting. Journal of Finance, 68(3), p. 1097-1131.

- Bacha, S., and Azouzi, M. A. (2019). How gender and emotions bias the credit decision-making in banking firms. Journal of Behavioral and Experimental Finance, 22, p. 183-191.

- Barber, B. M., and Lyon, J. D. (1997). Firm size, book-to-mark and ratio, and security randurns: A holdout sample of financial firms. Journal of Finance, 52(2), p. 875-883.

- Baron, R.M., and Kenny, D.A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), p. 1173-1182.

- Bauweraerts, J., Colot, O., Dupont, C., Giuliano, R., and Henry, N. (2017). Diversité de genre dans les organes de direction et performance des grandes entreprises belges. La Revue des Sciences de Gestion, 1(283), p. 49-56.

- Becker, G.S. (1967). Human capital: A theoretical and empirical analysis. Revue économique, 18(1), p. 132-133.

- Becker-Blease, J. R. (2011). Governance and innovation. Journal of Corporate Finance, 17(4), p. 947-958.

- Beji, R., Yousfi, O., Loukil, N., and Omri, A. (2020). Board diversity and corporate social responsibility: Empirical evidence from France. Journal of Business Ethics, p. 1-23.

- Bennouri, M., Chtiouib, T., Nagatic, H., and Nekhili, M. (2018). Female board directorship and firm performance: What really matters? Journal of Banking and Finance, 88, p. 267-291.

- Bianchi, M.S., Corvino, A., and Rigolini, A. (2012). Board diversity and structure: What implications for investments in innovation? Empirical evidence from Italian context. Corporate Ownership and Control, 10, p. 9-25.

- Bibi, U., Balli, H.O., Matthews, C., and Tripe, D. (2018). Impact of gender and governance on microfinance efficiency. Journal of International Financial Markands, Institutions and Money, 53, p. 307-319.

- Blundell, R., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, p. 115-43.

- Bocquet, R., Le Bas, C., Mothe, C., and Poussing, N. (2017). CSR, innovation, and firm performance in sluggish growth contexts: A firm–level empirical analysis. Journal of Business Ethics, 146 (1), p. 241-254.

- Boubaker, S., Dang, R., and Nguyen, D. K. (2014). Does board gender diversity improve the performance of French listed firms? Gestion, 31(1), p. 259-269.

- Brahma, S., Nwafor, C., and Boateng, A. (2020). Board gender diversity and firm performance: The UK evidence. International Journal of Finance and Economics, 1(16).

- Bruna, M. G., and Chauvet, M. (2010). La diversité, levier de performance... sous condition de management. Paris Dauphine University.

- Carter D. A., Simkins B. J., and Simpson W. G. (2003). Corporate governance, board diversity, and firm value. The Financial Review 38(1), p. 33-53.

- Carter, D. A., D’Souza, F., Simkins, B. J., and Simpson, W. G. (2010). The gender and ethnic diversity of US boards and board committees and firm financial performance. Corporate Governance: An international review 18(5), p. 396-414.

- Chakrabarty, S., and Bass, A. E. (2014). Corporate governance in microfinance institutions: Board composition and the ability to face institutional voids. Corporate Governance International Review, 22(5), p. 367-386.

- Chen, G., Liu, C., and Tjosvold, D. (2005). Conflict management for effective top management teams and innovation in China. Journal of Management Studies, 42(2), p. 277-300.

- Chen, J., Leung, W. S., and Evans, K. P. (2018). Female board representation, corporate innovation and firm performance. Journal of Empirical Finance, 48, p. 236-254.

- Choi, J., and Lee, J. (2017). Firm size and compositions of R&D expenditures: Evidence from a panel of R&D performing manufacturing firms. Industry and Innovation, 25(5), p. 459-481.

- Claes, M. T. (1999). Women, men and management styles. Int’l Lab. Rev., p. 138, 431.

- Conyona, M. J., and He, L. (2017). Firm performance and boardroom gender diversity: A quantile regression approach. Journal of Business Research, 79, p. 198-211.

- Cyert, R. M., and March, J. G. (1963). A behavioral theory of the firm Prentice-Hall. Englewood Cliffs, NJ.

- Dang, R., and Nguyen, D. (2016). Does board gender diversity make a difference? New evidence from quantile regression analysis. Management international/International Management/Gestiòn Internacional, 20(2), p. 95-106.

- Darmadi, S. (2011). Board diversity and firm performance: The Indonesian evidence. Corporate Ownership and Control, 8 (2-4), p. 450-466.

- Dezsö, C. L., and Ross, D. G. (2012). Does female representation in top management improve firm performance? A panel data investigation. Strategic management journal, 33(9), p. 1072-1089.

- Díaz-García, C., González-Moreno, A., and Jose Saez-Martinez, F. (2013). Gender diversity within RandD teams: Its impact on radicalness of innovation. Innovation, 15(2), p. 149-160.

- Eagly, A. H., Johannesen-Schmidt, M. C., and Van Engen, M. L. (2003). Transformational, transactional, and laissez-faire leadership styles: A meta-analysis comparing women and men. Psychological Bulletin, 129 (4), p. 569-591.

- Edwards, J. R., and Lambert, L. S. (2007). Methods for integrating moderation and mediation: A general analytical framework using moderated path analysis. Psychological Methods, 12(1), p. 1-22.

- Faems, D., and Subramanian, A. M. (2013). R&D manpower and technological performance: The impact of demographic and task-related diversity. Research Policy, 42(9), p. 1624-1633.

- Fang, V. W., Tian, X., and Tice, S. (2014). Does stock liquidity enhance or impede firm innovation? The Journal of Finance, 69(5), p. 2085-2125.

- Fiedler, F. E. (1964). A contingency model of leadership effectiveness. In Advances in experimental social psychology, 1, 149-190. Academic Press.

- Francoeur, C., Labelle, R., Balti, S., and Bouzaidi, S. (2019). To what extent do gender diverse boards enhance corporate social performance? Journal of Business Ethics, 155 (3), p. 343-357.

- Frye, M. B., and Pham, D. T. (2018). CEO gender and corporate board structures. The Quarterly Review of Economics and Finance, 69, p. 110-124.

- Galia, F., Zenou, E., and Ingham, M. (2015). Board composition and environmental innovation: does gender diversity matter?. International Journal of Entrepreneurship and Small Business, 24(1), p. 117-141.

- Garcia Martinez, M., Zouaghi, F., and Garcia Marco, T. (2017). Diversity is strategy: the effect of R&D team diversity on innovative performance. R&D Management, 47(2), p. 311-329.

- García-Sánchez, I. M., Suárez-Fernández, O., and Martínez-Ferrero, J. (2019). Female directors and impression management in sustainability reporting. International Business Review, 28(2), p. 359-374.

- Griffin, D., Li, K., and Xu, T. (2021). Board Gender Diversity and Corporate Innovation: International Evidence. Journal of Financial and Quantitative Analysis, 56(1), p. 123-154.

- Gunday, G., Ulusoy, G., Kilic, K., and Alpkan, L. (2011). Effects of innovation types on firm performance. International Journal of Production Economics 133 (2), p. 662-676.

- Han, S. (2019). CEO political preference and corporate innovation. Finance Research Letters, 28, p. 370-375.

- Hillman, A. J., Shropshire, C., and Cannella, A. (2007). Organizational predictors of women on corporate boards. The Academy of Management Journal 50(4), p. 941-952.

- Horbach, J., and Jacob, J. (2018). The relevance of personal characteristics and gender diversity for (eco‐) innovation activities at the firm‐level: Results from a linked employer–employee database in Germany. Business Strategy and the Environment, 27(7), p. 924-934.

- Hsu, P. H., Tian, X., and Xu, Y. (2014). Financial development and innovation: Cross–country evidence. Journal of Financial Economics 112 (1), p. 116-135.

- Iren, P., and Tee, K. (2018). Boardroom diversity and innovation in the UAE banks. International Journal of Innovation Management, 22(3), p. 1-29.

- Isidro, H., and Sobral, M. (2015). The effects of women on corporate boards on firm value, financial performance, and ethical and social compliance. Journal of Business Ethics, 132, p. 1-19.

- Jha, C. K., and Sarangi, S. (2018). Women and corruption: What positions must they hold to make a difference?. Journal of Economic Behavior and Organization, 151, p. 219-233.

- Joshi, A., and Jackson, S. E. (2003). Managing workforce diversity to enhance cooperation in organizations. International handbook of organizational teamwork and cooperative working, 12, p. 277-296.

- Joshi, A., and Roh, H. (2009). The role of context in work team diversity research: A meta-analytic review. Academy of management journal, 52(3), p. 599-627.

- Kanter, R. M. (1977). Men and women of the corporation: New edition. Basic Books, New York.

- Kanter, R. M. (1977). Some Effects of Proportions on Group Life: Skewed Sex Ratios and Responses to Token Women. American Journal of Sociology, 82(5), p. 965-990.

- Khan, W., and Vieito, J. P. (2013). CEO gender and firm performance. Journal of Economics and Business, 67, p. 55-66.

- Kim, D., and Starke, L. T. (2017). Gender diversity on corporate boards: Do women contribute unique skills? American Economic Review, 106 (5), p. 267-271.

- Kiradoo, G. (2019). Impact of corporate governance on the profitability and the financial performance of the organization. Journal of Management, 6(3), p. 192-16.

- Kochan, T., Bezrukova, K., Ely, R., Jackson, S., Joshi, A., Jehn, K., and Thomas, D. (2003). The effects of diversity on business performance: Report of the diversity research network. Human Resource Management: Published in Cooperation with the School of Business Administration, The University of Michigan and in alliance with the Society of Human Resources Management, 42(1), p. 3-21.

- Li, M., and Yang, J. (2019). Effects of CEO duality and tenure on innovation. Journal of Strategy and Management, 12(4), p. 536-552.

- Li, Z., Li, X., and Xia, A. (2020).Independent technical directors and their effect on corporate innovation in China. Journal of Accounting Research, 13(2), p. 175-199.

- Liu, C. (2018). Are women greener? Corporate gender diversity and environmental violations. Journal of Corporate Finance, 52, p. 118-142.

- Liu, Y., Zuobao, W., and Feixue, X. (2014). Do women directors improve firm performance in China? Journal of Corporate Finance, 28, p. 169-184.

- Low, D. C., Roberts, H., and Whiting, R. H. (2015). Board gender diversity and firm performance: Empirical evidence from Hong Kong, South Korea, Malaysia and Singapore. Pacific-Basin Finance Journal, 35, p. 381-401.

- Lu, J., and Wang, W. (2018). Managerial conservatism, board independence and corporate innovation. Journal of Corporate Finance, 48, p. 1-16.

- Marimuthu, M., and Kolandaisamy, I. (2009). Ethnic and gender diversity in boards of directors and their relevance to financial performance of Malaysian companies. Journal of sustainable development, 2(3), p. 139-148

- Markovic, S., and Bagherzadeh, M. (2018). How does breadth of external stakeholder cocreation influence innovation performance? Analyzing the mediating roles of knowledge sharing and product innovation. Journal of Business Research, 88, p. 173-186.

- Mefteh-Wali, S., and Rigobert, M. J. (2018). The dual nature of foreign currency debt and its impact on firm performance: Evidence from French non-financial firms. Management international/International Management/Gestiòn Internacional, 23(1), p. 68-77.

- Miller, T., and del Carmen Triana, M. (2009). Demographic diversity in the boardroom: Mediators of the board diversity–firm performance relationship. Journal of Management studies, 46(5), p. 755-786.

- Morris, D. M. (2018). Innovation and productivity among heterogeneous firms. Research Policy, 47(10), p. 918-1932.

- Musairah, S. K. M. K. (2015). Mediation and moderation analysis from the perspective of behavioral science. Jurnel Intelek, 10(1), p. 1-11.

- Na, K., and Shin, K. (2019). The gender effect on a firm’s innovative activities in the emerging economies. Sustainability, 11(7), p. 1992.

- Nekhili, M., and Gatfaoui, H. (2013). Are demographic attributes and firm characteristics drivers of gender diversity? Investigating women’s positions on French boards of directors. Journal of business ethics, 118 (2), p. 227-249.

- Nekhili, M., Chakroun, H., and Chtioui, T. (2018). Women’s leadership and firm performance: Family versus nonfamily firms. Journal of Business Ethics, 153 (2), p. 291-316.

- Nekhili, M., Nagati, H., Chtioui, T., and Nekhili, A. (2017). Gender-diverse board and the relevance of voluntary CSR reporting. International Review of Financial Analysis, 50, p. 81-100.

- Østergaard, C. R., Timmermans, B., and Kristinsson, K. (2011). Does a different view create something new? The effect of employee diversity on innovation. Research policy, 40(3), p. 500-509.

- Palvia, A., Vähämaa, E., and Vähämaa, S. (2015). Are female CEOs and chairwomen more conservative and risk averse? Evidence from the banking industry during the financial crisis. Journal of Business Ethics, 131 (3), p. 577-594.

- Post, C., and Byron, K. (2015). Women on boards and firm financial performance: A meta-analysis. The Academy of Management Journal, 58(5), p. 1948-1989.

- Roh, J., and Koo, J. (2019). The impacts of diversity on team innovation and the moderating effects of cooperative team culture. International Review of Public Administration, 24(4), p. 246-263.

- Rose, C. (2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), p. 404-413.

- Rosener J B. (1995). America’s Competitive Secret: Utilizing Women as a Management Strategy. Oxford University Press: New York.

- Ruiz-Jiménez, J. M., del Mar Fuentes-Fuentes, M., and Ruiz-Arroyo, M. (2016). Knowledge combination capability and innovation: The effects of gender diversity on top management teams in technology-based firms. Journal of business ethics, 135 (3), p. 503-515.

- Salem, R. (2019). Examining the investment behavior of Arab women in the stock market. Journal of Behavioral and Experimental Finance, 22, p. 151-160.

- Sheikh, S. (2018). The impact of market competition on the relation between CEO power and firm innovation. Journal of Multinational Financial Management, 44, p. 36-50.

- Sila, V., Gonzalez, A., and Hagendorff, J. (2016). Women on board: Does boardroom gender diversity affect firm risk? Journal of Corporate Finance, 36, p. 26-53.

- Singh, V., and Vinnicombe, S. (2004). Why so few women directors in top UK boardrooms? Evidence and theoretical explanations. Corporate governance: an international review, 12(4), p. 479-488.

- Smith, N. (2014). Gender quotas on boards of directors. IZA World of Labor.

- Smith, N., Smith, V., and Verner, M. (2006). Do women in top management affect firm performance? A panel study of 2,500 Danish firms. International Journal of Productivity and Performance Management, 55(7), p. 569-593.

- Stahl, G. K., Maznevski, M. L., Voigt, A., and Jonsen, K. (2010). Unraveling the effects of cultural diversity in teams: A meta-analysis of research on multicultural work groups. Journal of international business studies, 41(4), p. 690-709.

- Strom, R., D’Espallier, B., and Mersland, R. (2014). Female leadership, performance, and governance in microfinance institutions. Journal of Banking and Finance, 42, p. 60-75.

- Su, Z., Xiao, Z., and Yu, L. (2019). Do political connections enhance or impede corporate innovation? International Review of Economics and Finance, 63, p. 94-110.

- Sunder, J., Sunder, S.V., and Zhang, J. (2017). Pilot CEOs and corporate innovation. Journal of Financial Economics, 123 (1), p. 209-224.

- Teruel, M., Parra, M. D., and Segarra, A. (2015). Gender diversity and innovation in manufacturing and service firms. Working Paper, Universitat Rovira i Virgili Departament d’Economia.

- Toé, M. (2014). Diversité du genre au conseil d’administration: vers une amélioration de la gouvernance des entreprises? Gestion, 31(3), p. 87-113.

- Toé, M. (2012). Diversité et gouvernance des entreprises: contribution à la question de la représentativité des femmes dans les instances de gouvernance et ses enjeux. Gestion et management, Université Paris-Est.

- Toé, M., and Bationo, R. (2019). Réaction du marché financier à la nomination de femmes au conseil d’administration: Cas de la France, Revue des Sciences de Gestion, 1(295), p. 29-41.

- Tsou, M. W., and Yang, C. H. (2019). Does gender structure affect firm productivity? Evidence from China. China Economic Review, 55, p. 19-36.

- Van Knippenberg, D., De Dreu, C. K., and Homan, A. C. (2004). Work group diversity and group performance: an integrative model and research agenda. Journal of applied psychology, 89(6), p. 1008.

- Wadho, W., and Chaudhry, A. (2018). Innovation and firm performance in developing countries: The case of Pakistani textile and apparel manufacturers. Research Policy, 47(7), p. 1283-1294.

- Wojnicka-Sycz, E., and Sycz, P. (2016). Public innovation policy and other determinants of innovativeness in Poland. The Innovation Journal, 21(3), 1.

- Ye, D., Deng, J., Liu, Y., Szewczyk, S. H., and Chen, X. (2019). Does board gender diversity increase dividend payouts? Analysis of global evidence. Journal of Corporate Finance, 58, p. 1-26.

- Yi, A. (2011). Mind the gap: Half of Asia’s boards have no women, a risky position for governance and growth. Singapore: Korn/Ferry Institute.

- Yuan, R., and Wen, W. (2018). Managerial foreign experience and corporate innovation. Journal of Corporate Finance, 48, p. 752-770.

- Zuraik, A., and Kelly, L. (2019). The role of CEO transformational leadership and innovation climate in exploration and exploitation. European Journal of Innovation Management.

Parties annexes

Notes biographiques

Imen Bouchmel est doctorante en Science de gestion spécialité finance au sein de l’Institut Supérieur de Gestion de Tunis (ISG de Tunis). Elle est membre chercheur au laboratoire Gouvernance d’Entreprise, Finance Appliquée et Audit à l’ISG de Tunis (LR-GEF2A). Elle travaille sur les thématiques sur la finance verte et durable. En parallèle de ses études doctorale, elle enseigne à l’Institut Supérieur de Gestion de Tunis.

Jihene El Ouakdi est titulaire d’un doctorat (Ph.D) en Finance de l’Université Laval. Elle est enseignante universitaire à l’École Supérieure d’Économie Numérique (ESEN) et consultante senior en montage de projet d’investissement. Elle est aussi membre du Conseil d’Administration du TICDCE. Elle occupe le poste de VP Finance au Réseau Tuniso-Canadien des Affaires. Dr. El Ouakdi était Directrice de l’ESEN pour le mandat 2017-2020. Elle était responsable R&D à la direction de la dette au Ministère des Finances du Québec 2006-2008. Elle a reçu plusieurs honneurs académiques et a publié plusieurs articles de recherche sur une variété de sujets en finance.

Zied Ftiti est professeur d’économie monétaire et financière, responsable du centre de recherche (OCRE), et vice-doyen de la recherche à EDC Paris Business School. Après avoir obtenu son Master en Monnaie, Finance et Économie Internationale (Option Macroéconomie Appliquée) à l’Université de Lyon 2, il a obtenu son doctorat en Économie à l’Université de Lyon (Laboratoire GATE, CNRS-UMR 5824). En 2019, il a obtenu l’Habilitation à diriger les recherches en sciences économiques à l’Université de CY Paris, Cergy University. Son domaine de recherche porte sur l’économétrie financière, l’économétrie, les marchés financiers, l’économie monétaire et la macroéconomie. Le professeur Zied Ftiti a publié des livres et de nombreux articles dans des revues de premier plan.

Waël Louhichi est actuellement Professeur en Finance à l’ESSCA School of Management. Il a obtenu un diplôme de Doctorat en Sciences de Gestion de l’Université de Perpignan (France) et de la Louvain School of Management (Belgique). Il a publié dans plusieurs journaux internationaux tel que Sustainability Accounting, Management and Policy Journal, Journal of Financial Markets, Review of Quantitative Finance and Accounting, International Review of Financial Analysis, Review of Accounting and Finance, Management Decision, Journal of Applied Accounting Research, Econometric Reviews, Comptabilité, Contrôle, Audit, etc.).

Abdelwahed Omri est Professeur en Méthodes financières et Comptables à l’Institut Supérieur de Gestion de Tunis et directeur du laboratoire GEF2A Lab. Pr. L’OMRI a occupé divers postes. Il a été Directeur de l’École Doctorale de l’Institut Supérieur de Gestion de Tunis. Son domaine de recherche comprend le choix des méthodes comptables et la manipulation de l’information, la gouvernance et la Responsabilité Sociale des Entreprises.

Parties annexes

Notas biograficas

Imen Bouchmel es candidata a doctorado en Ciencias de la Gestión con especialización en finanzas en el Instituto Superior de Gestión de Túnez (ISG de Túnez). Es investigadora miembro del laboratorio de Gobierno Corporativo, Finanzas Aplicadas y Auditoría de ISG Tunis (LR-GEF2A). Trabaja en temas de finanzas verdes y sostenibles. Paralelamente a sus estudios de doctorado, imparte clases en el Instituto Superior de Gestión de Túnez.

Jihene El Ouakdi tiene su doctorado en Finanzas de l’Universidad Laval. Actualmente trabaja como profesora adjunta en la Escuela Superior de Economía Digital (ESEN) y como consultora senior de inversión. Es miembro de la junta directiva de TICDCE y vicepresidenta de finanzas en el “Réseau Tuniso-Canadien des Affaires (RTCA)”. Dr. El Ouakdi fue directora de ESEN para el período 2017-2020. Fue responsable de R&D en el Departamento de Deuda del Ministerio de Finanzas de Quebec 2006-2008. Recibió varios honores académicos y ha publicado varios artículos de investigación sobre una variedad de temas financieros.

Zied Ftiti: Zied Ftiti es profesor titular de Econometría Financiera y Director del Centro de Investigación (OCRE), y Decano Asociado de Investigación en la EDC Paris Business School. Después de completar su maestría en Dinero, Finanzas y Economía Internacional (Opción de Macroeconomía Aplicada) en la Universidad de Lyon 2, ha obtenido su doctorado en Economía en la Universidad de Lyon (Laboratorio GATE, CNRS-UMR 5824). En 2019, obtuvo la Habilitación para supervisar el doctorado en Economía en la Universidad de Cergy-Pontoise. Su área de investigación incluye la econometría financiera, la econometría, los mercados financieros, la economía monetaria y la macroeconomía. El profesor Zied Ftiti ha publicado libros y numerosos artículos en revistas de primer nivel.

Waël Louhichi: Dr. Waël Louhichi es profesor titular de finanzas en la ESSCA School of Management. ha obtenido su doctorado en la Universidad de Perpignan (Francia) y en la Louvain School of Management (Bélgica). Ha publicado varios artículos en revistas internacionales (Sustainability Accounting, Management and Policy Journal, Journal of Financial Markets, Review of Quantitative Finance and Accounting, International Review of Financial Analysis, Review of Accounting and Finance, Management Decision, Journal of Applied Accounting Research, Econometric Reviews, Comptabilité, Contrôle, Audit, entre otras).

Abdelwahed Omri es profesor de Métodos Financieros y Contables en el Instituto Superior de Gestión de Túnez y director del laboratorio GEF2A Lab. Pr. L’OMRI ha ocupado diversos cargos. Ha sido director de la Escuela de Doctorado del Instituto Superior de Gestión de Túnez. Su campo de investigación incluye la elección de métodos contables y la manipulación de la información, la gobernanza y la responsabilidad social de las empresas.

Liste des figures

Figure 1

The mediating effect of innovation

Figure 2

Female representation on board and executive committee between 2013 and 2017

Liste des tableaux

Table 1

Description of Variables

Table 2

Descriptive Statistics

Table 3

Correlation matrix and Variance inflation factor (VIF)

Table 4

Model 1—The direct effect of gender diversity on firm performance

Table 4 summarizes the two-step Dynamic Panel System GMM regression results, examining the direct effect of gender diversity on firm performance. The dependent variable is firm performance measured by the return on assets (ROA), return on equity (ROE), and market-to-book ratio (MB). Lag ROA, Lag ROE, Lag MB are the lagged vales of our dependent variable. The independent variable is gender diversity, which includes two measures: FB and FE. We control the effect of governance (by using INSTOWN, MAJSHARE, DUAL, and BINDEP), debt ratio (LEVERAGE), firm size (SIZE), information and communication technologies sector (ICTSECT), and industrial sector (INDSECT). ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Values in the parentheses represent p-values.

Table 5

Model 2—Impact of gender diversity on corporate innovation

Table 5 summarizes the two-step Dynamic Panel System GMM regression results, examining the effect of gender diversity on innovation. The dependent variable is innovation which is measured by its input LN (1+R&D) and output LN (1+PATENT). Lag LN (1+R&D) and Lag LN (1+PATENT) are the lagged values of our dependent variable. The independent variable is gender diversity, which includes FB and FE. We control the effect of governance (by using INSTOWN, MAJSHARE, DUAL, and BINDEP), debt ratio (LEVERAGE), firm size (SIZE), market-to-book ratio (MB), information and communication technologies sector (ICTSECT), and industrial sector (INDSECT). ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Values in the parentheses represent p-values.

Table 6

Model 3—The mediating effect of innovation on the relationship between gender diversity and firm performance

This table summarizes the two-step Dynamic Panel System GMM regression results, examining the impact of gender diversity and corporate innovation on firm performance. The dependent variable is firm performance measured by the return on assets (ROA), return on equity (ROE) and market-to-book ratio (MB). Lag ROA, Lag ROE, Lag MB are the lagged values of our dependent variable. The independent variables are innovation input and output measured by LN (1+R&D) and LN (1+PATENT) and gender diversity, which includes FB and FE. We control the effect of governance (by using INSTOWN, MAJSHARE, DUAL, and BINDEP), debt ratio (LEVERAGE), firm size (SIZE), information and communication technologies sector (ICTSECT), and industrial sector (INDSECT). ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Values in the parentheses represent p-values.