Résumés

Abstract

Multinational companies avoid taxes through sophisticated tax optimization techniques, also known as aggressive tax planning (ATP). This paper serves two purposes: to understand these techniques and to analyze the factors that thwart efforts against ATP by taking the European Union (EU) as a case study. We use an analytic approach based on literature survey. We explain different ATP activities at micro and macro levels. We find that the EU has remained ineffective against tax avoidance due to the lack of legal competences and political will. Finally, we make some recommendations in the current functioning framework of the EU.

Keywords:

- Corporate tax optimization strategies,

- aggressive tax planning,

- tax avoidance,

- European Union policies

Résumé

Les sociétés multinationales évitent les impôts grâce à des techniques d’optimisation sophistiquées appelées également planification fiscale agressive (ATP). Cet article a deux objectifs: comprendre ces techniques et analyser les facteurs qui entravent les efforts contre l’ATP en prenant l’Union européenne (UE) comme étude de cas. Nous utilisons une approche analytique basée sur une étude de la littérature. Nous expliquons les différentes techniques ATP aux niveaux micro et macroéconomique. Nous constatons que l’UE est restée inefficace contre l’évasion fiscale en raison du manque de compétences juridiques et de volonté politique. Enfin, nous faisons quelques recommandations dans le cadre du fonctionnement actuel de l’UE.

Mots-clés :

- Stratégies d’optimisation fiscale des entreprises,

- planification fiscale agressive,

- évitement fiscale,

- politiques de l’Union européenne

Resumen

Las corporaciones multinacionales evitan los impuestos con la ayuda de técnicas sofisticadas de optimización llamadas también planificación fiscal agresiva (ATP). Este articulo tiene dos propósitos: comprender estas técnicas y analizar los factores que frustran los esfuerzos de la Unión Europea (UE) contra ATP como un estudio de caso. Utilizamos un enfoque analítico basado en revisiones bibliográficas. Explicamos diferentes tácticas de ATP a nivel micro y macro. Encontramos que la UE ha permanecido ineficaz contra la evasión fiscal debido a la falta de competencias legales y voluntad política. Finalmente, hacemos algunas recomendaciones en el marco actual de funcionamiento de la UE.

Palabras clave:

- Estrategias de optimización fiscal,

- des entreprises,

- planificación fiscal agresiva,

- evasión de impuestos,

- políticas de la Unión Europea

Corps de l’article

Why has multinational corporations’ (MNCs) tax optimization become a great concern for most world nations? A main reason is the significant growing influence of MNCs in international trade. According to UNCTAD (2017), the percentage of the world’s Foreign Direct Investment (FDI) outward stock to global GDP has increased from 10% to 34.6% between 1990 and 2016. The existence of more than 100,000 MNCs with 900,000 foreign subsidiaries largely explains this growth, as FDI is seen as a vehicle for economic growth through long-term capital, up-to-date technology, managerial skills, jobs, information and services, many things that can make an economy more competitive (Noorbakhsh F et al., 2001; Busse and Groizard, 2008). Consequently, nation states have facilitated MNC operations by allowing a free flow of trade across their borders.

Meanwhile, over the last decade, public opinion about the MNCs has become increasingly negative due to several cases of tax evasion and avoidance. MNCs are blamed for the use of different techniques and arrangements for tax optimization. The consequences of such practices are negative for countries, leading them to lose a high amount of money every year. The Organization for Economic Cooperation and Development (OECD) has estimated the global annual loss of tax revenues from $100 to $240 billion due to Base Erosion and Profit Shifting (BEPS). Although tax evasion and avoidance have been a debatable topic over many years, these issues have recently gained immense attention due to well-known tax scandals including the “Panama Papers”, “Swiss Leaks” and “Lux Leaks” (Dalen, 2016). Many authorities around the world have been vocal to tackle the loopholes in international taxation laws.

The European Union (EU) illustrates perfectly the above-mentioned challenge or dilemma. The EU with its integrated and liberalized market has become an attractive region for FDI inflows, and Member States (MS) compete with each other for the lion’s share. At the same time, financial and budgetary crisis reinforce the need for fiscal adjustments. According to some estimates, the EU is losing about one trillion euros revenue annually due to tax evasion and avoidance (Murphy, 2012). Hence, MNC’s tax avoidance has become a sensitive topic and there is a serious need for fiscal justice in the EU.

The European Commission launched several initiatives to deal with taxation issues, putting the focus on tax transparency, fair, harmonized, competitive and stable tax rules. However, it is not sure whether they have been effective. Why has the EU not been able to curtail corporate tax avoidance while being an integrated economy with a strong regulatory capacity?

This paper has two objectives. Our first aim is to understand better the fiscal optimization strategies developed by MNCs, describing the main techniques used, and analyzing their main determinants. We then intend to identify and describe the factors which hinder the EU efforts in their fight against tax evasion and avoidance. We are guided by the idea that the leading causes are structural weaknesses in the construction of the EU and its regulatory framework. According to Article 115 of the Treaty of the functioning of the EU, taxation is a shared competence between MS and the EU requiring unanimity for decisions making. The fact that MS have their own taxation system is creating asymmetry throughout the Union.

We use a methodology based on an analytical approach that relies on a diagnosis of the situation from the widest possible literature on the subject, on a theoretical explanation of tax optimization, as well as a critical analysis of the arrangements put in place by the EU. Doing so, we contribute to the existing literature in two ways. Firstly, this will help understand the MNCs’ tax optimization strategies in a context of microeconomic and macroeconomic levers of tax optimization. Secondly, we highlight the causes of the inefficiency of actions taken against tax avoidance.

The paper is structured in 6 sections. In the second section, we shall typify the phenomenon of tax optimization with definition and measurement. Section 3 describes the leading tax optimization practices. Section 4 focuses on the determinants of tax optimization resulting from a large survey of the literature. Section 5 looks at the policies, measures, and actions against tax evasion and tax avoidance taken by the EU. It also highlights the obstacles in formulating taxation policies and suggests some recommendations. Finally, section 6 concludes the paper.

Characterization of Tax Optimization Phenomena

A Phenomenon Difficult to Define

The notion of tax optimization or tax planning is difficult to define because it is often confused with tax evasion and tax avoidance. Tax planning, in all its forms, has the same motivation: taxpayers exploit loopholes in international tax systems through a variety of techniques; their main objective is to pay the least amount of taxes. The ultimate consequence is the reduction of fiscal resources for governments, as well as the creation of a feeling of unfairness among the public.

The debate leads to the combination of two differentiating criteria: gravity and legality. We talk of tax avoidance when multinational MNCs engage in Aggressive Tax Planning practices (ATP) that involve reducing tax liability through arrangements which, although legal, are in contradiction with the intent of the law. Although protected by the legal system (Kay, 1980), tax optimization, in the light of the social contract theory (Rousseau, 2006), is a violation of the contract between economic agents and the governments. In the case of MNCs, they are guaranteed the opportunity to do business under the best possible conditions, provided that they undertake to pay their fair share of taxes. In response, these companies use ATP practices to transfer their profits to other countries and avoid taxes. They do not comply with fair play and with the intention of the law.

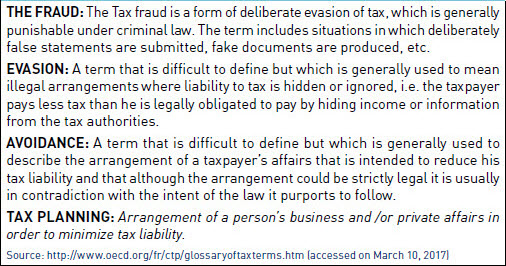

Contrary to all forms of tax avoidance, tax evasion is clearly illegal. The European Commission defined it as a criminal act of using illegal means to avoid paying taxes. We can also speak about tax fraud. The OECD (2017) makes a distinction between “tax evasion” and “fraud”. The first term means “illegal arrangements where liability to tax is hidden or ignored, i.e., the taxpayer pays less tax than he is legally obligated to pay by hiding income or information from the tax authorities”. The second term (fraud) is considered as “a form of deliberate evasion of tax, which is generally punishable under criminal law. The term includes situations in which deliberately false statements are submitted, fake documents are produced, etc. (see box 1, appendix A). In both cases, the tax dissimulation behavior is intentional, and the act is punishable by law, stressing the fact that this distinction between evasion and fraud made by the OECD is insufficiently clear.

Anyway, tax evasion is mostly done by individuals who may take advantage of an opaque national scheme. MNCs are more inclined to use the legal practices of tax avoidance because they can set up complex tax planning systems to reduce legally the level of taxes that they pay. This enables them to achieve their objectives without entering in “criminal” practices that could be more costly due to fines and / or reputational damage.

A Phenomenon Difficult to Measure

In a report addressing BEPS, the OECD (2013) highlights the difficulties of measuring tax evasion and avoidance, writing on p. 15: “it is difficult to reach solid conclusions about how much BEPS actually occurs with the availability of existing data.” The report even asserts that “Most of the writing on the topic is inconclusive, although there is abundant circumstantial evidence that BEPS behaviors are widespread. There are several studies and data indicating that there is increased segregation between the location where actual business activities and investment take place and the location where profits are reported for tax purposes”. However, the analysis of certain variables intuitively makes it possible to approach the phenomenon if not to measure it scientifically. These variables include income from corporate tax, effective tax rates and FDI.

The Evolution of the Share of Corporate Income Tax in Government Revenues

The corporate income tax is considered as one of the most important components of government revenue. The revenue losses through BEPS are not only a setback for government collections, but it may also negatively affect the perceived integrity of the tax system. Figure 1 (see appendix B) shows the trends of unweighted average taxes on corporate income as a percentage of total taxation and GDP in the OECD countries. In 1965, the OECD average corporate income tax was 8.8% of the total government tax revenue. It dropped to 7.6% in 1975 and it constantly increased until 2007 to 11.2%. It again decreased to 10.4% in 2008 and 9.11% in 2011. While on the other hand, revenue from corporate income as a percentage of GDP has increased over the years. It was 2.13% of GDP in 1965, but reached 3.65% in 2007 before reversing to 2.87% in 2012.

The significant decline in both variables from 2007 to 2010 in the recent past is mainly due to the financial and economic crisis. Therefore, we cannot draw any conclusion from these observations about the role of tax optimization behavior of corporations on the evolution of two variables.

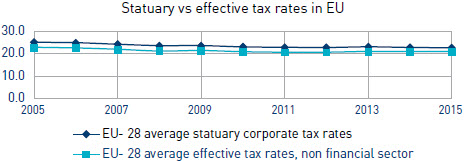

The Evolution of Effective Tax Rates

Here, we mainly focus on the difference between the statuary corporate tax rate (SCTR) and the real or effective corporate tax rates (ECTR) in the EU. Generally, the SCTR does not impose a tax burden on businesses operating in a country due to several motives: basic tax rules (tax allowances, deductions etc.), the method for calculating tax and the existence of tax incentive schemes, make it possible for the corporations to lower their taxes. Consequently, the difference between SCTR and ECTR does not allow us to characterize the existence of tax optimization behaviors of the corporations. Figure 2 in appendix B shows the differences between SCTR and ECTR in the EU-28 members for the last 10 years. We can see that the ECTR has declined from 23% in 2005 to 21.1% in 2015, which makes a reduction of 1.9%.

The evolution of the effective tax rate does not accurately measure the losses due to tax evasion or avoidance; instead, it explores tax havens and somehow highlights tax competition between countries.

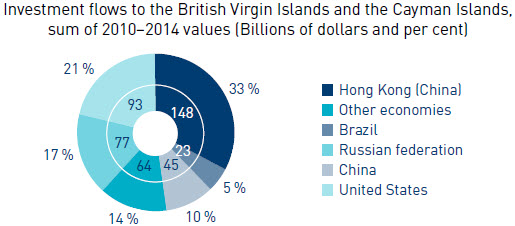

The Evolution of “Abnormal Flows” of Foreign Direct Investment

The most likely variable to observe in tax optimization behavior is the share of FDI to GDP in some countries. We must remember that FDI is a transnational investment flow by which the investor of the source country establishes a lasting interest in a company in the host country. However, some countries attract unprecedented FDI flows that are neither in accordance with their national wealth, nor with the size of their economy. This atypical nature of “abnormal” FDI flows shows a decoupling between the “real” economic activity of these countries and the very high amounts of capital they receive.

According to the UNCTAD (2016) report, FDI flows in offshore financial hubs and special purpose entities (SPEs) have remained significant, despite a decline in 2015. The report shows many unusual flows of investments directed to these offshore countries. For example, Luxembourg remained the primary recipient of SPE related investment flows from the U.S ($155 billion, 77% out of total), followed by the Netherlands. These figures hint the existence of complex networks of entities for tax planning considerations.

Some other favorable locations for offshore companies include the British Virgin Islands, Cayman Islands and Caribbean offshore centers (See Figure 3 appendix B). Between 2010 and 2014, British Virgin Island received 65% of FDI from Hong Kong, China, and Russia. The abnormal corporate profits registered in tax havens can also be indicative of tax avoidance. For example, in Bermuda, $44 billion of corporate profit was recorded in 2014 which was 779.4% of its GDP size (UNCTAD, 2016). This unparalleled ratio between FDI income and GDP in tax haven countries is the result of the financial activities of the holding companies. The role of these companies in tax optimization has increased over the years. They have become the main aggregators of earnings and have increased the geographical concentration of FDI income. The “abnormal” FDI flows therefore, can be indicative of tax optimization behavior.

In short, the phenomenon of tax avoidance is now widely studied even though it remains difficult to quantify. Hence, ambiguity in definition and limitation in measurement of tax optimization somehow have paved the way for multinational firms to formulate strategies and mechanisms of tax reduction.

Tax Optimization Strategies of Multinational Companies

Generally, aggressive tax optimization involves practices that reduce tax bills. These are intended to record the company’s expenses in a high-tax country and to systematically report profits in a low-tax jurisdiction. Commonly used techniques can be classified in four categories: those including practices associated with the organization of relationships between firms, those involving financing mechanisms, the techniques that use hybrid instruments, and finally the transfer pricing mechanism. However, companies often combine these different practices to get the most out of the loopholes in the international taxation system.

Fiscal Optimization by Organization of Relations Between Firms

The first category involves the organization of relationships between firms. In this scheme, giant MNCs form holding companies and SPEs in favorable tax regimes.

Provisions Favorable to the Establishment of Financial Holding Companies

The aim of the holding companies is to manage and hold equity securities. Their profits come from the dividends paid to them by the companies affiliated with them. In many countries, dividends are tax deductible. Therefore, a simple tax optimization technique consists in establishing a holding company in countries where tax laws exempt dividend income from tax. In the Netherlands, for example, the “Dutch Shareholding Exemption” system allows total exemption from dividends received by a holding company from its subsidiaries and from capital gains on the sale of equity securities.

The Special Case of “Captives” in Insurance and Reinsurance

To cover their risks, most MNCs use the services of companies specialized in insurance. They subscribe to their policies and pay premiums (deductible from the profits). On the contrary, certain groups choose to internalize this insurance function by forming companies dedicated to this function-called “captives of insurance”. From a purely organizational and economic point of view, the internalization of risk has obvious advantages. Since the premiums are tax-deductible, it is particularly easy to locate a captive in a favorable tax regime.

Contract Manufacturing

The Contract manufacturing means outsourcing the production activities into another country. There are different business advantages of this technique, but it also has certain tax implications. Consider a US parent company has a subsidiary in Ireland, which is a low tax country. The parent company has acquired the rights of an intangible asset (such as patents) in Ireland but the Irish subsidiary’s market is another country (for instance, in Germany) where the tax rates are high. Therefore, the Irish subsidiary makes a contract to a German manufacturer on cost-plus mark-up bases. Under such arrangements, the parent and subsidiary avoid paying high taxes (Gravelle, 2015).

Tax Optimization via Financing

Debt financing has evolved as a technique to optimize taxes because the financial expenses are deducted from the taxable profit. The most common technique used in this category is called “Thin Capitalization”. OECD (2012) has defined it as “…the situation in which a company is financed through a relatively high level of debt compared to equity” (p.3) with significant implications in terms of tax payments in the countries that allow the deductibility of interest payments from the profit. In this way, higher tax-deductible claims will reduce the taxable profit. This is particularly advantageous for the MNCs that do intra-group lending because they can lend or borrow from their affiliates to optimize their capital structure, and they convert their equity into intra-group loans to avoid taxes (Buettner et al., 2006; Graham and Tucker, 2006).

The Use Of Hybrid Mismatch Arrangements

OECD (2014) defines hybrid mismatch arrangements as “an arrangement that exploits a difference in the tax treatment of an entity or instrument under the laws of two or more tax jurisdictions to produce a mismatch in tax outcomes where that mismatch has the effect of lowering the aggregate tax burden of the parties to the arrangement” (p. 29).

There are different mismatch arrangements possible for tax avoidance purposes. One of the simple schemes is deduction/no inclusion method that calls for the deduction of payment in one country, for example, interest expense, but it avoids corresponding inclusion in the taxable income of another country. For instance, Company X is incorporated in France, provides funds to its subsidiary, Company Y, located in the Netherlands. Under French laws, the funds provided by Company X qualify as capital investments and the dividends are not subject to taxation. Similarly, the Netherlands treats the funds received by Company Y as loans and the interest expenses on these loans are tax-deductible. In this way, both subsidiaries save taxes.

Another arrangement is the double deduction, which means that two tax deductions are claimed for the same contractual payment in two different countries. Figure 4 gives an illustration. Suppose XinC is a parent company located in France, indirectly holding an operating subsidiary ZinC in the Netherlands. Between these two companies, there is a hybrid entity YinC, which is treated as a transparent or disregarded entity in France and non-transparent in the Netherlands for tax purposes. XinC holds all the equity of hybrid entity YinC (also located in the Netherlands), which in turn holds all the shares of ZinC company. YinC borrows from a third party (or from another company of the same group) to invest in ZinC. As a result of that loan, it pays interest which is tax-deductible. YinC is subject to income taxation in the Netherlands but it can offset its income tax obligation through interest expenses deductible under the Netherlands group tax relief regime. In contrast, France treats the hybrid entity as disregarded on a transparent entity and its interest expenses are allocated to XinC, where they can be deducted from taxable income. In this way, the entire group saves taxes both in France and the Netherlands under a double deduction mechanism of hybrid mismatches.

Tax Optimization Through Transfer Pricing

Generally, the term of transfer pricing (TP) refers to the pricing of goods and services transferred between two or more subsidiaries or units of the same company. Under this technique, one company establishes a foreign subsidiary in the form of a partnership or corporation in a country or state where the corporate tax rates are low or zero.

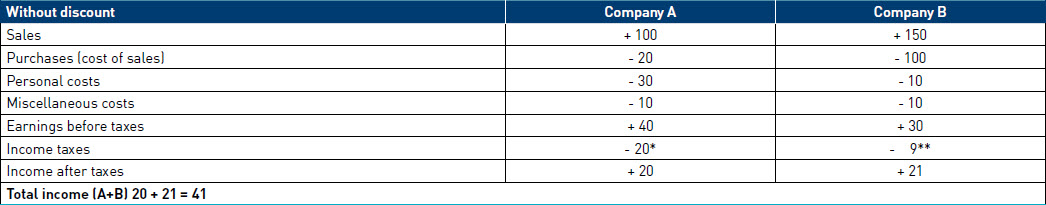

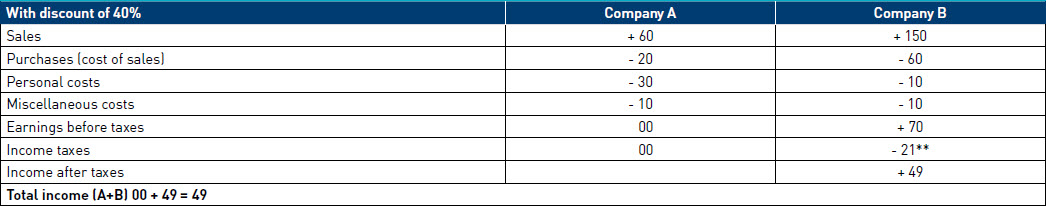

Consider the theoretical example we built to understand this mechanism (table 1 (a) and (b) present in appendix C). Suppose A is the parent company, and B is its subsidiary located abroad. Two situations can be imagined. In the first table 1 (a), there is no real financial coordination within the multinational group. Company A sells its products to company B. The sales revenue of A is = €100. This Figure corresponds to purchases by B. The operating account leads to a profit of €20 for A, 21 for B and a total of €41 for the group.

In the second case, company A decides to improve financial coordination with company B, its subsidiary. To do so, it decides a 40% discount on the prices of the products it charges to B. This will affect the operating profits of the two companies because B is located in a country where the tax rate is more advantageous. In doing so, company A minimizes its profit before tax and maximizes the total net profit from 41 to 49.

Our example measures the impact of TP. By applying this mechanism, the MNCs play on different tax systems between countries by setting prices that show profits in countries with the lowest taxes on income and zero profit in subsidiaries in high-tax locations. Many academic studies show multinational firms are involved in tax avoidance when there is no transfer pricing regulations or weak implementation of arm’s length principles for intra-group transactions (Bartelsman and Beetsma, 2003; Lohse and Riedel, 2012). However, there have been some recent changes in the taxation system in the US that may significantly affect the TP activities of the US MNCs. The latest tax reforms are called the “Tax Cuts and Jobs Act” under which the corporate tax rates were significantly reduced from 35% to 21%. Several other measures under this act were taken to discourage holding of intangible intellectual property (IP) and attributed profits outside the US[1].

One important thing to note is that most of the mechanisms of tax optimization overlap. MNCs may use many strategies simultaneously. We can illustrate this from the digital sector.

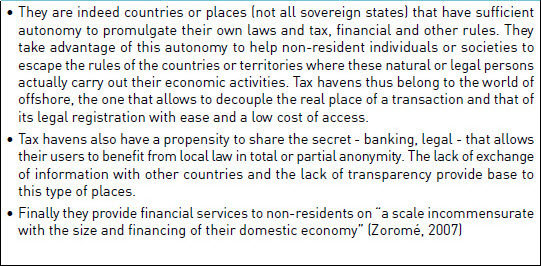

A Combination of Different Tax Optimization Tools: An Example from Digital Sector

The recent tax scandals especially involving the group of GAFA (Google, Amazon, Facebook, Apple) reveal that the international taxation regime is vulnerable to different tax avoidance strategies of the information technology giants. The globalization and digitalization of business models have facilitated the multinationals to locate their businesses in tax havens (see box 2, appendix A), which has made it difficult for tax authorities to understand these strategies. However, countries are also directly responsible for this situation since they are behind flexible tax rules or favorable tax incentives. For example, the EU “interest and royalty directive” makes it possible to avoid withholding taxes (Gravelle, 2015).

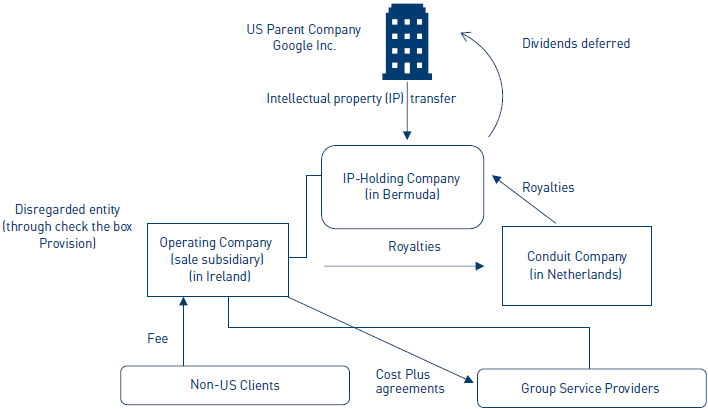

The tax optimization strategy of Google Inc. is one of the best illustrations of how to exploit the loopholes in international taxation regimes. This company uses the “Double Irish Dutch Sandwich” method (Wood, 2016), which involves a combination of Irish and Dutch subsidiaries to shift profits to low or no-tax jurisdictions. The profit is first shifted to an Irish company and then transferred to a Dutch subsidiary and finally to another Irish company located in a tax haven. Figure 5 (appendix B) describes this mechanism. Google Inc. transferred intangible assets to an Irish (IP-Holding) company located in Bermuda. This company has an operating subsidiary that sells advertising to Europe and a Dutch subsidiary (or conduit company), which is responsible for the transfer of royalties from the Irish sales company to the Irish holding company. In this arrangement, the important thing is that the holding has the management or tax home in Bermuda, where the corporate tax rate is 0%.

Moreover, the MNC bypasses the US controlled foreign corporation (CFC) rules through check-the-box provision[2]. Under this provision, the Irish operating and the Dutch Conduit companies are treated as one single Irish corporation and their income is combined in the US tax system. The royalty payments are thus disregarded. The dividend payments from IP-holding to the parent company are also deferred (Fuest et al., 2013). The multinational company avoids paying US tax since the foreign income earned by its foreign subsidiary is generally not subject to income tax until this income is repatriated and distributed as a dividend. However, the law on the Tax Cuts and Job Act (TCJA) which was modified in 2017, made significant changes[3]. Now the profits from foreign the US subsidiaries are subject to a transition tax. Similarly, a US shareholder of a CFC must include its overall low intangible tax income (GILTI) in the gross income of a taxation year. Finally, in the system which facilitates tax avoidance for Google Irish operations, the EU “interest and royalty directive” also makes it possible to save withholding taxes (Gravelle, 2015).

Many other examples exist that show how simple it seems for the MNCs to exploit the loopholes in international tax regimes. However, beyond the avoidance mechanisms, the important question is that of the underlying reasons for these practices.

How to Explain the Tax Optimization Strategies? A Survey of the Literature

The literature suggests many answers to this question. In traditional theory, the rational economic agent optimizes her profit under cost and risk constraints. However, other theoretical streams propose more complex explanations to understand tax avoidance strategies.

Microeconomic Theory and Tax Optimization Logic

In the framework of traditional microeconomic theory, the logic of corporate tax optimization can be explained simply. In a market economy, that is governed by the law of profit, any firm that wants to survive or to grow acts as a rational agent. This rationality implies maximizing profit and minimizing costs and risks.

If we simply define profit as the difference between the revenues (R) and the costs (C) of the firm: P = R – C, the rational firm can increase this difference P either by increasing R, by lowering C or by playing on both options simultaneously.

R can be increased by enhancing product volume, by expanding range of products in local market, and by acquiring other domestic firms. Similarly, C can be lowered by augmenting scale of production or modifying techniques to improve the productivity of factors of production.

The tax optimization strategy leads the firm to arbitrate between its profits and the costs that could result (penalty). Sandmo and Allingham (1972) pioneered this approach. In their model, which is considered as the traditional basic model of tax avoidance, the rational agent weighs the benefits of successful tax evasion and the risk of being detected and punished. As an extension, Cowell (1990) also argues that an individual plays pure gamble on evasion decisions because he is well aware of government policy, tax rate and the probability of audit. Hence, the evasion level is driven by the possibility of a penalty. More recently, Torgler (2007) extends the baseline models by investigating empirically the link between tax morale (attitude towards paying or evading taxes) and tax compliance. He provided the evidence that tax evasion is positively associated with tax rates.

The main interest of all research that is based on the individual behavior of tax optimization strategy is to highlight determinants such as tax rates, chances of detection, penalties and risk aversions. The disadvantage of this approach is that it does not consider that the firm is above all an organization whose governance is complex and also produces delegation of power costs that are called agency costs.

Agency Cost Theory and Tax Optimization

The agency theory, formalized by Jensen (1976), states that in an enterprise where ownership and decision-making functions are separate, managers and shareholders have an agency relationship. The managers are the agents, and the shareholders are the principals. The central idea necessary to understand the strategies of the stakeholders within the company is that of the existence of a conflict of interest. It is supposed to exist between the managers and the shareholders in the big modern company. Why?

The managers have their own objectives, a specific utility function that refers to satisfactions related to their income, their leisure, their professional environment, and, therefore ostentatious expenses. For this, they will seek to maximize the turnover of the firm under the constraint of a minimum profit, thus increasing the scope of activities of the firm. The shareholders have a simpler utility function. What interests them is the maximization of the profits of the firm that affects the return on their shares and the value of the invested capital. As a result, the interests of corporate managers and shareholders diverge in today’s big business. This divergence of interest is referred as agency cost.

This central idea of conflict of interest between the managers and the shareholders was developed to explain agency conflict and corporate governance issues in tax avoidance. Chen and Chu (2005) study corporate tax avoidance under the agent-principal model and suggests that in the case of tax evasion, the internal control is compromised and efficiency loss occurs. Desai and Dharampala (2006) investigate how the managers weigh the firm value in comparison to their choice of tax avoidance with special emphasis on the role of corporate governance. They conclude that incentive compensation is significant in determining corporate tax avoidance and higher powered-incentives are involved in less tax sheltering. However, it is difficult to provide a solid theoretical base on this element of tax evasion as the contractual relationship between agent and principal is flexible which affects the behavior of corporate managers.

The theory of agency costs, like microeconomic theory, is based on corporate tax evasion by linking it to individual and firm behavior in the context of the environment of a given country. In a globalized world, international activity is becoming a major aspect of business life. MNCs ignore neither the associated opportunities nor the constraints and threats attached to international expansion.

Globalization, Oligopolistic Competition and Tax Optimization

Globalization is defined by the set of changes in the international economy that tend to create a global market for labor, capital, goods, and services increasingly free from political borders of states. It means, more opportunities available to firms to increase their profits with more constraints.

If we see the MNCs’ perspective having a playing field at the world level, it is beneficial and easy for them to practice the art of arbitrage between international locations. Moreover, the concept of “perfect mobility” of capital, due to the development of new information technologies, has helped the MNCs to build up their cost center in a country with high tax rates, and to locate the profit center in a more attractive tax environment.

The emergence of new areas of monetary integration, such as the euro area, has also played a positive role. The creation of a monetary zone, with no further exchange rate risk, has streamlined and accelerated financial flows in a fiscally heterogeneous space. These parameters have therefore accentuated the propensity to tax arbitrage and the MNCs are anxious to maximize their returns in order to meet the requirements of their shareholders. The question of taxation has thus become central in the management of affairs; hence it leads to the development of tax offices and other specialists. Since the dilemma was so well-integrated to firms, for decades, they could implement their tax-saving strategies without too much hindrance.

Globalization also means more constraints. Competition with other companies is global and intense. Moreover, in most sectors, it is now oligopolistic. As we know, contrary to the monopoly or pure competition in which individual sellers react only to the impersonal forces of the market, in the oligopoly, strategic interactions characterize relations between firms. No one can ignore the strategy followed by his rivals and the choice of one affects that of the others. It is the play of “oligopolistic reactions” described very well by Frederic Knickerbocker (1973, p. 5), the first researcher to have studied the phenomenon. The oligopoly is thus characterized by a game in which “the behavior of companies tends towards a system of actions and reactions. Each oligopolist, like a chess player, uses both blows to improve his own position and others to prevent the opponent from building his attacks”.

The FDI theory in oligopolistic competition explains rivalry between firms in the following ways;

It suggests that risk-averse firms follow their competitors to avoid distorting oligopolistic equilibrium. If one firm moves to the international market, the other firms also consider their moves. This movement may “trigger a chain reaction of countermoves at both domestic and international levels by rivals anxious to protect their positions” (Schenk, 1996, p. 26). This strategy is called “follow-the-leader” in which firms imitate each other.

Another aspect of FDI in an oligopolistic competition is the global positioning of a firm vis-à-vis its competitors. Sometimes firms retaliate from a move. “It could also be that a specific FDI is undertaken to confuse competitors and hide real strategic intentions. Sometimes, MNCs may acquire assets and positions in given locations, not due to the properties of those assets and positions, but because they provide the investor with pawns in future games” (Hoenen and Hansen, 2009, p. 14).

Hence oligopolistic reaction is a relevant determinant of FDI, which can be extended to tax optimization strategies of multinational companies.

Macroeconomic Levers of Tax Optimization in the EU

In the EU, the firms exploit the tax competition between MS. Tax optimization would be impracticable without the existence of disparate national tax regimes and tax havens. At a European level, many countries play tax leverage to attract firms (e.g., Luxembourg, Ireland, Belgium, the Netherlands, and the United Kingdom). The existence of “tax havens” further accentuates the possibilities for tax optimization.

The countries often exploit the notion of national sovereignty by setting preferential tax laws and incentives. How to explain such a situation?

The first explanation relies on the principle of national sovereignty in budgetary matters, which is considered necessary for the autonomy, security, and functioning of the government (Biswas, 2002). Yet, paradoxically, MSs weaken their financial balances in the long term by giving MNCs the opportunity to avoid billions of euros of taxes. And finally, they also decrease their bargaining power with this category of firms.

The second one is linked to the comparative advantage notion and its extension to taxation. For example, within the EU, some countries such as Ireland and Luxembourg have extended the concept of comparative advantage to tax laws. Thus, they invoke it by justifying the use of tax as a tool to attract investors in the absence of particular resources. However, the extension of the notion of comparative advantage to the topic of taxation is not healthy. Unguided tax competition can harm the core idea of the EU as defined by the treaties. The principle of “free and undistorted” competition is no longer respected, and the MSs themselves causes this dysfunction.

Facing such paradoxes, what could the EU do and what would the effectiveness of its interventions be?

EU Policies Measures Against Tax Avoidance and Difficulties

The EU has a long-standing interest in corporate taxation matters. Its achievements have been real but often difficult because of the rules laid down in the treaties. For example, the rule of unanimity, which governs the area of sovereignty, constitutes a source of the recurring blockade and often leads to a considerable lengthening negotiation period before arriving at a common position. Hence, some essential reforms are needed to smooth the functioning of the EU. In this section, we present a brief overview of the EU policy measures, the difficulties in curbing tax avoidance, and finally, we propose some recommendations based on these problems.

EU Policy Measures in Corporation Taxation

The EU’s initial efforts in corporate taxation mainly addressed the harmonization of the tax system, a single tax rate and unification or coordination of taxation system across all MS. Since the 1960s, several reports and proposals were pushed forward regarding the harmonized tax rates but none of them were approved (Nicodeme, 2006).

In the 1990s, the European Commission intensified its efforts to tackle the challenge of tax evasion within the EU, despite the strong resistance of the MS. We divide these efforts into five types of measures and action plans:

Vote of directives about the non-EU resident and double taxation

The Code of Conduct for Business Taxation

Action plan against tax fraud and evasion 2012

Common Consolidated Corporate Tax Base (CCCTB)

The EU Audit Process

The Non-EU Residents and Double Taxation Directives

In order to avoid double taxation of cross-border activities of MNCs within the EU, four directives were adopted namely, Parent-Subsidiary Directive (for withholding taxes on dividends), Merger Directive (for cross border restructuring of corporations), Interest and Royalty Directive (for eliminating withholding taxes on interest and royalty payments), and Saving Directive (for automatic exchange of information between MS). Despite the frequent amendments made in these measures, they did not prove sufficient to curb tax dodging.

The Code of Conduct for Business Taxation

In 1997, the European Commission proposed four-track strategies to combat harmful tax competition and called for tax coordination across MS (European Commission, 1997). Among these strategies, one was the “Code of Conduct for Business Taxation” which meant to prevent all drawbacks and to abandon harmful tax competition between MS. However, as the measure had no binding force, it remained ineffective.

Action Plan Against Tax Fraud and Evasion 2012

An action plan against tax fraud and evasion, covering tax governance, transparency, harmful tax practices, and exchange of information within the EU, was proposed in 2012. It also aimed at amending and intensifying the application of the previous directives and the Code of Conduct for Business Taxation.

The subsequent policy measures include a tax transparency package (fighting against tax avoidance in 2015), action plan on corporate taxation (re-launching of CCTB as Common Corporate Consolidated Tax Base “CCCTB”, fair taxation of profits where they are generated etc.), and anti-tax avoidance package (the directive on anti-tax avoidance, recommendation on tax treaties etc.). Some parts of the action plans have been adopted and some are still in the process of an agreement. For example, the Directive 2011/16/EU on automatic exchange of information was amended in 2016. The new Council Directive 2016/881/EU require MNCs located in the EU to file country-by-country reports. Similarly, as part of the anti-tax avoidance package, Anti-Tax Avoidance Directive (ATAD) was adopted in 2016 and has come into force in the EU since January 2019.

Common Consolidated Corporate Tax Base (CCCTB)

To harmonize the tax base across MS, the Commission proposed a “Directive on the Introduction of a Common Consolidated Corporate Tax base” in 2011. The objective was not only to preserve the single market and remove tax obstacles but also to discourage tax evasion and fraud within the EU. But it was considered too ambitious in some of the aspects (for example, the establishment of a common corporate tax rate). Nevertheless, the European Commission has re-launched this proposal in October 2016 by making it more manageable and thus continues to combat tax avoidance and evasion within the Union.

The EU Audit Process

The EU adopted the legislation on the audit process in 2016, in conformity with international auditing standards. It is governed by Directive 2014/56 / EU and Regulation No 537/2014. Three features characterize the reform. First, firms have to change their auditors at least every 10 years. The rotation of audit firms is thus faster than in the past. Second, the reforms put restrictions on non-audit services (NAS), as some services, like tax consultations, can no longer be provided by audit firms. Finally, at least one expert from the relevant field must be included in the audit committee.

Despite, several attempts to reform it, certain weaknesses still remain in the audit process. The first is that the MSs are still free to adapt the legislation according to their local legal structure. For example, MSs may extend the audit firm rotation period to 20 years. The second limitation is that new audit legislation is largely silent on tax evasion and avoidance issues, with the main objective of combating fraud only.

Overall, despite all the regulations, principles and guidelines developed over the past three decades, ATP has remained a major challenge for the EU. Why is this case still a fundamental question?

Difficulties for the EU in Curbing Tax Evasion and Avoidance

European Commission is a supranational institution. Yet, it has not been able to have a real impact on tax evasion and tax avoidance. The reasons that explain its difficulties have three sources:

The influence and dominance of MS’ national interest

The limited legal competency of the EU in corporate taxation

The role of lobbying and regulatory capture dilemma for the EU citizens

Figure 6 (appendix B) highlights issues in the decision-making process regarding corporate taxation in the EU.

The Influence and Dominance Of MS’ National Interest

Three institutions participate in the decision making process: the European Commission that proposes the legislation, the Council that represents the interests of the MS and the EU parliament that represents the European citizens. In this troika process, two problems can explain why the EU in terms of regulation, does not work.

The first one is the weight of the national interest in the voting process. Since the legislation in the EU is a co-decision making-process between the Council and the European Parliament, political affiliations and national interests of Members of EU Parliament (MEPs) are reflected in the voting for proposals put forward by the European Commission. Despite the ideological cohesion of MEPs, in budgetary affairs, national interests are dominant in voting in the EU parliament (Hix, 2002; Hix et al., 2007; Hix and Noury, 2009). This could be one of the reasons that tax harmonization has not reached yet.

The second problem is about the democratic legitimacy of the European Commission. This institution is supranational but with bureaucratic control.

These two problems explain why the issues related to fiscal harmonization are sensitive and subject to national sovereignty. Therefore, any intervention at the EU level, in the field of corporate taxation, is confrontational.

Limited Legal Competency of the EU in Corporate Taxation

The EU has very limited power in taxation, which explains why this topic is largely excluded from the EU policy agenda (Moravcsik, 2002). This limited power is explained by the historical choices that have presided over the construction of Europe and is enshrined in its legal structure. Thus, by introducing the Subsidiarity Principle, the EU shares its powers with MS as set out in Article 5 (3) of the Treaty of the EU. This article says: “In areas which do not fall within its exclusive competence, the Community shall take action, in accordance with the principle of subsidiarityonly if and insofar as the objectives of the proposed action cannot be sufficiently achieved by the Member States and can therefore, by the Member States and can therefore, by reason of the scale and effects of the proposed action, be better achieved by the Community” (European Union, 2012, p. 1). In doing so, the taxation is firmly in the hands of national governments, whereas the EU has turned into a regulatory polity that has gained control over technical and apolitical issues of market regulations (Majone, 1996; Newton and Van Deth, 2005).

Hence, in this system of multi-level government, in case of conflict between the EU and MS, the latter will always be winners. In this regard, the CCCTB is an excellent example. It took nearly a decade to be voted on by the European Parliament and the Council. And no decision about its application has been taken yet.

Lobbying and Regulatory Capture Dilemma for EU Citizens

There are 11,225 lobbying organizations registered at the “Transparency Register” of the EU[4]. However, the actual number of active lobbyists is much more. According to the Guardian (2014), more than 30,000 lobbyists in the EU influence 75% of the legislations. These range from simple private firm’s interests to national interests.

In taxation matters, both the MNCs and national governments get involved in lobbying. For example, the UK Treasury cabinet ministers urged the European Commission to exclude Bermuda as a tax haven (Ashley, 2016). Similarly, former British Prime Minister David Cameron was involved in lobbying to stop a European Council decision that would have forced banks to reveal beneficiaries of trust funds. He asked for the inheritance planning exemption from the EU new law (Beattie and Smith, 2016). Nevertheless, firms are more active in lobbying and spend a lot of money. Doing this, they can influence regulations and they lobby successfully to reduce their tax bills. For instance, Google Inc. spent at least €4.25 million in 2015 for lobbying purposes in Brussels (Reuters, 2016). According to academic studies, an increase in the lobbying expenditures significantly reduces the firm’s effective tax rates (Richter et al., 2009; Hill et al., 2013).

The decision-making process within the EU, in which multinationals and national governments manage to get their preferred regulations that protect their respective interests at the expense of the public interest, is called “regulatory capture” (Carpenter and Moss, 2014). Although this aspect requires further research, based on the current evidence, we can conclude that it is one of the causes that hinder the EU’s efforts to curb tax evasion and avoidance. Under such context, what can the EU do to achieve its objectives of fiscal harmonization and to fight against ATP strategies of all kinds?

Few Recommendations or Areas of Interventions

For the past ten years, the EU has gone through major crises such as financial crisis, migration crisis and most recent Brexit. More broadly, there is a wider political crisis with the rise of populist and extreme-right movements in the results of various elections at both state and Union level. Europe seems to be at a crossroads. Either it reforms itself by becoming a political union beyond the current state as an economic union or it is irremediably endangered by being less and less understood by the people who compose it. The topic of corporate taxation could illustrate which political directions the EU can take.

Corporate taxation is a sensitive subject because the MS consider it as a subject of national sovereignty. Any reform in this area seems a real difficult task because they are not ready to give up their national prerogatives and interests in this area. Besides, the rule of unanimous voting at the European level protects them. This rule is one of the main obstacles to establishing a common tax base within the EU. At the same time, European legislators insist that the concept of the single market cannot be complete if the harmonization of direct taxation does not take place. Thus, reaching a consensus on this subject is a long way and requires fundamental changes in the functioning of the EU. Hence, in a pragmatic concern, solutions should be sought under the current framework.

Firstly, the EU’s intervention, as a supranational institution, can be strengthened under Article 48 of the Lisbon Treaty. This article invokes the “Passerelle Clauses” that switches special legislative procedure to ordinary legislative procedure and unanimous voting to qualified majority voting in a given policy area. This clause could be extended to tax policies to obstruct the veto power of particular MS. This would preserve the European sovereignty in taxation as mentioned by Pierre Moscovici (2019), the EU Commissioner for Economic and Financial Affairs, Taxation and Customs. The paradox is that the activation of this clause itself is subject to unanimous voting that makes a perplexing situation in the EU legislation and decision-making process. Despite this situation, efforts should be made to invoke the “Passerelle Clauses” in tax matters. This will open up the way for the adoption of several alternative options to potentially reform the current tax system in the EU countries.

Second, it is about channeling the mushrooming phenomenon of lobbyists and their growing influence on decision-making in Europe. These play with potential legislations in two phases. First, before the proposal is tabled, they can influence through the public consultation process with the European Commission. Once the proposal is presented for discussion in the European Parliament and the Council, they can pursue their interests by meeting the MEPs and Council members. But there are some serious transparency issues in this process as there are no official minutes or records of such meetings. The loopholes in the current transparency register must be reviewed. In this regard, the attachment of EU advisory and expert groups (for public consultation) with lobbying firms should be regulated to avoid conflict of interests because sometimes their assessments are industry-friendly. The footprints of their studies are found in the proposals. Moreover, “not on the registry, no meeting” principle should be applied across all sections of decision-making bodies of the EU. Currently, it applies only to the EU Commissioners.

Thirdly, at the micro-level, we regard the CCCTB proposal of the European Commission as a useful policy measure against tax avoidance and harmful tax competition through a single set of rules across the EU. However, these are global phenomena. By and large, the proposal is silent on the companies outside the EU and its incorporation with non-EU countries. Therefore, this proposal should be linked with OECD BEPS initiatives.

Conclusion

The MNCs have gained rapid growth through FDI in the world in the recent past but they are also accused of not paying their fair share of taxes. In this paper, we tried to build a better understanding of some common tax optimization strategies of MNCs and addressed the policy measures to tackle such activities in the EU as our case study. We used an evidence-based analytic approach and a broad survey of the literature in this field. Our main conclusions are as follows: MNCs are increasingly using sophisticated tax avoidance models assisted by specialized firms. Taking advantage of their corporate group structure and their character as transnational corporations, with greater ease in the mobility of FDI, they exploit tax disparities between countries to arbitrate the international location of their activities according to their own interests. Tax competition between countries and the complicity they enjoy with tax havens are their assets in tax optimization strategies. In contrast, the EU is missing legal competency in corporate taxation. The MSs exploit the notion of national sovereignty to veto any proposed legislation through unanimous voting. The MNCs also influence the decision-making process through lobbying, hence creating a situation of “regulatory capture”. Based on these findings, we conclude that without deep reforms in the functioning of the EU, the measures against tax evasion and avoidance deemed to be failures. More precisely, the competency of the EU as a supranational institution, under the current legal framework, in the direct taxation matters should be increased. It shall automatically reduce the veto power of MSs. Finally, the transparency in decision-making and uniformity of corporate tax laws across the EU should be ensured.

Future research prospects are possible in three directions. The first one is the formalization of the explanatory model of fiscal optimization strategies of MNCs. The second one is to test some of our theoretical analysis empirically. Particularly, focusing on a few sectors, the main strategies can be analyzed. Since data availability may be an obstacle to future research, building a relevant country-wise corporate tax return database can be the third direction. All the future results of avoidance strategies of the MNCs and their consequences on the countries’ economy may also be helpful for the policymakers.

Parties annexes

Appendices

Appendix A

Box 1: Terminologies of tax optimization

Box 2: The main characteristics of tax havens

Appendix B

Figure 1

Taxes on corporate profit OECD

Figure 2

Average statuary versus effective tax rate in EU

Figure 3

Investment flows to tax havens

Figure 4

Hybrid Entity arrangement

Figure 5

The double Irish Dutch sandwich mechanism

Figure 6

Causes of the inability of the EU in Corporate tax harmonization

Appendix c

Table 1

(a) case 1 No financial coordination

Table 1

(b) case 2 Existence of financial coordination

*Tax rate 50% ** Tax rate 30%

Acknowledgements

We are grateful to Management International’s anonymous referees for their comments and suggestions that have improved some parts of this article. Of course, we are responsible for all errors that remain. We also thank Vincent Montenero and Jean-Jacques Nowak for helping to correct our English.

Biographical notes

Dr. Hadjila Krifa-Schneider is Associated Professor Emeritus in Faculty of Economics and Social Sciences and Territories at University of Lille - Science and Technology- France. She also created the Master Management of European affairs and was its director of studies during from 2006-20. She was the deputy director of Rime Lab (laboratory of research) from 2015 to 2020. Her areas of interest as researcher include Globalization and Inequalities, Dynamics of Foreign Direct Investment; Openness, growth and regional inequalities; The strategies of multinational corporations and their consequences in economics; Corporate tax avoidance; the Enlargement of European Union.

Abdul Sattar is completed his PhD under the supervision of Associate Professor Emeritus, Dr. Hadjila Krifa-Schneider, in Faculty of Economic and Social Sciences, (RIME Lab) at the University of Lille-Science and Technology, France. His areas of interest include corporate tax avoidance, international trade and foreign direct investment. He is also associated as Assistant Professor with the Department of Management Sciences at Balochistan University of Information Technology Engineering, and Management Sciences (BUITEMS), Pakistan.

Notes

- [1]

-

[2]

US tax laws allow the MNCs to select a classification for federal income tax purpose. The US owner companies can mark a foreign subsidiary as corporations, partnership or disregarded entity in the check-the-box election. It allows a foreign entity to be treated differently in US and in a foreign country for tax purpose. The MNC declares its subsidiary in a tax haven as disregarded entity, which makes a loan to another subsidiary in another foreign jurisdiction. The US tax system does not recognize the loan and interest payments for tax purpose rather it recognizes all subsequent affiliates as a single subsidiary. But the foreign country allows the deduction of interest expense from taxable profit.

-

[3]

For more details, see https://www.irs.gov/newsroom/tax-cuts-and-jobs-act-a-comparison-for-large-businesses-and-international-taxpayers

-

[4]

http://ec.europa.eu/transparencyregister/public/homePage.do?redir=false&locale=en

Bibliography

- Ashley C. (2016). “Government ‘lobbying to protect Google’s £30bn tax haven in Bermuda”, The Independent, accessed April 20, 2017, http://www.independent.co.uk/news/uk/government-lobbying-to-protect-google-s-30bn-tax-haven-in-bermuda-a6844636.html

- Bartelsman E.; Beetsma R. (2003). “Why pay more? Corporate tax avoidance through transfer pricing in OECD countries”, Journal of Public Economics, Vol. 87, p. 2225-2252

- Beattie J.; Smith M. (2016), “David Cameron’s EU lobbying may have watered down offshore tax haven scrutiny”, Mirror, accessed April 20, 2017, http://www.mirror.co.uk/news/uk-news/david-camerons-eu-lobbying-watered-770560

- Biswas R. (2002). International tax competition: globalization and fiscal sovereignty, Common wealth secretariat

- Buettner T., Overesch M., Schreiber U.; Wamser, G. (2006). “Taxation and Capital Structure Choice-Evidence from a Panel of German Multinationals”, Munich: ZEW

- Busse M.; Groizard J. (2008). “Foreign Direct Investment, Regulations and Growth”, The World Economy, Vol. 31, No 7, p. 861-886.

- Carpenter D.; Moss D. (2012). Preventing Regulatory Capture: Special Interest Influence, and How to Limit It, Cambridge University Press. Available at: http://www.tobinproject.org/sites/tobinproject.org/files/assets/Kwak%20-%20Cultural%20Capture%20and%20the%20Financial%20Crisis.pdf.

- Chen K.; Chu C. (2005). “Internal control vs. external manipulation: A model of corporate income tax evasion”, RAND Journal of Economics, Vol. 36 No 1, p. 151-164.

- Cowell F. (1990). Cheating the government: The economics of evasion, Cambridge: MIT Press.

- Dalen S. (2016). Tax havens Secrecy jurisdictions and journalistic investigations: How to make it part of the global discussion, Reuters Institute Fellowship Paper University of Oxford

- Desai M.; Dharampala D. (2006). “Corporate tax avoidance and high-powered incentives”, Journal of Financial Economics, Vol. 79, p. 145-179.

- European Commission (1997). COM (97) 495: Towards Tax Coordination in the European Union, A package to tackle harmful tax competition, at http://aei.pitt.edu/3494/1/3494.pdf

- European Commission ZEW (2016). “Effective vs statuary tax rates”, accessed 27 May 2017, http://www.zew.de/en/

- European Union (2012). “Consolidated Version of the Treaty on European Union”, Official Journal of European Union, C326/1.

- Fuest C., Spengel, Finke K., Heckemeyer J.H.; Nusser H., (2013). “Profit Shifting and “Aggressive” Tax Planning by Multinational Firms: Issues and Options for Reform”, ZEW Discussion Paper

- Graham J.; Tucker A., (2006). “Tax shelters and corporate debt policy”, Journal of Financial Economics, Vol.81, p. 563-594.

- Gravelle J. (2015). “Tax Havens: International Tax Avoidance and Evasion”, Congressional Research Service (CRS)

- Hill M., Kubick T., Lockhart G.; Wan H. (2013). “The effectiveness and valuation of political tax minimization”, Journal of Banking & Finance, Vol. 37, No 8, p. 2836-2849.

- Hix S. (2002). “Parliamentary behaviour with two principals: preferences, parties, and voting in the European Parliament”, American Journal of Political Science, Vol. 46, p. 688-698.

- Hix S.; Noury A. (2009). “After enlargement: voting patterns in the sixth European Parliament”, Legislative Studies Quarterly, Vol. 34, p. 159-174.

- Hix S., Noury A.; Roland G. (2007). Democratic Politics in the European Parliament Cambridge University Press, Cambridge U.K

- Hoenen A.; Hansen M. (2009). “Oligopolistic competition and foreign direct investment (Re) Integrating the strategic management perspective in the theory of multinational corporations”, CBDS Working Paper Series 10, Copenhagen Business School.

- Jensen M. (1976). “Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure”, Journal of Financial Economics, Vol. 3 No 4.

- Kay G. (1980). “The anatomy of Tax avoidance in Income Distribution: Limits to Redistribution”, Proceedings of the 31st Symposium of the Colstor Research Society, University of Bristol: John Write and Sons Ltd, pp. 135-148

- Knickerbocker F. (1973). Oligopolistic Reaction and Multinational Enterprises, Harvard University Press

- Lohse T.; Riedel N. (2012). “The impact of transfer pricing regulations on profit shifting within European multinationals”, Discussion Paper 61, FZID

- Majone G. (1996). Regulating Europe, London: Routledge.

- Moravcsik A. (2002). “In defence of the ‘democratic deficit’: Reassessing legitimacy in the European Union”, Journal of Common Market Studies, Vol. 40 No 4, p. 603-624.

- Moscovici, p. (2019). Reforming decision-making for EU taxation policy, Retrieved May 16, 2019, from Brugegel.org: http://bruegel.org/2019/02/reforming-decision-making-for-eu-taxation-policy/

- Murphy R. (2012). Closing the European Tax Gap a Report for the Progressive Alliance of Socialists & Democrats in the European Parliament, Tax Research LLP.

- Newton K.; Van Deth J. (2005). Foundations of comparative politics, Cambridge: Cambridge University Press

- Nicodeme G. (2006). “Corporate Tax Competition and Coordination in the European Union: What do we know? Where do we stand”? Munich Personal RePEc Archive

- Noorbakhsh F., Poloni A.; Youssef A. (2001), “Human capital and FDI inflows to Developing Countries: New empirical evidence” World Development, Vol. 29 No 9, p. 1593-1610.

- OECD (2017). “Glossary of Tax Terms”, accessed 27 May, 2017 http://www.oecd.org/ctp/glossaryoftaxterms.htm#T

- OECD (2012). “Thin capitalization legislation, a background paper for country tax administration”, accessed May 27, 2017 http://www.oecd.org/ctp/tax-global/5.%20thin_capitalization_background.pdf

- OECD (2013). Addressing Base Erosion and Profit Shifting, OECD Publishing, http://dx.doi.org/10.1787/9789264192744-en

- OECD (2014). “Neutralizing the Effects of Hybrid Mismatch Arrangements”, OECD/G20 Base Erosion and Profit Shifting Project, accessed 20 April 2017, http://www.oecd-ilibrary.org/taxation/neutralising-the-effects-of-hybrid-mismatcharrangements_9789264218819-en

- OECD (2017). “Tax on corporate profits (indicator)”. doi: 10.1787/d30cc412-en (Accessed on 24 May 2017)

- OECD (2012). Hybrid Mismatch Arrangements: Tax Policies and Compliance Issues, Paris: Organisation for Economic Co-operation and Development.

- REUTERS (2016). Tech Giants Are Snapping Up Brussels Lobbyists as the EU Gets Tough, Retrieved 3 10, 2017, from Fortune.com: http://fortune.com/2016/09/08/tech-brussels-lobybyist-eu/

- Richter B. K., Samphantharak K.; Timmons J. (2009). “Lobbying and Taxes”, American Journal of Political Science Vol.53 No 4, p. 893-909.

- Rousseau J. (2006). The social contract, Good Book Classics.

- Sandmo A.; Allingham, M. (1972). “Income tax evasion: A theoritical Analysis”, Journal of Public Economics, Vol. 1, p. 323-338.

- Schenk H. (1999). Large mergers a matter of strategy rather than economics, Text box prepared for the UNCTAD’s World Investment Report 1999

- Torgler B. (2007). Tax Compliance and Tax Morale: A Theoretical and Empirical Analysis, Cheltenham, UK: : Edward Elgar.

- UNCTAD (2016). World Investment Report, Investor nationality: Policy Challenges, United Nations, accessed 24 May 2017 http://unctad.org/en/PublicationsLibrary/wir2016_en.pdf

- UNCTAD (2017). World Investment Report, investment and the digital economy, United Nations, accessed 24 May 2017 http://unctad.org/en/PublicationsLibrary/wir2017_en.pdf

- Wood R. W. (2016). “How Google Saved $3.6 Billion Taxes from Paper ‘Dutch Sandwich’”, at https://www.forbes.com/sites/robertwood/2016/12/22/how-google-saved-3-6-billion-taxes-from-paper-dutch-sandwich/#37ff050b1c19

- Zoromé A. (2007). Concept of Offshore Financial Centers: In Search of an Operational Definition”, IMF Working PaperWP/07/87, International Monetary Fund.

Parties annexes

Notes biographiques

Le Dr Hadjila Krifa-Schneider est Maître de Conférence Émérite à la Faculté des sciences économiques, sociales et des territoires de l’Université de Lille -Science et Technologie- France. Elle a également créé le Master Management des Affaires Européennes et l’a dirigé de 2006 à 2020. Elle a été la directrice adjointe du laboratoire de recherche Rime Lab de 2015 à 2020. Ses domaines d’intérêt, en tant que chercheuse, incluent la mondialisation et les inégalités, la dynamique de l’investissement étranger direct; L’ouverture au commerce, la croissance et les inégalités régionales; Les stratégies des sociétés multinationales et leurs conséquences économiques; L’évasion fiscale des entreprises; l’élargissement de l’Union européenne.

Abdul Sattar a terminé son doctorat sous la direction du Dr Hadjila-Krifa, Maître de conférences Emérite, à la Faculté des Sciences Economiques et Sociales, (RIME Lab) à l’Université de Lille-Science et Technologie, France. Ses domaines d’intérêt incluent l’évasion fiscale des entreprises, le commerce international et l’investissement étranger direct. Il est également associé au Département des Sciences de Gestion de l’Université du Balochistan des Sciences de L’ingénierie et de la Gestion des Technologies de L’information (BUITEMS) au Pakistan.

Parties annexes

Notas biograficas

Dr Hadjila Krifa-Schneider es a Profesora Titular Emeritus en la la Facultad de Ciencias Económicas y Sociales y de los Territorios de la Universidad de Lille - Science et Technologie- Francia. También creó el Máster en Gestión de Asuntos Europeos y lo dirigió desde 2006 hasta 2020 y lo dirigió desde 2006 hasta 2020. Fue subdirectora del laboratorio de investigación Rime Lab desde 2015 hasta 2020. Sus áreas de interés como investigadora incluyen Sus áreas de interés como investigadora incluyen Globalización y Desigualdades, Dinámica de la Inversión Extranjera Directa; Apertura, crecimiento y desigualdades regionales; Las estrategias de las corporaciones multinacionales y sus consecuencias en la economía; Evasión de impuestos corporativos; La ampliación de la Unión Europea.

Abdul Sattar completó su doctorado bajo la supervisión de la, Dr Hadjila Krifa Scheider, Profesor Asociado Emérito de la Facultad de Ciencias Económicas y Sociales (RIME Lab) de la Universidad de Lille-Science et Technologie, Francia. Sus áreas de interés incluyen evasión de impuestos corporativos, comercio internacional e inversión extranjera directa. También está asociado con el Departamento de Ciencias de la Gestión de la Universidad de Balochistán de Ingeniería de Tecnología de la Información y Ciencias de la Gestión (BUITEMS) en Pakistán.

Liste des figures

Figure 1

Taxes on corporate profit OECD

Figure 2

Average statuary versus effective tax rate in EU

Figure 3

Investment flows to tax havens

Figure 4

Hybrid Entity arrangement

Figure 5

The double Irish Dutch sandwich mechanism

Figure 6

Causes of the inability of the EU in Corporate tax harmonization

Liste des tableaux

Box 1: Terminologies of tax optimization

Box 2: The main characteristics of tax havens