Abstracts

Abstract

Some researchers have claimed that Chinese firms are impervious to political risk, calling into question the institutionalization of political risk by Chinese firms. Building on resource dependence theory and the literature on non-market strategies, this study finds significant impact by ownership structure, firm scale, and the degree of internationalization on the institutionalization of political risk assessments (IPRA) by Chinese firms. As such, state-owned firms and larger firms cultivate a higher level of IPRA. We find a positive impact of a firm’s scale and scope of internationalization, but insignificant impact of depth of internationalization.

Keywords:

- Chinese MNEs,

- Non-market Strategy,

- Political Risk,

- Political Connections,

- Resource Dependence Theory,

- State-ownership

Résumé

Il est affirmé que les entreprises chinoises étaient insensibles au risque politique, remettant en question l’institutionnalisation du risque politique par les entreprises chinoises. S’appuyant sur la théorie de la dépendance des ressources et la littérature sur les stratégies non marchandes, cette étude révèle un impact significatif de la structure de propriété, la taille et le degré d’internationalisation sur l’institutionnalisation des évaluations du risque politique (IPRA). Les entreprises publiques et les grandes entreprises cultivent un niveau plus élevé d’IPRA. Nous constatons un impact positif de la taille et de l’étendue de l’internationalisation, mais un impact insignifiant de la profondeur de l’internationalisation.

Mots-clés :

- Multinationales chinoises,

- Stratégie non marchande,

- Risque politique,

- Liens politiques,

- Théorie de la dépendance des ressources,

- Propriété d’Etat

Resumen

Se ha afirmado que las empresas chinas son inmunes al riesgo político, cuestionando la institucionalización del riesgo político por parte de las empresas chinas. Partiendo de la teoría de la dependencia de recursos y la literatura sobre estrategias no de mercado, encontramos que la estructura de propiedad, el tamaño y el grado de internacionalización influyen en la institucionalización de las evaluaciones de riesgo político (IPRA). Así, las empresas estatales y las grandes tienen mayor nivel de IPRA. Encontramos un impacto positivo de la escala y el alcance de la internacionalización, pero un impacto insignificante de la profundidad de la internacionalización.

Palabras clave:

- Empresas multinacionales chinas,

- Estrategia no de mercado,

- Riesgo político,

- Conexiones políticas,

- Teoría de la dependencia de recursos,

- Propiedad estatal

Article body

The rise of Foreign Direct Investment (FDI) from the emerging markets in recent years is a new feature in the global economy (Ramamurti, 2009). The World Investment Report (2014) reports that outward FDI from developing countries reached USD 454 billion—a record high—and contributed to 39% to total global FDI outflows in 2013. This rise of Outward Foreign Direct Investment (OFDI) from the emerging markets raises new questions about how political risk is perceived and managed (Casson and DaSilva Lopes, 2013).

In 2016, Chinese OFDI will reach over 200 billion dollars, and this figure is an underestimate because it does not take into account reinvested income, leverage, or foreign equity participation[1]. Companies from countries that were once seen as sources of political risk are now crossing borders and facing their own sets of political risks, both in other developing countries, as demonstrated by the quote at the beginning of this article, and in developed countries, as exemplified by Huawei’s alleged links to China’s security services which blocked its purchase of 3Leaf’s assets in the United States (Reuters, 2011).

Some researchers have claimed that Chinese investors are impervious to political risk, and invest in politically-risky countries because their institutional environment favors developing countries (Buckley et al., 2007). The political risks faced by firms can be defined as “the risk of a strategic, financial, or personnel loss for a firm because of such non-market factors as macroeconomic and social policies (…), or events related to political instability (terrorism, riots, coups, civil war, and insurrection)” (Kennedy, 1988, p. 27). Furthermore, political risk is considered to be a critical factor that determines OFDI (Alon, 1996).

Among the emerging markets, China has grown within a short period of time to become the world’s third largest investor[2]. The growing presence of Chinese firms abroad has exposed them to a variety of new sources of political risk. In 2011, for example, Chinese oil firms encountered major financial losses after the NATO campaign in Libya because their pre-conflict contracts were unaccepTable by the rebel forces (Engdahl, 2011). In 2012, twenty-nine Chinese workers from a subsidiary of Sinohydro were kidnapped by rebel forces in Sudan (Jacobs and Gettleman, 2012). In 2013, following the U.S. lead, Australia banned Huawei from bidding for commercial contracts related to national infrastructure (Reuters, 2013). It was argued that this would allow Huawei to introduce a “back door,” or a “Trojan horse,” for the Chinese military to monitor Australian data.

While efforts have been made to privatize the economy in China, state-owned enterprises (SOEs) still play a significant role in the Chinese economy and particularly in key industries (Li et al., 2018). For example, the party-state controls about 56% of the GDP (in comparison, the U.S. government controls 32%) (IMF, 2019; National Bureau of Statistics of China, 2016, 2018). Firms with more than 10% of state ownership (SOEs) represent 50% of the total market capitalization in China (Inoue et al., 2013). SOEs have been structured into large enterprise conglomerates bounded together by interlocking directorates, cross subsidization, intra-group trade and cross shareholding (Li et al., 2018). The communist party often protects monopolies reserved for central SOEs or restricts private participation in these sectors to a minimal level (Li et al., 2018). State ownership in China enables acquisition of crucial R&D and access to resources and, in turn, SOEs are expected to fulfill government requirements and follow government directives (Zhou et al., 2017). In fact, a significant share of China’s OFDI is carried out directly by Chinese state-owned enterprises and a significant share is targeted towards risky regions, raising the question of how Chinese firms institutionalize political risk (Alon et al., 2017; Alon et al., 2018).

The internationalization of Chinese firms challenges traditional theories of the firm. Buckley et al. (2007), for example, find the paradoxical assessment that Chinese OFDI is positively related to political risk. Quer et al. (2012) also confirm that political risk does not deter Chinese investment. Are the Chinese oblivious to political risk? Are they naïve? Or, do they have their own ways to institutionalize political risk? How multinationals in the emerging markets manage political risk will determine their ability to compete globally. Given their limited international experience, firms in developing countries may be disadvantaged by both administrative traditions and by a lack of capabilities and management know-how. As Poisson-de Haro and Bitektine (2015) underscore, differences in a firm´s structures and non-market capabilities (including political capabilities) lead to heterogeneous corporate strategies to respond to institutional pressures.

Firms become familiar and learn to manage political risk through a process of institutionalization of political risk assessment (IPRA). Following Al Khattab et al., (2008, p. 689), IPRA can be described as “the process of analysing and evaluating political risk within a firm” (Al Khattab et al., 2008, p. 689) and it comprises a three-stage process based on 1) the responsibility assignment, 2) frequency of conducting the assessment, and 3) risk assessment techniques[3]. IPRA can be seen as an adaptive response to the higher probability that potentially significant risks will arise from the political environment (Kobrin, 1982). As environmental uncertainty increases in turbulent environments, firms require higher information acquisition and processing, especially when the firm needs to manage multiple geographically dispersed locations, and this institutionalization allows firms to implement a more explicit and systematic procedure to assess political risk.

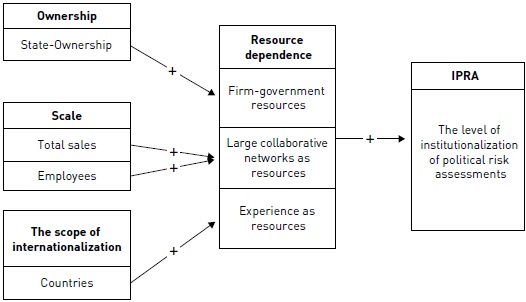

The purpose of this article is to examine how resources affect Chinese companies’ IPRA in their international expansion, with a specific focus on the firms’ ownership structure, the firms’ size, and the firms’ degree of internationalization. Resources here refer to “all assets, capabilities, organizational processes, firm attributes, information, knowledge, etc. controlled by the firm that enables the firm to conceive of and implement strategies that improve its efficiency and effectiveness” (Barney, 1991, p. 101). As a special type of resource, capabilities refer to the organization´s capacity to deploy and improve the productivity of resources (Makadok, 2001). Resources and capabilities can be of a political nature when they “… enable the firm to adapt to, anticipate or even shape changes in the corporate political environment” (Lawton et al. 2013, p. 230).

The major contribution of this article rests on emphasizing the important role of resource availability, i.e. those organizational characteristics that permit the firm obtain, develop and/or use more and more diverse tangible and intangible resources and capabilities, in determining a firm’s IPRA. Although firm’s size (Stapenhurst, 1992; Al Khattab et al., 2008) and the degree of internationalization (Hashmi and Guvenli, 1992; Al Khattab et al., 2008) had long been examined as important factors that determines firm’s IPRA, the mechanism how diverse firms develop distinct level of institutionalization remains ambiguous, overlooked or not strongly interpreted. This study, however, reveals that IPRA varies widely among different firms due to their different abilities to obtain resources which, in turn, determine the firm’s capability to identify and assess political risk.

In the next section, we will describe the literature and develop hypotheses to be tested on a Chinese sample of large multinationals. We develop hypotheses about the impact of firm’s size and that of degree of internationalization, distinguishing between depth (the extent of international operations measured through the number of years the firm has engaged in international business and the proportion of revenue gained from international operations) and that of scope of internationalization, (the geographic diversity of international operations measured through the total count of countries where the firm operates).

Literature review and hypotheses development

IPRA refers to a process which makes political risk assessment ’’more explicit and systematic’’. While IPRA can be operationalized in multiple ways, ranging from simple to very complicate mathematical formulae, at the very least, it requires the specification of responsibilities within the firm (Kobrin, 1982). Given the differences across firms in terms of history, trajectories, managerial structures, etc. the existence of a superior IPRA model is not realistic (Howell, 2001). Besides, the myriad of potential political risk sources and consequences, as well as the various degrees of firms’ exposure to political risk make the choice of the most appropriate IPRA procedure complex (Iankova and Katz, 2003). However, and while the degree can greatly vary, this process should be conducted with the aim of obtaining objective and subjective assessment of political risk on a continuous basis (Al Khattab et al., 2008).

Since, unlike most Western firms, many Chinese companies are SOEs, we are interested in the unique impact of state ownership on Chinese institutionalization of political risks. Literature has long shown that political leaders often grant favors to state-owned and other politically-connected firms (Lai and Warner, 2015). Amsden (1989) argues that governments can facilitate the access of these firms to technology, providing financial assistance and granting administrative privileges. Zhu and Chung (2014) highlight that MNEs tied to governments likely have preferential access to subsidized credits and other financial resources. They may also obtain preferential tax treatments, and government contracts (Faccio, 2006). Although abundant capital increases the likelihood of misallocations in SOEs, it also alleviates capital shortages that can constitute a fundamental barrier to internationalization and support risky projects that otherwise would not be undertaken (Musacchio et al., 2015).

The fact that a state is involved in the ownership structure of a MNE may also cause a cognitive bias with a direct impact on managerial risk taking by making managers more confident that they will receive some support, or even be bailed out, should they face political troubles in the host country (Hachana and Belanes, 2010). This institutional support can make MNEs more “risk-tolerant” and thus enjoy a greater capability to invest in broader geographic locations, including less sTable markets where private firms would be less likely to invest (Ren and Jack, 2014)[4]. Thus, political support from the home-country government could make firms less likely to be deterred by higher levels of political risk. Consequently, the need for IPRA can be expected to be lower in SOEs than private firms.

However, drawing on the resource dependence theory (Hillman et al., 2009; Pfeffer and Salancik, 1978) and the non-market strategy literature (Baron, 1995; Hillman et al., 2004), it is also possible to hypothesize the opposite effect and to expect that SOEs will institutionalize more political risk compared to private firms. Firms are constrained and affected by their environments, including the political environment. By attempting to influence and shape regulations and policies, firms can actively manoeuvre to achieve a more favorable environment (Hillman et al., 2009). As Pfeffer and Salancik (1978, p. 189) note: “The organization, through political mechanisms, attempts to create for itself an environment that is better for its interest.” Since the salience of a political issue is a fundamental factor for becoming involved in corporate political action (Hillman et al., 2004), this is more likely to occur when a firm is heavily dependent on the government (Meznar and Nigh, 1995).

Indeed, firms have been shown to increase their interactions with regulators when salient policy issues such as pricing, required investments, and the entry of new competitors, are subject to administrative considerations (Buchholz, 1990). This is the case, for example, for regulated industries where the higher exposure to threats arising from the political environment provides firms with incentives to establish close relationships with political actors (Sun et al., 2012) and to adopt a proactive approach toward the management of political risk (Jiménez et al., 2014; John and Lawton, 2017). While traditionally host government intervention has been immediately associated with negative consequences for the firm, studies have shown that a non-market environment may provide interesting opportunities and value-added through cooperative government-MNE relationships (Luo, 2001). This is particularly noTable in volatile emerging economies and during institutional transitions (Li et al., 2013).

When companies have a great dependence on political institutions and the policy context is unpredictable, they must frequently interact with the governments of both the home and host countries (Lawton et al., 2013). Frequency is actually one of the most important factors with a positive influence on the effectiveness of the capability-building mechanism based on experience accumulation (Zollo and Winter, 2002). Drawing on the resource- and capability-based view (Pensre, 1959; Wernerfelt, 1984; Barney, 1991), the non-market strategy literature (Baron, 1995; Hillman et al., 2004) has emphasized that experience dealing with political risk and interacting with authorities becomes very valuable to develop political capabilities, which allow firms to obtain competitive advantages by engaging in political activities (Hillman and Wan, 2005; Jiménez, 2010; Jiménez and Delgado-García, 2012). By doing so, they can inform pivotal decision-makers about the firm´s strategies and views, establish reputation and influence, and, to a certain extent, public policies (Luo, 2001). For instance, firms can leverage this experience to achieve more accuracy when assessing the level of political risk in a given location, enhance their negotiation, litigation and lobbying skills, obtain information from coalitions and political networks, and so forth (Jiménez et al., 2014; Lawton et al., 2013).

As a result of their higher dependence on political institutions, SOEs frequently interact with the government (Lawton et al., 2013). This more extensive experience compared to private firms in interacting with authorities makes them well prepared to interact at the non-market strategy level. Given their privileged access to or ties with key political powers, SOEs are in an advantageous position to develop political capabilities that may allow them to identify and mitigate risks both ex-ante and ex-post (Delios and Henisz, 2003a, 2003b; Holburn and Zelner, 2010). The creation of these political capabilities can be a very persuasive factor that makes SOEs more likely to institutionalize the assessment of political risk, not only to protect themselves from such political risk but even to take advantage of it. SOEs may enjoy critical political capabilities to which private firms have less access, such as inside information, direct access to decision-makers, diplomatic pressures, and so forth (Duanmu, 2014). As a recent example of these diplomatic pressures by the home government in order to protect the interests of the Chinese companies, after the arrest of Huawei´s executive Meng Wanzhou for alleged violations of US sanctions China has not only demanded her release (The Guardian, 2018a) but even detained nationals of Canada as retaliation (The Guardian, 2018b). Further, in the case of China, not only the national government can support firms but also regional and local ones (Li et al., 2017; Yan and Chang, 2018).

However, in order to benefit from these political capabilities, political risks cannot be treated as exogenous. Rather, political risk needs to be incorporated as a crucial issue in the strategic planning process. Although some authors argue that SOEs may be more inefficient and generally inferior to their competitors in terms of market-related capabilities (Megginson and Netter, 2001), their most extensive experience in interacting with the authorities makes them well prepared to interact at the non-market strategy level, leading to a higher institutionalization of political risk in order to identify the relevant political actors in the host country.

Furthermore, SOEs are usually under a closer scrutiny and need to account for the actions and results in a more formalized way. As a consequence of the stronger accountability requirements, it is reasonable to think that SOEs implement a more explicit and systematic procedure to assess political risk. As we expect these arguments in favour of a higher degree of IPRA in SOEs compared to private counterparts to offset the negative ones, we therefore formulate the following hypothesis:

H1.State-owned Chinese firms have a higher degree of IPRA compared to their private counterparts.

We also argue that two other organizational attributes, namely size and the degree of internationalization, play a critical role in the institutionalization of the political risk assessments of MNEs.

We expect larger firms, both in terms of assets and employees, to pay closer attention than smaller firms to political risk in their overseas operations. As Kobrin (1982) points out, smaller firms tend to rely on ad-hoc assessments of political risk, whereas larger firms tend to be more bureaucratized and engage in more sophisticated and systematic techniques. Managing the complex relations with all the relevant agents in the host environment, including the great variety of state agencies, regional governments, and federal entities, is a crucial factor for success in the international arena (Lyles and Steensma, 1996), but it is also quite consuming in terms of money and time. Bigger companies have access to a larger amount and greater variety of resources (financial, manpower, technology, and so forth) to devote to their assessments of political risk. They can also implement political actions, such as lobbying, hiring former politicians (interlocks), campaign contributions, or mobilizing networks of relations, to support the interests of the firm more easily than their smaller companies (Hillman and Wan, 2005). However, firms seeking to influence and shape policies need effective and active management and control of the political risk assessment process, which leads to more institutionalized and structured assessment techniques (Al Khattab et al., 2008).

The institutionalization of political risk is also likely to depend on the available organizational slack, i.e. non-committed resources, in the company (Mahoney and Pandian, 1992). Since the amount of slack is not infinite, there is a limit to the amount of knowledge that firms can absorb about the host country (Kumar, 2009). However, larger firms are able to have more organizational slack and therefore more financial discretion (Stan et al., 2014) which, in turn, allows them to be more capable of addressing the available resources for the assessment of political risk. Finally, larger firms also have more incentives to closely monitor political risks in their foreign investments in response to being more exposed to risk as they are more likely to attract the attention of the authorities (Henisz, 2000).

Thus, we propose the following hypothesis:

H2.Larger Chinese MNEs have a higher degree of IPRA.

Further, we expect the assessment of political risk to be more institutionalized in those companies that have a broader degree of internationalization. Firms with greater exposure to political risk have more interest in political risk assessments (Iankova and Katz, 2003) and MNEs with a broader degree of internationalization, both in terms of depth and scope, are more likely to be subject to potential negative consequences of political decisions than companies with less international exposure (Al Khattab et al., 2008). Indeed, Pahud de Mortanges and Allers (1996) demonstrate that potential exposure to political risk constitutes a key determinant of the institutionalization of political risk assessments.

The degree of internationalization, measured by the number of years in international business, is directly related to international experience (Al Khattab et al., 2008). Firms with less international experience may underscore the potential negative consequences of risks stemming from the political environment and therefore will pay less attention to it. In contrast, firms with a lot of experience are more likely to be well aware of the risks (maybe even already having suffered from them) and, as a consequence, they are likely to establish a more structured and institutionalized assessment.

The degree of internationalization has also been measured through the proportion of revenue coming from abroad. Thus, Hashmi and Guvenli (1992), in an analysis of a sample of U.S. firms, show that companies with higher international sales are more likely than other companies to institutionalize their political risk assessments. These authors also highlight that companies operating in more countries take political risk more seriously than other companies as they tend to more often find constraints due to political variables. In fact, companies with investments spread across many different countries have a greater incentive to be particularly alert to political risks as they may be exposed to a “contagion” effect. If a company is subject to detrimental treatment by a government (i.e., expropriations, unilateral modifications of previously agreed conditions, etc), a signal of weakness and/or illegitimacy is sent to other governments, which may then also be tempted to act opportunistically. This threat encourages firms with a broad degree of internationalization to institutionalize political risk in order to play a proactive role in the political arena (John and Lawton, 2017), both to prevent host governments from taking actions contrary to the interests of the firms and, if that were to occur, to discourage governments from other countries from taking similar actions. In addition, companies with subsidiaries in many countries can take advantage of their contacts with diverse types of environments to collect and accumulate experience that can then be useful in other potential locations for investments (Jiménez et al., 2014). Accordingly, we formulate the following hypothesis:

H3. Chinese MNEs with a broader degree of internationalization have a higher degree of IPRA.

Methodology

Research design

Despite the abundance of measures to study political risk at the country level, with multiple indices such as The International Country Risk Guide, The World Bank Governance Indicators, The Index of Economic Freedom, or The POLCONV index (Alon et al., 2017), there are not many established frameworks to analyse its institutionalization at the firm level. In this study we adopt the taxonomy developed by Al Khattab et al. (2008) that proposes a three-step process to analyse firms’ IPRA which comprehensively combines previous seminal contributions from Blank et al., (1980); Kobrin (1981; 1982) and Pahud de Mortanges and Allers (1996). This approach is based on a conceptualization of the institutionalization as a bipolar continuum from less to more institutionalized. By following this approach, we can conduct a finer-grained analysis than in studies using a binary coded variable to reflect whether the firm has institutionalized or not (Pahud de Mortanges and Allers, 1996). As previously mentioned, the three- stage process is based on 1) the responsibility assignment, 2) frequency of conducting the assessment, and 3) risk assessment techniques. Thus, this approach takes a step further from other analytical tools which focus only on risk assessment (Niebling and Shubik, 1982) or forecast (De la Torre and Neckar, 1988).

Responsibility assignment. The first stage identifies the respondents’ attitude on the allocation of responsibility for IPRA, as recommended in previous studies (Blank et al., 1980; Kobrin, 1982). Respondents were invited to give the answer on three levels of responsibility assignment: (a) no formal assignment of responsibility for an individual for PRA nor any effort made by any individual in the firm to do so; (b) no formal responsibility for an individual but related activities are conducted by various individuals; (c) the firm assigns formal responsibility to an individual(s) to evaluate the potential risks associated with the firm’s international business activities. Based on the answers, firms were categorized into different groups, ranging from “non-institutionalized”, to “less institutionalized” and “more institutionalized”, respectively. The score will be “5” if a firm chooses “non-institutionalized”, likewise, “10” for “less institutionalized” and “15” for “more institutionalized”.

Frequency of conducting the assessment. Respondents not included in the group of “non-institutionalized” were further suggested to choose the frequency of conducting the assessment in the second stage. Five choices, never, occasionally, yearly, quarterly and day-to-day, were listed according to the frequency. A greater degree of IPRA is assigned to those firms conducting political risk assessment more frequently. In this step, a firm will get a “5” score if it occasionally conducts the assessment, “0” for never, “10” for yearly, “15” for quarterly and “20” for day-to-day.

Risk assessment techniques. In the last stage, several techniques derived from literature, are brought forward. They are judgement and intuition of manager, expert opinion, Delphi technique, standardized checklist, scenario development and quantitative techniques. Respondents were asked to select the answer, matching their practice of political risk assessment. While virtually all firms in our sample employ a qualitative technique, mainly judgement and intuition or expert opinion (34 and 31 firms respectively), only around a third of them (15) rely on quantitative techniques. A firm would be considered as more institutionalized in the case of adopting both qualitative and quantitative techniques, compared to those firms which use only qualitative technique. Also, the more techniques firms adopted the greater degree of IPRA. Firms, again, were ordered according to the degree. Score “10” will be assigned if a firm uses both qualitative and quantitative techniques. Score “5” will be given if a firm only adopts a qualitative technique or a quantitative technique. Moreover, a firm will get score “6” if it uses two qualitative techniques[5].

The IPRA will be the total scores. For example, firm A assigns formal responsibility for individuals to evaluate the potential risks associated with the firm’s international business activities, conduct this assessment quarterly, and use one qualitative techniques and two quantitative techniques, it will get a total score of “41” which denotes its IPRA.

On this basis, a framework was created to examine the resource-related determinants of their various levels of IPRA by adding several additional firm-level variables: governmental connections (Cuervo-Cazurra et al., 2014; Hillman et al. 2004), firm’s size (Albright, 2004), and the degree of internationalization (Wyper, 1995). Survey questions were given in the form of mutually exclusive and multiple- choice items. A five-point Likert scale (with 1 indicating the least important and 5 indicating the most important) was applied. An English version of the questionnaire can be found in Annex 1[6].

The sample frame used in this study is the top 100 Chinese multinational firms listed by the China Enterprise Confederation (CEC) in 2013. These firms are chosen because of their leading position both in domestic competition and international expansion. Self-reported questionnaires were delivered by hand to the general manager (CEO) of the Chinese multinational enterprises[7], to ensure that all the respondents held a high level of responsibility. 76 copies were returned, of which 29 were unusable due to being incomplete or due to errors in completion. Eventually, 47 copies were qualified for analysis, 66% of which came from SOEs. While a self-reported survey was adopted for data collection, we also aimed to triangulate the data in order to minimize any potential respondent bias. This procedure was also useful to confirm the veracity of some responses to the survey and avoid errors. Specifically, mainstream website-based news sources (both Chinese and English media, including China Daily, Financial Times, etc.), were employed to get additional insights about the political risk assessment by Chinese firms. For instance, according to local news, China Three Gorges learned to do political risk assessment on international projects after the failure in Myanmar in 2011[8]. Huawei set up an overseas public relation department to deal with political risk since many authorities banned Huawei from bidding local projects in 2015. Also, the firms´ websites and annual reports were explored as additional sources of data to cross-check the firm-level descriptive statistics and verify the validity of the data.

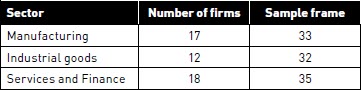

The respondents were categorized into nine sectors according to the Yahoo! Finance: Sector List.[9] The list of firms is shown in Annex 2. A χ2 test was used to test for any bias in the sample. The results suggested that there was no significant difference between the respondents and the sample list with respect to industry category (Pearson χ2 = 10.000, p = 0.530). Hence, the respondents are considered to be representative and the findings can be generalized[10].

Table 1

Sectoral breakdown

Measures

SOEs. Firms were divided into SOEs and non-SOEs according to their ownership. Following the previous literature, we use a dummy variable to determine whether or not the firms are SOEs (Inoue et al. 2013; Sun et al., 2015) and rely on two sources: one is the list of SOEs published by China’s State-owned Assets Supervision and Administration Commission of the State Council (SASAC);[11] the other is the firm annual reports in which their ownership is declared. Further, for unclear cases (7), we examined the firms’ home pages. Eventually, 31 out of the 47 firms were found to be SOEs.

Size. Two variables, total sales in US$ (SALES) and the number of employees (EMPLOYEES) were used to measure the relative scale of the organization. In order to categorize the samples, we referred to China’s national standard, which is “The classification standard of small, medium, and large sized enterprises” (Ministry of Industry and Information Technology of the People’s Republic of China [2011] No. 300).[12] Table 2 shows the results of the classification of the firms into three groups by total sales and number of employees.

Table 2

Number of firms in each category according to Chinese standard classifications

The degree of internationalization. In order to evaluate the degree of internationalization, the number of years engaged in international business (YEARS), the proportion of revenue obtained from international operations (REVENUE), and the number of foreign countries with which the firm has been involved (COUNTRIES) were adopted. It is necessary to make a finer-grained distinction between the depth (YEARS and REVENUE) and the scope (COUNTRIES) of international operations. The depth of the internationalization denotes the extent of international operations. The scope of internationalization denotes the geographic diversity of international operations (Jiménez, 2010; Clarke et al. 2013). Following the criteria adopted by Pahud de Mortanges and Allers (1996) and Al Khattab et al. (2008), firms were classified into three categories (Table 3).

Data analysis

The results of correlation matrices indicate that no serious problem of collinearity according to the limit proposed by Neter et al. (1985) and Kennedy (1992) (Table 4).

In order to use parametric statistics, normality and homogeneity should be fulfilled (Field, 2000). A Normal Quintiles-Quintiles chart reveals that all the variables were normally distributed, allowing us to conduct a Bartlett test for homogeneity. The output indicates that the assumption of homogeneity was reasonably met for the parametric statistics.

Table 3

Measures to categorize internationalization and the number of firms in each category

Table 4

Correlation matrix

Table 5

Results of the Bartlett test

In this case, parametric statistics were employed to examine the underlying connections among the variables and the effects of the factors.

The results of a one-way ANOVA suggests a statistically significant difference in the level of institutionalization between SOEs and non-SOEs (P<0.01). Moreover, in order to compare the means, a single-step multiple comparison procedure and a statistical test known as Tukey’s HSD test were adopted. The results indicate that SOEs have a higher degree of institutionalization of political risk assessments as compared to non-SOEs (Fig. 1),[13] thus confirming Hypothesis H1.

Regarding firm’s size, both SALES and EMPLOYEES are significantly related to the level of institutionalization according to the result of a one-way ANOVA. In other words, the levels of institutionalization are significantly different across the three categories of a firm’s total sales (P<0.01) and the number of employees (P<0.001). Further analysis of Tukey’s HSD test reveals that the mean of a large-sized firm is significantly greater than the mean of a small-sized firm (Fig. 2). Although the difference is not significant, the mean of a medium-sized firm (21.57 for SALES, and 25.64 for EMPLOYEES) is less than the mean of a large-sized firm (29.05 for SALES, and 29.74 for EMPLOYEES) and greater than the mean of a small-sized firm (15.58 for SALES, and 14.82 for EMPLOYEES). Thus, it can be concluded that larger firms in terms of total sales and number of employees, due to the higher amount of available resources and their more formalized procedures, are more likely to institutionalize the assessment of political risk than small firms. Consequently, Hypothesis H2 is supported.

Regarding to the degree of internationalization, an inconsistent conclusion is based on three different variables. The output of a one-way ANOVA indicates that there is no statistically significant difference in the level of institutionalization across the three groups of the firms’ number of years in international business, YEARS (P> 0.05), or a firm’s international revenue, REVENUE (P > 0.05). However, the number of countries does have a significant influence on the level of institutionalization, COUNTRIES (P< 0.01). In addition, the result of Tukey’s HSD test suggests that a highly internationalized firm has a higher degree of institutionalization of political risk assessment compared to a less internationalized firm.

Table 6

Results of a one-way ANOVA

FIGURE 1

Tukey’s HSD test for ownership

FIGURE 2

Tukey’s HSD test for scale

To summarize, our results support the hypothesis that government ownership is a significant determinant of political risk assessments. SOEs have a higher degree of institutionalization of political risk assessments as compared to their private counterparts. Similarly, evidence is found to support the hypothesis that a firm’s size has a positive impact on its institutionalization of political risk assessments. Accordingly, larger-scale firms institutionalize more than small- and medium-sized firms. Finally, our results produce some contradictions regarding the operationalization of internationalization. On the one hand, the findings show that there are no significant connections between internationalization and IPRA when the number of years or the proportion of revenue generated abroad is considered. On the other hand, our findings clearly support the hypothesis that the degree of internationalization measured by the number of foreign countries in which the firm operates significantly affects its IPRA.

Discussion

The trend of increasing global economic integration requires multinational firms to maintain a more institutionalized approach to factor political risk assessments into their international expansion and economic activities (Hillman and Wan, 2005). Alon et al. (2006) propose that global companies today should consider adopting a comprehensive political risk-assessment strategy to ensure that they invest in the right places and make the right decisions that are necessary to outperform their competitors. This can be done by relying on various types and distinct levels of resources drawn from firm-specific factors (Fig. 3).

The findings in this study suggest that state-ownership is positively associated with IPRA in Chinese multinational firms. As Zhu and Chung (2014) argue, government links grant SOEs accessibility to and feasibility of resources, such as political power and inside information. Hillman and Wan (2005) point out that SOEs are able to freely obtain these resources or to obtain them under better conditions. Drawing on this advantage, SOEs can identify and evaluate the political risks in a host country, avoiding harmful consequences or even obtaining crucial advantages that reduce the potential competition from their private counterparts (Duanmu, 2014). The classified or inside information from the firm-government relationship enables SOEs, but not their competitors, to make informed judgments about where, when, and whether to invest. Thus, firms are able to cultivate their institutional abilities so they can better associate with the relevant political actors. The resultant benefits to the firm include superior experience in identifying, evaluating, and assessing the underlying political risks in the host country, thus constituting the underpinnings of the SOEs’ higher degree of institutionalization.

Our results further reveal that firm´s size is positively associated to a firm’s IPRA, thus supporting Stapenhurst’s argument (1992) that large firms tend to make more formal political risk assessments. Together with more formalized procedures, larger firms have access to a broader amount and larger variety of resources to accomplish their overall political-risk control objectives, one of which is political risk assessments (Alvarez and Busenitz, 2001). For example, they can buy market reports from research organizations or even pay for specialized investigations and subscribe to statistical analysis services. Or, as Alon and Herbert (2009) suggest, they can engage in recruiting and training efforts to reduce uncertainty avoidance among current and potential local employees. However, the resources associated with large firms may be scarce and costly to acquire for small firms. The power of large firms also rests with the creation and development of large collaborative networks, underpinned by the integration of a widespread set of information sources which, as in the case of experience, also work as a political capability-building mechanism, whereas small firms have limited resources, thus they are constrained from managing complex systems. Through superior access to resources, and also more formalized procedures, large firms seem more capable of institutionalizing the assessment of political risk.

FIGURE 3

Firm-specific resource-based factors and the IPRA framework

In general, venturing into overseas markets is a risky activity since the journey is often accompanied by numerous risks, such as political, labor, and environmental risks due to a lack of knowledge necessary to exploit international opportunities (Alon and Qi, 2003). However, foreign entrants could use firm-specific resources to fight against the disadvantages in condition of knowing how and where to use the resources. Without engagement, it is difficult for firms to detect the internal and external sources of political risks that are related to societal, governmental, and economic factors, as revealed in Alon and Martin (1998). Learning and accumulating experience usually play a critical role when firms move into the global arena (Delios and Henisz, 2003a, 2003b). Our findings suggest that the number of countries in which a firm operates is also positively associated with its IPRA. This is consistent with Al Khattab’s (2008) finding. He argues that the greater the number of countries in which a firm operates, the greater the complexity of the task of political risk assessment. In contrast, the results indicate that there is no significant connection between the number of years and IPRA, which is similar to the findings by Al Khattab (2008) and Wyper (1995). Moreover, unlike the results detected by Al Khattab (2008), in our case the proportion of revenue generated abroad is not significantly associated to the IPRA. On this basis, we conclude from our results that the depth of internationalization is not significantly related to IPRA, whereas the scope of internationalization is significantly related to IPRA. Accordingly, this indicates that the geographic diversity of international operations is important for the development of institutionalized abilities.

Chinese outward foreign direct investment is fairly new (Alon et al., 2011). Chinese firms seem to invest in high-risk countries that are high in political risk, with high-risk modes of entry (i.e., direct investment, majority owned joint ventures, and mergers and acquisitions), and at a higher speed than expected (Ramamurti, 2012; Lattemann and Alon, 2015). In fact, Buckley et al. (2007) found that political risk in a host market actually encourages Chinese investment, rather than detract it[14]. Secondly, one unique characteristic of Chinese OFDI is that much of it is done by the State. This feature suggests that political motivations might trump economic ones as expected in private enterprises (Lattemann and Alon, 2015). This raises the question of whether in fact Chinese investments behave differently, especially as it relates to political risk, and is the motivation for our study.

Our results do show some interesting differences in contrast to Al Khattab (2008). They suggest that the diversity of environments provides a better understanding of political risk. Because many Chinese firms have concentrated their internationalization efforts in a few countries only (Alon et al., 2015), internationalization in terms of number of years or sales abroad may not necessarily translate into better political risk management. Overseas experience, even if it is in politically risky countries, has little value if it comes only from activities concentrated in a reduced set of locations. For instance, much of the Chinese OFDI, particularly in the oil and energy sector, has been to developing countries (Alon et al., 2015). While Chinese companies were able to manage the political risk environment in difficult places in Africa and the Middle East, where the level of economic development is low and authoritarianism is the likely political regime, in other countries where a strong rule of law is coupled with democracy, such as Western societies, they ran into problems. Child and Marinova (2014) suggested that the combination of host-home country pair may account for such an anomalous result. That is, because Chinese companies come from an institutionally-weak environment with strong government presence, they might find it easier to work with political agents in developing countries than in developed ones.

Compared to their Western counterparts, Chinese firms show some common but also divergent features. While studies focusing on Western MNEs have overlooked the role of state ownership on the political risk, de Pahud de Mortanges and Allers (1996) show that IPRA practices by Dutch firms is not very high and that this occurs across firms of different industries and sizes. Jiménez (2010) shows that previous experience represents a critical factor to understand the role of political risk in the internationalization strategy of Spanish MNEs. However, and contrary to our results for Chinese firms, firm´s size does not appear as a significant determinant. A proper study of the differences and the causes of the discrepancies in terms of IPRA between Western and Chinese MNEs is beyond the scope of this paper and it would require specific data and analyses. However, the results from these articles seem to indicate that Western companies rely more heavily on their previous experience more than on the amount of resources or formalized procedures to assess political risk in host locations. By contrast, state ownership, size and geographic scope seem to be crucial determinants in the case of Chinese MNEs. Yet, it is possible that the differences are also due to the fact that Western firms tend to avoid risky locations more than Chinese companies, or that the assessment of political risk is conducted at the subsidiary level rather than at the headquarters’ one.

This article contributes to the existing literature by looking at the political risk assessment of Chinese multinational firms. The rising presence of Chinese firms as international investors raises the concerns about their assessment of political risk. This study therefore focuses on it and illustrates that state ownership, firm’s size and the scope of internationalization are critical determinants of IPRA for Chinese firms.

The emergence of SOEs in global arena has inserted new chapters into the research agenda of political risk assessment. The relative concerns include its political threats to foreign countries, political risks faced by SOEs and its ability to institutionalize political risk assessment (Vernon and Aharoni, 2014). Another contribution of this article rests on the analysis of IPRA conducted by SOEs. This study reveals that state ownership is a critical source for Chinese enterprises to gain institutional forces.

Our research is subject to some limitations. Thus, our data comes from a declarative questionnaire and not from secondary sources. Survey data research of Chinese investment is very common, despite these weaknesses, mainly because of the difficulty in obtaining access to restrictive data in secondary sources. In China, guanxi – the personal relationship network - is often required to get access to restricted information (Chan et al. 2002). Building on our guanxi, we were able to reach some of the most important Chinese multinational firms listed by the China Enterprise Confederation (CEC) to get data that is not easily obtainable via traditional means. Besides, when possible, we checked the accuracy of information in the firm´s accounts. Unfortunately, however, the majority of respondents were not available for an interview, which restrict the richness of the data collected and constraints us to employ quantitative techniques based on surveys. Thus, our results cannot provide empirical evidence of causality, but only of the existence of a significant statistical relationship. Also, we acknowledge that the number of surveys is relatively low. However, the companies surveyed are among the biggest and most important in China and it has been shown that these type of companies are the ones doing the most of the OFDI (Kolstad and Wiig, 2012; Alon et al. 2014). Therefore, while the number is small, the companies included in the sample represent a significant part of the Chinese OFDI.

As potential avenues for future research, it would be extremely interesting to conduct semi-structured interviews with business leaders and/or public officials to better put into perspective the quantitative results and to deepen research questions about the specifics of the management of political risks by Chinese firms. In addition, and given that extrapolations of results to other contexts can only be done with caution, scholars could study the institutionalization of political risk determinants in firms from other emerging economies and, as previously discusses, as specific studies comparing the differences between firms from developed and developing countries.

Appendices

Appendices

Annex 1 . Questionnaire

Annex 2 . List of companies in this study

Biographical notes

Ilan Alon is Professor of Strategy and International Marketing at the University of Agder (Norway) and Editor-in-Chief of International Journal of Emerging Markets and European Journal of International Management. His research appeared in prestigious academic journals, such as Harvard Business Review, Journal of International Marketing, International Marketing Review, Management International Review, and Corporate Governance: An International Journal.

Alfredo Jiménez is Associate Professor at the Kedge Business School (France). His research interests are focused on the process of internationalization and on global virtual teams. He has previously published several papers in a wide range of journals, including Journal of International Business Studies, Journal of World Business, International Business Review, and Management International Review.

Hui Liu is a quantitative dealer of Hengfeng Bank, China. His research interests center on foreign direct invest, category of asset allocation, and risk management. As a dealer, he has been producing period research reports on capital market analysis, quantitative transaction and asset allocation.

Hua Wang is a professor of innovation management and managerial economics at emlyon business school. His research interests center on innovation management, multinational corporations’ strategies, Chinese outward foreign direct investment, and the automotive industry in China. As the Dean of emlyon business school Asia, he has produced several in-depth case studies of different industries and companies in China.

Notes

-

[1]

Figure obtained from Director Chen Li, MOFCOM, Beijing, China (Oct, 2016).

-

[2]

Outward FDI from China accounted for less than 0.44% of total global outward FDI in 2003. By 2013 it had increased to 2.33%. The data are calculated based on the World Investment Report (2004; 2014).

-

[3]

See the methodology section for a more detailed description of IPRA.

-

[4]

A manager in charge of international operations of a Chinese state-owned firm affirmed: “We are SOEs [state-owned enterprises]. We can afford huge losses or failures; therefore we can be more “risk-tolerant.” We dare to invest in Africa or Central Asia because if anything [bad] were to happen, we would survive. But for a NSOE [non-state-owned enterprise], it can be a fatal blow (Ren and Jack, 2014, p. 341).

-

[5]

Al Khattab et al. (2008) only distinguish between firms employing both quantitative and qualitative techniques and those employing exclusively qualitative techniques. However, among those firms relying only on a qualitative approach, some employ just one technique whereas others employ more than one. We believe it is important to account for this fact which shows a higher degree of IPRA. We conducted robustness tests in which we assigned alternative weights other than 5, 6 and 10 and results were consistent with those of the main models. Similarly, we also tested alternative weights for responsibility assignment and frequency of assessment and obtained similar results. We are grateful to an anonymous reviewer for drawing our attention to this issue.

-

[6]

The Chinese version of the questionnaire is available from the authors upon request.

-

[7]

The top 100 Chinese multinational firms are reported by the CEC every year. In our study, we use the list reported in 2013, available at http://www.cec1979.org.cn/china-500/chinese/content.php?id=146andt_id=1. The questionnaires were delivered by two sources according to the sample list: (1) the members of the Internationalization Forum of Chinese Enterprises, delivered in August 2013; (2) participants in the training course for managers of central government SOEs, delivered in November, 2013.

-

[8]

https://www.theguardian.com/environment/2011/oct/04/china-angry-burma-suspend-dam

-

[9]

In the Yahoo! Finance: Sector List firms are divided into nine sectors, each of which is composed of numerous individual industries, representing a wide swath of the economy. It is available at http://biz.yahoo.com/p/

-

[10]

We conducted some additional tests to verify that the results are robust to alternative industry classifications. Thus, we conducted a similar test using the International Standard Industrial Classification of All Economic Activities (ISIC) from the UN and also the Global Industry Classification Standard (GICS) from MSCI and S&P and found no significant differences. We are grateful to an anonymous reviewer for this suggestion.

-

[11]

The SASAC is a commission of the government People’s Republic of China directly under the State Council. It is responsible for managing SOEs, including appointing the top executives and approving any mergers or sales of stocks or assets as well as drafting related laws. The list of SOEs that we use in this article is published by this commission and is available at http://www.sasac.gov.cn/n1180/n1226/n2425/

-

[12]

For parsimonious reasons we do not list the standard category for all industries. It is available at link http://www.stats.gov.cn/statsinfo/auto2073/201310/t20131031_450691.html.

-

[13]

The characters (a, b) on the top indicate whether there are significant differences in the mean among the groups. For example, in Fig. 1, a non-SOE is indicated by ’a’ whereas a SOE is indicated by ’b’, suggesting that there is a significant mean difference between a SOE and a non-SOE.

-

[14]

Among the possible reasons for this finding, Buckley et al., (2007) suggest that Chinese FDI might have been promoted by political affiliations and connections of China with developing countries where, despite higher levels of risk, the bargaining position of China is strong. Similarly Chinese FDI has also been directed to communist countries or ideologically similar countries, where levels of political risk are also higher. Finally, additional reasons might be that Chinese firms invest in countries that are avoided by other investors due to ethical reasons or due to insufficient experience and due diligence (p. 510).

Bibliography

- Albright, Kendra S. (2004). “Environmental scanning: Radar for success,” Information Management Journal, Vol. 38, p. 38-45.

- Alon, Ilan; Anderson, John; Bailey, Nicholas J; Sutherland, Dylan (2017). “Political Risk and Chinese OFDI: Theoretical and Methodological Implications,” Academy of Management Proceeding, https://doi.org/10.5465/ambpp.2017.10009abstract

- Alon, Ilan; Anderson, John; Munim, Ziaul. Haque; Ho, Alice. (2018). “A review of the internationalization of Chinese enterprises”. Asia Pacific Journal of Management, Vol. 35, No 3, p. 573-605.

- Alon, Ilan; Fetscherin, Marc; Gugler, Philippe (2011). Chinese international investments. Palgrave Macmillan.

- Alon, Ilan; Gurumoorthy, Rajesh; Mitchell, Matthew C.; Steen, Teresa (2006). “Managing micropolitical risk: A cross-sector examination,” Thunderbird International Business Review, Vol. 48, p. 623-642.

- Alon, Ilan; Herbert, Theodore T. (2009). “A stranger in a strange land: Micro political risk and the multinational firm,” Business Horizons, Vol. 52, p. 127-137.

- Alon, Ilan; Leung, Guy Chun Kay; Simpson, Timothy J. (2015). “Outward Foreign Direct Investment by Chinese National Oil Companies”. Journal of East-West Business, Vol. 21, No 4, p. 292-312.

- Alon, Ilan; Matthew, Martin (1998). “A No rmative model of macro political risk assessment,” Multinational Business Review, Vol. 6, p. 10-19.

- Alon, Ilan; Qi, Min (2003). “Do international banks’ assessments of country risk follow a random walk? An empirical examination of the Middle East,” Journal of International Business Research, Vol. 2, p. 125-141.

- Alon, Ilan; Wang, Hua; Shen, Jun; & Zhang, Wenxian (2014). “Chinese state-owned enterprises go global”. Journal of Business Strategy, Vol. 35, No 6, p. 3-18.

- Alvarez, Sharon A.; Lowell W. Busenitz (2001). “The entrepreneurship of resource-based theory,” Journal of Management, Vol. 27, No 6, p. 755-775.

- Al Khattab, Adel; Anchor, John R.; Davies, EleaNo r MM (2008). “The institutionalisation of political risk assessment (IPRA) in Jordanian international firms,” International Business Review, Vol. 17, p. 688-702.

- Amsden, Alice Hoffenberg (1989). Asia´s next giant: South Korea and late industrialization. New York: Oxford University Press.

- Barney, Jay (1991). “Firm resources and sustained competitive advantage,” Journal of Management, Vol. 17, No 1, p. 99-120.

- Baron, David P. (1995). “Integrated strategies: Market and No n-market components,” California Management Review, Vol. 37, No 2, p. 47-65.

- Blank, Stephen (1980). Assessing the political environment: An emerging function in international companies, New York: Conference Board.

- Buchholz, Rogene A. (1990). Essentials of public policy for management, (2nd ed.), Upper Saddle River, NJ: Prentice-Hall.

- Buckley, Peter J.; Clegg, L. Jeremy; Cross, Adam R.; Liu Xin; Voss, Hinrich; Zheng, Ping (2007). “The determinants of Chinese outward foreign direct investment,” Journal of International Business Studies, Vol. 38, No 4, p. 499-518.

- Casson, Mark; Lopes, Teresa da Silva (2013). “Foreign direct investment in high-risk environments: An historical perspective,” Business History, Vol. 55, No 3, p. 375-404.

- Chan, Ricky. Y; Cheng, Louis. T; Szeto, Ricky. W. (2002). “The dynamics of guanxi and ethics for Chinese executives”. Journal of Business Ethics, Vol. 41, No 4, p. 327-336.

- Child, John; MariNo va, Svetla (2014). “The Role of Contextual Combinations in the Globalization of Chinese Firms”. Management and Organization Review, Vol. 10, p. 347-371.

- Clarke, James; Tamaschke, Rick; Liesch, Peter (2013). “International experience in international business research: A conceptualization and exploration of key themes. International Journal of Management Reviews, Vol. 15, No 3, p. 265-279.

- Cuervo-Cazurra, Alvaro; Inkpen, Andrew; Musacchio, Aldo; Ramaswamy, Kannan (2014). “Governments as owners: State-owned multinational companies,” Journal of International Business Studies, Vol. 45, No 8, p. 919-942.

- De La Torre, Jose; Neckar, David. H. (1988). “Forecasting political risks for international operations,” International Journal of Forecasting, Vol. 4, No 2, p. 221-241.

- Delios, Andrew; Henisz, Witold J. (2003a). “Policy uncertainty and the sequence of entry by Japanese firms, 1980-1998.” Journal of International Business Studies, Vol. 34, p. 227-241.

- Delios, Andrew; Henisz, Witold J. (2003b). “Political hazards, experience, and sequential strategies: The international expansion of Japanese firms, 1990-1998,” Strategic Management Journal, Vol. 24, No 11, p. 1153-1164.

- Duanmu, Jing-Lin (2014). “State-owned MNCs and host country expropriation risk: The role of home state soft power and ecoNo mic gunboat diplomacy,” Journal of International Business Studies, Vol. 45, No 8, p. 1044-1060.

- Engdahl, F. William (2011). “NATO’s War on Libya is Directed against China: AFRICOM and the Threat to China’s National Energy Security,” Global ResearchSeptember, 25.

- Faccio, Mara (2006). “Politically-connected firms,” American EcoNo mic Review, Vol. 96, p. 369-386.

- Field, Andy (2000). Discovering statistics using SPSS for Windows: Advanced techniques for the beginner, London: Sage.

- Hachana, Rym.; Belanes, Amel (2010). “Cognitive biases and managerial risk-taking: Empirical evidence from Tunisia,” Management International, Vol. 14, Nº2, p. 105-119.

- Hashmi, M. Anaam; Guvenli, Turgut (1992). “Importance of political risk assessment function in U.S. multinational corporations,” Global Finance Journal, Vol. 3, No 2, p. 137-144.

- Henisz, Witold Jerzy (2000). “The institutional environment for multinational investment,” Journal of Law, EcoNo mics and Organization, Vol. 16, No 2, p. 334-364.

- Hillman, Amy J.; Keim, Gerald D.; Schuler, Douglas (2004). “Corporate political activity: A review and research agenda,” Journal of Management, Vol. 30, No 6, p. 837-857.

- Hillman, Amy J.; Wan, William P. (2005). “The determinants of MNE subsidiaries’ political strategies: Evidence of institutional duality,” Journal of International Business Studies, Vol. 36, No 3, p. 322-340.

- Hillman, Amy J.; Withers, Michael C.; Collins, Brian J. (2009). “Resource dependence theory: A review,” Journal of Management, Vol. 35, p. 1404-1427.

- Holburn, Guy LF; Zelner, Bennet A. (2010). “Political capabilities, policy risk, and international investment strategy: Evidence from the global electric power generation industry,” Strategic Management Journal, Vol. 31, No 12, p. 1290-1315.

- Howell, L. D. (2001). The hand book of country and political risk analysis (3rd ed.) USA: Political Risk Services Group.

- Iankova, Elena; Katz, Jan (2003). “Strategies for political risk mediation by international firms in transition ecoNo mies: The case of Bulgaria,” Journal of World Business, Vol. 38, No 3, p. 182-203.

- IMF. (2019). IMF Data. IMF Data, https://data.imf.org/?sk=388DFA60-1D26-4ADE-B505-A05A558D9A42&sId=1479331931186 (Accessed May 14, 2019).

- INo ue, Carlos FKV; Lazzarini, Sérgio G.; Musacchio, Aldo (2013). “Leviathan as a miNo rity shareholder: Firm-level implications of equity purchases by the state,” Academy of Management Journal, Vol. 56, No 6, p. 1775-1801.

- Jacobs, A., and J. Gettleman. 2012. “Kidnappings of workers put pressure on China.” New York Times. http://www.nytimes.com/2012/02/01/world/africa/china-says-29-workers-still-missing-in-sudan.html.

- Jiménez, Alfredo (2010). “Does political risk affect the scope of expansion abroad? Evidence from Spanish MNEs.” International Business Review, Vol. 19, No 6, p. 619-633.

- Jiménez, Alfredo; Delgado-García, Juan Bautista (2012). “Proactive management of political risk and corporate performance: The case of Spanish multinational enterprises,” International Business Review, Vol. 21, No 6, p. 1029-1040.

- Jiménez, Alfredo; Luis-Rico, Isabel; Benito-Osorio, Diana (2014). “The influence of political risk on the scope of internationalization of regulated companies: Insights from a Spanish sample,” Journal of World Business, Vol. 49, No 3, p. 301-311.

- John, Anna; Thomas, Lawton (2017). “international political risk management: perspectives, approaches and emerging agendas”. International Journal of Management Reviews, Forthcoming.

- Kolstad, Ivar; Wiig, Arne (2012). “What determines Chinese outward FDI?”. Journal of World Business, Vol. 47, No 1, p. 26-34.

- Kennedy, Charles R. (1988). “Political risk management: A portfolio planning model.” Business Horizons, Vol. 31, No 6, p. 26-33.

- Kennedy, Peter (1992). Guide to ecoNo metrics, MIT Press: Cambridge, MA.

- Kobrin, Stephen Jay (1981). “Political assessment by international firms: Models or methodologies?,” Journal of Policy Modeling, Vol. 3, No 2, p. 251-270.

- Kobrin, Stephen Jay (1982). Managing political risk assessment: Strategic response to environmental change, Berkeley: University of California Press.

- Kumar, MV Shyam (2009). “The relationship between product and international diversification: The effects of short-run constraints and endogeneity,” Strategic Management Journal, Vol. 30, No 1, p. 99-116.

- Lai, Hongyi; Warner, Malcolm (2015). “Managing China´s energy sector: between the market and the state,” Asia Pacific Business Review, Vol. 21, No 1, p. 1-9.

- Lattemann, Christoph; Alon, Ilan (2015). “The Rise of Chinese Multinationals: A Strategic Threat or an EcoNo mic Opportunity,” Georgetown Journal of International Affairs, Vol. 16, No 1, p. 168-175.

- Lawton, Thomas; Rajwani, Tazeeb; Doh, Jonathan (2013). “The antecedents of political capabilities: A study of ownership, cross-border activity and organization at legacy airlines in a deregulatory context,” International Business Review, Vol. 22, No 1, p. 228-242.

- Li, Ming. Hua; Cui, Lin; Lu, Jiangyong. (2018). Varieties in state capitalism: Outward FDI strategies of central and local state-owned enterprises from emerging ecoNo my countries. In State-Owned Multinationals (pp. 175-210). Palgrave Macmillan, Cham.

- Li, Yuan; Peng, Mike W.; Macaulay, Craig D. (2013). “Market-political ambidexterity during institutional transitions,” Strategic Organization, Vol. 11, No 2, p. 205-213.

- Luo, Yadong (2001). “Toward a cooperative view of MNC-host government relations: Building blocks and performance implications,” Journal of International Business Studies, Vol. 32, No 3, p. 401-419.

- Lyles, Majorie A.; Steensma, H. Kevin (1996). “Competing for large-scale infrastructure projects in the emerging Asian markets: Factors of success,” Columbia Journal of World Business, Vol. 31, No 3, p. 64-75.

- Mahoney, Joseph T.; Pandian, J. Rajendran (1992). “The resource-based view within the conversation of strategic management.” Strategic Management Journal, Vol. 13, No 5, p. 363-380.

- Makadok, Richard. (2001). “Toward a synthesis of the resource-based and dynamic-capability views of rent creation”. Strategic Management Journal, Vol. 22, No 5, p. 387-401.

- Megginson, William L.; Netter, Jeffry M. (2001). “From state to market: A survey of empirical studies on privatization,” Journal of EcoNo mic Literature, Vol. 39, p. 321-389.

- Meznar, Martin B.; Nigh, Douglas (1995). “Buffer or bridge? Environmental and organizational determinants of public affairs activities in American firms,” Academy of Management Journal, Vol. 38, No 4, p. 975-996.

- Musacchio, Aldo; Lazzarini, Sergio G.; Aguilera, Ruth V. (2015). “New varieties of state capitalism: Strategic and governance implications,” Academy of Management Perspectives, Vol. 29, No 1, p. 115-131.

- National Bureau of Statistics of China. (2016). China Industrial Statistical Yearbook ( http://data.cnki.net/Yearbook/Single/N2017030049). Beijing: China Statistical Press.

- National Bureau of Statistics of China. (2018). China Statistical Yearbook ( http://www.stats.gov.cn/tjsj/ndsj/2018/indexeh.htm). Beijing: China Statistical Press.

- Neter, John; Wasserman, William; Kutner, Michael H. (1985). Applied linear statistical models: Regression, analysis of variance, and experimental designs, Homewood, IL: Richard D. Irwin. Inc.[701].

- Niebling, Karel; Shubik, martin (1982). “Business and international political risk,” European Management Journal, Vol. 1, No 1, p. 12-27.

- Pahud de Mortanges, Charles; Allers, Vivian (1996). “Political risk assessment: Theory and the experience of Dutch firms,” International Business Review, Vol. 5, No 3, p. 303-318.

- Peng, Mike W. (2012). “The global strategy of emerging multinationals from China,” Global Strategy Journal, Vol. 2, No 2, p. 97-107.

- Penrose, Edith (2009). The Theory of the Growth of the Firm. Oxford university press.

- Pfeffer, Jeffrey; Salancik, Gerald R. (1978). The external control of organizations: a resource dependence perspective, Stanford University Press. New York.

- Poisson-de Haro, Serge; Bitektine, Alex (2015). “Global sustainability pressures and strategic choice: The role of firms´ structures and No n-market capabilities in selection and implementation of sustainability initiatives,” Journal of World Business Vol. 50, No 2, p. 326-341.

- Quer, Diego; Claver, Enrique; Rienda, Laura (2012). “Political risk, cultural distance, and outward foreign direct investment: Empirical evidence from large Chinese firms,” Asia Pacific Journal of Management, Vol. 29, No 4, p. 1089-1104.

- Ramamurti, Ravi (2009). “What have we learned about emerging—market MNEs?” Emerging multinationals in emerging markets, p. 399-439.

- Ramamurti, Ravi. (2012). “What is really different about emerging market multinationals?”. Global Strategy Journal, Vol. 2, No 1, p. 41-47.

- Ren, Monica; Jack, Robert (2014). “China´s “steel hunger”: A comparative analysis of SOE and NSOE internationalization motivations and attitudes towards risk.” Contemporary Management Research, Vol. 10, No 4, p. 325-351.

- Reuters (2011). Huawei backs away from 3Leaf acquisition. http://www.reuters.com/article/2011/02/19/us-huawei-3leaf-idUSTRE71I38920110219.

- Reuters (2013). New Australian government upholds ban on China’s Huawei. http://www.reuters.com/article/2013/10/29/us-huawei-australia-idUSBRE99S01820131029.

- Stan, Ciprian V.; Peng, Mike W.; Bruton, Garry D. (2014). “Slack and the performance of state-owned enterprises,” Asia Pacific Journal of Management, Vol. 31, No 2, p. 473-495.

- Stapenhurst, Frederick (1992). “The rise and fall of political risk assessment?” Management Decision, Vol. 30, No 5, p. 54-57.

- Sun, Pei; Mellahi, Kamel; Wright, Mike (2012). “The contingent value of corporate political ties.” Academy of Management Perspectives, Vol. 26, No 3, p. 68-82.

- Sun, Sunny Li; Peng, Mike W.; Lee, Ruby P.; Tan, Weiqiang (2015). “Institutional open access at home and outward internationalization,” Journal of World Business, Vol. 50, No 2, p. 234-246.

- The Guardian (2018a) China demands release of Huawei executive arrested in Canada. https://www.theguardian.com/techNology/2018/dec/05/meng-wanzhou-huawei-cfo-arrested-vancouver.

- The Guardian (2018b). China detains second Canadian citizen as Huawei row intensifies https://www.theguardian.com/world/2018/dec/12/china-canada-diplomat-michael-kovrig-detention-latest-.

- UNCTAD. (2004). World investment report 2004: The shift towards services. New York and Geneva: UN Publications.

- UNCTAD. (2014). World investment report 2014: Investing in the SDGs: An Action Plan. New York and Geneva: UN Publications.

- VerNo n, Raymond; Aharoni, Yair (Eds.) (2014). State-Owned Enterprise in the Western EcoNo mies (Routledge Revivals), Routledge.

- Wernerfelt, Birger. (1984). “A resource-based view of the firm”. Strategic Management Journal, Vol. 5, p. 171-180.

- Wyper, C. (1995). The extent of usage of political risk analysis in UK multinational organisations, MPhil diss., University of Strathclyde, Glasgow.

- Zhou, Kevin Zhou; Gao, Gerald Yong; Zhao, Honxin. (2017). “State ownership and firm inNo vation in China: An integrated view of institutional and efficiency logics”. Administrative Science Quarterly, Vol. 62, No 2, p. 375-404.

- Zhu, Hongjin; Chung, Chi-Nien (2014). “Portfolios of political ties and business group strategy in emerging ecoNo mies: Evidence from Taiwan,” Administrative Science Quarterly, Vol. 59, p. 599-638.

- Zollo, Maurizio; Winter, Sidney G. (2002). “Deliberate learning and the evolution of dynamic capabilities,” Organization Science, Vol. 13, No 3, p. 339-351.

Appendices

Notes biographiques

Ilan Alon est professeur de stratégie et de marketing international à l’Université d’Agder (Norvège) et rédacteur en chef de l’International Journal of Emerging Markets et de l’European Journal of International Management. Ses recherches ont paru dans des revues universitaires prestigieuses telles que Harvard Business Review, la Revue internationale du marketing, la Revue internationale du marketing, la Revue internationale de gestion et la Gouvernance d’entreprise : une revue internationale.

Alfredo Jiménez est professeur associé à la Kedge Business School (France). Ses recherches portent sur le processus d’internationalisation et sur les équipes virtuelles globales. Auparavant, il a publié plusieurs articles dans de nombreuses revues, notamment le Journal of International Business Studies, le Journal of World Business, l’International Business Review et le Management International Review.

Hui Liu est un distributeur quantitatif de Hengfeng Bank, en Chine. Ses recherches portent sur l’investissement direct étranger, la catégorie de répartition de l’actif et la gestion des risques. En tant que courtier, il produit des rapports de recherche périodiques sur l’analyse des marchés financiers, les transactions quantitatives et la répartition de l’actif.

Hua Wang est professeur de gestion de l’innovation et d’économie de gestion à emlyon business school. Ses recherches portent sur la gestion de l’innovation, les stratégies des sociétés multinationales, les investissements étrangers directs à l’étranger chinois et l’industrie automobile chinoise. En tant que doyen d’emlyon Business School Asia, il a réalisé plusieurs études de cas approfondies de différents secteurs et entreprises en Chine.

Appendices

Notas biograficas

Ilan Alon es profesor de estrategia y marketing internacional en la Universidad de Agder (Noruega) y editor en jefe de International Journal of Emerging Markets y European Journal of International Management. Su investigación apareció en prestigiosas revistas académicas, como Harvard Business Review, Journal of International Marketing, International Marketing Review, Management International Review y Corporate Governance: An International Journal.

Alfredo Jiménez es profesor asociado en la Kedge Business School (Francia). Sus intereses de investigación se centran en el proceso de internacionalización y en los equipos virtuales globales. Anteriormente, ha publicado varios artículos en una amplia gama de revistas, entre ellas Journal of International Business Studies, Journal of World Business, International Business Review y Management International Review.

Hui Liu es un agente cuantitativo de Hengfeng Bank, China. Sus intereses de investigación se centran en la inversión extranjera directa, la categoría de asignación de activos y la gestión de riesgos. Como agente, ha estado produciendo informes de investigación sobre análisis del mercado de capitales, transacciones cuantitativas y asignación de activos.

Nathalie Belhoste es doctora en Ciencias Políticas (Sciences Po Paris) y profesora de geopolítica y gestión internacional en Grenoble Ecole de Management (Francia). Su investigación se centra en la empresa como entidad geopolítica y en la influencia de las multinacionales en la geopolítica global. Ha publicado en numerosas revistas científicas internacionales (Critical Perspectives on International Business, Human Relations, European Management Review, etc.).

List of figures

FIGURE 1

Tukey’s HSD test for ownership

FIGURE 2

Tukey’s HSD test for scale

FIGURE 3

Firm-specific resource-based factors and the IPRA framework

List of tables

Table 1

Sectoral breakdown

Table 2

Number of firms in each category according to Chinese standard classifications

Table 3

Measures to categorize internationalization and the number of firms in each category

Table 4

Correlation matrix

Table 5

Results of the Bartlett test

Table 6

Results of a one-way ANOVA

10.7202/039551ar

10.7202/039551ar