Abstracts

Abstract

This paper investigates the moderating role of quality of assurance services, focusing on their scope, level of application, and the choice of a professional auditor as assurance provider. The study also explores the relationship between the issuance of a standalone corporate social responsibility (CSR) report and a firm’s market value (as measured by Tobin’s q). The econometric analysis is based on a matched sample of large French firms listed in the SBF 120 index between 2007 and 2017. The findings indicate that the relationship between the issuance of a standalone CSR report and Tobin’s q is negative but becomes positive when firms use higher-quality assurance services.

Keywords:

- corporate social responsibility (CSR),

- assurance quality,

- firm market value,

- standalone CSR report

Résumé

L’article étudie le rôle modérateur de la qualité des services d’assurance, en référence à l’importance de son champ d’application, à son niveau d’application et à l’usage d’un auditeur externe, sur la relation entre la publication d’un rapport RSE spécifique et la valeur de marché de l’entreprise (évaluée par le q de Tobin). L’analyse économétrique se fonde sur un échantillon de grandes entreprises françaises cotées dans l’indice SBF 120 entre 2007 et 2017. Les résultats concluent que la relation entre la publication d’un rapport RSE spécifique et la performance boursière (mesurée par le q de Tobin) est négative, mais devient positive lorsque les entreprises recourent à des services d’assurance d’un niveau élevé de qualité.

Mots-clés :

- Assurance qualité RSE,

- valeur de marché de l’entreprise,

- rapport RSE spécifique

Resumen

El artículo investiga el papel moderador de la calidad de los servicios de seguro, con referencia a su alcance, nivel de aplicación y uso de un auditor externo, sobre la relación entre la publicación de un informe específico de RSE y el valor de mercado de la empresa (evaluado por la q de Tobin). El análisis econométrico se basa en una muestra de grandes empresas francesas que cotizan en el índice SBF 120 entre 2007 y 2017. Los resultados concluyen que la relación entre la publicación de un informe específico de RSE y los resultados bursátiles (medidos por la q de Tobin) es negativa, pero se vuelve positiva cuando las empresas utilizan servicios de garantía de alto nivel de calidad.

Palabras clave:

- Garantía de calidad de la RSE,

- valor de mercado de la empresa,

- informe específico de RSE

Article body

The practice of corporate social responsibility (CSR) has expanded over time, leading to a growing tendency for firms worldwide to actively disclose CSR information to the public, either in annual reports or in standalone CSR reports.[1] Among a wide range of channels for CSR communication (e.g., social reports, integrated reports, codes of conduct, thematic reports, web sites, stakeholder consultations, internal channels, prizes and events, cause-related marketing, interventions in the press and on TV, etc.), there is a growing tendency for companies to issue standalone non-financial reports to signal their greater intentions to comply with CSR commitments (Simnett et al., 2009; Clarkson et al., 2019). Thus, CSR reports are used as the main channel for communicating information about CSR duties to particular interest groups in society (Birth et al., 2007). The growth in the use of standalone CSR reports is likely to be motivated by the desire to develop better accountability for all the firm’s actions and all of the impacts of business (Cho et al., 2015).

In this regard, Hodge et al. (2009) argue that standalone reports are considerably more extensive and more detailed in order to attract more users to read the report. There are indeed substantial differences in the depth and breadth of CSR coverage between annual reports and standalone reports (Dhaliwal et al., 2011). For instance, Kolk (2008) indicates that the percentages of information related to governance and sustainability aspects, such as the structuring of sustainability within the organization, are considerably higher for separate sustainability reports than for integrated reports. While the use of voluntary standalone CSR reports is viewed as a powerful tool for communicating with stakeholder groups about sustainability disclosures, firms are not subject to mandatory and regulated issuance of standalone CSR reports. Despite the costs and benefits of issuing separate sustainability reports and financial reports (Mahoney et al., 2013; Thorne et al., 2014), standalone CSR reports are subject to concerns about the perceived credibility of the information provided, including the worry that they will be used as a tool for image enhancement (Michelon et al., 2015; Birkey et al., 2016). Prior empirical studies find mixed results regarding the relationship between the issuance of voluntary standalone CSR reports and a firm’s market value, thus underlining the credibility problem regarding CSR information contained in these reports. By and large, it is still unclear whether firms consider standalone CSR reports to be an effective tool for communicating among stakeholders (Patten and Zhao, 2014).

Meanwhile, external CSR assurance as an assessment of CSR reports has emerged with a view to enhancing the credibility of CSR reports (e.g., Simnett et al., 2009; Pflugrath et al., 2011; Velte and Stawinoga, 2017; Lajmi and Paché, 2020). CSR assurance reflects a process of normative isomorphism, which implies a transposition of professional rules and procedures from financial into non-financial auditing (Boiral and Gendron, 2011). The rise of assurance engagements in the area of sustainability has been considered the result of the increased availability of assurance guidelines or guidance statements of the AccountAbility1000 Assurance Standard (AA1000AS), the International Standard on Assurance Engagement 3000 (ISAE3000), and the GRI standards. All standards consider that assurance process involves methods and procedures with the aim to provide evidence that improves the confidence and credibility of CSR information and to assess the company’s reporting against some criteria. Previous literature reveals a general lack of confidence in CSR disclosures and confirms that assurance has emerged as a process to reduce the credibility gap surrounding CSR reporting. The evaluative framework of assurance based on international standards aims to assess the extent to which current assurance practices enhance transparency and accountability (O’Dwyer and Owen, 2005). Primarily, the preparation of a sustainability report in accordance with the GRI guidelines represents a signal of the credibility and quality of CSR reporting (Ruhnke and Gabriel, 2013).[2] To sum up, CSR assurance, as an external sustainability-oriented corporate governance mechanism (Lajmi and Paché, 2020), is likely to ensure that companies discharge their accountability to stakeholders (Ackers and Eccles, 2015).

Given the perceived greater need for credibility assessment of CSR information provided in standalone report, it is expected that the demand for higher quality assurance services will be stronger (Clarkson et al., 2019). Furthermore, the use of the annual report as a way to communicate on nonfinancial information clouds the assurance decision and the consistency of its quality (Simnett et al., 2009). Recent studies have focused on the fundamental role of third-party assurance as a valuable managerial tool for addressing concerns regarding the credibility and perceived reliability of CSR-related information disclosed in CSR reports (Simnett et al., 2009; Junior et al., 2014; Clarkson et al., 2019; Du and Wu, 2019). Such enhanced credibility of CSR reports through independent third-party assurance is reflected in investors’ greater willingness to invest, lower equity capital costs, reduced analyst forecast dispersion and errors, and higher market valuation. In a critical evaluation of assurance statement practices, O’Dwyer and Owen (2005) revealed, nevertheless, a large degree of management control over the assurance process. Meanwhile, the managerial interference in the assurance process alters, to a large extent, the relevance and the completeness of CSR reporting.

This paper examines whether a higher level of CSR assurance matters in the market valuation of voluntary standalone CSR reports, and questions the contributions of CSR assurance quality to the market valuation of voluntary standalone reports. The demand for assurance services is likely to be stronger for firms domiciled in stakeholder-oriented countries, as these services are a strategic tool for managing stakeholder relationships (Kolk and Perego, 2010). In this regard, a comparison of the French and Anglo-American contexts is of particular interest. Moreover, the literature on the contributions of CSR assurance to the relevance of sustainability reports has, in most cases, been limited to evaluating the effects of the presence or absence of external assurance, or to focusing on only some of the many key aspects of assurance. In this respect, Kolk and Perego (2010) express the need to examine the quality of CSR assurance statements, rather than merely their adoption, and to consider this research avenue of great value to both scholars and practitioners. Going beyond the question of the presence of key aspects of CSR assurance, the present study complements previous research by investigating the relationship between the issuance of a standalone CSR report and a firm’s market value, depending on the quality of assurance services (scope of assurance, level of assurance, and type of assurance provider). As far as we know, there is no existing research on the contributions of CSR assurance quality to the market valuation of voluntary standalone reports.

Using a sample of French firms listed in the SBF 120 index from 2007 to 2017, the paper investigates the impact of issuing a standalone CSR report on a firm’s market value. The issuance of a standalone CSR report is endogenously determined and moderated by the quality of assurance services. The decision to conduct the study in the French context is motivated by several reasons. Whereas the vast majority of studies were conducted in the Anglo-Saxon context, France is one of the stakeholders’ oriented countries in which the demand for assurance services is likely to be stronger (Kolk and Perego, 2010). As highlighted by Radhouane et al. (2020), France was a leader in 2008 in issuing assured CSR reports. Likewise, France is one of the few countries to have introduced legislation requiring the dissemination of CSR information since 2001, the year of the implementation of the “New Economic Regulations” (Chelli et al., 2018; Radhouane et al., 2018). In 2010, the French parliament passed the Grenelle II Law, which requires firms—as of the end of December 2011—to disclose information on their environmental, social, and sustainability performance in accordance with the GRI guidelines and makes external assurance by an independent third party compulsory for the verification of CSR-related information (Chelli et al., 2018; Gillet-Monjarret, 2018).[3] Whereas the Grenelle II Law aims to reinforce the credibility of societal information disseminated by firms, key aspects of the CSR assurance process are still offered on a voluntary basis and are affected by management practices that alter the relevance and the completeness of CSR reporting. From this point of view, two questions arise: (1) How the issuance of a voluntary standalone CSR report impacts the firm’s market value and is there a more pronounced effect in the period following the entry into force of the Grenelle II Law?; and (2) Does the relationship between the issuance of a standalone CSR report and market value improve when firms use higher-quality assurance services?

The paper is structured as follows. The first section discusses the background of the study and presents the research hypotheses. The second section describes the sample and research design. The empirical results are discussed in the third section. Finally, we underline the theoretical implications of the investigation, the managerial implications for practitioners and regulators, and limitations to the study as well as future research avenues.

Theoretical background and hypotheses

In response to disclosure requirements, many firms provide CSR information through standalone non-financial reports to signal their compliance with CSR commitments (Simnett et al., 2009; Husser and Evraert-Bardinet, 2014; Clarkson et al., 2019). From a signaling perspective, these firms are willing to make shareholders bear the additional costs of communication to distinguish themselves from firms with poor sustainability development performance (Mahoney et al., 2013). The rapid increase in CSR reporting in recent years shows a steadily growing willingness to voluntarily produce standalone CSR reports, even if these resources differ from integrated reports in their depth and breadth of CSR coverage. Hence, standalone CSR reports are likely to provide incrementally useful information for investors for evaluating firms’ adoption of long-term sustainability practices (Dhaliwal et al., 2011). Two topics of inquiry then arise: the impact of the standalone CSR report on a firm’s market value, and the moderating role that the quality of CSR assurance services may play in the relationships we posit.

Standalone CSR reports and firms’ market value

Several studies have investigated the factors motivating the issuance of standalone CSR reports. Nevertheless, no solid theoretical argument has been put forward in support of such issuance. Firms publishing standalone CSR reports demonstrate additional effort and commitment to improving transparency regarding long-term performance and risk management (Dhaliwal et al., 2011) and to signal their higher CSR performance scores (Mahoney et al., 2013). Patten and Zhao (2014) examine the growing adoption of standalone CSR reporting by the US retail industry and find that firms issuing standalone CSR reports have better environmental reputations than firms not doing so. For Birkey et al. (2016), standalone CSR reports are more likely to be used to enhance the environmental image of the issuing firms than as a signaling device to corporate investors. Giving support to arguments from signaling theory, Clarkson et al. (2019) find a positive association between issuing a standalone CSR report and inclusion in the Dow Jones Sustainability Index (DJSI), considered by the authors as an objective measure of a firm’s reputation for sustainability.

Despite the growing empirical literature revisiting market responses to the issuance of standalone CSR reports (Guidry and Patten, 2010; Dhaliwal et al., 2011; Berthelot et al., 2012; Cho et al., 2014; Wang and Li, 2016; Mervelskemper and Streit, 2017; Lajmi and Paché, 2020), there is limited evidence of their impact on users’ perceptions of the credibility of the information provided. The issuance of standalone sustainability reports may attract more users in that such reports are more extensive and more detailed (Hodge et al., 2009). Dhaliwal et al. (2011) find evidence that firms issuing a standalone CSR report with superior CSR performance are associated with a lower cost of capital. Berthelot et al. (2012) find in the Canadian context that investors perceive positively the potential benefits of issuing a standalone sustainability report. Wang and Li (2016) argue that the market valuation is higher for Chinese firms disclosing higher-quality standalone reports than for firms that do not. The authors explain these results by the fact that the Chinese business environment is often considered socially irresponsible and ethically questionable, leading to a greater importance of promoting CSR initiatives, such as the issuance of standalone CSR reports.

In contrast, Cho et al. (2014) and Clarkson et al. (2019) state that it is still unclear whether or not standalone CSR disclosure should be expected to be correlated with a firm’s market value. According to Michelon et al. (2015), standalone CSR reports provide more—but not necessarily better-quality—CSR information than what is reported in annual reports. Indeed, the advantage of integrated reports lies in the act of separating financial and non-financial information contextually (Vaz et al., 2016; Mervelskemper and Streit, 2017). Obviously, the relationship between the issuance of a standalone report and market value is likely to be moderated by a range of factors. Guidry and Patten (2010) examine the perceived value for shareholders of publishing a standalone sustainability report, and no significant impact on market value is observed. However, they find evidence that investors’ reactions vary according to the quality of standalone CSR reports measured by reference to GRI recommendations, and that the market reacts positively to higher-quality standalone reports. According to Martínez-Ferrero and García-Sánchez (2017) and Clarkson et al. (2019), market participants are reluctant to accept the provision of a CSR report without higher assurance quality. Given the conflicting arguments on how shareholders perceive the issuance of standalone CSR reports, a neutral hypothesis is formulated:

H1:The issuance of a standalone CSR report is related to the firm’s market value.

The moderating role of the quality of CSR assurance services

Despite the importance of assurance services in increasing the capital market benefits from the issuance of standalone CSR reports, the potential value of CSR assurance statements is still questionable (Deegan et al., 2006; Mock et al., 2007). At least three key aspects of assurance services are considered in the literature as potentially reflecting CSR assurance quality: (1) the scope of assurance; (2) the level of assurance; and (3) the identity of the assurance provider (O’Dwyer and Owen, 2005; Mock et al., 2007; Junior et al., 2014; Velte and Stawinoga, 2017; Braam and Peeters, 2018; Clarkson et al., 2019). The design of the assurance process as provided in CSR assurance statements is referred to as “aspects of practice” between firms and assurance providers, giving management an extensive margin of discretion in the portrayal of CSR assurance services.

Level of assurance

In 2003, the French National Company of Auditors (CNCC) issued a technical report in which three levels of verification were identified (reasonable, moderate, and limited levels of CSR assurance). The CSR assurance level determines the CSR assurance mission, which may be a verification of the processes for establishing CSR information, CSR reports information, or, at the same time, processes and CSR information (Gillet-Monjarret, 2014). Given that the nature, timing, and extent of the procedures carried out tend to be broader for the reasonable level of assurance engagement compared to those for the limited level, users’ confidence and their perceptions of the credibility of CSR reports are likely to be higher when the level of assurance is reasonable (Hodge et al., 2009; Gillet-Monjarret, 2014; Martínez-Ferrero and García-Sánchez, 2018). This improvement is mainly due to the reinforcement of the reporting and internal control systems implemented by the firms (Gillet-Monjarret, 2014). Hasan et al. (2005) suggest that the percentage of confidence for a moderate level of assurance engagement is 60%, whereas it is 88% for a high level of assurance engagement. They argue that, while a moderate level of assurance is a common way of expressing negative assurance, the wording used in expressing moderate assurance may alter users’ understanding of the level of assurance.

One interesting study in the French context is by Gillet-Monjarret (2018) who performs a lexical content analysis to assess in-depth specific characteristics of 232 assurance reports provided by 19 French companies publishing standalone CSR reports over the period from 2001 to 2015. She highlights that despite the fact that assurance reports follow the same architecture, there are substantial differences in the scope of reporting and the type of indicators audited between limited and reasonable levels. The separation between the limited and the moderate assurance levels is more ambiguous in that they are both formulated in a negative way (Gillet-Monjarret, 2018). The author also analyzes the pre-Grenelle II Law period (before 2012) and the post-Grenelle II Law period (after 2012). The analyze shows that while the words used for the engagement carried out was changed considerably, the implementation of the Grenelle II Law is found to contribute to the legitimization of the CSR assurance process by leading to a standardization of CSR reports and more clarity in the assurance engagements. Based on the above discussion, hypothesis H2 is formulated:

H2:The market valuation of a standalone report is higher when the level of assurance is reasonable than when the level of assurance is moderate or limited.

Scope of assurance

The scope of CSR assurance may reflect top management’s choice with regard to CSR reporting and CSR assurance services; choices are made by the firm and have to be approved by the assurance provider (Mock et al., 2007; Gillet-Monjarret, 2014). It may not be necessary for the assurance to cover the entire content of the CSR report; in other words, sustainability assurance statements may focus primarily on environmental aspects and aspects related to human resources and security. Firms can determine what information needs to be assured based on the demand by stakeholders for certain information and on assurance providers’ capabilities in terms of auditing this information (Mock et al., 2007). Providing a narrower scope of assurance may then be seen as assurance for detailed subject matter and requires more specific professional knowledge and experience in the assurance of environmental and social activities (Hodge et al., 2009).

The environmental section receives greater coverage than other sections of CSR assurance statements, implying greater demand for reliable environmental information from stakeholders (Mock et al., 2007; Hodge et al., 2009). Nevertheless, top management restrictions on the scope of assurance engagement—such as being environmentally focused—may reflect a lack of concern for the completeness of CSR reporting (O’Dwyer and Owen, 2005), and managers’ desire to remove from the assurance process prominent CSR duties, such as human resources, security, business ethics, and governance. Recently, Clarkson et al. (2019) find that firms with higher commitment to CSR, as measured by their inclusion in the Dow Jones Sustainability Index (DJSI), are more likely to adopt greater assurance scope on both environmental and social indicators. Using a large panel data set of listed companies from 21 European and North American countries, Braam and Peters (2018) find that companies domiciled in stakeholder-oriented countries commit to greater assurance scope to signal their good corporate social performance. Based on the discussion above, our third hypothesis is:

H3:The market valuation of a standalone report is markedly enhanced when combined with a broader scope of assurance.

Assurance provider

To carry out their CSR assurance engagements, firms may choose various types of external assurance providers in the accounting or non-accounting profession (Simnett et al., 2009; Pflugrath et al., 2011; Casey and Grenier, 2015). The role of the assurance providers, regardless of their identity, is to ensure that all significant CSR issues are appropriately reported and to produce CSR assurance statement offering conclusions on the veracity and completeness of CSR reports (Ackers, 2009). According to Martínez-Ferrero and García-Sánchez (2018), accounting firms are found to make more accurate and more detailed audits and offer more discussion about the assurance procedures than are engineering and consulting firms. Indeed, accounting firms have high reputational capital due to their audit expertise and experience, and they provide a higher perceived quality of assurance, thus allowing them to report more negative statements than non-accounting firms. Martínez-Ferrero and García-Sánchez (2018) also provide evidence of the greater ability of Big-4 audit firms to detect errors, omissions, or misrepresentations in a CSR report. Moreover, accounting firms are subject to ethical and independence requirements and follow global professional standards, which ensure that the assurance provided is of a consistently high quality, resulting in higher assurance fees (Simnett et al., 2009). In addition, accounting firms—as compared to specialist consultants—tend to cover the whole CSR report rather than focusing on some aspects of CSR duties (Hodge et al., 2009).

According to Martínez-Ferrero and García-Sánchez (2017), the high-quality assurance provided by accounting professions (Big-4 audit firms) is strictly linked to the development of accounting standards and ethics, enhancing the perception of credibility by investors. Sustainability consultants outside the auditing profession may possess specific skill sets and extensive knowledge of some subject matter for assurance engagements but may not outperform accounting providers’ skills, integrity, objectivity, confidentiality and professional behavior in the provision of specific services (Hodge et al., 2009). In the same vein, Pflugrath et al. (2011) highlight that assurance provided by a professional accountant outperforms assurance provided by a sustainability expert in terms of trustworthiness and expertise, leading to greater perceived credibility of CSR information and more confidence in sustainability reports. Consequently, firms seeking to manage stakeholder impressions tend to avoid accounting assurers (Casey and Grenier, 2015). Meanwhile, firms domiciled in stakeholder-oriented countries, such as France, are more likely to choose accounting professions for their assurance engagements (Simnett et al., 2009), as accounting firms are thought to be more conservative and cautious (O’Dwyer and Owen, 2005), and are likely to be more able to bolster the credibility of CSR reports (Dhaliwal et al., 2011). A signaling hypothesis is offered here to investigate whether shareholders perceive that assurance provided by accounting firms enhances the credibility of CSR information communicated through standalone CSR reports:

H4:The market valuation of a standalone CSR report is higher for firms assured by accounting firms than for those assured by consulting firms.

Research design

Sample

The initial sample includes SBF 120 firms listed on the French Stock Exchange between 2007 and 2017. The advantage of analyzing the period starting in 2007 is the significant increase in voluntary CSR disclosure by French companies (Dardour and Husser, 2016). Before that date, information on CSR was scarce and circumstantial. We follow Cormier and Gordon (2001) by removing financial firms, real estate firms, and foreign firms (15 firms) from the sample because of differences in regulation and corporate governance. In financial and banking companies, in addition to shareholders and managers, depositors, borrowers, and regulators have a strong stake in their governance and performance and exert greater pressure in order to prevent unethical practices and promote socially responsible behaviors (Khan, 2010; Kiliç, 2016). In addition to the fact that banks’ boards of directors are larger and more independent, directors in financial and real estate companies are likely to face greater liability risks compared to directors of non-financial firms (Adams and Mehran, 2012). Due to these structural differences in regulation and corporate governance structures, CSR reporting strategy may markedly differ in financial and banking companies that are prone to focus more on the products and customer dimensions and very little on items related to environment and energy (Kiliç, 2016). Finally, we removed firms with missing data, particularly—as reported in Dardour and Husser (2016)—those related to environmental and social performance.

Focusing on the quality of CSR assurance services, the final sample is limited to firm-years with CSR assurance statements, leading to an unbalanced panel of 596 firm-year observations representative of major industries in France, based on the Industry Classification Benchmark (ICB).[4] A content analysis was conducted on CSR assurance statements to determine the status of the key aspects of the assurance process and to code each of the moderating variables considered in the present study as proxies for the quality of assurance services. Data on the scope, the level, and the assurance provider, as well as data on governance, were hand-collected from corporate annual reports. Environmental and social performance and accounting information were gathered from the Thomson Reuters database.[5]

Model

The purpose of this paper is to investigate the moderating role of CSR assurance services (i.e., the level of assurance, the scope of assurance, the use of international standards for assurance engagements, and the choice of the type of assurance provider) in the relationship between the issuance of a standalone CSR report and a firm’s market value, measured by Tobin’s q. This relationship may be affected by some endogeneity issues. Three sources of endogeneity may lead to wrong causal inferences and have significant effects on the results: unobservable heterogeneity, simultaneity, and dynamic endogeneity (lagged reverse causality). As discussed in the literature, the decision to issue a standalone CSR report is correlated with various attributes and characteristics of the firm.

A simple ordinary least squares (OLS) estimation of the impact of a standalone CSR report on a firm’s market value as measured by Tobin’s q results in biased estimates because of the above-mentioned endogeneity issues. Further, simply including the lag of the market value as an explanatory variable may address the dynamic endogeneity issue but it neglects the unobservable heterogeneity and simultaneity issues (Bennouri et al., 2018). Meanwhile, the two-step General Method of Moments (GMM) estimation specification of Blundell and Bond (1998) is used to mitigate the different endogeneity concerns (Wintoki et al., 2012). The system GMM approach reduces endogeneity by combining two equations in level and in difference for the estimation of the relationship between the issuance of a standalone CSR report and a firm’s market value.[6] In this respect, the GMM system outperforms a wide range of alternative estimators, such as OLS, fixed-effect and instrumental variables two-stage least squares (2SLS-IV) estimates, in terms of bias and efficiency (Bennouri et al., 2018). Mostly, this method produces consistent estimators in the field of corporate governance, very often involving panel data with short period compared to the number of firms (Wintoki et al., 2012). Equation 1 is expressed as follows:

where assurance quality is an indicator variable of CSR assurance quality and was split into the three key aspects of assurance services as defined by the level of assurance (level), the scope of assurance (scope), and the type of assurance provider (provider). All other variables are defined in Table 1.[7] To measure the consistency of the GMM estimation, two specification tests were considered: the Arellano-Bond second-order autocorrelation test for the error terms and the Sargan/Hansen test of over-identifying restrictions.

Table 1

Variables and their measurement

Results

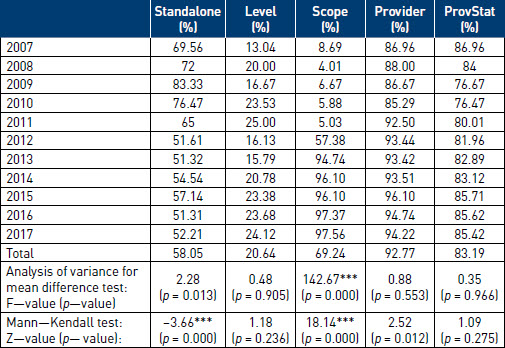

Table 2 presents descriptive statistics for the main and control variables used in our empirical analysis. Sample firm-years have an average Tobin’s q of 1,193. On average, firm-years issuing standalone CSR reports represent about 58% of our sample. Regarding assurance practices, we find that, among our sample firm-years, only 20.64% prefer to engage in a higher level of assurance, 69.24% choose a broader assurance scope, and 92.77% use a professional accountant as the assurance provider. Moreover, 67.28% of sample firm-years establish a CSR committee. As for control variables, Table 2 reports statistics that are largely in line with previous studies conducted in the French context in terms of magnitude (Nekhili et al., 2020).

Table 2

Descriptive statistics

Table 3 presents the use of standalone CSR reports and variations in assurance practices over an 11-year time period, from 2007 to 2017. Issuance of a standalone CSR report ranged from 69.56% in 2007 to a 52.21% in 2017, with a significant decrease in the use of standalone reports in the period following the entry into force of the Grenelle II Law in 2012. This may be explained by the fact that French companies were exposed to increased pressure after the enactment of legislation on CSR reporting (Perego and Kolk, 2012) that requires them to comply with an institutionalization process largely influenced by professional assurance entities’ practices (Kolk and Perego, 2012) and dominated by accounting firms (Simnett et al., 2009; Gillet-Monjarret, 2018). With regard to the French firms’ concerns regarding the quality of assurance services, the Grenelle II Law is likely to allow some standardization of the assurance engagement process (Gillet-Monjarret, 2018). Indeed, the level of assurance increased significantly from 13.04% in 2007 to 24.12% in 2017. This suggests that, although this proportion is very low, French firms seem to be more aware of the value of obtaining a reasonable level of assurance. For the scope of assurance, firms tend to cover the whole CSR report, showing spectacular growth in the percentage of the broader scope of assurance, from 8.69% in 2007 to 97.56% in 2017, with a notable increase observed from 2012. As expected, and as shown in Table 2, French-listed firms prefer a member of the auditing profession for their CSR assurance process, most often one of their statutory auditors. This choice is not likely to be affected by the entry into force of the Grenelle II Law in 2012.[8]

Test of H1

Table 4 reports the results of the OLS estimation (Model 1), the fixed-effects estimation (Model 2), the 2SLS-IV estimation using the lagged value of the endogenous regressor as the instrument (Model 3) and the system GMM estimation (Model 4). For all regressions, the variable of interest is the issuance of a standalone CSR report. Unlike in the OLS estimation, we include in the fixed-effect, instrumental variables and system GMM estimations the lagged values of Tobin’s q as an explanatory variable. For the four estimations, the impact of the issuance of a standalone CSR report on the firm’s market value is negative, albeit not significant, for the fixed-effect and the 2SLS-IV estimations. Indeed, the estimation of fixed effects will be consistent only if the past firm’s market value does not correlate with the current issuance of a standalone CSR report. Similarly, the coefficients resulting from the OLS and the instrumental variables estimations are economically less significant compared to the coefficient in the system GMM estimation. Overall, control variables correlate better with Tobin’s q when we use system GMM as the estimation method. The ambiguous results from previous studies comparing estimation methods are consistent with the assertion that the presence of self-selection and endogeneity problems lead generally to biased and inconsistent estimates (Roberts and Whited, 2013). Finally, the results of the Arellano-Bond second-order autocorrelation test for the error terms (AR2) and the Sargan/Hansen test of over-identifying restrictions provide consistency for the use of the system GMM regression methodology. Thus, for the rest of our empirical work, we restrict our analyses to the system GMM estimations.

Table 3

Yearly average values of the proportion of firm-years issuing standalone CSR reports and the variations of the assurance practices

Table 4

OLS, fixed-effect, and system GMM regressions of Tobin’s q on the issuance of a standalone CSR report

*, **, *** Represent significance at 0.10, 0.05 and 0.01 levels, respectively. All variables are as defined in Table 1.

In accordance with H1, the negative and significant impact of issuing a standalone CSR report on a firm’s market value is inconsistent with the results of Berthelot et al. (2012) in the Canadian context and of Wang and Li (2016) in the Chinese context. These differences may be due to the more stringent legislation on CSR reporting in France (Gillet-Monjarret, 2018). Stricter laws may lead shareholders to revise their assessments of the value of the issuance—or non-issuance—of standalone reports and to focus more on the enhancement of the credibility of the CSR information contained in such reports. Obviously, this presents an ethical challenge since the key aspects of the CSR assurance process are made on a voluntary basis. Another argument, closely related to the foregoing, is that the cost of providing standalone CSR reports—borne by shareholders—may not outweigh the associated benefits (Mahoney et al., 2013). In some studies, results show that, while shareholders are likely to react negatively to the issuance of a standalone CSR report, they respond positively to higher-quality assurance services as reflected by a broader scope of assurance, a reasonable level of assurance, and the choice of a professional accountant as assurance provider.

With regard to the control variables, the results depicted in Table 4 indicate that CSR performance is negatively valued by investors. High CSR performance may indicate a possible alliance between managers and stakeholders that counterbalances the dominance of shareholders, and that may be used by managers to obtain personal benefits at the expense of shareholders. The firm’s market value is positively correlated with the existence of a CSR committee, board independence, board meetings, audit committee size, and audit committee meetings. The regressions show that increases in ROA and leverage tend also to raise the firm’s market value. Tobin’s q is found to be negatively associated with family and institutional ownership, firm size, and with the financial crisis period. Firms operating within industries that are more exposed to environmental and social risks are found to strongly and negatively influence investors’ reactions, as assessed by market valuation. In agreement with the results obtained by Radhouane et al. (2020) in the French context, no definite conclusion can be drawn about the impact of the entry into force of the Grenelle II Law on firms’ market value (Tobin’s q).

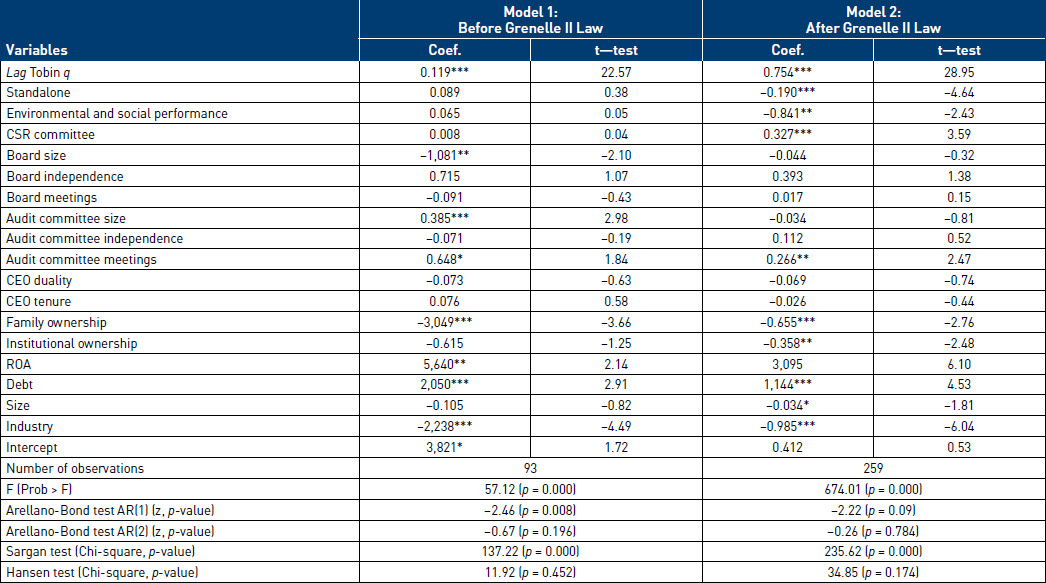

As pointed out by Chelli et al. (2018), Nekhili et al. (2017), and Radhouane et al. (2020), in the period preceding the entry into force of the Grenelle II Law in 2012, reporting on CSR information in accordance with the GRI was conducted on a wholly voluntary basis. We previously stated, in accordance with the results of Table 3, that French companies seemed to be more reluctant to use standalone reports in their CSR communication strategy in the period following the entry into force of the Grenelle II Law. As such, we would expect to find a marginal effect of the law on the shareholders’ perceptions of the credibility of CSR information provided in standalone reports. To shed light on this, we regress Tobin’s q on the issuance of a standalone report for the pre- and post-Grenelle II period. The results in Table 5 show that the market valuation of voluntary standalone CSR reports is more pronounced (in a negative way) and significant in the period following the entry into force of the Grenelle II Law. Relative to the pre-Grenelle II period, no significance is observed for the impact of the issuance of a standalone report on a firm’s market value. Such difference in the results seems to indicate that the mandatory compliance with GRI guidelines in the post-Grenelle II period has not only made companies more reluctant but also led shareholders to be more cautious about using standalone CSR reports. These findings should, however, be considered with care because of the small number of observations, notably in the pre-Grenelle II period.

Tests of H2, H3, and H4

Hypotheses H2, H3, and H4 state that higher-quality assurance services—the broader scope of assurance, the reasonable level of assurance, and the choice of a professional accountant as assurance provider—positively moderate the relationship between the issuance of a standalone report and a firm’s market value. The hypotheses were tested by estimating the marginal effect of each key aspect of assurance practices on the market valuation of a voluntary standalone CSR report. To do this, the joint test approach was used, and Equation 2 is expressed as follows:

where assurance quality is an indicator variable of higher-quality CSR assurance and was split into the three primary aspects of CSR assurance services as defined by the level of assurance, the scope of assurance, and the assurance provider. All other variables are defined in Table 1.

Table 5

System GMM regression of Tobin’s q on the issuance of a standalone CSR report before and after the entry into force of the Grenelle II Law

*, **, *** Represent significance at 0.10, 0.05 and 0.01 levels, respectively. All variables are as defined in Table 1.

Models 1, 2, and 3 in Table 6 include the main effects of both the issuance of a standalone CSR report and each aspect of CSR assurance services (level, scope, and provider, respectively). The results show that the issuance of a standalone CSR report is negatively and significantly related to the firm’s market value, regardless of the level of assurance (Model 1), the scope of assurance (Model 2), and the assurance provider (Model 3). The results presented in Table 6 also underline that each aspect of CSR assurance services has a positive and significant effect on a firm’s market value.[9]

In Models 1, 2, and 3 in Table 7, the interaction term between issuing a standalone CSR report (Standalone; β 2) and each aspect of CSR assurance services (Standalone*Assurance quality; β 4) is included. The issuance of a standalone CSR report combined with each proxy for higher-quality assurance services—broader scope of assurance, higher assurance level, and the use of a professional accountant as assurance provider—positively impacts the firm’s market value. The joint test of the sum of the coefficients on the issuance of a standalone CSR report and its intersection with each proxy of higher-quality assurance services (Standalone + Standalone*Assurance quality) was carried out to assess the marginal effect of higher-quality CSR assurance services.

In accordance with hypotheses H2, H3, and H4, the results in Table 7 show that the joint coefficients (β 2 + β 4) are positive and significant, providing evidence that the market valuation of a voluntary standalone report is markedly enhanced when combined with a broader scope of assurance, a higher assurance level, and the use of an accounting firm as assurance provider.

Supplementary analysis

The effects and the marginal effects observed above in Tables 6 and 7 for the choice of an accounting firm as assurance provider on the market valuation of voluntary standalone CSR reports may be altered if firms choose their statutory auditor as an independent third party for carrying out assurance engagements. To test this proposition, the third-party statutory auditor was considered as a moderating variable. In supplementary results (not shown here), the effects and the marginal effects of the choice of the statutory auditor as assurance provider on the market valuation of a standalone CSR report is unchanged and is highly positive and strongly significant.[10]

Conclusion

Using a sample of French-listed firms in the SBF 120 index over the period 2007–2017, the paper investigates the extent to which the issuance of standalone CSR reports is value-relevant by the capital market depending on the quality of CSR assurance services. The econometric analysis provides evidence that shareholders are reluctant to use information being disclosed in standalone reports in their assessments of CSR activities. Nevertheless, this impact becomes positive with a reasonable level of assurance, a broader scope of assurance, and the choice of an accounting firm as assurance provider. Going beyond previous studies (Deegan et al., 2006; Smith et al., 2011; Junior et al., 2014; Casey and Grenier, 2015; Clarkson et al., 2019; Du and Wu, 2019), the results show that all key aspects of assurance practices considered in the present study significantly contribute to the market valuation of voluntary standalone CSR reports.

Table 6

System GMM regression of Tobin’s q on the issuance of a standalone CSR report and the quality of assurance services

*, **, *** Represent significance at 0.10, 0.05 and 0.01 levels, respectively. All variables are as defined in Table 1.

Table 7

System GMM regression of Tobin’s q on the interaction between the issuance of a standalone CSR report and each aspect of CSR assurance services

*, **, *** Represent significance at 0.10, 0.05 and 0.01 levels, respectively. All variables are as defined in Table 1.

Theoretical implications

The results of this research will provide new insights on assurance practices at the firm level. The findings reveal the need for higher-quality assurance services to dispel the credibility problem surrounding the issuance of standalone reports, as stated in the signaling theory. Our findings offer further evidence that the quality of assurance practices has been proven to be an effective tool to reduce information asymmetries. This seems to be mainly the case in proactive companies that produce a wider range of standalone CSR reports as a powerful tool for communicating with stakeholder groups in regard to sustainability disclosure.

Another implication is that assurance practices should not only signal but also provide sufficient feedback on how firms meet the needs of their shareholders and investors. One of the important findings of the research is that the professional accountant as assurance provider impacts positively the firm’s market value. For high-quality feedback, it is therefore necessary to consider the selection process of assurance providers, who will have a deep knowledge of CSR practices (regulations, standards, international agreements, etc.). They are also required to be able to write reports dealing with key issues with conviction and communicate them effectively. The paper thus contributes to the debate on the level of competence of assurance providers, especially in controversial industries likely to be more exposed to environmental and social risks, such as oil, gas and chemicals, utilities, and manufacturing (Kolk and Perego, 2010). Generally, it appears that all key aspects of assurance practices are important because they convey causal explanations about what top managers should do to ensure the success of CSR reporting.

Managerial implications

The environmental audit procedure is complex and needs to be carried out by competent assurance providers in order to be conducted under efficient conditions and thus improve the images of firms. Indeed, environmental auditing is a useful management tool in the environmental protection sector and is beneficial for firms. It enables them to improve environmental performance, prevent environmental accidents, and avoid contraventions of existing laws. Broadly, it is a very positive signal to shareholders and investors. By and large, our results show that the relationship between the issuance of a standalone CSR report and a firm’s market value is positive when firms use higher-quality assurance services.

The study highlights implications for practitioners and regulators. Even if there is lower litigation risk faced by management and the third-party assurance provider for inaccurate or incomplete reporting, the disclosure of fees paid to the assurance provider is an important aspect that should be considered by regulators and practitioners alike. Following discussions with assurance providers from three countries, Simnett et al. (2009) highlight that, for the same engagements, the fees charged by audit firms are up to five times those charged by environmental consultants. In France, as in many other countries around the world, the disclosure of CSR assurance fees is not yet mandatory. Yet, it is an important signal to stakeholders to assess the value of the information provided. The amount of fees received by the assurance provider in relation to its turnover allows us to assess its economic dependence on a client, and therefore the risk of the assurance provider concealing certain negative environmental information. For audit and non-audit fees, the situation is strictly different in that the Financial Security Law of 2003 requires French firms to disclose the audit fees paid to audit firms.

The first issue for regulators then becomes that of the relevance of mandatory disclosure of assurance fees. While mandatory disclosure provides an approximate assessment of the assurance provider’s level of independence, it is not sufficient on its own. It must be accompanied, on the one hand, by precise obligations regarding the disclosure of information relating to the assurance provider’s competencies and, on the other hand, by the definition of strict ethical rules and a liability regime, in particular for firms presenting a significant environmental risk. The second issue is to determine to what extent CSR assurance fees may alter the independence of the statutory auditor as assurance provider. Regulators must ensure the application of transparency rules on the remuneration of assurance providers, for example, by establishing indicative pricing according to objective criteria (size of the firm, industry, level of environmental risk, etc.).

Limitations and future research avenues

The present work has several additional limitations that create opportunities for scholars to pursue important research avenues. The present study focuses on the largest non-financial French companies of the SBF 120 index. A meaningful avenue for future research is to consider smaller firms, as they are unlikely to have slack resources and they are less able to absorb the cost of improved assurance services (Ackers and Eccles, 2015). Another research avenue consists of studying a significant sample of environmental audit contracts signed between assurance providers and firms using in-depth textual analysis. The main goal would be to highlight the key elements of the contractual clauses in order to evaluate a possible relationship between the content of the contractual clauses, the perceived quality of the assurance services, and the firms’ market values. An additional research path consists of conducting cross-cultural research to assess the potential influence of institutional logics on the conditions of execution of environmental audits, including for the same assurance provider operating in several countries. The objective would be to identify whether or not there is strong convergence in institutional guidance on CSR reporting and assurance standards for CSR reports, which could have a significant impact on the quality of CSR assurance statements.

To assess environmental and social performance, the use of an alternative proprietary database may be also of interest. For instance, Semenova and Hassel (2015) examine the validity of Kinder, Lydenberg and Domini (KLD), Thomson Reuters ASSET4, and Global Engagement Services (GES) and find that the above-mentioned databases do not converge and can give even qualitatively different results. Last but not least, further studies are necessary to compare the quality of assurance services and the market valuation of the wide range of channels for CSR communication (e.g., social reports, integrated reports, web sites, stakeholder consultations, internal channels, prizes and events, cause-related marketing, interventions in the press and on TV, etc.).

Appendices

Appendices

appendix 1. Additional information on the system GMM approach

Whereas in the equation in level, market value is a function of the lags of the first differences and the error term; in the equation in difference, year-to-year differences are used as instruments. To estimate these equations simultaneously, the system GMM approach includes the dynamic structure of the relationship between firm’s market value and the issuance of a standalone report. The use of the past firm’s market value (Tobin’s q) and differences in independent variables as instruments is justified by the fact that the strategic decision of issuing a standalone report may be correlated with the current and past firm’s market value (one year lagged value of Tobin’s q) as well as to other firm characteristics (social and environmental performance, board structure, audit committee structure, etc.).

In this respect, the authors conduct the Arellano-Bond test for autocorrelation to test the null hypothesis of no second-order serial correlation for the error terms of the first-differenced equation [AR(2)]. Failure to reject the null hypothesis of no second-order serial correlation implies that the moment conditions are correctly specified, conditional for the use the system GMM model. Indeed, System GMM is more appropriate with only first-order serially correlated processes (Roodman, 2009). The authors have also performed the Sargan test for over-identifying restrictions to examine the overall validity of the instruments.

appendix 2. Process of variables selection

Dependent variable: Tobin’s q

Following Chung and Pruitt (1994), an approximation of Tobin’s q as a proxy for firm value is used. This approximation is consistent with much of the literature on CSR reporting (Cahan et al., 2016; Radhouane et al., 2020). Approximate Tobin’s q is measured by the market value of assets plus the book value of liabilities divided by the book value of total assets. Tobin’s q, as a market-based measure of firm performance, reflects investors’ expected cash flows and incorporates the level and risk of future profitability. When developing the hypotheses, the paper relied on Dhaliwal et al. (2011) in the investigation of the relationship between issuing a standalone CSR report and the cost of capital. The rationale behind the use of Tobin’s q is not unlike the one that justifies using the cost of capital, as these two variables are negatively related (Ben-Horim and Callen, 1989). Moreover, Plumlee et al. (2015) show that environmental disclosure impacts not only the cost of equity but also the expected future cash flows as the second component of firm value. As compared to the market-to-book ratio, Tobin’s q tends also to explain a greater proportion of the cross-sectional variation in firm valuation than the market-to-book ratio, which may lead to less precise market valuations of firms (Lang and Stulz, 1994). Finally, the advantage of using Tobin’s q over accounting-based performance measures, such as return on assets (ROA) and return on equity (ROE), is that it is less affected by accounting standards and by managers’ manipulations of earnings (Dechow et al., 1996), and it is more suitable in the assessment of the financial impact of the CSR reporting strategy.

Endogenous variable: The issuance of a standalone CSR report

Because standalone CSR reports are not mandatory, the analysis of this type of reports is likely to be a good way to study companies’ CSR disclosures (Gillet-Monjarret, 2018). As compared to annual reports, standalone CSR reports are likely to provide incrementally useful CSR information for investors to evaluate firms’ engagements regarding long-term sustainability (Dhaliwal et al., 2011). Nevertheless, there is no consensus on whether CSR information contained in standalone reports is more credible than information integrated into annual reports (Cho et al., 2014), or on how the issuance of a standalone report will affect a firm’s market value (Guidry and Patten, 2010; Berthelot et al., 2012; Cho et al., 2014; Wang and Li, 2016; Clarkson et al., 2019). Following previous literature (e.g., Simnett et al., 2009; Dhaliwal et al., 2011), the issuance of a standalone CSR report is represented by a dummy variable that takes the value of one if the firm issues a standalone CSR report, and zero otherwise. This dummy variable captures the dynamic trade-off between standalone and integrated report to communicate on CSR duties, subject to the evolution over time of legal constraints.

Moderating variables

The moderating variables are themselves somewhat interrelated and are represented by three alternative dummy variables as proxies for the quality of the CSR assurance services, including the level of assurance, the scope of assurance, and the type of CSR assurance provider. The level of assurance takes the value of one when the firm obtains a reasonable level of CSR assurance and zero when the firm obtains a moderate or a limited level of CSR assurance. Like Clarkson et al. (2019), the scope of assurance takes the value of one when the whole CSR report is assured (or both environmental and social indicators), and zero otherwise. The identity of the assurance provider equals one when CSR assurance is provided by at least one accounting firm, and zero otherwise.[11] Because higher-quality CSR assurance contributes to the credibility of the CSR information disclosed (Hodge et al., 2009; Pflugrath et al., 2011; Martínez-Ferrero and García-Sánchez, 2017, 2018; Clarkson et al., 2019), the three variables reflecting the quality of the assurance services are expected to positively moderate the relationship between the issuance of a standalone CSR report and a firm’s market value. Considering the different aspects of assurance services separately allows us to understand the extent to which each facet of the assurance process matters for market participants.

Control variables

Following previous empirical studies, various features of firms that potentially influence both the decision to issue a standalone CSR report and the firm’s market value are identified. The authors start by controlling for CSR performance. Greater CSR disclosure does not necessarily reflect better underlying CSR performance (Cormier et al., 2011). Firms with poor CSR performance suffer from adverse media coverage (García-Sánchez et al., 2014), affecting the perception of CSR reporting among primary stakeholders (Radhouane et al., 2018). Meanwhile, firms committing to better CSR performance are more likely to issue standalone CSR reports to signal their superior commitment to CSR duties (Mahoney et al., 2013; Clarkson et al., 2019). Likewise, firms with stronger CSR performance will bear lower costs when communicating CSR information through standalone reports than firms with weaker CSR performance (Mahoney et al., 2013).

Regarding governance structure, Kend (2015) finds that the presence of a sustainability (CSR) committee positively impacts the decision to issue a standalone sustainability report. For Michelon and Parbonetti (2012), board size is positively correlated with corporate sustainability disclosure through standalone CSR reports as compared to annual reports. Following Nekhili etal. (2017) and Radhouane et al. (2020), the authors control for board independence and board meetings, as they may drive CSR reporting strategy. Although there is a lack of empirical evidence on the impact of the audit committee on CSR disclosures, an effective audit committee, as an internal assurance mechanism, can contribute to the quality of CSR reporting and may then be considered an alternative to the external assurance services (Haji and Anifowose, 2016). Such as for the board of directors, the authors control for the size, the independence, and the number of meetings of the audit committee. Insofar as the issuance of a standalone report can be used by top management as a tool for image enhancement, the authors control for board-CEO power as a key factor influencing the CSR disclosure strategy (Vaz et al., 2016). In the present study, two measures of board-CEO power are considered, following Nekhili et al. (2017) and Radhouane et al. (2018): CEO duality and CEO tenure.

As highlighted by Nekhili et al. (2017), family ownership and institutional ownership are likely to be related to the CSR disclosure strategy. Family firms are likely to be more proactive than non-family firms in their response to stakeholders’ needs and may produce a wider range of standalone CSR reports (Campopiano and De Massis, 2015). For Dhaliwal et al. (2011), the issuance of standalone CSR reports is linked with institutional ownership. Regarding other firm attributes or characteristics, and consistent with previous studies, the authors also control for ROA (Dhaliwal et al., 2011; Clarkson et al., 2019) and leverage (Simnett et al., 2009; Clarkson et al., 2019). The authors control for firm size measured as the natural logarithm of total assets. Firm size captures several factors that may affect the decision of issuing a standalone report such as public pressure or financial constraints (Dhaliwal et al., 2011). With respect to the French context, the authors control for the Grenelle II Law, which makes CSR assurance mandatory by an independent third party and gives specific guidance to the assurance of sustainability reporting. It is instructive to remember that, despite the entry into force of the Grenelle II Law, key aspects of the CSR assurance process are still made on a voluntary basis and are affected by management practices. This variable equals one after the entry into force of the Grenelle II Law reforms in 2012, and zero otherwise.

The 2008 global financial crisis revealed the great vulnerability of stakeholders to the unethical and irresponsible behavior of certain corporate executives, leading some companies to increase their CSR disclosures to maintain their legitimacy or image and to ensure continued access to the resources they need (García-Benau et al., 2013; Pinto et al., 2014). Following previous work on the impact of the financial crisis in European countries, the authors introduce a dummy variable that takes the value of one for the years 2008 and 2009 and zero otherwise.[12] Finally, firms issuing standalone CSR reports are likely to have better social and environmental reputations (Patten and Zhao, 2014). Accordingly, the authors control for industry effects with four dummy variables using the classification of Kolk and Perego (2010). Similarly, they consider that companies operating in oil, gas and chemicals, utilities, and manufacturing industries are likely to be more exposed to environmental and social risks and might then be more prone to have a sustainability report assured.

appendix 3. Univariate analysis and propensity score matching

Table A presents the results of the mean difference tests between firm-years with the issuance of a standalone report (n = 346) and firm-years without a standalone report (n = 250). Firm-years with standalone reports have a significantly lower Tobin’s q than firm-years without standalone reports. Consistent with the findings of Clarkson et al. (2019), CSR (environmental and social) performance is significantly higher for firms issuing a standalone CSR report than for their counterparts. In line with Kend (2015), the results presented in Table A show that firm-year observations with a standalone report are more likely to have a CSR committee than firm-year observations without a standalone report. Additionally, boards of firms issuing standalone reports are larger than those of firms not issuing standalone reports. No significant differences are found for either board independence or the number of board meetings between the two sub-samples.

The results in Table A also suggest that firm-year observations with standalone CSR reports are more likely to have a longer-tenured CEO who often serves as board chairperson. From the analysis of ownership structure, firms issuing standalone CSR reports have a higher percentage of capital owned by family shareholders, but a smaller proportion of institutional investors, than firms without standalone CSR reports. Firm-years with standalone CSR reports are also characterized by relatively lower financial performance as measured by ROA (4.27% vs. 4.98%), less leveraging, and greater size than their counterparts. Finally, in line with Patten and Zhao (2014), firms operating in environmentally sensitive industries are less likely to issue a standalone CSR report.

The possible overlaps between the issuance of a standalone CSR report and the firm’s other characteristics may lead to inconsistencies in the market valuation of a standalone CSR report. In view of these inconsistencies, the propensity score matching (PSM) approach is used to control for self-selection bias. Following Wang and Li (2016), the authors matched without replacement firm-year observations where a standalone CSR report was issued (treatment group) with firm-year observations where it was not (control group), based on all control variables considered in the study. Both the treatment and control groups that have nearest-neighbor characteristics were considered to obtain a final matched sample of 380 firm-year observations: 190 treated cases issuing a standalone CSR report, and 190 control cases not issuing a standalone CSR report.

The post-match results in Table A show no significant mean difference between the two sub-samples for all control variables, which means that the matching is effective. Furthermore, when the treatment group is compared with the control group via the PSM approach, the results in Table A show a non-significant mean difference in the firm’s market value between the two sub-samples. These results indicate that firms issuing standalone CSR reports are not better perceived by market participants. The use of a PSM sample to regress Tobin’s q on the issuance of standalone CSR reports should then be more effective in separating the effects of firms’ control variables on Tobin’s q from those on the issuance of standalone CSR reports.

Table A

Mean difference test between firm-years with standalone CSR reports and firm-years without standalone CSR reports for the entire and matched samples

*, **, *** Represent significance at 0.10, 0.05 and 0.01 levels, respectively. All variables are as defined in Table 1.

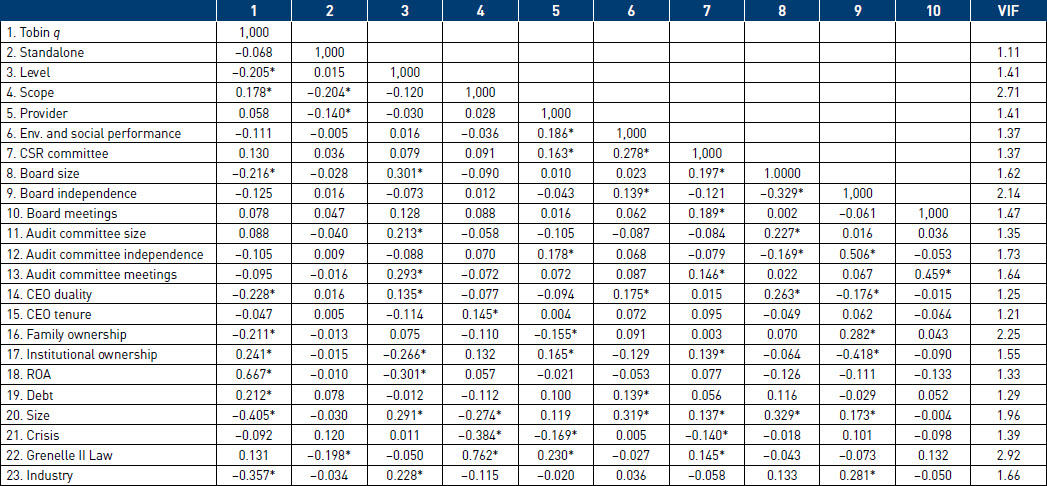

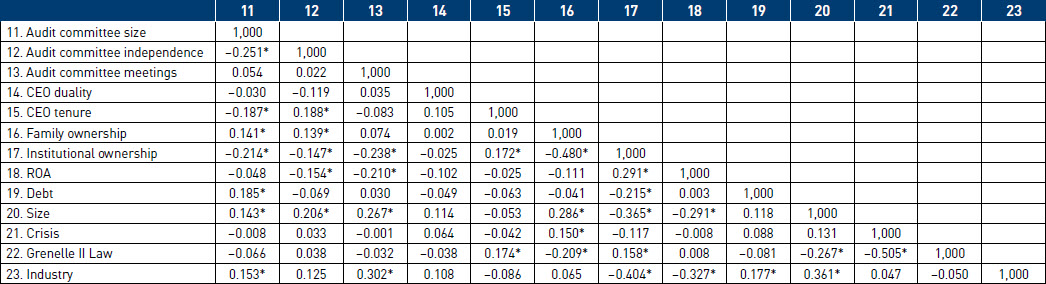

Based on the matched sample, Table B shows that the univariate correlation between the test variable (standalone CSR report), the moderating variables (scope, level, and assurance provider), and the remaining explanatory variables is not excessively high. Similarly, the variance inflation factors are lower than the standard limit of three, showing that multicollinearity problems do not seriously affect the results of the regressions.

Table B

Pairwise correlation

* Represents significance at 0.01 level. All variables are as defined in Table 1.

Acknowledgements

The authors would like to thank Patrick Cohendet and Bachir Mazouz for their comments and three anonymous reviewers of Management international for their insightful suggestions on a first draft of the manuscript.

Biographical notes

Mehdi Nekhili is a Professor of Management Science at Le Mans University (France). He is the founder of the chair “Governance & CSR”. Member of the ARGUMans research team, his main research interests include corporate finance, governance, management, auditing, and corporate social responsibility. He has published several papers in various refereed journals such as British Journal of Management, Journal of Banking & Finance, Journal of Business Ethics, Auditing: Journal of Practice & Theory, Journal of Business Research, International Review of Financial Analysis, The British Accounting Review, Corporate Governance: An International Review, and Journal of Business Finance & Accounting.

Amira Lajmi obtained her PhD in Management Science from Le Mans University (France) in 2020. Member of the ARGUMans research team, her main research interests include corporate finance, governance, management and corporate social responsibility. Her work has recently been published in many journals, especially Recherches en Sciences de Gestion, Revue des Sciences de Gestion and Environmental Economics.

Haithem Nagati is an Associate Professor at the emlyon Business School (France), and accredited to supervise PhD. His research interests focus on corporate governance, corporate social responsibility and supply chain management. His work has been published in several journals such as Journal of Business Research, Journal of Banking & Finance, Corporate Governance: An International Review, Sustainability Accounting, Management & Policy Journal, Journal of Cleaner Production, International Journal of Operations & Production Management, Production Planning & Control, Management Decision and International Journal of Human Resource Management.

Gilles Paché is a Professor of Management Science at Aix-Marseille University (France), where he was director for several years of the University Press of Aix-Marseille. Member of the CERGAM research team, he has more than 480 publications in the forms of journal papers, books, edited books, edited proceedings, edited special issues, book chapters, conference papers and reports. His major interests are service management, network organizations, governance of football clubs and supply chain management.

Notes

-

[1]

Standalone CSR reports may be variously referred to as “sustainability reports,” “environmental reports,” “global reporting initiative (GRI) reports,” or “citizenship reports” (Mahoney et al., 2013; Thorne et al., 2014).

-

[2]

The full version of the GRI’s sustainability reporting guidelines was published in 2000, with frequent updates made over the years. Importantly, in 2016, GRI improved the quality and facilitated the use of the guidelines by integrating the global best practices for reporting in a wide range of economic, environmental, and social effects. The standards will be compulsory for all reports that reference the GRI framework and that are published after July 1, 2018.

-

[3]

In this respect, it is worthy to notice the adoption by the European Union of the so-called Non-Financial Reporting (NFR) Directive (2014/95/EU) which aims to harmonize the non-financial reporting regulation in Europe. The transposition in 2017 of the EU extra-financial directive impacts the French law mainly by the replacement of the CSR report provided in Article 225 of the French Commercial Code by a new statement on extra-financial performance. This Directive came into effect in 2018 and applies to all large companies in the European Union, whether listed or not.

-

[4]

The Industry Classification Benchmark (ICB) was developed in January 2005 by Dow Jones and FTSE and was used by Euronext since 2006.

-

[5]

To measure environmental and social performance, we use the Thomson Reuters/S-Network ESG Best Practice Ratings, which, unlike ASSET4 ratings, assign a specific weight for each key performance indicator (KPI) used to measure the environmental, social and governance (ESG) performance. In this paper, we focus only on environmental and social performance, as many of the corporate governance performance KPIs are specified separately in our model as control variables.

-

[6]

Additional information on the system GMM approach is given in Appendix 1.

-

[7]

The process of variables selection is specified in Appendix 2.

-

[8]

Results of the univariate analysis and propensity score matching are presented in Appendix 3.

-

[9]

As highlighted above, in the period preceding the entry into force of the Grenelle II Law, reporting on CSR information in accordance with the GRI, as well as the external assurance of CSR information by an independent third party, were made on a voluntary basis. To assess the influence of the Grenelle II Law on the market valuation of the CSR assurance services, we regress Tobin’s q on both the issuance of a standalone report and each key aspect of assurance practices for the pre- and post-Grenelle II periods. Supplementary results show that the quality of assurance services is more value-relevant in the post-Grenelle II period when compared with the phase prior to 2012. These results may be explained by the fact that the implementation of the Grenelle II Law contributes to the legitimization of the CSR assurance process by leading to a standardization of CSR reports and more clarity in the assurance engagements (Gillet-Monjarret, 2018). Our results also show that, when controlling for the quality of assurance services, the impact of issuing a voluntary standalone CSR report on the firm’s market value remains unchanged—still negative and significant—in the period following the entry into force of the Grenelle II Law. Once more, it is worth noting that these findings should be considered with care because of the small number of observations, notably in the period following the implementation of Grenelle II Law.

-

[10]

Supplementary results are available from the authors upon request.

-

[11]

Some companies combine accounting professional with a different type of assurance provider (i.e., engineering and consulting firms). In this study, the authors consider that CSR assurance is provided by accounting firm since at least one of the assurance providers is professional accountant. The French law states that the CSR assurance engagement should be carried out by any independent third-party organization accredited by COFRAC. In the French context, most assurance providers are accounting firms (Gillet-Monjarret, 2018).

-

[12]

The financial crisis began in the US in 2007, and the effects were felt in Europe in 2008 and 2009 (Terazi and Şenel, 2011).

Bibliography

- Ackers, B. (2009). “Corporate social responsibility assurance: How do South African publicly listed companies compare?”, Meditari Accountancy Research, Vol. 17, No 2, p. 1-17.

- Ackers, B.; Eccles, N. (2015). “Mandatory corporate social responsibility assurance practices”, Accounting, Auditing & Accountability Journal, Vol. 20, No 3, p. 333-355.

- Adams, R.; Mehran, H. (2012). “Bank board structure and performance: Evidence for large bank holding companies”, Journal of Financial Intermediation, Vol. 21, No 2, p. 243-267.

- Braam, G.; Peeters, R. (2018). “Corporate sustainability performance and assurance on sustainability reports: Diffusion of accounting practices in the realm of sustainable development”, Corporate Social Responsibility & Environmental Management, Vol. 25, No 2, p. 164-181.

- Ben-Horim, M.; Callen, J. (1989). “The cost of capital, Macaulay’s duration, and Tobin’s q”, Journal of Financial Research, Vol. 12, No 2, p. 143-156.

- Bennouri, M.; Chtioui, T.; Nagati, H.; Nekhili, M. (2018). “Female board directorship and firm performance: What really matters?”, Journal of Banking & Finance, Vol. 88, p. 267-291.

- Berthelot, S.; Coulmont, M.; Serret, V. (2012). “Do investors value sustainability reports? A Canadian study”, Corporate Social Responsibility & Environmental Management, Vol. 19, No 6, p. 355-363.

- Birkey, R.; Michelon, G.; Patten, D.; Sankara, J. (2016). “Does assurance on CSR reporting enhance environmental reputation? An examination in the US context”, Accounting Forum, Vol. 40, No 3, p. 143-152.

- Birth, G.; Illia, L.; Lurati, F.; Zamparini, A. (2008). “Communicating CSR: Practices among Switzerland’s top 300 companies”, Corporate Communications: An International Journal, Vol. 13, No 2, p. 182-196.

- Blundell, R.; Bond, S. (1998). “Initial conditions and moment restrictions in dynamic panel data models”, Journal of Econometrics, Vol. 87, No 1, p. 115-143.

- Boiral, O.; Gendron, Y. (2011). “Sustainable development and certification practices: Lessons learned and prospects”, Business Strategy & the Environment, Vol. 20, No 5, p. 331-347.

- Cahan, S.; De Villiers, C.; Jeter, D.; Naiker, V.; Van Staden, C. (2016). “Are CSR disclosures value relevant? Cross-country evidence”, European Accounting Review, Vol. 25, No 3, p. 579-611.

- Campopiano, G.; De Massis, A. (2015). “Corporate social responsibility reporting: A content analysis in family and non-family firms”, Journal of Business Ethics, Vol. 129, No 3, p. 511-534.

- Casey, R.; Grenier, J. (2015). “Understanding and contributing to the enigma of corporate social responsibility (CSR) assurance in the United States”, Auditing: Journal of Practice & Theory, Vol. 34, No 1, p. 97-130.

- Chelli, M.; Durocher, S.; Fortin, A. (2018). “Normativity in environmental reporting: A comparison of three regimes”, Journal of Business Ethics, Vol. 149, No 2, p. 285-311.

- Cho, C.; Michelon, G.; Patten, D.; Roberts, R. (2014). “CSR report assurance in the USA: An empirical investigation of determinants and effects”, Sustainability Accounting, Management & Policy Journal, Vol. 5, No 2, p. 130-148.

- Cho, C.; Michelon, G.; Patten, D.; Roberts, R. (2015). “CSR disclosure: The more things change…?”, Accounting, Auditing & Accountability Journal, Vol. 28, No 1, p. 14-35.

- Chung, K.-H.; Pruitt, S. (1994). “A simple approximation of Tobin’s q”, Financial Management, Vol. 23, No 3, p. 70-74.

- Clarkson, P.; Li, Y.; Richardson, G.; Tsang, A. (2019). “Causes and consequences of voluntary assurance of CSR reports”, Accounting, Auditing & Accountability Journal, Vol. 32, p. 2451-2474.

- Cormier, D.; Gordon, I. (2001). “An examination of social and environmental reporting strategies”, Accounting, Auditing & Accountability Journal, Vol. 14, No 5, p. 587-616.

- Cormier, D.; Ledoux, M.; Magnan, M. (2011). “The informational contribution of social and environmental disclosures for investors”, Management Decision, Vol. 49, No 8, p. 1276-1304.

- Dardour, A.; Husser, J. (2016). “Does it pay to disclose CSR information? Evidence from French companies”, Management International, Vol. 20, Special Issue, p. 94-108.

- Dechow, P.; Sloan, R.; Sweeney, A. (1996). “Causes and consequences of earnings manipulation: An analysis of firms subject to enforcement actions by the SEC”, Contemporary Accounting Research, Vol. 13, No 1, p. 1-36.

- Deegan, C.; Cooper, B.; Shelly, M. (2006). “An investigation of TBL report assurance statements: UK and European evidence”, Managerial Auditing Journal, Vol. 21, No 4, p. 329-371.