Résumés

Abstract

The notion of impact is becoming important for international business schools, which are under increasing pressures related to their legitimacy. Although the term impact has gained in popularity, common approaches to business school impact rely either on academic publications or alumni’s salaries. To help uncover the potential for other approaches, we develop a conceptual framework as a basis for studying business school impact. The pluralism of approaches in terms of business school impact opens new spaces for original strategic choices, therefore limiting pressures for organizational isomorphism. Nevertheless, the notion of impact also has some limitations that need to be considered.

Keywords:

- business school,

- impact,

- legitimacy,

- citizenship

Résumé

La notion d’impact devient importante pour les écoles de commerce internationales, qui subissent des pressions croissantes sur leur légitimité. Bien que le terme d’impact soit devenu fréquent, les approches habituelles de l’impact des écoles de commerce s’appuient soit sur les publications scientifiques, soit sur les salaires des alumni. Afin de découvrir d’autres approches, nous développons un cadre conceptuel permettant d’étudier l’impact des écoles de commerce. Le pluralisme des approches en matière d’impact ouvre de nouvelles perspectives, et permet des choix stratégiques originaux, limitant les pressions à l’isomorphisme organisationnel. Toutefois, la notion d’impact a des limites qui doivent être considérées.

Mots-clés :

- écoles de commerce,

- impact,

- légitimité,

- citoyenneté

Resumen

La noción de impacto es cada vez mas importante para las escuelas de comercio internacionales, que están sometidas a crecientes presiones en cuanto a su legitimidad. Los enfoques habituales sobre el impacto de las escuelas de comercio se apoyan, ya sea, en las publicaciones científicas, o en los salarios de los alumni. Desarrollamos un marco conceptual que permite estudiar el impacto de las escuelas de comercio. El pluralismo de enfoques en materia de impacto de las escuelas de comercio abre nuevas perspectivas para tener opciones estratégicas originales. Sin embargo, la noción de impacto tiene también limitaciones.

Palabras clave:

- escuela comercio,

- impacto,

- legitimidad,

- ciudadanía

Corps de l’article

In a context of a growing international competition, the notion of impact has become particularly important for business schools, which are under various pressures related to their legitimacy (Cornuel, 2005; Wilson and Thomas, 2012). The impact of business schools has received much attention, especially since the 2008 financial crisis. On the one hand, business schools have been criticized for failing to fulfil their primary purpose of producing professional managers (Rousseau, 2012) and accused of producing irresponsible leaders (Chakravorti, 2014), arrogant MBA students and narcissistic teachers (Chark, 2014; Pfeffer, 2013). They have also been criticized for producing research considered as an expensive waste (Di Meglio, 2013). History tells us that economies can function well without business schools. Germany, for example, the fourth largest economy in the world and the largest in Europe has no world-renowned business school or top-ranked MBA programme (Bradshaw, 2013), which suggests either that “world-class” business schools are not a necessary element for a thriving national economy or that Germany might have performed even better with a stronger business school sector. On the other hand, there seems to be a growing intellectual interest in the question of the impact of business schools (Pfeffer and Fong, 2002), but there are few, if any, scientific works on the broadly defined notion of impact of business schools. We assume a reason for this is that the notion of impact is difficult to grasp and to evaluate and/or assess in a unified framework. Nevertheless, the notion of impact for higher education institutions has become an important theme in different countries, for example in the UK with the 2014 Research Excellence Framework (REF). Recently, the French FNEGE has launched, together with EFMD, a “Business School Impact System” (BSIS), initially called “Business School Impact Survey”, and aimed at helping schools to assess their impact on “the world around” (Bradshaw, 2014; EFMD, 2014). Since 2012, the American Association to Advance Collegiate Schools of Business (AACSB) has reflected on the impact of research for business schools (AACSB, 2012) and consequently updated its business accreditation standards to include the notion of impact (AACSB, 2015). Recently, the Australian Government (2016) has announced it will develop measures of research impact for its higher education institutions. These initiatives suggest the growing importance of the notion of impact for business schools on society at an international level, and the need for more scholarly discussion on this topic.

Based on the arguments of Simon (1967) and Rousseau (2012), business schools have failed in their primary purpose of producing a sustainable knowledge base for the education of professional managers. This argument assumes that business schools are professional schools, of which a distinctive characteristic and source of legitimacy is that they produce distinctive knowledge products relevant to practice. The argument of Hambrick (1994), and many others since, is that business schools have lost their way because faculty have become more and more focused on talking to each other rather than to external stakeholders. In a recent article, Aguinis et al. (2014) critically assess the dominant approach used to evaluate faculty impact in business schools based on counting publications in a set of ranked journals. The authors argue that such an approach rests on a narrow view of impact as it privileges only one set of stakeholders, the academic community, and one type of measure, the number of articles or citations. This narrow approach is likely, the authors argue, to threaten the credibility and sustainability of business school research in the longer term. Here there are echoes of the debates about the relevance of management research that go back to Hambrick’s (1994) seminal contribution and before. Aguinis et al. (2014) offer as a solution to the impact/relevance problem a pluralist view of scholarly impact which takes several stakeholders into account and considers several measures of impact for each stakeholder. In this paper, we add to this debate by building on a pluralist agenda to develop a conceptual framework for assessing the impact of business schools based on a broad conception, not limited to research, of their many roles and contributions to society.

The Concept of Business School Impact

Pettigrew and Starkey (2016: 656) claim that “how [business school] impact is to be defined beyond scholarly impact remains relatively undefined and contested”. Indeed, stakeholder theory (Donaldson and Preston, 2005) suggests that business schools’ concerns impact multiple stakeholders with probably divergent expectations. Thomas et al. (2013) suggest there are at least six different types of stakeholders around management education and business schools: (1) academia, (2) students, (3) the private sector, (4) media, (5) professional and trade organizations, and (6) the government and public sector. A theory of impact needs to take all those multiple stakeholders into account when studying the impact of business schools. Scholars have considered that business schools mainly seek to meet two goals: knowledge exploration through research and knowledge exploitation through instruction (Trieschmann et al. 2000) and we agree that the issue of knowledge is central but not unique to debates about impact. An underlying question about research impact is: what kind of knowledge and for whom? For many business school faculty, educated with the notion of academic impact as their primary concern, impact is too often narrowly equated with two impact “measures” – citations of papers published in leading journals and position in business press rankings. We argue that we need to adopt a wider lens to explore the literature on business school impact, which can be divided into three categories: economic impact, knowledge impact and responsibility impact.

In the impact literature beyond the academic, impact tends to be framed in the perspective of “economic impact”. One type of economic study of impact focuses on input-output measures such as job creation and local effects on economy. This type of analysis has generated many studies mainly related to universities and to a lesser extent to business schools. For instance, Cooke and Galt (2010) have conducted an economic analysis of the impact of business schools in the United Kingdom, while Kelly and McNicoll (2011) have analyzed the economic impact of the University of Kent. A second type of economic study takes as its touchstone of impact Becker’s (1964) theory of human capital according to which individuals invest in education to develop their human capital because this will lead to future higher revenues. O’Brien et al. (2010: 638) claim that research in business schools is “relevant and valuable in that it contributes to what is arguably the most critical metric of relevance for business school students: the economic value they accrue from their education”. In the context of business schools and management education, studies on impact have focused on increased salaries and other benefits for individual job applicants with a “business school education” or an “MBA” in the job market (Pfeffer, 1977; Zhao et al. 2006). The business media too tend to concentrate on the economic evaluation of “college degree’s true value” (Dwoskin, 2012) and refer, as in the Business Week and the Financial Times rankings, to value added in terms of salary enhancement after the completion of degrees, for example, an MBA. One criticism of this “value-added” approach is that it is a rather narrow (economistic) view of business school impact from the perspective of individual graduates and their future salary. As such, it does not help in assessing how well and/or how much business schools transfer knowledge that influences management practices through teaching, research and other types of activities. Finally, a third type of economic study focuses on the “innovation and entrepreneurship” impacts of higher education institutions. Examples include the impact study of Stanford University (Eesley and Miller, 2012) and of UK business schools (Thorpe and Rawlinson, 2013). The focus here is on the number of entrepreneurs, companies created and their economic value, plus activities and events organized by higher education institutions to foster entrepreneurship in a determined geographic scope.

A second perspective on the notion of impact relates to the knowledge transferred from business schools to management practices (Ghoshal, 2005; Pettigrew, 2011; Pfeffer and Fong, 2002), which can occur through teaching, research and other types of supports and activities. Here there is some skepticism, especially in Pfeffer and Fong’s (2002: 78) much discussed argument that “there is little evidence that business school research is influential on management practice, calling into question the professional relevance of management scholarship”. Shapiro et al. (2007) differentiate two issues for business schools related to this knowledge perspective and business school research more especially: a knowledge production problem (referred to as “lost before translation”) and a knowledge translation problem (referred to as “lost in translation”). This raises the question of the research relationship between management scholars and practicing managers and, assuming there is something useful hidden in academic papers waiting for translation into effective practice, how more effective translation of management research into publications, frameworks and tools that managers can use in their work might be promoted. Several studies have been published on how to improve knowledge transfer between academics and practitioners (Rynes et al., 2001; Bartunek, 2007) and the challenges of dealing with the “rigor-relevance” expectations in research (Shapiro et al., 2007; Worrell, 2009) but very few – if any – have focused on evaluating or assessing the impact of knowledge transferred from business schools to management practices. Some studies of the broader university focus on the transfer of universities’ knowledge to firms (Monjon and Waelbroeck, 2003) and take the different “channels of knowledge transfer” such as publications, consulting and patents (Agrawal, 2001) into account. For example, a study in the UK shows that university science parks have a positive impact on research productivity of companies located in those parks (Siegel et al., 2003). In this perspective, the importance of stakeholders’ alignment has been suggested to play an important role for management research (Starkey and Madan, 2001).

A third and more recent perspective on the impact of business schools relates to a “responsibility perspective” promoting inspirational behaviors and actions for business and society. Many business schools currently offer courses and curricula around the topic of responsible management: ethics, corporate social responsibility (CSR) and sustainability (Christensen et al. 2007). This appears in sharp contract with media reporting plagiarism among certain MBA candidates (Lavelle, 2013), or narcissism among business students (Bergman et al. 2010). Hopefully, a study by Slater and Dixon-Fowler (2010) finds a positive association between CEOs with an MBA and corporate environmental performance, which suggest an impact of the MBA on corporate environmental performance. Even though it is appealing, the “responsibility perspective” in business education also poses some risks of manipulations by graduates. According to Tourish et al. (2010), business schools offering transformational leadership education are exposed to the risk of producing graduates who will attempt to appeal to common needs (guided by precepts of transformational leadership) but who will simultaneously enact contradictory performance management systems (guided by agency theory). Therefore, promoting such a “responsibility perspective” in business schools for the benefits of society could lead to some unintended effects.

The three perspectives illustrate different though perhaps complementary dimensions of the impact of business schools. While the economic perspective focuses on material and financial impacts of business schools, the knowledge perspective relates to intangible ideas that influence or reshape management practices, and the responsibility perspective is about questioning and/or influencing ethical and identity postures. Although past scholarly works have focused on isolated phenomena (for example, the impact of the MBA on graduate salaries), we believe a unified framework is needed to better assess and/or evaluate business school impacts and that this should encompass economy, knowledge and responsibility impacts.

Towards an Impact Framework

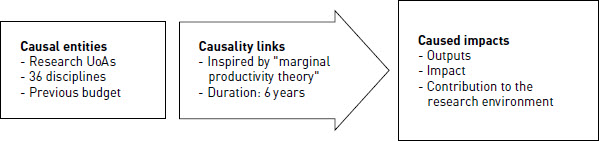

Although some authors have proposed conceptual models for research or scholarly impact (Aguinis et al., 2014; Goulet et al. 2016), the broader notion of business school impact has not yet been conceptualized in a unified framework for the three categories of impact. Recently, Finch et al. (2016) have developed a conceptual model of the business school value chain and an associated scorecard. The authors identify three sources of business school value, namely activity sources (eg. learning and teaching activities), input sources (eg. faculty), and processes sources (eg. class size). Their conceptual model offers some insights about the notion of business school impact. The social science literature on impact evaluation and the importance of causal effects (Berk, 2011) highlights the need to have at least three components to conceptualize any type of impact: some input variables are transformed through some process variables to generate some outcome variables (hence, called “impacts”). In line with these arguments, we propose a conceptual framework for theorizing impact in terms of a causal chain that has three interrelated components to be applied to business schools: (a) causal entities, (b) caused impacts and (c) causality links (see Figure 1). We describe each of these in the next paragraphs. In our framework, we conceptualize the type/nature of caused impacts in terms of economic, knowledge and responsibility perspectives.

FIGURE 1

Towards a framework for business school impact

First, a causal entity is a generator or catalyst of impact which can be decomposed into different sub-domains (or activities) and have those at different levels. For instance, a business school has some teaching and research activities (two different sub-domains) where different levels can be differentiated for teaching (individual course, program content, or school pedagogic approach) and research sub-domains (individual work, team research project, or school research conference). Each sub-domain at a specific level has also some intensity. For instance, research activity at the individual faculty level has an intensity that is usually measured by single-authored publications and/or scholarly communications.

Second, caused impacts represent the intended or unintended, direct or indirect, modifications at a specific level, which have been triggered by causal entities. Caused impacts are related to specific stakeholders and a specific type of benefit/damage characterized by some intensity. For instance, a direct (intended or not) impact triggered by individual research publications (causal entity) is an increase of the researcher’s contribution and recognition (impact type), often measured with the number of stars of publication journal (intensity), in his/her research community (stakeholder). At the same time, an individual researcher’s publications will also have an impact on a school’s research productivity and prestige (impact type), especially for media rankings and competitor schools (stakeholders) that count publications with the number of journal stars (intensity), as well as an indirect impact via the school reputation on the salary (impact type) of graduate students (stakeholder). Interestingly, the intended (or not) and direct (or not) nature of impact needs further development in what is meant by (un)intended or (in)direct impact, but also what are the implications of those features. The idea behind those two terms is that an intended direct impact is more easily appropriable by the causal entity than an indirect unintended impact.

Third, causality links are hypothetical influences between a causal entity and a caused impact. Any causality link needs to be theoretically supported. It is characterized by duration or term, as certain effects will take more time to occur than others. The duration of causality links implies thus that different impacts should be observed at different time horizons, either immediately or after a while. Certain causality links may be more or less strong, depending on other possible external influences. Interestingly, the mere fact of thinking in terms of impact influences real caused impacts. And different caused impacts (eg. company development) can influence some causal entities (eg. school funding), which suggests, in fact, a feedback loop (Moore, 1996).

This framework provides a basis for thinking about impact, raising questions about what elements (such as economy, knowledge and responsibility) are central to the impact debate and how they might be aligned or prioritized in particular contexts. The framework should also help to better consider and differentiate different impacts of business schools as they relate to economic, knowledge or responsibility outcomes and to relate them via some hypothetical influences anchored in theories to specific causal entities. For instance, while media rankings and accreditations may have promoted isomorphism (institutional theory) via a narrow focus on international academic scholars who are able to continuously publish articles in top scientific journals – thus acting on a limited knowledge-type of impact, business schools need also talented educators and practicing managers to inspire students via their behaviors (transformational leadership) for a responsibility-type of impact via teaching activities and internships coaching. From a different standpoint, the framework should also help business schools to think and act strategically – rather than mimicking other schools (Wilson and McKiernan, 2011) – in terms of intended impacts, with carefully selected causal entities and causality links. In that sense, the framework opens space for strategic thinking, for example, about where to focus attempts at differentiation, in terms of economy, knowledge or responsibility. More concretely, our conceptual framework could be used by business school leaders in the following order: (1) select specific stakeholders and a type/nature of targeted outcome (caused impact), (2) theorize about the required means for these ends (causality links), and (3) manage resources and processes accordingly (causal entities). In line with Kaplan and Norton (1996)’s arguments, organizational leaders have indeed to develop their own theory or model to relate causal entities and caused impacts. Besides, our framework can also be used to understand existing “impact models” for business schools, by highlighting their origins, supporting theories and purposes.

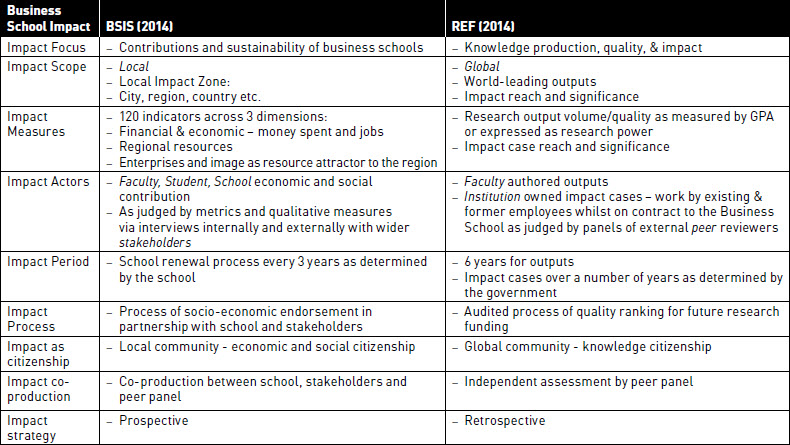

We now illustrate our framework with two contrasted examples of impact in action, examining two impact initiatives by two sets of influential stakeholders active in the business school sector in defining and measuring performance levels and funding research and teaching. The organizations behind the initiatives are the European Foundation for Management Development (EFMD) and the UK Higher Education Funding Council for England and Wales (HEFCE). We consider two initiatives promoted by these organizations as examples of stakeholder interventions in the impact domain – EFMD’s Business School Impact System (BSIS) initiative and the inclusion of an impact measure in HEFCE’s Research Excellence Framework (REF) as a UK national government initiative to assess research quality. These both incorporate, in their own ways, templates for evaluating and for promoting impact and both BSIS and REF focus on “economy”, “knowledge” and “responsibility”, reinforcing our proposition that a meaningful perspective on impact needs to take these elements seriously. Both BSIS and REF focus on what we would describe as impact effects (“caused impacts”). This raises the issue of how we might consider what causes impact (“causal entities”) and how these causes are “managed” in what we might term an impact chain, thus the nature of “causality links”. BSIS and REF provide interesting comparison cases, mingling retrospective analysis with prospective direction for the future of impact, and are likely to be of increasing strategic interest to management researchers and business schools.

The Case of BSIS

EFMD is an important global player in the business school policy world in a number of ways, most notably in its EQUIS accreditation program. In January 2014, the “Business School Impact System” (BSIS) was launched by EFMD and FNEGE (the French “Fondation Nationale pour l’Enseignement de la GEstion des Entreprises”). “The BSIS scheme identifies the tangible and intangible benefits that a Business School brings to its local environment in the pursuit of its educational activities” (EFMD, 2014). BSIS requires the definition of an “impact zone” and the definition of the business school scope (if the school is part of a larger institution). Its measurement process is based on a framework including 120 indicators covering originally three dimensions: (1) financial and economic impact, (2) impact on the regional community, (3) impact upon the attractiveness and image of the impact zone. In early 2016, these dimensions have been restructured in seven dimensions (Kalika, Shenton and Dubois, 2016).

When applying BSIS, two preliminary questions are important for any business school to consider before eventually applying. First, why is a business school interested in its impact? In general, the impact issue may arise at a strategic level when the stakeholders’ funding becomes more difficult, or when the existence or legitimacy of the school itself is at stake. In all cases, the impact notion helps answer the “what if” question, more specifically what would happen if the business school did not exist (Kalika et al., 2016). Second, what is the “impact zone”? The BSIS process indeed invites a business school to specify a zone that will be studied. There are two components to be defined in this “impact zone”: the definition of the school on one hand, and the definition of a geographical area on the other hand. As for the school definition, is it a department within a faculty? Is it an independent business school? This school definition is important for both conceptual and empirical levels, as it should facilitate the specification of the starting point of the caused impacts. The geographical area relates to the target area of the caused impact. It depends on the context of a business school, its strategy and its environment. The geographical area could be a town, a region, a country or several countries. The overall evaluation of a business school’s impact will depend on the answers provided to these two preliminary elements: the reasons to assess/evaluate impact and the impact zone.

BSIS uses several types of indicators for impact, and it leaves room for different kinds of impacts. Some impacts can be measured in a quantitative way while others are more qualitative and not easily measured. There are immediate or deferred impacts, direct or indirect. For these reasons, BSIS relies on quantitative indicators but also narrative data. Last but not least, the period during which an impact should be evaluated is important. If one year seems relevant for financial impact, it may be less significant for impact in terms of entrepreneurship, created companies or intellectual contribution. For the first original dimension of BSIS – financial and economic impact - the indicators are mostly quantitative. The direct financial impact is measured in terms of the budget of the Business School but also by the organizations linked to it – foundations, alumni, students associations, for example. Indirect financial impact is evaluated in terms of students’ expenditures, participants in executive education, participants in congresses, invited professors. Another aspect related to the financial and economic dimension is focused on new business creation. Concerning the second original dimension – impact on the regional community - this is evaluated through ten series of indicators mainly qualitative at the exception of the first one: resources available to companies (internships, students’ short missions, consulting activities from professors). The others indicators include publications, chairs having an impact on the regional community, public lectures, further education, part-time degree programmes, visiting lecturers, participation in the professional networks, participation to professional or civic functions in the region, global responsibility. Finally, the third original dimension – impact upon the attractiveness and image of the impact zone – looks at the school impact on the zone attractiveness for companies, students, job market, national and international intellectual production, (regional, national, international, online) image. In general, the theoretical/explanatory approach used by BSIS lies on a “what if” view: what would happen if a specific business school did not exist? Figure 2 illustrates our framework applied to BSIS.

The analysis of BSIS with the impact framework suggests two main observations. First, BSIS seems to mainly emphasize and evaluate “caused impacts”, as it has been built and structured around the notions of impact type or nature (economic and attractiveness/image) and stakeholder (regional community). In that sense, the three BSIS original dimensions may tend to overlap to some degree. For instance, if the region is part of the impact zone, then any regional community is likely to benefit from a school impact on the attractiveness and image of the impact zone. With a focus on “caused impacts”, BSIS probably needs to take more “causality links” and “causal entities” into account to better assess business school impact relative to committed resources. Second, BSIS assumes that a school has an impact on the attractiveness and image of its impact zone. However, an attractive zone (in Europe, for example, London, Paris, or Zurich) may have a stronger attractiveness and image impact on any particular school located in this zone. In this view, BSIS has adopted a particular assumption where business schools seem to play a major role in zone attractiveness impact. However, the higher the initial zone attractiveness, the smaller the impact that business schools can probably have on their zone. In general, the impact of business schools should not be neglected or ignored when it is considered negative (Ghoshal, 2005; Mintzberg, 2004), nor should it be overemphasized when it seems positive, for instance through an impact on “attractiveness and image of impact zone”. Specifying the causal entities and causality links – as stated above – would help here to nuance and contextualize this type of impact within BSIS.

FIGURE 2

Impact framework applied to BSIS (2014)

The Case of REF in the United Kingdom

The UK system of funding from government has evolved rapidly in recent years, in the light of the economic crisis and the different positions of the 3 UK political parties. Teaching for the non-STEM subjects (Science, Technology, Engineering, Mathematics), i.e. Arts, Humanities, Social Sciences, including Business and Management, receives funding via a loan system (guaranteed by government) to students (and parents) who then decide where to take that money in seeking entry to the university and the course of their choice. UK Students pay a fee of £9000 pounds for almost all their courses outside STEM subjects and leave university with loans that they pay back in a graduate tax. There is still however government funding for research, a reflection of the importance the government attaches to science research, and this is distributed in two ways, both competitive – through a competition for research funds from the research councils (in business and management, mainly through the Economic and Social Research Council (ESRC, 2014) and through research assessment exercises. We will concentrate on the latter in this paper.

The research assessment exercise (the RAE) began in 1986. There have been six RAEs since then with the last one taking place in 2008. RAE was replaced by REF (the Research Excellence Framework) in 2014. REF, like RAE before it, determines research resource allocation. Research funds are allocated in the light of the performance of individual units of assessment (UoAs) (university schools/departments) according to the REF metric. There has been a very significant change between RAE 2008 and REF 2014 intended to rebalance research clearly towards impact beyond only the academic. Academic impact is measured in terms of the quality of published outputs and tends to correlate with publication in quality journals, with the Chartered Association of Business Schools’ (CABS) Academic Journal Guide being used by many as a surrogate for quality with its 0-4 scale. There is much talk of 4* publications and “4 by 4s” staff and a lively transfer market in the run-up to the REF deadline, given that 4 by 4’s are only ever going to be a small minority. The major difference between the REF and its predecessor RAE is that REF includes a new and very explicit impact measure, and this clearly fits with the theme of our paper. The UK Higher Education Funding Council (HEFCE, 2014) defines levels of research performance in the following way (definitions of starred levels) and outputs (research publications) and impact are judged according to these criteria:

Four stars: Quality that is world-leading in terms of originality, significance and rigour.

Three stars: Quality that is internationally excellent in terms of originality, significance and rigour but which falls short of the highest standards of excellence.

Two stars: Quality that is recognised internationally in terms of originality, significance and rigour.

One stas: Quality that is recognised nationally in terms of originality, significance and rigour.

Unclassified: Quality that falls below the standard of nationally recognised work. Or work which does not meet the published definition of research for the purposes of this assessment.

REF results are reported in terms of the profile for a UoA of 4*, 3*, 2*, 1* and Unclassified outputs. These judgments, by panels of academic peers, are then translated into a plethora of league tables in which the main elements are research quality and research power. Research quality, by common consent, is judged in terms of the GPA (Grade Point Average) of a UoA - for example Unit A has a GPA of 3.4, Unit B a GPA of 3.35 … Unit X a GPA of 2.0. Research power is measured by summing the number of publications at a particular grade and is thus highly dependent on size of the UoA or on the number of staff it chooses to return for assessment. (In the last RAE, London Business School, for example, ranked 5th on Research Power.) Research quality carries an overall 65% weighting in the overall assessment with research funding being allocated in proportion to the number and the quality of research outputs.

Impact is defined by HEFCE broadly to include social, economic, cultural, environmental, health and quality of life benefits. Impact purely within academia is excluded as eligible for REF, so impact via the medium of research-led teaching is ineligible. Evidence for Impact in the submission is in terms of “Impact Case Studies” with each UoA required to submit a case study for 10 members of staff (so 10 cases studies if you have 100 academics in a school/department). Next to the impact sub-profile in REF, two other sub-profiles to be assessed are called “outputs” and “environment”. ‘Outputs’ are the product of any form of research, published between January 2008 and December 2013. They include publications such as journal articles, monographs and chapters in books, as well as outputs disseminated in other ways such as designs, performances and exhibitions. Environment refers to the strategy, resources and infrastructure that support research.

The criteria for assessing impacts are ‘reach’ and ‘significance’:

In assessing the impact described within a case study, the panel forms an overall view about its ‘reach and significance’ taken as a whole, rather than assess ‘reach and significance’ separately.

In assessing the impact template (REF) the panel considers the extent to which the unit’s approach described in the template is conducive to achieving impacts of ‘reach and significance’.

Impact of research is defined as follows and forms 20% of the judgement and funding:

Four stars: Outstanding impacts in terms of their reach and significance.

Three stars: Very considerable impacts in terms of their reach and significance.

Two stars: Considerable impacts in terms of their reach and significance.

One star: Recognised but modest impacts in terms of their reach and significance.

Unclassified: The impact is of little or no reach and significance; or the impact was not eligible; or the impact was not underpinned by excellent research produced by the submitted unit.

In terms of our framework (Figure 3), REF is inspired by ‘marginal productivity theory’ as it aims to assess research productivity to allocate future budgets.

The REF impact approach demonstrates an emphasis on the importance of knowledge. It also signals a clear determination on the part of government to address what it sees as a relevance issue and to try and demonstrate and ensure that investment in research leads to demonstrable effects beyond the university, although these can be described in terms beyond just economic benefit, for example, social, cultural, quality of life. So there is room here for “responsibility”. It will be very interesting to see what strategies UK business and management schools develop to focus on impact for the next REF (in 2020) and the extent to which the rules of the game become clearer. What does seem clear is that impact is likely to form a more significant element of the next research assessment exercise with some commentators suggesting that this could account for up to 30-40% of future research funding.

Comparison Between BSIS and REF Impact Dimensions

Having outlined two cases of impact assessment, we compare and contrast these approaches to gauge business school impact. Although both BSIS and REF are implemented by academic peers, their origin and purpose strongly differ in many regards. While BSIS was first born in France to help business schools, REF was rather raised to allocate public funds to UK business schools in line with the new public management philosophy. Table 1 illustrates how business school impact is gauged across various impact dimensions for each of them.

One clear divergence is between the focus of each of these impact assessment exercises. BSIS is focused upon proving the contributions and sustainability of the business school in an uncertain world where business, and thus the schools which provide their managers’ education, are under increasing scrutiny. REF by contrast focuses on the traditional engine of a university department: its knowledge production and wider impact. Whereas BSIS is primarily concerned with the local impact of a business school, the REF focuses on the ability of a business school to achieve global leading knowledge production and dissemination as measured by publication in world-class journals and the impact of its knowledge production through specific impact cases. The measures used to determine this impact also diverge. BSIS draws on a very wide range of indicators across three dimensions (financial and economic; regional community and attractiveness of the local impact zone). REF’s focus is global building from volume and quality comparisons of knowledge development and impact as measured by GPA or research power.

The actors and processes in these impact assessments also diverge. In the case of BSIS, the actors engaged in the process are wide ranging across all key local stakeholder groups from faculty and employers to wider business community members, such as chambers of commerce. For the REF the focus is upon the knowledge production community – faculty, their institutions and the panel of appointed peer reviewers for the subject area. Under BSIS, this process is voluntarily entered into, and if a school finds it beneficial they have the option to renew periodically. Under REF, this process is driven by an external body, HEFCE, which determines the regularity of the REF process. So BSIS is a voluntarist process which must therefore offer some tangible gain to a business school to encourage re-engagement and the development of the scheme. REF is an imposed audit of research impact. For the business school, BSIS offers an opportunity for wider socio-economic endorsement raising their status potentially in the local impact zone. REF addresses ‘peer status’ by recognizing that universities, and the business schools within them, compete for students and faculty in international markets where global knowledge reputation is paramount.

FIGURE 3

Impact framework applied to REF (2014)

Table 1

Business School Impact Dimensions

In framing citizenship as impact, BSIS offers the business school the opportunity to periodically co-produce with its key stakeholders a narrative of economic and social citizenship which builds from its current position. This exercise is prospective in its ambitions to secure the future of the school in its local impact zone. By contrast, the REF enables a periodic audit of knowledge production productivity, quality and impact to assess the knowledge citizenship of the business school within the global academic community. This audit is retrospective in focus but informs future research funding. These cases highlight the diverse challenges of citizenship confronting business schools as they seek to straddle both the global peer community of knowledge production whilst engaging effectively with the local stakeholder community concerns around economic and social citizenship.

Discussion

Since their creation, business schools have always been confronted with severe challenges related to their legitimacy. Common approaches to assess business school impact have focused either on research outputs (e.g. publications), or alumni’s salaries. However, business school impact should be considered more broadly, and our framework helps in promoting a pluralism of approaches and opening new spaces for original strategic choices. Business schools are indeed under pressure to become more socially accountable to a diverse group of stakeholders. During the last two decades, market mechanisms such as rankings and accreditation agencies have exerted strong pressures for accountability on business schools, insisting mostly on the need for openness to internationalization and high quality academic research. The result of these influences has been to promote an inflation of top-tier academic international publications, no matter how relevant or influential for managers and society, locally or at large. This has led to animated debates and reflections around the role and impact of business schools – especially after the 2008 financial crisis – and the research conducted in business schools. So, the notion of impact emerged as inherently linked to a quest for legitimacy and meaningfulness for business school activities. In recent years, the “impact” wave is thus becoming more visible for business schools and other higher education institutions. Whether it is focused on research only (e.g. REF) or any type of business school activity (e.g. BSIS), we argue that the notion of impact for business schools can help in contributing to their legitimacy, by developing citizenship defined as the process of reflecting about the broader meaning and consequences of their activities and acting for the benefits of society. In other terms, the notion of impact allows business schools to create a unique narrative about what they are doing, how and why they are doing it, and what are the expected or already achieved results. In this perspective, the pluralism of approaches in terms of business school impact broadly defined opens new spaces for original strategic choices, therefore limiting potentially pressures for organizational isomorphism that has been traditionally exerted by media rankings and accreditation processes.

With past studies on business school impact clustered in three categories – namely economic impact, knowledge impact, and responsibility impact – there is a need for a unified conceptual framework to theorize the broader notion of impact. Although our framework was raised through a reflection that started with business schools, we believe it can be used with other types of higher education institutions (e.g. engineering schools). Indeed, we assume that every higher education institution may be willing to target certain stakeholders with certain specific types of impact. Our framework thus allows us to theorize the notion of impact, without imposing any impact measure or criteria. Following the illustration of our framework with BSIS and REF, we call for the development of case studies in different business schools. A potentially attractive case could be one of a business school undergoing REF and BSIS processes together. Future research could also explore the relationships between different types of impact and the popular rankings of business schools. Further, studying the mere existence and potential types of impact for schools in different countries could highlight the cultural peculiarities of this construct.

Despite its attractive appeal, the notion of impact has also some limitations and pervasive effects that need to be considered. A main challenge for the notion of impact lies in its implementation and measurement. For instance, most REF indicators for impact are not far from the traditional old measures of research publications. In such a case, the notion of impact runs the risk of being perceived as a new buzzword that offers some re-packaging of the old (narrow) performance measures. Depending on the stated objectives (e.g. allocating research funds, or helping to build a narrative), the measurement of impact needs to be thought and designed differently. If the aim is to create a ranking list, the measurement of impact becomes more challenging and exposed to the risks of oversimplification. As we know, everything that counts cannot be counted, but everything that can be counted does not necessarily count. If the aim is to create a narrative, the targeted impact may be summarized by quantitative and qualitative data to make the case more convincing. However, many stakeholders (students, medias, companies, academics, etc.) love ranking lists that allow comparison of institutions. In the cases of BSIS and REF, the measurement of impact was based on two sources simultaneously: (1) traditional countable performance measures, and (2) experts’ subjective judgements. While BSIS does not aim to produce any type of ranking, REF aims to compare and position business schools in a ranking list, to be able to allocate research funds.

Another challenge to, or limitation of, the notion of impact for the academic community is related to their perceived loss of autonomy or independence. For many scholars, research in business schools should not necessarily aim to have measurable or visible impacts, as there is a difference between fundamental research for the sake of knowledge and applied research for the sake of private interests. The benefits of a voluntary exercise (such as BSIS) is that it promotes a useful dialogue between institutions and assessors. The danger of enforced audit with contested variables (such as REF) is that it promotes game playing rather than genuine change. Further, the idea of impact as an objective may lead to a bias in favor of applied research with short-term results and heavy communication campaigns, rather than the more discrete fundamental research with expected long-term results. In the United Kingdom, Stern (2016) has recently voiced concern about the distorting influence of REF on individual research strategy and institutional behaviors. The report criticizes the drive towards safe topics in research and short-termism, the reluctance to engage in risky or multidisciplinary topics to ensure reliable high quality publication within the REF period.

The notion of impact for business schools seems to be focused exclusively on the positive impacts for both BSIS and REF. However, it might be interesting to think about a list of potential negative impacts to minimize. For instance, after a series of corporate scandals and the 2008 financial crisis, business schools were accused of propagating irresponsible managerial behaviours. What have business schools done since the 2008 financial crisis to change anything in their finance masters programmes? How successful have they been in influencing and convincing financial institutions to revise their working methods? Interestingly, the notion of impact offers many opportunities to business schools to make strategic choices and decide where to go and how far to go. To increase business schools’ legitimacy, the notion of impact requires (1) the understanding of collective aims, (2) choosing a path, and (3) allowing pluralism in the vehicles, speeds and targets. Business schools and management research need to develop new narratives of community and economy, of “being-in-common”, the integration of economy, knowledge and responsibility and to justify this narrative in terms of the variety of impacts they generate for their different stakeholders. We suggest that impact, from this perspective, goes hand in hand with a renewed sense of citizenship.

Parties annexes

Biographical notes

Christophe Lejeune is Professor in Strategy and Organization at ESTA School of Business and Technology in Belfort, France. He holds a Ph.D. in economics and management from the Louvain School of Management, Universite catholique de Louvain, Belgium. His research interests include organizational identity, change, and knowledge transfer.

Ken Starkey is Professor of Management and Organisational Learning at Nottingham University Business School. His research interests include management education, strategy, organisation design and leadership development. He has published 12 books and articles in journals including Academy of Management Review, Academy of Management Learning & Education, Strategic Management Journal,Organization Science, Business Ethics Quarterly,Organization Studies, and Journal of Management Studies. He is a Fellow of the Academy of Social Sciences and of the British Academy of Management.

Michel Kalika is an emeritus Professor at the University Jean Moulin, Iaelyon School of Management. He has published more than 25 books and approximately a hundred various other publications in strategy and information technology. His research focuses on the use of e-mail by managers (the “Millefeuille” theory) and the impact of Business Schools. He is the co-Director of the BSIS (Business School Impact System) methodology he developed for FNEGE & EFMD. Michel Kalika is also the President of the Business Science Institute (international Executive DBA programme).

Sue Tempest is a Professor of Strategic Management and Learning, and Deputy Dean at Nottingham University Business School. Her research interests include: organizational learning; management education and business school strategy; strategy, knowledge and learning; demographic ageing and strategy. She has published in journals such as Academy of Management Learning & Education,Organization Science, Human Relations, Organization Studies, Journal of Management Studies, Long Range Planning, Management Learning and European Management Review.

Bibliography

- AACSB (2012), Impact of Research. A Guide for Business Schools. Tampa, FL: AACSB.

- AACSB (2015), Eligibility Procedures and Accreditation Standards for Business Accreditation. Tampa, FL: AACSB.

- Agrawal, A. (2001), “University-to-industry knowledge transfer: literature review and unanswered questions”, International Journal Management Reviews, Vol. 3, N°4, p. 285-302.

- Aguinis, H., Shapiro, D.L., Antonacopoulou, E.P., Cummings, T.G. (2014), “Scholarly impact: a pluralist conceptualization”, Academy of Management Learning & Education, Vol. 13, N°4, p. 623-639.

- Australian Government (2016), Measuring impact and engagement of university research, National Innovation and Science Agenda, retrieved from: http://www.innovation.gov.au/page/measuring-impact-and-engagement-university-research

- Bartunek, J. M. (2007), “Academic-practitioner collaboration need not require joint or relevant research: Toward a relational scholarship of integration”, Academy of Management Journal, Vol. 11, N°2, p. 244-246.

- Becker, G.S. (1964), Human capital: a theoretical and empirical analysis, with special reference to education, Chicago: University of Chicago Press.

- Bergman, J.Z., Westerman, J.W., Daly, J.P. (2010), “Narcissism in management education”, Academy of Management Learning & Education, Vol. 9, N°1, p. 119-131.

- Berk, R. (2011), “Evidence-based versus junk-based evaluation research: some lessons from 35 years of the Evaluation Review”, Evaluation Review, Vol. 35, N°3, p. 191-203.

- Bradshaw, D. (2014), “EFMD helps business schools measure impact on community”, Financial Times, 30 January 2014, retrieved from: http://www.ft.com/cms/s/2/7eef430c-8843-11e3-a926-00144feab7de.html#axzz2znQnLh8k

- Bradshaw, D. (2013), “A disregard for business schools”, Financial Times, 15 April 2013, retrieved from: http://www.ft.com/cms/s/2/3a53012e-8d86-11e2-82d2-00144feabdc0.html?ftcamp=p#axzz2znTWeJaB

- Chakravorti, B. (2014), “How business schools create irresponsible leaders”, Business Week, 21 April 2014, retrieved from: http://www.businessweek.com/articles/2014-04-21/how-business-schools-create-irresponsible-leaders

- Christensen, L.J., Peirce, E., Hartman, L.P., Hoffman, W.M., Carrier J. (2007), “Ethics, CSR and sustainability in the Financial Times top 50 global business schools”, Journal of Business Ethics, Vol. 73, p. 347-368.

- Clark, P. (2014), “Think MBA students are arrogant? Blame their narcissistic teachers”, Business Week, 5 March 2014, retrieved from: http://www.businessweek.com/articles/2014-03-05/think-mba-students-are-arrogant-blame-their-narcissistic-teachers

- Cooke, A., Galt, V. (2010), “The impact of business schools in the UK”, Association of Business Schools.

- Cornuel, E. (2005), “The role of business schools in society”, Journal of Management Development, Vol. 24, N°9, p. 819-829.

- Di Meglio, F. (2013), “Is B-school research an expensive waste?”, Business Week, 22 February 2013, retrieved from: http://www.businessweek.com/articles/2013-02-22/is-b-school-research-an-expensive-waste

- Donaldson, T., Preston, L.E. (1995), “The stakeholder theory of the corporation: concepts, evidence, and implications”, Academy of Management Review, Vol. 20, N°1, p. 65-91.

- Dwoskin, E. (2012), “Calculating a college degree’s true value”, Business Week, 20 December 2012, retrieved from: http://www.businessweek.com/articles/2012-12-20/calculating-a-college-degrees-true-value

- Eesley, C.E., Miller, W.F. (2012), Stanford University’s economic impact via innovation and entrepreneurship, October, research report retrieved from: https://engineering.stanford.edu/sites/default/files/Stanford_Alumni_Innovation_Survey_Report_102412_1.pdf

- EFMD (2014), The key tool for measuring your business school’s impact on the world around it. Accessed on http://www.efmd.org/bsis on 31 January 2014

- ESRC (2014), Economic and Social Research Council, http://www.esrc.ac.uk, accessed on 15 March 2014.

- Finch, D.J., Varella, P., Foster, W., Sundararajan, B., Bates, K., Nadeau, J., O’Reilly, N., Deephouse, D.L. (2016), “The business school scorecard: Examining the systematic sources of business school value”, Canadian Journal of Administrative Sciences, Vol. 33, p. 277-289.

- Ghoshal, S. (2005), “Bad management theories are destroying good management practices”, Academy of Management Learning and Education, Vol. 4, N°1, p. 75-91.

- Goulet, L.R., Lopes, K.L., White, J.B. (2016), “Mission-driven expected impact: Assessing scholarly output for 2013 Association to Advance Collegiate Schools of Business standards”, Journal of Education for Business, Vol. 91, N°1, p. 11-18.

- Hambrick, D.C. (1994), “1993 Presidential Address: What if the Academy actually mattered”, Academy of Management Review, Vol. 19, N°1, p. 11-16.

- HEFCE (2014), Higher Education Funding Council for England,http://www.hefce.ac.uk, accessed on 15 March 2014

- Kalika, M., Shenton, G., Dubois, P.H. (2016), “What happens if a business school disappears? The intellectual foundations of BSIS”, Journal of Management Development, Vol. 35, N°7, p. 878-888.

- Kaplan, R.S., Norton, D.P. (1996), The balanced scorecard: translating strategy into action, Boston: Harvard Business Press.

- Kelly, U., McNicoll, I. (2011), The economic impact of the University of Kent, retrieved from: http://www.kent.ac.uk/about/impactreport-oct11.pdf

- Lavelle, L. (2013), “Dozens of MBA applicants tossed over plagiarism”, Business Week, 7 February 2013, retrieved from: http://www.businessweek.com/articles/2013-02-07/dozens-of-mba-applicants-tossed-over-plagiarism

- Mintzberg, H. (2004), Developing Managers. Not MBAs. London: FT Prentice Hall.

- Monjon, S., Waelbroeck, P. (2003), “Assessing spillovers from universities to firms: evidence from French firm-level data”, International Journal of Industrial Organization, Vol. 21, p. 1255-1270

- Moore, J.F. (1996), The death of competition: Leadership and strategy in the age of business ecosystems. Harper Business.

- O’Brien, J. P., Drnevich, P. L., Crook, T. R., Armstrong, C. E. (2010), “Does business school research add economic value for students?”, Academy of Management Learning & Education, Vol. 9, N°4, p. 638-651.

- Pettigrew, A.M. (2011), “Scholarship with impact”, British Journal of Management, Vol. 22, N°3, p. 347-354.

- Pettigrew, A.M., Starkey, K. (2016), “The legitimacy and impact of business schools – Key issues and a research agenda”, Academy of Management Learning & Education, Vol. 15, N°4, p. 649-664.

- Pfeffer, J. (1977), “Effects of an MBA and socioeconomic origins on business school graduates’ salaries”, Journal of Applied Psychology, Vol. 62, N°6, p. 698-705.

- Pfeffer, J., Fong, C. (2002), “The end of business schools? Less success than meets the eye”, Academy of Management Learning & Education, Vol. 1, N°1, p. 78-95.

- Pfeffer, J. (2013), “Does it matter if B-schools produce narcissists?” Business Week, 15 January 2013, retrieved from: http://www.businessweek.com/articles/2013-01-15/does-it-matter-if-b-schools-produce-narcissists

- REF (2014), Research Excellence Framework, http://www.ref.ac.uk, accessed on 15 March 2014

- Rousseau, D. M. (2012), “Designing a better business school: Channeling Herbert Simon, addressing the critics and developing actionable knowledge for professionalizing managers”, Journal of Management Studies, Vol. 49, N°3, p. 600-618.

- Rynes, S. L., Bartunek, J. M., Daft, R. L. (2001), “Across the great divide: knowledge creation and transfer between practitioners and academics”, Academy of Management Journal, Vol. 44, N°2, p. 340-355.

- Shapiro, D.L., Kirkman, B.L., Courtney, H.G. (2007), “Perceived causes and solutions of the translation problem in management research”, Academy of Management Journal, Vol. 50, N°2, p. 249-266.

- Siegel, D.S., Westhead, P., Wright, M. (2003), “Assessing the impact of university science parks on research productivity: exploratory firm-level evidence from the United Kingdom”, International Journal of Industrial Organization, Vol. 2, p. 1357-1369.

- Simon, H.A. (1967), “The business school: a problem in organizational design”, Journal of Management Studies, Vol. 4, p. 1-16.

- Slater, D.J., Dixon-Fowler, H.R. (2010). “The future of the planet in the hands of MBAs: an examination of CEO MBA education and corporate environmental performance”, Academy of Management Learning & Education, Vol. 9, N°3, p. 429-441.

- Starkey, K., Madan, P. (2001), “Bridging the relevance gap: Aligning stakeholders in the future of management research”, British Journal of Management, Vol. 12, Special Issue: S3-S26.

- Stern, N. (2016), “Building on success and learning from experience, An independent review of the Research Excellence Framework”, retrieved from: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/541338/ind-16-9-ref-stern-review.pdf

- Tourish, D., Craig, R., Amernic, J. (2010), “Transformational leadership education and agency perspectives in business school pedagogy: a marriage of inconvenience?”, British Journal of Management, Vol. 21, p. S40-S59.

- Thomas, H., Thomas, L., Wilson, A. (2013), Promises fulfilled and unfulfilled in management education. Bingley: Emerald.

- Thorpe, R., Rawlinson, R. (2013), “The role of UK business schools in driving innovation and growth in the domestic economy, Association of Business Schools”, retrieved from: http://www.associationofbusinessschools.org/sites/default/files/130516_absinnovation_web.pdf,

- Trieschmann, J., Dennis A., Northcraft, G., Niemi, A. (2000), “Serving multiple constituencies in business schools: MBA program versus research performance”, Academy of Management Journal, Vol. 43, N°6, p. 1130-1141.

- Wilson, D., McKiernan, P. (2011), “Global mimicry: putting strategic choice back on the business school agenda”, British Journal of Management, Vol. 22, p. 457-469.

- Wilson, D., Thomas, H. (2012), “The legitimacy of the business of business schools: what’s the future?”, Journal of Management Development, Vol. 31, N°4, p. 368-376.

- Worrell, D.L. (2009), “Assessing business scholarship: the difficulties in moving beyond the rigor-relevance paradigm trap”, Academy of Management Learning & Education, Vol. 8, N°1, p. 127-130.

- Zhao, J.J., Truell, A.D., Alexander, M.W., Hill, I.B., D. (2006), “Less success than meets the eye? The impact of master of business administration education on graduates’careers”, Journal of Education for Business, May/June, p. 261-268.

Parties annexes

Notes biographiques

Christophe Lejeune est professeur de stratégie et organisation à l’ESTA (Ecole Supérieure des Technologies et des Affaires) à Belfort, France. Il est titulaire d’un doctorat en sciences économiques et de gestion de la Louvain School of Management, Université catholique de Louvain. Ses intérêts de recherche portent sur l’identité organisationnelle, le changement et le transfert de connaissances.

Ken Starkey est professeur de management et apprentissage organisationnel à la Nottingham University Business School. Ses intérêts de recherche incluent la formation en gestion, la stratégie, le design organisationnel et le développement du leadership. Il a publié 12 ouvrages et des articles dans des revues incluant Academy of Management Review, Academy of Management Learning & Education, Strategic Management Journal,Organization Science, Business Ethics Quarterly,Organization Studies, et Journal of Management Studies. Il est membre de l’Académie des Sciences Sociales de la British Academy of Management.

Michel Kalika est professeur émérite à l’université Jean Moulin, iaelyon School of Management. Il a publié plus de 25 ouvrages et une centaine d’articles et cas en stratégie et système d’information. Ses recherches se focalisent sur la surcharge informationnelle (« Millefeuille » theory) et sur l’impact des Business Schools. Il est le co-directeur de la méthodologie BSIS (Business School Impact System) développée pour la FNEGE & EFMD. Il est aussi le président du Business Science Institute (programme de DBA International)

Sue Tempest est professeur de management stratégique et apprentissage organisationnel, et vice-doyenne à la Notthingham University Business School. Ses intérêts de recherche incluent : l’apprentissage organisationnel, la formation en gestion, et la stratégie des écoles de commerce; stratégie, connaissance et apprentissage; vieillissement démographique et stratégie. Elle a publié dans des revues telles que : Academy of Management Learning & Education,Organization Science, Human Relations, Organization Studies, Journal of Management Studies, Long Range Planning, Management Learning et European Management Review.

Parties annexes

Notas biograficas

Christophe Lejeune es profesor de estrategia y organización en el ESTA (Ecole Supérieure des Technologies et des Affaires) en Belfort, Francia. Es titular de un doctorado en ciencias económicas y de gestión de la Louvain School of Management, Université Catholique de Louvain. Sus campos de investigación se centran en la identidad organizativa, el cambio y la transferencia de conocimientos.

Ken Starkey es profesor de gestión y aprendizaje organizativo en la Nottingham University Business School. Sus campos de investigación incluyen la formación en gestión, la estrategia, el diseño organizativo y el desarrollo del liderazgo. Ha realizado 12 publicaciones científicas y artículos en las revistas incluyendo Academy of Management Review, Academy of Management Learning & Education, Strategic Management Journal, Organization Science, Business Ethics Quaterly, Organizaton Studies, y Journal of Management Studies. Es miembro de la Academia de Ciencias Sociales de la British Academy of Management.

Michel Kalika es profesor emérito en la Universidad Jean Moulin, iaelyon School of Management. Ha realizado 25 publicaciones científicas y un centenar de artículos y casos en estratégia y sistema de información. Sus investigaciones se focalizan en la sobrecarga informativa ( «Millefeuille» theory) y sobre el impacto de los Business Schools. Es el co-director de la metodología BSIS (Business School Impact System) desarrollada para la FNEGE & EFMD. Es también presidente del Business Science Institute (programa de DBA International).

Sue Tempest es profesora de gestión estratégica y de aprendizaje organizativo, y vice-decana de la Notthingham University Business School. Sus campos de investigación incluyen: el aprendizaje organizativo, la formación en gestión y la estrategia de las escuelas de comercio. Ha publicado en revistas tales como: Academy of Management Learning & Education, Organization Science, Human Relations, Organization Studies, Journal of Management Studies, Long Range Planning, Management Learning y European Management Review.

Liste des figures

FIGURE 1

Towards a framework for business school impact

FIGURE 2

Impact framework applied to BSIS (2014)

FIGURE 3

Impact framework applied to REF (2014)

Liste des tableaux

Table 1

Business School Impact Dimensions