Abstracts

Abstract

This study investigates how news-based scores in ESG (Environmental, Social, and corporate Governance) may have influenced the monthly stocks’ market return in Switzerland, the US, and the UK during the 2007–2011 period. We find that the variation of the overall ESG score is only significant in the UK. We also show that the changes in sub-category ratings of GRI (namely, governance, economic, environment, labor, human rights, society, and products) exhibit a small but significant impact on the stock’s performance during limited periods or on limited sectors, which varies among the countries. Finally, our non-parametric kernel regression highlights that the function linking a stock’s performance to its ESG-score changes is probably non-linear.

Keywords:

- ESG,

- performance,

- score,

- information,

- stock,

- GRI

Résumé

Cette étude examine dans quelle mesure les informations ESG (Environnement, Social et Gouvernance d’entreprise), agrégées sous forme de scores, peuvent influencer les rendements mensuels des actions sur les marchés en Suisse, aux États-Unis, et au Royaume-Uni, au cours de la période 2007-2011. Nous constatons que la variation de la note globale ESG n’est significative qu’au Royaume-Uni. Nous montrons également que les changements dans les sous-catégories de notes du GRI (à savoir, la gouvernance, l’économie, l’environnement, le travail, les droits humains, la société et les produits) présentent un impact faible mais significatif sur la performance des actions, mais seulement sur des périodes restreintes ou pour des secteurs limités, qui varient contextuellement selon les pays. Enfin, notre régression non-paramétrique met en évidence la non-linéarité probable de la fonction reliant la performance d’une action à ses changements de score ESG.

Mots-clés :

- ESG,

- performance,

- score,

- information,

- action,

- GRI

Resumen

Este estudio investiga cómo las noticias basadas en puntuaciones en ESG (Enviromental, Social & Governance Index) pueden haber influido en la rentabilidad mensual de los valores de las empresas en Suiza, los EE.UU. y el Reino Unido durante el período 2007-2011. Los resultados muestran que la variación de la puntuación globalen ESG sólo es significativa en el Reino Unido. Además los resultados también muestran que los cambios de clasificación en las subcategorías (es decir, la gobernanza, la economía, el medio ambiente, el trabajo, los derechos humanos, la sociedad y los productos) presenta un pequeño pero significativo impacto en el rendimiento de las acciones durante períodos limitados o en sectores limitados, los cuales varían en los distintos países. Por último, nuestra regresión no paramétrica Kernel subraya que la función que relaciona el rendimiento en bolsa con los cambios en las puntuaciones ESG es probablemente no lineal.

Palabras clave:

- ESG,

- rendimiento,

- puntuación,

- información,

- acciones,

- GRI

Article body

We would like to thank Professor Chris Mallin of Norwich Business School for her review and constructive comments on an earlier version of this paper.

The question of how and why investors take into account Corporate Social Responsibility (CSR) activities of firms when making their investment decision is highly relevant for research on CSR disclosure and CSR investments, as well as for firms themselves. This study investigates how news-based scores in environmental, social, and corporate governance (ESG) may have influenced the monthly stocks’ market return in Switzerland, the US, and the UK during the 2007–2011 period. Our model is a multifactor linear model, consisting of the classic four-factors (Fama-French’s three factors and momentum), plus a fifth factor, the ESG score, which represents the potential of the ESG to explain monthly returns during the observed period. By linear regression, we find that the variation of the overall ESG score is not significant in the US and Switzerland for the observed stocks. In the UK however, the change in the overall ESG score is a significant and slightly negative factor of the observed stocks’ monthly performance in the 2007–2010 period. Using the same model, we also study if the changes in sub-categories of ESG ratings (namely, governance, economic, environment, labor, human rights, society, and products) could explain the monthly market return. We find that the changes in sub-category ratings exhibit a small but significant impact on the stock’s performance during limited periods or on limited sectors, which varies among the countries. Finally, to explore a possible non-linear influence of the ESG score over monthly returns, we use a non-parametric model for Switzerland during the 2007–2011 period. The non-parametric kernel regression shows that the function linking a stock’s performance to its ESG-score changes is probably non-linear.

Introduction

Socially responsible investment (SRI) consists of introducing criteria related to sustainability into investment decisions, in contrast to classic investment that focuses solely on financial criteria. Sustainability criteria are usually organized around three themes: environmental, social/society and corporate governance (ESG). The first form of SRI, the exclusion of certain sectors such as weapons, alcohol, and tobacco for religious or moral purposes, can be traced back to the 18th century. The exclusion-based strategies now incorporate exclusions based on recent international standards and norms and still apply to more than half of SRI in Europe. In addition, the modern form of SRI uses various positive screening strategies such as the “best-in-class” approach, which favors companies with better rates, according to ESG criteria, than other companies in the same sector (Cf. Appendix A). In addition, active strategies such as sustainability-themed funds or shareholder rights usage to direct a corporate strategy are also growing in popularity.

SRI in all its forms has experienced growing popularity in the last decade[1]. This interest comes mainly from institutional investors, as public funds undergo further moral pressure toward sustainability from communities and legislators. The popularity of responsible investment has grown even more following the 2007 financial crisis that shattered the confidence of investors in financial markets and traditional investments, while triggering many new policies and rules. SRI proved to be a safer investment during dropping markets, while rewarding investors with a certain moral satisfaction, thus emerging as a seductive alternative investment portfolio approach. It is still unclear, however, how ESG criteria will reflect into to a firm’s market performance, which is the main question of this study. The question of how and why investors take into account Corporate Social Responsibility (CSR) activities of firms when making their investment decision is highly relevant for research on CSR disclosure and CSR investments as well as for firms themselves.

The academic world has been actively studying the field of modern SRI since the 1990s. This long lasting interest has been fuelled by the growth in SRI and a lack of a clear consensus despite numerous studies. Historically, evaluation of SRI studies was hindered by a lack of theory, data, and methodology (McWilliams and Siegel; 1999, Margolis et al.; 2007). Recently, ESG-related data have become more accessible and standardized, and successful methodologies have been identified. As a result, more and more papers offering sound theoretical framework as well as strong associated results are being published, mainly focused on the American market. However, given large variations in the empirical results, some authors warn that there is no conclusive evidence regarding the relationship between ESG and financial performance of companies (Ioannou and Serafeim; 2011, Orlitzky; 2013).Therefore, our research question is how the individual company’s market and financial performance relate to ESG criteria.

The last financial crisis showed the SRI potential to reduce the risk of an investment through better long-term management of a company, and this perspective seems more and more attractive to investors. Our hypothesis is that companies with high ESG scores have a lower residual risk and therefore a higher financial performance. We also believe that publicly available ESG information should reflect positively in the market price as investors may associate this information with lower residual risk and higher goodwill.

We therefore propose an original econometric study of the monthly market performance related to ESG criteria for major companies in Switzerland; the US, and the UK between 2007 and 2011.[2] Our approach, in order to include ESG into a company’s market price, is a linear model using Carhart four-factors plus ESG criteria, as well as a non-parametric model for kernel regression on the same variables.

Our results show that the variation of the global ESG score is a significant and slightly negative factor of a stock’s monthly performance in the UK, but is not significant in the US or Switzerland. The changes in sub-categories ratings (for instance, governance, environment, and labor) exhibit a small, significant influence over the stock’s performance only during limited periods or on limited sectors, which varies among the countries. Moreover, the non-parametric regression shows that the response of market performance related to ESG is nonlinear.

Our results provide valuable information for asset managers looking to include ESG criteria into their portfolio strategy, and for companies to understand the influence of ESG news–based ratings on their market price. This study also contributes to the literature on corporate social responsibility by showing how ESG criteria may link to a firm’s market performance with a new methodological approach. The non-parametric response of performance to ESG criteria may open a new way of research to better understand the complexity of this relationship (Orlitzky; 2013).

CSR and financial performance

Academia seeks actively to demonstrate a connection between the various ESG criteria and financial performance, and an increasing number of studies have been devoted to this topic over the past ten years. First we believe it is important to make a distinction between studies on the overall performance of an SRI portfolio or fund (Renneboog et al.; 2008, and Galema et al.; 2008) and studies on the financial performance of a single firm or stock related to its ESG efforts.

The first category, i.e. studies comparing the performance of SRI funds to non-SRI funds, does not take enough into account the SRI funds’ heterogeneity. Indeed, the practices of fund management significantly differ in the world (Sandberg et al., 2009). For instance, almost all SRI funds in the US use negative screening criteria, which is far from being the case in Europe. In Europe, the best-in-class approach- where the leading companies with regard to ESG criteria from all industries are included in the portfolio- is the norm, and often considered at the cutting-edge of SRI (Statman and Glushkov, 2009). A few studies try to overcome this heterogeneity. For instance, Capelle-Blancard and Monjon (2011) use a different approach by looking into the determinants of the financial performance among the SRI funds. They demonstrate that a higher screening intensity reduces the risk-adjusted return, but this result is significant only for sector-specific screening criteria; transversal screening criteria do not necessarily lead to poor diversification, and so, do not reduce financial performances. For all these reasons, it is not straightforward to associate the performance of an SRI fund or constructed portfolio to the performance of its individual stocks as this would require additional theories on the construction and management of the portfolio. As a result, we will focus our following literature review primarily on studies that help explaining the link between a single firm’s ESG commitment and its stock’s performance. To begin with, we will look at studies that explore why ESG could signal a change in the financial performance of a corporate. For a single company, the stock’s market performance should later adjust to the corporate’s operational and financial performance, at least in the semi-strong form of the efficient-market hypothesis.

Linking Social Responsibility and Corporate Performance

Regarding the definition of a “responsible” company, a theory often mentioned is the stakeholder theory of R.E. Freeman (1984). His theory of modern management says that the managers of a company must take into account all stakeholders, that is to say, employees, civil society, and suppliers in their investment decisions and not just shareholders. Although the stakeholder theory has laid a framework in the methods of corporate social responsibility (for instance ISO 26000 on Global Reporting Initiative uses methods similar to those suggested by Freeman), it does not provide information about the relative performance of a company applying ESG principles in relation to its peers. As a result, several studies tried to identify and evaluate these effects and show that CSR activities can create opportunities for firms: to increase image or sales (Albuquerque et al., 2012); to attract or motivate employees (Balakrishnan et al. 2011); to lower the costs of capital (El Ghoul et al. 2011); to reduce the “residual risk” (Sharfman and Fernando, 2008); or to anticipate “best practices” (Eccles et al. 2012).

A prevailing view on the positive impact of ESG activities is to enhance a firm’s image—let us call it the “ESG advertising” effect. From a marketing perspective, adopting a policy of sustainability would provide costs and benefits similar to those of an advertising campaign. Waddock and Graves (1997) demonstrated a strong relationship between a company’s reputation (according to the list of most admired by Fortune magazine) and its ratings in social responsibility. The impact of ESG advertising seems bigger for firms whose clients are individuals rather than other firms. A survey for Switzerland from Birth et al. (2008) surveyed the 300 largest Swiss companies on their CSR communication; 81% of respondents claimed to direct their communication toward customers and 62% point out that their primary objective is customer loyalty. In addition, a recent work (Albuquerque et al., 2012) demonstrates that ESG is a strategic product sold to clients by a company and that this product is bringing more positive revenues the sooner it is created, with late followers receiving less value from it.

In a similar way, Porter and Kramer (2011) showed that CSR could become part of a company’s competitive advantage if approached in a strategic way. In particular, societal concerns can yield productivity benefits to a company; “society benefits because employees and their family become healthier, and the firm minimizes employee’s absences and loss of productivity”. Moreover, a global survey of 1,122 corporate executives suggests that CEOs perceived benefits from CSR because it increases attractiveness for potential and existing employees (Economist, 2008). The research of Battacharya et al. (2008) and Balakrishnan et al. (2011) tend to confirm those findings. The latest, using a laboratory experiment, show how corporate giving to charity motivates employees. They highlight a double effect: a strong altruism effect and a signaling effect. First, employees contribute more to employers as the level of corporate giving increases, even if their contribution solely goes to charity. Second, even when employees compete with charity to get back part of their contributions, employees’ contributions will increase as the level of corporate giving increases: a charitable employer may signal more sharing of benefits for employees.

Among the reasons why ESG should lead to increased performance for a firm, a widely accepted theory in SRI is the “cost of capital” reduction. The prevailing opinion is that the costs incurred by the establishment of a socially responsible structure in a company are offset by a decrease in its cost of capital. In view of this, Mackey et al. (2007) postulates that responsible behavior is a “product” sold by companies to socially responsible investors; but is this product a profitable one for a company? Previous studies tend to believe that the impact of investors’ opinion on the cost of capital is not a significant one. Angel and Rivoli (1997) demonstrated through an analysis based on the CAPM that the impact of a boycott of shareholders on the cost of capital of a company would probably be small if less than 65% of the shareholders were boycotting the firm. Similarly, Teoh, Welch, and Wazzan’s (1999) study on the largest shareholder boycott in South Africa shows minimal impact on securities. With SRI investments reaching about 12% of all institutional investment in the US as of 2010, this could be a bone of contention. However, a recent analysis from El Ghoul et al. (2011), using accounting models on American firms, reveals a constantly lower cost of capital for firms with high SRI ratings (KLD rating), bringing a renewed interest to the cost of capital theory.

Another common theoretical position around ESG and firms’ performance is the residual risk’s “information effect.” Several authors (Kurtz, 2005; Sharfman and Fernando, 2008) argue that the ratings of a company on non-accounting parameters tell us about how the company controls the risks it faces. Therefore, high ESG ratings would mean lower residual risk for such companies compared to the market. This paradigm is tightly linked to the well-known reputational risk. The media in the last ten years have evolved tremendously and the propagation of news, both good and bad, is now extremely fast. A reputation risk issue on ESG criteria could affect the company market price,[3] or even destroy a thus-far successful company.[4] The risk reduction effect of ESG is not to be neglected, as reputation risk arises as a major threat for companies today.

One last group of principles concerns what could be called the “best practices’ anticipation” theory. Porter (1991) explains, about environmental regulations, that the costs arising from the implementation of a sustainable structure are offset in time by improving business productivity. This anticipation theory claims two type benefits: first, sustainable companies should also have a better distribution of costs in relation to upgrading to future regulations. This could be measured, for instance, by the stability of cash flows over time, in contrast to other companies increased spending to adapt to new regulations in target years. Secondly, companies putting in place regulations before others are the leaders in best practices, they are more advanced and forward thinking compared to their peers, which should lead to an increase in its wealth and the wealth of its shareholders. This is what Garriga and Melé (2004) call the instrumental theory of corporate social responsibility, further supported in a recent paper from Eccles et al. (2012), who explains from a management standpoint how mandatory innovation in products, processes, and business models in sustainable firms leads to better performance.

In contrast, let us now review some theories on how high ESG standards could negatively affect a firm’s performance. One can reply to the stakeholder theory that the primary purpose of a business is solely to increase the wealth of its shareholders (Friedman, 1962), and any other purpose diverting the firm from this purpose will make it less effective. Some work such as Mackey et al. (2007) and Graff, Zivin, and Small (2005) argue that a shareholder expects from a firm to maximize its wealth without ESG constraints, and that ESG engagement should be done separately, by for instance giving to charity. A shareholder investing in a firm with ESG constraints makes a consumption choice where the charity portion is going to the firm, hence he expects a lower cost of capital from the firm. This model should lead to neutral effect for the performance of firms with high ESG ratings, but it does not account for the risk reduction effect of ESG.

Another branch bringing controversy are the recent studies on “sin stocks.” Hong and Kacperczyk (2006) and Statman and Glushkov (2008) studied “sin stocks” (tobacco, weapons, alcohol) and found that they shows superior performance to the same extent as companies highly praised by socially responsible investors. Consequently, they argue that contrary to common belief, social responsibility efforts as such are not reflected in the share price.

To summarize, setting-up an ESG program within a firm has some costs that the firm expects to be compensated by an advertising effect, more stable revenues from loyal clients and motivated employees, and a possibly lower cost of capital, i.e., lower expected return from investors. In the process, the company might as well lower its risk and perform better, because considering all of its stakeholders will bring a broader view of its risks and processes. Our first hypothesis is therefore:

We expect a slightly positive relationship between yearly ESG ratings of a firm and its yearly financial performance. (H1.a )

This concept of synergies created within a firm by engaging with stakeholders, whether it is clients, business partners, or employees, is not quite new. It could be considered as part of the goodwill priced on top of the book value by investors. Therefore, when a positive ESG score or news is published, we should observe higher demand, growth, and higher market prices for the corresponding firm as investors should recognize this added value and lower residual risks. This additional value and lower residual risk should be reflected in a stocks market model as a positive alpha of the stock.

We expect a slightly positive relationship between monthly ESG ratings of a firm and its monthly risk-adjusted market performance. (H1.b)

This is consistent with the findings of Gompers, Ishii, and Metrick (2003) who found that low-rated companies in terms of governance had a risk-adjusted performance below average. A study by Russo and Fouts (1997) also showed that, after adjusting for the most probable parameters (size, growth, media, finance, and others), companies with better environmental scores had a better-than-average performance. More recently, Edmans (2007) also found, taking into account the parameters of the model of Carhart four-factors (market risk, size, style, and momentum) that companies ranked by Fortune among the one hundred most-desirable employers outperformed the average.

Finally, a few excellent meta-analyses have been performed on SRI studies that summarize the findings in the domain and provide a good overview of the methods used. The synthesis work carried out by Orlitzky et al. (2003) and more recently, Margolis et al. (2007) for instance, concludes that there is, in general, a slightly positive relationship between ESG and financial performance of companies, although less so over the last decade. However, given large variations in the empirical results, some authors warn that there is no conclusive evidence regarding this correlation and emphasize that explanations for the link are complex (Ioannou and Serafeim; 2011, Orlitzky; 2013).

Measuring the financial and CSR performances

Indeed, though the link between a firm’s market performance and ESG criteria has been much discussed in recent literature, the empirical results, however, are often inconclusive. This lack of consistency in the results may be explained by the multiplicity of data and methodologies used among studies. Especially, the strength of the link between financial and CSR performances depends on the way the two performances are measured and numerous moderating variables (Gramlich and Finster 2013). With support from the above-mentioned meta-analyses and additional ones cited below, we review the methods used in previous studies leading to significant results and summarize our findings below.

There is no doubt that the model used in the studies to evaluate a firm’s performance plays a central role. We can distinguish first between studies that assess the market performance (stock market returns) and the accounting financial performance of a company. In general, accounting models more often bring significant, positive results than market models. An example of an accounting model is the Ohlson (1995) model with ROE, ROA, and Tobin’s q variables. The major problem with accounting models is the number of samples, as it is limited to yearly or quarterly observations that may be hard find for long periods (over ten years). For market models, the simple CAPM model has been progressively abandoned in the profit of multifactor models such as Fama and French, Fama and MacBeth and Carhart (1997) models. Regressions on such multifactor models generally lead to significant positive results, whereas CAPM-based models bring little results.

Logic would suggest that working on the most recent practicable data with the longest possible observation period would provide a certain significance during statistics tests; however, the availability of ESG data might limit the ability of the researchers. Revelli and Viviani’s (2013) recent meta-analysis shows that an observation period of less than 5 years tends to show negative coefficients, whereas 5 to 10 years of data usually bring the most positive results. They also record that having an observation panel of more than 100 samples will greatly increase the significance. Nonetheless, the most common practical issue causing discrepancies in results might be the sampling frequency. Orlitzky et al. (2003) believe it to be the main cause of variance among studies in corporate social responsibility.

It should be emphasized that each of the three categories of ESG scores, whether it is environment, society, or governance, brings overall positive results regarding accounting performance. However, if we speak about market or fund performance, the results vary greatly with the selected category, which could explain why previous findings argue that stock market rewards are rarely observable at the aggregate level. Hence, we can expect, if using a market model, that ratings in different subcategories could bring a neutral, negative, or a positive influence. Therefore, we add the following hypothesis to our study: Environmental, Social/Society or Governance factors do not affect market performance in the same proportion (H2)

The most studied ESG category is by far governance, whose positive effect brings a consensus among studies (Orlitzky et al., 2003); second is environment, while society factors are the less studied. Horváthová’s (2010) meta-analysis on ecological studies warns that a simple correlation coefficient will bring more negative results when linking performance to ecological factors. Therefore it seems appropriate to rely on advanced econometric methods instead. She also warns that a positive link is found more frequently in common law countries than in civil law countries, which bring us to our next topic.

Concerning the country of observation, there seems to be a difference in the results obtained in the US and other countries. Studies in the US bring positive results more often, while non-US studies lead to neutral results. An attempt to justify these discrepancies is the activism of US pension funds toward sustainability. An interesting study would be to compare emerging markets, as well as the influence of the legal system toward ESG results across categories as Horváthová (2010) did, but this can be made difficult as most data providers focus on developed countries.

To summarize our findings, to provide certain significance during statistics tests, a study should make the choice of an accounting model or a multifactor market model as a base for their performance model. If a market model is used, we should break down the ESG observation into sub-categories, as the aggregated score would lead to no result. The observation period should be over 5 years or at least 100 samples. There might be a need to resample the data according to previous studies if no significant results can be found. Finally, we should expect less positive results in non-US studies that in US ones.

Methodology

Models

We propose below an original study of over 200 large US, UK, and Swiss companies, based on the availability of ESG scores and Fama-French factors. Our study on the performance of companies will compare their ESG ratings available from Covalence with their market performance adjusted for various factors during the 2007–2011 period. We measured the change in the market value of a stock using a five-factor linear market model derived from Carhart’s model (Carhart, 1997). Carhart’s model explains a stock’s market performance based on the Fama-French three factors (Fama and French, 1993), namely the market’s excess return (RM-RF), the small firms’ excess return (SMB), and the growth firms’ excess return (HML). In addition, Carhart’s four-factors model adds the momentum factor (WML) to model the market trend anomaly. Our hypothesis to add our fifth factor, called ESG, is that the ESG score variations could explain partly the stocks’ performance, as it would represent the overall opinion of investors about a corporate’s ability to lower its risks and anticipate trends. We expect a neutral or slightly positive relationship between ESG ratings and adjusted market performance (Hypothesis H1.b).

(Model 1)

In addition, we want to test if the relation with each factor is indeed linear. In case of the four-factors, the wide recognition of those factors might have shaped the response in a linear way. However, in case of the ESG score, we believe that the positive variations or negative variations may not affect the stocks in the same way, and that the magnitude of the change in ESG score might affect the stock’s performance in a non-linear way. To test the shape of this response without constraint, we conduct a non-parametric regression on the five factors of the first model.

(Model 2)

In parametric regression, we must determine the functions f(x) from the start. In non-parametric regression, no hypothesis is made about the f(x) functions; instead, it is deduced from the data themselves. The objective of the kernel regression is to find a non-linear relation i.e., f(x) between two random variables, in our case (StockReturn-RF) and each other variable of the model. As in ordinary least squares (OLS), a weighted sum of the (StockReturn-RF) observations is used to obtain the fitted values. An important parameter when fitting the curve to observation is the bandwidth, which provides smoothing so that only some level variation will affect the fitting, and “noise” variation, on the contrary, will not affect it. We estimate the unknown regression function using Nadaraya-Watson kernel implemented in the R “np” package that uses automatic (data-driven) bandwidth selection.

Dependent and Independent Variables

The stock market return (StockReturn) is computed monthly for each stock based on month-end close prices by Telekurs. For Switzerland, the risk-free rate (RF) and four factors (RM-RF, SMB, HMW, and WML) are available until 2011 on the Amman-Steiner website.[5] RF is the Swiss Franc call money rate from Factset and the market return is a constructed portfolio bringing returns very similar to the Swiss performance index (SPI). The UK four-factors are taken from the University of Exeter’s[6] website, available until 2010 at the time of our study. RF (risk-free rate) is the monthly return on three-month UK Treasury bills, while RM is the total return computed on the FT All-Share Index. The four factors for the US are available on the Jason Hu website[7] until June 2011 where RF also represents the yield of three-month US Treasury bills. More details on the construction of the factors are available on the respective websites.

Concerning our ESG variable, it corresponds to the change in the Global EthicalQuote® score (hereafter global score or rating) between the beginning and the end of the observation period. It can also correspond to the change in each of the respective sub-scores of one the following sub-category (governance, economic, environment, labor, human rights, society, products), as we will test those variables successively.

The Global EthicalQuote® score and the score in each sub-category are monthly news-based ratings provided by Covalence[8] on various ESG thematic. More details about how Covalence computes those ratings and how they link to the Global Reporting Initiative (GRI) are available in our data section.

Control Variables

To take into account the specificities of the companies, we considered two control variables commonly used for the analysis of results within the same market: firm size and sector. In our sample, however, the 11 firms are among medium or large within their respective markets. In a study on common stock returns, Banz (1981) has shown that smaller firms have higher returns, but this effect is not distinctive between medium and large firms. Since our sample only consists of medium and large firms, we tend to believe that the parameter influencing the stock returns will not play differently relative to the size factor; therefore, we disregard this factor in our market model.

Concerning the sector variable, we will split our sample in the US and UK according to their sectors, as presented in Table 1. As our sample for Switzerland is too small to consider each sector individually, we decided instead to group the firms into the three themed groups that are detailed below. The rationale for the first group is that it seems that those firms that are selling consumer products directly to individuals are more impacted by ESG activities (Eccles, 2012), so we want to see if their market prices are differently influenced by ESG news. We also segregate banks and insurance as a special group because of the indirect influence of the assets holdings.

ESG data

Our first study sample consists of 618 monthly observations of change in ESG ratings, corresponding market parameters on 11 stocks for Switzerland from 2007 to 2011. Our second study sample consists of 1,335 monthly observations of change in ESG ratings and corresponding financial parameters on 32 UK firms, with observation range from year 2007 to 2010. Our last study sample consists of 8,039 monthly observations of change in ESG ratings and corresponding financial parameters on 189 US firms, with observations ranging from 2007 to 2011.

In each case, the ESG variable corresponds to the change in the ESG ratings. ESG ratings available nowadays can be categorized as compliance-based ratings and news-based ratings, this study’s ratings following the second category. The compliance-based ratings depend on the compliance of a firm with respect to some pre-defined rules; for instance, CO2 emissions, the presence of external auditors, the disclosure of a code of business conduct and ethics. They often follow the Global Reporting Initiative (GRI) directives, which has set a standard set of rules for firms to comply with. The rating is then computed depending on how the firm is complying with the rules. Such data are found, for instance, on Thomson Reuters’s ASSET4 or CSRHub. The news-based scores, on the other hand, are based on positive and negative news concerning a company found in newspapers and other media and which contains keywords in relation to environment, society, and governance; for instance, trials, charities, and NGO activities. Regardless of the method chosen to create the ratings, the awarded ESG scores are classified by most providers according to large categories of ideals, often in the number of three (ESG) or four (ecological, corporate governance, community, i.e., contribution to society, and humanitarian, i.e., non-operating employees). An overall ESG score that aggregates all categories is usually available.

The compliance-based and news–based rating systems each have certain advantages and disadvantages. The first method seems easier to assess because it is following a grid of specific criteria, but the exact knowledge of what is required to comply with a rule gives companies the freedom to simulate good conduct by, for instance, disclosing a code of conduct which is in fact not followed internally. Another problem is that it offers only a qualitative but not a quantitative appreciation, so it may not allow to compare companies that both comply with the same criterion. Finally, compliance rules rely on a yearly evaluation, which makes it hard for re-assessment during the year.

Tableau 1

Sectors of the empirical study

News-based scores have the advantage of being re-assessed more often, as they are based on news communicated by the media and may therefore come from several sources external to the company, providing different opinions in an ad-hoc manner. The major drawback is the media’s over-exposure of big companies and client-facing businesses relative to others. Large companies will be drowned in a flood of accusation by some organizations or conversely, the media will extensively cover their good deeds, while smaller companies will remain in the shadows and often without a realistic score. To address this issue, advanced news-based scores compute the media exposure and adjust the ratings accordingly.

Here are more details on how the ESG scores from Covalence are calculated. The score is obtained by comparing the amounts of positive and negative information collected on the Web, i.e., by subtracting daily the negative information from the positive information. When a majority of negative information is observed, the score then becomes a negative number.

To overcome the bias due to media exposure and size, a rate representing the total volume of information affecting the company score is introduced into the formula.

Media exposure adjustment:

An erosion factor of 2% per month gives less importance to old news as compared to the latest ones. The final score takes into account results performed by several human analysts specialized in ESG.

A text encoded in the database must also be attached to one or two criteria among the fifty “criteria for business contribution to human development” listed below. Those criteria follow the dimensions of the GRI’s sustainability reporting and are distributed among seven dimensions. This allows Covalence to compute the sub-score for each dimension, namely: A_Governance, B_Economic, C_Environment, D_Labor, E_HumanRights, F_Society, G_Products. Table 2 summarizes the groups and the criteria belonging to it.

The availability of sub-ratings in each of the seven ESG dimensions, on top of the global score, will allow us to test which group may have an influence on the stock’s excess return (Hypothesis H2).

Tableau 2

Methodology of Covalence score

Result

Descriptive Statistics

The descriptive statistics of our first sample (market Model 1 and 2) is summarized in the table below for each country. For Switzerland, we have 618 observations for each variable over the period 2007–2011 and 8,039 for the US on the same period. We have 1,335 observations in the UK between 2007 and 2010. The stock excess returns range between -53% and +49% in Switzerland, -63% and +90% in the UK, and -78 and +260% in the US. The ESG ratings experience a higher range of variations (e.g., Switzerland, between -4,500% and 180%) than the other dependent variables (e.g., Switzerland, min - 15% and max 12%).

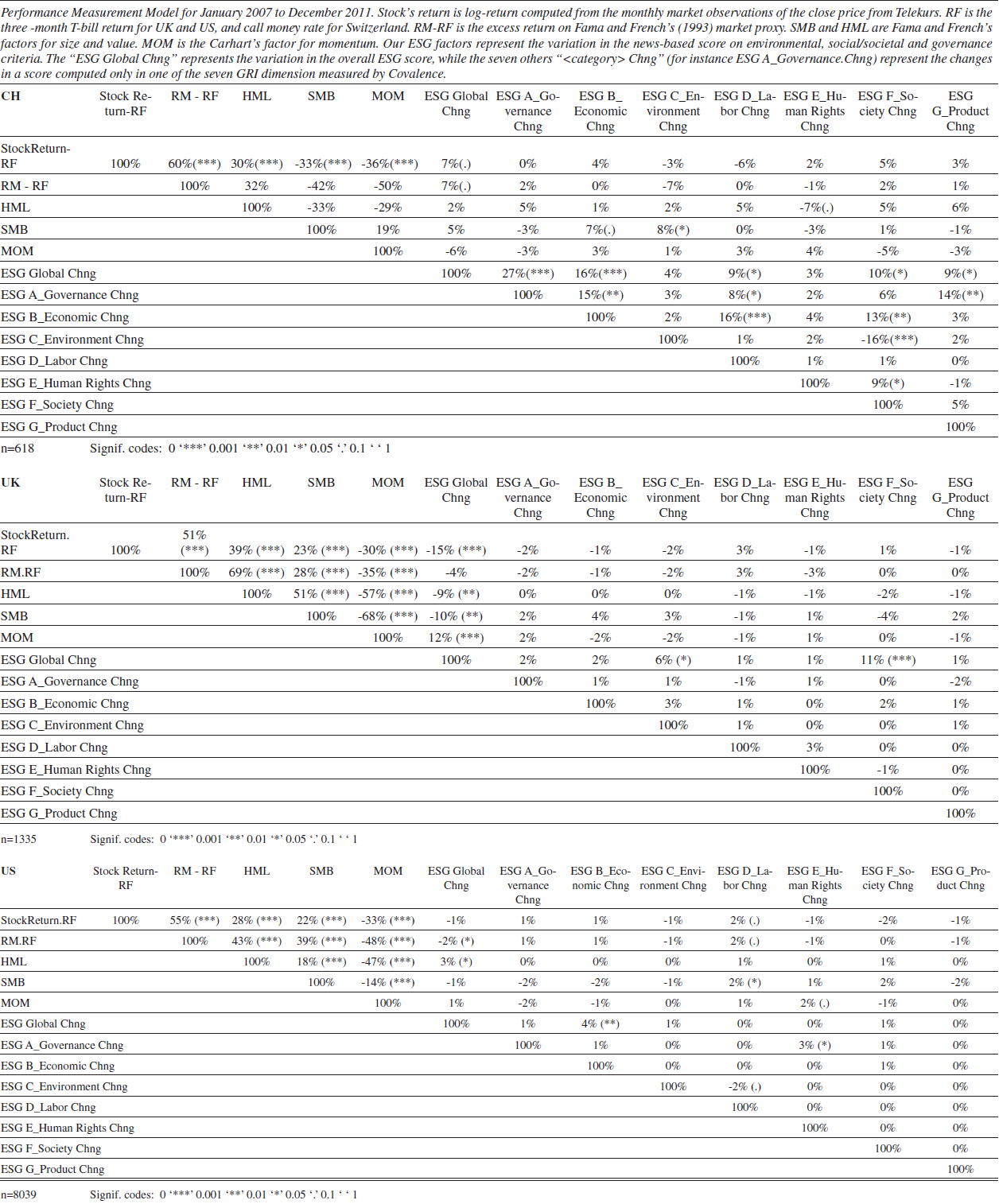

We test positively for normality by drawing histograms, where the high kurtosis can be noted for the ESG scores. Heteroscedasticity is tested negatively by using a plot of each of our independent variables against the square of the residual, showing no pronounced pattern. The multi-colinearity between the Carhart four-factors’ and the ESG scores’ change is low with VIF indices below 2. The Pearson correlation between the excess stock return and the variables are shown in Table 2. In the overall sample, the four-factors are, as expected, highly correlated with the stock’s excess return. For Switzerland and the UK stocks excess return is also correlated to the global ESG score, positively for Switzerland, and negatively for the UK. The US does not display any significant correlation between the stock’s excess return and the global score, but a positive one with the labor sub-score changes. Despite the high correlation between the four-factors for all countries and ESG scores for Switzerland, the VIF indices are low and below 3 for all coefficients.

Tableau 3

Descriptive statistics

Model 1 Analysis

We run our regression toward Model 1 in R, with results presented below. As expected, the market premium RM-RF shows the highest positive significance toward the stock’s performance. The other classic factors also display a various degree of significance with an expected negative coefficient for SMB since all of our firms are large-cap and an expected positive coefficient for our firm since our stocks are value stocks, confirming global findings on Fama-French models. The momentum factor seems slightly negative for Switzerland. Our first model linear regression shows a slightly positive relationship between the EthicalQuote global score and the market performance; however, it is not significant. The coefficient factor for the ESG Global score change over stock’s market performance is 0.004, which is very small. A bigger sample might be required to confirm such a small effect in a significant manner.

To explore the influence of each ESG subcategory individually, we then regress for a linear model consisting of four factors, and the score changes in each of the seven subcategories. The figures are presented below. For Switzerland, economic news expectedly demonstrates a positive relation to stock market performance. The overall sample exhibits a significant negative relation between labor score changes and the stock’s excess return changes. This small negative impact of labor ratings over the whole period, which might confirm Friedman’s (1970) concern that business should focus on profit only, but this effect tends to disappear in recent years as we later explore regression by year. Labor rating results from positive and negative news concerning the labor practices and decent work, such as employment and employee benefits, trade unions, health and safety at work, training and education, and diversity (see Table 2 for equivalent GRI criteria). A bivariate Granger causality test with a one-period shift shows a highly significant probability that it is the labor’s score change that is causing the changes in market value. We also consistently measure the impact of ESG news-based ratings to be smaller in comparison with market premium and smaller than SMB, HML, and MOM factors.

For the US and UK, only the market premium and momentum factors show a high degree of significance. Society news demonstrates a statistically significant relation in the UK over the whole period, but the factor’s coefficient seems too small to be meaningful.

Insert Table 6

In order to further explore the relationship with each ESG subcategory, we observe each category’s score per year. For Switzerland, over year 2011, the environment score exhibits a positive and significant (P < (t) 0.05) influence over the stock market’s performance, while the labor score’s significant negative coefficient only seems to apply to the year 2008. Those results suggest that some factors may be more influential during some periods or context, as, for instance, 2008’s sensitivity to labor when the financial crisis began. For labor, this could mean that positive news concerning the employee benefits of employment are perceived negatively in the markets during a crisis or more probably that negative news, such as lay-offs, are still perceived as a positive sign that the business is restructuring, which might be challenged. 2011’s sensitivity to environmental questions might have been triggered by the Fukushima Daiichi nuclear disaster or by the 2011 proposal for a new regulation from the Swiss federal office to cut CO2 emission, which was finally rejected. The environment category in our news-based score contains news related to materials, energy, water management, biodiversity, emission and waste, pollution, ecological impact of products and transports.

Changes in the society score also show a significant positive coefficient for year 2008. A bivariate Granger causality test for each variable with respect to the stock’s excess return does not enable us to conclude on the direction of causality.

The UK sample demonstrates a negative, but significant, coefficient over the year 2009 for the society score (local communities, humanitarian action, corruption and lobbying, etc.) has a negative significant relation with market performance, which might be a reaction to the lingering recovery and the MP expenses scandal causing defiance toward anything but economic value. The economic score, which gathers new related to economic performance and social factors, such as wages, local sourcing and hiring, and property rights has a positive significant relation with market performance for 2010, but the causality is not confirmed by the Granger test. Therefore, it is unknown if the firms improved their socio-economics because of better performances that usual, or the firms with a higher socio-economic score were having better market performances. The US sample shows a positive significant coefficient toward society score changes in 2007 and a slightly negative one for the year 2009 regarding product changes (product safety and labeling, product social impact, consumer privacy, etc.), but both impacts are very small. As we will see later with our split by sector, products score shows a significant positive relation to the technology sector in the whole period.

Tableau 4

Correlation between variables

Tableau 5

Regression results for Model 1

Tableau 6

Regression results for Model 1 - Sub-scores

As described in our methodology section, we then split our sample by sector and groups in order to control for a possible industry effect. The application of our linear model for each sector/group shows the following results: The influence of market premium RM-RF is still the highest significant factor, and the other three factors show their previous significance over the period. For Switzerland, the client-facing groups show a positive significant factor toward human rights. Banks and financial firms seems positively influenced by society and negatively by labor changes, while the rest of the industry seems oriented toward economic ESG news. For the UK, oil and gas shows a highly significant positive factor for environment news, which links to the oil split affair. For banks, there seems to be a negative link toward society, while media has a very positive one. The travel industry seems to have a negative link with labor.

For the US, we find that financial services seem negatively influenced by society score changes, while oil and gas are neutral toward such changes. Retail seems influenced negatively by economic changes and telecom by labor changes. Technology, however, seems positively influenced by product changes and telecom by governance and economic.

Model 2 Analysis

The functions obtained with a non-parametric kernel regression for each parameter over the whole Swiss sample are as follows:

f1 = positive linear function of RM-RF, a confirmation or a consequence of CAPM

f3 = positive linear function of HML with almost flat slope

f5 = the function of ESG Global Ethical quote score seems to be flat until a certain amount of positive change in score. It then becomes positive linear but with a cap, i.e., past a certain threshold, the ESG score has little additional influence on market performance.

Tableau 7

Regression results for Model 1 - Sub-scores per year

Tableau 8

Regression results for Model 1 – Sectors and Sector’s groups

This could mean that ESG-related information is of importance to investors but that investors may be unable to distinguish between “virtuous” companies and those that are “very virtuous.”

Non-parametric regression over the ESG score in each category shows highly nonlinear functions for B_Economic and C_Labor score changes, which could require further confirmation on bigger sample or different markets.

The functions obtained with a non-parametric kernel regression for each parameter over the whole sample are presented in Figure 2 below. The shape of the function displayed for each ESG factors does not seems significant. Since the non-parametric regression is sensitive to the bandwidth, a more detailed regression could be conducted using a non-automatic bandwidth to better tailor the variation of the data sample.

Conclusion

Our research question was how the individual company’s market and financial performance relate to ESG criteria. We tried to identify the influence of ESG ratings on a firm’s market performance in Switzerland, the UK, and the US, with two linear and nonlinear models.

In theory, a good ESG rating should signal firms with lower residual risks and therefore increase their market value as demand and valuation would adjust accordingly. We tested monthly stock’s excess performance over a five-year period for several Swiss, US, and UK companies and their related news-based ratings in various ESG categories. We find a neutral or slightly negative relationship with the overall rating for the UK but not for the US or Switzerland. Our results regarding the sub-categories scores highlight the fact that the link with such scores and market performance is highly dependent on the year and sector. Those results could be a sign that investors do not recognize ESG ratings variation as a flag of a lower/higher residual risk, except for periods where the market is sensitive to specific conditions. Only under those conditions would the prices adjust to the better/worst perception of the risk of the firm, which could be an interesting topic to expand in the field of behavioral finance. We also consistently measured the impact of ESG news-based ratings on the stock’s market return to be smaller than the Fama-French and momentum factors. Our results should, however, be considered with care as our sample only consists of hundreds of firms and as such, should be extended to a larger number of firms and a longer observation period in order to confirm the link with theory. The kernel regression for Switzerland displays a nonlinear relation for news-based ratings toward the market over the whole period, which could be taken into account and may lead to further studies using a non-linear relationship.

Figure 1

Regression results for Model 2

Non-linear functions for the Performance Measurement Model for January 2007 to December 2011. Model 2 is a non-linear Market model to explain StockReturn-RF based on functions of the variables hereafter Stock’s return is log-return computed from the monthly market observations of the close price from Telekurs. RF is the three -month T-bill return for UK and US, and the call money rate for Switzerland. RM-RF is the excess return on Fama and French’s (1993) market proxy. SMB and HML are Fama and French’s factors for size and value. MOM is the Carhart’s factor for momentum. Global Chng factor represent the variation in the news-based score on environmental, social/societal and governance criteria. The graphs represent the estimated functions of the StocksReturn-RF(y-axis) depending of the variable in the x-axis.

To conclude, the studies following the stakeholder theory (Freeman, 1984) postulates that there are some benefits for firms to improve their ESG ratings as this could increase their performance. However, we show that this link has yet to be fully understood and recognized by the market, as it will not sanction an overall monthly increase or decrease of ESG ratings, except during specific, contextual periods. It is an interesting result for a firm’s management, who might want to show their good deeds in periods when this factor is under exposure -for instance, when there is a discussion on a new regulation that the firm is already compliant with. It is also interesting for public policy makers and regulators to know that the market does not clearly sanction negative or positive ESG efforts yet and that firms or investors, despite being favorably minded toward sustainability, might need further incentives from them.

Figure 2

Regression results for Model 2 – Sub-scores

Non-linear functions for the Performance Measurement Model for January 2007 to December 2011. Model 2 is a non-linear Market model to explain StockReturn-RF based on functions of the variables hereafter Stock’s return is log-return computed from the monthly market observations of the close price from Telekurs. RF is the three -month T-bill return for UK and US, and the call money rate for Switzerland. RM-RF is the excess return on Fama and French’s (1993) market proxy. SMB and HML are Fama and French’s factors for size and value. MOM is the Carhart’s factor for momentum. Global Chng factor represent the variation in the news-based score on environmental, social/societal and governance criteria. The graphs represent the estimated functions of the StocksReturn-RF(y-axis) depending of the variable in the x-axis.

This study also contributes to the literature evaluating the relationship between financial and CSR performances, and the non-parametric response of performance to ESG criteria may open a new way of research to better understand the complexity of this relationship (Orlitzky; 2013). In addition, it would be interesting to further study the link between an ESG news-based rating and market performance with regard to a larger sample and other countries, as well as study the link between those returns and financial performance using accounting models over the same period.

Appendices

Appendix

Appendix A

Fig. A1 - Socially Responsible Investment – Acknowledged Strategies

Fig. A2 - US and European SRI Growth –US SIF 2012 Executive Summary report, EURO SIF 2012 report

Biographical notes

Jean-Michel Sahut is a Professor at IPAG Business School Paris. He teaches Corporate Finance, Financial Accounting and Serious Game for engineering and management students. Previously, he was a Professor at Geneva School of Business Administration, University of Applied Sciences (Ch), an Associate Dean for Research at Amiens School of Management (Fr), a Professor of Finance at Telecom & Management Paris Sud (Fr) and the director of the RESFIN Laboratory. He has published more than sixty articles about finance, governance, CSR and entrepreneurship in international peer review journals and five books.

Hélène Pasquini-Descomps is a PhD student at the University of Geneva (Ch) and a lecturer at Geneva School of Business Administration, University of Applied Sciences (Ch), where she teaches Market and Corporate Finance. She received her Master’s degree in Telecom Engineering from the Swiss Federal Institute of Technology Lausanne (EPFL), and has over 10 years professional experience working in Investment Banking and Asset Management in Japan, US and Switzerland. Her main research interests are finance, sustainability and cost-effectiveness, with a special interest on corporate and public policies, statistics and simulation modeling.

Notes

-

[1]

According to US SIF, assets under SRI strategies went from $2.1 bn in 1999 to $3.7 bn in 2002. EURO SIF claims a 1.7 € bn in 2005, coming to 11.7 € bn in 2011 which includes norm-based screening since 2009.

-

[2]

The UK period is 2007 to 2010 only, as we did not have the four-factors for the year 2011 at the time of the study.

-

[3]

Apple’s Foxconn scandal on labor conditions may have cause share prices to drop 5% when it was announced, taking all other factors into account. http://seekingalpha.com/article/926801-did-foxconn-bring-down-apple-stock

-

[4]

Following the Jan.2013 horsemeat scandal, the French company Spanghero filed for bankruptcy in April 2013 http://www.huffingtonpost.fr/2013/04/19/viande-cheval-spanghero-place-liquidation-judiciaire_n_3115675.html

- [5]

-

[6]

http://business-school.exeter.ac.uk/research/areas/centres/xfi/research/famafrench/files/

- [7]

-

[8]

Covalence SA is a limited company based in Geneva, Switzerland, founded in 2001. They provide ESG ratings, news and data of the world’s largest companies to investors, as well as reputation research and benchmarks to corporations. http://www.covalence.ch/

Bibliography

- Albuquerque, R., Durnev, A., Koskinen, Y., 2012. Corporate Social Responsibility and Asset Pricing in Industry Equilibrium. Working paper.

- Angel, J.J., Rivoli, P., 1997. Does ethical investing impose a cost upon the firm? The Journal of Investing 6 (4), 57-61.

- Balakrishnan, R. Sprinkle, G.B., Williamson M.G., 2011. Contracting Benefits of Corporate Giving. An Experimental Investigation. The Accounting Review 86 (6), 1887–1907.

- Banz, R.W., 1981. The relationship between return and market value of common stocks. Journal of Financial Economics 9, 3–18.

- Battacharya, C.B., Sen, S., Korschun, D., 2008, Using Corporate Social Responsibility to Win the War for Talents. MIT Sloan Management Review 49 (2), 37–44.

- Capelle-Blancard, G. and Monjon S., 2011. The performance of socially responsible funds does the screening process matter? CEPII, Working paper n°2011-12.

- Carhart, M.M., 1997. On Persistence in Mutual Fund Performance. The Journal of Finance 52(1), 57–82.

- Edmans, A., 2011. Does the stock market fully value intangibles? Employee satisfaction and equity prices. Journal of Financial Economics 101 (3), 621–640.

- Eccles, R.G., Ioannou, I., Serafeim, G., 2012. The Impact of a Corporate Culture of Sustainability on Corporate Behavior and Performance. National Bureau of Economic Research Working Paper Series n°17950.

- Economist, 2008. Just good business. Special report on CSR. January, 19th.

- El Ghoul, S., Guedhami, O., Kwok, C.C.Y., Mishra, D.R., 2011. Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance 35(9), 2388–2406.

- Fama, Eugene F., Kenneth R. French, 1993. Common risk factors in the returns on bonds and stocks. Journal of Financial Economics 33 (1), 3–53.

- Freeman, R.E., 1984. Strategic management: A stakeholder approach. Cambridge University Press, Cambridge.

- Friedman, M., 1970. The Social Responsibility of Business is to Increase its Profits. New York Times Magazine.

- Galema, R. Plantinga, A. and B.Scholtens. 2008. The stocks at stake: Return and risk in socially responsible investment. Journal of Banking & Finance 32 (12), 2646–2654.

- Garriga, E., Melé, D., 2004. Corporate Social Responsibility Theories: Mapping the Territory. Journal of Business Ethics 53, 51–71.

- Gompers, P., Ishii, J., Metrick, A., 2003. Corporate Governance and Equity Prices. Quarterly Journal of Economics 118 (1), 107-156.

- Graff Zivin, J., Small, A., 2005. A Modigliani-Miller Theory of Altruistic Corporate Social Responsibility. B.E. Journal of Economic Analysis & Policy: Topics in Economic Analysis & Policy 5, 1–21.

- Gramlich, D. Finster, N., 2013; Corporate Sustainability and Risk. Journal of Business Economics 83, 631–664.

- Gregory Birth, Laura Illia, Francesco Lurati, Alessandra Zamparini, 2008. Communicating CSR: practices among Switzerland’s top 300 companies. Corporate Communications: An International Journal 13, 182–196.

- Hong, H., Kacperczyk, M., 2009. The price of sin: The effects of social norms on markets. Journal of Financial Economics 93, 15–36.

- Horváthová, E., 2010. Does environmental performance affect financial performance? A meta-analysis. Ecological Economics 70, 52–59.

- Ionnou, I., Serafeim, G., 2011. The Consequences of Mandatory Corporate Sustainability Reporting. Working Paper, Harvard Business School.

- Jensen, M.C., Meckling, W.H., 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3, 305–360.

- Jensen, M.C., 1986. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers.American Economic Review 76, 323.

- Kang, K.H., Lee, S., Huh, C., 2010. Impacts of positive and negative corporate social responsibility activities on company performance in the hospitality industry. International Journal of Hospitality Management 29, 72–82.

- Kurtz, L., 2005. Answers to Four Questions. Journal of Investing 14(3), 125–139.

- Mackey, A., Mackey, T.B., Barney, J.B., 2007. Corporate social responsibility and firm performance: investor preferences and corporate strategies. Academy of Management Review 32 (3), 817–835.

- Margolis, J., Elfenbein, H., Walsh, J., 2007. Does it pay to be good ? A meta-analysis and redirection of research on the relationship between corporate social and financial performance, Working Paper Harvard University.

- McWilliams, A., Siegel, D., 1997. Event studies in management research: theoretical and empirical issues. Academy of Management Journal 40 (3), 626–657.

- Myers, S.C., 1977. Determinants of Corporate borrowing. Journal of Financial Economics 5, 147–175.

- Ohlson, J.A., 1995. Earnings, Book Values, and Dividends in Equity Valuation. Contemporary Accounting Research 11 (2), 661–687.

- Orlitzky, M., Schmidt, F.L., Rynes, S.L., 2003.Corporate Social and Financial Performance: A Meta-Analysis. Organization Studies, 24 (3), 403–441.

- Orlitzky, M., 2013. Corporate Social Responsibility, Noise, and Stock Market Volatility. Academy of Management Perspectives 27 (3), 238–254.

- Porter, M.E., 1991. America’s green strategy. Scientific American, 264 (4), 168.

- Porter, M.E., Kramer, M.R., 2011. The big idea: created shared value. Harvard Business Review, January-February, 4-17.

- Renneboog, L., Horst, T., Zhang, C., 2008. Socially responsible investments: Institutional aspects, performance, and investor behavior. Journal of Banking & Finance, 32 (9), 1723–1742.

- Revelli, C., Viviani, J, 2013. Performance financière de l’investissement socialement responsable (ISR) : une méta-analyse. Finance Contrôle Stratégie [Online], 15-4 |2013, Online since 18 March 2013. URL : http://fcs.revues.org/1222.

- Russo, M.V., Fouts, P.A., 1997. A resource-based perspective on corporate environmental performance and profitability. Academy of Management Journal 40 (3), 534–559.

- Sandberg, J., C., Juravle, T.D. Hedesström, and I. Hamilton, 2009. The heterogeneity of socially responsible investment. Journal of Business Ethics, 87, 519-533.

- Sharfman, M.P., Fernando, C.S., 2008. Environmental risk management and the cost of capital. Strategic Management Journal 29 (6), 569–592.

- Statman, M., Glushkov, D., 2009. The Wages of Social Responsibility. Financial Analysts Journal 65 (4), 33–46.

- Teoh, S.H., Welch, I., Wazzan, C.P., 1999. The Effect of Socially Activist Investment Policies on the Financial Markets: Evidence from the South African Boycott. Journal of Business 72, 35–89.

- Waddock, S.A., Graves, S.B., 1997. Finding the link between stakeholder relations and quality. Journal of Investing 6 (4), 20-24.

Appendices

Notes biographiques

Jean-Michel Sahut est professeur à l’IPAG Business School Paris. Il enseigne la Finance d’entreprise, la Comptabilité financière et les Jeux de simulation pour les étudiants en ingénierie et en gestion. Auparavant, il a été professeur à la HEG, University of Applied Sciences (Ch), doyen associé à la recherche au Groupe Sup de Co Amiens (Fr), professeur de Finance à Télécom & Management Sud Paris (Fr) et directeur du Laboratoire RESFIN. Il a publié plus de soixante articles en finance, gouvernance, RSE et entrepreneuriat dans des revues scientifiques internationales et cinq livres.

Hélène Pasquini-Descomps est doctorante à l’Université de Genève (Ch) et adjoint scientifique à la Haute École de gestion de Genève (Ch), où elle enseigne la finance d’entreprise et la finance de marché. Ingénieure diplômée de l’École Polytechnique Fédérale de Lausanne (EPFL) en Systèmes de Communications, elle dispose de plus 10 ans d’expérience professionnelle internationale en banque privée et banque d’investissement au Japon, aux États-Unis et en Suisse. Ses principaux thèmes de recherche sont la finance, le développement durable et l’efficience, avec un intérêt particulier pour les politiques publiques et entrepreneuriales, ainsi que les statistiques et la modélisation numérique.

Appendices

Notas biograficas

Jean-Michel Sahut actualmente es Catedrático en la Escuela de Negocios IPAG Paris, impartiendo docencia de Finanzas Corporativas, Contabilidad Financiera y «Serious Game» para los estudiantes de ingeniería y de gestión. Anteriormente, impartió docencia en la Escuela de Ginebra de Administración de Empresas (Suiza) y en Telecom & Management Paris Sud (Francia). Ha sido investigador en la Escuela de Administración de Amiens y director del Laboratorio RESFIN. Además, ha publicado más de sesenta artículos sobre finanzas, gobierno de la empresa, responsabilidad social corporativa y emprendimiento. Todos ellos en revistas internacionales con sistema de revisión por pares y cinco libros.

Hélène Pasquini-Descomps actualmente es candidata al doctorado en la Universidad de Ginebra (Ch) y profesora asistente en la Escuela de Ginebra de Administración de Empresas, Universidad de Ciencias Aplicadas (Ch), donde imparte clases de Mercado y Finanzas Corporativas. Recibió su Maestría en Ingeniería Telecom del Instituto Federal Suizo de Tecnología de Lausana (EPFL), y tiene más de 10 años de experiencia profesional trabajando en Banca de Inversión y Gestión de Activos en Japón, Estados Unidos y Suiza. Sus principales líneas de investigación son las finanzas, la sostenibilidad y la rentabilidad, con un especial interés en las políticas corporativas y públicas, las estadísticas y los modelos de simulación.

List of figures

Figure 1

Regression results for Model 2

Non-linear functions for the Performance Measurement Model for January 2007 to December 2011. Model 2 is a non-linear Market model to explain StockReturn-RF based on functions of the variables hereafter Stock’s return is log-return computed from the monthly market observations of the close price from Telekurs. RF is the three -month T-bill return for UK and US, and the call money rate for Switzerland. RM-RF is the excess return on Fama and French’s (1993) market proxy. SMB and HML are Fama and French’s factors for size and value. MOM is the Carhart’s factor for momentum. Global Chng factor represent the variation in the news-based score on environmental, social/societal and governance criteria. The graphs represent the estimated functions of the StocksReturn-RF(y-axis) depending of the variable in the x-axis.

Figure 2

Regression results for Model 2 – Sub-scores

Non-linear functions for the Performance Measurement Model for January 2007 to December 2011. Model 2 is a non-linear Market model to explain StockReturn-RF based on functions of the variables hereafter Stock’s return is log-return computed from the monthly market observations of the close price from Telekurs. RF is the three -month T-bill return for UK and US, and the call money rate for Switzerland. RM-RF is the excess return on Fama and French’s (1993) market proxy. SMB and HML are Fama and French’s factors for size and value. MOM is the Carhart’s factor for momentum. Global Chng factor represent the variation in the news-based score on environmental, social/societal and governance criteria. The graphs represent the estimated functions of the StocksReturn-RF(y-axis) depending of the variable in the x-axis.

List of tables

Tableau 1

Sectors of the empirical study

Tableau 2

Methodology of Covalence score

Tableau 3

Descriptive statistics

Tableau 4

Correlation between variables

Tableau 5

Regression results for Model 1

Tableau 6

Regression results for Model 1 - Sub-scores

Tableau 7

Regression results for Model 1 - Sub-scores per year

Tableau 8

Regression results for Model 1 – Sectors and Sector’s groups

Fig. A1 - Socially Responsible Investment – Acknowledged Strategies

Fig. A2 - US and European SRI Growth –US SIF 2012 Executive Summary report, EURO SIF 2012 report