Résumés

Abstract

This paper assesses the relevance of the Gravity model to investigations of alliance flows within and between countries. Accordingly we aim to identify how different distance dimensions impact the alliance partner choice. Inspired by economics research, we use the Gravity model to estimate and analyse bilateral alliance flows within countries and between country pairs. Our results show that the richer the companies’ home countries are, the more alliances are found between firms of these two countries. We also reveal that too much geographic and cultural distance between two countries decreases the number of alliances signed between firms of these countries.

Keywords:

- Domestic and international alliances,

- Gravity model,

- Distances,

- CAGE Distance Framework

Résumé

Cet article évalue la pertinence du modèle gravitaire pour comprendre les flux d’alliances bilatérales au sein d’un pays et entre différents pays. Inspirés par les recherches en économie, nous utilisons ce modèle pour identifier l’impact des différentes dimensions de la distance sur le choix du partenaire d’alliance. Nos résultats montrent que plus les pays sont riches, plus le nombre d’alliances entre les entreprises de ces pays est important. Nous révélons également que des distances géographique et culturelle trop importantes entre deux pays ont tendance à diminuer le nombre d’alliances signées entre les entreprises de ces pays.

Mots-clés :

- Alliances nationales et internationales,

- Modèle gravitaire,

- Distances,

- CAGE Distance Framework

Resumen

Este articulo evalúa la importancia sobre el modelo de Gravity para las investigaciones de flujos de alianzas locales y entre países. Nuestro objetivo es identificar cómo las diferentes dimensiones en distancia afectan la elección de un socio aliado. Inspirados en la investigación económica, utilizamos el modelo de Gravity para estimar y analizar los flujos de la alianza bilateral dentro de los países y entre pares de países. Nuestros resultados demuestran que cuantos más ricos son los países de origen de las empresas, más alianzas se crean entre las empresas de estos dos países. También demostramos que la lejanía geográfica y cultural entre dos países disminuye el número de alianzas.

Palabras clave:

- Las alianzas nacionales e internacionales,

- Modelo de Gravity,

- Distancias,

- CAGE Distance Framework

Corps de l’article

Introduction

Alliance formation is an important component of companies’ strategy (Dunning, 1995) and is an ever-growing field of research in both the strategic management and the international business literature (Teng & Das, 2008). More precisely, alliances are seen as a critical way to develop activities on either domestic or international markets such that dedicated research in international business and strategic management is closely related to economic theories (Beamish & Lupton, 2016). In this paper, we build on economic theories regarding foreign direct investment (FDI) and Gravity models to understand the choice of partners in alliances. More precisely, we assess the relevance of the Gravity model to the investigation of alliance flows within and between countries, and we identify how different distance dimensions impact the choice of a partner. Gravity models are most often used to investigate FDI flows, but they have never been used in an alliance context. This research thus allows us to show how determinants of bilateral FDI flows can also be used to understand alliance formation.

Research explains that alliances are considered to be one of many types of development modes that exist alongside acquisition (and FDI abroad) or organic growth (Kogut, 1985). When choosing to form an alliance, either locally or internationally, the choice of the alliance partner is considered crucial, as it is an important factor for the operation, performance and success of alliances (Dacin, et al., 1997; Pangarkar & Klein, 2001; Nielsen, 2003). It is therefore essential that decision makers are able to choose the “right” partner (Beamish, 1985; Kauser & Shaw, 2004). In the alliance literature, the choice of a partner is explained by the task and/or partner characteristics (Geringer, 1991; Glaister & Buckley, 1996). This choice may become even more difficult in an international context because of the national differences between potential partners (Luo, 2002, 2007). Indeed, within the literature on international alliances, many studies highlight and analyse country differences between partners (Mayrhofer, 2004; Nielsen, 2007; Meschi & Riccio, 2008; Zaheer & Hernandez, 2011). These differences can be classified as different types of distance (Berry et al. 2010). A consensus has emerged that the different types of distance generally negatively affect both the likelihood and level of cooperation between partners. Consequently, firms tend to choose a local or regional business partner whenever possible (Rugman & Verbeke, 2004; Oh & Rugman, 2014; Ghemawat, 2016). For this reason, even if the question of distance is traditionally addressed within the context of international alliances, we argue that for most alliances (R&D, production, marketing etc.), domestic partners can be seen as substitutes to international partners, such that it is necessary to investigate both domestic and international alliances to understand the impact of the different types of distance on partner selection.

Building on the CAGE Distance Framework (Ghemawat, 2001), we aim to reveal how the different types of distance (divided into cultural, administrative, geographic and economic distance) impact the choice of a partner for a domestic or international alliance at the country level. The originality of this study lies in the fact that only a few studies have empirically investigated several distance dimensions simultaneously in an alliance context (Moalla, 2015; Choi and Contractor, 2016). Furthermore, so far, most distance-related studies have been performed at the firm level, even though research argues that to obtain a more holistic understanding of a phenomenon, one should also consider other levels of analysis (individuals, groups, enterprises, countries) (Felin & Foss 2009; Rousseau, 2011). In this study, we are interested in how the micro-level strategic decisions made at a company level are aggregated at the country level. Through this analysis, we hope to arrive at new insight into how different distance dimensions impact partner selection at a global level. Because the determinants might differ according to the type of entry mode or alliance, it is important to understand whether, at the aggregated level, some distance dimensions are more important than others.

To understand firms’ choices of alliance partners in an international context and using a country-level approach, we draw from the economic literature on bilateral trade and FDI. At first glance, alliances appear different from FDI because they require a lower investment of resources, as well as shared risk between the partners and access to the partner’s network resources (Gulati, 1998). However, alliances also have several commonalities with FDI, including location-based advantages (Kogut, 1985) and the challenge of entering unknown territory. Furthermore, some alliances (equity alliances such as joint ventures) are traditionally categorized as FDI. Consequently, we can state that in both FDI and alliances, companies face some common risks in regard to country differences, even if they can react differently to these risks (Canabal & White, 2008).

To investigate the role of the different types of distance, we use the Gravity model. The Gravity model shows that there is a positive relationship between countries’ economic sizes and trade, but there is a negative relationship between the distance separating the countries and trade (Buch et al., 2004; Combes et al. 2006). The Gravity model has been used to explain several other phenomena in addition to trade and FDI flows (Kleinert & Toubal, 2010). Consequently, we want to assess its relevance for predicting alliance flows between country pairs. To the best of our knowledge, this has never been done in the literature on domestic or international alliances. Based on the existing literature on Gravity models for FDI and on the literature on alliances, we propose five hypotheses. Our results show that that there is a positive relation between the number of alliances between country pairs and the economic size of the countries involved. In other words, the richer the partnering countries are, the more alliances we find between them. Secondly, we find that there is a negative relation between the geographic distance (measured in kilometres) between the partners and the number of alliances signed between the countries. This means that the farther away the partnering countries are physically, the fewer the alliances between them. Our findings also reveal that too much cultural distance negatively impacts the number of alliances between country pairs. Finally, we find that administrative and economic distances do not affect the number of alliances.

Our study contributes to research on strategic management, international business and economic theories. We contribute to the existing alliance literature, as well the international business literature, by testing several distance dimensions at a country level, which helps to broaden our understanding of the choice of alliance partner in an international context. We have found that it is relevant to divide distance into different dimensions and that each dimension impacts the choice of a partner differently. Our analysis therefore strengthens the results of several other studies that have highlighted the importance of country differences between companies (Mayrhofer, 2004; Kaufmann & O’Neil, 2007; Meschi & Riccio, 2008; Lavie et al., 2012). We also conclude that alliances, and therefore choices of partners, are more often made locally or between neighbouring countries, where geographical and cultural differences are reduced. This paper also contributes to the economic literature, more precisely, the gravity literature, as we show that the Gravity model is also useful in an alliance context and may help to better understand the choice of partner in an international context.

Literature review and hypotheses

The Gravity model: from international trade to FDI flows

The Gravity model is inspired by Newton’s gravity equation in physics, which states that the gravitational forces between two bodies depend on their mass and the distance between them (Zwinkels & Beugelsdijk, 2010). In the 1960s, the logic of Newton’s gravity equation was applied to the field of international trade by Tinbergen (1962) and Linnemann (1966). Applied in this context, the Gravity model postulates that the magnitude of international trade flows between two countries depends on the same two types of factors: 1) “Mass” factors, such as the economic size of the countries or their level of economic development (measured in GDP), which increase trade flows and 2) “distance” factors, such as the geographic distance or other barriers between the countries, which reduce trade flows (Fratianni et al., 2011).

The first contributions based on the Gravity model mainly aimed to describe bilateral trade flows (see Head & Mayer (2013) for a synthesis of empirical and theoretical contributions based on the gravity approach). In the last twenty years, a new stream of research, especially in economics, has applied the Gravity model to a different type of flows: Foreign Direct Investments (Kleinert & Toubal, 2010; Fratianni et al., 2011). This approach improved the existing theory of FDI, and it has been argued that the Gravity model is “…the most successful empirical specification for bilateral FDI” (Paniagua et al., 2015). However, Li and Vashchilko (2010) remark that even if the Gravity model is a solid empirical tool to explain FDI flows, its theoretical foundations are still limited. Some theoretical attempts have been proposed by authors such as Brainard (1997), Egger and Pfaffermayr (2004) and Kleinert and Toubal (2010), who develop models in which multinational firms face a trade-off between exporting and setting up a firm or plant in a foreign country using FDI.

Nevertheless, the largest body of research concerning FDI remains empirical, and it is structured around two streams of research. A first set of contributions aims at understanding the determinants of FDI bilateral flows. These contributions identify different forms of distance beyond traditional geographic distance, such as the impact of cultural or psychic distance (Dow & Ferencikova, 2010); they also consider other factors that reduce FDI flows, such as the level of political risk in the host country (Bevan & Estrin, 2004). In contrast, other researchers identify factors that mitigate the negative impact of distance, such as bilateral trade and investment agreements (Berger et al., 2013) or institutional factors (Benassy-Quéré et al., 2007). In parallel, a second set of contributions investigates more technical issues related to FDI bilateral flows. Some articles use the Gravity model to investigate the dynamics of FDI bilateral flows and to understand the impact of external shocks on their variations (Zwinkels & Beugelsdijk, 2010; Kahouli & Maktouf, 2015), while others analyse the impact of concentrating FDI on a limited number of firms on the value of the gravity coefficients (Paniagua et al., 2015).

An application of the Gravity model to international alliances

When considering research on FDI flows, all the articles mentioned above focus their attention on FDI as a whole. However, FDI can take many forms. According to the OECD, “…FDI is defined as a cross-border investment by a resident entity in one economy with the objective of obtaining a lasting interest in an enterprise resident in another economy”[1]. In other words, FDI is an investment made by a company or entity based in one country in a company or entity based in another country. Firms making foreign direct investments typically have a significant degree of influence and control over the foreign company into which the investment is made. Thus, FDI may take different forms, such as direct acquisition of a foreign firm, construction of a facility in the foreign country, or investment in a joint venture with a foreign partner. However, cooperative entry modes (e.g., alliances and joint ventures) are rarely treated specifically in the FDI literature.

In the present paper, we focus our attention on cooperative entry modes such as alliances for three reasons. First, cooperative entry modes are rarely treated specifically in the FDI literature, although their growth rate is twice as large as that of other types of FDI (Owen & Yawson, 2013). According to Greve et al. (2014), more than 4,000 alliances are created each year. Among these alliances, for the year 2015, the SDC (Securities Data Company) Platinum database reveals that joint ventures account for 80% of all strategic alliances created. Second, according to Raff et al. (2009), joint ventures account for 40% of FDI flows, but they have never been studied alone using the Gravity model. Consequently, studying FDI as a whole does not provide us with a clear picture of the potential specificities of joint ventures in the context of the Gravity model, and, in particular, it does not consider non-equity alliances. Finally, focusing on FDI does not allow us to take into account strategic alliances made nationally (which accounted for more than 49% of all alliances made in 2015).

Studies have found that the cultural differences between partners (Calantone & Zhao, 2001), as well as the partners’ political and economic differences (Meschi et al. 2017) and the structural complexity of their alliance (Shenkar, 1990), influence the success of the joint venture. Thus, within the research on FDI and cooperative entry modes, studies have already emphasized the importance of country differences. This is paradoxical because several researchers have highlighted that strategic alliances (including joint ventures) and wholly owned subsidiaries are impacted differently by the various forms of distance (Morschett et al., 2010; Brouthers, 2013, Moalla, 2015). For the reasons mentioned here, we are interested in knowing the extent to which FDI and alliances are similarly affected by country differences and how the Gravity model may help to explain these similarities.

No previous studies have investigated alliances as a whole (including not only domestic and international alliances but also equity and non-equity alliances) while simultaneously measuring country differences. Thus, we find that although a sizeable field of research has investigated FDI from a gravity perspective, almost no research has studied the bilateral flows of strategic alliances (i.e., joint ventures and non-equity agreements, which are not accounted for in FDI statistics). The only contribution to the study of strategic alliances that uses a gravity approach is that of Owen and Yawson (2013), but they use the gravity approach as a control model to test its impact on the information costs of cross-border strategic alliances. We thus find that it crucial to apply the Gravity model to both domestic and international alliances (joint ventures and non-equity agreements). Analysing the flow of alliances may help us broaden our understanding of firms’ choices of alliance partners.

The determinants of alliance flows: the key role of distance

When looking for a new alliance partner, firms can employ task-related as well as partner-related selection criteria (Shah & Swaminathan, 2008). The task-related criteria are associated with the partner’s skills and capabilities (Dussauge et al., 2007), whereas partner-related criteria are related to the characteristics of the partner, such as its national and corporate cultures (Luo, 1998; 2002). In the present paper, we aim to contribute to the literature that focuses on partner-related criteria by looking at how country differences affect the choice of partner in strategic alliances.

From the gravity literature on international trade and FDI bilateral flows, we know that countries’ sizes (measured by GDP) have a positive effect on the volume of the flow, while distance between two countries has a negative effect (Kleinert & Toubal, 2010; Head & Mayer, 2013). Limiting the concept of distance to the geographic distance between the two countries is, however, too restrictive if we seek to understand the flow of alliances. In fact, as research has progressed, other forms of distance have been integrated into the Gravity model, such as cultural distance (Dow & Ferencikova, 2010; Felbermayr & Toubal, 2010) and psychic and institutional distance (Benassy-Quéré et al., 2007). This is referred to as the “spirit of gravity,” wherein other estimations correlate with the geographical distance and the countries’ GDP (Head & Mayer, 2013).

Similarly, in the alliance literature, we find several contributions that have underlined the importance of country differences between the involved partners (Mayrhofer, 2004; Meschi & Riccio, 2008; Zaheer & Hernandez, 2011, Le Roy et al., 2016). These differences are significant, positively or negatively, for the results of the cooperation, and they convince a company to choose either a global partner or a local partner. A consensus has emerged – and most contributions have shown – that country differences affect business relations negatively, which is why companies tend to choose a “close” partner, physically, legally and mentally (Rugman & Verbeke, 2004). As shown in the FDI literature, these differences can be identified as different types of distances between the partners (Ghemawat, 2001).

Despite the large number of contributions to the subject, no consensus has yet been reached regarding how to specify and measure the concept of distance in the international business literature (Ambos & Håkanson, 2014). Thus, there seems to be a lack of clarity concerning the dimensions of distance as well as its measurement (Hutzschenreuter et al., 2015). When considering all types of distance found in the literature, the majority can be regrouped according to the division of cultural, administrative, geographic and economic distance, which constitutes the CAGE Distance Framework (Ghemawat, 2016). Most studies tend to analyse these dimensions separately, but Ghemawat offers a holistic framework that is based on the research by Johanson and Vahlne (1977). The industry and the countries involved in the different dimensions may affect the uncertainty of cooperation in different ways. The CAGE perspective is particularly relevant to gravity studies, as Ghemawat (2016) himself uses Gravity models to assess the impact of the different types of distance on several international flows (but not on alliances). The CAGE Distance Framework has already been tested in an alliance context (Moalla, 2015), but to the best of our knowledge, without applying the Gravity model.

Hypotheses

Following the structure of the CAGE Distance Framework mentioned above, we take a closer look at the four distance dimensions to propose four hypotheses related to their impact on the bilateral flows of alliances. In addition, according to the basic variables in the Gravity model, we include a hypothesis regarding the importance of the countries’ GDP levels.

Cultural distance

Cultural distance is most often recognized as stemming from informal institutions, such as national habits, beliefs, social norms and values. These are representative of their country and/or their organization and determine how the individuals and the organizations interact with others (Porter, 1990; Ghemawat, 2001; Hofstede, 2001). Too much cultural distance between the companies’ countries of origin is associated with a high degree of uncertainty and with difficulties in cooperation (Shenkar et al., 2008; Håkanson & Ambos, 2010; Trompenaars, 2010). It can create mistrust, misunderstandings, miscommunication and individual conflicts, which make the management of the alliance difficult (Parkhe, 1998; Ambos & Ambos, 2009; Kim & Parkhe, 2009). These factors can affect both the probability of market selection and the entry mode (Pedersen & Petersen, 2004; Chiambaretto & Wassmer, in press).

Out of the four types of distance in the CAGE Distance Framework, cultural distance seems to be the most blurred and has proven itself difficult to conceptualize and measure (Shenkar, 2012; Christoffersen, 2013). However, one example of an often-used measurement in distance research is Hofstede’s (1980) cultural values, which were later redefined by Kogut and Singh (1988): (1) Power distance refers to a country’s acceptance of inequality in social systems; (2) Individualism/collectivism is the degree to which people look after themselves and their families (individualism) versus the degree to which they identify with social groupings (collectivism); (3) Masculinity–femininity refers to the preference for achievement versus affiliation, as well as to traditional role distinctions between the sexes; (4) Uncertainty avoidance refers to the general level of discomfort with unstructured or unusual circumstances within a society. Later, Hofstede added two more dimensions: (5) Long term orientation, which refers to how each society maintains links with its own past while dealing with the challenges of the present and the future; and (6) Indulgence, which refers to the extent to which a society permits its members to enjoy life and have fun. When measuring cultural distance, these six cultural values are transformed into cultural scores that may help to determine cultural distance. Despite the rich use of this measure in international business research, Hofestede’s values have been criticized for relying on narrow and outdated data as well as for relying too much on Western values (Kogut & Singh, 1988; Shenkar, 2001). For these reasons, several frameworks that encompass other cultural dimensions have been proposed by researchers such as Trompenaars and Hampden-Turner (1998) and Shalom Schwartz (2014). The best-known alternative is the Global Leadership and Organizational Behavior Effectiveness (GLOBE) framework (House et al., 2004). Despite the concerns raised and the alternative cultural measures proposed, Hofestede’s index remains a dominant research instrument within culture-related studies (Dow, 2014), which is why we use this measurement in our study.

When using Hofstede’s cultural values or other measures in empirical studies, it is most often found that a strong level of cultural distance between the companies’ countries of origin can generate a high level of uncertainty (Shenkar, 2012; Hutzschenreuter et al., 2015). Consequently, fewer alliances should be observed between countries with a large cultural distance. Accordingly, more alliances should be found when there is a low level of cultural distance (Tung & Verbeke, 2010). Similarly, the gravity literature on trade and FDI flows has shown that cultural distance tends to reduce the flows between countries (De Groot et al., 2004; Benassy-Quéré et al., 2007).

We therefore propose the following hypotheses:

Hypothesis 1: The greater the level of cultural distance between two countries, the fewer the number of alliances signed between firms of these two countries.

Administrative distance

The creation of international alliances can be impacted by institutional arrangements in a given country because companies have to adapt and make choices from a defined set of legitimate options (Dong & Glaister, 2006). This determines the boundaries of opportunity and the constraints that companies encounter when creating an international alliance (Frankel & Rose, 2002; Chiambaretto, 2015). Legitimate options can be translated into national laws and policies, trading blocs, common currency and political hostility (Ghemawat, 2007), and the differences between countries’ institutional settings generate a particular level of administrative distance.

Local government policies are often observed as the most common barriers to cross-border cooperation. These barriers can be established either by the company’s home country or by an international organization (Prévot & Meschi, 2006; Lehiany & Chiambaretto, 2014; Estrin et al., 2016). If the legal barriers are important, or if the administrative standards are significantly different between the companies’ countries of origin, the administrative distance is considered to be large. According to Ghemawat (2016), firms are less likely to develop international interactions with countries that are administratively distant.

Furthermore, other studies argue that the presence of similar legal jurisdictions (i.e., low administrative distance) in countries can facilitate market entries and favour cross-border alliances (Berger et al., 2013; Brouthers, 2013). Research shows, for example, that European cross-border alliances are associated with a lower degree of legal uncertainty than are other international alliances (Mayrhofer, 2004). When they have similar levels of administration, firms from different countries tend to present a higher level of fit and can foster cooperation (Mitsuhashi & Greve, 2009; Greve et al., 2014). We therefore propose the following hypothesis:

Hypothesis 2: The greater the level of administrative distance between two countries, the fewer the number of alliances signed between firms of these two countries.

Geographical distance

Geographical distance, measured in kilometres between the companies’ countries of origin, naturally plays a role when a firm is choosing a partner abroad. The number of kilometres is more or less important depending on the industry and the sector of the partners, as it affects their transportation and communication costs (Ghemawat, 2001; Berry et al., 2010; Meyer et al., 2011). In general, both tangible and intangible products, as well as services, are affected by geographic distance (Brewer, 2007). However, it is also important to take into account the size and shape of each country (distance to borders, access to waterways, transport and communications infrastructure, etc.) (Ghemawat, 2007). All these parameters have an effect on the costs of the alliance and must be taken into consideration when choosing an international partner.

Research states that when looking at the flows of international trade or FDI, national and local factors are more significant than previously assumed and that distance and borders still play an important role in international business (Krugman 1997, Combes et al., 2005; Kleinert & Toubal, 2010). The number of trade flows decreases as the kilometres of transport increase, which Combes et al. (2006) refer to as the “distance tyranny” (p.116).

The same trends are found in the international alliance literature, where it is argued that the farther away a country is from a home country, the harder it is for the two partners to do business (Ganesan et al., 2005; Kraus et al., 2010). Despite a few contributions showing that geographical distance has a positive influence on international cooperation (Zaheer & Hernandez, 2011; Le Roy et al., 2016), the more general assumption is that the farther away a company seeks a partner, the harder it will be to conduct business with that partner (Kleinert & Toubal, 2010). This leads us to the following hypothesis:

Hypothesis 3: The greater the level of geographic distance between two countries, the fewer the number of alliances signed between firms of these two countries.

Economic distance

The less recognized dimension of distance is the economic dimension, as it is difficult to derive theoretically (Hutzschenreuter et al., 2015). However, it is often integrated into multidimensional measures (Head & Mayer, 2013) and is, for example, captured as differences between the wealth and sizes of countries, as measured by GDP, per-capita incomes, human development indices and differences in resources (financial, human, natural, infrastructure, information and knowledge) (Tinbergen, 1962; Combes et al. 2006; Kleinert & Toubal, 2010).

Economic distance between the companies’ countries of origin may help shed some light on the choice of an international partner, as economic distance is considered to have a negative effect on international business if the distance becomes too large (Brewer, 2007; Berry et al., 2010). In addition, more alliances can be found when the countries of the partnering firms are similar in their levels of development, so that firms from rich countries will partner more with firms from equally rich countries than with firms from poorer countries (Ghemawat, 2007; Meschi and Riccio, 2008). We therefore assume:

Hypothesis 4: The greater the level of economic distance between two countries, the fewer the number of alliances signed between firms of these two countries.

Market attractiveness

In addition to testing the four standard types of distance in the CAGE Distance Framework, we also set a standard hypothesis that is usually integrated into Gravity models.

It is shown in the alliance literature that rich countries engage in more cross-border activities and alliances compared with poorer countries because rich countries represent attractive markets for foreign firms (Meschi & Riccio, 2008; Tung & Verbeke, 2010). The concept of market attractiveness is essential in the gravity literature, whether it is for trade or FDI flows (Head & Mayer, 2013; Kleinert & Toubal, 2010). Indeed, the larger the country, the larger the number of firms and consumers, and consequently, the higher the likelihood of observing interactions that involve firms from this country. We thus state our final hypothesis:

Hypothesis 5: The greater the economic size of two countries, the greater the number of alliances signed between firms of these two countries.

Methods

Sample characteristics

To estimate our gravity equations for the flow of alliances, we relied on the SDC (Securities Data Company) Platinum database, which lists all public alliances around the world (Schilling, 2009). It contains a large amount of information, compiled since 1970, about alliances and joint ventures on a global scale. Alliances are mostly concentrated in a limited number of countries. To prevent our sample from having too many country pairs with no alliances between them (which would imply a large number of zeros in our analyses), we focused our attention on the bilateral flows of alliances among OECD countries and their associate members (China, India, South Africa, Indonesia and Brazil). Hereafter, the sample includes 39 countries. We have paired the countries without considering the “direction” of the alliances, yielding 741 country pairs (=39x38/2). In addition, we have added the domestic alliance flow for each of the 39 countries (39 + 741). This gives us a sample of 780 observations, which are detailed in Table 1. For the period of September 2014 to September 2015, 652 international and domestic alliances (equity and non-equity agreements) have been created among OECD and affiliate members. Regarding our sample, 49% of the alliances are domestic and 51% are international. It is important to stress that with regard to domestic alliances, we will experience a large number of zeros concerning the different types of distance, but this is no less interesting for our analyses. As shown by previous alliance research, a low distance (or even a distance equal to zero) may be seen as an advantage when looking for a partner and may thus have an impact on the total number of alliances. In fact, any type of distance (from 0 upward) is important when estimating gravity models (Head & Mayer, 2013). Table 1 below describes the number of alliances between the country pairs in the database. It shows that most country pairs (being the same or different countries) formed no alliances during the period. When alliances are created between two countries, the total number of alliances remains limited. Only a few country pairs (less than 3%) formed more than 10 alliances during the period.

Table 1

Descriptive statistics for the number of alliances between country pairs

Variables and measures

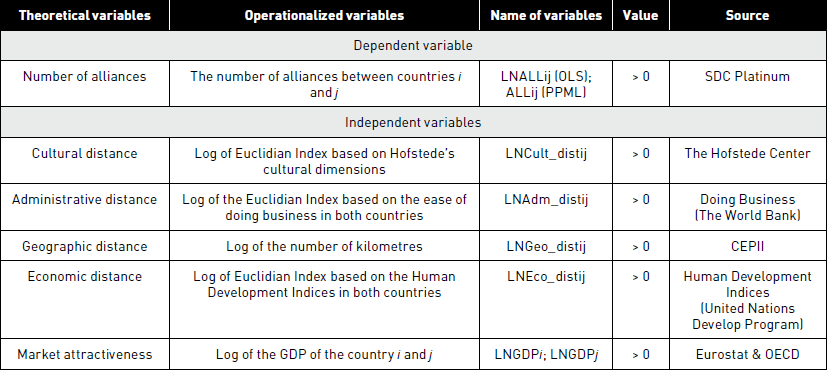

Dependent variable

The dependent variable, ALLij, measures the number of alliances between country i and country j. As we will explain in more detail below, we have used two methods to estimate the flow of alliances: an OLS with log-linear regrwession (OLS) and a Poisson Pseudo Maximum Likelihood (PPML)[2]. For the OLS regression, we have taken the log of the dependent variable. There are, therefore, two types of dependent variables: LNALLij (for the OLS) and ALLij (for the PPML).

Independent variables

Five independent variables are used in our models. The first four variables are related to the different types of distances highlighted in the CAGE Distance Framework.

(1) The first independent variable is cultural distance. It is measured as the log of the cultural distance between countries i and j (LNCult_distij). To create this variable, we collected data from the Hofstede Center’s website,[3] where we identified each country in the Hofstede Index. To merge these measures into one cultural value, we have used the Euclidian index and the Pythagorean Theorem (Drogendijk & Slangen, 2006). The distance has been calculated with the following formula: ![]() . The aggregated sum represents the cultural distance between two countries.

. The aggregated sum represents the cultural distance between two countries.

(2) The second independent variable assesses the administrative distance between two countries and is also measured as the log of the administrative distance (LNAdm_distij) between the two countries. For this variable, we relied on a construct similar to that used for cultural distance but based on the data available in the Doing Business Reports of the World Bank[4]. From the Doing Business Reports, we used the Distance to Frontier Score (DTF) from 2014 for each partnering country to create the variable.

(3) The third distance-related variable is the geographical distance between the countries. It is measured as the log of the distance between countries i and j in kilometres (LNGeo_distij). The geographic distance is measured between the most important cities (in terms of population and economic activity) of the two countries, which are – for the most part – also the official capitals[5]. The data are provided by the CEPII’s GeoDist database, which contains bilateral distances and country-specific information on approximately 225 countries (Mayer & Zignago, 2011). The database also provides geographical distance measures for within-country flows based on measures computed by weighted city population data from the principal cities in a country. This information is helpful for our analysis when dealing with domestic alliances for which we would like to avoid assuming that the geographical distance between the companies is equal to zero.

(4) The last distance-related variable is the economic distance between the countries. It is measured as the log of differences between scores on the Human Development Indices for countries i and j (LNEco_distij) in 2014, which are available on the website of the United Nations Development Program[6].

In addition, to estimate the impact of market attractiveness (5), and as a basic element of the Gravity model, we integrated the log of the GDP in 2014 for country i and country j using data from the OECD[7] and created two variables: LNGDPi and LNGDPj.

All the variables are summarized in Table 2 below.

Table 2

Variable presentation

Data analysis

Historically, because the gravity model is a multiplicative model, gravity equations used to be estimated using an OLS with log-linear specification (Fratianni et al., 2011; Head & Mayer, 2013). We therefore apply this method to our study. However, a log-linear specification raises several issues from an estimation point of view, and nonlinear specifications have been used more extensively in recent years. Indeed, Silva and Tenreyro (2006) show that in the presence of heteroscedasticity in the error term, the log-linearization can cause the OLS estimator to be biased. Furthermore, the log-linearization is incompatible with the presence of zeros for the dependent variables because several countries do not have any alliances between them. Omitting these zero-valued observations would create a biased sample that could lead to biased results (Helpman et al., 2008). Silva and Tenreyro (2006) instead suggest using a Poisson Pseudo Maximum Likelihood (PPML) model to estimate the parameters. PPML models are more robust in the presence of heteroscedasticity of error terms and are able to address data containing important zero-valued observations (Kleinert & Toubal, 2010; Fratianni et al., 2011; Head & Mayer, 2013).

Nevertheless, despite a stronger robustness of the PPML estimation, most articles using Gravity models combine OLS and PPML estimators to look for potential differences. Following this approach, we estimate the coefficients for two equations. The first equation (1) is based on the OLS model, while the second one (2) is based on the PPML model:

Results

Descriptive statistics

We provide descriptive statistics and the correlation matrix for the variables in Table 3 below.

First, we find a high correlation between the constant and the market attractiveness variables: LNGDPi (0.320) and LNGDPj (0.378). We see that there is a negative correlation between the dependent variable and the geographical distance variable (-0.048). Together with the variable of economic distance (0.008), this is the only correlation where the constant is not significant. The correlations with both cultural distance (-0.286) and administrative distance (-0.095) are significantly negative. There is no sign of multicollinearity (r > 9). This is confirmed by the VIF (Variance Inflation Factor), as we find no values higher than 2 (Neter et al., 1985).

Table 3

Descriptive statistics and correlations

Linear regression and PPML analysis

Table 4 helps us to analyse our two models, in which we test the impact of different distance measures on the number of alliances between country pairs. The table includes the results from the OLS with log-linear regression (OLS) as well as from the Poisson Pseudo Maximum Likelihood (PPML). We find that that all variables are highly significant except administrative distance and economic distance. We note that the significance of the variables remains the same for all estimation models used. Nevertheless, because the for the PPML analysis is stronger than that for the OLS, which indicates that this model better explains alliance flows; below, we report only the results of the PPML analysis (Silva & Tenreyro, 2006).

When looking into the results of the PPML analysis in greater depth, we find, consistent with our hypothesis, that there is a negative and significant relation between our dependent variable and the variable for cultural distance (β = -0.345, p < 0.05). The larger the cultural distance between country i and country j, the lower the number of alliances between the countries. Therefore, our results support hypothesis 1.

Second, we find no significant relation between the number of alliances created and the administrative distance (β = 0.039, p = 0.796). We therefore reject hypothesis 2.

Third, the geographic distance is found to have a negative and significant impact (β = -0.295, p < 0.05) on the dependent variable. So, the larger the geographical distance between country i and country j, the lower the number of alliances between companies belonging to these countries. The results are thus in line with our hypothesis 3.

Also, we find that there is no significant relation between the dependent variable and the economic distance (β = 2.967, p = 0.139). Based on the results, we reject hypothesis 4.

We further find that there is a positive and significant relation between the dependent variable Allij and the market attractiveness of the countries: LNGDPi (β = 0.628, p < 0.001) and LNGDPj (β = 0.924, p < 0.001). In other words, if the GDP of country i or j increases, more alliances are expected to be formed between firms from country i and country j. Based on these results, we confirm hypothesis 5.

Table 4

Results of the linear regressions

OLS: R2 = 0.33; PPML: R2 = 0.65; *p < 0.1; **p < 0.05; ***p < 0.01; ****p < 0.001. Numbers in parentheses are standard errors.

Additional analysis

Because our sample includes two different types of alliances – domestic and international – one could question whether the effect of the distances varies within each type of alliance. For that reason, we have compared the results of two PPML analyses: a sample including all alliances (domestic and international) and a sample including only international alliances. As expected, we found some similarities and differences in the coefficients. The signs and significance of the coefficients are the same for four variables (LNGDPi, LNGDPj, LNAdm_distij and LNGeo_distij); however, they differ for the variables that measure economic and cultural distance. We explain these differences based on the fact that when dividing the sample, we removed (or emphasized) some distance effects that play a key role in the choice between a domestic or an international partner. Because we wish to contribute to the international business literature, where the choice between doing business locally or internationally is central, we chose to discuss the results based on the full sample in order to provide the most complete picture of the distance effects.

Discussion and concluding remarks

The relevance of the Gravity model for understanding alliance flows between countries

First, our analysis shows that there is a positive relation between the number of alliances between country pairs and the economic size of the countries involved in the alliance. Second, we find that there is a negative relation between the number of alliances between a pair of countries and the geographical distance between the countries. These two results confirm the theory behind the Gravity model, which, in our study, has also proven to be valid in an alliance setting.

Third, the statistical results showed that other distance dimensions from the CAGE Distance Framework might also help explain the number of alliances between country pairs. We found that too much cultural distance decreases the number of alliances between countries. This is interesting in a global world where firms can potentially work with anybody they wish to but where cultural differences apparently still create obstacles to cooperation. This point confirms the results of the “alliance” contributions in the literature that have highlighted this relationship (Kaufmann & O’Neil, 2007; Meschi & Riccio, 2008; Beugelsdijk et al., 2014; Li & Parboteeah, 2015). It could also indicate that the success of alliances depends heavily on the people involved in them (Herrmann & Datta, 2002; Prévot & Meschi, 2006; Ambos & Ambos, 2010), particularly where cultural differences can be considered a challenge.

Lastly, we found no relation between administrative distance and economic distance and the number of alliances between country pairs. We suspect that this is related to our sample consisting of OECD countries and their partners. Regarding administrative distance, we note that the composition of our sample may lead to the inclusion of countries that are quite close from an administrative point of view. Consequently, this criterion does not explain most of the variation in alliance flows between country pairs, and thus it is not surprising to have a non-significant coefficient.

Quite similar reasoning could be applied to economic distance. The OECD countries mainly consist of Western countries and thus advanced economies; however, some of their key partners are Brazil, India and China. These emerging economies have undergone explosive growth in recent years; they have become global markets that many advanced economies seek to enter using alliances (Ghemawat, 2016). For these reasons, one could expect to find many alliances between companies from advanced and emerging economies, a finding that is not congruent with the high level of economic distance between these actors. This trend could be one explanation for the non-validation of our hypothesis.

Overall, we find that the Gravity model has proven itself useful in a strategic alliance setting and, when integrating different distance dimensions from the CAGE Distance Framework, it has helped us to understand the structure of alliance flows between country pairs. Our results indicate that the distance dimensions impact the number of alliances between countries differently. This discovery can be used to broaden our understanding of which factors impact the choice of an alliance partner.

Contributions to the existing literature

The starting point of this paper was the use of the Gravity model, as applied in research on FDI. Beyond the FDI context, the gravity literature has also been used in many other contexts, such as trade flows (Head & Mayer, 2013), financial flows (Kleinert & Toubal, 2010), immigration flows (Lewer & Van den Berg, 2008) and social networks (Combes et al., 2005). However, to our knowledge, the gravity approach has never been used in a strategic alliance setting. This is surprising because we know that joint ventures account for 40% of FDI; therefore, there seems to be much to learn about how the Gravity model can be used to explain the formation of strategic alliances both nationally and internationally.

With this study, we have confirmed that the Gravity model is a useful tool when looking at alliance flows. We found that the basic elements of the Gravity model (the negative effect of geographic distance and the positive effect of the level of economic development of the countries) are also valid in an alliance context. Furthermore, we found that the Gravity model is very well adapted to including other types of distances that also affect the alliance flow, such as cultural distance.

We found it fruitful to divide distance between partners into the different distance dimensions and to test these simultaneously. Using the Gravity model to test our hypotheses, we found that the different distance dimensions impact the alliance flow differently. Our analysis contributes to the results of several other studies that have highlighted the importance of partner-related criteria and country differences between partners (Geringer, 1991; Mayrhofer, 2004; Kaufmann & O’Neil, 2007; Meschi & Riccio, 2008; Lavie et al., 2012). By testing the distance dimensions simultaneously, we join the small group of authors who have treated several distance dimensions at the same time to obtain a more holistic understanding of the impact of distance on international cooperation (Angué & Mayrhofer, 2010; Berry et al., 2010; Moalla, 2015; Choi and Contractor, 2016).

However, our results concerning administrative distance and economic distance are different from the results of most other studies in the existing literature (Nielsen, 2003; Majocchi et al., 2013). We found that these types of distance do not have a significant impact on the number of alliances between countries. We suspect that this result is related to the content of our sample: OECD countries and their partners.

Managerial implications

This study aims at informing both academics and practitioners by giving them insights into the effects of different distance dimensions on partner selection. We also provide tools with which to analyse and approach these differences. These tools include the awareness of country differences and the use of the CAGE Distance Framework, as well as the use of the Gravity model in a partner selection context. If managers do not take this into account, they take the risk that country differences will inhibit – rather than reinforce – their strategies. We thus hope that our findings will serve as guidelines for practitioners and be a useful complement to economic reports and analyses produced by companies when looking for new partners for alliances. Our results encourage decision makers to integrate all of the distance dimensions into their analyses to obtain a more complete picture of potential risks and advantages when choosing an alliance partner.

Limitations and directions for future research

These conclusions cannot be accepted without considering their limitations, which offer interesting opportunities for further studies. Theoretically, the concept of distance has been treated by other research disciplines but has been defined differently, as seen in the concept of proximity in economics (Porter, 1998) and in the concepts of embeddedness and syndication networks in sociology (Sorenson & Stuart, 2001; Carrincazeaux et al., 2008). It would be interesting to combine these definitions and theories to expand our understanding of the concept of distance.

Furthermore, we have not looked into the “direction” of the alliances. Integrating an inward/outward perspective could affect our findings, as the objectives of these two types of alliances are different (Welch & Luostarinen, 1993) and could deepen our understanding of partner choices. Empirically, we are aware that other explanatory factors may explain the choice of an alliance partner. Other explanatory factors could include company size, network dynamics, technology or production complementarity, and norms and contract regulations, all of which might be sector-dependent (Greve et al., 2014). The different distance dimensions should have different effects depending on the industry, as certain industries are more distance-sensitive than others (Ghemawat, 2016). The same could be said about the location of an alliance, as we found some differences between the effect of distances in domestic and international alliances in our robustness analysis of the results. It would be interesting to integrate a larger research context by testing how the type and location of alliances, the alliance industry and the object of the alliance are affected by the different distance dimensions.

In addition, our approach was mainly static and did not consider the impact of international experience or previous alliances on the flows of alliances between countries. The different types of distance are in fact dynamic and change over time. International experience allows companies to accumulate skills and capabilities, and it is often seen as a way to reduce the liability of foreignness (Prévot & Meschi, 2006; Kaufmann & O’Neil, 2007; Chakrabarti & Mitchell, 2013; Christoffersen, 2013; Hutzschenreuter et al., 2015). Continuous contact increases the level of trust between the partners and thus facilitates their cooperative relationship (Zhou & Guillén, 2015). Research also shows that it is advantageous for the alliance managers in a company to have cosmopolitan profiles, which can mitigate the effects of cultural differences (Nielsen & Nielsen, 2011). Along with the positive effect of international experience comes the longevity of the alliance. It is shown that, for example, longevity moderates the negative effect of cultural distance (Meschi & Riccio, 2008). Extending our results to include the above-mentioned perspectives could be a promising avenue for future research.

Parties annexes

Acknowledgements

We would like to thank the editors Nadine Tournois and Philippe Very for their helpful and constructive comments. We also wish to thank the two anonymous reviewers for their high-quality comments and discussions, which have helped to improve the quality of the article. We are also grateful to Pierre-Xavier Meschi for comments on an earlier version of the research. Finally, we would like to thank LABEX Entreprendre for the financial support for this work.

Biographical notes

Juliane Engsig is PhD fellow in Strategic Management at the University of Montpellier (Montpellier Management Institute). Her research interests revolve around alliance formation, determinants for partner choice and the importance of distances in inter-organizational relationships. Her PhD is financed by the Labex Entreprendre.

Paul Chiambaretto is Associate Professor of Strategy and Marketing at Montpellier Business School and Associate Researcher at Ecole Polytechnique. His research focuses on inter-organizational strategies such as alliances and coopetition, with an emphasis on the air transport industry. He was appointed to several visiting researcher positions at Oxford University (UK), at Concordia University (Canada) and at Umea University (Sweden). His research has been published in ranked journals such as Industrial Marketing Management, International Studies of Management and Organization, Long Range Planning, M@n@gement, Recherche et Applications en Marketing, Management International, Annals of Regional Science, Journal of Air Transport Management, etc.

Frédéric Le Roy is Professor in Strategic Management at the University of Montpellier (Montpellier Management Institute) and Montpellier Business School. He is head of the research group MRM-Strategic Management and head of the Coopetition Lab (hosted by the Labex Entreprendre). He is also director of the Master Consulting in Management, Organization and Strategy. His researches focus on coopetition, open innovation and entrepreneurships. He published several books and many research articles in journals as Long Range Planning, British Journal of Management, European Management Review, Industrial Marketing Management, Small Business Economics, etc.

Notes

- [1]

-

[2]

Because of the many zeros that are not defined in the logarithm, we have calculated the log values as log(1+x)

- [3]

- [4]

-

[5]

For 13 of the 225 countries, the CEPII database considers that the capital is not the “economic center” of the country but another city. For these cases, the distance data are computed from both the capital and the economic center city (Mayer & Zignago, 2011: 9).

- [6]

- [7]

Bibliography

- Ambos, Tina; Ambos, Björn (2009). “The impact of distance on knowledge transfer effectiveness in multinational corporations”, Journal of International Management, vol. 15, n° 1, p. 1-14.

- Ambos, Björn; Håkanson, Lars (2014). “The Concept of Distance in International Management Research”, Journal of International Management, vol. 20, n°1, p. 1-7.

- Angue, Katia; Mayrhofer, Ulrike (2010). “Coopérations internationales en R&D: les effets de la distance sur le choix du pays des partenaires”, M@n@gement, vol. 13, n°1, p. 2-37.

- Beamish, Paul W. (1985). “The characteristics of joint ventures in developed and developing countries”, Columbia Journal of World Business, vol. 20, p. 13–19.

- Beamish, Paul W.; Lupton, Nathaniel C. (2016). “Cooperative strategies in international business and management: Reflections on the past 50 years and future directions”, Journal of World Business, vol. 51, n° 1, p. 163-175.

- Benassy-Quéré, Agnès; Coupet, Maylis; Mayer, Thierry (2007). “Institutional Determinants of Foreign Direct Investment”, The World Economy, vol. 30, n°5, p. 764-782.

- Berger, Axel; Busse, Matthias; Nunnenkamp, Peter; Roy, Martin (2013). “ Do trade and investment agreements lead to more FDI? Accounting for key provisions inside the black box”, International Economics and Economic Policy, vol. 10, n°2, p. 247-275.

- Beugelsdijk, Sjoerd; Slangen, Arjen; Maseland, Robbert; Onrust, Marjolijn (2014). “The impact of home-host cultural distance on foreign affiliate sales: The moderating role of cultural variation within host countries”, Journal of Business Research, vol. 67, n°8, p. 1638-1646.

- Bevan, Alan A.; Estrin, Saul (2004). “The determinants of foreign direct investment into European transition economies”, Journal of Comparative Economics, vol. 32, n°4, p. 775-787.

- Berry, Heather; Guillén, Mauro F; Zhou, Nan (2010). “An institutional approach to cross-national Distance”, Journal of International Business Studies, vol. 41, n° 9, p. 1460-1480.

- Brainard, Lael. S. (1997). “An Empirical Assessment of the Proximity Concentration Trade off between Multinational Sales and Trade”, American Economic Review, vol. 87, n° 4, p. 520-544.

- Brewer, Paul A. (2007) “Operationalizing psychic distance: a revised approach”, Journal of International Marketing, vol. 15, n°1, p. 44–66.

- Brouthers, Keith D. (2013). “A retrospective on: Institutional, cultural and transaction cost influences on entry mode choice and performance”, Journal of International Business Studies, vol. 44, n°1, p. 14-22.

- Brouthers, Keith. D.; Hennart, Jean-Francois (2007). “Boundaries of the firm: Insights from international entry mode research”, Journal of Management, vol. 33, n°3, p. 395–425.

- Buch, Claudia; Kleinert, Jörn; Toubal, Farid (2004) “The distance puzzle: on the interpretation of the distance coefficient in gravity equations”, Economic Letters, vol. 83, n° 3, p. 293–298.

- Calantone, Roger J; Zhao, Yushan S. (2001). “Joint Ventures in China: A Comparative Study of Japanese, Korean, and U.S. Partners”, Journal of International Marketing, vol. 9, n°1, p. 1-23.

- Canabal, Anne; White, George O. (2008). “Entry mode research: Past and future”, International Business Review, vol. 17, p. 267-284.

- Carrincazeaux, Christophe; Grossetti, Michel; Talbot, Damien (2008). “Clusters, Proximities and Networks”, European Planning Studies, vol. 16, n°5, p. 613-616.

- Chakrabarti, Abhirup; Mitchell, Will (2013). “The persistent effect of geographic distance in acquisition target selection”, Organization Science, vol. 24, n° 6, p. 1805–1830.

- Chiambaretto, Paul (2015). “Resource Dependence and Power-balancing Operations in Alliances: The Role of Market Redefinition Strategies”, M@n@gement, vol. 18, n° 3, p. 205–233.

- Chiambaretto, Paul, Wassmer, Ulrich. in press. “Resource utilization as an internal driver of alliance portfolio evolution: The Qatar Airways case (1993–2010)”, Long Range Planning, (p. 1-21).

- Christoffersen, Jeppe (2013). “A Review of Antecedents of International Strategic Alliance Performance: Synthesized Evidence and New Directions for Core Constructs”, International Journal of Management Reviews, vol. 15, n° 1, p. 66–85.

- Choi, Jeongho; Contractor, Farok (2016). “Choosing an appropriate alliance governance mode: The role of institutional, cultural and geographical distance in international research & development (R&D) collaborations”, Journal of International Business Studies, vol. 47, n°2, p. 210-232.

- Combes, Pierre-Philippe; Lafourcade, Miren; Mayer, Thierry (2005). “The trade-creating effects of business and social networks: evidence from France”, Journal of International Economics, vol. 66, n° 1, p. 1-29.

- Combes, Pierre-Philippe; Mayer, Thierry; Thisse, Jacques-François (2006). Economie géographique: l’intégration des régions et des nations, Paris: Economica, 350 p.

- Dacin, Tina M.; Hitt, Michael A; Levitas, Edward (1997). “Selecting partners for successful international alliances: Examination of U.S. and Korean firms”, Journal of World Business, vol. 32, n° 1, p. 3–16.

- De Groot, Henri L. F.; Linders, Gert-Jan; Rietveld, Piet; Subramanian, Uma (2004). “The Institutional Determinants of Bilateral Trade Patterns”, International Review for Social Sciences, vol. 57, n°1, p. 103-123.

- Dong, Li; Glaister, Keith W. (2006); “Motives and partner selection criteria in international strategic alliances: Perspectives of Chinese firms”, International Business Review, vol. 15, n° 6, p. 577-600.

- Dow, Douglas; Ferencikova, Sonia (2010). “More than just national cultural distance: Testing new distance scales on FDI in Slovakia”, International Business Review, vol. 19, n° 1, p. 46-58.

- Dow, Douglas (2014). “Distance in International Business Research: Are We Really making Any Progress?”, dans M. Laaksonen, A. Arslan & M. Kontkanen (eds.), Contributions to International Business: Essayes in Honour of Professor Jorma Larimo, Vaasa, Finland: University of Vaasa, p. 119-140.

- Drogendijk, Rian; Slangen, Arjen (2006). “Hofstede, Schwartz, or managerial perceptions? The effects of different cultural distance measures on establishment mode choices by multinational enterprises”, International Business Review, vol. 15, n° 4, p. 361-380.

- Dunning, John H. (1995). “Reappraising the eclectic paradigm in an age of alliance capitalism”, Journal of International Business Studies, vol. 26, n° 3, p. 461–491.

- Dussauge, Pierre; Garette, Bernard; Mitchell, Will (2007). “Asymmetric Performance: The Market Share Impact of Scale and Link Alliances in the Global Auto Industry”, Strategic Management Journal, vol. 25, n° 7, p. 701–711.

- Egger, Peter; Pfaffermayr, Michael (2004). “Distance, trade and FDI: a Hausman–Taylor SUR approach”, Journal of applied Econometrics, vol. 19, n°2, p. 227-246.

- Estrin, Saul; Meyer, Klaus E.; Nielsen, Bo B.; Nielsen, Sabina (2016). “Home country institutions and the internationalization of state owned enterprises: A cross-country analysis”, Journal of World Business, vol. 51, n° 2, p. 294-307.

- Felbermayr, Gabriel; Toubal, Farid (2010). “Cultural proximity and trade”, European Economic Review, vol. 54, n° 2, p. 279–293.

- Felin, Teppo; Foss, Nicolai J. (2009). “Organizational routines: Historical drift, a course-correction, and prospects for future work”, Scandinavian Journal of Management, vol. 25, n° 2, p. 157-167.

- Frankel, Jeffrey; Rose, Andrew (2002). “An Estimate of the Effect of Common Currencies on Trade and Income”, The Quarterly Journal of Economics, vol. 117, n° 2, p. 437-466.

- Fratianni, Michele U.; Marchionne, Francesco; HoonOh, Chang (2011). “A commentary on the gravity equation in international business research”, The Multinational Business Review, vol. 19, n°1, p. 36-46.

- Ganesan, Shankar; Malter, Alan J.; Rindfleisch, Aric (2005). “Does Distance Still Matter? Geographic Proximity and New Product Development”, Journal of Marketing, vol. 69, n° 4 p. 44-60.

- Geringer, John M. (1991). “Strategic determinants of partner selection criteria in international joint ventures)”, Journal of International Business, vol. 22, n° 1, p. 41-62.

- Ghemawat, Pankaj (2016). The Laws of Globalization and Business Applications, Cambridge: Cambridge University Press, 391p.

- Ghemawat, Pankaj (2007). Redefining Global Strategy. Crossing Borders in A World Where Differences Still Matter, Boston, Massachusetts: Harvard Business Review Press, 257p.

- Ghemawat, Pankaj (2001). “Distance Still Matters. The Hard Reality of Global Expansion”, Harvard Business Review, vol. 79, n° 8, p. 137–147.

- Glaister, Keith W.; Buckley, Peter J. (1996). “Strategic motives for international alliance formation”, Journal of Management Studies, vol. 33, n° 3, p. 301-332.

- Greve, Henrich; Rowley, Tim; Shipilov, Andrew (2014). Network advantage: How to Unlock Value From Your Alliances and Partnerships, New Jersey: John Wiley & Sons, 320 p.

- Gulati, Ranjay (1998). “Alliances and networks”, Strategic Management Journal, vol. 19, n° 4, p. 293–317.

- Head, Keith; Mayer, Thierry (2013). “Gravity Equations: Workhorse, Toolkit, and Cookbook. International trade and regional economics”, CEPR Discussion Paper, Centre for Economic Policy Research, n° 9322, p. 1-65.

- Helpman, Elhanan, Melitz, Marc, Rubinstein, Yona (2008). “Estimating Trade Flows: Trading Partners and Trading Volumes”, Quarterly Journal of Economics, vol. 123, n°2, p. 441-487.

- Herrmann, Pol; Datta, Deepak K. (2002). “CEO Successor Characteristics and the Choice of Foreign Market Entry Mode: An Empirical Study”, Journal of International Business Studies, vol. 33, n° 3, p. 551-569.

- Hofstede, Geert (2001). Culture’s Consequences: Comparing Values, Behaviors, Institutions, and Organizations Across Nations, Sage Publications: Berverly Hills, 616 p.

- Hofstede, Geert (1980). Culture’s consequences: International differences in work-related values, Berverly Hills: Sage Publications, 328p.

- House, Robert J.; Hanges, Paul J.; Javidan, Mansour; Dorfman, Peter W.; Gupta, Vipin (2004). Culture, Leadership, and Organizations: The Globe Study of 62 Societies, Thousand Oaks: Sage Publications, 848p.

- Hutzschenreuter, Thomas; Kleindienst, Ingo; Lange, Sandra (2016). “The Concept of Distance in International Business Research: A Review and Research Agenda”, International Journal of Management Reviews, vol. 18, n°2, p. 160-179.

- Håkanson, Lars; Ambos, Björn (2010). “The antecedents of physic distance”, Journal of International Management, vol. 16, n° 3, p. 195-210.

- Johanson, Jan; Vahlne, Jan-Erik (1977). “The internationalization process of the firm – a model of knowledge development and increasing foreign market commitment”, Journal of International Business Studies, vol. 8, n° 1, p. 23-32.

- Kahouli, Bassem; Maktouf, Samir (2015). “The determinants of FDI and the impact of the economic crisis on the implementation of RTAs: A static and dynamic Gravity model”, International Business Review, vol. 24, n°3, p. 518-529.

- Kaufmann, Jeffrey B.; O’neil, Hugh M. (2007). “Do culturally distant partners choose different types of joint ventures?”, Journal of World Business, vol. 42, n° 4, p. 435–448.

- Kauser, Saleema; Shaw, Vivienne (2004). “International strategic alliances: objectives, motives and success”, Journal of Global Marketing, vol. 17, n° 2/3, p. 7-43.

- Kim, Jooheon; Parkhe, Arvind (2009). “Competing and Cooperating Similarity in Global Strategic Alliances: An Exploratory Examination”, British Journal of Management, vol. 20, n° 3, p. 363–376.

- Kleinert, Jörn; Toubal, Farid (2010). “Gravity for FDI”, Review of International Economics, vol. 18, n° 1, p. 1–13.

- Kogut, Bruce; Singh, Harbir (1988). “The Effect of National Culture on the Choice of Entry Mode”, Journal of International Business Studies, vol. 19, n° 3, p. 411-432.

- Kogut, Bruce (1985). “Designing global strategies: profiting from operational flexibility”, MIT Sloan Management Review, vol. 26, p. 27–38.

- Kraus, Sascha; Ambos, Tina C.; Eggers, Felix; Cesinger, Beate (2015). “Distance and perceptions of risk in internationalization decisions”, Journal of Business Research, vol. 68, n°7, p. 1501-1505.

- Krugman, Paul (1997) Development, geography, and economic theory, Massachusetts: The MIT Press, 128p.

- Lavie, Dovev; Haunschild, Pamela R.; Khanna, Poonam (2012). “Organizational differences, relational mechanisms, and alliance performance”, Strategic Management Journal, vol. 33, n° 13, p. 1453-1479.

- Lehiany, Benjamin; Chiambaretto, Paul (2014). “ASMA: Un dispositif d’Analyse Séquentielle et Multidimensionelle des Alliances”, Management international, vol. 18, p. 88–105.

- Le Roy, Frédéric; Robert, Marc; Lasch, Frank (2016). “Choosing the best partner for product innovation: Talking to the enemy or to a friend?”, International Studies of Management & Organization, vol. 46, n° 2, p. 1-20.

- Lewer, Joshua J.; Van Den Berg, Hendrik (2008) “A Gravity model of immigration”, Economics Letters, vol. 99, n° 1, p. 164-167.

- Li, Chengguanf; Parboteeah, Praveen (2015). “The effect of culture on the responsiveness of firms to mimetic forces: imitative foreign joint ventures entries into China, 1985-2003”, Journal of World Business, vol. 50, n° 3, p. 465-476.

- Li, Quan; Vashchilko, Tatiana (2010). “Dyadic military conflict, security alliances, and bilateral FDI flows”, Journal of International Business Studies, vol. 41, n° 5, p. 765-782.

- Linnemann, Hans (1966). An Econometric Study of International Trade Flows. Amsterdam: North-Holland, 234p.

- Luo, Yadong (2007). “Are joint venture partners more opportunistic in a more volatile environment?”, Strategic Management Journal, vol. 28, n° 1, p. 39-60.

- Luo, Yadong (2002). “Contract, cooperation, and performance in international joint ventures”, Strategic Management Journal, vol. 23, n° 10, p. 903–919.

- Luo, Yadong (1998). “Joint venture success in China: How should we select a good partner?”, Journal of World Business, vol. 33, n° 2, p. 145–166.

- Majocchi, Antonio; Mayrhofer, Ulrike; Camps, Joaquin (2013). “Joint ventures or non-equity alliances? Evidence from Italian firms”, Management Decision, vol. 51, n°2, p. 380-395.

- Mayrhofer, Ulrike (2004). “The influence of national origin and uncertainty on the choice between cooperation and merger-acquisition: an analysis of French and German firms”, International Business Review, vol. 13, n° 1, p. 83–99.

- Mayer, Thierry; Zignago, Soledad (2011). “Notes on CEPII’s distances measures: the GeoDist Database”, CEPII Working Paper 2011-25.

- Meschi, Pierre-Xavier; Riccio, Edson Luiz (2008). “Country risk, national cultural differences between partners and survival of international joint ventures in Brazil”, International Business Review, vol. 17, n° 3, p. 250–266.

- Meschi, Pierre-Xavier; Ricard, Antonin; Moore, Ernesto Tapia (2017). “Fast and Furious or Slow and Cautious? The Joint Impact of Age at Internationalization, Speed, and Risk Diversity on the Survival of Exporting Firms”, Journal of International Management, vol. 23, n° 3, p. 279-291.

- Meyer, Klaus E.; Mudambi, Ram; Narula, Rajneesh (2011). “Multinational Enterprises and Local Contexts: The Opportunities and Challenges of Multiple Embeddedness”, Journal of Management Studies, vol. 42, n° 2, p. 235-252.

- Mitsuhashi, Hitoshi; Greve, Henrich (2009). “A Matching Theory of Alliance Formation and Organizational Success: Complementarity and Compatibility”, Academy of Management Journal, vol. 52, n° 5, p. 975–995.

- Moalla, Emna (2015). “Vers une approche multidimensionnelle de la distance face au choix du mode de rapprochement sur les marchés étrangers”, Management International, vol. 19, p. 117-134.

- Morschett, Dirk; Schramm-Klein, Hanna; Swoboda, Bernhard (2010). “Decades of research on market entry modes: What do we really know about external antecedents of entry mode choice?”, Journal of International Management, vol. 16, n°1, p. 60-77.

- Neter, John; Wasserman, William; Kutner, Michael H. (1985) Applied linear statistical models: Regression, analysis of variance, and experimental design, Homewood: R. D. Irwin, 1408p.

- Nielsen, Bo Bernhard (2007). “Determining international strategic alliance performance: A multidimensional approach”, International Business Review, vol. 16, n° 3, p. 337-361.

- Nielsen, Bo Bernhard (2003). “An Empirical Investigation of the Drivers of International Strategic Alliance Formation”, European Management Journal, vol. 21, n° 3, p. 301-322.

- Nielsen, Bo Bernhard; Nielsen, Sabina (2011). “The Role of Top Management Team International Orientation in Strategic Decision-Making: The Choice of Foreign Entry Mode”, Journal of World Business, vol. 46, n°2, p. 185-93.

- Oh, Chang Hoon; Rugman, Alan M. (2014). “The Dynamics of Regional and Global Multinationals, 1999-2008”, Multinational Business Review, vol. 22, n°2, p. 108-117.

- Owen, Sian; Yawson, Alfred (2013). “Information asymmetry and international strategic alliances”, Journal of Banking & Finance, vol. 37, n°10, p. 3890-3903.

- Parkhe, Arvind (1998). “Understanding trust in international alliances”, Journal of World Business, vol. 33, n° 3, p. 219–240.

- Pangarkar, Nitin; Klein, Saul (2001). “The impact of alliance purpose and partner similarity on alliance governance”, British Journal of Management, vol. 12, n° 4, p. 341-353.

- Paniagua, Jordi; Figueiredo, Erik; Sapena, Juan (2015). “Quantile regression for the FDI gravity equation”, Journal of Business Research, vol. 68, n°7, p. 1512-1518.

- Pedersen, Torben; Petersen, Bent (2004). “Learning About Foreign Markets: Are Entrant Firms Exposed to a “Shock Effect”?”, Journal of International Marketing, vol. 12, n° 1, p. 103-123.

- Porter, Michael E. (1990). “The competitive advantage of nations”, Competitive Intelligence Review, vol. 1, n° 1, p. 73-93.

- Porter, Michael E. (1998). “Clusters and the new economics of competition”, Harvard Business Review, vol. 76, n°6, p. 77-90.

- Prévot, Frédéric; Meschi, Pierre-Xavier (2006). “Evolution of an International Joint Venture: The case of a French-Brazilian Joint Venture”, Thunderbird International Business Review, vol. 48 n° 3, p. 297-319.

- Raff, Horst; Ryan, Michael; Stähler, Frank (2009). “The choice of market entry mode: Greenfield investment, M&A and joint venture”, International Review of Economics & Finance, vol. 18, n° 1, p. 3-10.

- Rousseau, Denise M. (2011). “Reinforcing the Micro/Macro Bridge: Organizational Thinking and Pluralistic vehicles”, Journal of Management, vol. 37, n° 2, p. 429-442.

- Rugman, Alan M.; Verbeke, Alain (2004). “A Perspective on Regional and Global Strategies of Multinational Enterprises”, Journal of International Business Studies; vol. 35, n°1, p. 3-18.

- Schilling, Melissa (2009). “Understandig the alliance data”, Strategic Management Journal, vol. 30, n° 3, p. 233-260.

- Schwartz, Shalom H. (2014). “National Culture as Value Orientations: Consequences of Value Differences and Cultural Distance”, dans V. A. Ginsburgh & D. Throsby (eds.), Handbook of the Economics of Art and Culture, Oxford: Elsevier, p. 547-586

- Shah, Reshma; Swaminathan, Vanitha (2008). “Factors influencing partner selection in strategic alliances: the moderating role of alliance context”, Strategic Management Journal, vol. 29, n° 5, p. 471-494.

- Shenkar, Oded (2012). “Beyond cultural distance: Switching to a friction lens in the study of cultural differences”, Journal of International Business Studies, vol. 43, n° 1, p. 12-17.

- Shenkar, Oded (2001). “Cultural distance revisited: toward a more rigorous conceptualization and measurement of cultural difference”, Journal of International Business Studies, vol. 32, n° 3, p. 519-535.

- Shenkar, Oded (1990). “International Joint Venture’s Problems in China: Risk and Remedies”, Long Range Planning, vol. 23, n° 3, p. 82-90.

- Shenkar, Oded; Luo, Yadong; Yeheskel, Orly (2008). “From “distance” to “friction”: substituting metaphors and redirecting intercultural research”, Academy of Management Review, vol. 33, n° 4, p. 905-923.

- Silva, Santos; Tenreyro, Silvana (2006). “The Log of Gravity”, Review of Economics and Statistics, vol. 88, n° 4, p. 641–658.

- Sorenson, Olav; Stuart, Toby E. (2001). “Syndication Networks and the Spatial Distribution of Venture Capital Investments”, American Journal of Sociology, vol. 106, n°6, p. 1546-1588.

- Tinbergen, Jan (1962). Shaping the World Economy: Suggestions for an International Economic Policy, New York, Twentieth Century Fund, 346p.

- Trompenaars, Alfon; Hampden-Turner, Charles (1998). Riding the Waves of Culture; Understanding Cultural Diversity in Global Business, 2nd edn, New York; McGraw Hill, 274p.

- Trompenaars, Fons; Maarten Asser N. (2010). The Global M & A Tango: Cross-Cultural Dimensions of Mergers and Acquisitions, Oxford: Infinite Ideas Limited, 256 p.

- Tung, Rosalie L.; Verbeke, Alain (2010). “Beyond Hofstede and GLOBE: Improving thequality of cross-cultural research”, Journal of International Business Studies, vol. 41, n° 8, p. 1259-1274.

- Welch, Lawrence S.; Luostarinen, Reijo K. (1993). “Inward-Outward Connections in Internationalization”, Journal of International Marketing, vol. 1, n 1, p. 44-56.

- Zaheer, Akbar; Hernandez, Exequiel (2011). “The geographic scope of the MNC and its alliance portfolio: resolving the paradox of distance”, Global Strategy Journal, vol. 1, n° 1-2, p. 109–126.

- Zhou, Nan; Guillén, Mauro F (2015). “From home country to home base: a dynamic approach to the liability of foreignness”, Strategic Management Journal, vol. 36, n 6, p. 907-917.

- Zwinkels, Remco C.J.; Beugelsdijk, Sjoerd (2010). “Gravity equations: Workhorse or Trojan horse in explaining trade and FDI patterns across time and space?”, International Business Review, vol. 19, n°1, p. 102-115.

Parties annexes

Notes biographiques

Juliane Engsig est doctorante en Sciences de gestion à l’Université de Montpellier (Montpellier Management Institute). Ses recherches portent sur la formation des alliances, les déterminants du choix de partenaire et l’importance des distances dans les relations inter-organisationnelles. Sa thèse est financée par le Labex Entreprendre.