Abstracts

Abstract

This article explores the legitimacy of a proximity mobile payment (PMP) system by exploring the social aspects related to its use (social acceptability). A qualitative study was conducted with 27 customers using a PMP service and 8 professionals familiar with PMP. Results highlighted the importance of the consumption system and service provider as institutions. More specifically, a PMP system can only be accepted and legitimized if it is supported by the three institutional pillars: cognitive, normative and regulatory. Recommendations are thus proposed to PMP service providers in order to rethink and optimize the implementation of their PMP system.

Keywords:

- legitimacy,

- proximity mobile payment,

- social,

- acceptability,

- Neo-Institutional Theory

Résumé

Cet article explore la légitimité d’un système de paiement mobile de proximité (PMP) en explorant les aspects sociaux liés à son utilisation (acceptabilité sociale). Une étude qualitative a été menée auprès de 27 clients utilisant un service de PMP et de 8 professionnels familiarisés avec le PMP. Les résultats ont mis en évidence l’importance du système de consommation et du fournisseur de services en tant qu’institutions. Plus précisément, un système de PMP ne peut être accepté et légitimé que s’il est soutenu par les trois piliers institutionnels : cognitif, normatif et réglementaire. Des recommandations sont ainsi proposées aux prestataires de services de PMP afin de repenser et d’optimiser la mise en oeuvre de leur système de PMP.

Mots-clés :

- légitimité,

- paiement mobile de proximité,

- social,

- acceptabilité,

- théorie néo-institutionnelle

Resumen

Este artículo explora la legitimidad de un sistema de pago móvil de proximidad (PMP) explorando los aspectos sociales relacionados con su uso (aceptabilidad social). Se realizó un estudio cualitativo con 27 clientes que utilizan el servicio PMP y 8 profesionales familiarizados con PMP. Los resultados destacaron la importancia del sistema de consumo y proveedor de servicios como instituciones. Más específicamente, un sistema de PMP solo puede ser aceptado y legitimado si se sustenta en los tres pilares institucionales: cognitivo, normativo y regulatorio. De esta forma, se proponen recomendaciones a los proveedores de servicios PMP para repensar y optimizar la implementación de su sistema PMP.

Palabras clave:

- legitimidad,

- pago móvil de proximidad,

- social,

- aceptabilidad,

- teoría neoinstitucional

Article body

The significant growth in the volume of mobile payments worldwide ($ 57.9 billion for proximity mobile payment in 2017 and an expected increase of up to $ 411.4 billion by the end of 2022)[1], seems to have revolutionized traditional payment methods (Oliveira et al., 2016). In some countries, consumers are now able to pay for their purchases at the retailers point of sale (PoS) using their smartphones. Despite the supposed benefits such as convenience, speed and cost (Taylor, 2016), mobile payments have not yet been widely adopted (e.g. less than 15% of people will use their smartphones to make proximity payments)[2]. This cannot only be explained by the fact that mobile technologies are not developed enough or not easy to use. The adoption of a means of payment also depends on the functioning of the ecosystem in which they evolve (Almazan and Vonthron, 2014). The influence of the ecosystem can, for example, explain the failure of some mobile payment systems like Moneo in France (Sahut, 2008a) and QuickTap in the UK[3] which were supposed to be an alternative to cash for small purchases. The main reasons of their failure lie in the little acceptance of users, complexity of the system, its cost for retailers, and the competition of banks. Other mobile applications like Apple Pay and Samsung Pay have still not been widely adopted (First Annapolis, 2016[4]). Despite the investments of service providers, we can see that the adoption of mobile payment services has been slower than many had expected (Statista, 2017[5]). Researchers are therefore calling on mobile payments providers to better understand the factors which motivate consumer adoption of mobile payment.

Studies on mobile payment remain scarce in comparison to other mobile features (Oliveira et al., 2016), and most of the existing studies have focused more on the antecedents of its adoption without distinguishing between remote mobile payment (RMP) and proximity mobile payment (PMP) (Yang et al., 2012) or considering it in its social context (Slade et al., 2014).

These theoretical and practical observations lead us to consider the legitimacy of PMP by investigating social aspects related to its use. How and why some technologies are rapidly adopted while others are not is an issue which has interested a lot of researchers (Utterback 1994). A recent research stream has called for a more “institutional view” in order to understand this adoption process (Munir and Philipps, 2005; Shi et al., 2008). The Neo-Institutional Theory provides alternative explanations to those delivered by traditional adoption theories which mainly highlight functionality, rationality and self-interest. The latter also underestimate the influence of social contexts and overlook the social embeddedness of the innovation adoption process (Granovetter, 1985; Shi et al., 2008). A literature review shows that very few studies have addressed the role of social influence in consumer adoption of payment innovations (Slade et al., 2014).

To fill this gap, and drawing upon Neo-Institutional Theory, the aim of this research is to understand the legitimacy of PMP. Several researchers have stated that organizations and consumer practices only become legitimate by complying with institutions (Singh et al., 1986). Institutionalization is defined as the anchoring of social practices in mental schemas on the macro-social level, inducing a kind of automatic cognition in individuals and facilitating the anticipation of reactions in a given context (DiMaggio, 1997). This institutionalization is based on three pillars: cognitive, normative and regulatory. These three pillars will be considered in order to determine the legitimacy of a PMP. Legitimacy is regarded as the perception of how a company or a consumer practice can be socially and institutionally accepted (Humphreys, 2010 a). This perceived value by individuals will give the user the necessary reasons to accept and adopt this mode of payment. To explore this, the theoretical framework of neo-institutionalism was chosen for this research. As part of this research, we will focus on both individual perceptions of consumers and the perspectives of professionals in order to gain a deeper insight into the dimensions defining the cognitive, regulatory and normative frameworks.

The remainder of this paper is structured as follows. First of all, an overview of the literature dealing with PMP, adoption innovation theories against Neo-Institutionalization Theory and their failure to capture all social factors, and finally legitimacy and social acceptability of PMP. Then the research methodology and main results are presented. The paper concludes with a discussion and proposed theoretical and managerial implications.

Theoretical Background

Proximity Mobile Payment (PMP)

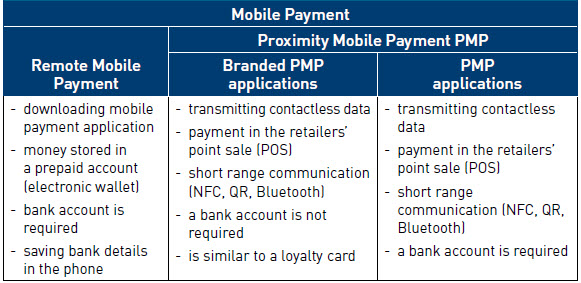

Studies on mobile payment in general are still scarce compared to related areas such as mobile commerce, e-banking or m-banking (Oliveira et al., 2016). However, their number is steadily increasing (Dahlberg et al., 2015), predicting a revolution in the payments market (Hedman and Henningsson, 2015). Mobile payment systems can be classified into two categories: remote mobile payment (RMP) systems and proximity mobile payment (PMP) systems (Slade et al., 2014). RMP systems typically involve downloading an application and then using it on a mobile device to pay for online purchases (e.g. Apple Pay and Lyf Pay). Users can also have an amount of money stored in a prepaid account or withdraw funds directly from a bank account (Taylor, 2016). Users are also able to carry out PMP with applications like Apple Pay but this mode of payment requires them to save their bank details on their smartphone, in contrast to dedicated and branded PMP applications (e.g. the Starbucks application) which generally play the role of a loyalty card with a reward system.

PMP systems consist of transmitting contactless data relating to the transaction from a customer’s smartphone to a terminal of mobile payment in the retailers’ point of sale (PoS) via various technologies of short-range communication (NFC, QR code, Bluetooth, etc.). To pay for their purchases at the retailers’ PoS, consumers scan a QR code using a mobile payment application or use their smartphones via the Near Field Communication (NFC) device (Liébana-Cabanillas et al., 2015). PMP is a potential substitute for other traditional payments like credit cards or cash payments (Slade et al., 2014). (See table 1)

Many studies have examined the determinants of acceptance and adoption of RMP (remote mobile payment) in contrast to PMP (Yang et al., 2012). The few studies which have focused on PMP have been limited to explaining the intentions of use, neglecting to investigate the process that leads to its acceptance and adoption (Kujala et al., 2017). Other studies on PMP have highlighted the reasons for adoption according to a value based-approach (De Kerviler et al., 2016). Along the same lines, recent studies have focused on the intentions of use of NFC mobile payments (Morosan and DeFranco, 2016) as well as on user profiles (Gerpott and Meinert, 2017). All of these studies have overlooked the dynamic and social perspective of acceptance (Jasperson et al., 2005) and used traditional adoption theories to explain or predict behaviors. Yet several researchers have highlighted the critical role of social factors in influencing technology adoption (Shi et al., 2008; Kim and Park, 2011) as well as the effect of the network on technology adoption behavior (Hsu and Lu, 2004). Researchers are therefore now questioning whether traditional adoption theories, which mainly focus on subjective norms and normative components, grasp all the meanings and influences of the broad social context (Conner and Armitage, 1998). In a more general way, researchers acknowledge that the impact of social and environmental factors on technology adoption requires further in-depth investigation. Such in-depth explanations can only be achieved by going beyond traditional theories (Granovetter, 1985; Munir and Phillips, 2005; Kim and Park, 2011) and exploring more holistic theories like Neo-Institutional Theory (Shi et al., 2008) which seems very promising for gaining insight into PMP acceptance and adoption and assessing its ongoing legitimacy.

Table 1

Mobile payment systems

Innovation Adoption Theories

Several theories have been developed in the literature to account for innovation acceptance and adoption. Although interesting, these traditional theories have either totally neglected or not sufficiently considered social and environmental factors through which new technologies and innovations become accepted (Granovetter, 1985; Kim and Park, 2011). The Theory of Reasoned Action (TRA) (Fishbein and Ajzen, 1975) postulates that behavioral intentions are dependent on two factors: attitude and subjective norms. Social influence is only represented by subjective norms which do not reflect the wider social context (Conner and Armitage, 1998; Kim and Park, 2011). The Theory of Planned Behavior (TPB) (Ajzen, 1991) is an extension of the Theory of Reasoned Action (TRA) (Fishbein and Ajzen, 1975) and integrates the individual’s perception of control over their behavior as a new component to explain behavioral intentions. The TRA also formed the foundation of the Technology Acceptance Model (TAM) (Davis, 1989). The (TAM) posits that behavioral intentions to use a system are determined by perceived ease of use, perceived usefulness and subjective norms. The effects of wider environmental and social contexts are still neglected with both the TPB and TAM. Venkatesh et al. (2003) proposed the Unified Theory of Acceptance and Use of Technology (UTAUT). The UTAUT model argues that behavioral intentions towards a technology are influenced by four moderators (age, gender, experience and voluntariness of use) and four variables: performance expectancy, effort expectancy, facilitating conditions and social influence. Social influence is represented by subjective norms, image and social factor. Although the validity of the model has been investigated in different contexts (Lin and Bhattacherjee, 2008) some observations must be made. Firstly, the three components of social influence are included only because their statistical proximities. Furthermore, several researchers (Zhou et al., 2010) have tended to only keep subjective norms when testing the model. Thus, this raises questions regarding the relevance of using social influence as defined therein to explain behavioral intention and adoption. Although most of these models consider social influence factors, they mainly rely on subjective norms to capture the full extent of social influence. They lose sight of the network effects and their influence on technology adoption behaviors (Hsu and Lu, 2004). The same point can also be made for the Innovation Diffusion Theory (IDT) (Rogers, 2003). IDT describes the process through which new ideas, practices and technologies spread within a social system. Indeed, and even if the social system is one of the main elements in the diffusion process, several researchers (Koenig-Lewis et al., 2010) highlight the primacy of the five characteristics (relative advantage, complexity, compatibility, trialability and observability) of innovations. These characteristics are deemed to influence the rates of diffusion and adoption of innovations. Some researchers (Chau and Tam, 1997) state that IDT lacks accuracy because it applies to all kinds of innovation, while the adoption of an innovation in the field of information technologies may have particular characteristics. Moreover, Carlsson (2006) indicates that IDT may be limited in the context of mobile technologies. Indeed, while almost all individuals have adopted mobile phones, many have nevertheless not leveraged this technology for mobile banking and mobile payments. Although it is a step forward in conceptualizing the social dimension of use throughout the diffusion process, the IDT does not develop this process. Only the adoption process (Shi et al., 2008) based on the five characteristics of innovation, has been widely explained. Table 2 below summarizes the main contributions of innovation adoption theories.

Neo-Institutional Theory proposes that social interactions and networks have a great impact on individuals’ beliefs, attitudes and behaviors (Scott, 2013). According to Neo-Institutional Theory, decisions are not only driven by monetary or utility optimization, but also by social and cultural factors in order to gain legitimacy. Neo-Institutional Theory is therefore different from traditional innovation adoption theories which mainly highlight individual factors, rationality and self-interest and wherein social and environmental factors are not adequately addressed (Shi et al., 2008). A more “institutional view” is consequently needed in order to gain a better understanding of the adoption process (Munir and Philipps, 2005). Neo-Institutional Theory is quite different from traditional explanations, as it considers a wider set of contextual and environmental factors. It highlights the social embeddedness and anchoring of the process through which an innovation become broadly adopted (Granovetter, 1985).

Neo-Institutional Theory

Neo-Institutional Theory has become one of the prevailing frameworks used to explain organizational dynamics (Greenwood et al., 2008). It differs from the old vision of intuitionalism (Selznick, 1948) by the fact that it rejects the total rationality of individuals and advocates informal characteristics of institutions (DiMaggio and Powell, 1991). These organizational dynamics are not merely supported by technological requirements, but also by cultural, political and social foundations (Suchman, 1995). Despite the fact that Neo- Institutional Theory has been mainly focused on an organizational or meso level (Singh at al., 1986), it can nevertheless also be applied on an individual or micro level (Shi et al., 2008; Humphreys, 2010a). Indeed, it has been argued that institutions can act on the level of individual relationships (Scott, 2013). For example, Humphreys and Latour (2013) as well Humphreys (2010 a) demonstrated how casino gambling has been progressively adopted by Americans and legitimated as a consumption practice. They found this by studying the impact of cultural representations and changes in the institutional environment on consumer perceptions and practices. Humphreys (2010b) also proposed several strategies to amplify, extend and connect the casino industry to different frames in order to facilitate its legitimacy and therefore its institutionalization.

Table 2

Synthesis of the main innovation adoption theories

Early studies (Veblen, 1909; Hughes, 1936) also pointed out how institutions are anchored and integrated in the behaviors of individuals. Since 1919, Veblen has also defined institutions as “settled habits of thought common to the generality of man” (Veblen, 1919, p.239). However, understanding the emergence of a new market or diffusing and maintaining a consumption practice is not an easy task: it is a complex process requiring compliance with institutions (Singh et al., 1986). Scott (2013) defined institutions as “social structures that have attained a high degree of resilience. They are composed of cultural-cognitive, normative, and regulative elements that, together with associated activities and resources, provide stability and meaning to social life” (Scott 2013, p.33). He, then identified the three pillars of institutions, which are: the cognitive pillar, the regulatory pillar and the normative pillar. The cognitive pillar describes the degree to which a practice is “taken for granted” and the ease with which it can be assimilated and shared in accordance with cultural patterns and beliefs (Suchman, 1995). It is constructed and created through experience, enabling consumers to gain familiarity with the consumption practice (Hoch and Ha, 1986). The regulatory pillar is formed by the laws and formal rules that are enacted by governments and regulatory bodies. Finally, the normative pillar includes standards and values defining goals and objectives. Norms are informally established by professionals such as consultants or opinion leaders, as well as by media. The conformity to these institutions and the different actors of the environment deliver legitimacy to consumption practices and innovations which can be easily accepted and adopted (Shi et al., 2008). Legitimacy is essential for the success and even the survival (Reast et al., 2013) of a company, and consumers would be much more loyal to companies adopting socially accepted practices (Sen et Bhattacharya, 2001). It also reflects the degree to which a company is socially accepted at both individual and collective levels, and is aligned with the megamarketing vision (Kotler, 1986). A megamarketing vision defines markets as going beyond the consumer/organization dyad and englobing all the actors that can institutionalize a consumption practice (Kotler, 1986).

Legitimacy and Acceptability Processes of PMP

Legitimation is the social process of making a practice or an organization congruent with the configuration of other values, institutions, and social norms (Suchman, 1995). It is the process through which a product, idea, or industry becomes widely accepted. A product, a service or a practice which consumers perceive as socially appropriate will be supported and requested, and thus legitimized (Humphreys and Latour, 2013). Legitimacy is therefore derived from socially accepted consumption practices (Humphreys, 2010a). PMP as a technological payment system must therefore be used, adopted and socially accepted in order to be legitimized.

Understanding the mechanisms leading to the use and acceptance of a technology requires study of the processes underpinning technology acceptability. Usage is defined as “a set of practices, a particular way of using something, a set of rules shared socially by a reference group and built over time” (Docq and Daele, 2001). Applied to technology, this definition places usage in a dynamic as well as temporal perspective (Bobillier-Chaumon and Dubois, 2009). The social acceptability of technology usage is not just a matter of duty or politeness, but a mix of aspects ranging from appearance, social status, to culture (Campbell, 2007). The process of performing actions and gathering feedback is circular and changing over time and experiences help users to make better decisions. Indeed, the use presupposes an iterative confrontation of technology with users according to three phases: prior acceptability, acceptance and, finally, appropriation (Bobillier-Chaumon and Dubois, 2009; Jasperson et al., 2005). Prior acceptability is the first step in the acceptability process. This takes place in the phase that precedes the confrontation of the user with the new technology until the first tests. During this first stage, the user begins to establish representations and meanings about the use of this new technology, to formulate their first judgments (Dubois and Bobillier-Chaumon, 2009). Acceptance is the second step in the acceptability process. This begins with the first use and can last up to six months (Venkatesh, et al., 2003). Acceptance of a technology is defined by its actual usability. Beyond objective measures of acceptance, it extends to subjective measures aimed at determining perceptions related to the use of a technology and to estimate the level of satisfaction of its user. These first two stages of the acceptability process of a technology (prior acceptability and acceptance) form the adoption phase considered as the first phase of use, before appropriation (Breton and Proulx, 2002).

Appropriation is the third step in the acceptability process. It refers to the ordinary use of technology and the way in which the individual personally invests in technology in accordance with their personal and cultural values to shape their own use (Barcenilla and Bastien, 2009). The duration of this phase of appropriation can extend up to six years (Dias 1999) depending on the context of use.Technology adoption encompasses use, acceptance and internalization (Breton and Proulx, 2002). The success of the adoption stage of PMP determines the continuity of its use over time and its appropriation (Lee et al., 2007) and therefore its legitimacy (Humphreys and Latour, 2013).

Methodology

For the purpose of the present research - which is to identify the cognitive, regulatory and normative pillars of legitimacy of PMP in order to predict and explain its social acceptability - the case of a PMP application “FlashPay” (See Appendix 1), used by a service brand (a restaurant chain) in Tunisia, is investigated. In order to gain a deep understanding of the social acceptability of PMP, a qualitative longitudinal study is conducted and interviews are held with customers and professionals.

This payment solution is a pilot project of a global strategy of disintermediation of payment and targets several sectors (restaurants, bars, coffee shops, and retail). FlashPay is a mobile application which enables customers to create an account, recharge it with the amount of money they choose, and pay their consumption from this account. They are also able to monitor their consumption from their mobile phone and keep track of their expenses. Users don’t need to provide their bank references when using FlashPay. It is an application provided by the brand to guarantee their customers easy and speedy payment and is similar to the already existing Starbucks’ PMP application used in the United States and Europe. The choice of the Tunisian market, which is an emerging one, is justified by the fact that FlashPay is a completely new mode of payment in Tunisia, and developers are aiming to extend it to other brands and not limit it to a single brand, as is the case of the Starbucks application. FlashPay is also chosen because it was launched recently, in 2017, and therefore provides a good opportunity to closely study the acceptability process of this PMP application in order to identify its legitimacy pillars. This case is particularly interesting, as it provided the possibility to study different stages of the social acceptability process of this PMP system. Neo-Institutional Theory highlights the importance of considering all actors who can act within a given market (Chaney and Marshall, 2013). Thus, two types of interviews were conducted with consumers and professionals. Interviews with professionals were held with 8 actors acquainted with mobile payment and operating in different fields: 2 bankers, 2 managers of an IT service company, a director at the Ministry of Finance and 3 brand managers (catering and mass distribution). Interviews with professionals lasted on average 50 minutes. Three themes were addressed: (1) factors that can support or inhibit PMP, (2) actors who can contribute to the development and adoption of FlashPay, and (3) the likelihood that “FlashPay” will be adopted by other brands.

Interviews with consumers were conducted in two stages: during the first testing of the application (prior acceptability stage) and again six months later (acceptance stage). The choice of longitudinal study is justified by the dynamic and temporal nature of the process of acceptability of a given technology (Bobillier-Chaumon and Dubois, 2009). Indeed, Neo- Institutional Theory invites marketing to adopt a dynamic vision of the markets in order to capture over time how the company will legitimize its offer and facilitate its diffusion (Humphreys, 2010b).

Semi-structured interviews of an average duration of 40 minutes were held with 27 customers of the brand (15 men and 12 women of varied age and socio-professional categories), when “FlashPay” was launched in April 2017. Interviewees were the first to have tested and used the pilot project “FlashPay”. They were mostly familiar with the use of Information and Communication Technologies (ICTs) and more specifically smartphones and mobile applications. Nearly two-thirds of them were accustomed to using their smartphone to carry out transactions (payment of bills, transfer of money, purchases, electronic wallet “Google Wallet”). Three themes were addressed with customers: (1) feedback on their experience with FlashPay, (2) their feelings, opinions and attitudes towards this payment system, and (3) their intentions regarding future use. These same customers were re-contacted six months later (October 2017) following their first use. A period of six months has been theorized as the required amount of time for the stage of accepting a technology (Venkatesh, et al., 2003). 21 of the 27 interviewees continued to use “FlashPay” (See appendix 2). These interviews were fully transcribed. Thematic analysis was conducted on the collected data (200 pages of transcription). According to the recommendations of Miles and Huberman (2003), a list of pre-codes was established, inspired by the elements identified in the literature. This list of codes was refined according to the emerging codes from the collected data. Then, each researcher proceeded, independently, to analyze and classify the verbatim for each theme. They then worked together to establish a single codification.

Results

Analysis of the data collected from consumers and professionals provided insights into the pillars of Neo-Institutional Theory and more knowledge about the diffusion of PMP as a social practice. The thematic analysis of the collected data from consumers using FlashPay enabled the researchers to trace the evolution of users’ representations and perceptions of the PMP application during the acceptability process (Bobillier-Chaumon and Dubois, 2009; Jasperson et al., 2005). The continuous use of this technological PMP system leads the user to integrate it in their daily life by giving it meaning. The following sections present the developments of meanings in the two phases of prior acceptability and acceptance.

The Pillars of Prior Acceptability of the PMP System

Cognitive pillar assimilation: During the prior acceptability phase, users attribute different values and meanings to the PMP application, which promote its social legitimacy. Using PMP leads to changes in cognition. Indeed, data analysis revealed different meanings relating to the use of PMP which concerned its convenience, such as ease of use, perceived practicality and capacity of the mobile technology to limit the efforts required of the user: “...it makes my life easier ... it’s much easier, faster and more practical to pay with the mobile app…” (Kenza, 19, Student) “It’ll definitely speed up the payment. I would not need to look for the waiter every time, especially at lunch time when the restaurant is full and waiters are often overwhelmed. I think it’s easier and quicker to pay by phone” (Ory, 36, Manager). These meanings also refer to the value of time and budget optimization insofar as interviewees talk about time saving and budget control facilitated by the use of the mobile application: “ … I come several times a day to this place, FlashPay allows me to gain at least 20 minutes of waiting time, its a huge time saving that I can use to set up other appointments with my customers” (Malik, 35, Medical Representative). “…it is me who sets the amount to recharge, so it is possible to control and monitor my expenses…” (Karim, 40, Sales Representative), “... with the mobile app I can consult the history of my expenses and spending, a kind of traceability ... it helps me to better manage and control my money” (Nadia, 38, Associate Professor).

All of these attributed meanings reinforce the capability of the PMP system to empower the consumer (Shankar et al., 2006). More ease in managing time, money and controlling one’s own consumption are the new watchwords of the new consumer image (Cova and Cova, 2009). All of these interpretations support the image of, on the one hand a co-producing consumer, autonomous through their own skills on the one hand and subject to a consumption system shaping their beliefs on the other hand (Shankar et al., 2006). According to these considerations, the use of PMP is arguably a component which supports the governmentality of consumers (Zwick et al., 2008) through the benefits and meanings it produces. Including the use of PMP in an approach to consumption which recognizes the active, participative and sovereign role of the consumer gives PMP a kind cognitive legitimacy which is favorable to its institutionalization (Hoch and Ha, 1986).

Normative pillar assimilation: In addition to the cognitive pillar induced by consumption, another form of normative legitimacy is distinguished. The value of reassurance was for example identified in users’ comments. Some interviewees refer to the security and insurance customers need to feel when providing their personal data. New payment technology systems often raise the issue of perceived risk and such perceived risk has a negative effect on individuals’ intentions to use a system of payment (Sahut, 2008b) and a PMP in particular (De Kerviler et al., 2016). However, FlashPay users talked about how this PMP system made them feel reassured, and that they are loyal to the brand: “I have no apprehension about the use of this application. I trust the brand. I am a regular customer” (Alin, 37, Entrepreneur). “…technical problems can occur, a network break or a bug are things that could happen anywhere and everywhere ... Here, the app is like our favorite coffee-shop, it’s our place. Showing patience and tolerance is normal towards something akin to a second family!” (Camelia, 26, PhD Student).

The company is thus clearly perceived as an institution guaranteeing payment security and reassuring users. Companies providing this type of payment, which are supposed to have a certain legitimacy in the eyes of their customers, can in turn confer some normative legitimacy to the PMP system (Kotler, 1986). This is a role which is recognized by Neo-Institutional Theory assigning a very important role to professionals through the normative pillar (Chaney and Marshall, 2013). Beyond this consumer-company dyad, Neo-Institutional Theory emphasizes the need to consider account all players (competitors, distributors, legislators, suppliers, critics, media, etc.) who can act within a given market (DiMaggio, 1997). In the case of ‘‘FlashPay’’, some customers consider the fact that this application does not ask for their bank details as a real source of reassurance: “No risk as I do not enter my bank details, there is no risk of being stolen, scammed or something like that …” (Nill, 28, Project Manager). “It’s like a virtual wallet, you’ll never forget it! And that only has a small amount of money in it, enough to get something to eat or have a drink ... “(Gilles, 47, Engineer).

Similarly, the fact that recharging the account with monetary units does not entail any financial cost for the customer is considered as a sign of benevolence. PMP seems even to make consumers forget that there is an app and a brand underpinning the use. A caring company which does not indulge in opportunistic behavior. This feeling thus reinforces the normative legitimacy of the company and the PMP application that it proposes. “When I recharge my account, no fee or commission is deducted… With many mobile applications it is rare to have something for free; I find it really good and transparent…” (Camelia, 26, PhD Student).

Thus, users position this payment system in relation to other mobile applications and other similar systems provided by other phone or banking operators. A form of legitimacy that refers to the image a company wants to reflect about itself and about its offer (Rosa et al., 1999) is therefore developed. This kind of differentiated positioning helps the company to reach the second level of normative legitimacy which is required in order to have a strong position in the marketplace (Chaney and Marshall, 2013).

The Pillars of Acceptance of the PMP System

The continuous use of this PMP system leads the user to integrate it into their daily life and consequently give it a deeper sense. It is in this way that the user acquires greater agency over their actions and their environment, to finally change norms and codes and, in so doing, legitimize use of the PMP. Thus, time was found to be a determining factor in legitimizing the adoption of the PMP system, which can be considered as an institution (Urien and Naccache, 2005). Indeed the meanings attributed to the PMP system are reinforced over time.

Cognitive pillar reinforcement: Six months later, interviewed users perceived PMP as a system enabling them to better control their service experience in terms of effort, time and expense, but also in terms of interactions with the restaurant staff (waiters). These elements are associated with the value of freedom, which is crucial in the construction of the new consumer image (Cova and Cova, 2009). Indeed, paying the bill without feeling indebted to the waiter (feeling obliged to pay extra for the service) gives the customer a feeling of freedom and control over their experience: “This application avoids me having to give a tip when I don’t want to” (Amira, 36, Sports Coach). “Personally, I’ve never liked waiting for the bill ... I prefer to pay with the application when I decide to leave” (Khaled, 53, Architect). These meanings which users associate with PMP enhance their perception of freedom, of control over their experience, and of their agency, thus consolidating the legitimacy of using PMP as a tool supporting their consumption.

Regulatory pillar assimilation: In addition to the cognitive pillar supported by consumption and the normative pillar supported by the provider and their environment (Chaney et al., 2016), a regulatory pillar is required. Some consumers justify their use of PMP for reasons which go beyond convenience to evoke moral legitimacy, which stems from the value of citizenship. Even if there are as yet no laws specifically pertaining to PMP applications in Tunisia, this payment method is perceived by some interviewees as being a way to limit fraud and give users a sense of citizenship: “…this payment process can be a way to limit fraud and corruption which is unfortunately anchored in our society…”(Nadia, 38, Associate Professor).“Total transparency, all transactions are traced, no more possibility of fraud… It is time for managers to pay their taxes, for economic prosperity and social equity, that’s what this type of payment can guarantee” (Hedi, 52, civil servant).

Similarly, some respondents said that adopting this application is useful for limiting inappropriate behavior from waiters: “…this mode of payment is reassuring for both the customer and the company ... no risk of being ripped off. If this method of payment becomes widespread, it will contribute towards improving our economic situation” (Karim, 40, Sales Representative). Others justify their adoption of this payment system in terms of their ecological concerns: “I think that this application is an ecological alternative to the use of bank notes”(Kenza, 19, Student).

What about Those Who Have Not Adopted the PMP System?

When the 27 interviewed customers were re-contacted 6 months later during the launching phase of the application, 21 of them reported that they had continued to use the PMP app. Those 6 respondents who did not continue to use PMP explained their non-adoption of PMP for various reasons which related to non-assimilation of the cognitive and normative pillars.

Non-Assimilation of the Cognitive Pillar

The non-perception of convenience values and time and budget optimization suggests some resistance to change and a form of resilience of the “old” consumption and payment system considered as an institution (Chaney et al., 2016). “Personally, I do not mind waiting and lining up, I prefer keeping my old habits…” (Amel, 32, Nurse). “I don’t want to waste time and energy trying to understand how to use, recharge and scan… Unfortunately, technical failures such as connection problems are a waste of time and energy” (Ilyas, 45, Web Designer). “… You can spend a lot of money without being aware of it because it is very easy to pay with the application. I think that it is not easy to control spending as advocated by several users. In contrast, when you are paying with cash, you can control your money yourself”(Selma, 29, Accountant). Despite the unquestionable evolution of consumption towards a system that provides more freedom, agency and governmentality to the consumer (Zwick et al., 2008), some people perceive risk and express resistance to PMP as a new way of payment (Slade et al, 2014). They have difficulty in trusting and integrating it in their lives because of their fear of losing autonomy (Shankar et al., 2006) and the freedom of choice: “In my opinion, this application is useless ... it would make me too dependent on that restaurant and limit my choices” (Ilyas, 45, Web Designer).

Non-Assimilation of the Normative Pillar

According to those who didn’t adopted PMP, non-loyalty to the brand is a major inhibitor to adoption. “... to be honest, I am not a loyal customer in the true sense of the word. I go to other places... this application will make me too dependent on this restaurant, whereas I prefer to be free to go where I want, to try new restaurant, new recipes ... It is probably very useful to loyal customers…” (Amal, 32, Nurse). Similarly, the frequency of technical incidents can explain the lack of enthusiasm among some respondents. “The waiter couldn’t scan the code, he repeated the operation several times but to it didn’t work. Finally, I paid cash because the payment transaction failed; I was very annoyed and disappointed”(Jamal, 58, retired).

Non-loyalty and the incidence of technical problems can prevent adoption of PMP and thus hinder its legitimacy. Indeed, because of the lack of commitment towards an institutional authority (PMP company provider), some customers have difficulty in becoming involved and in adopting PMP. This result goes hand-in-hand with the importance given by the Neo-Institutional Theory to professionals who have the power to shape institutions to legitimize or not a consumption practice through setting norms (Chaney et al., 2016).

Types of Legitimacy According to Professionals

Analysis of the interviews conducted with professionals enabled us to identify the different types of legitimacy required, as well as the actors involved in ensuring the diffusion of PMP.

Cognitive-Cultural Legitimacy

Cognitive-cultural legitimacy is the degree to which a practice is “taken for granted,” and perceived as congruent with cognitive schemas and cultural frameworks (Scott, 2013). Achieving the aim of changing consumer payment habits is a real challenge. To do so, consumers must become familiar with this mode of payment and see benefits to it which go beyond simply being a means of payment. “FlashPay is the solution that can make life easier for everyone. No more need for cash or carrying cards at the risk of losing them. Everything can be done via your mobile phone. FlashPay also allows you to transfer money between people independently and without any intermediation ... For us, FlashPay is more than payment, it’s a real loyalty program associated with a relational marketing strategy by offering users discounts, credits, gifts…” (The initiator of the FlashPay PMP solution). “FlashPay” was conceived as a way to maintain a strong relationship with existing customers and to build a relationship with new customers (Slade et al, 2014; De Kerviler et al., 2016).

Normative Legitimacy

Normative legitimacy is the degree of congruence of a practice with the norms and values in the social system (Humphreys, 2010a). All payment solutions, regardless of their type or form, pose a strong security issue. We can imagine that all consumers need to be sure that their money is safe from any risk of misappropriation or theft in order to accept using a new mode of payment. Often, the institution proposing a mode of payment is the guarantor. In the case of a credit card, for example, banks undertake this role (Sahut and M. Galuszewska, 2004). And in the case of “FlashPay”, the brand is the guarantor of the security of the transaction. “Adopting FlashPay is conditioned by the need to reassure users, whether they are consumers or businesses. So, in the first phase of the FlashPay launch, the brand alone seems to be enough to reassure its customers. In a second step, the brand must be able to reassure potential partner retailers about the durability of the customer database and the security of transactions. A partnership with a bank can give the necessary credibility to facilitate the release of FlashPay” (General Manager of commercial bank 1).

Indeed, banks which are the first providers of payment solutions do not seem to perceive in “FlashPay” a threat but rather a real opportunity. “FlashPay”, with its different potential partners, is an opportunity for banks to recruit new business customers and big accounts. “A partnership with FlashPay? Yes, why not! If this solution is adopted by many retailers as well as a large number of customers, this will involve the deposit of large sums in our bank and potential revenues. That’s a gain for us as a commercial bank” (General Manager of a commercial bank 2).

Bank managers believe that “FlashPay” needs to be associated with banks, just like Visa and MasterCard are, if it wants to have several partnerships with other brands. If the PMP solution wants to achieve strong credibility, keep control of transaction flows and avoid inconvenience to customers, a large and sophisticated infrastructure is needed. This is why partnering with a bank may be required according to bank managers.

Regulatory Legitimacy

Regulatory legitimacy is defined as the degree to which a practice conforms to rules and regulations set by governments or regulatory agencies (Humphreys, 2010a). Indeed, the diffusion and adoption of PMP requires government involvement to encourage brands to be transparent in their transactions and to adopt “FlashPay” and integrate it into their payment methods.

“Using FlashPay enables the company to have a record of all transactions. This is something that many businesses do not want! Here, in Tunisia, the majority of people use cash for small daily transactions and this suits some businesses which do not want to declare their real turnover to the taxman!”

The initiator of FlashPay

“We are facing a real crisis of trust between the government and companies. We have already suggested to sellers to use a pay station connected to the Ministry to facilitate tax declarations and show transparency. No seller has adhered to this proposal. Maybe the incentives have failed! I think we need to embrace this type of initiative by offering a better tax grid to businesses that use systems like FlashPay. Changing things requires real involvement from the government”

Director of the Ministry of Finance

What we can notice from the discourse of the two interviewees above is that the corruption of some businesses, combined with a total absence of any real will of the government to set rules regulating PMP, are one of the many factors that are hindering the diffusion of PMP. It seems that establishing laws regarding PMP is not a current priority for the Tunisian government.

Territorial Legitimacy

As in Humphrey’s work (2010a) on legitimization of casino gambling, a fourth type of legitimacy has been identified: territorial legitimacy is the legitimacy that a practice gains as a result of being present and anchored in an area (Humphreys, 2010a). Indeed, beyond the objective of retaining restaurant customers, “FlashPay” is a pilot project, testing the acceptability of this type of payment with a view to generalizing it to several other commercial brands. “Concretely, our strategy is to segment the market by catchment area. In each area, a coffee shop with a good attendance will be targeted to host and promote FlashPay. A large number of consumers using FlashPay will serve as a means to convince other brands in different business areas to adopt FlashPay. The larger the FlashPay network grows, the more legitimacy we will gain” (The initiator of FlashPay).

Brands that are likely to use “FlashPay” perceive in it a competitive advantage and an opportunity to retain customers and gain new ones. “Offering our customers this payment solution is probably a way to retain them, but it is mainly a way to recruit new customers with high purchasing power. If we perceive an added value in terms of turnover with the adoption of FlashPay, we will not hesitate to generalize it to our entire distribution network “(Manager of a supermarket chain). Territorial legitimacy is thus gained progressively in different areas and districts in which there are a concentration of stores with a very good attendance and consumers who are sensitive to the benefits FlashPay could provide them.

Discussion and Implications

Understanding the mechanisms underpinning the institutionalization of a PMP system is enhanced through the identification of its legitimacy pillars. Anchored in the cognitive, normative and regulatory pillars, consumption becomes deeply embedded in consumer habits, who will no longer question its legitimacy or purpose (Scott, 2013). As a technology, the use of a PMP system evolves in the context of the user’s life and in the environment with which they interact. Indeed, from the perspective of Neo-Institutional Theory, interaction with the payment system seems to produce interpretative schemes which refer to the ways in which the individual adopts the system in order to appropriate it and create their own meanings (Orlikowski, 1992). These meanings go beyond the general sense of the experience, which the company considers when designing the system (ease and speed of payment), to encompass several benefits for consumers (better control of the service, managing your budget, protecting yourself and fighting against fraud, preserving the environment, etc.). These interpretations define the value-in-use of PMP and enable predictions concerning its legitimacy and institutionalization. In-keeping with the handful of existing studies, convenience also appears here to be particularly important in accounting for the adoption of PMP (De Kerviler et al., 2016) and also its legitimization. By addressing the issue in a dynamic vision as advocated by the Neo-Institutional Theory (Humphreys, 2010b), this study has identified the cognitive, normative and regulatory pillars of legitimacy.

The cognitive pillar, which is essentially shaped by the consumption system, must fit into the new consumer’s image (Cova and Cova, 2009) and new consumption habits or even their lifestyle (Bernthal et al., 2005) for a better acceptability of PMP. Acceptability is required for this new payment method which has had difficulty in competing with RMP (De Kerviler et al., 2016). Indeed, this first result could provide an initial explanation of the failure of some examples of PMP systems like Moneo in France or QuickTap in the UK. Being often under the governance of a bank or a phone operator, this type of PMP does not seem to be perceived as providing freedom to the consumer. Economic actors like banks can state several conditions (fees, a ceiling price…) and PMP users would not perceive it as a means of supporting their governmentality (Zwick et al., 2008) nor of their ability to control their transactions. Since that our focus is on the Tunisian market we can also explain the fact that customers tend to accept this PMP solution by their level of “uncertainty avoidance” (Hosftede, 1991). Given their belief in destiny, Tunisian society seems to have little control over uncertainty and strong acceptance of risk (Soyah and Magroun, 2004; El Louadi, 2004) even if it’s about a payment solution.

For the regulatory pillar, there is no specific legal restriction on PMP. However, this type of payment system seems to fit perfectly with the aim of the United States to fight fraud and corruption by ensuring traceability of transactions. The case of “FlashPay” in a developing country like Tunisia has shown that fuzzy regulations promote the emergence of financial innovation despite the lack of security. In contrast, very strict regulations, such as for e-money in Europe, will tend to increase barriers to entry and discourage start-up innovations.

Concerning the normative pillar, the company providing “FlashPay” seems to be a central element in the adoption of this payment system, thus representing an institution. Indeed, all customers who were already loyal have adopted “FlashPay” with the exception of those who encountered technical problems during the first tests. This result explains the success of the Starbucks payment application (12 million active users in the US and Canada) which is very similar to “FlashPay”. This application is a dematerialized form of its old loyalty program. In addition to this, “FlashPay” has converted several customers who were not particularly loyal customers. One of the main factors explaining both the adoption of “FlashPay” and the success of the Starbucks PMP application is the proximity relationship between the customer and the provider of this payment method. This also goes in line with the collectivist character (Hosftede, 1991) of the Tunisian society. This collectivist spirit of the Tunisian society has shown to be a driver for making sellers more likely to adopt a customer-oriented behavior and explains the responsiveness of customers to a relational approach (Abbes et al, 2017). Indeed, creating a good customer-seller relationship could strengthen consumer attachment towards the seller and brand (Pellat, et al, 2010) and consequently make customers more likely to accept and adopt their new products and services like payment solutions (Rexha et al, 2003).

Such a personal and sometimes friendly relationship is more difficult to establish with a bank or a phone operator and can arguably explain the low rate of adoption of PMP systems initiated by this type of actor. This point of view is not entirely shared by bank managers, who conversely think that an association with financial institutions is required in order for the PMP solution to grow.

Finally a fourth type of legitimacy - territorial legitimacy (Humphreys, 2010a) - emerged from the discourse of professionals, who think that the adoption and diffusion of “FlashPay” should be progressive and rely on partnerships with businesses having a great portfolio of customers and located in interesting areas. The territorial legitimacy of casinos in Nevada was considered as an important step for the acceptance of casino gambling in the remaining American States (Humphreys, 2010a).

From a theoretical point of view, the present research contributes towards consolidating the existing literature adopting an institutional perspective to address marketing issues. Using Neo-Institutional Theory enabled the researchers to go beyond traditional innovation theories which overlook the social embeddedness of the innovation adoption process (Granovetter, 1985; Shi et al., 2008). The results of this research are in-keeping with other studies (Chaney et al., 2016) supporting the argument that consumption practices can only be accepted and legitimized if supported by the three institutional pillars. One contribution of this research is that it focuses on individual perceptions of consumers and on the perceptions of other actors such as bank managers, IT service providers and government representatives. Indeed, Neo-Institutional Theory is increasingly interested in individuals and their interactions and seeks to explore how these interactions can shape and change institutions (Powell and Colyvas, 2008). This change of anchoring from the meso to the micro level has implied changes in the methodology usually used, as in the case in our research. In fact, the first works taking into account a meso level approach used quantitative methods. Researches in the micro approach, that puts the individual at the heart of institutional dynamics, have to favor qualitative methods that illustrate the richness and complexity of the interaction of the individual with institutions (Chaney and Ben Slimane, 2014).

The adoption behavior of PMP refers to a continuum incorporating the different stages of technology integration in the social and economic environments of the individual. More specifically, the contribution of this research is to enrich the models of acceptability which predict intentions of use as measured by social legitimacy. PMP users acquire, over time, the power to act on their environment and change the norms and codes therein, thus legitimizing the use of PMP. Therefore, consumers and companies have the ability to act on other institutions to initiate a new cycle of stability and continuity of this payment system (Zietsma and Lawrence, 2010). Along with consumption practices (Scott, 2013), time is also considered as an institution (Urien and Naccache, 2005).

From a managerial perspective, different recommendations could be addressed in order to consolidate the legitimacy of PMP. Beyond its role as an electronic wallet, a PMP application can help retailers to develop their loyalty programs for better interaction with their customers (Yang et al., 2012; Taylor, 2016). Systems for geolocation, remote order or even accumulation of loyalty and reward points could be included. Results could help companies (retailers, banks, telephone operators) to rethink the design and implementation strategy of their PMP systems in order to ensure their adoption and avoid failure. On the cognitive level, anchoring the PMP in the cultural and social habits and patterns of the new consumer’s image (Cova and Cova, 2009) is strongly recommended. In line with Humphreys works, (2010a, 2010b) where the positive side of gambling (like wining money, escape) were emphasized, amplification strategies can be implemented by highlighting the benefits of “FlashPay” (convenience, freedom, saving time and effort) to anchor PMP in the consumers’ habits or even to shape their lifestyles (Penãloza and Barnhart, 2011). This was also the conclusion of Bernthal et al. (2005) who studied how the credit/debt practices of US consumers could shape their lifestyles. A moral dimension to the PMP is also needed, with clear and simple communication and a focus on the usefulness of PMP. Moreover, actions rewarding PMP users who register new customers as affiliates could be an interesting way to increase the adoption of PMP. However, collaborative production of cultural meanings about PMP with others in the social arena was not observed in the present research, nor in that of Penãloza and Barnhart (2011) about the normalization of credit/debt cards.

On the normative level, trust and proximity bonds between the customer and the PMP service provider must first be established in order to promote the acceptability of this method of payment and facilitate its institutionalization. Associating PMP with other well accepted services (geolocation, remote order…) could achieve normalization of the practice (Jasperson et al., 2005). Implementing an extension strategy (Humphreys, 2010b) by developing partnerships with other known brands seems a potential solution in order to achieve more credibility and to reach more consumers. An extension strategy was for example very suitable to legitimize Casinos industry by enlarging the initial offer which nowadays includes restaurants, hotels, disco, pools and different other entertaining facilities (Humphreys, 2010b).

On a regulatory level, lobbying actions can be carried out with influential groups. These actions can focus on fighting fraud and corruption using PMP. It is also important to think in terms of networks with a megamarketing vision (Chaney et al., 2016) to ensure the generalization of this mode of payment to several brands in different sectors of activity. We have to consider the entire organizational field, as well as all parties that are likely to influence the adoption of PMP systems. A bridging strategy (Humphreys, 2010b) through collaborative systems linking service providers (the restaurant chain in the present case), mobile phone operators, IT providers, banks and even consumer protection associations will be essential to the institutionalization of PMP. In line with the work of Humphreys (2010b) a bridging strategy could also reframe a whole industry by having connections with citizenship institutions in order to limit the criticism towards an industry.

Finally, this research is not without limitations as it has focused on a particular example of PMP exclusive to a single service brand. Caution should therefore be taken when extrapolating these results to other cultural and social contexts. Future research to verify the legitimacy pillars for PMPs in other types of brands and different business sectors is strongly recommended. It is also important to broaden investigations to other forms of PMP. As a result, future research which can empirically validate these early results would be interesting. Studying changes in the meaning of use of PMP through the acceptability process by incorporating an appropriation phase is also strongly recommended to ensure better legitimacy and institutionalization of PMP as a new consumption practice.

Appendices

Appendices

Appendix 1. “FlashPay” mobile application

appendix 2. Respondents’ profile

Biographical notes

Intissar Abbes has a Phd in management science, specializing in marketing from IAE Lyon and IHEC Carthage. She is an associate professor of Higher Education at IHEC Carthage. She is the author of several research articles and co-author of a book “Journey to the Heart of the Purchase Impulse” (L’Harmattan edition). She is interested consumer behavior, distribution management, experiential marketing, co-creation, digital marketing and innovation marketing.

Yousra Hallem, is an associate Professor at INSEEC School of Business and Economics. She has a PhD in Management sciences. She is graduated from the University of Strasbourg in France. She taught at University of Lyon, EM Strasbourg Business School and IDRAC Business School. Her research is about consumer behavior, tourism marketing, transformative marketing, and digital marketing. She has publications in several ranked journals such as Journal of Retailing and Consumer Services, Journal of Travel and Tourism Marketing, Management International and Management & Avenir.

Lubica Hikkerova is a professor at the IPAG Business School, Paris. She obtained her PhD at Matej Bel University in Banska Bystrica, Slovakia (ISO 9001 certified). His main research fields are summed up in two axes; marketing in tourism on the one hand, the development of entrepreneurship and small businesses on the other.

Nouha Chbak is a graduate of IHEC Carthage. It was as part of her master’s thesis that she participated in this research.

Notes

-

[1]

Transparency Market Research, 2017

-

[2]

Global Mobile Consumer Survey, Deloitte 2017

-

[3]

https://www.paymentscardsandmobile.com/barclaycard-orange-shut-quick-tap-nfc-service/

- [4]

-

[5]

https://www.statista.com/chart/7793/mobile-payment-transaction-volume/

Bibliography

- Abbes, I., Mouelhi, N. B. D., & Hallem, Y. (2017). L’orientation client des vendeurs comme moyen d’adaptation à l’international. Une étude comparative France-Tunisie sur le cas de l’enseigne Zara. Question (s) de management, 3, p. 19-37.

- Ajzen I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50 (2), p. 179-211.

- Almazan, M., & Vonthron, N. (2014). Mobile Money for the Unbanked, Mobile money profitability: A digital ecosystem to drive healthy margins, GSMA.

- Barcenilla J et Bastien JMC (2009) L’acceptabilité des nouvelles technologies: quelles relations avec l’ergonomie, l’utilisabilité et l’expérience utilisateur?. Le travail humain 72(4): p. 311-331.

- Bernthal, M. J., Crockett, D., & Rose, R. L. (2005). Credit cards as lifestyle facilitators. Journal of consumer research, 32(1), p. 130-145.

- Bobillier-Chaumon, M.-É., & Dubois, M. (2009). L’adoption des technologies en situation professionnelle: quelles articulations possibles entre acceptabilité et acceptation ? Le travail humain, 72(4), p. 355.

- Breton, P., & Proulx, S. (2002). Usages des Technologies de l’Information et de la Communication, L’explosion de la communication à l’aube du XXI ème siècle. Paris: Ed. la découverte.

- Campbell, S. (2007). Perceptions of Mobile Phone Use in Public Settings: A Cross-Cultural Comparison. International Journal of Communication, 1, p. 738-757.

- Carlsson, B. (2006). Internationalization of innovation systems: A survey of the literature. Research policy, 35(1), p. 56-67.

- Chaney, D., Ben Slimane, K., & Humphreys, A. (2016). Megamarketing expanded by neo-institutional theory. Journal of Strategic Marketing, 24(6), p. 470-483.

- Chaney, D., & Marshall, R. (2013). Social legitimacy versus distinctiveness: mapping the place of consumers in the mental representations of managers in an institutionalized environment. Journal of Business Research, 66(9), p. 1550-1558.

- Chaney, D., & Ben Slimane, K. (2014). A neo-institutional analytic grid for extending marketing to institutional dimensions. Recherche et Applications en Marketing (English Edition), 29(2), p. 95-111.

- Chau, P. Y., & Tam, K. Y. (1997). Factors affecting the adoption of open systems: an exploratory study. MIS quarterly, p. 1-24.

- Conner, M., & Armitage, C. J. (1998). Extending the theory of planned behavior: A review and avenues for further research. Journal of Applied Social Psychology, 28(15), p. 1429-1464.

- Cova, B., & Cova, V., (2009). Les figures du nouveau consommateur : une genèse de la gouvernementalité du consommateur, Recherche et application en Marketing, 24 (3), p. 81-100.

- Dahlberg, T., Guo, J., & Ondrus, J. (2015). A critical review of mobile payment research. Electronic Commerce Research and Applications, 14(5), p. 265-284.

- Davis, F.D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 13, p. 319-339.

- De Kerviler, G., Demoulin, N.T., & Zidda, P. (2016). Adoption of in-store mobile payment: Are perceived risk and convenience the only drivers? Journal of Retailing and Consumer Services,31, p. 334-344.

- Dias, L. B. (1999). Integrating Technology. Learning and Leading with Technology, 27(3), p. 10-14.

- DiMaggio, P. (1997). Culture and cognition. Annual Review of Sociology 23, 1, p. 263.

- DiMaggio, P. J., & Powell, W. W. (1991). Introduction to the new institutionalism. The new institutionalism in organizational analysis, p. 1-38.

- Docq, F., & Daele, A. (2001). Uses of ICT tools for CSCL: how do student make as their’s own the designed environment? Maastricht: Actes du colloque EURO CSCL.

- El Louadi M. (2004), Cultures et communication dans le monde arabe, Systèmes d’Information et Management, 9 (3), p. 117-143.

- Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behavior: An introduction to theory and research. Reading, MA: Addison-Wesley.

- Greenwood, R., Oliver, C., Sahlin-Andersson, K., & Suddaby, R. (2008). Introduction. In Greenwood, R., Oliver, C., Suddaby, R., & Sahlin-Andersson, K. (éd.) The HandBook of Organizational Institutionalism, London: SAGE, p. 1-46.

- Gerpott, T. J., & Meinert, P. (2017). Who signs up for NFC mobile payment services? Mobile network operator subscribers in Germany. Electronic Commerce Research and Applications, 23, p. 1-13.

- Granovetter, M. (1985). Economic action and social structure: The problem of embeddedness. American journal of sociology, 91(3), p. 481-510.

- Hedman, J., & Henningsson, S. (2015). The new normal: Market cooperation in the mobile payments ecosystem. Electronic Commerce Research and Applications, 14(5), p. 305-318.

- Hoch, S. J., & Ha, Y. W. (1986). Consumer learning: Advertising and the ambiguity of product experience. Journal of consumer research, 13(2), p. 221-233.

- Hofstede G. (1991), Cultures and organizations—software of the mind, New York: McGraw Hill.

- Hughes, E. C. (1936). The ecological aspect of institutions. American sociological review, 1(2), p. 180-189.

- Humphreys, A. (2010a). Semiotic structure and the legitimation of consumption practices: the case of casino gambling. Journal of Consumer Research, 37(3), p. 490-510.

- Humphreys, A. (2010b). Megamarketing: the creation of markets as a social process. Journal of Marketing, 74(2), p. 1-19.

- Humphreys, A., & Latour, K. A. (2013). Framing the game: Assessing the impact of cultural representations on consumer perceptions of legitimacy. Journal of Consumer Research, 40(4), p. 773-795.

- Hsu, C. L., & Lu, H. P. (2004). Why do people play on-line games? An extended TAM with social influences and flow experience. Information & management, 41(7), p. 853-868.

- Jasperson, S., Carter, P.E., & Zmud, R.W. (2005). A comprehensive conceptualization of post –adoptive behaviors associated with information technology enabled. MIS Quarterly, 29(3), p. 525-557.

- Kim, S. H., & Park, H. J. (2011). Effects of social influence on consumers’ voluntary adoption of innovations prompted by others. Journal of Business Research, 64(11), p. 1190-1194.

- Koenig-Lewis, N., Palmer, A., & Moll, A. (2010). Predicting young consumers’ take up of mobile banking services. International journal of bank marketing, 28(5), p. 410-432.

- Kotler, P. (1986). Megamarketing. Harvard Business Review 64(March-April): p. 117-124.

- Kujala, S., Mugge, R., & Miron-Shatz, T. (2017). The role of expectations in service evaluation: A longitudinal study of a proximity mobile payment service. International Journal of Human-Computer Studies, 98, p. 51-61.

- Kulviwat, S., Bruner II, G. C., & Al-Shuridah, O. (2009). The role of social influence on adoption of high tech innovations: The moderating effect of public/private consumption. Journal of Business Research, 62(7), p. 706-712.

- Liébana-Cabanillas, F., Ramos de Luna, I., & Montoro-Ríos, F. J. (2015). User behaviour in QR mobile payment system: the QR Payment Acceptance Model. Technology Analysis & Strategic Management, 27(9), p. 1031-1049.

- Lee, C.C., Cheng, H. K., & Cheng, H.-H. (2007). An empirical study of mobile commerce in insurance industry: Task – technology fit and individual differences. Decision Support Systems, 43, p. 95-110.

- Lin, C. P., & Bhattacherjee, A. (2008). Elucidating individual intention to use interactive information technologies: The role of network externalities. International Journal of Electronic Commerce, 13(1), p. 85-108.

- Miles, M.B., & Huberman, A.M. (2003). Qualitative data analysis. SAGE.

- Morosan, C., & DeFranco, A. (2016). It’s about time: Revisiting UTAUT2 to examine consumers’ intentions to use NFC mobile payments in hotels. International Journal of Hospitality Management, 53, p. 17-29.

- Munir, K. A., & Phillips, N. (2005). The birth of the ‘Kodak Moment’: Institutional entrepreneurship and the adoption of new technologies. Organization studies, 26(11), p. 1665-1687.

- Oliveira, T., Thomas, M., Baptista, G., & Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in Human Behavior,61, p. 404-414.

- Orlikowski, W.J. (1992). The duality of technology: Rethinking the concept of technology in organizations. Organization science, 3(3), p. 398-427.

- Pellat, G., Poujol, F., & Siadou-Martin, B. (2010). L’orientation client du vendeur du point de vue du consommateur: les apports de la théorie de l’attachement. Management & Avenir, 1, p. 246-266.

- Peñaloza, L., & Barnhart, M. (2011). Living US capitalism: The normalization of credit/debt. Journal of Consumer Research, 38(4), p. 743-762.

- Proulx, S. (2005). Penser les usages des technologies de l’information et de la communication aujourd’hui: enjeux–modèles–tendances. Enjeux et usages des TIC: aspects sociaux et culturels, 1, p. 7-20.

- Powell, W. W., & Colyvas, J. A. (2008). Microfoundations of institutional theory. The Sage handbook of organizational institutionalism, 276, p. 298.

- Reast, J., Maon, F., Lindgreen, A., & Vanhamme, J. (2013). Legitimacy-seeking organizational strategies in controversial industries: A case study analysis and a bidimensional model. Journal of Business Ethics, 118(1), p. 139-153.

- Rexha, N., Kingshott, R. P. J., & Aw, A. S. S. (2003). The impact of the relational plan on adoption of electronic banking. Journal of services marketing, 17(1), p. 53-67.

- Rogers, E. M. (2003). The diffusion of innovation 5th edition.

- Rosa, J.A., Porac, J.F., Runser-Spanjol, J., & Saxon, M.S. (1999). Sociocognitive dynamics in a product market. Journal of Marketing, 63(4), p. 64-77.

- Sahut, JM., & Galuszewska M. (2004). Electronic payment market: a non-optimal equilibrium. International Symposium on Applications and the Internet Workshops. proceedings of 2004 Workshops, Tokyo, Japan, p. 3-8.

- Sahut, JM. (2008a). The Adoption and Diffusion of Electronic Wallets. Journal of Internet Banking and Commerce, 13(1), p. 1-10.

- Sahut, JM. (2008b). Internet Payment and Banks. International Journal of Business, 13(4), p. 361-376.

- Scott, W. R. (2013). Institutions and organizations: Ideas, interests and identities (4th ed.). Los Angeles, CA: Sage.

- Selznick, P. (1948). Foundations of the theory of organization. American sociological review, 13(1), p. 25-35.

- Sen, S., & Bhattacharya, C. B. (2001). Does doing good always lead to doing better? Consumer reactions to corporate social responsibility. Journal of marketing Research, 38(2), p. 225-243.

- Singh, J.V., Tucker, D.J., & House, R.J. (1986). Organizational legitimacy and the liability of newness. AdministrativeScience Quarterly, 31(2), p. 171-193.

- Shankar, A., Cherrier, H., & Canniford, R. (2006). Consumer empowerment: a Foucauldian interpretation. European Journal of Marketing, 40(9/10), p. 1013-1030.

- Shi, W., Shambare, N., & Wang, J. (2008). The adoption of internet banking: An institutional theory perspective. Journal of Financial Services Marketing, 12(4), p. 272-286.

- Slade, E., Williams. M., Dwivedi, Y., & Piercy, N. (2014). Exploring consumer adoption of proximity mobile payments. Journal of Strategic Marketing, 23(3), p. 209-223.

- Soyah T. et Magroun W. (2004), Influence du contexte culturel tunisien sur l’orientation des systèmes d’information des banques tunisiennes, Colloque CIDEGEF, Université Saint-Joseph, Beyrouth, 28-29 octobre.

- Suchman, M.C. (1995). Managing legitimacy: strategic and institutional approaches. Academy of ManagementReview, 20(3), p. 571-610.

- Taylor, E. (2016). Mobile payment technologies in retail: a review of potential benefits and risks. International Journal of Retail & Distribution Management, 44(2), p. 159-177.

- Utterback, J. M. (1994). Radical innovation and corporate regeneration. Research Technology Management, 37(4), p. 10.

- Urien, B., & Naccache, P. (2005). Du temps GMT au temps BMT: une interprétation de l’échec de l’Internet Time au regard de l’épistémologie réaliste critique. RevueSciences de Gestion, 49, p. 149-169.

- Veblen, T. (1909). The limitations of marginal utility. Journal of political Economy, 17(9), p. 620-636.

- Venkatesh, V., Morris, M., Davis, G., & Davis, F. D. (2003). User acceptance of information technology: toward a unified view. MIS Quarterly, 27(3), p. 425-478.

- Yang, S., Lu, Y., Gupta, S., Cao, Y., & Zhang, R. (2012). Mobile payment services adoption across time: An empirical study of the effects of behavioural beliefs, social influences, and personal traits. Computers in Human Behaviour, 28, p. 129-142.

- Zhou, T., Lu, Y. & Wang, B. (2010). Integrating TTF and UTAUT to Explain Mobile Banking User Adoption. Computers in Human Behavior, 26, p. 760-767.

- Zietsma, C., & Lawrence, T.B. (2010). Institutional work in the transformation of an organizational field: the interplay of boundary work and practice work. Administrative Science Quarterly, 55(2), p. 189-221.

- Zwick, D., Bonsu, S. K., & Darmody, A. (2008). Putting Consumers to Work: Co-creation and new marketing governmentality. Journal of consumer culture, 8(2), p. 163-196.

Appendices

Notes biographiques

Intissar Abbes est titulaire d’un doctorat en sciences de gestion, spécialité marketing de l’IAE de Lyon et de l’IHEC Carthage. Maître assistante de l’enseignement supérieur à l’IHEC Carthage, elle est l’auteur de plusieurs articles de recherche et co-auteur d’un ouvrage « voyage au coeur de l’impulsion d’achat » (édition L’Harmattan). Elle est spécialiste en comportement du consommateur, management de la distribution, marketing expérientiel, co-création, marketing digital et marketing de l’innovation.

Yousra Hallem, est professeure associée à INSEEC School of Business and Economics. Elle a un doctorat en sciences de gestion. Elle est diplômée de l’Université de Strasbourg en France. Elle a enseigné à l’Université de Lyon, à EM Strasbourg Business School et IDRAC Business School. Ses recherches portent sur le comportement du consommateur, le marketing touristique, le marketing transformatif et le marketing digital. Elle a des publications dans plusieurs revues comme Journal of Retailing and Consumer Services, Journal of Travel and Tourism Marketing, Management International et Management & Avenir.

Lubica Hikkerova est professeur à l’IPAG Business School, Paris. Elle a obtenu son doctorat à l’Université Matej Bel de Banska Bystrica, Slovaquie (certifiée ISO 9001). Ses principaux champs de recherche se résument en deux axes; le marketing dans le tourisme d’une part, le développement de l’entrepreneuriat et des petites entreprises d’autre part.

Nouha Chbak est diplômée de l’IHEC Carthage. C’est dans le cadre de son mémoire de Master qu’elle a participé à cette recherche.

Appendices

Notas biograficas

Intissar Abbes tiene un doctorado en ciencias de la gestión, especializado en marketing de IAE Lyon e IHEC Carthage. Es profesora asociada de educación superior en IHEC Carthage. Es autora de varios artículos de investigación y coautora del libro “Journey to the Heart of the Purchase Impulse” (edición de L’Harmattan). Le interesa el comportamiento del consumidor, la gestión de la distribución, el marketing experiencial, la co-creación, el marketing digital y el marketing de innovación.

Yousra Hallem, es profesora asociada en INSEEC School of Business and Economics. Tiene un doctorado en ciencias de la gestión. Ella se graduó de la Universidad de Estrasburgo en Francia. Ella enseñó en la Universidad de Lyon, la Escuela de Negocios de Estrasburgo y la Escuela de Negocios IDRAC. Su investigación es sobre el comportamiento del consumidor, el marketing turístico, el marketing transformativo y el marketing digital. Ella tiene publicacionesen varias revistas especializadas como Journal of Retailing and Consumer Services, Journal of Travel and Tourism Marketing, Management International et Management & Avenir.

Lubica Hikkerova es profesora en IPAG Business School, París. Obtuvo su doctorado en la Universidad Matej Bel en Banská Bystrica, Eslovaquia. Sus principales campos de investigación se resumen en dos ejes; Por una parte la comercialización y el marketing en el sector turístico y por otra la creación y el desarrollo de pequeñas y medianas empresas.

Nouha Chbak se graduó en IHEC Carthage. Fue como parte de su tesis de maestría que participó en esta investigación.

List of figures

List of tables

Table 1

Mobile payment systems

Table 2

Synthesis of the main innovation adoption theories

People who continued to use “FlashPay” 6 months after

People who continued to use “FlashPay” 6 months after