Résumés

Abstract

Given the importance of corporate social responsibility (CSR) and corporate governance, this study examines the association between board composition and CSR disclosure on a sample of S&P 500 firms over the period from 2004 to 2015. Unlike existing studies, we control for potential sources of endogeneity using a system-generalized method of moments (system GMM) estimator. In doing so, we find no evidence that board size, board independence or CEO duality has any significant influence on CSR disclosure. Rather, our results suggest that, when the problem of endogeneity is correctly taken into account, the link between board composition and CSR disclosure is neutral.

Keywords:

- corporate governance,

- CSR disclosure,

- agency theory,

- resource dependence theory,

- corporate social responsibility,

- board composition

Résumé

Compte tenu de l’importance de la responsabilité sociale des entreprises (RSE) et de la gouvernance des entreprises, cette étude examine l’association entre la composition du conseil d’administration et la divulgation d’informations RSE sur un échantillon d’entreprises composant l’indice S&P 500 au cours de la période 2004 à 2015. Contrairement aux études existantes, nous contrôlons les potentielles sources d’endogénéité à l’aide d’un estimateur de la méthode des moments généralisée (système GMM). Ce faisant, nous ne trouvons aucune preuve que la taille du conseil, son indépendance ou la dualité des fonctions de PDG ont une influence significative sur la divulgation d’information en matière de RSE. Nos résultats suggèrent plutôt que, lorsque le problème d’endogénéité est correctement pris en compte, le lien entre la composition du conseil d’administration et la divulgation d’information RSE est neutre.

Mots-clés :

- gouvernance d’entreprise,

- Divulgation d’information RSE,

- théorie de l’agence,

- théologie de la dépendance aux ressources,

- responsabilité sociale des entreprises,

- composition du conseil

Resumen

Dada la importancia de la responsabilidad social corporativa (RSC) y el gobierno corporativo, este estudio examina la asociación entre la composición de la junta directiva y la divulgación de la RSC en una muestra de empresas pertenecientes al S&P 500 durante el período de 2004 a 2015. A diferencia de los estudios existentes, controlamos las posibles fuentes de uso de endogeneidad de un estimador con el método de momentos generalizado por sistema (sistema GMM). Al hacerlo, no encontramos evidencia de que el tamaño de la junta directiva, su independencia o la dualidad del CEO tengan una influencia significativa en la divulgación de la RSC. Nuestros resultados sugieren que, cuando el problema de la endogeneidad se tiene en cuenta correctamente, el vínculo entre la composición de la junta directiva y la divulgación de la RSC es neutral.

Palabras clave:

- gobierno corporativo,

- divulgación de RSC,

- teoría de la Agencia,

- teoría de dependencia de recursos,

- responsabilidad social corporativa,

- composición del tablero

Corps de l’article

For some years now, there has been increasing public interest concerning the role of companies with regard to social, environmental and ethical issues (Reverte, 2009). Issues such as employee well-being, gender representation within organizations, pollution, waste, and human rights, are gaining prominence. In this context, companies have been required to communicate to a broader audience than just their shareholders and challenged to display more information regarding their operations in the process. Indeed, shareholders, as well as investors, are now particularly keen on receiving information detailing how companies deal with environmental, societal and governance (ESG) risks. Consequently, companies are under growing pressure to disclose ESG information in their annual reports, as these qualities are now perceived as critical factors (e.g. Ioannou and Serafeim, 2015). Corporate social responsibility (CSR) disclosure is, therefore, a major concern for companies that needs to be addressed.

Boards of directors are increasingly viewed as governing bodies with the ability to take important steps toward ESG disclosure (e.g. Michelon and Parbonetti, 2012). In their literature review on agency and resource dependence theories, Hill and Jones (1992) assign to the board of directors (hereafter BoD) a prominent role in controlling the sustainable behavior of their organization, as well as being accounTable to shareholders, creditors’ groups and various other stakeholders. It is expected that firms with an effective board (through their size, degree of independence, and the dual function of the chair and CEO) are more likely to engage in and facilitate CSR disclosure (Gray et al., 1995).

Existing empirical research provides mixed results regarding the effects of board composition (hereafter BC) on ESG disclosure. For instance, some studies (e.g. Harjoto and Jo, 2011; Husted and de Sousa-Filho, 2019) have found that board independence has a positive and significant influence on CSR disclosure levels. Conversely, other studies have been unable to confirm this relationship (e.g. Hillman et al., 2001; David et al., 2007). The real effect of board mechanisms on CSR disclosure, therefore, remains unclear.

From an econometric standpoint, establishing a causal relationship between BC and CSR disclosure is challenging. Board characteristics are not exogenous variables randomly selected. According to Adams et al. (2010), they tend to be endogenously chosen by firms in response to specific situations (e.g. in terms of governance or firm performance – FP). Two main sources of endogeneity may affect the relationship between board characteristics and CSR disclosure: omitted unobservable firm characteristics (both fixed and time-varying) and reverse causality (e.g. Wintoki et al., 2012; Sila et al., 2016). To the best of our knowledge, existing studies use either ordinary least squares (OLS) or panel data methods, but neither of these take into account endogeneity issues (see Table 1).

This study makes several contributions to existing CSR and corporate governance (hereafter CG) literature. Firstly, in their literature review, Jain and Jamali (2016) call for further research because the effect of BC on CSR disclosure is still an open question and empirical evidence remains inconclusive (see Table 1). Furthermore, the aforementioned authors notice that, among the considerable number of studies analyzing the effects of CSR, only a few specifically examine the effects of BC on CSR disclosure. This does not seem sufficient, given the growing demand for information from stakeholders. Consequently, our paper contributes more generally to the literature on the hitherto inconclusive debate concerning board characteristics and CSR disclosure.

Secondly, our study differs from the existing literature as we deal with endogeneity issues. Specifically, consistent with Wintoki et al. (2012) or Sila et al. (2016), we use a dynamic panel system estimator to estimate a dynamic model using a system-generalized method of moments (system GMM) estimator. We argue that this approach improves on the traditional pooled OLS and fixed-effect (FE) methods used by existing literature. Our article, therefore, contributes to the issue of BC and CSR disclosure from an econometric standpoint.

The purpose of this article, therefore, is to re-examine the relationship between board characteristics (board independence, board size, and CEO duality) and CSR disclosure by applying a dynamic panel system and, also the GMM. To achieve this, we use a dataset of 382 US firms listed on the Standard & Poor’s 500 (S&P 500) Index from 2004 to 2015.

The remainder of this article is structured as follows. Sections 2 and 3 present the theoretical framework and the hypotheses developed, respectively. Section 4 outlines the research design. Sections 5 and 6 present the sample, data and variables. The results and discussion (together with preliminary statistics) and concluding remarks are offered in Sections 7 and 8, respectively.

Theoretical Framework

According to a Green Paper presented by the European Commission in 2001, CSR is “a concept whereby companies integrate social and environmental concerns in their business operations and in their interaction with their stakeholders on a voluntary basis” (Commission of the European Communities, 2001, p. 6).[1] Moreover, the Green Paper views CG as a system or interface that manages and controls relationships between the management, the BoD, and the stakeholders. Fundamentally, CG is set up to optimize the value of a firm, through aligning the interests of managers and shareholders at the lowest cost (Turnbull, 2017). Within this context, Waddock and Graves (1997) argue that CG allows for a balance between the firm’s economic and social interests, as well as between individual and collective ones. It is by taking stakeholder expectations into account and not solely that of shareholder interests, as suggested by the agency theory (Jensen and Meckling, 1976), that many companies have decided to communicate a firm’s CSR orientation via CSR disclosure. Indeed, Reynolds and Yuthas (2008) argue that “what corporations choose to include in these reports provides important signals about organizational interests and priorities” (p. 60).

CSR disclosure is fundamentally based on the “Triple Bottom Line” (TBL) functioning of the firm (Elkington, 1997). This approach gives equal weight to economic, environmental, and social dimensions. In essence, managers run a firm by simultaneously achieving economic, environmental, and social objectives. As such, annual reports should include financial, social, and environmental elements explaining the firm’s CSR strategy. Finally, by definition, sustainable development involves society, the economy, and the environment as a whole (Milne and Gray, 2013). In this context, CSR reporting requires firms to have a deep commitment to collect and disclose detailed data on their operations. In the US, the Security and Exchange Commission’s (SEC) Regulation S-K requires that specific information is disclosed via annual reports. Milne and Gray (2013) stress that transparency, accountability, and responsibility are the key principles of quality CG.

Although sustainability is not required in the US, many companies do issue CSR information, recognizing its importance for keeping stakeholders informed regarding a firm’s CSR policy. Furthermore, these companies often use the Global Initiative Reporting (GRI) guidelines as a basis for CSR reporting (Milne and Gray, 2013).

Theoretically speaking, Walls et al. (2012) and Jain and Jamali (2016) found that the most widely used theoretical perspectives were agency theory (Jensen and Meckling, 1976) and resource dependence (RD) theory (Pfeffer and Salancik, 1978). This is consistent with strategic management literature examining the role of BoD in a firm’s decision-making (e.g. Judge and Zeithaml, 1992; Goodstein et al., 1994).

Agency theory deals with the relationship between the principal (e.g. shareholder) and the agents of the principal (e.g. managers or directors). Conflicts of interest may arise between principals and agents due to the separation of ownership and control existing in organizations (Berle and Means, 1932; Fama and Jensen, 1983). As such, the primary function of a board is to monitor the actions of agents (managers) in order to protect the interests of the principal (owner) (Jensen and Meckling, 1976; Eisenhardt, 1989). To counter any potential opportunistic behavior and agency costs that arise, BC is put in place to ensure that managers are acting in shareholders’ interests (Dalton et al., 1998).

Agency theory, therefore, posits that effective board structures may ensure alignment of managers’ interests with both shareholders’ and stakeholders’ long-term interests in respect of CSR (Chang et al., 2017). Furthermore, due to the separation of ownership from management, an asymmetry of information can form, which can be exploited by the management. However, the quality of governance can counter this asymmetry of information through disclosure (Healy and Palepu, 1995) or transparency/accountability (Hermalin and Weisbach, 2007).

The other theoretical perspective applied in the literature is RD theory (Pfeffer and Salancik, 1978), which views the firm as an open system interacting with institutional forces but also transacting with other organizations in order to gain the resources required for the firm’s survival (Granovetter, 1985). Within this framework, the function of the BoD is resource provision. Directors are perceived as being a critical channel for valuable resources and information, as well as for advice and counsel on organizational survival and success (Pfeffer and Salancik, 1978). They can provide critical linkages to resources and also leverage social capital through their board linkages (Hillman and Dalziel, 2003). This is assumed to enable managers to adopt pro-social activities that could, in turn, enhance FP (e.g. Berrone and Gomez-Mejia, 2009).

In the context of CSR, directors play a key role as resource providers, as CSR involves the efficient management of the various stakeholder interests (Clarkson, 1995). Put another way, given that the implementation of successful CSR requires a thorough knowledge of multiple stakeholders’ requirements, directors who are able to provide a breadth of resources are likely to have a significant influence on a firm’s commitment to CSR issues (Chang et al., 2017).

Empirically, the link between CSR and BoD has attracted the attention of research literature around the world – see Jain and Jamali (2016). However, we have only located nineteen empirical studies that specifically tested the effect of BC on CSR disclosure. This is relatively small given the importance of CSR nowadays. Table 1 summarizes these 19 studies.

As highlighted in Table 1, the empirical evidence regarding the effect of BC on CSR disclosure is mixed. In general, empirical studies find a positive relationship existing between board independence and CSR disclosure. However, there is evidence that this link might be negative. As for board size and CEO duality, we have found that the link is mixed. If the mixed results are likely the result of differences due to data stemming from different countries, time periods, sample sizes, and measurement problems of CSR disclosure, then we argue that these results are either directly or indirectly affected by endogeneity issues.

Hypotheses Development

For clarity reasons, it is appropriate to specify what CG is. According to Adams et al. (2010), governance quality can either be captured by the BC or by measures that capture board diligence. Board independence, board size, and CEO duality are often used as relevant attributes to proxy the CG quality, as highlighted in Table 1. Because of this, we have developed our hypotheses around these three main mechanisms.

Board Size

The effect of board size on the quality of board decisions and FP (Dalton et al., 1999) remains an open question. Indeed, two conflicting visions are apparent. On the one hand, agency theory argues that large boards often face free-rider problems (Dalton et al., 1999), as well as severe challenges to coordination and communication (Jensen, 1993). In such cases, Goodstein et al. (1994) suggest that larger boards are unable to implement strategic action plans. On the other hand, RD theory suggests that larger boards provide an increased pool of expertise and resources for the organization (Pfeffer, 1972), which can, in turn, increase FP by allowing the firm to become better established in its environment by securing critical resources (Goodstein et al., 1994).

With respect to CSR, boards are responsible for implementing CSR agendas in order to meet stakeholders’ expectations (Donaldson and Preston, 1995; Jamali et al., 2008). According to Linck et al. (2008), the size of the board reflects a firm’s complexity and the degree to which it benefits from advice. Board size is a function of a firm’s level of leverage, capital structure or degree of diversification. Following Jizi (2017), we argue that the firms in our sample (i.e. belonging to the S&P 500) are the largest quoted companies in the US and are inherently complex to run. Consequently, we presume that larger boards are more likely to be efficient at dealing with their firm’s CSR agenda and the need to communicate with stakeholders. Thus, we propose the following:

H1: CSR disclosure is positively related to board size.

Board Independence

According to agency theory, independent boards are supposed to reduce agency costs, therefore, subsequently increasing a firm’s value (Fama and Jensen, 1983). Indeed, independent boards monitor and oversee management behavior more efficiently than non-independent boards, and direct firms’ long-term activities in respect of CSR (Post et al., 2011).

Since independent directors are more prone to favor the firm’s long-term success and to ensure that management takes into account stakeholders’ requests regarding CSR (Luoma and Goodstein, 1999), board independence is more likely to lead to the promotion of CSR because independent directors are more prone to favor long-term success as the priority. Empirically, existing studies have found that board independence is positively and significantly related to CSR choice (Jo and Harjoto, 2011). Compared with non-independent directors, independent directors place more emphasis on the discretionary component of CSR (philanthropy). Furthermore, the accounting literature has also shown that firms with boards consisting of a majority of independent directors are more willing to disclose their CSR activities (e.g. Cheng and Courtenay, 2006; Chau and Gray, 2010). Following Jizi (2017), we suggest that, in order to ensure a firm’s sustainability and to reduce information asymmetry, independent boards will shepherd management toward CSR activities and favor extra-financial reporting for stakeholders. We, therefore, assert the following:

H2: CSR disclosure is positively related to board independence.

Table 1

Summary of the main empirical studies

1 Brazil, Mexico, Colombia and Chile // N: firm-years observations

OLS: Ordinary Least Squares; FE: Fixed Effect; 2SLS: Two-Stage Least Squares; SEM: Structural Equation Modeling; and GLS: Generalized Least Squares

CEO Duality

CEO duality occurs when the same individual holds both the CEO (management) and chair (control) positions simultaneously (Rechner and Dalton, 1991). According to Surroca and Tribó (2008), CEO duality is evidence of a managerial power concentration existing within a firm. For instance, CEOs have the authority to appoint directors favorable to themselves (Haniffa and Cooke, 2002). In this context, non-independent directors are more likely to countenance managerial decisions that are unfavorable to shareholders’ interests to avoid confrontation with a powerful CEO (Dey, 2008) and to keep their seat on the BoD. Furthermore, as chair of the board, the CEO has the power to influence the information provided to board members (Haniffa and Cooke, 2002). Empirically, most studies suggest that a board’s capabilities in terms of oversight, monitoring and control are negatively correlated with CEO duality (Tuggle et al., 2010), along with the level of voluntary disclosure (e.g. Chau and Gray, 2010). In contrast, some studies have shown that CEO duality may increase firms’ CSR reporting or tone down the supervision and monitoring of stakeholder pressure and release (Haniffa and Cooke, 2005; Jizi et al., 2014).

Contextually, regulatory bodies and investors (especially institutional investors) in the US have proposed a distinct role for the CEO and the chair of the board, because firms with CEO duality may suffer from poor CG (Linck et al., 2009)2009. As a result, we hypothesize that firms with CEO duality are more likely to reduce the supervision and monitoring role of the BoD, which, in turn, may lower CSR disclosure levels. Given these factors, we put forward the following:

H3: CSR disclosure is negatively related to CEO duality.

Methodology

Model

To test our hypotheses, we have generated the following baseline model:

Eq. [1] is generally estimated using OLS or FE methods (e.g. Jizi, 2017°; Hussain et al., 2018) under the assumption that the relationship between board structure and CSR is static. However, recent studies have shown that this relationship is dynamic in nature (Wintoki et al., 2012). Furthermore, those studies may suffer from endogeneity biases. Indeed, Wintoki et al. (2012) argue that traditional econometric approaches (e.g. OLS and FE methods) are not sufficiently effective in dealing with endogeneity issues – which we address in the next subsection.

Endogeneity Issues

Wintoki et al. (2012) argue that corporate financial decisions are likely to be dynamic in nature; that is, past action may act as a proxy for important firm attributes that are not observable but significantly influence current action. This phenomenon is referred to by Wintoki et al. (2012) as “dynamic endogeneity.” Recent literature (e.g. Wintoki et al., 2012; Sila et al., 2016) argues that models ignoring dynamic endogeneity are more likely to yield biased and inconsistent results. Consequently, Eq. [1] is rewritten as follows:

At this stage, Eq. [2] raises concerns regarding two other sources of endogeneity: unobserved heterogeneity (or omitted variable bias) and reverse causality. Omitted unobservable firm characteristics (which might be fixed or variable across time), such as country effect (Dhaliwal et al., 2012) or a firm’s risk-taking behavior (Sila et al., 2016), may significantly affect the firm’s CSR disclosure and also the board mechanisms. However, these antecedents may be difficult to observe and measure, meaning they are usually omitted from an econometric specification. In general, the literature deals with this issue by using panel data analysis and an FE estimator, being able to take this bias into account under certain assumptions (Wooldridge, 2010). However, this treatment may not be sufficient because of a second endogeneity source in the shape of reverse causality (Sila et al., 2016).

The second issue associated with endogeneity is reverse causality (or simultaneity); that is to say, when the dependent and one or more of the explanatory variables are jointly determined (Gippel et al., 2015). For example, on the one hand, it is quite conceivable that a higher proportion of independent directors may increase a firm’s CSR disclosure but, on the other hand, it is also possible that firms change their BC in response to a higher CSR commitment. Consequently, not to take this phenomenon into consideration might turn the relationship biased, as the direction of causality can go both ways (Gippel et al., 2015).

Estimation Approach

Following Wintoki et al. (2012) and Sila et al. (2016), we use the dynamic panel system GMM estimator proposed by Arellano and Bover (1995) and Blundell and Bond (1998), as this method may alleviate all the above concerns. A GMM estimator may be viewed as a system of two simultaneous equations, including one for levels and another for differences, allowing us to treat all the explanatory variables in Eq. [2] as endogenous. Following Wintoki et al. (2012), firm age and year dummies are assumed to be exogenously determined. We employed a system GMM estimation with Windmeijer-corrected robust errors (Windmeijer, 2005).

Data and Variable Definitions

Sample and Data

The initial study sample included all the companies that made up the S&P 500 as of 31 December 2015 and covering the period from 2004 to 2015. This index represents a broad cross-section of the US equity market, including stock traded on the New York Stock Exchange (NYSE) and Nasdaq stock markets. The S&P 500 captures over 80% of the total domestic US equity float-adjusted market capitalization. The index has already been used in previous studies (e.g. Jo and Harjoto, 2011), but this study focuses exclusively on large-sized companies because they are more likely to be under scrutiny from various stakeholders regarding their CSR policies (e.g. Watts and Zimmerman, 1978).

Financial (SIC codes 6000-6999) and utility (SIC codes 4900-4999) firms were excluded due to their particular features (in terms of specific disclosure requirements and accounting regulations) (e.g. Jiraporn et al., 2014). Finally, observations with insufficient data were also excluded from the analysis. The final sample consisted of 382 firms and 3,245 firm-year observations. All data comes from the Bloomberg database.

Variables

Dependent variable. Consistent with Ioannou and Serafeim (2015) and Jizi (2017), we proxy a firm’s CSR disclosure through Bloomberg’s ESG disclosure score, as this measures the “extent of a company’s environmental, social, and governance (ESG) disclosure.”[2] Scores range from 0.1 to 100. Firms that disclose little CSR information will display a low score, and those that release more CSR data will have a higher score. The score is adjusted by Bloomberg to account for the firm’s industry and to ensure that each firm is evaluated only on data relevant to its particular sector. The existing literature has emphasized that Bloomberg’s disclosure scores are the ones attracting investors’ attention (Eccles et al., 2011; Ioannou and Serafeim, 2015).

The Bloomberg ESG disclosure score is based on the Global Reporting Initiative’s (GRI) Sustainability Reporting Guidelines, which is the most widely used framework for voluntary reporting of environmental and social performance (Eccles et al., 2011). As the reliability and credibility of CSR information have been challenged (e.g. Michelon et al., 2016), many companies have established the legitimacy, quality and, ultimately, the credibility of a firm’s CSR policy by using the GRI guidelines. As a result, Bloomberg’s ESG score is a good indicator of a firm’s CSR policy as it ranges from 0-100.

Empirically, the existing literature is largely based on data provided by Kinder, Lydenberg, and Domini (KLD) (see Nollet et al., 2016). Margolis et al. (2007) suggested that alternative CSR measures should be considered. To sum up, KLD ratings use a binary scale where a value of “1” indicates the presence of a particular issue, and “0” otherwise. A KLD score is calculated by subtracting the ’concerns’ from the ’strengths’ to obtain a net value (see Hillman and Keim, 2001). Compared to Bloomberg’s ESG score, the KLD measure is not detailed, ranging from -2 to +2 (Nollet et al., 2016).

Independent variables. Board size is measured using the total number of board directors (Wintoki et al., 2012). Board independence is measured as the proportion of independent – outside/non-executive – directors (following the definition of Hermalin and Weisbach, 1998) on the board (Wintoki et al., 2012). Finally, CEO duality is measured as a dummy variable that is equal to 1 if the CEO is also the chair, and 0 if otherwise (Wintoki et al., 2012).

Control variables. The size of the firm, economic performance, and firm risk are the most widely used control variables (Waddock and Graves, 1997). Furthermore, McWilliams and Siegel (2000) emphasize the need for any model to take R&D expenditure into account to avoid specification problems. Firm size is calculated as the natural logarithm of total assets. Large firms are more likely to be under scrutiny from the community and stakeholders due to their size (e.g. Jizi et al., 2014). In their literature review, Griffin and Mahon (1997) find that the return on assets (ROA) (calculated as operating income before depreciation divided by total assets, according to Wintoki et al., 2012) is a common FP measure in CSR studies. This controls for the impact of a firm’s performance level on its CSR investments. This measure is used as a proxy for economic performance. Leverage (calculated as the ratio of total debt to total assets, according to Bhagat and Bolton, 2008) allows us to control for whether highly leveraged firms are less willing to allocate funds to CSR activities, and so are less likely to communicate (e.g. Reverte, 2009). Following McWilliams and Siegel (2000), R&D intensity is measured as the ratio of R&D expenses to total assets. These authors argue that R&D intensity is a key strategic predictor of CSR since many CSR aspects create a product innovation, a process innovation, or both. This line of reasoning is confirmed by Padgett and Galan (2010). We control for firm growth (defined as sales growth between t and t-1), since Lins et al. (2017) have recently shown that high-CSR firms are more likely to have higher sales growth than low-CSR firms. This suggests that a firm’s operational growth is a predictor of CSR. Moreover, given that our period of study extends from 2004 to 2015, this encompasses the last financial crisis (the 2007-2008 global financial crisis). We have decided to take these phenomena into account considering that Lins et al. (2017) find it has had a significant effect on CSR intensity and corporate social performance. Following Ivashina and Scharfstein (2010), we define the financial crisis as occurring from 2007 through 2008. As such, we used a binary variable (’Crisis’). Finally, all our regressions include industry dummy variables based on the industry grouping defined by Campbell (1996) in order to take industrial sector differentials into account.

Empirical Results

Descriptive Statistics and Correlation Analysis

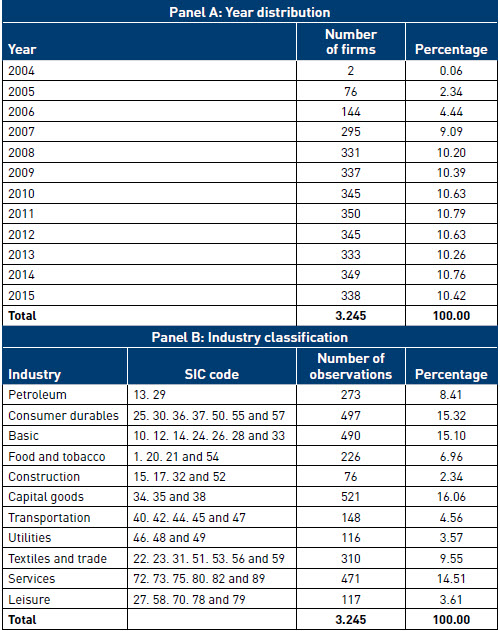

Table 2 provides sample distributions by year and by industry. Panel A shows that there is some significant difference in the number of observations over the study period, which can be explained by Bloomberg not evaluating firms’ CSR disclosure prior to 2007. Panel B reports the sample distribution by industry based on Campbell’s (1996) industry classification. Most of the observations come from three industries: capital goods (16.06%), consumer durables (15.32%) and basic (15.10%) These industrial sectors account for approximately 46% of the whole sample. Firms in the construction sector are the least represented in our sample (2.34%). This suggests the importance of controlling for industry affiliation in our empirical analysis.

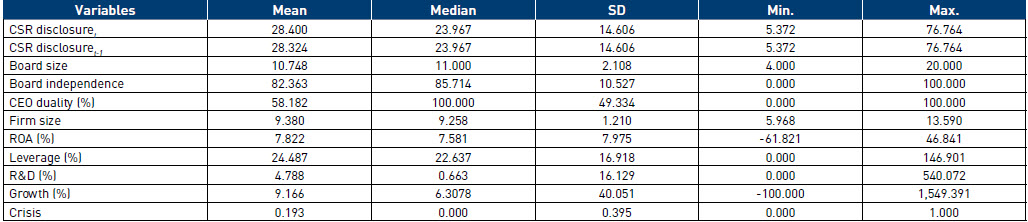

Table 3 presents the descriptive statistics of all the variables. The key dependent variable, CSR disclosure, has mean and median values of 28.40 and 23.97, respectively. Our values are comparable to those reported by Nollet et al. (2016), who documented a mean of 25.16 for firms listed on the S&P 500 over the period 2007-2011. However, our values are slightly lower than those reported by Jizi (2017), who found a mean value of 30.88 for firms listed on the FTSE 350 Index[3] during the period 2007-2012.

Regarding our independent variables, Table 3 shows that the mean (median) board size in our sample is 10.75 (11.00). This value is higher than that reported by Wintoki et al. (2012), who documented an average (median) value of between 7 and 8 members for a sample of more than 6,000 firms over the period 1991-2003. Our value for the mean (median) proportion of independent directors (outsiders) is 82.36% (85.71%). This is higher than the figures reported in other US studies. Furthermore, the CEO is also the board chair in 58.18% of cases, which is lower than figures found in existing literature (e.g. Bhagat and Bolton, 2008°; Linck et al., 2009). This is probably due to the impact of the Sarbanes-Oxley Act (SOX) of 2002 and other contemporary reforms from boards and governance that greatly altered the BC of US companies (Linck et al., 2009)2009.

Table 2

Sample characteristics

Panel A reports the sample distribution across years.

Panel B reports the sample distribution across industries based on Campbell's (1996) industrial classification

The sample contains 3,245 firm-year observations over the period 2004-2015.

Finally, the means of our firm size, ROA and leverage variables are 9.38%, 7.82%, and 24.49%, respectively. For comparison, Wintoki et al. (2012) report 6-8% for ROA and 15-17% for leverage.

Table 4 reports the variable correlations. As a rule of thumb, a correlation of 0.70 or higher in absolute value may indicate a multi-collinearity issue. Several key relations are worth noting. Firstly, the correlation between CSR disclosuret and CSR disclosuret-1 is positive and significant (at the 1% level). This result seems to confirm the assertion of Wintoki et al. (2002) that past action might significantly affect the current action. As such, any empirical model should be specified in a dynamic manner, with past performance used as an explanatory variable. Secondly, our independent variables are all positively and significantly correlated (at the 1% level) with the dependent variable, which is likely to at least offer some support for the proposition that these independent variables interact with CSR disclosure.

As reported in Table 4, the largest significant correlation among the variables used in Eq. [2] is 0.497 (in bold). This figure is well below the threshold of 0.80 suggested by Gujarati (2003). This suggests that the multicollinearity issue is unlikely to be a serious problem in our estimations. We also calculated the variance inflation factors (VIF) for all the variables (unreported). The VIFs ranged from 1.03 to 1.41, well below the cut-off of 10 recommended by Wooldridge (2014). Consequently, multicollinearity has had little impact on our analyses.

OLS and GMM Estimators

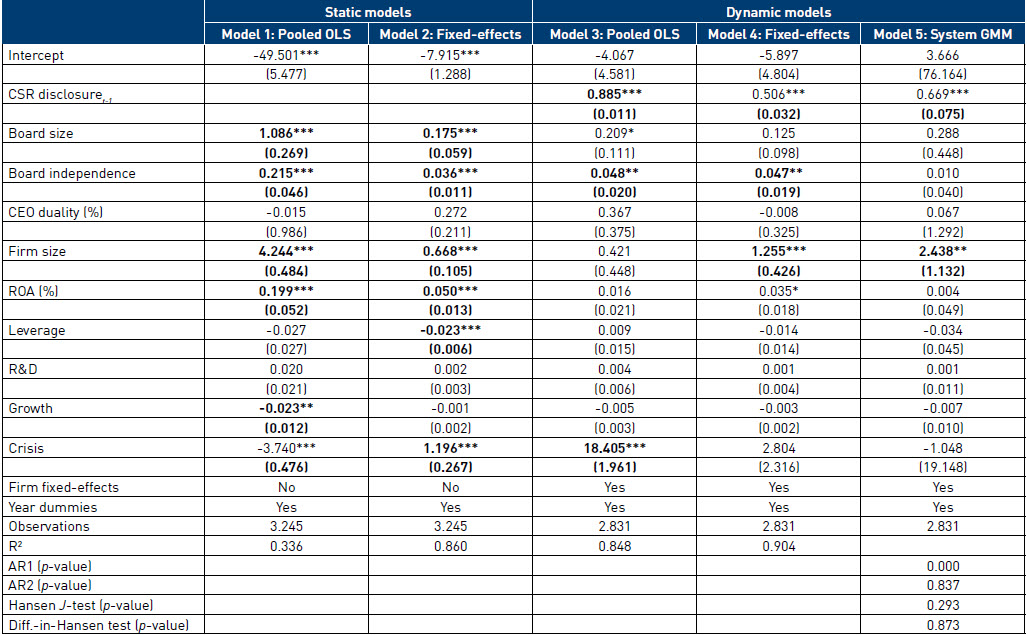

In this study, we examine the effect of board structures on CSR disclosure in a dynamic environment. For comparison with the dynamic estimates, Table 5 presents the results from static pooled OLS (column 1) and panel fixed-effects models (column 2). Models 1 and 2 reveal that the coefficients for board size and board independence are positively and significantly correlated (at the 1% level) with CSR disclosure. These results are consistent with Jizi et al. (2014) and Jizi (2017), among others, who show a positive relationship between board independence and CSR disclosure levels. Likewise, our results are in line with Jizi et al. (2014), who found a positive relationship between board size and CSR disclosure. CEO duality has no significant impact (at the 10% level) on CSR disclosure. Overall, our results are consistent with the existing literature. However, when we estimate Eq. [2] in a dynamic framework, it is another story.

Table 3

Descriptive statistics

N = 3,245 except for CSR disclosuret-1 with N = 2,832. Variables are defined in the subsection on “Variables”.

Table 4

Correlation matrix

VIF = variance inflation factors. Variables are defined in the subsection on “Variables”. *** and ** indicate significance at the 1% and 5% levels, respectively.

The results obtained from pooled OLS and FE estimators in a dynamic environment are, respectively, reported in columns 3 and 4 of Table 5. Models 3 and 4 show that the coefficient of the past CSR disclosure variable is found to be positive at the 1% significance level (β = 0.89; p-value = 0.000 in model 3 and β = 0.51; p-value = 0.000 in model 4). This result supports the assertion of Wintoki et al. (2012) that performance is path-dependent, i.e. past performance has a significant effect on current performance. In this case, current ESG disclosure is influenced by past ESG disclosure. In a dynamic framework, we notice that only board independence has a positive and significant effect (at the 5% level) on CSR disclosure, while board size and CEO duality have no significant influence. These preliminary results seem to support hypothesis 2 – supporting the existing literature (e.g. Jizi et al., 2014; Jizi, 2017) – and reject hypotheses 1 and 3. However, our results are likely to be affected by endogeneity problems, which are not controlled by the OLS and FE methods (Wintoki et al., 2012). Below, we discuss the results obtained from the two-step system GMM method that controls for potential sources of endogeneity.

As noted earlier, the CG literature has emphasized that the CG variables used in Eq. [2] are endogenous (Wintoki et al., 2012; Sila et al., 2016). Due to this, we used a GMM estimator to alleviate the endogeneity issue. However, the validity of this approach depends on the lagged instrumental variables being exogenous (Roodman, 2009). To examine the validity of the system GMM estimator statistically, we conducted a Hansen J-test[4] and a difference-in-Hansen test.[5] Table 5 shows that the Hansen J-test yields a p-value of 0.293. This implies that the instruments (as a group) used in the system GMM model are valid. Consistent with Roodman (2009), we applied the difference-in-Hansen test of exogeneity to the subsets of system GMM-type instruments and standard instruments. Again, we do not reject the null hypothesis that the additional moment conditions are valid. The values reported for AR(1) and AR(2) are the p-values that refer to the first- and second-order autocorrelated disturbances in the first-differenced equation. As expected, there is high first-order autocorrelation and no evidence of significant second-order autocorrelation. Consequently, our test statistics support a proper specification.

Table 5 shows that the β1 arising from the two-step system GMM (0.669) is higher than that obtained by FE (0.506), but well below the OLS estimate (.885). This is consistent with the two-step system GMM being likely to yield reasonable estimates – or at least better than OLS and FE methods.

Unlike the results for Models 1 to 4, the results obtained after controlling for dynamic endogeneity, simultaneity, and unobserved heterogeneity, using the two-step system GMM estimator with the Windmeijer (2005) finite-sample correction, show that board structure variables have no significant effects (at the 10% level) on CSR disclosure. Consequently, there is no evidence of a significant link between board structures and the level of a firm’s CSR disclosure, as suggested by the existing literature. Our results are consistent with the findings of the CG literature (e.g. Wintoki et al., 2012) suggesting that, when the sources of endogeneity are carefully considered (dynamic endogeneity, simultaneity, and unobserved heterogeneity), board structure variables have no effect on FP. It would appear that we see the same phenomenon when we properly specify the relationship between CG mechanisms and CSR disclosure.

Regarding the control variables, we note that firm size alone is positively and significantly (at the 5% level) correlated with CSR disclosure. Our results confirm the view that large firms are more likely to be under scrutiny from various stakeholders (Watts and Zimmerman, 1978). None of the other variables are significantly correlated with CSR disclosure (at conventional thresholds of significance).

Concluding Remarks

In this study, we investigate how BC (namely, board independence and size, and CEO duality) impact firms’ CSR disclosure. Indeed, CG theories (agency and RD approach) suggest that BC promotes firms’ CSR disclosure. As shown in Table 1, most of the existing empirical studies put aside the endogeneity issue. Therefore, we re-examine this relationship by using a robust GMM specification that accounts for potential endogeneity issues that may have influenced the results of existing studies. Overall, based on GMM estimation, we find that BC is not significantly correlated with CSR disclosure. Our results are consistent with the CG literature (e.g. Wintoki et al., 2012; Sila et al., 2016) suggesting that BC has no significant effect on FP. By contrast, while using the OLS and FE models, we find that board size and board independence are positively and significantly correlated with CSR disclosure (in static models), which confirms the results of existing literature (see Table 1). Furthermore, we find that the level of past CSR disclosure is positively and significantly correlated with firms’ current CSR disclosure. This suggests that including the previous level of CSR disclosure in the model may help to control for unobserved historical factors in the relationship between CG and CSR disclosure. Our results support the claim of Wintoki et al. (2012) that the link between CG and firm performance (here corporate social performance through CSR disclosure) should be considered in a dynamic framework. Our results are consistent with the CG literature (e.g. Nguyen et al., 2014), arguing that when potential sources of endogeneity are correctly considered BC has no influence on firm performance (and ultimately CSR disclosure). Consequently, beyond differences due to data from different countries (hence different CG systems), period of analysis, measurement and estimation issues, we argue that the results of existing studies (see Table 1) are likely biased due to a failure to account for endogeneity issues. The literature acknowledges two types of endogeneity: unobservable heterogeneity and simultaneity (Wintoki et al., 2012). They also had a third source of endogeneity: dynamic endogeneity. This means that a firm’s current actions (here CSR disclosure) are affected by its previous actions. In our case, current CSR disclosure is likely to affect BC choices, which in turn may affect future CSR disclosure. This line of reasoning is supported by Harris and Raviv (2006) or Adams et al. (2010), who argue that BC is not exogeneous but rather endogenous. Thus, endogeneity creates serious estimation issues if BC is determined on the basis of unobservable criteria. Generally, CG structures are inherently endogenous because firms model its governance according to the governance issues they encounter. Of course, following Himmelberg et al. (1999), we do not ignore, nor minimize, the importance of agency conflicts or provisions of resources but we suggest, as with Wintoki et al. (2012), that cross-sectional BC differences are the fruit of both unobservable heterogeneity and a firm’s history. As such, any attempt to explain the effect of BC on CSR disclosure that does not take into account that the sources of endogeneity may be biased. The contrasting results presented in Table 1 are likely due to endogeneity issues. We argue that, in future, investigating the relationship between BC and CSR disclosure needs to consider the sources of endogeneity: (i) unobservable heterogeneity (FE effects); (ii) simultaneity (better BC may lead to CSR disclosure or vice versa); and (iii) dynamic endogeneity (current CSR disclosure is affected by past CSR disclosure). We demonstrate that when controlling for endogeneity and taking into account the dynamic nature relationship between BC and CSR disclosure (Wintoki et al., 2012), there is no evidence that board size, board independence, nor CEO duality affect CSR disclosure in any way.

Table 5

Main results

This table presents the results from estimating Eq. [2] through various specifications: (1) a static ordinary least squares (OLS) model; (2) a static fixed-effects model; (3) a dynamic OLS model; (4) a dynamic fixed-effects model; and (5) a two-step generalized method of moments (GMM) approach. Models 1 and 3 are obtained from the OLS method with clustering at the firm level. Models 2 and 4 are obtained from fixed-effects (within-groups estimator). Robust standard errors are in parentheses. Year dummies and industry dummies (based on Campbell's 1996 industrial classification) are unreported. ***, ** and * indicate significance at the 1%, 5% and 10% levels, respectively.

Theoretically, however, reporting an insignificant relationship between BC and CSR disclosure is somewhat unexpected, because many companies have been implementing CSR policies as a part of their strategic agendas, which requires management and BoD involvement. Besides, complying with the CG best practices should be considered as a good sign for stakeholders that a firm is taking CSR into account in its activities and is proactive on this matter. In reality, the insignificant relationship that we observe may indicate that CSR disclosure has been institutionalized, as suggested by Shabana et al. (2017). They argue that, in a “defensive reporting” stage, CSR disclosure is used as a tool to fill in the gap between firms’ and stakeholders’ expectations. Similarly, in an “imitative diffusion” stage, the dissemination of CSR information is widespread among firms. CSR disclosure, therefore, becomes a largely institutionalized tool; a standard to which firms must comply. Thus, BC has no real effect on CSR disclosure as it is institutionalized. Our findings tend to confirm these stages. Moreover, for legislators, firms and, ultimately, stakeholders, our findings help to provide useful insights into the role and efficiency of BoD in CSR disclosure. Furthermore, the insignificant relationship between BC and CSR disclosure may be due to the possibility of reverse causality (Wintoki et al., 2012), i.e. firms choose their BC optimally based on idiosyncratic characteristics, such as the level of a firm’s CSR and of its disclosure. We, therefore, argue that our findings have significant implications for both regulators and policymakers. Indeed, in the aftermath of the 2007-2008 financial crisis, many voices have been calling for more regulation and stricter control mechanisms. If CG mechanisms are not useful in improving firms’ CSR disclosure then alternative means may need to be explored, because our study shows that BC has no significant effect. Our study is a contribution to this debate surrounding alternative mechanisms that increase and strengthen CSR disclosure.

Our study is subject to some caveats. Firstly, similar to static models, misspecification may affect the results of the dynamic system GMM. However, we have checked our model’s validity using many of the different tests available. As such, serious misspecification problems are likely to be minimal. Second, due to the lack of data regarding CG practices, our study, like existing ones, is a proxy for observable CG structures, such as board size, the independence of the board, and CEO duality. Many studies have shown that other governance mechanisms are likely to impact CSR disclosure; for instance, ownership structure or directors’ social ties and educational background (Jain and Jamali, 2016). Therefore, it is possible that other CG mechanisms also impact CSR disclosure, as our study only considers one part of the phenomenon. Secondly, future research will profit from examining the relationship between BC and CSR disclosure in SMEs (small and medium-sized enterprises), as they face many of the same difficulties (Baumann-Pauly et al., 2013).

Parties annexes

Biographical notes

Dr. Rey Dang is Associate Professor of Finance at ISTEC Business School, France. His main research areas cover corporate governance, board gender diversity and firm performance. He has published in many different journals, such as Management International, Journal of Applied Accounting Research, Applied Economics Letters or Management & Avenir.

Houanti L’hocine: I am Researcher and Associate Professor in economics and CSR at La Rochelle Business School. Ph D. in economy from the University of Perpignan - France. I am Head of MSC CSR of Excelia Group. Member of IRSI (Institute of Social Responsibility through Innovation) of Excelia Group. I work on issues related to corporate social responsibility and sustainable development. I am also interested in issues related to gender diversity in companies. I also work with companies to understand the various issues related to CSR and its implementation in processes and functions, particularly in terms of governance.

Nhu Tuyên Lê is Associate Professor in Accounting and Financial Statements Analysis at Grenoble École de Management. With a cross-disciplinary approach, her research questioned the role of accounting and its impact in the evolution of societies, and more specifically in the emerging post-communist market economies, more particularly Vietnam. The question on alternatives in representing business activities through indicators going beyond financial ones, in social commitments and behavior taking into account the social and environmental issues bridging with the reflection on the notion of Degrowth and its translations in practices is among her current research interests.

Jean-Michel Sahut is a Professor at IDRAC Business School. He teaches Corporate Finance, Financial Accounting and Serious Game for engineering and management students. Previously, he was a Professor at Geneva School of Business Administration, University of Applied Sciences (Ch), an Associate Dean for Research at Amiens School of Management (Fr), a Professor of Finance at Telecom & Management Paris Sud (Fr) and the director of the RESFIN Laboratory. He has published more than 90 articles about finance, governance, CSR and entrepreneurship in international peer review journals and five books.

Notes

-

[1]

Commission of the European Communities: 2001, Green Paper “Promoting a European Framework for Corporate Social Responsibility,” (2001) Brussels.

-

[2]

See the Bloomberg website.

-

[3]

The FTSE 350 Index is a market-capitalization-weighted stock market index that includes the 350 largest market capitalizations on the London Stock Exchange.

-

[4]

In essence, Hansen’s (1982) test is a test of overidentifying restrictions. The joint null hypothesis assumes that the excluded instruments are correctly excluded from the structural equation and that the structural equation is correctly specified. Under this hypothesis, the test statistic is asymptotically distributed as chi-squared in the number of overidentifying restrictions.

-

[5]

The p-values test the validity of the additional moment restriction that is necessary for the system GMM given in Eq. [2].

Bibliography

- Adams, Renée B., Hermalin, Benjamin E. et Weisbach, Michael S. (2010). “The role of boards of directors in corporate governance: A conceptual framework and survey”, Journal of Economic Literature, Vol. 48, N° 1, p. 58-107.

- Arellano, Manuel et Bover, Olympia. (1995). “Another look at the instrumental variable estimation of error-components models”, Journal of Econometrics, Vol. 68, N° 1, p. 29-51.

- Bai, Ge. (2013). “How do board size and occupational background of directors influence social performance in for-profit and non-profit organizations? Evidence from California hospitals”, Journal of Business Ethics, Vol. 118, N° 1, p. 171-187.

- Baumann-Pauly, Dorothée, Wickert, Christopher, Spence, Laura J. et Scherer, Andreas Georg. (2013). “Organizing corporate social responsibility in small and large firms: Size matters”, Journal of Business Ethics, Vol. 115, N° 4, p. 693-705.

- Berle, Adolf A. et Means, Gardiner C. (1932). The modern corporation and private property, New York: Macmillan, 396 p.

- Berrone, Pascual et Gomez-Mejia, Luis R. (2009). “Environmental performance and executive compensation: An integrated agency-institutional perspective”, Academy of Management Journal, Vol. 52, N° 1, p. 103-126.

- Bhagat, Sanjai et Bolton, Brian. (2008). “Corporate governance and firm performance”, Journal of Corporate Finance, Vol. 14, N° 3, p. 257-273.

- Blundell, Richard et Bond, Stephen. (1998). “Initial conditions and moment restrictions in dynamic panel data models”, Journal of Econometrics, Vol. 87, N° 1, p. 115-143.

- Campbell, John Y. (1996). “Understanding risk and return”, Journal of Political Economy, Vol. 104, N° 2, p. 298-345.

- Chang, Young Kyun, Oh, Won-Yong, Park, Jee Hyun et Jang, Myoung Gyun. (2017). “Exploring the relationship between board characteristics and CSR: Empirical evidence from Korea”, Journal of Business Ethics, Vol. 140, N° 2, p. 225-242.

- Chau, Gerald et Gray, Sidney J. (2010). “Family ownership, board independence and voluntary disclosure: Evidence from Hong Kong”, Journal of International Accounting, Auditing and Taxation, Vol. 19, N° 2, p. 93-109.

- Cheng, Eugene C. M. et Courtenay, Stephen M. (2006). “Board composition, regulatory regime and voluntary disclosure”, International Journal of Accounting, Vol. 41, N° 3, p. 262-289.

- Clarkson, Max E. (1995). “A stakeholder framework for analyzing and evaluating corporate social performance”, Academy of Management Review, Vol. 20, N° 1, p. 92-117.

- Dalton, Dan R., Daily, Catherine M., Ellstrand, Alan E. et Johnson, Jonathan L. (1998). “Meta-analytic reviews of board composition, leadership structure, and financial performance”, Strategic Management Journal, Vol. 19, N° 3, p. 269.

- Dalton, Dan R., Daily, Catherine M., Johnson, Jonathan L. et Ellstrand, Alan E. (1999). “Number of directors and financial performance: A meta-analysis”, Academy of Management Journal, Vol. 42, N° 6, p. 674-686.

- David, Parthiban, Bloom, Matt et Hillman, Amy J. (2007). “Investor activism, managerial responsiveness, and corporate social performance”, Strategic Management Journal, Vol. 28, N° 1, p. 91-100.

- Deutsch, Yuval et Valente, Mike. (2013). “Compensating outside directors with stock: The impact on non-primary stakeholders”, Journal of Business Ethics, Vol. 116, N° 1, p. 67-85.

- Dey, Aiyesha. (2008). “Corporate governance and agency conflicts”, Journal of Accounting Research, Vol. 46, N° 5, p. 1143-1181.

- Dhaliwal, Dan S., Radhakrishnan, Suresh, Tsang, Albert et Yong George, Yang. (2012). “Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure”, Accounting Review, Vol. 87, N° 3, p. 723-759.

- Donaldson, Thomas et Preston, Lee E. (1995). “The stakeholder theory of the corporation: Concepts, evidence, and implications”, Academy of Management Review, Vol. 20, N° 1, p. 65-91.

- Eccles, Robert G., Serafeim, George et Krzus, Michael P. (2011). “Market interest in nonfinancial information”, Journal of Applied Corporate Finance, Vol. 23, N° 4, p. 113-127.

- Eisenhardt, Kathleen M. (1989). “Agency theory: An assessment and review”, Academy of Management Review, Vol. 14, N° 1, p. 57-74.

- Elkington, John. (1997). Cannibals with forks: the triple bottom line of 21 st century business, Oxford: Capstone, p.

- Fabrizi, Michele, Mallin, Christine et Michelon, Giovanna. (2014). “The role of CEO’s personal incentives in driving corporate social responsibility”, Journal of Business Ethics, Vol. 124, N° 2, p. 311-326.

- Fama, Eugene F. et Jensen, Michael C. (1983). “Separation of ownership and control”, The Journal of Law and Economics, Vol. 26, N° 2, p. 301-325.

- Gippel, Jennifer, Smith, Tom et Zhu, Yushu. (2015). “Endogeneity in accounting and finance research: Natural experiments as a state-of-the-art solution”, Abacus, Vol. 51, N° 2, p. 143-168.

- Goodstein, Jerry, Gautam, Kanak et Boeker, Warren. (1994). “The effects of board size and diversity on strategic change”, Strategic Management Journal, Vol. 15, N° 3, p. 241-250.

- Granovetter, Mark. (1985). “Economic action and social structure: The problem of embeddedness”, American Journal of Sociology, Vol. 91, N° 3, p. 481-510.

- Gray, Rob, Kouhy, Reza et Lavers, Simon. (1995). “Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure”, Accounting, Auditing & Accountability Journal, Vol. 8, N° 2, p. 47-77.

- Griffin, Jennifer J. et Mahon, John F. (1997). “The corporate social performance and corporate financial performance debate: Twenty-five years of incomparable research”, Business & Society, Vol. 36, N° 1, p. 5-31.

- Gujarati, Damodar N. (2003). Basic econometrics - 4th ed., Boston: McGraw-Hill, 1002 p.

- Hafsi, Taïeb et Turgut, Gokhan. (2013). “Boardroom diversity and its effect on social performance: Conceptualization and empirical evidence”, Journal of Business Ethics, Vol. 112, N° 3, p. 463-479.

- Haniffa, R. M. et Cooke, Terry E. (2002). “Culture, corporate governance and disclosure in Malaysian corporations”, Abacus, Vol. 38, N° 3, p. 317-349.

- Haniffa, R. M. et Cooke, Terry E. (2005). “The impact of culture and governance on corporate social reporting”, Journal of Accounting and Public Policy, Vol. 24, N° 5, p. 391-430.

- Hansen, Lars Peter. (1982). “Large sample properties of generalized method of moments estimators”, Econometrica, Vol. 50, N° 4, p. 1029-1054.

- Harjoto, Maretno A. et Jo, Hoje. (2011). “Corporate governance and CSR nexus”, Journal of Business Ethics, Vol. 100, N° 1, p. 45-67.

- Harris, Milton et Raviv, Artur. (2006). “A theory of board control and size”, The Review of Financial Studies, Vol. 21, N° 4, p. 1797-1832.

- Healy, Paul M. et Palepu, Krishna G. (1995). “The challenges of investor communication The case of CUC International, Inc.”, Journal of Financial Economics, Vol. 38, N° 2, p. 111-140.

- Hermalin, Benjamin E. et Weisbach, Michael S. (1998). “Endogenously chosen boards of directors and their monitoring of the CEO”, American Economic Review, Vol. 88, N° 1, p. 96-118.

- Hill, Charles W. L. et Jones, Thomas M. (1992). “Stakeholder-agency theory”, Journal of Management Studies, Vol. 29, N° 2, p. 131-154.

- Hillman, Amy J. et Dalziel, Thomas. (2003). “Boards of directors and firm performance: Integrating agency and resource dependence perspectives”, Academy of Management Review, Vol. 28, N° 3, p. 383-396.

- Hillman, Amy J. et Keim, Gerald D. (2001). “Shareholder value, stakeholder management, and social issues: What’s the bottom line?”, Strategic Management Journal, Vol. 22, N° 2, p. 125-139.

- Hillman, Amy J., Keim, Gerald D. et Luce, Rebecca A. (2001). “Board composition and stakeholder performance: Do stakeholder directors make a difference?”, Business & Society, Vol. 40, N° 3, p. 295-314.

- Himmelberg, Charles P., Hubbard, R. Glenn et Palia, Darius. (1999). “Understanding the determinants of managerial ownership and the link between ownership and performance”, Journal of Financial Economics, Vol. 53, N° 3, p. 353-384.

- Hussain, Nazim, Rigoni, Ugo et Orij, René P. (2018). “Corporate governance and sustainability performance: Analysis of triple bottom line Performance”, Journal of Business Ethics, Vol. 149, N° 2, p. 411-432.

- Husted, Bryan W. et de Sousa-Filho, José Milton. (2019). “Board structure and environmental, social, and governance disclosure in Latin America”, Journal of Business Research, Vol. 102, N° p. 220-227.

- Ioannou, Ioannis et Serafeim, George. (2015). “The impact of corporate social responsibility on investment recommendations: Analysts’ perceptions and shifting institutional logics”, Strategic Management Journal, Vol. 36, N° 7, p. 1053-1081.

- Ivashina, Victoria et Scharfstein, David. (2010). “Bank Lending during the Financial Crisis of 2008”, Journal of Financial Economics, Vol. 97, N° 3, p. 319-338.

- Jain, Tanusree et Jamali, Dima. (2016). “Looking inside the black box: The effect of corporate governance on corporate social responsibility”, Corporate Governance: An International Review, Vol. 24, N° 3, p. 253-273.

- Jamali, Dima, Safieddine, Asem M. et Rabbath, Myriam. (2008). “Corporate governance and corporate social responsibility synergies and interrelationships”, Corporate Governance: An International Review, Vol. 16, N° 5, p. 443-459.

- Jensen, Michael C. (1993). “The modern industrial revolution, exit, and the failure of internal control systems”, Journal of Finance, Vol. 48, N° 3, p. 831-880.

- Jensen, Michael C. et Meckling, William H. (1976). “Theory of the firm: Managerial behavior, agency costs and ownership structure”, Journal of Financial Economics, Vol. 3, N° 4, p. 305-360.

- Jiraporn, Pornsit, Jiraporn, Napatsorn, Boeprasert, Adisak et Chang, Kiyoung. (2014). “Does corporate social responsibility (CSR) improve credit ratings? Evidence from geographic identification”, Financial Management, Vol. 43, N° 3, p. 505-531.

- Jizi, Mohammad Issam. (2017). “The influence of board composition on sustainable development disclosure”, Business Strategy and the Environment, Vol. forthcoming, N° p.

- Jizi, Mohammad Issam, Salama, Aly, Dixon, Robert et Stratling, Rebecca. (2014). “Corporate governance and corporate social responsibility disclosure: Evidence from the US banking sector”, Journal of Business Ethics, Vol. 125, N° 4, p. 601-615.

- Jo, Hoje et Harjoto, Maretno A. (2011). “Corporate governance and firm value: The impact of corporate social responsibility”, Journal of Business Ethics, Vol. 103, N° 3, p. 351-383.

- Judge, William Q. et Zeithaml, Carl P. (1992). “Institutional and strategic choice perspectives on board involvement in the strategic decision process”, Academy of Management Journal, Vol. 35, N° 4, p. 766-794.

- Linck, James S., Netter, Jeffry M. et Yang, Tina. (2008). “The determinants of board structure”, Journal of Financial Economics, Vol. 87, N° 2, p. 308-328.

- Linck, James S., Netter, Jeifry M. et Yang, Tina. (2009). “The effects and unintended consequences of the Sarbanes-Oxley Act on the supply and demand for directors”, Review of Financial Studies, Vol. 22, N° 8, p. 3287-3328.

- Lins, Karl V., Servaes, Henri et Tamayo, Ane. (2017). “Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis”, Journal of Finance, Vol. 72, N° 4, p. 1785-1824.

- Luoma, Patrice et Goodstein, Jerry. (1999). “Stakeholders and corporate boards: Institutional influences on board composition and structure”, Academy of Management Journal, Vol. 42, N° 5, p. 553-563.

- Mallin, Christine, Michelon, Giovanna et Raggi, Davide. (2013). “Monitoring intensity and stakeholders’ orientation: how does governance affect social and environmental disclosure?”, Journal of Business Ethics, Vol. 114, N° 1, p. 29-43.

- McWilliams, Abagail et Siegel, Donald. (2000). “Corporate social responsibility and financial performance: Correlation or misspecification?”, Strategic Management Journal, Vol. 21, N° 5, p. 603-609.

- Michelon, Giovanna et Parbonetti, Antonio. (2012). “The effect of corporate governance on sustainability disclosure”, Journal of Management & Governance, Vol. 16, N° 3, p. 477-509.

- Michelon, Giovanna, Pilonato, Silvia, Ricceri, Federica et Roberts, Robin W. (2016). “Behind camouflaging: traditional and innovative theoretical perspectives in social and environmental accounting research”, Sustainability Accounting, Management and Policy Journal, Vol. 7, N° 1, p. 2-25.

- Milne, Markus J. et Gray, Rob. (2013). “W (h) ither ecology? The triple bottom line, the global reporting initiative, and corporate sustainability reporting”, Journal of Business Ethics, Vol. 118, N° 1, p. 13-29.

- Nguyen, Tuan, Locke, Stuart et Reddy, Krishna. (2014). “A dynamic estimation of governance structures and financial performance for Singaporean companies”, Economic Modelling, Vol. 40, N° June, p. 1-11.

- Nollet, Joscha, Filis, George et Mitrokostas, Evangelos. (2016). “Corporate social responsibility and financial performance: A non-linear and disaggregated approach”, Economic Modelling, Vol. 52, N° Part B January, p. 400-407.

- Padgett, Robert et Galan, Jose. (2010). “The effect of R&D intensity on corporate social responsibility”, Journal of Business Ethics, Vol. 93, N° 3, p. 407-418.

- Pfeffer, Jeffrey. (1972). “Size and composition of corporate boards of directors: The organization and its environment”, Administrative science quarterly, Vol. 17, N° 2, p. 218-228.

- Pfeffer, Jeffrey et Salancik, Gerald R. (1978). The external control of organizations: A resource dependence perspective, New York: Harper & Row, 300 p.

- Post, Corinne, Rahman, Noushi et Rubow, Emily. (2011). “Green governance: Boards of directors’ composition and environmental corporate social responsibility”, Business & Society, Vol. 50, N° 1, p. 189-223.

- Rechner, Paula L. et Dalton, Dan R. (1991). “CEO duality and organizational performance: A longitudinal analysis”, Strategic Management Journal, Vol. 12, N° 2, p. 155-160.

- Reverte, Carmelo. (2009). “Determinants of corporate social responsibility disclosure ratings by Spanish listed firms”, Journal of Business Ethics, Vol. 88, N° 2, p. 351-366.

- Reynolds, MaryAnn et Yuthas, Kristi. (2008). “Moral discourse and corporate social responsibility reporting”, Journal of Business Ethics, Vol. 78, N° 1-2, p. 47-64.

- Roodman, David. (2009). “How to do xtabond2: An introduction to difference and system GMM in Stata”, The Stata Journal, Vol. 9, N° 1, p. 86-136.

- Shabana, Kareem M., Buchholtz, Ann K. et Carroll, Archie B. (2017). “The institutionalization of corporate social responsibility reporting”, Business & Society, Vol. 56, N° 8, p. 1107-1135.

- Sila, Vathunyoo, Gonzalez, Angelica et Hagendorff, Jens. (2016). “Women on board: Does boardroom gender diversity affect firm risk?”, Journal of Corporate Finance, Vol. 36, N° February, p. 26-53.

- Surroca, Jordi et Tribó, Josep A. (2008). “Managerial entrenchment and corporate social performance”, Journal of Business Finance & Accounting, Vol. 35, N° 5-6, p. 748-789.

- Tuggle, Christopher S., Sirmon, David G., Reutzel, Christopher R. et Bierman, Leonard. (2010). “Commanding board of director attention: investigating how organizational performance and CEO duality affect board members’ attention to monitoring”, Strategic Management Journal, Vol. 31, N° 9, p. 946-968.

- Turnbull, Shann. (2017). “Defining and achieving good governance”, dans Aras G. et Ingley C. (sous la direction de), Corporate Behavior and Sustainability, Routledge, Abingdon, Oxfordshire, p. 234-251.

- Waddock, Sandra A. et Graves, Samuel B. (1997). “The corporate social performance-financial performance link”, Strategic Management Journal, Vol. 18, N° 4, p. 303-319.

- Walls, Judith L., Berrone, Pascual et Phan, Phillip H. (2012). “Corporate governance and environmental performance: Is there really a link?”, Strategic Management Journal, Vol. 33, N° 8, p. 885-913.

- Watts, Ross L. et Zimmerman, Jerold L. (1978). “Towards a positive theory of the determination of accounting standards”, Accounting Review, Vol. 53, N° 1, p. 112.

- Windmeijer, Frank. (2005). “A finite sample correction for the variance of linear efficient two-step GMM estimators”, Journal of Econometrics, Vol. 126, N° 1, p. 25-51.

- Wintoki, M. Babajide, Linck, James S. et Netter, Jeffry M. (2012). “Endogeneity and the dynamics of internal corporate governance”, Journal of Financial Economics, Vol. 105, N° 3, p. 581-606.

- Wooldridge, Jeffrey M. (2010). Econometric analysis of cross section and panel data - 2nd edition, Cambridge: MIT Press, 1064 p.

- Wooldridge, Jeffrey M. (2014). Introduction to econometrics, Andover: Cengage Learning, 912 p.

- Zhang, Jason Q, Zhu, Hong et Ding, Hung-bin. (2013). “°Board composition and corporate social responsibility: An empirical investigation in the post Sarbanes-Oxley era”, Journal of Business Ethics, Vol. 114, N° 3, p. 381-392.

Parties annexes

Notes biographiques

Rey Dang est un professeur associé en Finance à ISTEC école de commerce, France. Ses principaux domaines de recherche sont la gouvernance d’entreprise, la représentation des femmes au conseil d’administration et la performance de l’entreprise. Il a déjà publié de nombreux articles de recherche dans des revues, telles que Management International, Journal of Applied Accounting Research, Applied Economics Letters ou Management & Avenir.

Houanti L’hocine : Professeur Associé en économie et RSE à la Rochelle Business School. Doctorat d’économie obtenu à l’université de Perpignan en France. Responsable pédagogique du MSC Management des Stratégies du Développement Durable, de la RSE et de l’Environnement. Membre de l’IRSI (Institut de la Responsabilité Sociale par l’Innovation), coordinateur de chaires entreprises. Les axes de recherche : la RSE et le développement durable, la diversité du genre au sein des entreprises. Il intervient aussi auprès des entreprises pour comprendre les différents enjeux liés à la RSE et son implémentation dans les processus et les fonctions, notamment en termes de gouvernance.

Nhu Tuyên Lê est Professeure Associée de Comptabilité et d’Analyse financière à Grenoble École de Management. Ses travaux de recherche s’inscrivent dans le courant transdisciplinaire qui s’interroge sur les rôles de la comptabilité et son impact dans l’évolution des économies, plus spécifiquement les nouvelles économies de marché émergentes post-communistes dont le Vietnam. Elle s’intéresse aux représentations alternatives non financières reposant sur les engagements et les comportements humains dans la prise en compte des problématiques environnementales et sociétales à la lumière du courant de réflexion Degrowth. Les nouvelles formes d’activités économiques en émergence observables dans nos sociétés telles que les entités agricoles de proximité basées sur les valeurs communautaires « Community Supported Agriculture » constituent l’un de ses centres d’intérêt de recherche.

Jean-Michel Sahut est professeur à l’IDRAC Business School. Il enseigne la Finance d’entreprise, la Comptabilité financière et les Jeux de simulation pour les étudiants en ingénierie et en gestion. Auparavant, il a été professeur à la HEG, University of Applied Sciences (Ch), doyen associé à la recherche au Groupe Sup de Co Amiens (Fr), professeur de Finance à Télécom & Management Sud Paris (Fr) et directeur du Laboratoire RESFIN. Il a publié plus de 90 articles en finance, gouvernance, RSE et entrepreneuriat dans des revues scientifiques internationales et cinq livres.

Parties annexes

Notas biograficas

Rey Dang es un profesor asociado de finanzas en la escuela de comercio ISTEC, Francia. Entre sus principales temas de investigación destacan: la gobernanza empresarial, la representatividad de las mujeres en las juntas ejecutivas, y el rendimiento de la empresa. Ya ha publicado numerosos artículos de investigación en revistas, como por ejemplo en Management International, Journal of Applied Accounting Research, Applied Economics Letters o Management & Avenir.

Houanti L’hocine: Profesor asociado de Economía y RSE en la Escuela de Negocios de La Rochelle, Francia. Doctor en Economía por la Universidad de Perpignan, Francia. Responsable pedagógico de la RSE y Medio Ambiente del MSC (Gestión de las Estrategias de Desarrollo Sostenible). Miembro del IRSI (Instituto de Responsabilidad Social a través de la Innovación), coordinador de proyectos empresariales. Áreas de investigación: RSE y desarrollo sostenible, diversidad de género en las empresas. También interviene en empresas para comprender los diversos problemas relacionados con la RSE y su implementación en los procesos y funciones, concretamente en términos de gestión.

Nhu Tuyên Lê es Profesora Asociada de Contabilidad y Análisis Financiero en Grenoble École de Management. Sus trabajos de investigación se inscriben en la corriente transdisciplinaria que se cuestiona sobre los roles de la contabilidad y su impacto en la evolución de las economías, más específicamente en las nuevas economías de mercado post-comunistas emergentes, como la de Vietnam. Se interesa por las representaciones alternativas no financieras que se apoyan en los compromisos y comportamientos humanos al tomar en consideración las problemáticas medioambientales y sociales según la corriente de reflexión del decrecimiento. Las nuevas formas de actividad económica emergentes observables en nuestras sociedades tales como las entidades agrícolas de proximidad basadas en los valores comunitarios de la “Agricultura apoyada por la comunidad” constituyen uno de sus principales intereses para la investigación.

Jean-Michel Sahut actualmente es Catedrático en la Escuela de Negocios IDRAC, impartiendo docencia de Finanzas Corporativas, Contabilidad Financiera y “Serious Game” para los estudiantes de ingeniería y de gestión. Anteriormente, impartió docencia en la Escuela de Ginebra de Administración de Empresas (Suiza) y en Telecom & Management Paris Sud (Francia). Ha sido investigador en la Escuela de Administración de Amiens y director del Laboratorio RESFIN. Además, ha publicado más de 90 artículos sobre finanzas, gobierno de la empresa, responsabilidad social corporativa y emprendimiento. Todos ellos en revistas internacionales con sistema de revisión por pares y cinco libros.

Liste des tableaux

Table 1

Summary of the main empirical studies

Table 2

Sample characteristics

Table 3

Descriptive statistics

Table 4

Correlation matrix

Table 5

Main results

This table presents the results from estimating Eq. [2] through various specifications: (1) a static ordinary least squares (OLS) model; (2) a static fixed-effects model; (3) a dynamic OLS model; (4) a dynamic fixed-effects model; and (5) a two-step generalized method of moments (GMM) approach. Models 1 and 3 are obtained from the OLS method with clustering at the firm level. Models 2 and 4 are obtained from fixed-effects (within-groups estimator). Robust standard errors are in parentheses. Year dummies and industry dummies (based on Campbell's 1996 industrial classification) are unreported. ***, ** and * indicate significance at the 1%, 5% and 10% levels, respectively.